The meat alternative market is expanding rapidly, driven by rising consumer awareness of health, environmental, and ethical considerations associated with animal-based protein consumption. The demand for plant-based meat substitutes has surged due to evolving dietary preferences and the increasing availability of innovative product formats.

Advances in food technology have enhanced texture, flavor, and nutritional equivalence, bridging the gap between traditional meat and its alternatives. The market benefits from the growing presence of flexitarian consumers and supportive investments from major food manufacturers.

Global retail and foodservice channels are broadening distribution, further improving accessibility. As sustainability and clean-label trends continue to shape purchasing behavior, the meat alternative market is expected to witness sustained growth supported by technological innovation and expanding product portfolios.

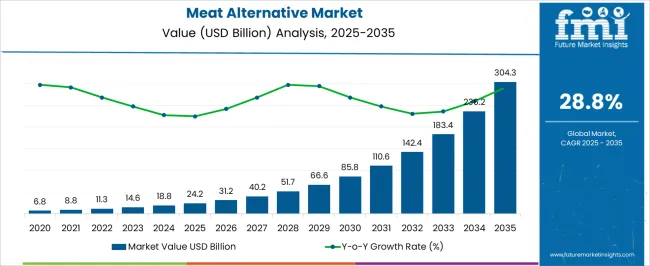

| Metric | Value |

|---|---|

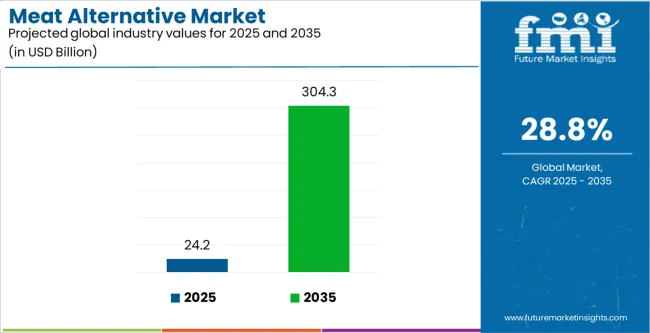

| Meat Alternative Market Estimated Value in (2025 E) | USD 24.2 billion |

| Meat Alternative Market Forecast Value in (2035 F) | USD 304.3 billion |

| Forecast CAGR (2025 to 2035) | 28.8% |

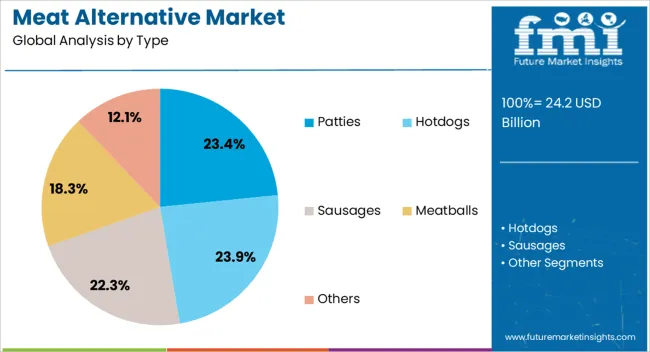

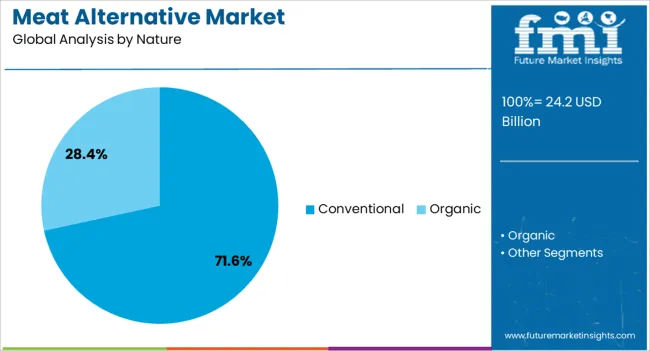

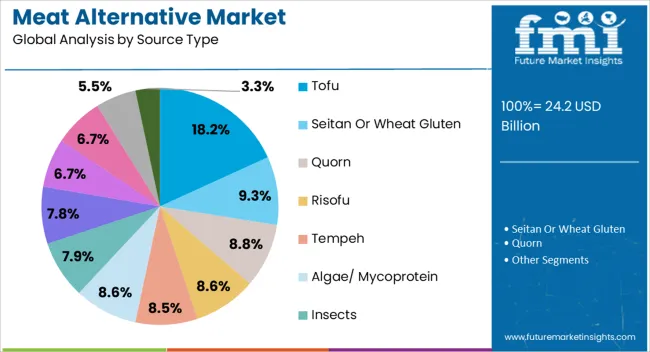

The market is segmented by Type, Nature, Source Type, Application, and Distribution Channel and region. By Type, the market is divided into Patties, Hotdogs, Sausages, Meatballs, and Others. In terms of Nature, the market is classified into Conventional and Organic. Based on Source Type, the market is segmented into Tofu, Seitan Or Wheat Gluten, Quorn, Risofu, Tempeh, Algae/ Mycoprotein, Insects, Textured Vegetable Protein, Fermented Proteins, Fish Protein, Cultured Or ‘Clean’ Meat, and Others (Yaso, Nato And Miso). By Application, the market is divided into Frozen Food, Bakeries, Pet Food, Supplements, and Others. By Distribution Channel, the market is segmented into Supermarkets, Departmental Store, Modern Trade, Food Chain Services, Online Stores, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The patties segment leads the type category with approximately 23.4% share, attributed to its strong acceptance as a direct substitute for traditional burger formats. Its familiarity, convenience, and high protein content have made it a preferred choice among consumers transitioning toward plant-based diets.

Manufacturers are leveraging extrusion and flavoring technologies to replicate the sensory experience of conventional beef patties, supporting repeat purchases. The segment also benefits from the widespread availability of plant-based patties in quick-service restaurants and retail chains.

Continuous product innovation focusing on cleaner ingredients and improved mouthfeel has reinforced its popularity. With increasing marketing investments and consumer familiarity, the patties segment is projected to retain its dominant market position.

The conventional segment dominates the nature category with approximately 71.6% share, supported by well-established production methods and cost-efficient ingredient sourcing. Conventional meat alternatives utilize widely available plant proteins such as soy, wheat, and pea, ensuring stable supply chains and scalability.

The segment’s strong retail presence and affordability have enabled mass-market penetration, particularly in price-sensitive regions. Manufacturers continue to optimize formulation and processing techniques to enhance taste and texture while maintaining competitive pricing.

Despite the growth of organic and premium alternatives, conventional products remain the backbone of the market due to their accessibility and familiarity. With consistent demand across mainstream consumers, this segment is expected to sustain its lead through the forecast horizon.

The tofu segment holds approximately 18.2% share in the source type category, representing one of the most established plant-based protein sources in the global market. Its long-standing presence in Asian and Western diets has supported steady consumption, particularly among health-conscious and vegetarian populations.

Tofu’s versatility across culinary applications and its favorable nutritional profile, rich in amino acids and low in saturated fat, have maintained its relevance in modern plant-based diets. Increased commercialization of tofu-based meat alternatives in frozen and ready-to-eat formats has expanded consumer reach.

The segment’s growth is reinforced by its simplicity, affordability, and compatibility with regional cuisines. With growing emphasis on traditional yet healthy protein sources, tofu is expected to continue holding a significant role in the meat alternative industry.

Reshaping Meat Industries with Innovative Meat Alternative Proteins

Technological advancements are expected to be a game-changer for meat alternative producers. A lot has been achieved in the past couple of years, with the development of mock meat, mycoprotein, and impossible burgers, which has paved a path for plant-based meat out of the trough.

Previously available meat alternatives did not taste or look like meat, despite their name. However, with an increase in research and development in the meat alternative market several new and unique products have been introduced. The availability of clean-label and plant-based products in the market such as tofu, tempeh, TVP, seitan, Quorn, soy, and wheat are the best meat alternatives.

Making Gluten-free, Sustainable Lifestyle a Reality

A growing number of vegans and flexitarians is projected to drive the market’s growth. A substantial portion of the population is focused on restraining animal protein consumption and more than 50% aim to make this a lasting change. The consumption of vegan food is ubiquitous like in restaurants, grocery stores, bakeries, and vegan lunches at school and home. The rise in the use of meat alternatives to support the trend of a gluten-free, sustainable lifestyle is inevitable.

The table below sheds a light on the growth opportunities in the selected countries.

| Countries | CAGR |

|---|---|

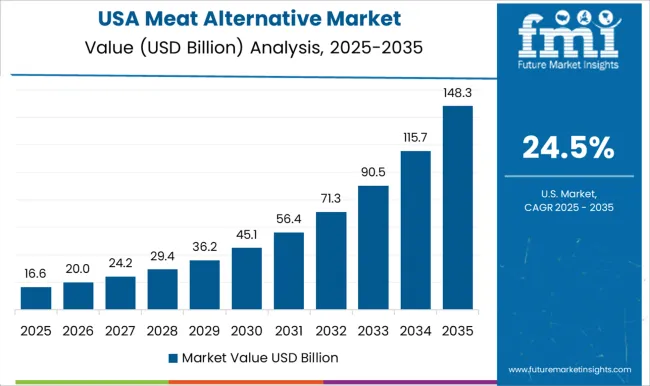

| United States | 10.3% |

| United Kingdom | 8.1% |

| China | 6.2% |

| India | 3% |

| Japan | 2.4% |

India has exhibited positive trends in the expansion of the manufacturing base of meat alternatives due to the 100% FDI opportunity in the food processing industry, while the consumer market is largely driven by rising health concerns and veganism vogue.

Indian diet is deficient in protein despite producing protein-rich foods like legumes, soybeans, beans, dairy, meat, fish, and poultry. Plant-based protein sources can play a vital role in the treatment of deficiency because they are not only diverse but also easy to use.

India has a sizeable consumer base and a significant market share. This country is also expected to have fast growth during the forecast period, owing to an increase in demand for vegan products. The government has taken major steps to increase the market share of meat alternatives. In the future, plant-based meat analogs and cultured meat are expected to emerge as promising protein sources to develop meat alternatives.

Meat and dairy products are staples of the Western diet, but there has been a shift from an animal meat-based diet to a plant-based one due to rising health concerns like obesity, high cholesterol levels, heart risk, and even cancer. Seeking a healthy alternative to meat, and veganism are drivers for the meat alternative market in the United States in recent years.

Various big companies and start-ups have taken steps to drive the market towards meat alternative products. For example, KFC introduced Beyond Fried Chicken, a line of plant-based meats, in several locations across the world. The data shows a surety of the rising meat alternative market in the United States.

Industrialization in China has increased discretionary income for the region's middle classes. This has increased consumer demand for nutritious, high-quality, high-protein food products. Consumer eating habits are changing, and more people are removing meat from their diets.

Food products like wheat, soybeans, and peas can easily be incorporated into classic Chinese dishes like dumplings and rolls and are significantly cheaper. As a result, the increased demand for meat alternatives in the region has driven the meat Alternative market trend.

A busy lifestyle drives the popularity of meat alternatives for its convenience, especially with the rise in global culinary trends. The foodservice industry benefits from the efficiency of using pre-prepared meat alternatives. Increased accessibility through supermarkets and online platforms contributes to the growth in sales revenue.

In Japan, manufacturers are focusing on innovation and marketing efforts to meet consumer preferences, while e-commerce facilitates easy access. The acceptance of meat alternatives in Japan is influenced by culinary trends, convenience, and competitive pricing, supported by favorable trade policies, local customization, and adherence to culinary traditions.

| Top Source Type | Tofu |

|---|---|

| Market Share in 2025 | 14.2% |

The tofu segment is estimated to garner a market share of 14.2% in 2025. Tofu is the first choice of consumers seeking cheaper plant-based meat alternatives. Increasing demand for classic vegetarian staples such as tofu is anticipated to compel manufacturers to come up with their frozen variants.

| Top Distribution Channel | Online Sales Channel |

|---|---|

| Market Share in 2025 | 17.3% |

The online sales channel is projected to account for a 17.3% market share in 2025. People are increasingly opting for online channels to make their food-related purchases due to access to a wider product range from different brands on a fingertip.

Home delivery convenience offered by online platforms is particularly appealing factor for busy people. Thus, the target segment is poised to witness significant growth through 2035.

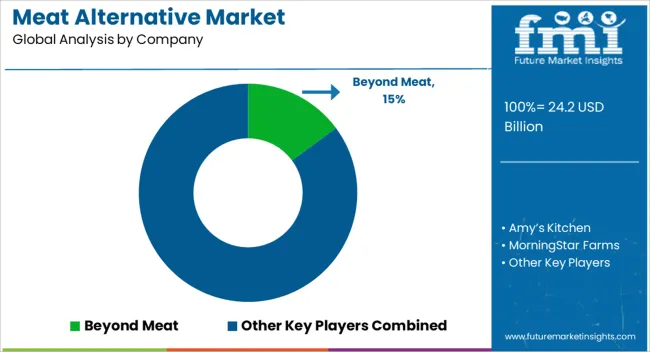

Market players are emphasizing the innovation of plant-based meat alternatives as they gain consumers’ perspectives on the constant need for change. To distinguish themselves from the crowd, top companies are narrowing down their focus on the taste, texture, and dietary requirements of customers, like providing gluten-free, low-fat, and allergen-free options.

Industry participants are further investing in marketing and brand building to increase their recognition power among potential customers. Adding onto this, brands are strengthening their ties with different distributors to ensure wide visibility on store shelves.

To make the shift towards meat alternatives easy, market players are competitively pricing their offerings so that price doesn’t remain the issue while choosing vegetarian substitutes for meat.

Recent Developments in the Meat Alternative Market

The global meat alternative market is estimated to be valued at USD 24.2 billion in 2025.

The market size for the meat alternative market is projected to reach USD 304.3 billion by 2035.

The meat alternative market is expected to grow at a 28.8% CAGR between 2025 and 2035.

The key product types in meat alternative market are patties, hotdogs, sausages, meatballs and others.

In terms of nature, conventional segment to command 71.6% share in the meat alternative market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Soy-Based Meat Alternative Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Demand for Alternative Protein Meat Extenders with Shelf-life Control in CIS Size and Share Forecast Outlook 2025 to 2035

Meat Snacks Market Size and Share Forecast Outlook 2025 to 2035

Meat, Poultry, and Seafood Packaging Market Size and Share Forecast Outlook 2025 to 2035

Meat Extracts Market Size and Share Forecast Outlook 2025 to 2035

Meat Trays Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Meat Interleaving Paper Market Size and Share Forecast Outlook 2025 to 2035

Meat Enzyme Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Meat Mixers Market Size and Share Forecast Outlook 2025 to 2035

Meat Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

Meat Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Meat Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Meat Mincers Market Size and Share Forecast Outlook 2025 to 2035

Meat Tenderizer Market Size and Share Forecast Outlook 2025 to 2035

Meat Starter Cultures Market Size and Share Forecast Outlook 2025 to 2035

Meat Based FPP Market Size and Share Forecast Outlook 2025 to 2035

Meat Dicing Machine Market Size and Share Forecast Outlook 2025 to 2035

Meat Seasonings Market Size and Share Forecast Outlook 2025 to 2035

Meat Substitutes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Meat Packaging Market Trends - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA