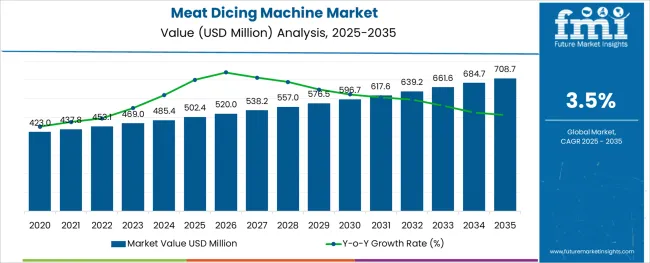

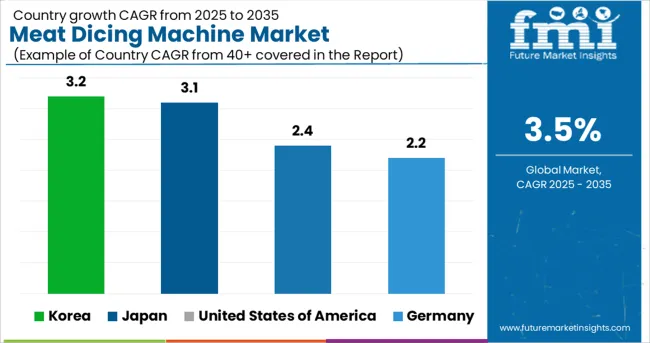

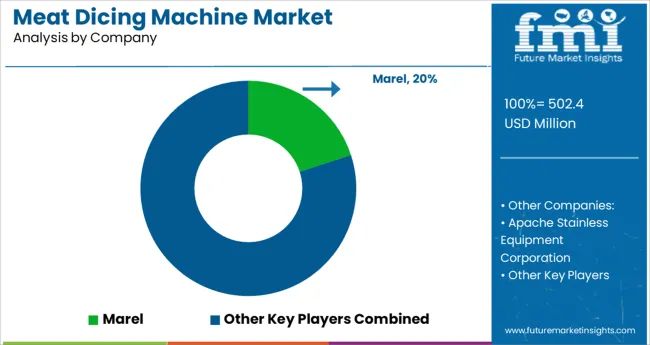

The Meat Dicing Machine Market is estimated to be valued at USD 502.4 million in 2025 and is projected to reach USD 708.7 million by 2035, registering a compound annual growth rate (CAGR) of 3.5% over the forecast period.

The meat dicing machine market is experiencing notable growth as demand for precise, efficient, and hygienic meat processing solutions intensifies across the global food industry. Rising consumer preference for ready-to-cook and portion-controlled meat products is compelling processors to adopt advanced dicing technologies that ensure uniformity and quality.

Automation in meat processing facilities is being prioritized to reduce labor costs, enhance throughput, and comply with stringent food safety standards. Growth opportunities are expected to be fueled by technological innovations in cutting mechanisms, integration of smart control systems, and expanding cold-chain infrastructure.

Furthermore, the increasing emphasis on operational efficiency, waste reduction, and scalability in meat processing plants is paving the path for the adoption of sophisticated dicing machines capable of handling diverse meat types and high production volumes.

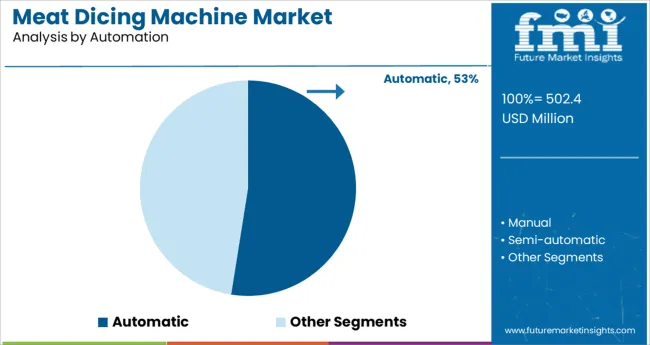

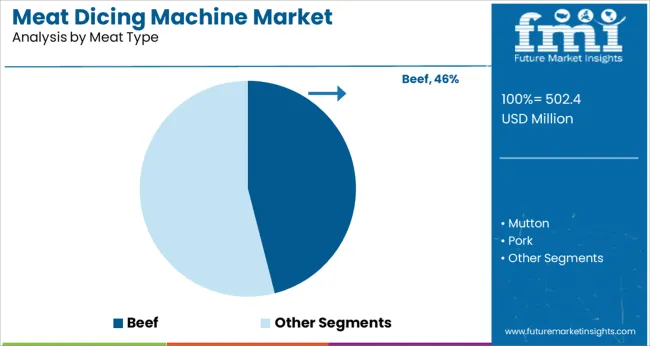

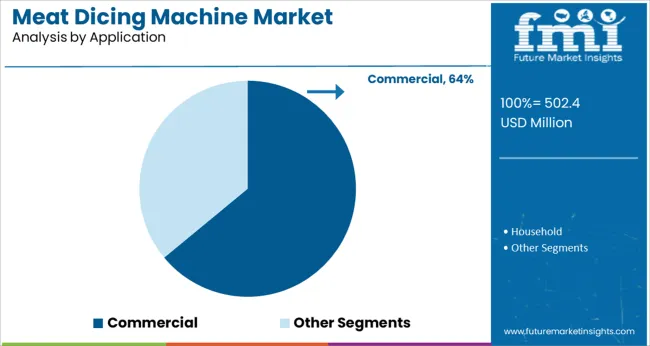

The market is segmented by Automation, Meat Type, and Application and region. By Automation, the market is divided into Automatic, Manual, and Semi-automatic. In terms of Meat Type, the market is classified into Beef, Mutton, and Pork. Based on Application, the market is segmented into Commercial and Household. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Automation, Meat Type, and Application and region. By Automation, the market is divided into Automatic, Manual, and Semi-automatic. In terms of Meat Type, the market is classified into Beef, Mutton, and Pork. Based on Application, the market is segmented into Commercial and Household. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by automation, the automatic segment is expected to account for 52.5% of the total market revenue in 2025, positioning it as the leading automation type. This dominance has been supported by the ability of automatic machines to deliver consistent precision and higher output with minimal human intervention, aligning with the industry’s focus on hygiene and efficiency.

Adoption has been driven by processors seeking to mitigate labor shortages while maintaining product consistency and compliance with food safety regulations. The integration of programmable settings, advanced sensors, and automated cleaning systems has enabled seamless operation and reduced downtime.

As operational cost savings and productivity gains continue to be prioritized, the automatic segment is set to maintain its stronghold within the market.

Segmented by meat type, the beef segment is projected to hold 46.0% of the market revenue in 2025, affirming its leadership among meat categories. This prominence has been underpinned by the high demand for diced beef in foodservice, retail, and industrial applications where portion control and uniformity are essential.

The ability of dicing machines to process beef efficiently while preserving texture and minimizing waste has enhanced their appeal to processors. Advancements in blade technology and machine robustness have further reinforced the segment’s dominance by enabling precise cuts even with tougher beef cuts.

The beef segment continues to benefit from sustained consumer demand for beef-based dishes and the need for consistent quality across large production volumes.

When segmented by application, the commercial segment is anticipated to capture 64.0% of the market revenue in 2025, securing its position as the foremost application domain. This leadership has been fueled by the extensive deployment of meat dicing machines in restaurants, hotels, catering services, and institutional kitchens that prioritize speed, hygiene, and quality.

Commercial users have increasingly favored dicing machines to meet the rising demand for ready-to-cook and portion-controlled meat offerings in high-volume settings. The segment’s growth has also been reinforced by its focus on efficiency gains, compliance with food handling standards, and the ability to adapt quickly to varying menu requirements.

Strong emphasis on consistent output and labor optimization within the commercial food sector continues to solidify this segment’s leading share in the market.

Consumers across the globe are getting indulged in hectic schedules with robust urbanization across developing countries. Inflating income levels are inculcating desires to consume ready-to-eat meat products or processed meat products amongst consumers. Therefore, a rising need to dice meat arises before further processing them, and this aspect is estimated to drive the sales of frozen meat dicing machines during the estimated period of study.

Increased expenditure on research and development activities has resulted in the development of new technologies, such as the integration of equipment for different purposes, including slicing, blending, and dicing, to save transfer costs and maintain hygiene levels. These trends are directly proportional to the rising market shares of meat-dicing machines through 2035.

After analyzing the market in-depth, the experts of FMI have unveiled that the meat dicing machine market has been witnessing an unprecedented surge in the past few years. There is an approximate rise of USD 502.4 million surge in the total market value from 2025 to 2025. The market during the period 2020 to 2025 registered a CAGR of 2.1%.

The market growth can be attributed to the rapidly increasing market size of fast-food outlets like Domino's, KFC, McDonald’s, and more, which are expanding their business across multiple countries, boosting the adoption of meat-dicing machines.

Besides this growth-propelling element prevailing in the forum, it has been identified by the analysts at FMI that there is an increased consumption of meat by athletes, and people worldwide are becoming very conscious about their health and hygiene. The beef meat dicing machine manufacturers are adhering to the concerns related to hygiene since the manual labor and dicing of meat by hand is getting eliminated, consumers are more inclined towards buying sliced and diced meat by machines, thereby impacting the market size of meat dicing machines in recent years.

Automatic Meat Dicing Machine - By Automation Type

It is identified that the automatic meat dicing machine segment is likely to dominate the automation category. This segment is anticipated to account for a steady pace of advancement, registering a CAGR of 4.5% through 2035. The segment accounted for a historical CAGR of 2.6% and is likely to hold favorable shares during the estimated study period. The factors responsible for the dominance of automatic meat dicing machines are:

Commercial Segment - By Application

The commercial meat dicing machine segment is projected to exert a positive influence in the global meat dicing machine market. The segment is transcending at a moderate pace of 3.8% CAGR during the forecast period and has registered a historical CAGR of 2.5% during the period 2020 to 2025. The factors responsible for the favorable advancement of this segment are as follows:

| Country | United States of America |

|---|---|

| Statistics | The USA meat dicing machine market is estimated to advance at a CAGR of 2.4% during the forecast period. This country is projected to touch a high of USD 708.7 million by the end of 2035. An approximate surge of USD 502.4 million has been witnessed from 2025 to 20502.4. Historical CAGR: 1.9% |

| Growth Propellants | The factors fueling market growth for dicing machines in the USA are:

|

| Country | Germany |

|---|---|

| Statistics | The meat dicing machine market in Germany has registered a steady pace of growth, with a 2.2% CAGR estimated during the forecast period. The country is currently accountable for a market valuation of USD 502.4 Million in 20502.4. There has been an approximate increase of USD 6 million from the base year to the current. Historical CAGR: 1.6% |

| Growth Propellants | The key elements contributing to the market growth in this European country are:

|

| Country | Japan |

|---|---|

| Statistics | The Japan meat dicing machine market is anticipated to advance at an average paced CAGR of 3.1% through 2035. The market valuation is projected to reach USD 41 million by the end of the forecast period and has witnessed a surge of USD 11 million from 2025 to 20502.4. Historical CAGR: 2.2% |

| Growth Propellants | The factors leading to the growth of the meat dicing machine in Japan are:

|

| Country | Korea |

|---|---|

| Statistics | The market in Korea is projected to advance at a CAGR of 3.2% during the forecast period and acquire substantial shares in the global meat-dicing market. |

| Growth Propellants | Factors owing to the growth of the market in Korea are:

|

The approach of New Entrants to Revamp the Meat Dicing Machine Landscape Through 2035

The new entrants in the meat dicing machine market are leveraging advancements in technology to launch new products and gain a competitive advantage. These firms are continually investing in research and development activities to keep themselves in tandem with the changing consumer preferences and end-use industry demands. Efforts are being made to strengthen their foothold in the forum and aid the further progression of the meat-dicing machines market.

Top Start-ups to Watch For

Prolific Machines - Cultured Meat Start-up

This start-up is ceding an entirely rare and innovative approach to curating meat and dicing them. They are incorporating the Henry Ford approach to cultivate meat using animal cells, assembling them into a structure of tissue that resembles the same meat we eat, and diversifying their range of meat saws for convenient handling.

Zaftec India - Meat Dicer Start-up

Zaftech Machines & Equipment offers industrial mincers which have been designed and developed over time based on the specific requirements of those working with these professional processing systems.

Robust, mechanically perfect, easy, and quick to dismantle and re-assemble for cleaning purposes - they are veritable production machines. The refrigerated versions highlight bonus features never before seen in similar machines: containment of bacterial load, absence of product oxidation, maintenance of sensory properties, etc.

Attempts of Key Players to Spur Demand for Meat Dicing Machines

The global market is highly competitive due to the presence of multinational and local participants. New product development with faster processing times and high hygiene levels is one of the key strategies adopted by market participants to expand their product offerings to reinforce their competitive positions in the market.

Meat dicing machine suppliers are also forming strategic partnerships with other industry players to develop machinery that can perform multiple tasks, such as chopping, slicing, blending, and dicing, together with sharing expertise for Research and Development and exploring new markets. Moreover, value chain integration is one of the important strategies adopted by market players.

Recently, Sharfen upgraded their meat-slicing machines. It is identified that Scharfen machines strive for clean and consistent processing of your slicing products with zero waste. Their scale settings enable perfect product handling, whether shaving turkey or slicing triple-thick cut bacon.

Recent Developments

The global meat dicing machine market is estimated to be valued at USD 502.4 million in 2025.

It is projected to reach USD 708.7 million by 2035.

The market is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types are automatic, manual and semi-automatic.

beef segment is expected to dominate with a 46.0% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Meat Snacks Market Size and Share Forecast Outlook 2025 to 2035

Meat Alternative Market Forecast and Outlook 2025 to 2035

Meat, Poultry, and Seafood Packaging Market Size and Share Forecast Outlook 2025 to 2035

Meat Extracts Market Size and Share Forecast Outlook 2025 to 2035

Meat Trays Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Meat Interleaving Paper Market Size and Share Forecast Outlook 2025 to 2035

Meat Enzyme Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Meat Mixers Market Size and Share Forecast Outlook 2025 to 2035

Meat Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

Meat Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Meat Mincers Market Size and Share Forecast Outlook 2025 to 2035

Meat Tenderizer Market Size and Share Forecast Outlook 2025 to 2035

Meat Starter Cultures Market Size and Share Forecast Outlook 2025 to 2035

Meat Based FPP Market Size and Share Forecast Outlook 2025 to 2035

Meat Seasonings Market Size and Share Forecast Outlook 2025 to 2035

Meat Substitutes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Meat Packaging Market Trends - Growth & Forecast 2025 to 2035

Meat Emulsions Market Growth - Demand & Industry Insights 2025 to 2035

Analyzing Meat Packaging Market Share & Industry Growth

Market Share Breakdown of Meat, Poultry, and Seafood Packaging Manufacturers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA