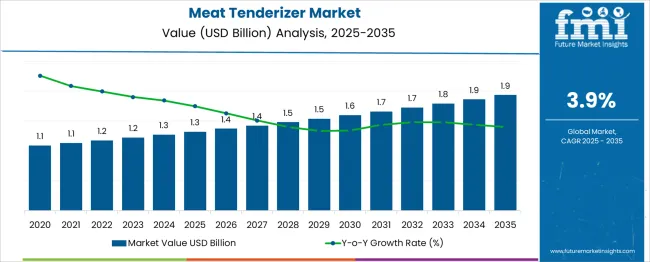

The Meat Tenderizer Market is estimated to be valued at USD 1.3 billion in 2025 and is projected to reach USD 1.9 billion by 2035, registering a compound annual growth rate (CAGR) of 3.9% over the forecast period. Between 2025 and 2030, the market is projected to grow gradually from USD 1.3 billion to USD 1.6 billion, indicating moderate expansion. Year-on-year analysis shows a steady climb, with values expected at USD 1.4 billion in both 2026 and 2027, reaching USD 1.5 billion in 2028 and 2029.

This progression reflects consistent demand supported by growth in processed meat consumption and the rising popularity of ready-to-cook products in household and foodservice sectors. From 2028 to 2030, the upward trend is likely to continue as manufacturers innovate enzyme-based and clean-label formulations to align with evolving consumer preferences for natural additives.

Regional adoption is expected to strengthen in emerging economies, where meat processing capacities and quick-service restaurants are expanding. Market competitiveness is anticipated to hinge on cost efficiency, application versatility, and regulatory compliance for food safety standards. These developments highlight that meat tenderizers will remain essential for texture improvement and value addition in processed meats, making them integral to the evolving dynamics of modern meat processing and culinary applications globally.

| Metric | Value |

|---|---|

| Meat Tenderizer Market Estimated Value in (2025 E) | USD 1.3 billion |

| Meat Tenderizer Market Forecast Value in (2035 F) | USD 1.9 billion |

| Forecast CAGR (2025 to 2035) | 3.9% |

The meat tenderizers market holds a focused position within its parent categories. In the food additives market, it accounts for nearly 4–5%, as tenderizers are a specialized sub-segment compared to preservatives, emulsifiers, and flavor enhancers. Within the processed meat industry market, its share is approximately 6–7%, as tenderizers are essential for enhancing texture and palatability in ready-to-cook and packaged meat products.

The seasonings and spices market sees a relatively small share of 2–3%, as tenderizers often complement marinades rather than dominate the category. In the enzymes market (food-grade), the share is higher at 8–9%, given that many tenderizers are enzyme-based, particularly using papain and bromelain.

The meat processing ingredients market holds the highest share at 10–12%, reflecting their integral role in meat preparation and processing. This market is expanding due to increased consumption of processed meats, consumer demand for improved texture, and the growing trend of convenience cooking.

Innovations in natural enzyme formulations and clean-label solutions are further driving acceptance across foodservice and household applications. These factors indicate that while meat tenderizers form a small part of broader ingredient markets, they are gaining strategic importance as manufacturers focus on texture enhancement, quality retention, and premium meat product positioning.

The meat tenderizer market is progressing steadily as advancements in food processing technology, changing dietary preferences, and demand for high-quality meat products shape its trajectory. Increased awareness of meat texture and palatability has encouraged both commercial and consumer segments to adopt effective tenderizing solutions.

Manufacturers have responded by developing products that improve consistency, reduce preparation time, and enhance flavor absorption without compromising food safety. The market’s future growth is expected to be supported by innovations in hygienic designs, growing emphasis on efficient kitchen operations, and rising meat consumption in emerging economies.

Trends toward premiumization of meat products, coupled with regulatory focus on maintaining food standards, are paving the way for sustained adoption across diverse end-use domains. As operational efficiency and product quality continue to drive purchasing decisions, the meat tenderizer market is poised for broader penetration and technological advancement.

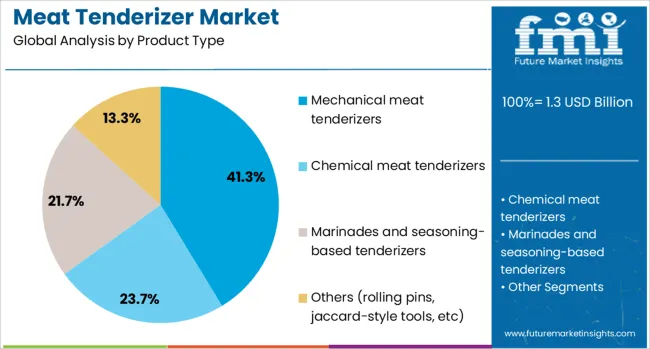

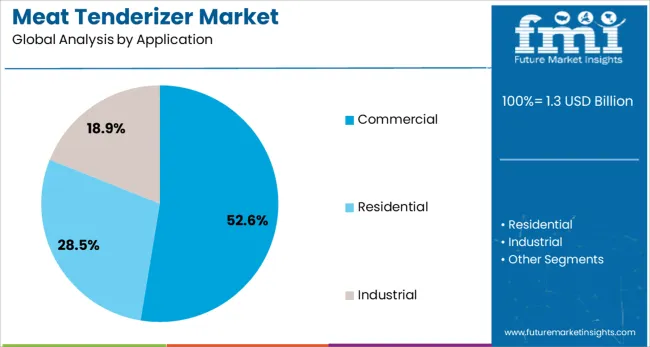

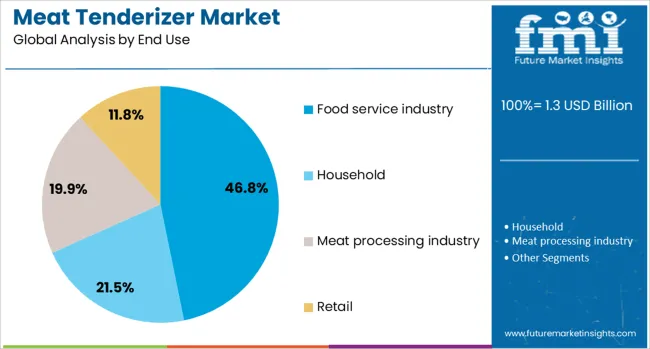

The meat tenderizer market is segmented by product type, application, end use, distribution channel, and geographic regions. The meat tenderizer market is divided by product type into Mechanical meat tenderizers, Chemical meat tenderizers, Marinades and seasoning-based tenderizers, and Others (rolling pins, jaccard-style tools, etc).

In terms of application, the meat tenderizer market is classified into Commercial, Residential, and Industrial. Based on end use, the meat tenderizer market is segmented into the Food service industry, Household, Meat processing industry, and Retail. The distribution channel of the meat tenderizer market is segmented into Offline and Online. Regionally, the meat tenderizer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by product type, mechanical meat tenderizers are anticipated to command 41.30% of the total market revenue in 2025, establishing themselves as the leading subsegment. This position has been reinforced by their ability to deliver uniform results with minimal skill requirements, making them indispensable in high-volume meat processing and commercial kitchens.

Their robust construction, ease of maintenance, and adaptability to various meat cuts have supported widespread adoption. Advancements in ergonomic designs and safety features have further improved their appeal, enabling faster processing without compromising operator safety.

Enhanced durability and the ability to withstand repeated usage in demanding environments have contributed significantly to their preference over alternative solutions. These characteristics have ensured mechanical meat tenderizers remain a reliable choice for businesses prioritizing efficiency and consistent product quality.

In terms of application, the commercial segment is projected to hold 52.60% of the total market revenue in 2025, maintaining its leadership. The growing need for standardized, high-throughput meat preparation in restaurants, butcheries, and catering services has driven this dominance.

Commercial kitchens have increasingly relied on tenderizers to reduce preparation time, minimize waste, and ensure customer satisfaction with tender, evenly textured meat. The operational efficiency and cost savings realized through reduced labor dependency and optimized portion control have reinforced their adoption.

Additionally, heightened competition in the hospitality sector has necessitated consistent quality and presentation, further cementing the role of meat tenderizers in commercial settings. These dynamics have solidified the commercial segment’s position as the primary contributor to the market’s revenue.

When analyzed by end use, the food service industry is expected to account for 46.80% of the total market revenue in 2025, positioning it as the leading segment. This leadership has been attributed to the sector’s continuous demand for high-quality, aesthetically pleasing meat dishes that meet customer expectations in both taste and texture.

The operational intensity of the food service industry, with its emphasis on quick turnaround times and standardized menu offerings, has created a strong dependency on efficient tenderizing equipment. Investments in modern kitchen infrastructure and staff training have facilitated seamless integration of tenderizers into daily operations.

The ability to deliver consistently tender products while managing costs effectively has further enhanced their value proposition in this segment. The food service industry’s scale, pace, and quality requirements have thus ensured its continued prominence within the meat tenderizer market.

The meat tenderizer market is seeing increased adoption among processors, foodservice operators, and retail brands focused on enhancing texture and cook quality. In 2024, demand rose for enzymatic and mechanical tenderizers used in both meat preparation and pre-packaged offerings. In 2025, culinary channels incorporated advanced tenderizer formats for premium cuts and restaurant-grade preparations.

Providers delivering validated tenderizing solutions with consistent performance, recipe alignment, and operational ease are gaining recognition across food production and chain kitchen operations.

Consumer expectations for uniform tenderness have pushed processors to standardize meat texture across product lines. In 2024, meat processors began deploying enzymatic tenderizers to achieve repeatable softness in high-cut items without altering cooking behavior. In 2025, foodpack brands utilized mechanical tenderizer tools to reduce variability between batches, especially in lean or tough cuts.

These shifts indicate that consistency in mouthfeel is guiding tenderizer adoption. Suppliers providing tenderizing solutions with validated activity profiles and minimal impact on flavor or moisture retention are thus gaining traction in production settings.

Seafood processing presents a growing opportunity due to its natural variation in texture and consumer preference for softer products. In 2024, pilot programs introduced enzyme-based tenderizers tailored for fish and shellfish to enhance eating quality and yield. In 2025, processors scaled use of marine-specific tenderization to deliver consistent texture in higher-value species such as grouper and tuna.

These initiatives demonstrate that targeted tenderizing approaches can improve product acceptability and reduce preparation time in kitchens. Suppliers capable of formulating stable, marine-certified tenderizer blends with minimal residue and consumer-acceptable labeling are well placed to address expanding seafood-tenderizer demand.

Stringent regulations concerning the use of chemical tenderizers have emerged as a critical barrier for market participants. In 2024, regional food safety authorities introduced tighter guidelines on permissible enzyme and chemical limits, creating compliance challenges for processors.

By 2025, increased inspection frequency and labeling requirements restricted the launch of new synthetic formulations, delaying product approvals in several markets. This scenario indicates that compliance complexity rather than product performance is constraining growth opportunities. Companies focusing on natural ingredient alternatives and transparent labeling strategies are better positioned to maintain consumer trust while adhering to evolving regulatory frameworks.

The preference for enzyme-based tenderizers derived from natural sources is reshaping the competitive landscape. In 2024, producers introduced papain and bromelain-based solutions to cater to the growing requirement for cleaner formulations in processed meat applications. By 2025, integrated blends combining plant enzymes with functional seasonings became popular among large-scale meat processors aiming for flavor enhancement and textural uniformity.

These developments highlight that innovation in natural solutions rather than reliance on synthetic compounds is defining market direction. Suppliers offering enzyme-rich tenderizers with predictable performance and compatibility with industrial processing systems are expected to secure significant traction.

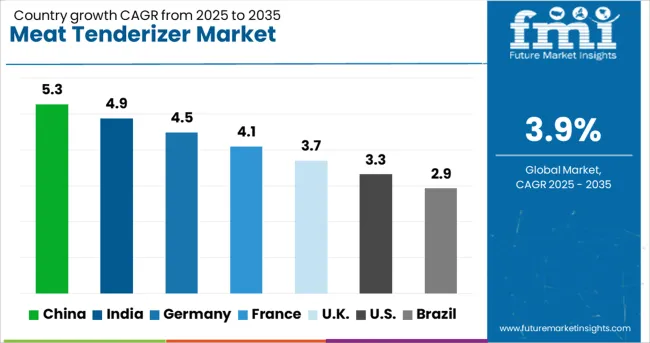

| Country | CAGR |

|---|---|

| China | 5.3% |

| India | 4.9% |

| Germany | 4.5% |

| France | 4.1% |

| UK | 3.7% |

| USA | 3.3% |

| Brazil | 2.9% |

The global meat tenderizer market is projected to grow at a CAGR of 3.9% from 2025 to 2035. China leads with 5.3%, followed by India at 4.9% and Germany at 4.5%. France records 4.1%, while the United Kingdom posts 3.7%. Growth is driven by rising meat consumption, increased demand for value-added processed meat products, and the adoption of enzymatic and mechanical tenderizing solutions. China and India dominate due to expanding food service sectors and processed meat demand, while Germany focuses on natural, clean-label tenderizers. France and the UK emphasize premium meat quality enhancement for gourmet and ready-to-cook segments.

The meat tenderizer market in China is set to grow at 5.3%, supported by an expanding processed meat sector and increasing demand from restaurants and catering services. Enzymatic tenderizers dominate due to their efficiency in marination and large-scale production. Manufacturers introduce natural enzyme-based solutions to address health-conscious consumer preferences. The rapid growth of e-commerce channels is further enabling easy availability of meat tenderizing products across the country.

The market in India is projected to grow at 4.9%, driven by the rising consumption of ready-to-cook and marinated meat products in urban centers. Papain-based tenderizers remain dominant because of cost efficiency and cultural adaptability. Manufacturers invest in plant-based enzymatic solutions to cater to vegetarian dietary preferences in food processing. Expansion of quick-service restaurants continues to push tenderizer demand in commercial kitchens.

Germany is expected to grow at 4.5%, fueled by premium meat consumption and innovation in natural tenderizing methods. Clean-label enzymatic tenderizers dominate adoption across gourmet dining and packaged meat products. Regulatory compliance under EU food safety laws drives preference for chemical-free formulations. Manufacturers develop advanced marination systems combining texture improvement and flavor infusion for high-end meat processing.

The market in France is forecast to grow at 4.1%, supported by strong culinary heritage and increasing adoption of value-added meat products. Enzymatic tenderizers are widely used in marination for fine dining and home cooking applications. Companies focus on multifunctional tenderizers offering both texture and flavor enhancement. Growing interest in convenience-based products also encourages demand for tenderized, ready-to-cook meat options in retail.

The UK is projected to grow at 3.7%, with strong demand coming from the hospitality and ready-meal segments. Mechanical tenderizing equipment dominates in commercial kitchens to improve efficiency. Enzymatic tenderizers integrated with seasoning blends gain traction in retail for marinated meat offerings. Health-conscious trends lead to the development of low-sodium tenderizer formulations to cater to evolving dietary needs.

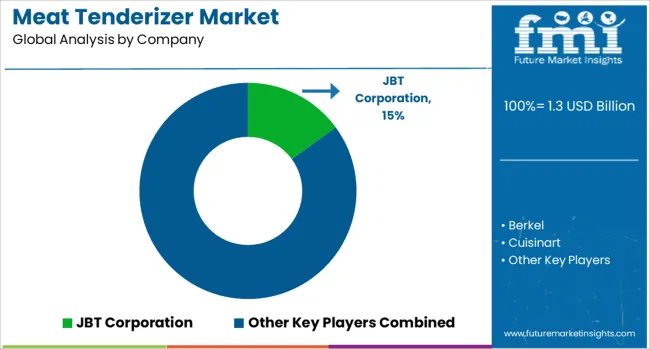

The meat tenderizers market is moderately competitive, with JBT Corporation holding a significant position due to its industrial-scale tenderizing equipment designed for high-volume meat processing. The company’s advanced machinery ensures consistent meat quality, making it a preferred choice among large food processors.

Key players include Berkel, Cuisinart, Deni, Hamilton Beach, HIC (Harold Import Co.), Jaccard Corporation, KitchenAid, Maverick, Oxo International, ThermoWorks, Tovolo, Westmark, Wilton Industries, and Zyliss — each offering manual and electric tenderizers catering to both commercial kitchens and household consumers.

These companies focus on user-friendly designs, durability, and precision in tenderizing to improve cooking efficiency and enhance meat texture. The market is witnessing steady demand due to rising consumption of processed and home-cooked meat products, coupled with a growing preference for tools that reduce cooking time while retaining flavor and tenderness. Innovations such as adjustable blade systems, ergonomic handles, and multi-functional tenderizers are gaining traction among consumers.

In addition, premium brands are introducing stainless steel and dishwasher-safe models for enhanced convenience and hygiene. E-commerce growth and the popularity of cooking appliances as part of lifestyle trends further accelerate product adoption globally.

Innovation in the meat tenderizer market includes natural enzyme solutions such as papain, bromelain, and proteases, advanced manual and powered tenderizing tools, and health-oriented formulations aimed at improving meat texture, flavor, and overall quality for both industrial and household applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 Billion |

| Product Type | Mechanical meat tenderizers, Chemical meat tenderizers, Marinades and seasoning-based tenderizers, and Others (rolling pins, jaccard-style tools, etc) |

| Application | Commercial, Residential, and Industrial |

| End Use | Food service industry, Household, Meat processing industry, and Retail |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | JBT Corporation, Berkel, Cuisinart, Deni, Hamilton Beach, HIC (Harold Import Co.), Jaccard Corporation, KitchenAid, Maverick, Oxo International, ThermoWorks, Tovolo, Westmark, Wilton Industries, and Zyliss |

| Additional Attributes | Dollar sales by product type (mechanical, chemical, marinade/seasoning), regional demand trends, competitive landscape, buyer preferences for natural and clean-label formulations, integration with foodservice and retail sectors, innovations in enzyme-based and eco-friendly tenderizers. |

The global meat tenderizer market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the meat tenderizer market is projected to reach USD 1.9 billion by 2035.

The meat tenderizer market is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types in meat tenderizer market are mechanical meat tenderizers, chemical meat tenderizers, marinades and seasoning-based tenderizers and others (rolling pins, jaccard-style tools, etc).

In terms of application, commercial segment to command 52.6% share in the meat tenderizer market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Meat Snacks Market Size and Share Forecast Outlook 2025 to 2035

Meat Alternative Market Forecast and Outlook 2025 to 2035

Meat, Poultry, and Seafood Packaging Market Size and Share Forecast Outlook 2025 to 2035

Meat Extracts Market Size and Share Forecast Outlook 2025 to 2035

Meat Trays Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Meat Interleaving Paper Market Size and Share Forecast Outlook 2025 to 2035

Meat Enzyme Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Meat Mixers Market Size and Share Forecast Outlook 2025 to 2035

Meat Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

Meat Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Meat Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Meat Mincers Market Size and Share Forecast Outlook 2025 to 2035

Meat Starter Cultures Market Size and Share Forecast Outlook 2025 to 2035

Meat Based FPP Market Size and Share Forecast Outlook 2025 to 2035

Meat Dicing Machine Market Size and Share Forecast Outlook 2025 to 2035

Meat Seasonings Market Size and Share Forecast Outlook 2025 to 2035

Meat Substitutes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Meat Packaging Market Trends - Growth & Forecast 2025 to 2035

Meat Emulsions Market Growth - Demand & Industry Insights 2025 to 2035

Analyzing Meat Packaging Market Share & Industry Growth

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA