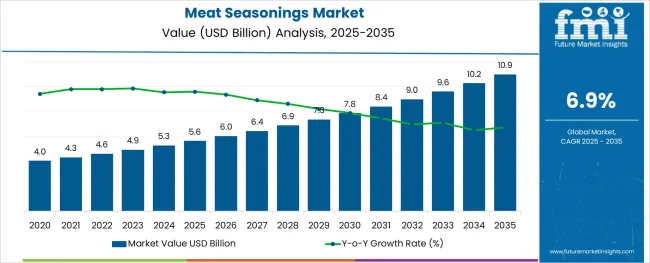

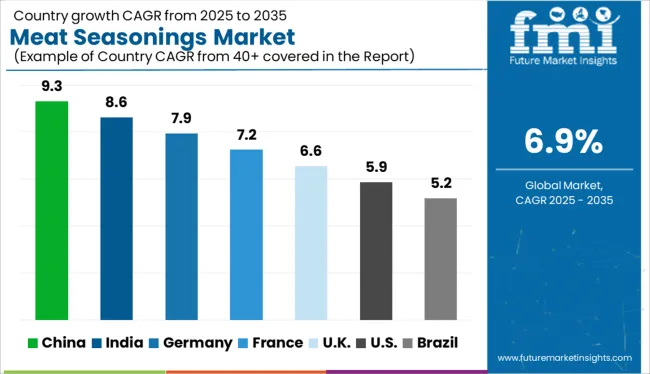

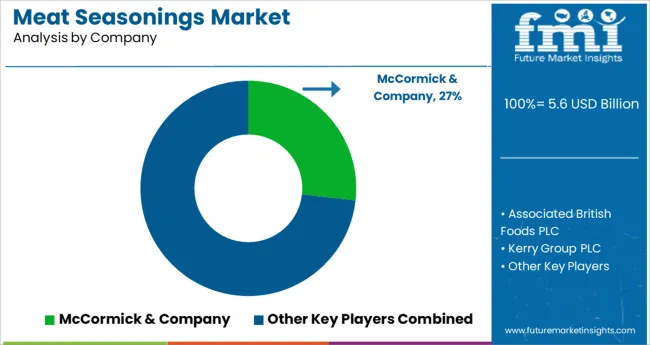

The Meat Seasonings Market is estimated to be valued at USD 5.6 billion in 2025 and is projected to reach USD 10.9 billion by 2035, registering a compound annual growth rate (CAGR) of 6.9% over the forecast period.

The meat seasonings market is expanding steadily as consumer demand grows for flavorful and convenient meat and poultry products. Industry insights indicate an increasing preference for seasonings that enhance taste while meeting clean-label and natural ingredient trends. The packaged food industry continues to develop new ready-to-cook and ready-to-eat meat products, fueling the need for diverse seasoning blends.

Rising urbanization and changing lifestyles have led to higher consumption of processed meat items that rely heavily on quality seasoning for product differentiation. Additionally, manufacturers are innovating with functional seasonings that provide not only flavor but also preservation benefits.

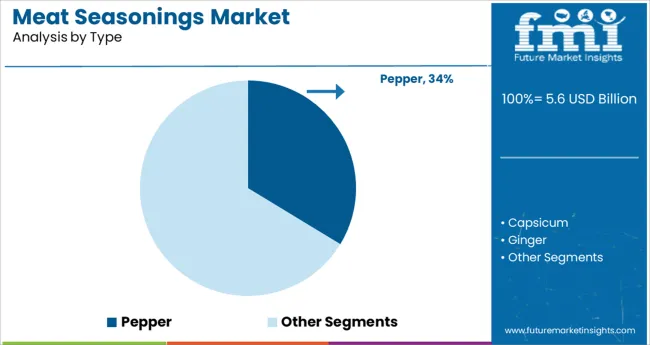

Regulatory emphasis on food safety and quality standards has encouraged the adoption of reliable seasoning solutions. Looking forward, the market is expected to grow through product innovations, expanded application in meat processing, and rising packaged food consumption globally. Segment growth is led by the Pepper type, dominant in seasoning blends, meat and poultry products as the primary application, and the packaged food industry as the largest end-use segment.

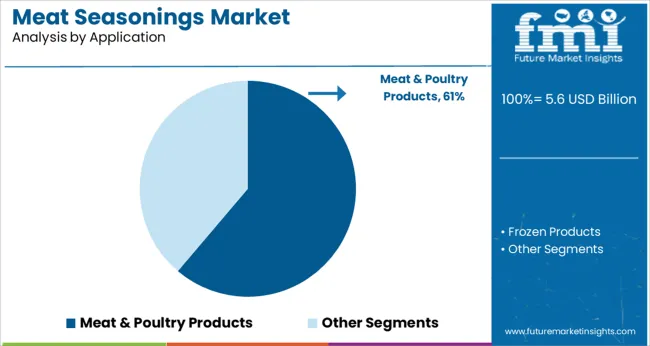

The market is segmented by Type, Application, and End Use and region. By Type, the market is divided into Pepper, Capsicum, Ginger, Cinnamon, Cumin, Turmeric, Nutmeg & Mace, Cardamom, Coriander, Cloves, and Others. In terms of Application, the market is classified into Meat & Poultry Products and Frozen Products.

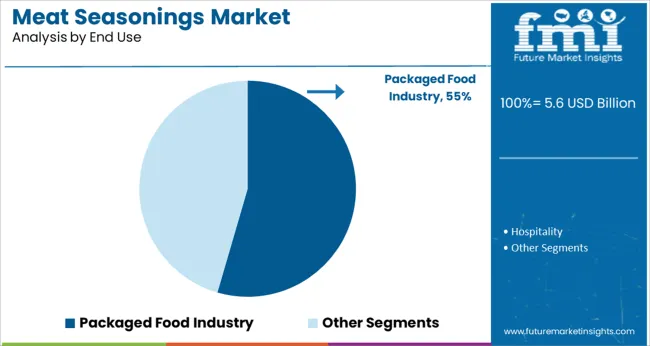

Based on End Use, the market is segmented into Packaged Food Industry and Hospitality. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Pepper segment is expected to hold 33.7% of the meat seasonings market revenue in 2025, maintaining its leadership among seasoning types. Pepper is valued for its robust flavor profile that complements a wide variety of meat and poultry products. Its versatility in cooking methods ranging from grilling to roasting has sustained its popularity.

Additionally, pepper’s natural preservative qualities have been appreciated for enhancing shelf life without artificial additives. Consumer familiarity and acceptance, combined with its global availability, have contributed to the segment’s strong position.

As demand grows for authentic and bold flavors in meat seasoning blends, pepper remains a fundamental ingredient in seasoning formulations.

The Meat & Poultry Products segment is projected to account for 61.2% of the meat seasonings market revenue in 2025, solidifying its role as the primary application area. This segment benefits from the rising consumption of both fresh and processed meat products that require consistent seasoning for flavor and preservation.

The increasing popularity of marinated, pre-seasoned, and ready-to-cook meat products has heightened the importance of specialized seasoning blends tailored to different meats. Food manufacturers focus on improving sensory appeal and product shelf life, boosting seasoning usage.

Furthermore, evolving consumer taste preferences toward ethnic and spicy flavors have expanded seasoning varieties within this application. The segment’s growth is supported by continuous innovations and the expanding global meat market.

The Packaged Food Industry segment is projected to contribute 54.5% of the meat seasonings market revenue in 2025, retaining its dominant position among end uses. Growth in this segment is fueled by the increasing demand for convenience foods and ready-to-eat meals, where seasoning quality directly impacts consumer satisfaction.

The rise of retail chains and online grocery platforms has improved access to packaged meat products, accelerating market expansion. Manufacturers in this sector prioritize flavor consistency, product safety, and extended shelf life, making seasonings critical components.

Additionally, health-conscious trends have led to the development of seasoning blends with reduced sodium and natural ingredients, aligning with consumer preferences. As packaged meat consumption continues to rise globally, the Packaged Food Industry segment is expected to maintain its leading role in driving demand for meat seasonings.

Key factors which are boosting the sales of meat seasonings are the consumption of processed food. Also, the driving factor for the growth in the sales of meat seasonings is the usage of organic meat products. The organic poultry market is growing at a considerable rate. The increase in consumption of meat products in Latin America and Southeast Asia has further fueled the demand for meat seasonings.

Rising demand for pork meat, greater emphasis on processed meat and poultry products, and the rise in consumer preference toward protein-rich food have been the driving factor in sales of meat seasonings.

One of the major factors that have affected the demand for meat seasonings is the perceived health risk of eating meat. As USDA and other government agencies have put more energy toward promoting healthy lifestyles, new regulations for the supply of processed meat may impact the meat seasonings market.

Regarding geography, the meat seasonings market has been categorized into six critical regions, including North America, Europe, APEJ, Japan, Latin America, and the Middle East & Africa.

The demand for meat seasonings is expected to register a healthy CAGR during the forecast period due to the high demand for protein-rich food.

Regarding regions, North America accounts for a significant share of the meat seasonings market, owing to the high growth and need for a healthy eating regime in the region as compared to other developed regions.

Moreover, the North America region accounts for a healthy share in terms of consumption of meat products, meat seasonings being primarily used for the development of poultry products for further processed products because of its bland flavor and soft texture, which allow producers to imparting desired flavor profiles, the meat consumption in the region is anticipated to further add value to the sales of meat seasonings in the region.

In terms of the developing region of Asia-Pacific, the growth of the demand for meat seasonings is significantly high in the forecast period owing to factors such as rapid economic development, globalization, and increasing adoption of meat seasonings in the food & beverages industry and its sub-verticals.

Over the forecast period, the sales of meat seasonings in the Asia-Pacific market are anticipated to grow significantly, owing to the growth of the hotel industry in the region.

Overall, the global demand for meat seasonings is expected to increase considerably by the end of the forecast period. Sales of meat seasonings for the Asia Pacific region are also expected to witness rapid growth during the forecast period, primarily attributed to the growth of the food and beverage industry, especially in China and India. The meat seasonings market is growing at a faster rate and is expected to grow at a high CAGR in the forecasted years.

The main players in the meat seasonings market are focusing on producing more organic meat seasonings to suit consumer demand as well as creating novel meat seasoning products that can be used in a variety of meat food products. The major businesses are also searching for new prospects in the international food and beverage sector.

Few players identified in meat seasonings market are:

The businesses are heavily investing in research and development to create novel items that will raise both the quality and output of poultry meat and improve the sales of meat seasonings.

For instance, FONA International LLC was purchased by McCormick & Company in December 2024. In order to meet the needs of a wide range of clients in the food & beverage and nutritional markets, FONA, a leading maker of clean and natural flavours, offers solutions.

The report consists of key players, contributing to the meat seasonings market share. It also consists of organic and inorganic growth strategies adopted by market players to improve their market positions. This exclusive report analysis the competitive landscape and meat seasonings market share acquired by players to strengthen their market position.

| Report Attribute | Details |

|---|---|

| Growth rate | CAGR of 6.9% from 2025 to 2035 |

| Base year for estimation | 2024 |

| Historical data | 2020 to 2024 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in million and CAGR from 2025 to 2035 |

| Report coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis |

| Segments covered | Type, application, end use, region |

| Regional scope | North America; Western Europe; Eastern Europe; Middle East; Africa; ASEAN; South Asia; Rest of Asia; Australia and New Zealand |

| Country scope | USA, Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, Belgium, Poland, Czech Republic, China, India, Japan, Australia, Brazil, Argentina, Colombia, Saudi Arabia, UAE, Iran, South Africa |

| Key companies profiled | McCormick & Company; Associated British Foods PLC; Kerry Group PLC; Olam International Limited; Ajinomoto Co.; Inc; Ariake Japan Company; SHS Group; Dohler Group |

| Customization scope | Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. |

The global meat seasonings market is estimated to be valued at USD 5.6 billion in 2025.

It is projected to reach USD 10.9 billion by 2035.

The market is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types are pepper, capsicum, ginger, cinnamon, cumin, turmeric, nutmeg & mace, cardamom, coriander, cloves and others.

meat & poultry products segment is expected to dominate with a 61.2% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Meat Snacks Market Size and Share Forecast Outlook 2025 to 2035

Meat Alternative Market Forecast and Outlook 2025 to 2035

Meat, Poultry, and Seafood Packaging Market Size and Share Forecast Outlook 2025 to 2035

Meat Extracts Market Size and Share Forecast Outlook 2025 to 2035

Meat Trays Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Meat Interleaving Paper Market Size and Share Forecast Outlook 2025 to 2035

Meat Enzyme Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Meat Mixers Market Size and Share Forecast Outlook 2025 to 2035

Meat Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

Meat Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Meat Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Meat Mincers Market Size and Share Forecast Outlook 2025 to 2035

Meat Tenderizer Market Size and Share Forecast Outlook 2025 to 2035

Meat Starter Cultures Market Size and Share Forecast Outlook 2025 to 2035

Meat Based FPP Market Size and Share Forecast Outlook 2025 to 2035

Meat Dicing Machine Market Size and Share Forecast Outlook 2025 to 2035

Meat Substitutes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Meat Packaging Market Trends - Growth & Forecast 2025 to 2035

Meat Emulsions Market Growth - Demand & Industry Insights 2025 to 2035

Analyzing Meat Packaging Market Share & Industry Growth

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA