The ice cream parlor market is set to exhibit USD 21.4 billion in 2025. The industry is poised to expand at 4.9% CAGR from 2025 to 2035 and register USD 96.9 billion by 2035.

The industry growth can be largely attributed to the changing consumer preferences, unique flavors, and a considerable rising demand for the premium and artistic ones. Urbanization and lifestyle changes are the major causes which are contributing to the increase in the number of specialty parlors which is being visited a spot where people are on a quest for choosing unique flavors, high quality ingredients, and healthier options.

The emphasis on new and experimental flavors has resulted in a bout of creativity with the parlors dealing with alien ingredients, fusion flavors, and make-your-own options. Vegan, keto-friendly, and plant-based ice creams are also seeing a surge in popularity, with brands launching coconut, almond, and oat milk-based flavors specifically for dietary preferences. Industry trends that include the request of consumers for ice cream flavors with lower sugar, higher protein, or functional inputs, such as probiotics, are equally the factors forming the industry.

Some of the big businesses, which are Halo Top and Enlightened, have commercialized this tendency effectively by bringing low-calorie and high-protein desserts to the industry that are in line with health-conscious individuals. On account of the increased disposable income, the tendency of turning toward sweet dessert and the social media exposure of the aesthetic desserts, the surge for the specialized parlors is anticipated.

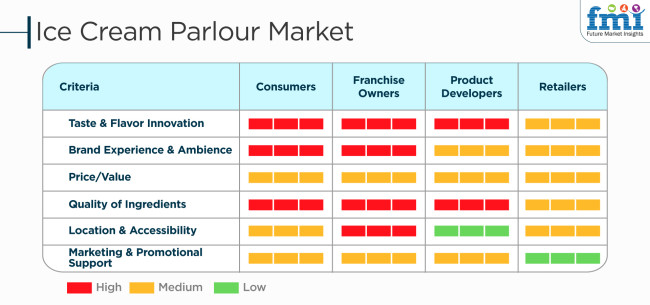

The Ice Cream Parlour industry is influenced by various stakeholders such as consumers, franchise owners, product developers, and priority of the retailers. Consumers do rank taste, flavor innovation, and brand experience as the most important factors driving purchasing behavior. They also rate quality ingredients as important but with medium importance on price and convenience. Franchise owners mirror consumers, prioritize brand experience and taste innovation to gain a competitive advantage in the market.

Product developers pay attention to taste, quality, and price/value of ingredients, with innovation balanced with affordability. But the retailers differ in their thoughts. They emphasize medium importance for taste, brand experience, and quality of ingredients but most highly emphasize marketing and promotion support to encourage sales. They care less about location and convenience and instead try to keep the product stable and available. This organized foresight assists firms in refining their strategies and confronting specific stakeholder issues to raise customer satisfaction, market coverage, and profitability within the competitive ice cream parlor business.

Between 2020 and 2024, the industry experienced changes spurred by evolving consumer tastes, health-oriented trends, and digitalization. The popularity of plant-based and low-calorie products spurred demand for protein-enriched and dairy-free products. Premiumization became more popular, with artisanal and exotic flavors gaining popularity among customers looking for differentiated experiences. Online ordering and delivery services also increased, allowing parlors to expand their reach through app-based platforms and ghost kitchens.

Between 2025 and 2035, sustainability and technology will reshape the industry. While AI-personalization will enhance flavor creation, robots-and automation will drive production. Sustainable packaging and carbon-neutral production processes will become the norm, as consumers demand sustainability. Functional ice creams laced with probiotics, adaptogens, and vitamins will become demanding among consumers conscious of wellness. Industry innovations will continue to meet the rapidly changing consumer needs, which will also include new retail ideas such as experiential parlors and hybrid dessert cafes.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The industry is growing at a steady pacedue to increasing inclination of consumers toward indulgence products, growing expenditure on desserts, and the rising number of premium and artisanal ice cream brands. Sales were briefly affected during the pandemic, butdemand came roaring back post-Easter. | The introduction of a diverse range of products with different flavors and the advent of plant-based options will lead to a faster growth rate in the industry, complemented by the emergence ofdigital ordering platforms. And so, the growth will come fromyour expansion into emerging markets. |

| Growing disposable income,urbanization, and the popularity of frozen desserts were some of the factors contributing to industry growth. Demandfor premium and organic ice creams was strong, particularly among health-oriented consumers. | Trends in sustainability, healthy consumer choices,and customer personalization based on artificial intelligence are growth drivers. Vegan, lactose-free and low-calorieversions will be in demand. We could get ice cream directly from vendingmachines and robot parlors. |

| Brand loyalty, variety of flavours and price points were the main things consumers focusedon. Take away and home-delivery ice cream have hit new heights of popularity during the pandemic - aswell as those of partnerships with delivery platforms. | Sustainability, healthbenefits, and unique experiences will take center stage for consumers. The innovative applications, taking ice cream to a new level through personalized andmade-to-order, AI-driven recommendations, will become a significant trend. |

| Organic,dairy-free, and low-calorie ice creams responded to health-conscious consumers. Exotic flavors based on local and global cuisines are taking flight. | New production techniquescreate functional, probiotic-fortified ice creams and other hybrids. Thevery experience of consumers will transform with innovations like nitrogen-based ice creams and 3D-printed desserts. |

| Significant presence inNorth America and Europe, with gradual growth in Asia-Pacific and Latin America Whereas, luxury ice cream brands started to gainpopularity with affluent consumers. | Growth will be led by emerging markets - especially in Asia-Pacific, driven by expanding spend from themiddle class and urbanization. Growth will be driven by global brands expanding into tier-2and tier-3 cities. |

| In-store experience was further developed with themed cafés,interactive menus and limited-edition collaborations with food influencers. | Theseinclude self-service kiosks, AI-powered order customization, and AR-powered interactive experiences in smart parlors. In addition, retail partnerships withsupermarkets and convenience stores will further widespread. |

| Brands reactedby looking for packaging solutions, reducing use of plastic, and sourcing ingredients sustainably. Sustainability was at earlyadoption stage only. | Regulatory-affiliated institutions will demand stricter environmental controls, compellingfirms to adapt biodegradable packing, carbon-neutral production and ethical procurement of raw materials. Parlors willbe fused with renewable energy solutions |

| Sales were largely through traditional parlors, supermarkets & food service outlets, with growing penetration via e commerce& app based delivery services. | 2019 will be the year ofonline ordering, subscription-based ice cream delivery, and direct-to-consumer (DTC) models. AI predictive ordering & drone-delivered ice cream willtake off. |

Cost fluctuations of raw materials are the most important risk factors in the industry. The prices of ingredients like dairy, sugar, and flavouring agents are subject to price volatility because of supply chain disruptions, climate changes affecting crop yields, and inflationary pressures. Extremely high spikes in the input costs if not managed in an adept manner can cause losses in profit margins.

Seasonality is another critical challenge. Typical ice cream sales are at their height during the hot months and son are the relaxing sales in cold seasons. Forexample, parlors can implement promotional strategies such as introducing seasonal flavors, expanding the product line (e.g., hot desserts, coffee), or starting delivery-cum-sales to surmount the problem of undeviating revenue all through the year.

Health and dietary trends are both a threat and an opportunity to parlors. The increasing consumer demand for healthier options results in the loss of industry share for those parlors that do not offer low-calorie, dairy-free, or plant-based options. Expansion of the menu can not only guarantee the meeting of changing consumer preferences but also secure a competitive advantage.

Operational costs that have rent, utilities, and labor costs as their contenders can heavily tilt the sustainability of a business. While high foot traffic places attract the need for premium rental costs, labor shortages can either be there or wages are rising that can add burden to the company. Besides, good cost management practices and shrewd workforce arrangements are necessary for the long-term survival of the business.

The industry is characterized by cut-throat competition with local parlors and multinational brands hunting for the same customer base. Businesses without solid branding, distinctiveness in product offerings, or customer engagement tactics may find it difficult to build customer loyalties. The parlors may resort to using flavor creativity, interactive store designs, and digital marketing to stay distinct at these crowded avenues.

The pricing strategy of the industry should tie in profit margins with the preferences of the customers. As ice cream is frequently brought into the picture during impulsive purchase decisions, prices should be appealing but they also have to reflect, the brand value, ingredient quality, and industry positioning of the brand to increase sales volume.

Value-based pricing is the right strategy for high-end and artisanal brands. Customers are open to paying more for such things as special flavors, organic ingredients, or handmade small-batch production. This methodology ensures quality, exclusivity, and the entire loading experience of the parlor is given prime time.

The cost-plus pricing technique is simple; just a fixed percentage is added to production costs. Thus, this is the safest way to keep your profit margins consistent but it is not always convenient, i.e. it may not always reflect industry trends or consumer willingness to pay. Carrying out such adjustments would be necessary to ensure competitiveness.

Pricing competitively is pivotal when there are several parlors in the vicinity. Prices equal to or less than competitors’ would help in pulling the price-sensitive consumers in. However, it is also imperative that product differentiation is done by utilizing flavors, branding, or loyalty programs to desk price wars and protect profitability.

Dynamic pricing is also possible to implement in terms of time, season, or promotions. Giving discounts on a slow day or raising prices during the high season may help increase revenue. Uncommon flavors for a dabbed period only or combo deals would also uplift the turnover without any hint of losing actual perceived value.

Entrance pricing is one of the advertised strategies that a new establishment or product can utilize. The payment of reduced prices of goods and services at an initial stage can lure in customers and solate brand awareness. Gaining a well-established customer base would occur first, and then, prices would be increased in stages to keep the balance in profitability and customer loyalty.

Branded or franchise parlors have the largest share because ofawareness, consistency and reach. Chains such as Baskin-Robbins, Dairy Queen, and Cold Stone Creamery employ mass-scale marketing techniques and a uniformity of recipes,to create a wide and repeat customer base.

Franchise parlors have the benefits of scale and can offer competitive priced due totheir use of quality ingredients and high hygiene standards. Such creative flavors and sophisticated offerings, likeCold Stone’s mix-ins or Dairy Queen’s Blizzard menu, have helped such brands spread throughout the world.

Artisanal parlors are gaining traction owing to consumer insistence on high-end, handmade, and specialty taste experiences. Compared to mass-made ice creams, the artisanal kind is created from superior quality, natural components in the absence of artificial add-ins or preservatives. This goes with increasing preference for organic and clean-label products as increasingly more consumers crave healthy indulgence. Furthermore, being able to present bespoke tastes, dairy-free, and plant-based choices has broadened its client base as it includes persons with dietary conditions.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 2.72% |

| India | 7.12% |

| Germany | 4.22% |

| China | 6.62% |

| Australia | 4.42% |

The USA industry is experiencing growing upswings due to changing consumer trends, a growing demand for gourmet and premium flavors, and an emphasis on healthy options. Organic ingredient-based gourmet ice cream, dairy-free, and low-calorie are more in demand, drawing health-oriented consumers and lactose-intolerant individuals. The USA ice cream market is more than USD 11 billion in sales, according to the International Dairy Foods Association (IDFA), proving its robust industry potential.

Experiential dessert culture is also a significant growth driver, with parlors providing experiential and customized dessert experiences like nitrogen ice creams, mix-in toppings, and branded collaborations for unique taste experiences. Greater demand for grab-and-go desserts has fueled growth in parlors in urban areas.

Technological innovation and digitalization are also drivers of market growth in the ice cream parlor market. Mobile, app, and delivery ordering have enhanced access to ice cream, while food delivery app partnerships with parlors such as DoorDash and UberEats have enabled the expansion of reach to consumers. Seasonal and limited-edition flavors by leading players drive consumer engagement, while efforts such as the use of local ingredients and green packaging drive green consumers.

FMI is of the opinion that the USA ice cream parlor industry is slated to grow at a 2.72% CAGR during the study period.

Growth Drivers in the USA

| Key Drivers | Description |

|---|---|

| Premium & Gourmet Flavors | Increase in consumer appetite for dairy-free, low-calorie, and organic ice creams. |

| Experiential Dessert Culture | Experiential parlors with flavors such as nitrogen ice creams and mix-in toppings. |

| Digitalization & Online Sales | Increase in ordering online through apps and digital media. |

| Sustainable & Local Sourcing | Increase in utilizing environment-friendly packaging and local sourcing. |

Indian industry is growing fast with the help of shifting consumer mindsets, increased disposable incomes, and the rising out-of-home dessert culture. The industry will grow with a high growth pace as per the Indian Ice Cream Manufacturers Association (IICMA) with the entry of international and domestic players. Urbanization has caused premium, artisan, and fusion flavor demand to rise, and India's climate supports the consumption of ice cream throughout the year.

There has also been increasing demand for health-oriented varieties such as low-fat, lactose-free, and protein-rich ice creams. Classic flavors based on Indian sweets such as kulfi, rabri, and gulkand have become popular, which are in tune with local sensibilities.

Food delivery portals have further consolidated the industry to such an extent that parlors can spread their wings beyond walk-ins. Digitalization and innovation in products will continue to support India's business growth.

FMI is of the opinion that the Indian industry is slated to grow at a 7.12% CAGR during the study period.

Growth Drivers in India

| Key Drivers | Explanation |

|---|---|

| Urbanization & Premium Flavors | Growing demand for fusion and artisanal flavors in urban cities. |

| Year-Round Ice Cream Demand | Since the climate is appropriate, ice cream can be consumed throughout the year. |

| Health-Conscious Options | Growth in demand for low-fat, high-protein, and lactose-free ice creams. |

| Digital & Food Delivery Growth | Internet-based food delivery platforms broadening industry access. |

FMI is of the opinion that the German industry is slated to grow at a 4.22% CAGR during the study period. Industry is spurred by changing consumer patterns towards premium, hand-made, and health-oriented products. Hand-made ice creams and old-fashioned gelato have been a cultural favorite in German society, which is traditionally produced by Italian family-run enterprises. Growing demand for organic, plant-based, and dairy-free ice creams is, however, being generated owing to the popularity of veganism.

Germany's robust coffee culture has also seen parlor growth, with chains offering coffee pairings, waffles, and even fully customizable sundaes. Sustainability efforts like environmentally friendly packaging and local ingredients resonate with Germany's eco-conscious consumer base.

Limited-season and seasonal flavors based on local fruits like Bavarian cream and Black Forest cherries have also fueled industry growth. Pop-up parlors, ice cream vans, and online ordering have also gained popularity across the country.

Growth Drivers in Germany

| Key Drivers | Details |

|---|---|

| Plant-Based & Vegan Trends | More demand for plant-based and dairy-free ice cream alternatives. |

| Incorporating Café Culture | Ice cream parlors offering accompanying coffee, waffles, and personalized sundaes. |

| Sustainability Initiatives | More use of environmentally friendly packaging and locally available ingredients. |

| Seasonal & Limited Flavors | Seasonal flavors based on locally available ingredients in season. |

Chinese industry is experiencing a significant growth on the back of growing disposable incomes, urbanization, and premiumization of frozen dessert purchases. Ice cream consumption has seen an increase with an affinity for new flavors like red bean, black sesame, durian, and tea flavors like oolong and jasmine tea, as per the China Association of Bakery & Confectionery Industry.

Internet trends and e-commerce business are market movers, with viral marketing and social media shaping purchasing habits. Contactless buying, AI-powered vending machines, and app-based deliveries have never been more convenient when it comes to ice cream. Holiday periods such as the Chinese New Year and school holidays also stimulate demand.

FMI is of the opinion that the China ice cream parlor industry is slated to grow at a 6.62% CAGR during the study period.

Growth Drivers in China

| Key Drivers | Data |

|---|---|

| One-of-a-Kind & Localized Flavors | Red bean and black sesame as emerging flavors. |

| Online & E-Commerce Growth | E-commerce and AI vending machines pushing accessibility further. |

| Holiday & Festival Demand | Higher holiday and festival consumption. |

| Premiumization of Desserts | Increased demand for premium and imported ice cream brands. |

Australian industry is recording well because of positive climatic conditions, rising demand for quality and artisanal ice creams, and more health-conscious consumption. Local ingredient-flavor unique tastes like macadamia, wattleseed, and finger lime have gained popularity. Food tourism and café culture of Sydney and Melbourne also influenced the industry.

Ethical sourcing and sustainability have also been emphasized, with parlors using green packaging and locally sourced produce. Vegan, gluten-free, and high-protein ice creams are going mainstream as people focus on health. Online order food and mobile dessert trucks popularity has facilitated ease of access, with greater reach to consumers.

FMI is of the opinion that the Australian industry is slated to grow at a 4.42% CAGR during the study period.

Growth Drivers in Australia

| Key Drivers | Details |

|---|---|

| Native Ingredient Flavors | Demand for distinct flavors such as wattleseed and finger lime. |

| Sustainability & Responsible Sourcing | Shift to greener packaging and local sourcing. |

| Health-Conscious Trends | Increased demand for plant-based, gluten-free, protein-packed ice creams. |

| Online & Mobile Sales Growth | Fuel channel growth with food order apps and food wagons in the mobile channel. |

The industry is witnessing international and local chains as well as independent parlors fighting to set themselves apart through flavor innovation, quality, pricing, and customer experience. These multinational corporations extensively rely on their strong brand pulls, vast supply chains, and expensively pumped marketing into reaching out to the consumers. They enriched their product ranges with new lines of low-fat, lactose-free, plant-based, and exotic flavors appealing to a large consumer preference. Franchise expansion, joint ventures, and modernization in both manufacturing and distribution are some of the adopted strategies that enable sustaining a global presence for these organizations.

However, independent and artisanal ice-cream parlors are actively gaining in the industry, promoting their creating by hand, locally sourced, and top-quality products. These businesses claim to set themselves apart through small batch production, unique flavors, environmentally friendly initiatives, and packaging. Most of the independence employs direct-to-consumer (DTC) models, online orders, delivery services, and social media marketing to establish loyal customer bases. As competition intensifies, seasonal flavors, limited-time collaborations, and exclusive products have increasingly been applied by both major as well as minor players to strengthen customer engagement and maintain brand relevance.

Industry Share Analysis by Company

| Company Name | Estimated Industry Share (%) |

|---|---|

| Baskin-Robbins | 20-24% |

| D.Q. Corp. | 15-19% |

| Cold Stone Creamery | 10-14% |

| Ben & Jerry’s Homemade, Inc. | 8-12% |

| Häagen-Dazs | 7-11% |

| Other Companies (combined) | 25-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Baskin-Robbins | Global leader with an extensive range of flavors, seasonal offerings as well as strong franchise presence. |

| D.Q. Corp. | Offers soft-serve ice cream and specialty frozen treats, leveraging its fast-food presence for expansion. |

| Cold Stone Creamery | Focuses on premium, mix-in-based ice creams with a strong in-store experience and international reach. |

| Ben & Jerry’s Homemade, Inc. | Known for innovative, socially conscious flavors and sustainability-driven business practices. |

| Häagen-Dazs | Premium brand specializing in high-quality, rich-flavored ice creams with a strong retail and café presence. |

Baskin-Robbins (20-24%)

Maintains a leading position through a diversified flavor portfolio, global franchising as well as impressive marketing strategies.

D.Q. Corp. (15-19%)

It has the advantage of using fast-food chains to drive demand for ice cream, capturing more of the soft serve and frozen treat markets.

Cold Stone Creamery (10-14%)

Selection with personal mix-in opportunities and side-advantage interactive customer experience.

Ben & Jerry’s Homemade, Inc. (8-12%)

Innovative flavors, ethical sourcing, and sustainability guarantees.

Häagen-Dazs (7-11%)

Caters to the premium consumer with high-end ingredients as well as indulgent flavors.

Other Key Players (25-30% Combined)

By type, the industry is divided into branded/franchise and independent.

By product, the industry is bifurcated into traditional and artisanal.

By region, the industry is segregated into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The industry is slated to reach USD 21.4 billion in 2025.

The industry is projected to witness USD 96.9 billion by 2035.

Artisanal parlors are widely preferred.

Major players include Baskin-Robbins, D.Q. Corp., Cold Stone Creamery (Kahala Franchising, LLC.), Ben & Jerry's Homemade, Inc., Häagen-Dazs, Amorino, Ghirardelli Chocolate Company, Marble Slab Creamery, Cream Stone, and Natural Ice Creams.

India, slated to experience 7.12% CAGR during the forecast period, is projected to experience fastest growth.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 4: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 5: North America Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 6: North America Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 8: Latin America Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 9: Latin America Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 10: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 11: Western Europe Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 12: Western Europe Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 13: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Eastern Europe Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 15: Eastern Europe Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 16: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 17: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 18: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 19: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 20: East Asia Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 21: East Asia Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 22: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 23: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 24: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Product, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 7: Global Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 8: Global Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 9: Global Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 10: Global Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 11: Global Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 13: Global Market Attractiveness by Type, 2024 to 2034

Figure 14: Global Market Attractiveness by Product, 2024 to 2034

Figure 15: Global Market Attractiveness by Region, 2024 to 2034

Figure 16: North America Market Value (US$ Million) by Type, 2024 to 2034

Figure 17: North America Market Value (US$ Million) by Product, 2024 to 2034

Figure 18: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 22: North America Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 23: North America Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 24: North America Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 25: North America Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 26: North America Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 27: North America Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 28: North America Market Attractiveness by Type, 2024 to 2034

Figure 29: North America Market Attractiveness by Product, 2024 to 2034

Figure 30: North America Market Attractiveness by Country, 2024 to 2034

Figure 31: Latin America Market Value (US$ Million) by Type, 2024 to 2034

Figure 32: Latin America Market Value (US$ Million) by Product, 2024 to 2034

Figure 33: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 37: Latin America Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 40: Latin America Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 41: Latin America Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 43: Latin America Market Attractiveness by Type, 2024 to 2034

Figure 44: Latin America Market Attractiveness by Product, 2024 to 2034

Figure 45: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 46: Western Europe Market Value (US$ Million) by Type, 2024 to 2034

Figure 47: Western Europe Market Value (US$ Million) by Product, 2024 to 2034

Figure 48: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 49: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 50: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 51: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 52: Western Europe Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 53: Western Europe Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 54: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 55: Western Europe Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 56: Western Europe Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 57: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 58: Western Europe Market Attractiveness by Type, 2024 to 2034

Figure 59: Western Europe Market Attractiveness by Product, 2024 to 2034

Figure 60: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 61: Eastern Europe Market Value (US$ Million) by Type, 2024 to 2034

Figure 62: Eastern Europe Market Value (US$ Million) by Product, 2024 to 2034

Figure 63: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 64: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 65: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 66: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 67: Eastern Europe Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 68: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 69: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 70: Eastern Europe Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 71: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 72: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 73: Eastern Europe Market Attractiveness by Type, 2024 to 2034

Figure 74: Eastern Europe Market Attractiveness by Product, 2024 to 2034

Figure 75: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 76: South Asia and Pacific Market Value (US$ Million) by Type, 2024 to 2034

Figure 77: South Asia and Pacific Market Value (US$ Million) by Product, 2024 to 2034

Figure 78: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 79: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 80: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 81: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 82: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 83: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 84: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 85: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 86: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 87: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 88: South Asia and Pacific Market Attractiveness by Type, 2024 to 2034

Figure 89: South Asia and Pacific Market Attractiveness by Product, 2024 to 2034

Figure 90: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 91: East Asia Market Value (US$ Million) by Type, 2024 to 2034

Figure 92: East Asia Market Value (US$ Million) by Product, 2024 to 2034

Figure 93: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 94: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 95: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 96: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 97: East Asia Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 98: East Asia Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 99: East Asia Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 100: East Asia Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 101: East Asia Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 102: East Asia Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 103: East Asia Market Attractiveness by Type, 2024 to 2034

Figure 104: East Asia Market Attractiveness by Product, 2024 to 2034

Figure 105: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 106: Middle East and Africa Market Value (US$ Million) by Type, 2024 to 2034

Figure 107: Middle East and Africa Market Value (US$ Million) by Product, 2024 to 2034

Figure 108: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 109: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 110: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 111: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 112: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 113: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 114: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 115: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 116: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 117: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 118: Middle East and Africa Market Attractiveness by Type, 2024 to 2034

Figure 119: Middle East and Africa Market Attractiveness by Product, 2024 to 2034

Figure 120: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Breaking Down Market Share in the Ice Cream Parlor Industry

ICE Start And Stop System Market Size and Share Forecast Outlook 2025 to 2035

Ice Boxes Market Size and Share Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Iced Tea Business

Ice Detection System Market Trends, Growth & Forecast 2025 to 2035

Ice Cube Tray Market Trends & Growth Forecast 2024-2034

Ice Maker Machines Market

Ice Transport Buckets Market

Ice Cream Coating Market Size and Share Forecast Outlook 2025 to 2035

Ice-cream Premix and Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Ice Cream Equipment Market Size and Share Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Ice Cream and Frozen Dessert Market from 2025 to 2035

Ice Cream Packaging Market - Outlook 2025 to 2035

Ice Cream Processing Equipment Market Growth - Trends, Demand & Innovations 2025 to 2035

Ice Cream Service Supplies Market - Premium Serving Essentials 2025 to 2035

Ice Cream Container Market Size & Trends Forecast 2024-2034

Ice-cream Maker Market

Rice Bran Fatty Alcohols Market Size and Share Forecast Outlook 2025 to 2035

Rice Water Skincare Market Forecast and Outlook 2025 to 2035

Rice Water Haircare Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA