The global dairy-free cream market is poised for steady growth as consumers increasingly seek plant-based alternatives to traditional dairy products. Dairy-free cream, made from ingredients such as coconut, almond, soy, or oats, offers a versatile option for cooking, baking, and enhancing beverages.

This market expansion is driven by a combination of factors: the rise in lactose intolerance, growing vegan and flexitarian diets, and an overall push toward healthier, sustainable food choices. Food and beverage manufacturers are continuously innovating in flavor, texture, and nutritional profiles, making dairy-free cream an appealing option for both health-conscious consumers and environmentally aware shoppers.

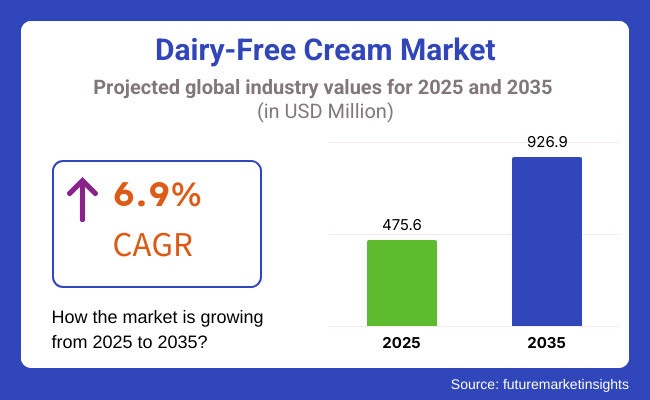

With ongoing innovation and expanding applications, the dairy-free cream market is expected to experience consistent growth through 2035. In 2025, the dairy-free cream market was estimated at approximately USD 475.6 Million. By 2035, it is projected to grow to around USD 926.9 Million, reflecting a compound annual growth rate (CAGR) of 6.9%. This growth highlights the increasing global shift toward plant-based and dairy-free products.

North America is still a major market for dairy-free cream, largely due to high levels of lactose intolerance, an established plant-based food market, and an increasing demand for clean-label and allergen-friendly products. Similar trend is rising across the USA and Canada, with the dairy-free creams experiencing constant innovation in flavor and texture along with growing availability in mainstream grocery aisles and foodservice.

Another important market is Europe, which has a rich plant-based culinary heritage and an increasing pool of flexitarian and vegan consumers. Dairy-free creams are gaining popularity in the culinary and beverage sectors, driven by innovative processors in the United Kingdom, Sweden, and Germany. The market is also bolstered by Europe’s emphasis on sustainability and lowering the environmental footprint of food production.

With rapid urbanization, rising disposable incomes, and the increasing popularity of dairy-free cream as part of the plant-based diet, the Asia-Pacific region is projected to be the fastest-growing market for dairy-free cream. In Japan through dietary preferences and health considerations as well as the global influence in the food trends, heightening demand for dairy-free products also is seen in China and India.

Challenges

High Production Costs, Taste and Texture Limitations, and Regulatory Compliance

The demand for dairy free cream, which is primarily counterpart in small ingredient spark supply that uses plant-based ingredients and processing technologies. Plant-based creams (made from almond, coconut, oat, and soy) are more expensive than traditional dairy cream because they require bespoke extraction, emulsification, and fortification techniques to engender a creamy texture and stability.

Another key hurdle: taste and texture limitations, since replicating the richness, mouthfeel, and foaming properties of dairy cream is still a technical challenge. Regulatory compliance also adds to complexities-with FDA, EFSA and countless food safety agencies insisting upon stringent labeling, allergen declarations, and clean-label commitments, particularly concerning non-dairy and vegan certifications.

Opportunities

Growth in Vegan and Lactose-Free Products, Functional Ingredients, and AI-Optimized Dairy Alternatives

Despite these obstacles, the plant-based cream industry enjoys strong growth potential, owing to an increasing demand for vegan, lactose-free, and functional food products. Thus, the market for plant-based sources of coffee, bakery, confectionery, and cooking applications non-dairy creamers is flourishing, enhanced by the growing number of plant-based eaters.

Technologies such as AI is driving innovations involving food formulation, precision fermentation and enzyme catalysis breakthroughs to enhance plant proteins, push texture improvements, and even dairy-like taste in plant-based creams. The introduction of fortified dairy-free creams with added probiotics, vitamins and protein is also creating avenues in functional nutrition.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with non-dairy labeling, allergen-free claims, and clean-label transparency. |

| Consumer Trends | Demand for vegan, lactose-free, and allergen-friendly dairy alternatives. |

| Industry Adoption | High usage in coffee, bakery, confectionery, and plant-based food applications. |

| Supply Chain and Sourcing | Dependence on plant-based fats (coconut, almond, oat, soy) and emulsifiers. |

| Market Competition | Dominated by traditional dairy alternative brands and plant-based food manufacturers. |

| Market Growth Drivers | Growth fueled by increasing vegan population, lactose-intolerant consumers, and plant-based innovation. |

| Sustainability and Environmental Impact | Moderate adoption of eco-friendly ingredient sourcing and recyclable packaging. |

| Integration of Smart Technologies | Early adoption of enzyme-based emulsification and AI-driven ingredient selection. |

| Advancements in Food Science | Development of creamier plant-based alternatives with enhanced foaming and stability. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter GMO-free certifications, carbon-neutral food sourcing, and AI-driven ingredient traceability. |

| Consumer Trends | Growth in high-protein, probiotic-enhanced, and AI-optimized dairy-free cream formulations. |

| Industry Adoption | Expansion into functional dairy-free creams, personalized nutrition, and smart plant-based ingredient formulations. |

| Supply Chain and Sourcing | Shift toward precision fermentation, sustainable plant-based emulsifiers, and bioengineered fat alternatives. |

| Market Competition | Entry of AI-driven food science startups, sustainable ingredient firms, and biotech-based dairy-free innovators. |

| Market Growth Drivers | Accelerated by precision fermentation, AI-powered taste optimization, and sustainable plant-derived ingredients. |

| Sustainability and Environmental Impact | Large-scale shift toward carbon-neutral dairy-free cream production, regenerative agriculture, and zero-waste processing. |

| Integration of Smart Technologies | Expansion into IoT-enabled quality control, AI-assisted texture enhancement, and smart plant-based dairy replacements. |

| Advancements in Food Science | Evolution toward bioengineered plant proteins, AI-optimized fat structures, and dairy-free functional cream solutions. |

The dairy-free cream market in the USA is experiencing consumers becoming increasingly aware of veganism, lactose intolerance, and the growing passion for dairy-free products offered in the foodservice and retail industries, are among the factors fueling the expansion of the market. The development of new dairy-free cream systems made from almond, oat, soy, and coconut bases is also driving the growth of the industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.0% |

The dairy-free cream market in the United Kingdom also is growing rapidly as people are increasingly shifting towards plant-based diets and sustainable food choices. The rapid rise in the market for vegan-friendly cafes and restaurants is one of the factors driving the demand for dairy-free cream in coffee coupled with dessert and baking applications. Market dynamics are also being shaped by regulatory initiatives promoting plant-based alternatives or reducing dairy consumption.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.8% |

The dairy-free cream market has always been consistently on the rise in the region of the European Union, where consumers are constantly looking for healthy with ethical dairy alternatives. The market is growing due to the robust presence of plant-based food brands and a growing innovation in dairy-free products such as barista-friendly dairy free, and whipping cream alternatives. Supportive government policies to reduce consumption of animal-based products are also boosting growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.9% |

The dairy-free cream market in Japan is experiencing moderate growth, thanks to expanding health consciousness and dietary changes in favor of plant-derived substitutes. Increase use of dairy-free creams in matcha drinks alongside desserts and confectionery are stimulating the market growth. Furthermore, advancements in dairy-free cream products based on soy and rice are contributing to the growth potential of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.8% |

The increasing adoption of vegan and flexitarian diets in South Korea is driving the growth of the dairy-free cream market in the country. The growing presence of a dairy-free cream in coffee shops, bakeries, and specialty stores has majorly fueled the market demand. Government support for plant-based food innovation and sustainability initiatives is also driving industry growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.0% |

Owing to the rapid transition of consumers to plant-based, vegan-friendly, and lactose-free products in the food & beverage sector is propelling the demand for the Dairy-Free Cream in the global market. Plant-based cream is a substitute for traditional dairy-based cream in applications, including for baking, coffee, cooking, and desserts.

Concerns not only over lactose intolerance, but even dairy allergies, along with the push for sustainable food options, have prompted manufacturers to concentrate more on innovative, functional and clean-label dairy-free formulations. Based on Product Type, the market is segmented into Soy Cream, Almond Cream, Oat Cream, Coconut Cream and Others; Source of Ingredients, the market is segmented into Soy, Almonds, Oats, Coconuts).

The most significant portion of the dairy-free cream market is occupied by oat cream since oat-based dairy alternatives are becoming popular due to their creamy texture, natural sweetness, and sustainability. For instance, oat cream is used in coffee and plant-based whipped toppings, soups, and sauces due to its excellent foaming, emulsification, and heat stability properties.

Driven by a growing interest in oat-based dairy alternatives in speciality and barista-style beverages, manufacturers are surging oat cream innovations with enhanced textures, organic formulations and fortified nutritional profiles. This only increased demand for oat-based cream alternatives in dairy-free cooking, with the rise in oat milk consumption.

Coconut cream is also experiencing significant growth, especially when it comes to Asian cuisine, dairy-free desserts, and tropical-flavored drinks. Coconut cream adds rich texture, natural fat content, and a slightly sweet flavor, so it’s been a popular option in vegan ice creams, smooth soups, and dairy-free coffee creamers

As demand increases for exotic, organic and allergen-free dairy substitutes, coconut cream is becoming an ingredient of choice in clean-label, gluten-free and ketogenic food formulations. The rising attention on functional foods with coconut and MCT (medium-chain triglyceride) content are also contributing to this segment growth.

Considering the basis of this, the coconut-based dairy-free cream is the leading market share holder in the market as the coconuts are one of the most used ingredient in vegan, keto and allergen free food products. Dairy-free cream based on coconut is characterized by a high-fat content, natural creaminess and versatility, and is thus well-suited for use in cooking, baking or specialty coffee applications.

The growing plant-based foods market, combined with increasing demand for high-fat dairy alternatives and tropical flavors, has added coconut-derived ingredients to the formulation list for high-end plant-based creams. Market demand is further boosted by the growing focus on sustainable coconut farming and on ethically sourced coconut products.

A oat-based dairy-free cream category is also rising due to growing interest from health-conscious and regular consumers for clean, sustainable and allergen-free solutions. Oats bring sweetness, a neutral taste, and good foaming for dairy-free lattes, barista creams, and plant-based heavy creams.

Due to the increase in consumer interest towards oat bases dairy free alternatives, the oat cream producing companies are spending on oat cream by supplementing fibers, vitamins & calcium to increase the nutritional value and innovation to the product.

The dairy-free cream market is projected to grow as demand for plant-based foods, lactose-free products, and clean-label formulations increases. As consumers look for nutritional, allergen-free, and sustainable substitutes for dairy, innovation is happening in AI-assisted ingredient optimization, emulsification technology, and high-quality fat mimetics.

The market consists of several types of players, including plant-based food manufacturers, dairy alternative brands, and functional ingredient suppliers, all of whom participate in the technological development of dairy-free cream processing, AI-based texture improvement, and development of sustainable plant-based ingredients.

Market Share Analysis by Key Players & Dairy-Free Cream Manufacturers

| Company Name | Estimated Market Share (%) |

|---|---|

| Danone S.A. (Alpro, Silk) | 18-22% |

| Nestlé S.A. (Natural Bliss, Wunda) | 12-16% |

| Califia Farms LLC | 10-14% |

| Oatly AB | 8-12% |

| So Delicious Dairy Free (Danone North America) | 5-9% |

| Other Plant-Based Cream Brands (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Danone S.A. (Alpro, Silk) | Develops AI-optimized plant-based creams, organic dairy-free alternatives, and emulsification technology for enhanced texture. |

| Nestlé S.A. (Natural Bliss, Wunda) | Specializes in lactose-free and oat-based creamers, AI-powered fat mimetics, and sustainable dairy-free ingredient formulations. |

| Califia Farms LLC | Provides almond and coconut-based creams, AI-assisted taste enhancement, and clean-label formulations. |

| Oatly AB | Focuses on oat-based dairy-free cream innovations, AI-driven sensory profile matching, and barista-quality texture solutions. |

| So Delicious Dairy Free (Danone North America) | Offers coconut milk-based dairy-free creams, AI-powered stability analysis, and functional ingredient blending. |

Key Market Insights

Danone S.A. (Alpro, Silk) (18-22%)

Danone leads the dairy-free cream market, offering plant-based alternatives with AI-enhanced emulsification, sustainable ingredient sourcing, and optimized texture for coffee and culinary applications.

Nestlé S.A. (Natural Bliss, Wunda) (12-16%)

Nestlé specializes in lactose-free, oat, and soy-based creamers, ensuring AI-driven fat replacement optimization and premium taste consistency.

Califia Farms LLC (10-14%)

Califia provides almond and coconut-based dairy-free creams, optimizing AI-assisted texture enhancement and sugar-reduction technologies.

Oatly AB (8-12%)

Oatly focuses on barista-grade oat-based creams, integrating AI-powered viscosity improvements and foaming stability for coffee and beverage applications.

So Delicious Dairy Free (5-9%)

So Delicious develops coconut and cashew-based creams, ensuring AI-enhanced mouthfeel consistency and high-performance dairy-free applications.

Other Key Players (30-40% Combined)

Several plant-based food companies, functional ingredient suppliers, and specialty dairy-free brands contribute to next-generation dairy-free cream innovations, AI-powered fat mimetic development, and sustainable plant-based texture optimization. These include:

The overall market size for dairy-free cream market was USD 475.6 Million in 2025.

Dairy-free cream market is expected to reach USD 926.9 Million in 2035.

The demand for dairy-free cream is expected to rise due to increasing lactose intolerance cases, growing consumer preference for plant-based alternatives, and expanding applications in bakery, confectionery, and ready-to-drink beverages.

The top 5 countries which drives the development of dairy-free cream market are USA, UK, Europe Union, Japan and South Korea.

Oat Cream and Coconut-Based Ingredients to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Product, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 8: Global Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by End-use Industries, 2018 to 2033

Table 10: Global Market Volume (Tons) Forecast by End-use Industries, 2018 to 2033

Table 11: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 12: Global Market Volume (Tons) Forecast by Sales Channel, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 16: North America Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 18: North America Market Volume (Tons) Forecast by Product, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 20: North America Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 21: North America Market Value (US$ Million) Forecast by End-use Industries, 2018 to 2033

Table 22: North America Market Volume (Tons) Forecast by End-use Industries, 2018 to 2033

Table 23: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 24: North America Market Volume (Tons) Forecast by Sales Channel, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 28: Latin America Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 30: Latin America Market Volume (Tons) Forecast by Product, 2018 to 2033

Table 31: Latin America Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 32: Latin America Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 33: Latin America Market Value (US$ Million) Forecast by End-use Industries, 2018 to 2033

Table 34: Latin America Market Volume (Tons) Forecast by End-use Industries, 2018 to 2033

Table 35: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 36: Latin America Market Volume (Tons) Forecast by Sales Channel, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 40: Europe Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 41: Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 42: Europe Market Volume (Tons) Forecast by Product, 2018 to 2033

Table 43: Europe Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 44: Europe Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 45: Europe Market Value (US$ Million) Forecast by End-use Industries, 2018 to 2033

Table 46: Europe Market Volume (Tons) Forecast by End-use Industries, 2018 to 2033

Table 47: Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 48: Europe Market Volume (Tons) Forecast by Sales Channel, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: Asia Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 51: Asia Pacific Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 52: Asia Pacific Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 53: Asia Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 54: Asia Pacific Market Volume (Tons) Forecast by Product, 2018 to 2033

Table 55: Asia Pacific Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 56: Asia Pacific Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 57: Asia Pacific Market Value (US$ Million) Forecast by End-use Industries, 2018 to 2033

Table 58: Asia Pacific Market Volume (Tons) Forecast by End-use Industries, 2018 to 2033

Table 59: Asia Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 60: Asia Pacific Market Volume (Tons) Forecast by Sales Channel, 2018 to 2033

Table 61: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: MEA Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 63: MEA Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 64: MEA Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 65: MEA Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 66: MEA Market Volume (Tons) Forecast by Product, 2018 to 2033

Table 67: MEA Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 68: MEA Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 69: MEA Market Value (US$ Million) Forecast by End-use Industries, 2018 to 2033

Table 70: MEA Market Volume (Tons) Forecast by End-use Industries, 2018 to 2033

Table 71: MEA Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 72: MEA Market Volume (Tons) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Source, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Grade, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End-use Industries, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 8: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 12: Global Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 16: Global Market Volume (Tons) Analysis by Product, 2018 to 2033

Figure 17: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 19: Global Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 20: Global Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 21: Global Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 22: Global Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 23: Global Market Value (US$ Million) Analysis by End-use Industries, 2018 to 2033

Figure 24: Global Market Volume (Tons) Analysis by End-use Industries, 2018 to 2033

Figure 25: Global Market Value Share (%) and BPS Analysis by End-use Industries, 2023 to 2033

Figure 26: Global Market Y-o-Y Growth (%) Projections by End-use Industries, 2023 to 2033

Figure 27: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 28: Global Market Volume (Tons) Analysis by Sales Channel, 2018 to 2033

Figure 29: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 30: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 31: Global Market Attractiveness by Source, 2023 to 2033

Figure 32: Global Market Attractiveness by Product, 2023 to 2033

Figure 33: Global Market Attractiveness by Grade, 2023 to 2033

Figure 34: Global Market Attractiveness by End-use Industries, 2023 to 2033

Figure 35: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 36: Global Market Attractiveness by Region, 2023 to 2033

Figure 37: North America Market Value (US$ Million) by Source, 2023 to 2033

Figure 38: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 39: North America Market Value (US$ Million) by Grade, 2023 to 2033

Figure 40: North America Market Value (US$ Million) by End-use Industries, 2023 to 2033

Figure 41: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 42: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 44: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 45: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 46: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 47: North America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 48: North America Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 49: North America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 50: North America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 51: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 52: North America Market Volume (Tons) Analysis by Product, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 55: North America Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 56: North America Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 57: North America Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 58: North America Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 59: North America Market Value (US$ Million) Analysis by End-use Industries, 2018 to 2033

Figure 60: North America Market Volume (Tons) Analysis by End-use Industries, 2018 to 2033

Figure 61: North America Market Value Share (%) and BPS Analysis by End-use Industries, 2023 to 2033

Figure 62: North America Market Y-o-Y Growth (%) Projections by End-use Industries, 2023 to 2033

Figure 63: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 64: North America Market Volume (Tons) Analysis by Sales Channel, 2018 to 2033

Figure 65: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 66: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 67: North America Market Attractiveness by Source, 2023 to 2033

Figure 68: North America Market Attractiveness by Product, 2023 to 2033

Figure 69: North America Market Attractiveness by Grade, 2023 to 2033

Figure 70: North America Market Attractiveness by End-use Industries, 2023 to 2033

Figure 71: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 72: North America Market Attractiveness by Country, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) by Source, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 75: Latin America Market Value (US$ Million) by Grade, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) by End-use Industries, 2023 to 2033

Figure 77: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 81: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 82: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 83: Latin America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 84: Latin America Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 85: Latin America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 87: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 88: Latin America Market Volume (Tons) Analysis by Product, 2018 to 2033

Figure 89: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 90: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 91: Latin America Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 92: Latin America Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 93: Latin America Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 94: Latin America Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 95: Latin America Market Value (US$ Million) Analysis by End-use Industries, 2018 to 2033

Figure 96: Latin America Market Volume (Tons) Analysis by End-use Industries, 2018 to 2033

Figure 97: Latin America Market Value Share (%) and BPS Analysis by End-use Industries, 2023 to 2033

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by End-use Industries, 2023 to 2033

Figure 99: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 100: Latin America Market Volume (Tons) Analysis by Sales Channel, 2018 to 2033

Figure 101: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 102: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 103: Latin America Market Attractiveness by Source, 2023 to 2033

Figure 104: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 105: Latin America Market Attractiveness by Grade, 2023 to 2033

Figure 106: Latin America Market Attractiveness by End-use Industries, 2023 to 2033

Figure 107: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 108: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 109: Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 110: Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 111: Europe Market Value (US$ Million) by Grade, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) by End-use Industries, 2023 to 2033

Figure 113: Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 114: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 115: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 116: Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 117: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 118: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 119: Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 120: Europe Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 121: Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 122: Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 123: Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 124: Europe Market Volume (Tons) Analysis by Product, 2018 to 2033

Figure 125: Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 126: Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 127: Europe Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 128: Europe Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 129: Europe Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 130: Europe Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 131: Europe Market Value (US$ Million) Analysis by End-use Industries, 2018 to 2033

Figure 132: Europe Market Volume (Tons) Analysis by End-use Industries, 2018 to 2033

Figure 133: Europe Market Value Share (%) and BPS Analysis by End-use Industries, 2023 to 2033

Figure 134: Europe Market Y-o-Y Growth (%) Projections by End-use Industries, 2023 to 2033

Figure 135: Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 136: Europe Market Volume (Tons) Analysis by Sales Channel, 2018 to 2033

Figure 137: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 138: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 139: Europe Market Attractiveness by Source, 2023 to 2033

Figure 140: Europe Market Attractiveness by Product, 2023 to 2033

Figure 141: Europe Market Attractiveness by Grade, 2023 to 2033

Figure 142: Europe Market Attractiveness by End-use Industries, 2023 to 2033

Figure 143: Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 144: Europe Market Attractiveness by Country, 2023 to 2033

Figure 145: Asia Pacific Market Value (US$ Million) by Source, 2023 to 2033

Figure 146: Asia Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 147: Asia Pacific Market Value (US$ Million) by Grade, 2023 to 2033

Figure 148: Asia Pacific Market Value (US$ Million) by End-use Industries, 2023 to 2033

Figure 149: Asia Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 150: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 151: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 152: Asia Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 153: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 154: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 155: Asia Pacific Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 156: Asia Pacific Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 157: Asia Pacific Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 158: Asia Pacific Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 159: Asia Pacific Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 160: Asia Pacific Market Volume (Tons) Analysis by Product, 2018 to 2033

Figure 161: Asia Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 162: Asia Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 163: Asia Pacific Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 164: Asia Pacific Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 165: Asia Pacific Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 166: Asia Pacific Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 167: Asia Pacific Market Value (US$ Million) Analysis by End-use Industries, 2018 to 2033

Figure 168: Asia Pacific Market Volume (Tons) Analysis by End-use Industries, 2018 to 2033

Figure 169: Asia Pacific Market Value Share (%) and BPS Analysis by End-use Industries, 2023 to 2033

Figure 170: Asia Pacific Market Y-o-Y Growth (%) Projections by End-use Industries, 2023 to 2033

Figure 171: Asia Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 172: Asia Pacific Market Volume (Tons) Analysis by Sales Channel, 2018 to 2033

Figure 173: Asia Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 174: Asia Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 175: Asia Pacific Market Attractiveness by Source, 2023 to 2033

Figure 176: Asia Pacific Market Attractiveness by Product, 2023 to 2033

Figure 177: Asia Pacific Market Attractiveness by Grade, 2023 to 2033

Figure 178: Asia Pacific Market Attractiveness by End-use Industries, 2023 to 2033

Figure 179: Asia Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 180: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: MEA Market Value (US$ Million) by Source, 2023 to 2033

Figure 182: MEA Market Value (US$ Million) by Product, 2023 to 2033

Figure 183: MEA Market Value (US$ Million) by Grade, 2023 to 2033

Figure 184: MEA Market Value (US$ Million) by End-use Industries, 2023 to 2033

Figure 185: MEA Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 186: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 187: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 188: MEA Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 189: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 190: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 191: MEA Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 192: MEA Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 193: MEA Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 194: MEA Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 195: MEA Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 196: MEA Market Volume (Tons) Analysis by Product, 2018 to 2033

Figure 197: MEA Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 198: MEA Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 199: MEA Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 200: MEA Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 201: MEA Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 202: MEA Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 203: MEA Market Value (US$ Million) Analysis by End-use Industries, 2018 to 2033

Figure 204: MEA Market Volume (Tons) Analysis by End-use Industries, 2018 to 2033

Figure 205: MEA Market Value Share (%) and BPS Analysis by End-use Industries, 2023 to 2033

Figure 206: MEA Market Y-o-Y Growth (%) Projections by End-use Industries, 2023 to 2033

Figure 207: MEA Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 208: MEA Market Volume (Tons) Analysis by Sales Channel, 2018 to 2033

Figure 209: MEA Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 210: MEA Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 211: MEA Market Attractiveness by Source, 2023 to 2033

Figure 212: MEA Market Attractiveness by Product, 2023 to 2033

Figure 213: MEA Market Attractiveness by Grade, 2023 to 2033

Figure 214: MEA Market Attractiveness by End-use Industries, 2023 to 2033

Figure 215: MEA Market Attractiveness by Sales Channel, 2023 to 2033

Figure 216: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cream of Tartar Market Size and Share Forecast Outlook 2025 to 2035

Cream Separator Market Size and Share Forecast Outlook 2025 to 2035

Cream Cheese Market Analysis – Size, Share, and Forecast 2025 to 2035

BB Cream Market Analysis by Skin Type, SPF Type, End Uses, Sales Channel and Region through 2025 to 2035

Ice Cream Coating Market Size and Share Forecast Outlook 2025 to 2035

Ice-cream Premix and Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Ice Cream Equipment Market Size and Share Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Ice Cream and Frozen Dessert Market from 2025 to 2035

Ice Cream Packaging Market - Outlook 2025 to 2035

Ice Cream Processing Equipment Market Growth - Trends, Demand & Innovations 2025 to 2035

Ice Cream Service Supplies Market - Premium Serving Essentials 2025 to 2035

Ice Cream Parlor Market Analysis by Type, Product Type, and Region Through 2035

Breaking Down Market Share in the Ice Cream Parlor Industry

Ice Cream Container Market Size & Trends Forecast 2024-2034

Dry Cream Substitute Market

Ice-cream Maker Market

Precis of Key Trends Shaping Sour Cream Powder Business Landscape.

DMAE Cream Market Report – Growth & Industry Trends 2024-2034

A2 Ice Cream Market Size and Share Forecast Outlook 2025 to 2035

Coffee Creamer Market Analysis by Form, Nature, Category, Application and Sales Channel Through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA