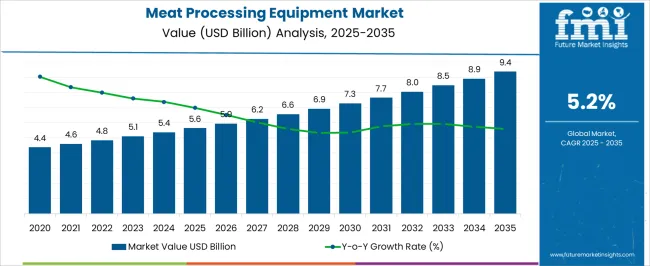

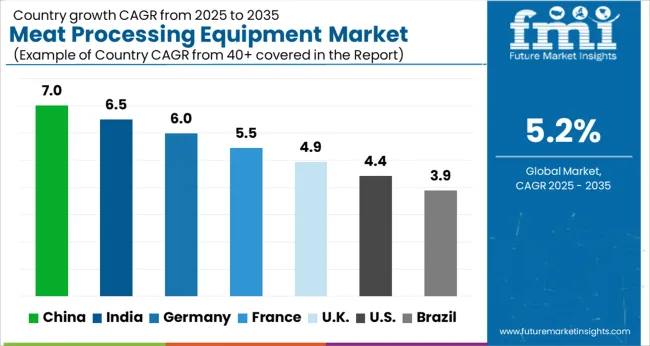

The Meat Processing Equipment Market is estimated to be valued at USD 5.6 billion in 2025 and is projected to reach USD 9.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

| Metric | Value |

|---|---|

| Meat Processing Equipment Market Estimated Value in (2025 E) | USD 5.6 billion |

| Meat Processing Equipment Market Forecast Value in (2035 F) | USD 9.4 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The meat processing equipment market is undergoing significant growth driven by increasing demand for processed meat products and advances in automation technology. Rising consumer preference for convenience foods and heightened food safety regulations have encouraged meat processors to upgrade their equipment with more efficient, hygienic, and automated solutions.

Technological improvements are enhancing cutting precision, throughput, and traceability, which are critical in maintaining quality and reducing waste. The surge in processed meat consumption, particularly in emerging economies, coupled with expanding cold chain infrastructure, is fueling market expansion.

Future growth is expected to be supported by continued investments in equipment modernization, integration of IoT and AI for process optimization, and increasing focus on sustainable and energy-efficient operations. Collaboration between equipment manufacturers and meat producers is fostering innovation, facilitating tailored solutions that address diverse processing requirements and compliance standards.

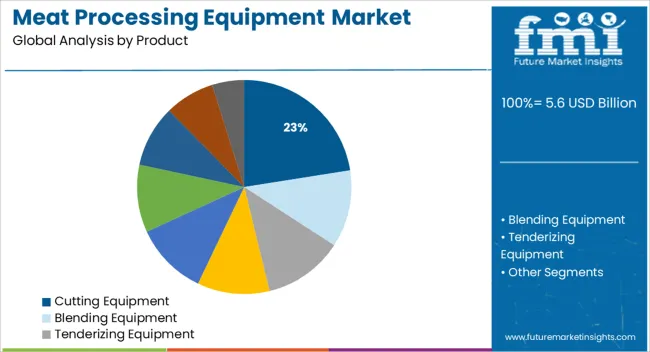

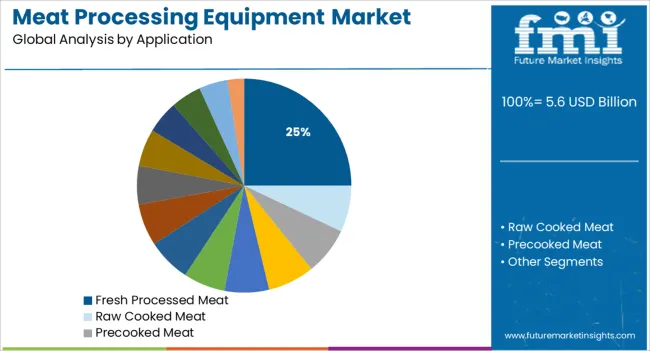

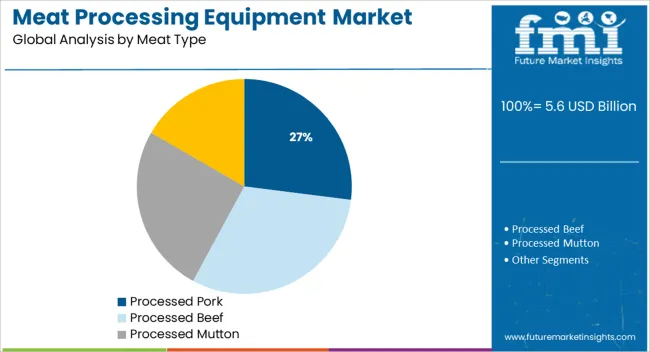

The market is segmented by Product, Application, Meat Type, and Automation and region. By Product, the market is divided into Cutting Equipment, Blending Equipment, Tenderizing Equipment, Filling Equipment, Slicing Equipment, Grinding Equipment, Smoking Equipment, Massaging Equipment, and Other Types (Brine Injectors, Emulsifying Machines, and Ice Flakers). In terms of Application, the market is classified into Fresh Processed Meat, Raw Cooked Meat, Precooked Meat, Raw Fermented Sausage, Cured Meat, Dried Meat, Catering, Meat Shop, Hotel, Restaurant, Meat Processing Unit, Poultry Industries, Further Processing, and Other (Sun-Drying Meat, Mincing, and Grinding Meat). Based on Meat Type, the market is segmented into Processed Pork, Processed Beef, Processed Mutton, and Others (Horses, Rabbits, Camels, and Yak). By Automation, the market is divided into Automatic and Semi-Automatic. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cutting equipment product segment is expected to account for 22.5% of the total market revenue in 2025, positioning it as a leading product category. This dominance is attributed to the critical role cutting equipment plays in improving yield, consistency, and processing speed in meat operations.

Advances in blade technology, automation, and safety features have driven adoption across large-scale meat processors seeking to enhance operational efficiency and reduce labor costs. The ability of cutting equipment to handle diverse meat cuts and sizes while maintaining product integrity has also been a key factor.

Manufacturers’ focus on customizable solutions and integration with downstream processing equipment has strengthened the segment’s position. Furthermore, stringent hygiene and sanitation requirements have elevated demand for cutting systems that facilitate easy cleaning and reduce contamination risks, reinforcing the segment’s market leadership.

The fresh processed meat application segment is projected to hold 25.0% of the market revenue share in 2025, marking it as the dominant application area. Growth in this segment is driven by rising consumer demand for fresh, minimally processed meat products that offer convenience without compromising quality.

Retailers and foodservice providers are increasingly sourcing equipment tailored to fresh meat processing to ensure product freshness, texture, and safety. Investment in equipment that supports portion control, trimming, and packaging is gaining traction, enabling processors to meet diverse consumer preferences and regulatory standards.

The segment’s growth is further supported by expanding cold chain logistics and urbanization, which facilitate wider distribution and availability of fresh meat products. Emphasis on traceability and quality assurance throughout the processing stages has underscored the importance of specialized equipment for this application.

The processed pork segment is anticipated to capture 27.0% of the market revenue in 2025, establishing it as the leading meat type category. This prominence is linked to the high global consumption of pork and the expanding demand for processed pork products such as sausages, hams, and cured meats.

Equipment designed specifically for pork processing has been in greater demand due to the need for precise cutting, deboning, and portioning that preserves product quality and maximizes yield. Market participants have invested in advanced machinery capable of handling pork’s unique characteristics, including fat distribution and muscle structure.

Moreover, evolving consumer tastes toward ready-to-eat and convenience pork products have encouraged processors to adopt specialized equipment to increase throughput and maintain consistent product standards. The processed pork segment’s leadership is further reinforced by its substantial presence in both traditional and emerging markets, driving continuous equipment demand.

As per FMI, the global meat processing equipment market exhibited considerable growth at a CAGR of 4.3% in the historical period from 2020 to 2024. Rising food security concerns are anticipated to push growth in the global market. High disposable income, rapid urbanization, and the busy lifestyles of consumers have positively influenced sales of processed meats.

This, combined with the rising premiumization of meat items and expanding purchaser admittance to coordinated retail locations like grocery stores, is fortifying the market development. Besides, key players are significantly putting their resources into the development of new processing technologies. They are also aiming to automate meat processing hardware solutions with an inbuilt sensor framework to hold a strategic advantage in the business.

They are likewise engaging in essential acquisitions and mergers for expanding their production volume and broadening their distribution channels. Apart from that, increasing demand for protein-rich food items like meat with rising awareness about the benefits of consuming such food items is expected to boost the global meat processing equipment market in the assessment period.

Meat Processors like Tyson Foods are Investing in Advanced Meat Cutting Machines in the USA

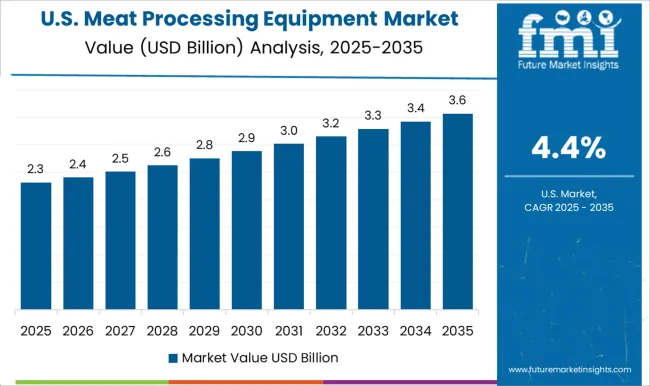

The meat processing equipment market in the USA is set to exhibit growth at a CAGR of 68% during the forecast period, says FMI. Increasing investments by key meat processing companies in automating their facilities and burgeoning demand for processed meat are expected to drive the USA market. Besides, the presence of various reputed meat processing companies such as JBS USA, Tyson Foods, and Cargill Meat Solutions Corp. is another vital factor that would push the USA market.

High Production of Beef in the UK to Push the Demand for Slaughtering Machines

The UK meat processing equipment market is projected to showcase steady growth throughout the forecast period, finds FMI. As to the UK Government, veal and beef production was 74,000 tons, which is 1.2% higher than that in May 2024. Also, prime cattle (young bulls, heifers, and steers) slaughtering were down 2.0% at 165,000 head in May 2024. These numbers are projected to grow at a fast pace in the next ten years, thereby augmenting sales of meat processing equipment in the UK

High Demand for Ready-to-eat Food in India to Drive Sales of Butcher Equipment

In India, the adoption of meat processing equipment is anticipated to surge owing to rising demand for ready-to-eat food products, stable economic growth, and changing lifestyles of consumers. The Indian government is also expected to put forward favorable norms to support the manufacturing of processed food items, which is expected to push the trade of processed meat.

Vee Tech International, Cactus Profiles Pvt. Ltd, Dr. Froeb Pvt. Ltd, JD Engineering, ATS Food Equipment India Pvt. Ltd, Bresco India, BSA India Food Ingredients Pvt. Ltd, A.S. Engineers, Sunniva Engineering, Chishtiya Poultry Services, Marine Industrial Machines, Deepak Engineers, and Vinod Industries are some of the leading companies in the India meat processing equipment market in India.

Meat Grinding Equipment to Showcase Lucrative Growth by the End of 2035

Based on product type, the grinding equipment segment is anticipated to remain at the forefront in terms of share in the global meat processing equipment market. Grinding equipment is mainly used to grind large pieces of tenderized meat into smaller pieces. Some of the commonly used grinders are utilized to separate connective tissues and bone pieces such as tendons from the muscle meat. Increasing the use of grinding equipment for processing various products such as hamburgers, sausages, and minced meat is expected to drive the segment.

The global meat processing equipment market is highly fragmented and competitive due to the presence of several local and regional companies. Key players are adopting a wide range of marketing strategies such as partnerships, expansions, mergers & acquisitions, and collaborations.

Some of the leading companies operating in the meat processing equipment market are GEA Group, BT Corporation, Marel, Illinois Tools Work, The Middleby Corporation, Bettcher Industries, Equipamientos Carnicos, Biro Manufacturing Company, Braher, RZPO, Bizerba, Riopel Industries, Minerva Omega Group, Risco, Millard Manufacturing Corporation, Apache Stainless Equipment Corporation, Gee Gee Foods & Packaging, PSS Svidnik, Ross Industries Inc., and Metalbud Nowicki among others.

Don’t Be a Jerky Manufacturer: Go for The Best Meat Processing Equipment from Duravant, Prime Equipment Group, And BAADER

The meat processing equipment industry is booming. As more people are interested in healthy living, more companies are turning to meat processing equipment for their benefit. Not only do these machines save food from going to waste, but they also provide a healthier option for consumers. Companies like Duravant, Prime Equipment Group, and BADDER provide superior meat processing equipment to meet end-user needs.

Duravant is a global producer and manufacturer of engineered equipment for the food processing, packaging, and material handling sectors. The business is divided into three divisions: food processing, packaging machinery, and material handling.

Duravant's Food Processing sector goods are mostly utilized in the processing of pig, beef, and poultry products for large food corporations and are classified into three key categories: pumps, fillers/dicers, and heat equipment.

The Packaging Machinery segment's product line includes components and systems for filling, closing, weighing, and handling open-mouth bags. The business operates internationally under the Fischbein brand name, offering a variety of products ranging from manual to semi-automated to fully automated equipment. These items are used in a wide range of end-use sectors, including agriculture, food, pet food, chemicals, and construction materials.

In April 2024, Duravant LLC announced the signing of a definitive agreement to acquire Foodmate, a leading manufacturer of poultry processing equipment with offices in Ball Ground, Georgia, and Numansdorp, the Netherlands. Foodmate's automated secondary processing systems for chicken are widely regarded as the industry's gold standard.

Another leading player, Prime Equipment Group, Inc. is a poultry processing equipment manufacturer established in the USA that has won the industry's confidence for more than two decades by providing creative, dependable, and hard-working solutions for practically every point on the contemporary processing line.

In June 2020, JBT Corporation, a global technology solutions supplier to high-value areas of the food and beverage industry, announced the completion of its purchase of Prime Equipment Group, Inc.

BAADER Group is a globally recognized producer and provider of high-quality food processing machinery and solutions for the fish, poultry, meat, fruit, and vegetable processing industries. From the handling of live and raw protein sources to the completed food products, the firm designs and engineers unique and holistic solutions that provide intelligent, safe, efficient, and sustainable food processing in all phases.

In April 2024, BAADER announced the introduction of the new BAADER 608 machine, which is the most powerful and biggest member of the BAADERING technology machine family. This machine is the most innovative and sanitary of its kind due to its upgraded design. It establishes new norms for food quality, value generation, process dependability, and user-friendliness.

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 5.6 billion |

| Projected Market Valuation (2035) | USD 9.4 billion |

| Value-based CAGR (2025 to 2035) | 5.2% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | Value (USD Million) |

| Key Regions Covered | North America; Latin America; Europe; Asia Pacific; Oceania; Middle East and Africa (MEA) |

| Key Countries Covered | USA, Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, Argentina, South Africa, UAE |

| Key Segments Covered | Product Type, Application, Automation, Meat Type, Region |

| Key Companies Profiled | Duravant; Prime Equipment Group, Inc.; BAADER; BANSS; Stephan Machinery GmbH; GEA Group; BT Corporation; Marel; Illinois Tools Work; The Middleby Corporation; Bettcher Industries; Equipamientos Carnicos; Biro Manufacturing Company; Braher; RZPO; Bizerba; Riopel Industries; Minerva Omega Group; Risco; Millard Manufacturing Corporation; Apache Stainless Equipment Corporation; Gee Foods & Packaging; PSS Svidnik; Ross Industries Inc; Metalbud Nowicki |

| Report Coverage | Market Forecast, Company Share Analysis, Competitive Landscape, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global meat processing equipment market is estimated to be valued at USD 5.6 billion in 2025.

The market size for the meat processing equipment market is projected to reach USD 9.4 billion by 2035.

The meat processing equipment market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in meat processing equipment market are cutting equipment, blending equipment, tenderizing equipment, filling equipment, slicing equipment, grinding equipment, smoking equipment, massaging equipment and other types (brine injectors, emulsifying machines, and ice flakers).

In terms of application, fresh processed meat segment to command 25.0% share in the meat processing equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tea Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Seed Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Sand Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Wine Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fish Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Equipment Market - Size, Share, and Forecast Outlook 2025 to 2035

Wafer Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fruit Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Dairy Processing Equipment Market Outlook – Growth, Demand & Forecast 2023-2033

Cotton Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Bakery Processing Equipment Market Analysis by Product Type, End User, Application & Region: A Forecast for 2025 and 2035

Mineral Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Bioprocessing Analytics Equipment Market Size and Share Forecast Outlook 2025 to 2035

Poultry Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Beverage Processing Equipment Market Size, Growth, and Forecast 2025 to 2035

Chocolate Processing Equipment Market Size, Growth, and Forecast 2025 to 2035

Ice Cream Processing Equipment Market Growth - Trends, Demand & Innovations 2025 to 2035

Shale Gas Processing Equipment Market

Upstream Bioprocessing Equipment Market - Growth, Trends & Forecast 2025 to 2035

Animal Feed Processing Equipment Market Analysis & Forecast by Function, Feed Type, End-User, Automation, and Region through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA