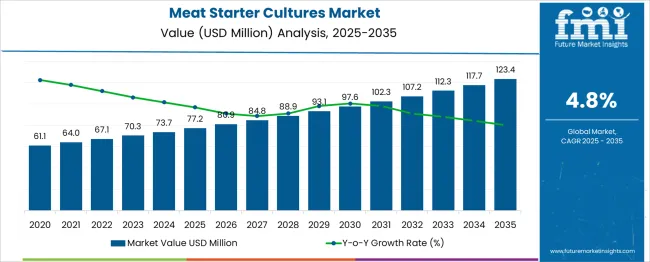

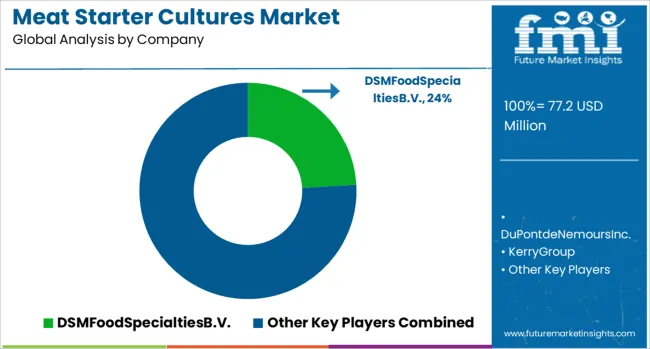

The Meat Starter Cultures Market is estimated to be valued at USD 77.2 million in 2025 and is projected to reach USD 123.4 million by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

Year‑on‑year growth for 2025‑2030 shows values rising to 80.9, 84.8, 88.9, 93.1, and 97.6 million; associated percentage gains are 4.79, 4.82, 4.83, 4.72, and 4.83 percent. The standard deviation of these five rates is only 0.05 percentage points, indicating extremely low volatility and a predictable demand curve. Annual absolute increments move from USD 3.7 million (2025‑2026) to USD 4.5 million (2029‑2030), a 22 percent uplift that signals mild acceleration as capacity and strain diversity grow. Extending the 4.8 percent compound rate beyond 2030 lifts revenues to approximately USD 102.3 million in 2031, 112.3 million in 2033, and the published USD 123.4 million in 2035, with yearly additions surpassing USD 5 million late in the period. Such consistent, low‑variance expansion affords suppliers the confidence to lock in long‑term fermentation contracts, invest in freeze‑drying upgrades, and expand distribution in growth regions without fear of demand shocks. A demand profile this stable favors scale economies, incremental R&D on multifunctional strains, and logistics optimization rather than aggressive price hedging or speculative expansion.

| Metric | Value |

|---|---|

| Meat Starter Cultures Market Estimated Value in (2025 E) | USD 77.2 million |

| Meat Starter Cultures Market Forecast Value in (2035 F) | USD 123.4 million |

| Forecast CAGR (2025 to 2035) | 4.8% |

The meat starter cultures market commands a focused yet influential position within multiple ingredient and preservation segments. In the food cultures and enzymes market, it contributes 7–9 %, as dairy and bakery strains dominate volume. Within the meat processing ingredients market, the share climbs to 10–12 % because starter cultures are essential for color formation, flavor development, and pathogen inhibition in cured and fermented meats.

Across the broader fermented foods market, which includes yogurt, sauerkraut, and kombucha, meat starter cultures hold 3–4 %, with plant‑ and dairy‑based ferments claiming larger portions. In the food safety and preservation solutions market, the segment captures 5–6 %, reflecting its role as a microbial hurdle alongside nitrites, antioxidants, and modified‑atmosphere packaging. Finally, in the functional food ingredients market, the contribution remains 2–3 %, as fibers, probiotics, and botanical extracts generate higher sales.

Although these percentages appear modest, demand is accelerating due to rising interest in artisanal charcuterie, stricter pathogen‑reduction standards, and consumer desire for distinctive regional flavors. Innovations in mixed multifunctional strains, sodium‑reduced fermentations, and bioprotective cultures are expanding application scopes, reinforcing meat starter cultures as a critical enabler of safe, high‑quality, and value‑added fermented meat products worldwide.

The meat starter cultures market is witnessing accelerated growth due to the increasing emphasis on product safety, standardized fermentation, and consistent organoleptic properties in processed meat production. As consumers demand more natural and additive-free meat products, manufacturers are investing in microbial technologies that enhance flavor, texture, and shelf-life without compromising food safety. Stringent regulatory frameworks in North America and Europe governing microbial content and pathogen control have reinforced the need for reliable and well-characterized starter cultures.

Technological innovations in bioprocessing, freeze-drying, and microbial strain optimization have enabled more efficient application of starter cultures across traditional and industrial-scale meat curing operations. The integration of molecular biology tools and genomics for strain identification and efficacy testing has further strengthened quality assurance protocols.

In emerging markets, rising consumption of fermented meat products and improvements in cold chain logistics are expanding adoption across mid-sized processors. Over the coming years, demand is expected to scale further with the adoption of multi-strain formulations and compatibility with automation in meat processing facilities.

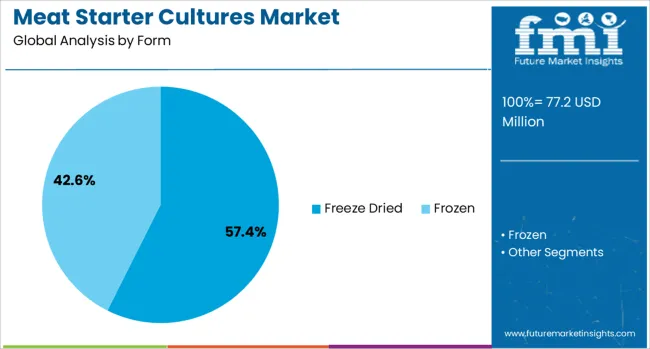

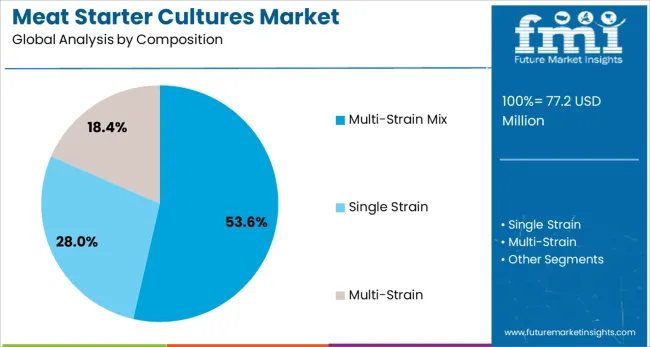

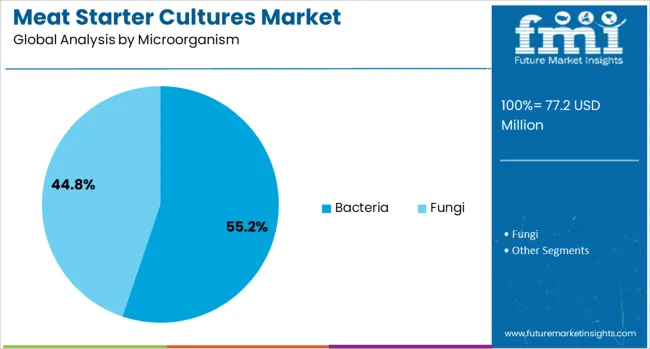

The meat starter cultures market is segmented by form, composition, microorganism, application, and geographic regions. The meat starter cultures market is divided into freeze-dried and Frozen. The meat starter cultures market is classified into Multi-Strain Mix, Single Strain, and Multi-Strain. Based on the microorganisms of the meat starter cultures, the market is segmented into Bacteria and Fungi. By application of the meat starter cultures, the market is segmented into Sausages, Salami, Dry-Cured Meat, and Others. Regionally, the meat starter cultures industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The freeze dried form segment is projected to hold 57.4% of the total revenue share in the meat starter cultures market in 2025, making it the leading formulation type. This dominance is being driven by the extended shelf stability, ease of transportation, and rehydration efficiency offered by freeze dried cultures. Their low moisture content provides microbial viability over long storage durations without refrigeration, which is critical for manufacturers operating across diverse climatic conditions.

Additionally, the uniform performance and reduced risk of contamination during mixing have made freeze dried forms a preferred choice in automated and industrial meat processing setups. The ability to retain metabolic activity after rehydration enables consistent fermentation results across batches, which is essential for maintaining product quality.

Compatibility with vacuum packaging and controlled-dose sachets further adds to operational convenience. As processors aim for greater standardization and traceability in their production lines, freeze dried cultures continue to gain preference over liquid or frozen alternatives due to their superior handling, scalability, and performance reliability.

The multi strain mix composition segment is expected to account for 53.6% of the revenue share in the meat starter cultures market in 2025, reflecting its strong commercial relevance. The growth of this segment is being supported by the demand for synergistic microbial interactions that enhance flavor complexity, acidification rate, and textural consistency in cured and fermented meats. Multi strain formulations combine specific bacteria or fungi that work in concert to optimize fermentation kinetics while offering resilience against competing spoilage organisms.

These mixes also provide manufacturers with flexibility in processing different meat types under variable environmental conditions. The increased control over flavor profiles, reduced fermentation time, and improved safety margins have made multi strain mixes the preferred option in high-throughput facilities.

Moreover, the adaptability of these cultures to various starter formats, including direct vat inoculation and pre-fermentation solutions, allows seamless integration into diverse production workflows. Enhanced quality predictability and repeatability across batches further support their continued dominance in modern meat processing operations.

The bacteria microorganism segment is anticipated to capture 55.2% of the total revenue share in the meat starter cultures market in 2025, maintaining its position as the most utilized microbial type. The segment's strength is attributed to the effectiveness of bacterial strains, particularly lactic acid bacteria, in acidifying meat products and inhibiting spoilage microorganisms. Bacterial cultures play a pivotal role in shaping the safety, texture, and flavor profile of fermented meats by rapidly lowering pH levels and producing antimicrobial compounds.

Their reliability in ensuring food safety compliance has positioned them as indispensable tools in regulated meat environments. Advances in bacterial strain development, including genomically characterized and non-GMO variants, have widened their application scope while aligning with clean-label demands.

Bacterial cultures offer superior process predictability compared to yeasts or molds, making them ideal for high-volume commercial processing. Their compatibility with both traditional and industrial methods, along with scalable dosing strategies, continues to reinforce their leadership in starter culture selection across global meat processing markets.

Meat starter cultures are being deployed across meat processing operations to enhance product safety, consistency and flavour development during fermentation and preservation. These cultures include bacteria strains used in sausage, salami and cured meats to regulate pH, inhibit pathogens, and deliver desirable sensory profiles. Adoption has been observed in artisanal producers, industrial manufacturers and regional delicatessen operations. Suppliers offering well‑characterized microbial blends with validated performance data and traceable sourcing are positioned to lead in this evolving culinary ingredient segment.

Meat starter cultures have been implemented to achieve standardized fermentation outcomes and reduce microbiological risks in processed meat products. Controlled inoculation with selected lactic acid bacteria strains has enabled predictable pH reduction, which is critical for pathogen suppression and product shelf stability. These cultures have also contributed to flavour enhancement and colour development, improving consumer acceptance. Industrial processors and specialty meat producers have adopted starter cultures to comply with strict food safety standards and regulatory norms. Formulations designed for specific meat types such as dry-cured sausages or semi-dry fermented products have expanded application versatility. As manufacturers prioritize consistency, quality assurance and safety compliance, demand for scientifically validated starter cultures has steadily increased across global processing operations.

Market expansion has been hindered by the need for stringent storage and handling protocols to maintain culture viability. Cold chain continuity is essential during transportation and warehousing, creating logistical challenges in regions with limited refrigeration infrastructure. Cost considerations have influenced smaller processors who may rely on traditional fermentation methods rather than controlled starter inoculation. Integration of starter cultures into diverse production workflows requires technical expertise and strict adherence to process parameters to prevent spoilage or flavour defects. Regulatory approval processes for microbial strains can delay market entry, especially in countries with complex compliance frameworks. These factors have collectively constrained rapid adoption, particularly among small-scale processors in emerging markets where investment in advanced systems remains limited.

Demand for unique flavor profiles in gourmet and craft meat products has created openings for bespoke starter culture formulations. Partnerships with artisanal producers have enabled co‑development of cultures tailored to regional taste preferences and heritage recipes. Growth in clean‑label trends has supported interest in multifunctional cultures that reduce reliance on chemical additives while maintaining safety. Expansion into plant‑based meat analogs has presented novel applications for microbial fermentation to reproduce meat‑like textures and flavors. Contract manufacturing of freeze‑dried cultures for micro‑producers is being leveraged to extend reach into niche segments. Digital platforms for culture selection, recipe customization, and performance tracking are emerging to improve customer support and product development cycles.

Automation of culture dosing and in‑line pH measurement has become standard in advanced meat plants, enabling real‑time process control and reducing manual interventions. Remote monitoring systems are being deployed to track fermentation kinetics and alert operators to deviations. Novel strains of protective cultures with enhanced antimicrobial peptide production are being introduced to increase shelf stability and reduce spoilage. Genomic screening of starter candidates supports faster strain selection for targeted flavor and safety attributes. Sustainable sourcing of culture growth media from renewable by‑products is under exploration to minimize waste. Integration of predictive analytics for fermentation outcomes is improving yield optimization and reducing production cycle times.

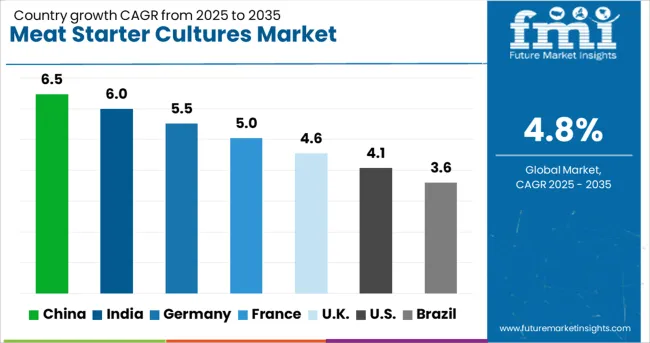

| Country | CAGR |

|---|---|

| China | 6.5% |

| India | 6.0% |

| Germany | 5.5% |

| France | 5.0% |

| UK | 4.6% |

| USA | 4.1% |

| Brazil | 3.6% |

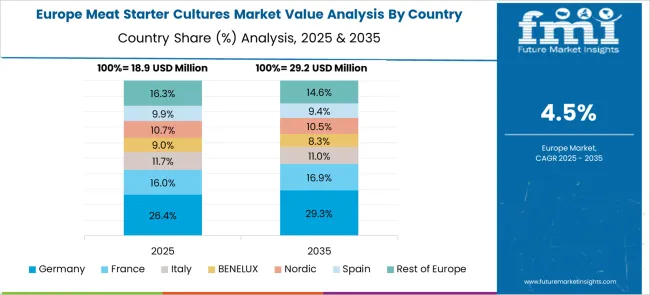

The global meat starter cultures market is projected to grow at a 4.8% CAGR from 2025 to 2035, driven by rising demand for processed meat and improved fermentation technologies. Among BRICS nations, China leads with a 6.5% CAGR, supported by industrial-scale meat processing and preference for natural preservation. India follows at 6.0%, driven by packaged meat adoption and technological advancements in curing solutions. Within OECD economies, Germany records 5.5%, backed by strict quality regulations and growth in premium meat products. France posts 5.0% as clean-label fermented meat gains traction, while the UK grows at 4.6% due to innovation in low-salt and nitrate-free products. The report includes insights from 40+ countries, with five highlighted below.

India is projected to grow at a 6.0% CAGR, supported by the rising demand for packaged and ready-to-eat meat products. Domestic meat processors are incorporating starter cultures to improve product safety and enhance curing consistency. The trend toward low-nitrate formulations is creating opportunities for bio-protective culture blends. Meat exports, particularly in processed poultry and lamb segments, are driving adoption of advanced fermentation systems to meet international standards. Local and global suppliers are investing in capacity expansion to cater to quick-service restaurant chains and organized retail formats. Cold chain infrastructure improvements also contribute to the growing use of starter cultures.

China is forecast to register a 6.5% CAGR, driven by large-scale processed meat manufacturing and the popularity of fermented meat products. Domestic meat processors are investing in starter cultures that improve flavor, texture, and shelf life while reducing dependency on chemical additives. Demand for lactic acid bacteria blends is increasing due to their role in enhancing safety and consistency in sausages and cured meats. Multinational suppliers are entering joint ventures with local firms to expand market share and leverage cold chain networks. Growth in quick-service restaurants and convenience foods further boosts demand for meat starter cultures in both retail and foodservice sectors.

Germany is anticipated to grow at a 5.5% CAGR, driven by high demand for premium processed meats and strict compliance with EU food safety regulations. Starter cultures are widely applied in the production of sausages and dry-cured meats, where flavor stability and safety are critical. German meat processors are adopting advanced freeze-dried cultures to achieve consistent fermentation outcomes and extended shelf life. The market is witnessing increased R&D investment in cultures designed for low-salt formulations to meet consumer health preferences. Export-driven demand for high-quality fermented meat products further strengthens growth prospects in the country.

France is expected to grow at a 5.0% CAGR, supported by the popularity of artisanal charcuterie and rising preference for clean-label products. Meat processors are focusing on cultures that enable nitrate-free curing and deliver superior texture and aroma. Local producers are collaborating with biotech firms to develop natural antimicrobial cultures that extend shelf life without synthetic additives. Demand for traditional fermented meat products, such as saucisson, is complemented by innovations in functional cultures that improve nutritional value. Online retail and specialty stores are expanding distribution channels for premium cured meat products across France.

The United Kingdom is forecast to post a 4.6% CAGR, driven by growing consumer demand for reduced-salt and health-focused processed meat options. Meat manufacturers are adopting multi-strain cultures that support faster fermentation while maintaining authentic flavor. Premiumization trends in sausages and cured meat categories are encouraging investment in high-quality culture solutions. Imports of advanced starter cultures from European suppliers are increasing due to the absence of large-scale local production. E-commerce channels and gourmet retail formats are enhancing market accessibility, while foodservice providers adopt cultures for menu diversification.

The meat starter cultures market is highly competitive, led by prominent players such as DSM Food Specialties B.V., DuPont de Nemours Inc., Kerry Group, Lallemand Inc., and Biochem S.R.L., which focus on developing specialized microbial strains to improve flavor, texture, safety, and shelf life of processed meats.

DSM and DuPont leverage extensive research and innovation capabilities to provide customized starter culture solutions tailored to diverse meat products, including sausages, cured meats, and fermented specialties. Kerry Group and Lallemand emphasize clean-label and natural fermentation technologies to meet consumer preferences for minimally processed foods. Biochem S.R.L. strengthens its market presence through niche offerings and partnerships with regional meat processors. Competitive differentiation hinges on strain efficacy, product consistency, and regulatory compliance across global markets, with players investing heavily in R&D to develop cultures that enhance pathogen control and reduce additive use.

The industry faces moderate entry barriers due to technical complexity and strict food safety standards, which favor established companies with robust quality systems and global supply chains. Market rivalry intensifies as manufacturers compete to address evolving consumer demands for authentic flavors, extended shelf life, and natural preservation methods. Strategic priorities include expanding portfolio breadth, improving culture adaptability to various meat matrices, and supporting customers with application expertise and technical services.

Future growth is expected to be driven by increasing meat consumption, regulatory pressures to reduce chemical preservatives, and innovation in probiotic and functional starter cultures tailored to health-conscious consumers and clean-label product trends.

| Item | Value |

|---|---|

| Quantitative Units | USD 77.2 Million |

| Form | Freeze Dried and Frozen |

| Composition | Multi-Strain Mix, Single Strain, and Multi-Strain |

| Microorganism | Bacteria and Fungi |

| Application | Sausages, Salami, Dry-Cured Meat, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DSMFoodSpecialtiesB.V., DuPontdeNemoursInc., KerryGroup, LallemandInc., and BiochemS.R.L |

| Additional Attributes | Dollar sales by culture type (lactic acid bacteria, coagulase-negative staphylococci, and molds) and application (dry sausages, fermented meats, and salami), driven by demand for consistent flavor development, texture enhancement, and microbial safety in meat processing. Europe leads adoption due to a strong tradition of fermented meat products, while Asia-Pacific shows rising potential with growing processed meat consumption. Innovation focuses on starter cultures with probiotic potential, enhanced pH control, and reduced fermentation time, along with clean-label solutions catering to natural meat processing requirements. Manufacturers emphasize strain stability under varying temperature conditions and integration with spice blends for flavor uniformity and quality assurance. |

The global meat starter cultures market is estimated to be valued at USD 77.2 million in 2025.

The market size for the meat starter cultures market is projected to reach USD 123.4 million by 2035.

The meat starter cultures market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in meat starter cultures market are freeze dried and frozen.

In terms of composition, multi-strain mix segment to command 53.6% share in the meat starter cultures market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Meat Snacks Market Size and Share Forecast Outlook 2025 to 2035

Meat Alternative Market Forecast and Outlook 2025 to 2035

Meat, Poultry, and Seafood Packaging Market Size and Share Forecast Outlook 2025 to 2035

Meat Extracts Market Size and Share Forecast Outlook 2025 to 2035

Meat Trays Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Meat Interleaving Paper Market Size and Share Forecast Outlook 2025 to 2035

Meat Enzyme Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Meat Mixers Market Size and Share Forecast Outlook 2025 to 2035

Meat Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

Meat Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Meat Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Meat Mincers Market Size and Share Forecast Outlook 2025 to 2035

Meat Tenderizer Market Size and Share Forecast Outlook 2025 to 2035

Meat Based FPP Market Size and Share Forecast Outlook 2025 to 2035

Meat Dicing Machine Market Size and Share Forecast Outlook 2025 to 2035

Meat Seasonings Market Size and Share Forecast Outlook 2025 to 2035

Meat Substitutes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Meat Packaging Market Trends - Growth & Forecast 2025 to 2035

Meat Emulsions Market Growth - Demand & Industry Insights 2025 to 2035

Analyzing Meat Packaging Market Share & Industry Growth

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA