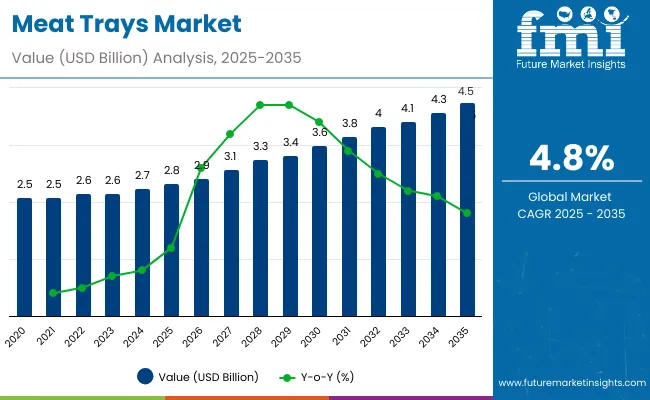

The meat trays market is forecast to expand from USD 2.8 billion in 2025 to USD 4.5 billion by 2035, gaining USD 1.7 billion over the decade. This represents a 60.7% increase, with the market advancing at a CAGR of 4.8%. Overall, the industry grows by a 1.6 multiple during the forecast window.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 2.8 billion |

| Industry Value (2035F) | USD 4.5 billion |

| CAGR (2025 to 2035) | 4.8% |

From 2025 to 2030, the market climbs from USD 2.8 billion to USD 3.6 billion, contributing USD 0.8 billion or 47.1% of decade growth. This phase is influenced by food safety regulations, rising packaged meat consumption, and strong cold-chain distribution. PET and MAP trays dominate adoption for durability and extended freshness.

Between 2030 and 2035, the market rises from USD 3.6 billion to USD 4.5 billion, adding USD 0.9 billion or 52.9% of growth. Sustainability and innovation define this period, with moldedfiber and biodegradable trays gaining prominence. Retail sustainability commitments and branding improvements reinforce long-term demand for eco-friendly and high-performance tray solutions.

From 2020 to 2024, the meat trays market grew steadily as packaged meat penetration rose, retailers standardized shelf-ready formats, and safety regulations tightened. A large share of revenues came from PET and MAP solutions led by supermarket programs and processor partnerships. Leaders emphasized barrier strength, recyclability, sealing integrity, and cold-chain performance. Differentiation centered on light weighting, clarity, and retail branding, while ovenable and compostable formats scaled selectively. Service-led audits and certifications contributed a smaller revenue share versus direct tray procurement.

By 2035, the market will reach USD 4.5 billion at 4.8% CAGR, with recyclable PET, hybrid barrier trays, and fiber-based solutions accounting for a rising portion of value. Competition will intensify as providers pair trays with automation-ready sealing lines and digital traceability. Established players will diversify into moldedfiber and mono-material designs, while regional entrants gain share with cost-efficient, retail-compliant formats tailored to poultry, red meat, and seafood distribution.

The global meat trays market is expanding due to heightened emphasis on food safety, hygiene, and shelf-life extension. PET and MAP trays lead growth because of barrier properties, durability, and compliance with international safety standards. Retail penetration, cold-chain expansion, and rising consumer demand for packaged red meat and poultry reinforce market adoption.

Sustainability is an added driver, with moldedfiber and compostable trays gaining traction in developed markets. Lightweight designs, recyclable multilayer films, and digital branding improve functionality and visibility. Growing packaged food sales, coupled with eco-conscious regulations, further strengthen adoption across supermarkets and food processors globally.

The meat trays market is segmented based on material, tray type, application, distribution channel, and end-use industry. The material segment includes polyethylene terephthalate, polyvinyl chloride, polypropylene, polystyrene, moldedfiber, and aluminum, each offering unique benefits such as clarity, durability, and sustainability. Tray types comprise standard trays, modified atmosphere packaging trays, vacuum skin packaging trays, dual-ovenable trays, and biodegradable or compostable trays, supporting diverse industry needs.

Applications include fresh red meat, processed meat, poultry, and seafood, which represent the major packaged food categories. Distribution channels consist of supermarkets and hypermarkets, convenience stores, butcher shops, and online retail. End-use industries encompass food processing companies, retail and supermarkets, and the foodservice sector, where trays enable branding, compliance, and efficiency.

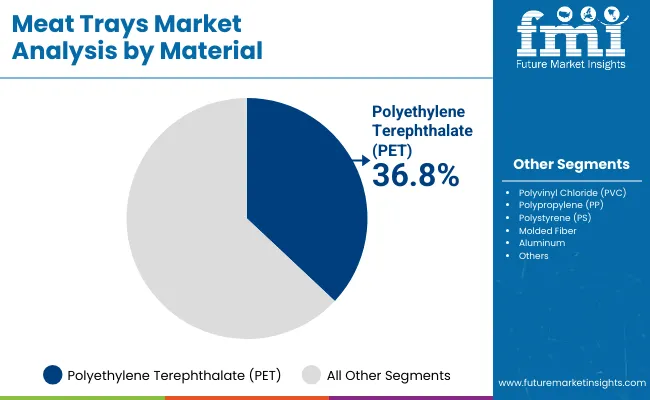

PET trays are projected to represent 36.8% of the market in 2025. Their high clarity, strength, and recyclability position them as the most reliable choice for packaged meat applications. PET offers excellent oxygen barrier properties, ensuring product freshness and safety while providing tamper resistance. This makes them especially valuable for red meat and poultry categories where shelf life and hygiene are critical.

The growth of PET trays is also supported by compatibility with automated sealing lines and recycling systems. Retailers value PET formats for consistent branding and shelf-ready presentation, aligning with sustainability targets. As regulations tighten around non-recyclable plastics, PET’s circular economy alignment ensures it retains leadership. Long-term resilience is reinforced by ongoing innovations in lightweighting and mono-material solutions.

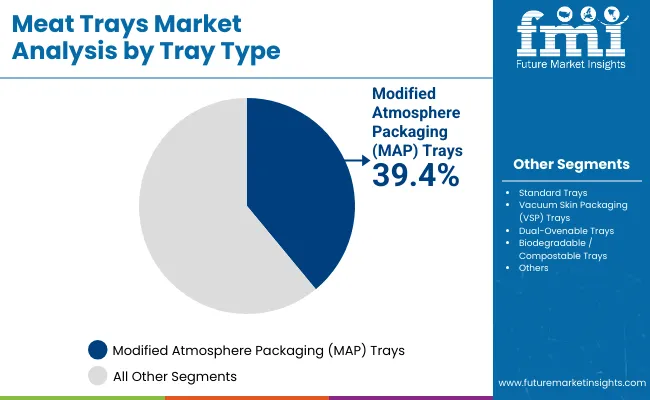

MAP trays are forecast to capture 39.4% of the market in 2025 due to their ability to extend freshness and maintain quality. By modifying internal atmospheres, these trays reduce spoilage and help stabilize color, flavor, and texture. The technology allows long-distance distribution, reducing waste and improving food safety compliance, which benefits both retailers and processors globally.

Adoption of MAP trays is further enhanced by expansion of cold-chain logistics, particularly in Asia-Pacific and Latin America. Supermarkets prefer MAP solutions for consistent performance and reduced shrinkage. Their role in maintaining freshness directly contributes to profitability by cutting waste. Combined with consumer demand for safe, high-quality packaged meat, MAP trays will continue to hold dominance in this segment.

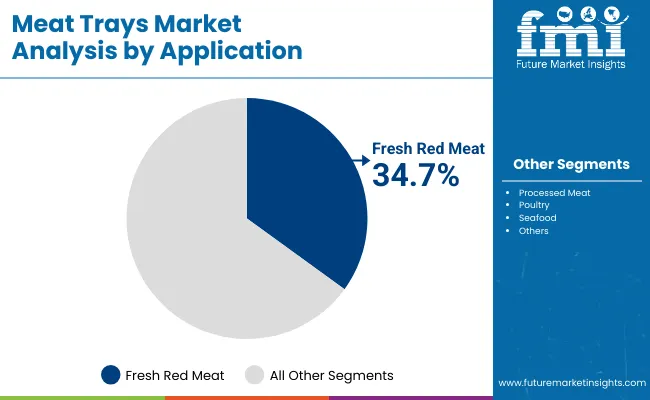

Fresh red meat is expected to account for 34.7% of the market in 2025. The segment benefits from rising consumer demand for hygienically packaged meat with extended shelf life. PET and MAP trays dominate adoption in this category due to their ability to ensure freshness, maintain quality, and prevent contamination. Stringent hygiene regulations also reinforce the reliance on advanced tray formats for red meat packaging.

The expansion of premium retail channels further drives tray use in this category. Supermarkets emphasize tray-based packaging for red meat to sustain margins and attract quality-conscious consumers. As urbanization and cold-chain distribution improve in developing regions, red meat tray demand will continue to expand. This makes fresh red meat the most resilient and profitable application within the global market.

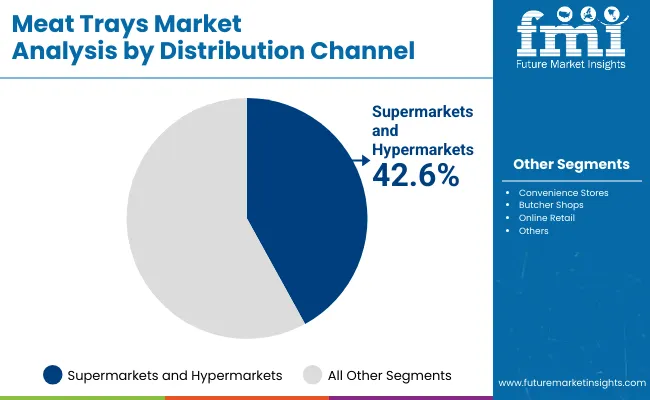

Supermarkets and hypermarkets are projected to account for 42.6% of demand in 2025. Their large-scale operations rely heavily on standardized packaging formats for efficiency, branding, and compliance. Supermarkets adopt PET and MAP trays to guarantee hygiene, safety, and visual appeal, making them the leading distribution channel for packaged meat products globally.

Expansion of modern retail across Asia-Pacific and Latin America strengthens this dominance. Sustainability initiatives by global retailers are pushing suppliers to innovate with recyclable and moldedfiber trays. Their volume-based purchasing power allows them to influence packaging trends, reinforcing supermarkets and hypermarkets as the cornerstone of meat tray adoption through 2035.

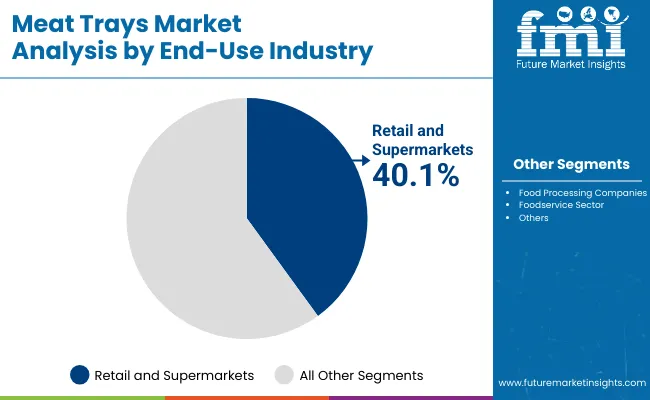

Retail and supermarkets are expected to contribute 40.1% of demand in 2025. As the primary sellers of packaged meat, their adoption of trays ensures standardized presentation, freshness, and safety. Sustainability programs accelerate use of recyclable PET and moldedfiber, aligning with consumer preference for eco-friendly packaging. These factors secure their dominance in end-use demand.

Retailers also prioritize branding through advanced tray formats, integrating features like labeling compatibility and high-clarity designs. Their focus on sustainability and efficiency ensures they continue shaping innovation in the market. With high purchasing capacity and direct consumer interaction, supermarkets will remain the largest end-use industry in meat trays throughout the forecast horizon.

Efficiency Gains, Food Safety, and Shelf-Life Drive Adoption

Trays improve efficiency by extending freshness, preventing contamination, and enabling longer distribution cycles. PET and MAP dominate for reliability and compliance with safety standards. Retail expansion and urbanization reinforce adoption, especially in emerging economies where demand for packaged red meat and poultry is accelerating.

High Costs, Plastic Regulations, and Waste Concerns Limit Growth

Adoption of moldedfiber and biodegradable trays is slowed by higher costs compared to PS or PVC. Raw material price fluctuations impact profitability. Regulatory restrictions on plastics increase compliance burdens, particularly for smaller processors. These factors restrain adoption in cost-sensitive regions, even as sustainability pressures rise.

Eco-Friendly Innovations, Branding, and Automation Define Trends

Moldedfiber and compostable trays are gaining visibility, driven by retailer sustainability commitments. Lightweight designs reduce material use without compromising safety. Digital printing enhances branding and consumer engagement. Automation and high-speed tray production improve cost efficiency, ensuring scalability. These trends highlight the market’s shift toward sustainable, innovative, and consumer-focused packaging solutions.

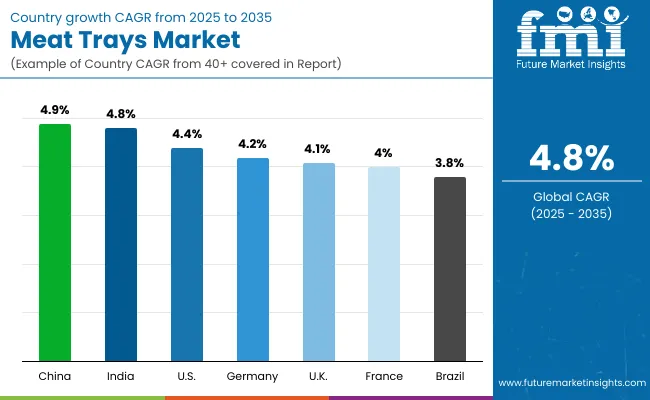

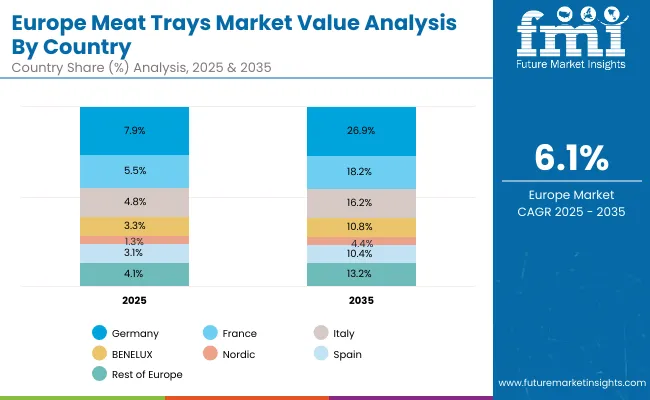

The global meat trays market is witnessing steady expansion, supported by hygiene-focused regulations, retail standardization, and sustainability goals. Asia-Pacific leads growth, with China and India driving rapid adoption through retail modernization and poultry demand. Developed markets such as the USA, Germany, and Japan focus on recyclable PET, moldedfiber, and MAP tray innovation to comply with strict environmental mandates and consumer expectations for safe, high-performance packaging solutions.

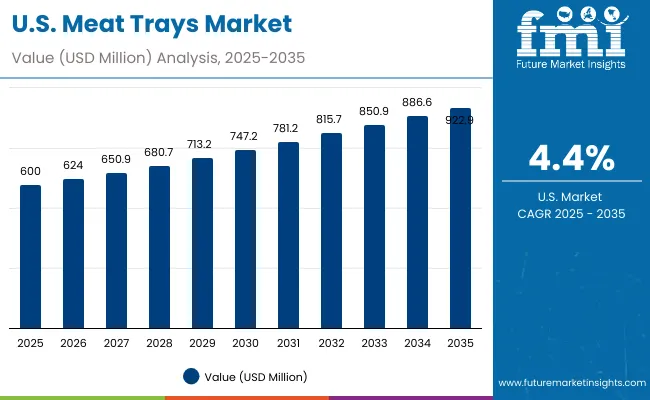

The USA meat trays market is expected to grow at a CAGR of 4.4% between 2025 and 2035, driven by widespread packaged meat consumption, advanced retail chains, and regulatory mandates for food safety. Growing consumer demand for branded, high-quality trays reinforces PET and MAP formats. Supermarkets and hypermarkets remain dominant due to scale and stringent compliance requirements.

Germany’s market will expand at a CAGR of 4.2% during 2025-2035. Strong sustainability commitments, strict regulations, and advanced retail penetration drive tray adoption. German supermarkets focus on replacing plastics with moldedfiber and recyclable PET solutions. MAP trays dominate due to their shelf-life extension capabilities, aligning with the high-quality expectations of German consumers.

The UK market is forecast to expand at a CAGR of 4.1%, influenced by leading supermarket initiatives in sustainable packaging. Strong consumer awareness accelerates demand for moldedfiber and MAP solutions. The emphasis is on hygienic presentation and compliance with regulations that favor recyclable and compostable tray solutions across poultry and red meat categories.

China’s meat trays market will grow fastest at a CAGR of 4.9% through 2035. Rising urbanization, cold-chain infrastructure expansion, and retail modernization drive tray demand. The government’s food safety initiatives and consumer preference for packaged seafood and poultry reinforce PET and MAP tray adoption. Retailers are increasingly shifting to lightweight recyclable trays.

India’s market is projected to grow at 4.8% CAGR from 2025 to 2035. Rising poultry consumption, expanding supermarket networks, and affordability of PET and PP trays support growth. Urbanization accelerates adoption, while modern retail chains drive demand for trays that ensure freshness and affordability. Foodservice expansion further strengthens long-term prospects.

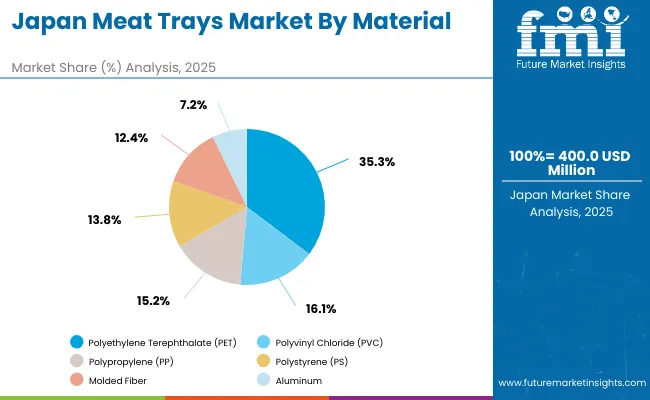

Japan’s market is set to expand at 4.0% CAGR during the forecast period. Strict hygiene standards, eco-friendly adoption, and seafood packaging demand support growth. Japanese consumers value recyclable PET and moldedfiber trays, particularly for seafood and premium meats. MAP trays play a strong role in reducing spoilage, aligning with the country’s strict food safety norms.

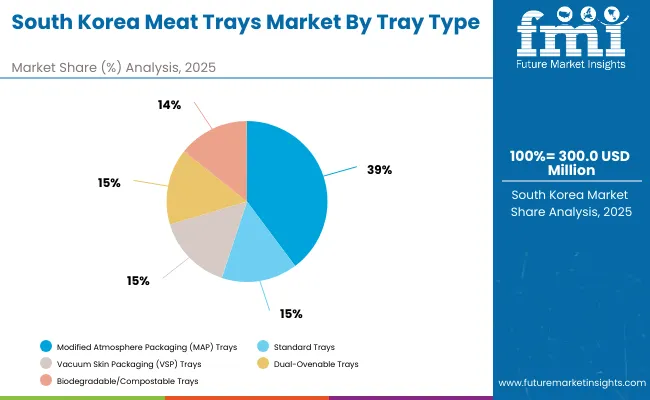

South Korea’s meat trays market will grow at a CAGR of 4.2%. Strong seafood consumption, modern retail penetration, and preference for convenience packaging drive demand. Compostable and moldedfiber trays are being integrated by retailers alongside MAP trays to meet sustainability targets while maintaining quality.

Japan’s meat trays market, valued at USD 400 million in 2025, is led by polyethylene terephthalate (PET), holding 35.3% share due to its durability, clarity, and recyclability. Polyvinyl chloride (PVC) follows with 16.1%, maintaining usage despite sustainability concerns. Polypropylene (PP) accounts for 15.2%, preferred for versatility and microwave compatibility. Polystyrene (PS) secures 13.8% as a cost-efficient material, while moldedfiber stands at 12.4%, reflecting growth in eco-friendly packaging. Aluminum contributes 7.2%, primarily for premium and ovenable tray applications. This mix reflects Japan’s balance between conventional plastics and emerging sustainable materials, aligning with regulatory and consumer-driven sustainability trends.

South Korea’s meat trays market, worth USD 300 million in 2025, is dominated by modified atmosphere packaging (MAP) trays with 38.6% share, driven by rising demand for extended shelf life and food safety. Standard trays follow at 15.0%, remaining relevant for cost-sensitive applications. Vacuum skin packaging (VSP) trays account for 14.9%, gaining popularity in premium meat preservation. Dual-ovenable trays represent 13.2%, meeting convenience-driven cooking needs. Biodegradable and compostable trays capture 11.3%, reflecting South Korea’s growing commitment to eco-friendly alternatives. The market showcases a clear tilt toward high-performance, technology-driven solutions while steadily incorporating sustainable options in response to environmental pressures.

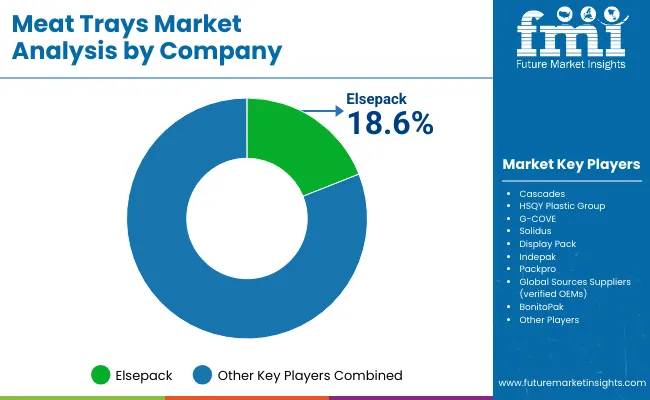

The meat trays market is moderately fragmented, with a balance of global leaders and regional specialists competing on performance, sustainability, and cost efficiency. Key companies such as Elsepack, Cascades, HSQY Plastic Group, and G-COVE dominate PET and MAP tray production, offering durability and compliance with safety standards. Solidus, Display Pack, and Indepak invest heavily in moldedfiber and biodegradable innovations, targeting eco-conscious European and North American markets.

Emerging suppliers like Packpro, BonitoPak, and Global Sources OEMs provide scalability and cost-efficient solutions, expanding tray availability for supermarkets and food processors worldwide. Competitive strategies increasingly emphasize lightweight designs, digital branding compatibility, and recyclability. Investment in automation and smart packaging further enhances tray performance. The competitive landscape reflects a shift toward sustainability, innovation, and retailer partnerships, ensuring companies that adapt quickly remain positioned for long-term growth.

Key Developments of Meat Trays Market

| Item | Value |

|---|---|

| Quantitative Units | USD 2.8 Billion |

| By Material | PET, PVC, PP, PS, Molded Fiber, Aluminum |

| By Tray Type | Standard Trays, MAP Trays, VSP Trays, Dual- Ovenable Trays, Biodegradable/Compostable Trays |

| By Application | Fresh Red Meat, Processed Meat, Poultry, Seafood |

| By Distribution Channel | Supermarkets & Hypermarkets, Convenience Stores, Butcher Shops, Online Retail |

| By End-Use Industry | Food Processing Companies, Retail & Supermarkets, Foodservice Sector |

| Key Companies Profiled | Elsepack, Cascades, HSQY Plastic Group, G-COVE, Solidus, Display Pack, Indepak, Packpro, BonitoPak, Global Sources Suppliers (OEMs) |

| Additional Attributes | Growth supported by food safety, PET’s barrier strength, MAP shelf-life extension, cold-chain expansion, sustainability initiatives, molded fiber adoption, and automation in tray production. |

The Meat Trays Market will be valued at USD 2.8 billion in 2025.

The Meat Trays Market will reach USD 4.5 billion by 2035.

The Meat Trays Market will expand at a CAGR of 4.8% during 2025-2035.

Supermarkets and hypermarkets will lead the Meat Trays Market in 2025 with a 42.6% share.

The Asia-Pacific region will be the fastest-growing market, led by China at 4.9% CAGR.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Meat Alternative Market Forecast and Outlook 2025 to 2035

Meat, Poultry, and Seafood Packaging Market Size and Share Forecast Outlook 2025 to 2035

Meat Extracts Market Size and Share Forecast Outlook 2025 to 2035

Meat Interleaving Paper Market Size and Share Forecast Outlook 2025 to 2035

Meat Enzyme Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Meat Mixers Market Size and Share Forecast Outlook 2025 to 2035

Meat Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

Meat Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Meat Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Meat Mincers Market Size and Share Forecast Outlook 2025 to 2035

Meat Tenderizer Market Size and Share Forecast Outlook 2025 to 2035

Meat Starter Cultures Market Size and Share Forecast Outlook 2025 to 2035

Meat Based FPP Market Size and Share Forecast Outlook 2025 to 2035

Meat Dicing Machine Market Size and Share Forecast Outlook 2025 to 2035

Meat Seasonings Market Size and Share Forecast Outlook 2025 to 2035

Meat Substitutes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Meat Packaging Market Trends - Growth & Forecast 2025 to 2035

Meat Emulsions Market Growth - Demand & Industry Insights 2025 to 2035

Analyzing Meat Packaging Market Share & Industry Growth

Market Share Breakdown of Meat, Poultry, and Seafood Packaging Manufacturers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA