The soy-based meat alternative market is projected to grow from USD 6.3 billion in 2025 to USD 16.8 billion by 2035, with a CAGR of 10.3%.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 6.3 billion |

| Industry Value (2035) | USD 16.8 billion |

| CAGR (2025 to 2035) | 10.3% |

Reformulation efforts have reduced sodium content by up to 22% across leading SKUs while maintaining price points below USD 4.50 per unit in key markets. Over 65% of new product launches in 2023 to 2025 have focused on minced, patty, or nugget formats, reflecting high-volume retail and QSR demand.

Contract manufacturing facilities in Vietnam, Poland, and Serbia have increased throughput by 18-25% over the last two years, responding to expanded private-label orders from EU and APAC-based retailers. More than 40% of current global soy protein sourcing now involves identity-preserved or non-GMO streams, reflecting growing traceability mandates in North America and Europe.

Published on September 11, 2023, by USA Soy in sponsored content titled “Soy protein innovation drives new opportunity in plant-based foods”, the article highlights consumer preferences and ingredient advancements. A United Soybean Board survey in August 2023 found 64% of consumers prioritize taste in plant-based meat alternatives.

David Sabbagh of IFF emphasized that taste and texture remain non-negotiable for most consumers. IFF’s SUPRO® TEX 7110 was introduced as a soy-based ingredient mimicking whole-muscle meat textures. The report also underscored supply reliability from USA-grown soybeans, with Mac Marshall of the United Soybean Board citing rising global demand for their consistency and quality.

Soy-based meat alternatives hold varying shares across related parent industries. In the plant-based meat sector, soy accounts for around 45% of global consumption due to its established use and processing flexibility. Within the meat substitutes industry, its share is estimated at approximately 39%, supported by its availability and price advantage over newer ingredients.

In the soy-based food category, meat substitutes make up nearly 89% of the segment’s value, indicating concentrated demand in this application. In the broader edible plant protein market, soy remains one of the primary ingredients, though precise figures vary. Within the alternative protein landscape, which includes fermentation and cell-based sources, soy-based options contribute between 35% and 50% based on volume and commercialization levels.

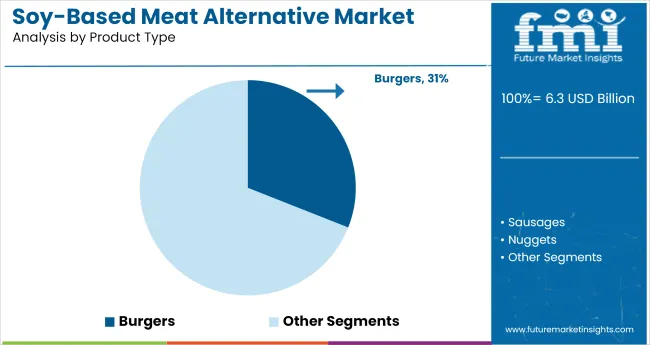

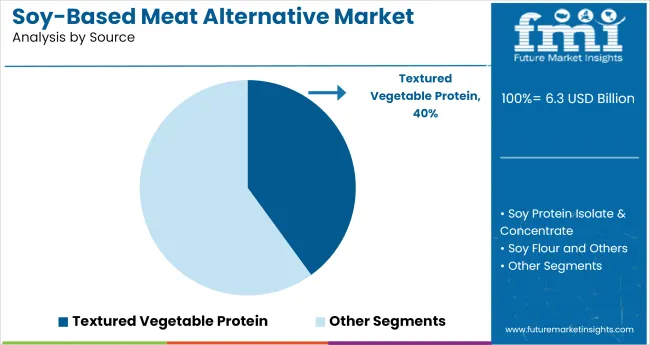

The industry is segmented by product type into burgers, nuggets, sausages, and others. By source, it includes textured vegetable protein (TVP), soy protein isolate, soy flour, and other soy derivatives.

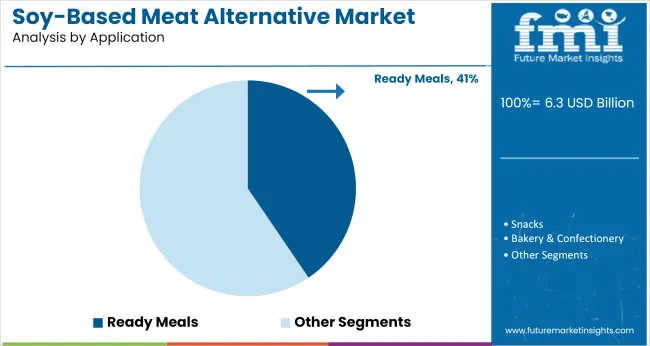

By application, the industry includes ready meals, frozen food products, snack formats, and foodservice applications. Regional analysis includes North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and Middle East & Africa.

Soy-based burgers are forecast to hold 31% of the product type segment in 2025. Their format familiarity supports higher trial and repeat purchases, especially in North America and Europe. Brands such as Impossible Foods and Beyond Meat popularized the segment, but affordability and formulation stability have shifted attention to soy inputs.

Nestlé’s Garden Gourmet line in Europe and Gardein by Conagra in the USA now offer soy-based burger patties for both retail and foodservice. Asian players like OmniFoods and Zhenmeat have also launched soy-centric patties tailored to local palates.

TVP is expected to contribute 40% to the source segment in 2025. Its adaptability across mince, chunk, and strip forms makes it a manufacturing staple. Companies such as Archer Daniels Midland (ADM), CHS Inc., and Wilmar International have vertically integrated supply chains to ensure steady TVP availability.

ADM's ProFam line is widely used in institutional applications, while small-scale co-packers in Brazil and India use domestic soy to reduce costs. Thai Union has entered the space via foodservice partnerships focused on TVP meal kits.

Ready meals are expected to account for 40.5% of application share in 2025. Soy’s texture retention and low rehydration cost make it a default base for ready-to-eat formats. Nestlé, through its Maggi and Lean Cuisine sub-brands, integrates soy meat into microwavable entrees.

Hain Celestial's Linda McCartney brand leads soy-based lasagna and bolognese offerings in the UK. CP Foods in Thailand and Bonduelle in France have adapted soy for Asian and European ready-meal kits. These companies focus on volume, packaging stability, and institutional alignment.

The soy-based meat alternative industry is undergoing structural shifts, with manufacturers favoring vertically integrated soy processing and extrusion-based production to control input costs. Retailers are simplifying assortments under private labels, using bulk contracting to retain margins. Legacy soy-processing regions are driving capacity utilization for scalable, cost-efficient protein formats.

Protein-Rich Meat Alternative Gains Nutritional Validation

Clinical research and commercial trials have driven renewed momentum for soy-based meat analogues in industries. Nutrition-focused campaigns around plant protein completeness are prompting buyers to choose soy over newer, costlier ingredients. Specialty retail performance and consumer repurchase rates have improved steadily, as soy-based SKUs prove adaptable for both refrigerated and shelf-stable formats.

Margin Pressure from Commodity Volatility and Processing Costs

Soy-based meat alternative producers are confronting cost shocks across raw material procurement, energy-intensive extrusion, and import logistics. Free-on-board pricing for bulk soy flour has risen, while freight volatility, especially from Brazil and India, is prompting reconsideration of sourcing strategies. Smaller players have absorbed losses, while larger firms renegotiate contracts to retain margins.

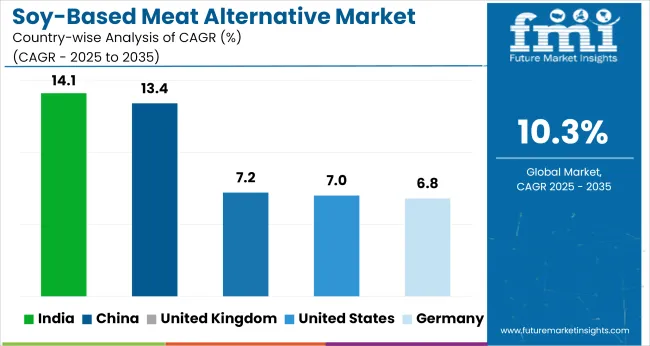

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 14.1% |

| China | 13.4% |

| United Kingdom | 7.2% |

| United States | 7.0% |

| Germany | 6.8% |

Global demand for soy-based meat alternatives is expected to grow at a 10.3% CAGR between 2025 and 2035. India leads the group at 14.1%, outperforming the global average by nearly four percentage points. Rising protein consumption, soy processing cluster expansion, and pricing parity with poultry in parts of western and southern regions are contributing to the surge.

China follows at 13.4%, where consumption is rising across institutional catering, retail chains, and ready-to-heat formats. BRICS economies are now outperforming legacy producers in both volume and growth.

The United States, United Kingdom, and Germany trail the global average. The USA CAGR of 7.0% reflects stagnation in frozen alt-meat categories and slowing repeat purchases due to ingredient scrutiny. The United Kingdom, at 7.2%, shows volume constraints in chilled and ambient channels, with fewer new SKUs launched in recent years. Germany posts 6.8%, slowed by private-label rationalization and increased preference for hybrid meat formats.

The report covers detailed analysis of 40+ countries and the top five countries have been shared as a reference.

Sales of soy-based meat alternative in United States are growing at a CAGR of 7.0% from 2025 to 2035. This growth is driven by product reformulation and the rising number of flexitarian consumers who prefer plant-based substitutes. Companies such as Beyond Meat and Impossible Foods are revolutionizing the plant-based meat industry, while Whole Foods and Walmart have significantly increased their availability of soy-based alternatives.

The shift toward plant-based diets in the USA is further fueled by concerns over health risks associated with traditional meat consumption, including obesity and cardiovascular diseases. As the demand for healthier options increases, the industry for soy-based products is expanding, particularly in the form of soy burgers, sausages, and plant-based meatballs.

Demand for the soy-based meat alternative in the United Kingdom is expanding at a CAGR of 7.2% from 2025 to 2035. The rise in flexitarian diets is driving this growth, with an increasing number of UK consumers reducing their meat consumption due to health and environmental concerns.

Companies like Tesco and Sainsbury's have expanded their plant-based offerings, while brands such as Quorn and Alpro are leading the industry with soy-based alternatives. These alternatives are highly sought after by consumers looking for nutritious food options. Furthermore, the UK’s growing focus on clean-label products and organic food has been a significant driver in increasing consumer demand for soy-based products.

The soy-based meat alternative market in China is set to grow at a robust CAGR of 13.4% from 2025 to 2035. The industry is driven by traditional soy consumption, including products like tofu and soy milk, alongside a growing interest in plant-based diets. Companies such as Hubei Jinqiao and VeganHut have emerged as strong players, offering soy-based meat alternatives tailored to local tastes.

As health awareness increases among consumers and government programs encourage dietary shifts, demand for soy-based alternatives continues to accelerate. International brands like Beyond Meat have entered the industry, contributing to greater awareness and adoption of plant-based products.

Sales for soy-based meat alternative in India are forecasted to grow at an exceptional CAGR of 14.1% from 2025 to 2035. The demand is rising due to increased awareness of health and dietary preferences. India has a large vegetarian population, with soy-based products such as soy kebabs and soy milk being staple foods.

Local brands like GoodDot and Veggie Champ are gaining traction, providing soy-based meat alternatives that cater to the Indian palate. Moreover, urban growth and a rise in disposable incomes are enabling broader access to plant-based products in cities. The demand is further supported by India’s growing interest in reducing meat consumption due to concerns over health and environmental impacts.

Demand for soy-based meat alternative in Germany is projected to expand at a CAGR of 6.8% from 2025 to 2035. Germany has long been a leader in plant-based food consumption, with an increasing number of consumers seeking clean-label and organic options. Companies like Taifun and Veganz are capitalizing on the market by providing high-quality, organic soy-based meat alternatives.

Germany’s strong food culture and emphasis on health are key drivers of this demand. Consumers are more conscious of their environmental footprint, and many prefer soy-based alternatives to meat due to their perceived health benefits and reduced environmental impact. This shift is supported by Germany’s stringent food labeling laws, which emphasize transparency and ethical sourcing.

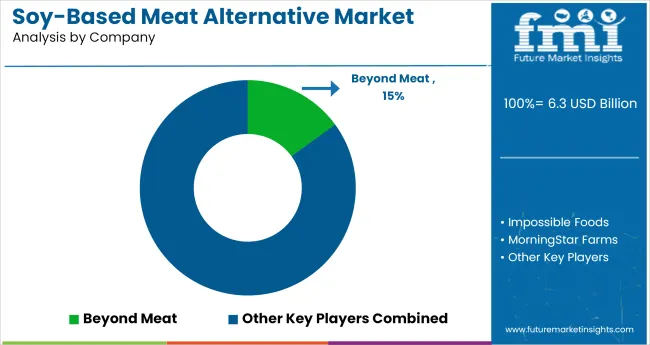

Leading Company - Beyond Meat Industry Share - 15%

In the soy-based meat alternative market, companies are expanding through ingredient innovation, retail penetration, and hybrid protein formats. Beyond Meat, Impossible Foods, and MorningStar Farms dominate with soy-based burgers and crumbles across major supermarkets and foodservice chains.

European players like Quorn, The Vegetarian Butcher, and VBites focus on soy-enhanced deli lines, appealing to ethical and flexitarian consumers. Amy’s Kitchen and Tofurky cater to frozen aisle buyers in North America. Emerging brands such as Prime Roots, Redefine Meat, and Sunfed are innovating with soy fermentation and 3D-printed textures.

Maple Leaf Foods and Unilever use regional sourcing to optimize cost. Competitive advantage now depends on clean-label soy sourcing, co-manufacturing partnerships, and culinary adaptability across retail, QSRs, and prepared food channels.

Recent Soy-based Meat Alternative Industry News

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 6.3 billion |

| Projected Industry Size (2035) | USD 16.8 billion |

| CAGR (2025 to 2035) | 10.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million metric tons for volume |

| Product Types Analyzed (Segment 1) | Burgers, Sausages, Nuggets, Meatballs, Deli Slices, Crumbles |

| Sources Analyzed (Segment 2) | Textured Vegetable Protein, Soy Protein Isolate & Concentrate, Soy Flour and Others |

| Applications Analyzed (Segment 3) | Ready Meals, Snacks, Bakery & Confectionery, Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Others |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Beyond Meat, Impossible Foods, MorningStar Farms, Quorn Foods, The Vegetarian Butcher, VBites Foods Ltd, Amy’s Kitchen, Tofurky (Conagra Brands), Prime Roots, Redefine Meat Ltd, Sunfed, Maple Leaf Foods, Unilever |

| Additional Attributes | Dollar sales, share by product and distribution channel, growth in ready-meal and QSR demand, rising use of textured vegetable protein in large-scale production, soy reformulations for sodium reduction, regional sourcing shifts for soy protein |

The indusrtry includes burgers, sausages, nuggets, meatballs, deli slices, and crumbles.

The segmentation is into textured vegetable protein, soy protein isolate & concentrate and Soy Flour and Others.

The segments include ready meals, snacks, bakery & confectionery, and others.

The industry is segmented as North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific and Others.

The industry is projected to reach USD 16.8 billion by 2035.

The industry is expected to grow at a CAGR of 10.3% from 2025 to 2035.

Burgers are expected to dominate with a 31.0% share in 2025.

The industry is estimated to reach USD 6.3 billion in 2025.

South Asia, led by India, is expected to be the key growth region with a projected CAGR of 14.1%.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Meat Alternative Market Forecast and Outlook 2025 to 2035

Demand for Alternative Protein Meat Extenders with Shelf-life Control in CIS Size and Share Forecast Outlook 2025 to 2035

Meat Snacks Market Size and Share Forecast Outlook 2025 to 2035

Meat, Poultry, and Seafood Packaging Market Size and Share Forecast Outlook 2025 to 2035

Alternative Lending Platform Market Size and Share Forecast Outlook 2025 to 2035

Alternatives For Injectable Diabetes Care Market Size and Share Forecast Outlook 2025 to 2035

Alternative Fuel Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Meat Extracts Market Size and Share Forecast Outlook 2025 to 2035

Meat Trays Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Meat Interleaving Paper Market Size and Share Forecast Outlook 2025 to 2035

Meat Enzyme Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Meat Mixers Market Size and Share Forecast Outlook 2025 to 2035

Meat Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

Meat Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Meat Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Meat Mincers Market Size and Share Forecast Outlook 2025 to 2035

Alternative Protein Production Equipment Market Size and Share Forecast Outlook 2025 to 2035

Meat Tenderizer Market Size and Share Forecast Outlook 2025 to 2035

Meat Starter Cultures Market Size and Share Forecast Outlook 2025 to 2035

Alternative Proteins for Pets Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA