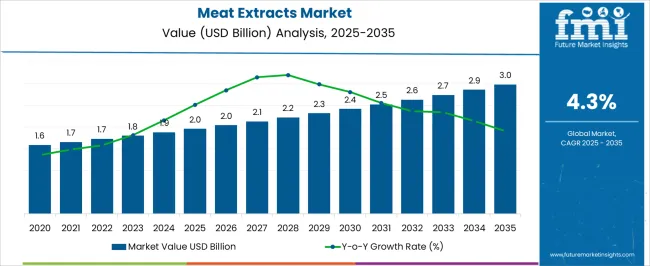

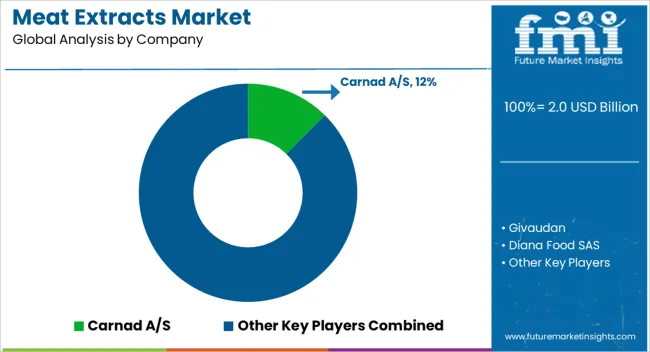

The meat extracts market is estimated to be valued at USD 2.0 billion in 2025 and is projected to reach USD 3.0 billion by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period.

The meat extracts market, valued at USD 2.0 billion in 2025 and projected to reach USD 3.0 billion by 2035 with a CAGR of 4.3%, is significantly influenced by regulatory frameworks governing food safety, labeling, and production standards. Regulations on allowable ingredients, processing methods, and microbial safety have a direct impact on market operations, as manufacturers must comply with stringent guidelines to ensure consumer safety. These regulations often necessitate investment in quality control systems, testing laboratories, and compliance documentation, which increases operational costs but also enhances product credibility.

Labeling requirements, including nutritional content, allergen warnings, and origin disclosures, affect product formulations and marketing strategies. Regulatory oversight on additives and preservatives can constrain ingredient selection, driving innovation toward natural, low-sodium, or preservative-free meat extracts to align with compliance standards. The international trade regulations and export certifications create barriers for market entry in certain regions, shaping supply chain strategies and affecting regional growth. Over the forecast period, regulatory changes are expected to continue shaping market dynamics.

Gradual alignment with global food safety standards, particularly in emerging markets, will encourage adoption of certified production processes and traceability systems. The regulatory landscape exerts both protective and restrictive effects, enforcing quality and safety while influencing cost structures, market entry, and product innovation throughout the ten-year horizon.

| Metric | Value |

|---|---|

| Meat Extracts Market Estimated Value in (2025 E) | USD 2.0 billion |

| Meat Extracts Market Forecast Value in (2035 F) | USD 3.0 billion |

| Forecast CAGR (2025 to 2035) | 4.3% |

The meat extracts market represents a specialized segment within the global food ingredients and flavoring industry, emphasizing concentrated protein, taste enhancement, and functional applications. Within the broader food ingredients sector, it accounts for about 3.6%, driven by demand from processed foods, ready-to-eat meals, and culinary applications. In the meat and protein derivatives industry, its share is approximately 4.2%, reflecting usage in soups, sauces, snacks, and seasoning blends. Across the flavor enhancers and condiments market, it holds around 3.1%, supporting taste intensification and product standardization.

Within the processed and convenience foods category, it represents 3.8%, highlighting adoption by food manufacturers seeking consistent flavor profiles. In the global savory and culinary solutions segment, the market contributes about 2.9%, emphasizing its role in enhancing palatability, protein content, and functional properties. Recent developments in the meat extracts market have focused on process optimization, high-quality protein extraction, and product diversification.

Innovations include natural, low-sodium, and concentrated formulations to meet evolving consumer preferences. Key players are investing in advanced extraction techniques, hygienic processing, and shelf-stable packaging to extend product usability and maintain flavor integrity. Strategic initiatives include collaborations with food manufacturers to develop ready-to-use and functional culinary solutions.

Growing interest in alternative protein blends, hybrid formulations, and clean-label products is shaping product innovation. The regulatory compliance and quality certification are being emphasized to ensure safety, traceability, and consistency. These trends demonstrate how efficiency, product innovation, and consumer-focused solutions are driving the market.

The meat extracts market is gaining traction due to its growing adoption in processed foods, culinary applications, and nutritional products. Rising consumer demand for protein-rich, flavor-enhancing ingredients is a key factor driving usage across ready meals, soups, sauces, and snacks. Meat extracts offer intense umami profiles, clean-label appeal, and long shelf life, making them ideal for both industrial and household use.

Market growth is also supported by innovations in extraction technologies that improve flavor retention and nutrient preservation without synthetic additives. Increased preference for natural ingredients over artificial flavorings has further boosted demand.

As the global foodservice industry recovers and expands, the need for high-quality, cost-effective meat-based ingredients is expected to rise. Future market dynamics will likely be shaped by growing convenience food consumption, expanding urban populations, and a rising focus on functional and fortified food ingredients

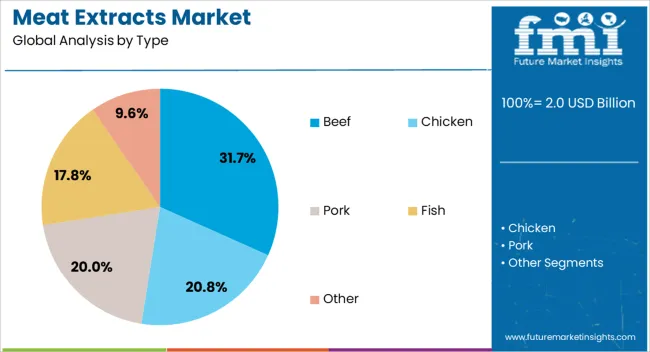

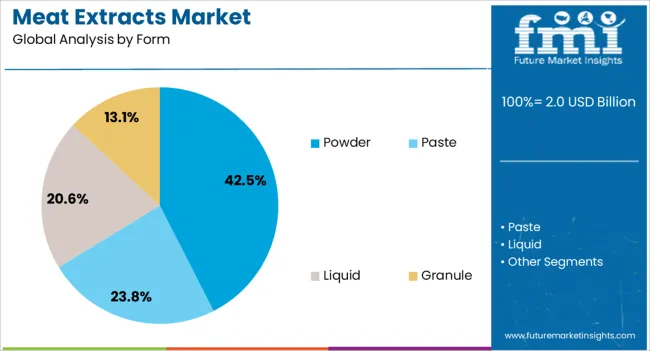

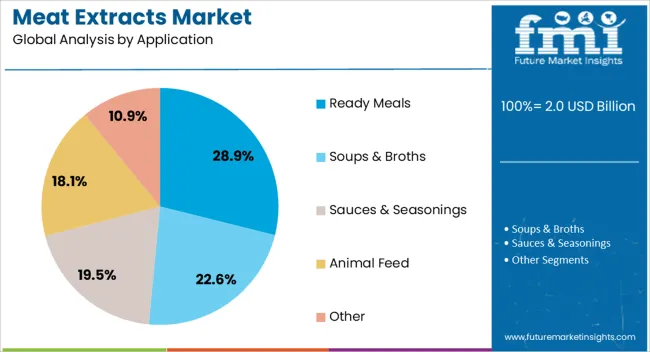

The meat extracts market is segmented by type, form, application, and geographic regions. By type, meat extracts market is divided into beef, chicken, pork, fish, and other. In terms of form, meat extracts market is classified into powder, paste, liquid, and granule. Based on application, meat extracts market is segmented into ready meals, soups & broths, sauces & seasonings, animal feed, and other. Regionally, the meat extracts industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The beef segment leads the type category with a 31.7% market share, reflecting its widespread use in imparting deep, savory flavors to a variety of food products. Known for its strong taste profile and high protein content, beef extract is favored in the preparation of broths, soups, gravies, and ready meals. Its popularity is sustained by its compatibility with global cuisine formats, especially in Western and Asian markets.

Beef extracts also provide nutritional value, making them suitable for both culinary and therapeutic applications. Manufacturers continue to invest in refining extraction processes to offer clean-label, preservative-free beef concentrates that align with evolving health-conscious consumer preferences.

Demand is further reinforced by the foodservice industry's reliance on consistent flavor delivery across large-scale production. The segment is expected to maintain strong momentum as product innovations and convenience-driven consumption trends persist

The powder form segment accounts for 42.5% of the meat extracts market, owing to its superior shelf stability, ease of transportation, and versatile usage in dry mixes and instant food formulations. Powdered meat extracts are preferred by manufacturers for their ability to integrate seamlessly into spice blends, seasoning packets, and dehydrated meal products without altering texture or moisture balance.

This format also allows for controlled dosage, minimal wastage, and improved storage economics, which are vital in large-scale food production. Demand is growing across both food processing and foodservice sectors, with an emphasis on ingredients that offer robust flavor profiles and natural origin claims.

Technological advancements in drying and encapsulation techniques have enhanced flavor retention and solubility, boosting product appeal. The segment is expected to see continued growth as powdered extracts become a staple in convenience foods and global distribution networks expand

Ready meals dominate the application category with a 28.9% share, driven by rising global consumption of convenient, time-saving food solutions that do not compromise on taste or nutritional value. Meat extracts serve as essential components in enhancing the flavor intensity and authenticity of ready-to-eat and frozen meals, making them a popular choice for food manufacturers.

Their role in delivering consistent taste profiles across large production batches is especially valued in mass-market products. The increasing demand for protein-enriched ready meals and ethnic cuisine variants has further accelerated usage of meat extracts in this segment.

Additionally, health-conscious consumers are gravitating toward natural flavoring solutions, prompting producers to substitute synthetic enhancers with meat-based alternatives. This segment is expected to witness sustained growth as busy lifestyles, urbanization, and dual-income households continue to drive reliance on pre-packaged meal solutions

The market has witnessed considerable growth due to increasing demand for concentrated flavors in food and beverage applications. Meat extracts, derived from beef, poultry, or other meats through heating and dehydration, are widely used as flavor enhancers, protein sources, and functional ingredients in soups, sauces, ready-to-eat meals, and snacks. The rising preference for natural and clean-label ingredients has increased their appeal among manufacturers aiming to improve taste profiles without synthetic additives. The advancements in extraction technology and packaging have improved shelf life and consistency, encouraging their incorporation into processed foods.

Meat extracts are increasingly utilized as natural flavoring agents to improve taste intensity and depth in processed foods, sauces, and ready-to-eat meals. Their concentrated form allows for the enhancement of savory notes without excessive use of raw meat, offering cost efficiency and consistency in large-scale production. Food manufacturers have leveraged meat extracts to create authentic flavors while adhering to clean-label demands. They are also applied in culinary applications such as stocks, bouillons, and seasoning powders, where they provide rich umami profiles and enhance consumer sensory experiences. With rising consumer interest in gourmet and premium ready-to-eat products, meat extracts have become integral in developing appealing flavors across various processed food categories.

Meat extracts are not only valued for flavor but also for their nutritional and functional properties. They provide proteins, amino acids, and minerals, contributing to the nutritional profile of processed foods and functional formulations. These extracts are applied in soups, broths, and meat-based snacks to enhance protein content while maintaining palatability. Functional applications include their use as emulsifiers, stabilizers, or binding agents in food processing. The ability to deliver both taste and nutrition has encouraged adoption in health-oriented and high-protein products. The meat extracts have been adapted for use in ready-to-eat meals, catering to consumers seeking convenient and nutrient-rich food options without compromising on flavor.

Technological advancements in extraction, dehydration, and concentration processes have strengthened the meat extracts market. Innovations such as low-temperature processing, vacuum evaporation, and spray-drying have improved flavor retention, nutritional quality, and product stability. These processes enable manufacturers to produce concentrated, standardized extracts with longer shelf life suitable for industrial-scale applications. Furthermore, packaging advancements such as vacuum-sealed pouches and aseptic containers have enhanced product safety and distribution efficiency. Industry players are investing in research and development to optimize extraction methods and create differentiated products, including specialty meat extracts targeting specific culinary applications. Such innovations have broadened the scope and versatility of meat extracts across global food manufacturing.

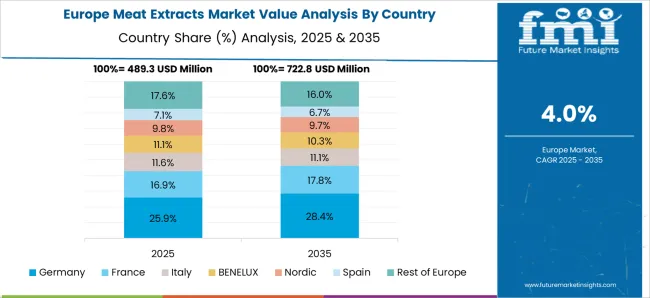

Asia Pacific leads the meat extracts market due to growing processed food consumption, expanding foodservice sectors, and increasing urban population. North America emphasizes clean-label and high-protein product development, driving the adoption of concentrated meat extracts. Europe focuses on premium culinary applications, convenience foods, and functional ingredients. Key market players concentrate on expanding production capacities, enhancing product quality, and strategic partnerships with food manufacturers to strengthen supply chains. Competitive strategies include diversification of extract types, innovation in processing technology, and regional distribution expansion. Regulatory compliance, quality certifications, and evolving consumer preferences continue to influence market growth and competition globally.

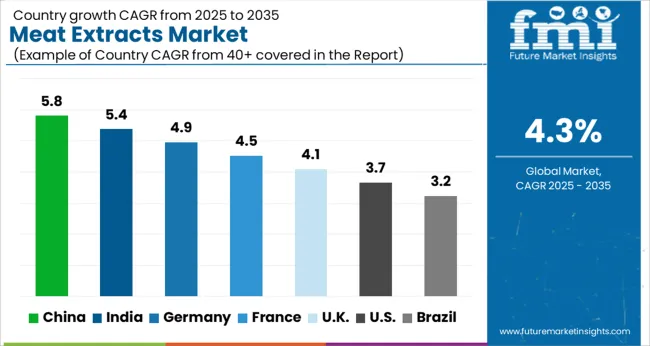

| Country | CAGR |

|---|---|

| China | 5.8% |

| India | 5.4% |

| Germany | 4.9% |

| France | 4.5% |

| UK | 4.1% |

| USA | 3.7% |

| Brazil | 3.2% |

The market is projected to grow at a CAGR of 4.3% between 2025 and 2035. China leads at 5.8%, driven by increasing demand for processed food products and protein-rich ingredients. India follows at 5.4%, supported by the expansion of food processing industries and rising culinary applications. Germany records 4.9%, reflecting high standards in food safety and consistent domestic consumption. The UK stands at 4.1%, benefiting from diversified food product innovations, while the USA at 3.7% shows steady growth through established manufacturing and retail channels. These trends indicate a consistent focus on quality, innovation, and efficiency in the market. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 5.8%, driven by increasing demand from processed food, convenience meals, and ready-to-eat product segments. Food manufacturers are integrating meat extracts to enhance flavor, protein content, and shelf life in soups, sauces, and snack products. The market is supported by rapid urban population clusters and evolving consumer preference for high-quality processed foods. Domestic producers collaborate with global suppliers to meet rising industrial requirements, while innovations in concentrated extracts and natural flavor formulations strengthen competitive positioning.

India is expanding at a CAGR of 5.4%, supported by rising packaged food consumption, increasing adoption in instant soups, sauces, and seasoning blends. Manufacturers focus on protein-enriched extracts suitable for industrial and retail applications. Regional preference for taste and convenience drives innovation in concentrated flavors and ready-to-use meat extracts. Partnerships between local producers and multinational companies are increasing product availability, while regulatory compliance ensures safe and high-quality offerings.

Germany is growing at a CAGR of 4.9%, driven by industrial food production, convenience meals, and processed meat sectors. The market emphasizes natural flavor extracts and protein enrichment to meet consumer preferences for quality and taste. Innovation in low-sodium and clean-label meat extracts is increasing, targeting health-conscious buyers. German companies, along with European partners, focus on efficient extraction technologies and compliance with strict food safety regulations.

The United Kingdom is projected to grow at a CAGR of 4.1%, influenced by increasing consumption of convenience foods, ready-to-eat meals, and sauces. Meat extracts are valued for their ability to enhance flavor, shelf life, and protein content. Food manufacturers are adopting natural and concentrated formulations to cater to evolving consumer taste and health trends. The market is supported by both domestic production and imports from European suppliers.

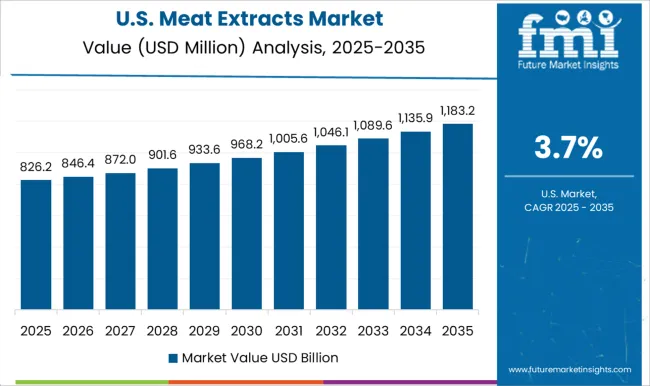

The United States is expanding at a CAGR of 3.7%, supported by widespread adoption in processed and convenience foods, snack items, and ready-to-eat products. Consumer preference for flavor-enhanced meals and protein-enriched products drives demand. Manufacturers are increasingly using natural extracts and high-quality concentrated solutions to improve product performance. Strategic partnerships with global suppliers facilitate consistent supply and innovation

The market is characterized by a blend of global ingredient manufacturers and specialized protein solution providers. Carnad A/S, Givaudan, and Diana Food SAS hold strong positions through extensive product portfolios, strong R&D capabilities, and established distribution channels that cater to food processing, seasoning, and flavoring industries worldwide. Their global presence and focus on high-quality, standardized meat extracts support brand loyalty and long-term contracts with large-scale food manufacturers.

Essentia Protein Solutions, BRF SA, and JBS S.A. compete by offering customizable meat extract solutions tailored to regional tastes and applications, leveraging expertise in protein concentration, clean-label formulations, and sustainable sourcing. Ajinomoto Co. Inc., Symrise AG, and Nikken Foods differentiate themselves through innovation in natural flavor enhancement, functional meat derivatives, and integration of bioactive peptides to meet evolving consumer preferences for health and nutrition.

Emerging market players like Haco Holding AG, Ariake Japan Co. Ltd, Maverick Biosciences, and Titan Biotech Ltd. focus on niche segments, organic or specialty meat extracts, and collaborations with food service providers. Increasing emphasis on supply chain traceability, regulatory compliance, and clean-label trends drives competition. Companies investing in sustainable sourcing, product innovation, and global distribution expansion are better positioned to capture market share in this evolving, quality-driven sector.

| Items | Values |

|---|---|

| Quantitative Units | USD 2.0 billion |

| Type | Beef, Chicken, Pork, Fish, and Other |

| Form | Powder, Paste, Liquid, and Granule |

| Application | Ready Meals, Soups & Broths, Sauces & Seasonings, Animal Feed, and Other |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Carnad A/S, Givaudan, Diana Food SAS, Essentia Protein Solutions, BRF SA, International Dehydrated Foods Inc., Foodex Inti Ingredients, Ajinomoto Co. Inc, JBS S.A., Symrise AG, Nikken Foods, Haco Holding AG, Ariake Japan Co. Ltd, Maverick Biosciences, and Titan Biotech Ltd. |

| Additional Attributes | Dollar sales by extract type and application, demand dynamics across food processing, culinary, and convenience sectors, regional trends in natural flavor adoption, innovation in concentration techniques, shelf-life extension, and clean-label formulations, environmental impact of livestock sourcing and processing, and emerging use cases in ready-to-eat meals, savory snacks, and functional protein products. |

The global meat extracts market is estimated to be valued at USD 2.0 billion in 2025.

The market size for the meat extracts market is projected to reach USD 3.0 billion by 2035.

The meat extracts market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in meat extracts market are beef, chicken, pork, fish and other.

In terms of form, powder segment to command 42.5% share in the meat extracts market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Meat Alternative Market Forecast and Outlook 2025 to 2035

Meat, Poultry, and Seafood Packaging Market Size and Share Forecast Outlook 2025 to 2035

Meat Trays Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Meat Interleaving Paper Market Size and Share Forecast Outlook 2025 to 2035

Meat Enzyme Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Meat Mixers Market Size and Share Forecast Outlook 2025 to 2035

Meat Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

Meat Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Meat Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Meat Mincers Market Size and Share Forecast Outlook 2025 to 2035

Meat Tenderizer Market Size and Share Forecast Outlook 2025 to 2035

Meat Starter Cultures Market Size and Share Forecast Outlook 2025 to 2035

Meat Based FPP Market Size and Share Forecast Outlook 2025 to 2035

Meat Dicing Machine Market Size and Share Forecast Outlook 2025 to 2035

Meat Seasonings Market Size and Share Forecast Outlook 2025 to 2035

Meat Substitutes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Meat Packaging Market Trends - Growth & Forecast 2025 to 2035

Meat Emulsions Market Growth - Demand & Industry Insights 2025 to 2035

Analyzing Meat Packaging Market Share & Industry Growth

Market Share Breakdown of Meat, Poultry, and Seafood Packaging Manufacturers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA