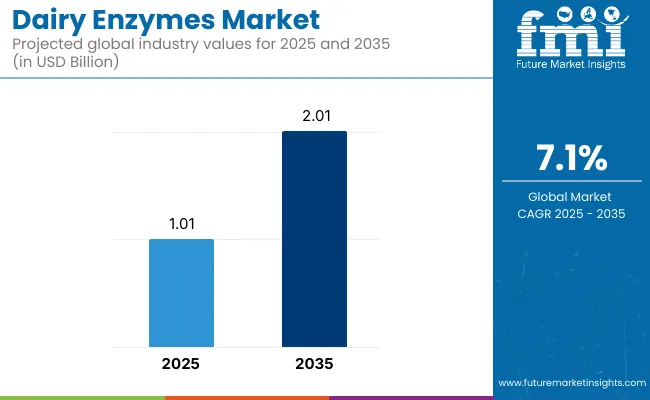

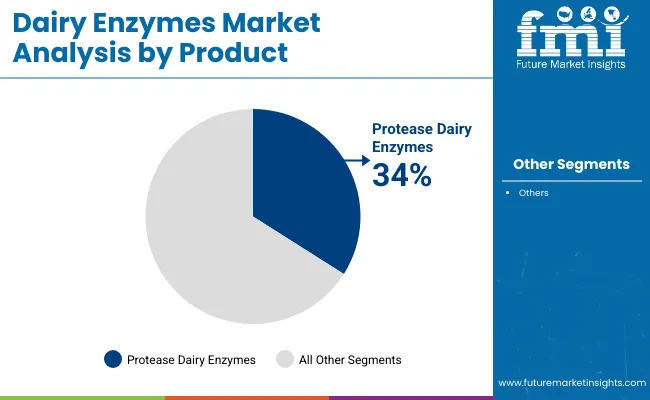

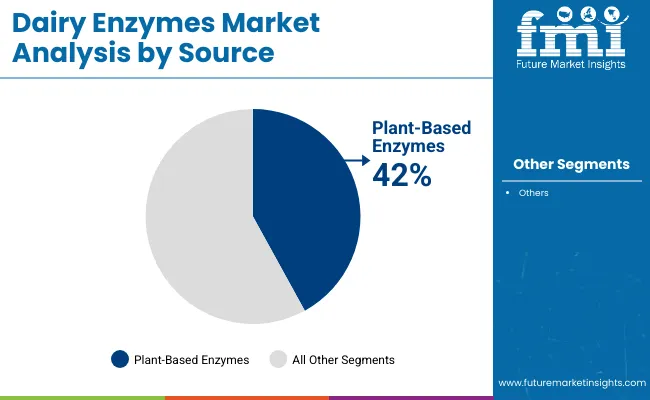

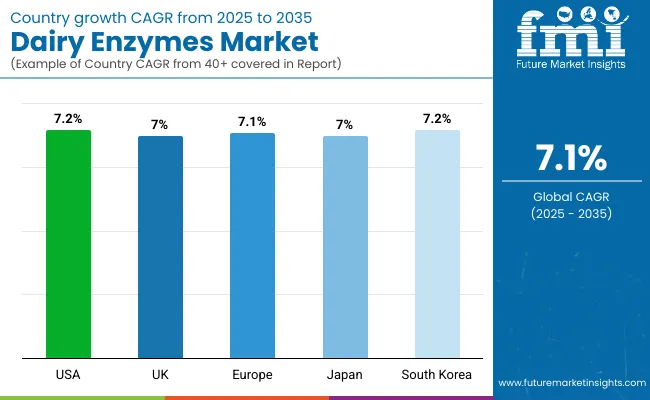

The global Dairy Enzymes Market is expected to grow from USD 1.01 billion in 2025 to USD 2.01 billion by 2035, registering a CAGR of 7.1%. Protease enzymes are projected to capture about 34 % of product demand, while plant-based sources are anticipated to hold roughly 42% of the source segment.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 1.01 billion |

| Projected Market Size in 2035 | USD 2.01 billion |

| CAGR (2025 to 2035) | 7.1% |

The market’s expansion is expected to be underpinned by a steady rise in lactose-free, high-protein, and clean-label dairy offerings. Heightened awareness of digestive wellness and protein enrichment is encouraging processors to incorporate enzymes that improve texture, flavour, and nutritional profiles. Growth momentum is being reinforced by continual improvements in fermentation efficiency, which are allowing manufacturers to reduce processing time and energy expenditure.

Demand is being driven chiefly by lactase, protease, and carbohydrate-modifying enzymes. Lactase is being adopted to hydrolyse lactose for lactose-intolerant consumers, whereas protease is being used to tailor casein and whey proteins for smoother cheese maturation and high-protein yoghurts. At the same time, carbohydrate enzymes are being leveraged to enhance sweetness and mouthfeel without added sugars, a feature increasingly sought by health-conscious shoppers.

Regional growth patterns remain differentiated. North America is expected to retain the largest share thanks to a mature dairy processing base and strong consumer appetite for functional dairy. Europe is projected to follow closely on the back of stringent quality standards and a deep cheesemaking heritage. Asia-Pacific is forecast to be the fastest-growing region, as urbanisation and rising disposable incomes lift per-capita dairy intake and spur demand for fortified, digestive-friendly products.

Several challenges are likely to shape the competitive landscape. High production costs linked to specialised fermentation, strict regulatory compliance requirements for enzyme purity, and growing interest in plant-based dairy substitutes are expected to exert pressure on traditional dairy enzyme volumes.

Even so, opportunities are being created by the escalating demand for lactose-free lines, precision-fermentation advances that enable customised enzyme profiles, and rising investment in microbial or engineered rennet for vegetarian cheese production. Continued research into enzyme specificity and stability is expected to foster next-generation solutions that deliver improved yield, flavour, and shelf-life benefits.

Protease dairy enzymes are anticipated to dominate the product category, capturing approximately 34% of the total market share in 2025. This leadership is driven by their pivotal role in cheese production, milk protein hydrolysis, and the formulation of protein-enriched dairy items such as yogurts and fortified milk beverages.

These enzymes break down casein and whey proteins into smaller peptides, which enhances the texture, flavour, and digestibility of dairy products. As demand for high-protein and functional dairy continues to surge, protease enzymes are witnessing widespread application across both traditional and plant-based formulations. Additionally, their use in dairy alternatives such as almond and oat milk is expanding, where they help improve solubility, mouthfeel, and emulsification properties.

Key Highlights:

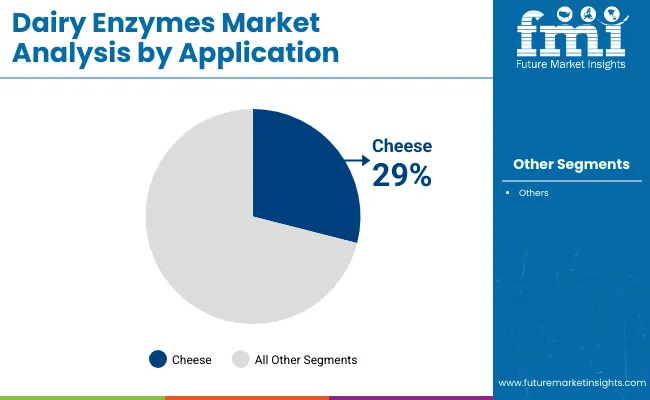

Cheese is projected to lead the application segment in the global dairy enzymes market, commanding an estimated 29% market share in 2025. Enzymes such as protease and microbial rennet are critical to the cheese-making process, influencing coagulation, texture development, flavour maturation, and shelf-life enhancement.

Cheese production requires precise enzymatic control, and as artisanal, aged, and specialty cheese varieties gain popularity globally, the demand for advanced enzyme formulations is rising. Innovations in enzyme engineering have allowed for greater consistency and speed in cheese ripening, enabling manufacturers to improve output without compromising quality. Moreover, the shift toward vegetarian cheese has driven adoption of microbial and plant-based enzyme substitutes for animal rennet.

Key Highlights:

Plant-based enzymes are expected to hold the dominant position in the source segment, accounting for approximately 42% of the market share in 2025. Their rising popularity stems from growing consumer demand for vegan, vegetarian, and clean-label dairy products, along with the industry's shift toward sustainable and animal-free processing solutions.

Derived from botanical and microbial sources, these enzymes are widely used in processing plant-based dairy alternatives such as oat milk, almond milk, and soy-based yogurts. They play a key role in improving protein solubility, texture, and nutritional quality of both conventional and non-dairy formulations. Furthermore, advancements in fermentation technology and the availability of non-GMO plant enzyme solutions have enhanced their functionality across diverse dairy applications.

Key Highlights:

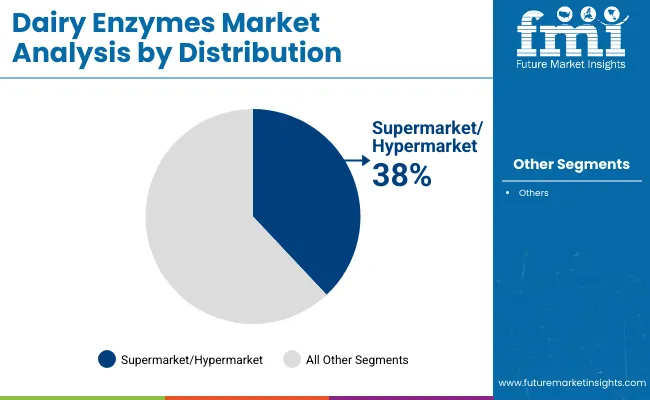

The supermarket/hypermarket segment is expected to lead the distribution channel category, holding around 38% of the global dairy enzymes market share in 2025. This dominance is due to the extensive presence of large-format retail chains offering a wide selection of dairy products, including lactose-free, high-protein, and functional variants that rely heavily on enzyme processing.

These retail formats provide visibility and shelf space to both conventional and plant-based dairy lines, making them ideal platforms for enzyme-driven dairy innovation. With consumers increasingly prioritizing digestive health, protein intake, and label transparency, supermarkets are curating premium dairy products processed using advanced enzymes. Additionally, well-developed cold-chain infrastructure ensures that enzyme-sensitive dairy items are stocked and transported efficiently.

Key Highlights:

High Production Costs, Regulatory Compliance, and Plant-Based Dairy Alternatives

Lactase and other dairy enzymes like protease, lipase, and rennet, need specialized fermentation and biotechnological processes, which increase operational costs. A major challenge is compliance with regulations: food safety organizations like the FDA, EFSA and FSSAI have strict standards related to enzyme purity, microbial sourcing and allergen labeling, not to mention the effects on the end product.

We also expect some pressure from decreasing demand from the rising plant-based dairy alternatives trend resulting in shifting consumer preferences away from traditional dairy processing and leading to the lower demand for certain enzymes used in cheese, yogurt and milk-based products.

Growth in Lactose-Free Dairy, Functional Dairy Products, and Enzyme Innovation

However, these challenges are outweighed by the growing demand for lactose-free products, functional dairy formulations, and advanced enzyme technology in the food industry which businesses in dairy enzyme market can leverage upon. The growing incidence of lactose intolerance is driving up the need for lactase enzymes, which allow dairy producers to market their products to lactose-intolerant customers.

Texture, flavor, and digestibility enzymes are also sought after for high-protein dairies, probiotic-rich yogurts, as well as premium cheeses. Innovative microbial fermentation systems, as well as genetically engineered enzymes and AI-driven optimizations of those enzymes, are improving processing efficiencies and sustainability in producing dairy products as well.

The USA dairy enzymes market has also seen a steady growth owing to the growing demand for lactose-free dairy products, clean-label ingredients, and functional dairy formulations. Increasing usage of enzyme processing solution in cheese making, yogurt fermentation, milk processing is supporting market growth. Moreover, the industry growth is further supported by advancements in biotechnology and enzyme optimization.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.2% |

United Kingdom, the increasing demand for plant-based dairy substitutes, as well as the growing tendency of low-fat or digestive-friendly dairy products, are driving the expansion of the dairy enzymes sector.

With growing consumer demand for lactose-free, high-protein dairy products, enzyme innovation continues to drive innovation. Moreover, the increasing focus of regulatory authorities on food safety, along with the growing adoption of sustainable dairy processing methods is supporting the growth of enzymatic solutions in dairy industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.0% |

The dairy enzymes market is developing consistently throughout Europe due to dairy producers focusing on advanced processing technology to improve the quality and sustainability of products.

The growing consumer inclination towards probiotic-enriched and functional dairy products is shaping the demand for enzymes for fermentation and milk processing. Changes in the realigning landscape to give clearer shape of market trends are the of the stringent food additive regulation of EU and dairy product formulation.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 7.1% |

The market for dairy enzymes in Japan is growing at moderate rate, driven by rising demand for functional and digestive-health dairy derivatives. Industry growth is propelled by the popularity of yogurt with enzymes, fermented dairy, and lactose-free milk. Other drivers include innovations in enzyme engineering and probiotic-enhanced dairy formulations.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.0% |

The increasing use of fermented dairy items and plant-based dairy substitutes is boosting growth in the dairy enzymes market in South Korea. A heightened consumer interest in gut health and digestive wellness is driving the demand for enzyme-based dairy innovations. Furthermore, government initiatives supporting biotechnology and enzyme research are driving the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.2% |

The dairy enzymes market is witnessing heightened competition among biotechnology firms, enzyme producers, and dairy solution providers, all focusing on enhanced product quality, digestive health, and processing efficiency. Companies are prioritizing AI-assisted enzyme engineering, sustainable fermentation, and customised enzyme formulations for evolving consumer needs.

Tier 1 players such as Chr. Hansen Holding A/S, Novozymes A/S, and Kerry Group Plc are leading innovation in enzyme-based dairy processing, while Tier 2 players including Amano Enzyme Inc., Enmex S.A. de C.V., and Advanced Enzyme Technologies Ltd. are expanding offerings in specialty and regional segments. The market remains moderately consolidated with diversified R&D pipelines targeting both traditional dairy and non-dairy enzyme applications.

Firms are increasingly leveraging AI tools for enzyme activity prediction, fermentation control, and personalised enzyme selection. Partnerships between dairy processors and biotech innovators are also gaining traction, especially to address rising demand for lactose-free, protein-fortified, and vegan-friendly dairy products.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 1.01 billion |

| Projected Market Size (2035) | USD 2.01 billion |

| CAGR (2025 to 2035) | 7.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | USD Billion for Value |

| Product Segments Analyzed | Carbohydrate Enzymes, Protease, Lipase, Polymerase & Nuclease, Phytase, Others |

| Application Segments Analyzed | Milk, Cheese, Ice Creams & Desserts, Yogurt, Whey, Infant Formula, Others |

| Source Types Analyzed | Plant-Based, Animal & Micro-organism Based |

| Distribution Channels Analyzed | E-Commerce, Speciality Retailers, Supermarket/Hypermarket, Others |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia Pacific, Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, South Korea, China, India |

| Key Players Profiled | Chr. Hansen Holding A/S, Novozymes A/S, Kerry Group Plc, DuPont (IFF), DSM-Firmenich, Amano Enzyme Inc., Biocatalysts Ltd., Enmex S.A. de C.V., Advanced Enzyme Technologies |

| Additional Data Points Covered | Country-wise CAGR, Share by Enzyme Type and Source, Competitive Strategy Insights, AI & Biotech Adoption Trends, Plant-Based Dairy Enzyme Penetration |

Carbohydrate Dairy Enzymes, Protease Dairy Enzymes, Polymerase & Nuclease Dairy Enzymes, Lipase Dairy Enzymes, Phytase Dairy Enzymes, Other Dairy Enzymes

Milk, Cheese, Ice Creams & Desserts, Yogurt, Whey, Infant Formula, Other Applications

Plant-Based, Animal and Micro-organisms Based

E-Commerce, Speciality Retailers, Supermarket/Hypermarket, Others

The global dairy enzymes market is projected to reach USD 2.01 billion by 2035.

Protease dairy enzymes lead the market, accounting for approximately 34% share in 2025.

Demand is rising due to clean-label trends and increased production of vegan and allergen-friendly dairy products.

Asia-Pacific is the fastest-growing region, driven by rising per-capita dairy consumption and expanding urban populations.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dairy Product Packaging Market Size and Share Forecast Outlook 2025 to 2035

Dairy Container Market Analysis Size and Share Forecast Outlook 2025 to 2035

Dairy Packaging Market Size and Share Forecast Outlook 2025 to 2035

Dairy Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Dairy Alternatives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Filtration Systems Market Size and Share Forecast Outlook 2025 to 2035

Dairy Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Dairy Concentrate Market Forecast and Outlook 2025 to 2035

Dairy Testing Services Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Dairy-Free Smoothies Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy-Based Dressings Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy-Free Spreads Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Blends Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Whiteners Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Flavors Market Trends - Growth & Industry Forecast 2025 to 2035

Dairy-Free Evaporated Milk Market Analysis by Application, Type, Sales Channel Through 2025 to 2035

Dairy Protein Crisps Market Flavor, Packaging, Application and Distribution Channel Through 2025 to 2035

Dairy Products Market Analysis by Product Type, End Use, Distribution Channel and Region through 2035

Dairy-Free Cream Market Insights – Plant-Based Dairy Alternatives 2025 to 2035

Dairy Snacks Market Growth - Consumer Preferences & Industry Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA