A rising demand for safety in the aviation, marine and transportation industries has led to a steep rise in demand for ice detection systems. The systems integrated within these vehicles are essential for preventing ice build-up that can lead to accidents on planes, roadways and in maritime vessels.

In addition, the adoption of ice detection solutions in industrial applications like wind energy and telecommunications infrastructure has also seen a rise so that operations can continue without interruption in adverse weather conditions. Moreover, the arrival of technology is improving the robustness and precision of these systems, contributing to a steady growth of the global ice detection system market.

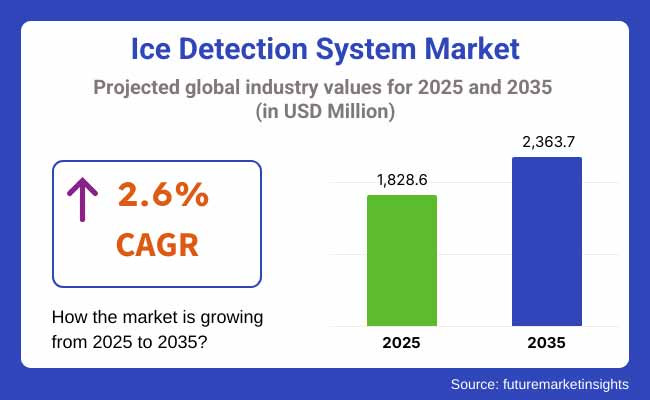

Market Size in 2025 is USD 1,828.6 million and Market Size in 2035 is estimated to be USD 2,363.7 million at a CAGR of 2.6%. Owing to the increasing market for home decoration and higher standards of home furnishing among people across the world, the market for all readymade curtains is increasing rapidly.

The well-established aviation and transportation sectors in North America result in a considerable portion of the ice detection system market being held there. This part of the country often has a lot of ice, so ice detection solutions are necessary to stay safe.

This is further granting support to market growth as strict government regulatory standards, such as FAA regulations in the USA for de-icing and ice detection system incorporation in aircraft, are implemented. They are also being enhanced by advances in sensor technology and AI-based ice detection software that aid in real-time monitoring and early warnings.

The ice detection system market in Europe is anticipated to expand at a moderate pace owing to increase in demand in aviation, maritime and energy sectors. The region's rigid aviation safety regulations and increasing investments in wind energy infrastructure are driving the demand for ice detection technologies. Germany, France, UK and several other countries are at the forefront in developing operational safety using automated ice detection and remediation solutions for transportation and industrial applications.

The Asia-Pacific region is expected to record a higher CAGR due to the increasing air traffic, the developing transportation sector structure, and the industrialization. Countries like China, Japan and India(relying on Advanced weather monitoring and ice detection technologies )are focusing on improving aviation and transport safety. Moreover, the growing renewable energy industry, particularly in terms of wind power generation, is driving the need for ice detection systems to avoid ice buildup on turbine blades and ensure peak performance.

Challenges

High Initial Investment, Complex Integration, and Regulatory Compliance

The cost of implementation of advanced ice detection systems is high, especially for small and medium enterprises. Specialist skills and technological adaptability are important for the integration of these systems with the existing infrastructure. Most ice detection technologies are used across numerous industries, and rolling them out across diverse regions simply adds to the difficulty of meeting localized regulatory standards.

Operational costs are increased further due to lack of skilled professionals required for the maintenance of the system. Standardization is further complicated by the fact that each region has unique environmental characteristics that require different solution approaches to ice detection. As regulatory and technological contexts change, companies will also need to invest constantly in R&D to stay competitive.

Opportunities

Growing Demand for Aviation and Transportation Safety, Renewable Energy Expansion, and AI-Based Monitoring

The demand for a wide range of commercial amiable, transportation, and industrial sectors to admit into account the increased safety is increasing the market of ice detection systems. While investments in renewables (wind in particular) are growing, so are needs for reliable ice detection solutions.

In addition, advances in artificial intelligence (AI) are likely to be improved through the use of AI-based monitoring systems and automated de-icing solutions providing higher efficiencies and reduced operating risks stimulating market growth. ice detection technologies for public safety temper growth of smart city initiatives.

These advances in miniaturization are allowing for broader adoption across a range of industries. Tech-service provider and government collaborations are gaining immense momentum in terms of product innovation and time to market.

Demand from aviation, transportation, and energy sectors in particular ballooned from 2020 to 2024 due to rising worries about the impact of climate change with extreme weather events increasing in frequency and severity on the safety of travelers and infrastructure. The presentations included integration of monitoring sensors in-airport de-icing systems; automated ice alerts improving road safety; and real-time monitoring technologies in wind turbines. However, high costs, limited accuracy, and fragmented regulatory requirements have hampered wide adoption.

The market will be shaped by AI-powered systems coupled with process automation and Internet of Things connectivity, as well as self-learning detection systems. Pushing the need for entirely automated, predictive ice detection solutions will be the growth of smart city development; the expansion of AI-driven autonomous transportation systems, along with booms in offshore wind energy; all of which will be developing rapidly.

From Eco-friendly anti-icing coatings to sustainable de-icing solutions will see considerable traction as the governments and industries are forcing for low carbon, environmentally friendly alternatives to traditional chemical based de-icing routes.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with aviation safety and transportation weather monitoring regulations. |

| Consumer Trends | Demand for manual and semi-automated ice detection in aviation and roadways. |

| Industry Adoption | Used primarily in airports, bridges, and marine navigation. |

| Supply Chain and Sourcing | Dependence on traditional temperature and moisture sensors. |

| Market Competition | Dominated by aviation equipment manufacturers and weather monitoring firms. |

| Market Growth Drivers | Increased investment in aviation de-icing solutions and weather-resistant infrastructure. |

| Sustainability and Environmental Impact | Early adoption of low-impact de-icing fluids and automated detection technologies. |

| Integration of Smart Technologies | Introduction of automated ice detection for aircraft and bridges. |

| Advancements in Ice Detection Technology | Development of infrared ice sensors and optical detection systems. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter real-time ice monitoring standards, smart infrastructure mandates, and AI-based hazard prevention. |

| Consumer Trends | Growth in fully automated AI-based ice detection, predictive analytics, and smart de-icing systems. |

| Industry Adoption | Expansion into smart cities, autonomous vehicles, and offshore wind farms. |

| Supply Chain and Sourcing | Shift toward AI-driven imaging sensors, laser-based detection, and smart monitoring systems. |

| Market Competition | Entry of AI-powered sensor companies, smart city solution providers, and IoT-based ice detection firms. |

| Market Growth Drivers | Accelerated by smart ice detection networks, predictive maintenance systems, and real-time hazard mitigation. |

| Sustainability and Environmental Impact | Large-scale shift toward eco-friendly anti-icing coatings, AI-powered ice hazard prevention, and low-energy sensor systems. |

| Integration of Smart Technologies | Expansion into AI-driven de-icing systems, IoT-enabled transportation safety, and cloud-connected ice monitoring. |

| Advancements in Ice Detection Technology | Evolution toward hyperspectral imaging, drone-based ice monitoring, and real-time AI-assisted weather tracking. |

Stringent aviation safety regulations, increasing road safety measures, and expanding wind energy installations are key fragments behind the largest usage of ice detection systems in the United States. In aviation and renewable energy platforms, we are seeing great traction around AI-based ice monitoring solutions and automated de-icing technologies.

That's why government agencies find it worthy of funding research on next-generation ice detection sensors with improved accuracy. With the rise of self-driving vehicles, the need for road ice monitoring solutions in real time will further increase. Aerospace manufacturers are teaming up with AI companies to place smart ice prevention system on their aircrafts.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 2.6% |

With UK Investment in wind energy, and a focus on aviation safety, there are increased opportunities for ice detection solutions. Methods like robotic de-icing systems and AI-driven ice detection technologies are redefining the market landscape. The UK government is pouring funding into AI-enabled transportation safety initiatives, further driving uptake of ice detection system.

Another example would be smart infrastructure by integrating AI that allows for real-time monitoring of ice on highways and railways. There are some foremost aerospace research institutions which are promoting the development of ice detection technology.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 2.6% |

Regulatory frameworks are stringent in the EU market. German, French, and Dutch public utilities are spending the money on smart ice detection solutions. EU member states are already using an IoT-connected ice detection system to increase efficiency in transportation networks.

Investment in sustainable alternatives to standard de-icing solutions helps decrease environmental impact while still allowing for operational safely. Increasing use of AI-driven predictive analytics is enhancing the insurance of ice prevention and response systems.

| Region | CAGR (2025 to 2035) |

|---|---|

| EU | 2.6% |

Japan has also been a key player in the ice detection system market with significant investments in aviation safety, smart transportation, and wind energy. Japan is deploying AI-based ice detection solutions in its high-speed rail network to keep operations running during winter. Japan's sophisticated robotics sector is developing automated de-icing capabilities for both aircraft and roads. Other work is being done through government and private sector partnerships to research next-generation ice detection sensors.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 2.6% |

In Korea, there is an increasing demand in several areas for ice detection technologies, especially aviation, wind energy, and smart infrastructure projects. The government is also investing in artificial intelligence-powered weather monitoring systems that will help the agencies improve the accuracy of their ice forecasts.

Ice detection and mitigation tech has been introduced on South Korean high-frequency rail services as the country expands an expanding network. In addition, joint research between Korean universities and global tech companies is leading to innovations in ice prevention and detection solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 2.6% |

This is mainly due to the increasing demand for accurate and real-time detection of ice in defence and aerospace industries which rapidly fuel up demand for magneto restrict ice detector and optical ice detector segments. Individuals specializing in these segments are critical in enhancing flight safety, maximizing aircraft performance, and ensuring operational efficiency under challenging weather conditions.

Due to their advantage of real-time detection and high-precision ice accumulation monitoring, magneto restrictive ice detectors is a widely adopted segment over others in the ice detector market. Magneto restrictive detectors, in contrast to other types of ice detection systems, measure the variations of the magnetic field within the system to detect the presence of ice formations, providing high accuracy and reliability.

The increase in demand for aircraft safety solutions with magneto restrictive ice detection to provide real-time alerts, automatic anti-icing activation, and integration with aircraft control systems are making their way into the market. Magneto restrictive ice detectors are overwhelmingly preferred in commercial and military air frames according to studies, comprising 60% or better or all installations due to their efficiency in extremely cold weather.

The introduction of AI-embedded systems capable of predicting ice accumulation events and providing connectivity with ice monitoring systems for accurate risk evaluation has contributed to the segment growth and improved the overall operational reliability by synchronizing with automated systems for de-icing purposes.

Moreover, the adoption has been further fuelled by AI-driven predictive ice detection with analytics on-real-time ice layer thickness, adaptive sensor calibration, and synchronized alerts in aircraft to enhance situational awareness and reactive changes in flight.

However, recent advancements in magneto restrictive ice detection technologies offer improved resilience with robust coating on sensors, materials that can endure extreme temperature, and reduced power consumption that further drive the market as they see extensive application in commercial as well as military aviation.

Although magneto restrictive ice detector segment can provide improved accuracy, real time detection, and can be easily integrated with other systems, it also faces high production costs, complex installation and sensitivity to calibration. Nonetheless, the advances in such areas like AI-integrated sensor optimization, hybrid magneto optical ice detection and low-cost sensor miniaturization, is making these systems more feasible for uni-aviation and UAV ice detection systems to keep expanding.

We have had strong market adoption of our optical ice detectors, especially among modern aircraft and UAV manufacturers, as industries look for non-contact, high-sensitivity ice detection. Optical ice detectors employ laser-based or infrared technology to measure ice sweat formation in real time, which significantly decreases the probability of sensor interference relative to magneto restrictive sensors, improving accuracy.

Market adoption has been propelled by the increasing need for passive ice detection technologies, such as laser-based optical sensors, infrared ice buildup assessors, and AI-enabled mining processing. More than 55% of new generation aircraft rely on optical ice detectors because they can be adapted for various environmental conditions.

Also, The development of advanced UAV and drone safety technologies incorporated with cutting-edge real-time ice detection algorithms, AI-driven visual ice tracking, and featherweight optical sensor design has fueled market expansion and enhanced performance in autonomous aerial operations.

Adoption has been further stimulated through the adoption of AI-powered optical detection systems with smart ice contamination filtering and self-calibrating infrared analyzers with predictive ice buildup models resulting in better reliability and proactive aircraft safety.

Miniaturized optical ice detectors, increasingly lightweight and aerodynamic sensor housings, higher detection range, low-power infrared laser emitters have all promoted market growth, as detection miniaturization ensures better compatibility with UAV and commercial aircraft applications.

The segment that is estimated to hold the largest share and also witnessing a faster growth in the market is the optical ice detector as it offers advantages such as non-contact detection, high accuracy, and AI-driven analytics. But innovations in AI-based optical sensor calibration, advanced spectral ice detection based on inline optical calibration, and optical-magneto resistive detection working in dual mode are improving reliability, which guarantees that optical ice detection solutions will continue to expand.

Horizontal segment refers to the use of technologically advanced ice detection mechanisms that helps aerospace manufacturers and defense organizations to increase the safety of flight, avoid structural damage and also enhance mission accomplishments.

Commercial and military aircraft manufacturers increasingly incorporate advanced ice sensors to avoid in-flight icing, making ice detection systems a major consumer of the technology. Modern ice detection systems surpass traditional de-icing methods by offering real-time monitoring, enabling immediate counteractions that deter performance degradation.

Market adoption is driven by growing demand for machine-enabled ice detection and mitigation systems, providing real-time pilot warnings, automated de-icing coordination and integrated flight performance improvements. More than 65% of commercial airlines invest in ice detection technology according to international aviation safety regulations.

Market growth is aided by the growth of intelligent aircraft maintenance, utilizing predictive ice accumulation analytics, AI-powered adaptation to flights and a safety cloud connection.Hybrid ice detection solutions with magneto restrictive-optical sensor fusion, automated wing and engine anti-icing systems, and passive predictive AI-based risk modeling further improved its adoption to guarantee higher safety and efficient aircraft operation.

These advancements have enhanced the market growth for lightweight, high-precision airplane ice detection sensors with aerodynamic integration, low power consumption capabilities, and adjustable response mechanisms, thus facilitating their successful application in both commercial and defense industries.

The airplane segment has a significant share in the market owing to sustainability around flight safety, regulatory compliance, and fuel economy becoming the advantages of this segment; however, high integration charges, sensor calibration complexity, and periodic maintenance cost barriers must be addressed for the segment growth.

Nonetheless, developments in AI-enabled flight safety enhancement, hybrid detection sensors, and real-time aircraft environmental adaptation are enhancing efficiency, reinforcing the optimistic outlook on airplane ice detection technologies.

Market penetration to high-altitude and extreme weather flight conditions has been widespread for robots (UAVs) used for defense manufacturing, research robots and commercial-use drones, opening the door for manufacturers to focus on ice detection solutions. UAVs are like other planes in some respects, but unlike the typical aircraft types, they require highly effective, lightweight, and power-sensitive ice detection system to ensure operational stability.

Adding to the market adoption are the growing needs for UAV-integrated ice detection, which includes real-time ice buildup sensors, AI-algorithm based flight path adjustments, and UAVs with their own autonomous anti-icing countermeasures. Over half of long-range UAVs have ice detection systems to ensure mission reliability in harsh weather environments, studies show.

Growing applications of high-altitude UAVs, including, weather monitoring drones, autonomous cargo delivery UAVs, military reconnaissance aircraft etc. has reinforced the growth of the data market, which will create demand for compact and intelligent ice detection operational methods.

The adoption has been driven further by advances in flight safety for well-designed UAV systems, such as ice detection-linked autopilot corrections, real-time structural integrity assessment, and the ability to adapt to cascade hybrid propulsion systems.The market growth has been maximized with the development of new generation customized UAVs that is ultra-lightweight and energy-efficient, miniaturized optical sensors, AI based analytics for flight conditions, and hybrid detection systems.

However, the UAV segment is restrained due to limited power available for onboard ice detection systems, environmental interferences in sensor performance, and a need for lightweight sensor integration; though, its adoption in this segment continues due to its promising feats of improving UAV flight stability to reduce mission risk and enhance the reliability of autonomous operation.

But, advances in AI driven UAV ice detection calibration, solar powered ice mitigation technologies, real time UAV environmental adaptivity are enhancing efficiency and ensuring UAV ice detection applications capabilities still grow.

The growing demand for the real-time ice detection systems in aviation, transportation, and industrial sectors, along with development in detection technology powered by artificial intelligence, are the factors driving the market. Rising concerns pertaining to aviation safety, road accident preventions, and infrastructure damage due to ice formation are bolstering demand for high-precision detection systems.

Leading companies within the sector emphasize AI-based sensor integration, automated prophylactic measures against icy conditions, and real-time data analysis for targeted risk mitigation. Key players comprising aerospace safety services, sensor suppliers and industrial monitoring solution providers developing accurate, lower-cost, and application-specific ice detection technologies.

Market Share Analysis by Key Players & Ice Detection System Providers

| Company Name | Estimated Market Share (%) |

|---|---|

| Collins Aerospace (Raytheon Technologies) | 18-22% |

| Honeywell International Inc. | 14-18% |

| Vaisala Oyj | 12-16% |

| Laird Thermal Systems | 8-12% |

| OTT HydroMet | 6-10% |

| Other Ice Detection System Providers (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Collins Aerospace (Raytheon Technologies) | Develops AI-powered aircraft ice detection sensors, automated anti-icing systems, and real-time monitoring technologies. |

| Honeywell International Inc. | Specializes in AI-enhanced weather monitoring, ice detection radar for aviation, and automated runway ice prediction systems. |

| Vaisala Oyj | Focuses on AI-driven road and airport ice detection, real-time environmental monitoring, and smart weather forecasting solutions. |

| Laird Thermal Systems | Provides AI-optimized ice sensing technology, automotive and industrial ice detection solutions, and thermal management systems. |

| OTT HydroMet | Offers AI-assisted hydrological ice monitoring, remote ice detection sensors, and climate data analytics for infrastructure safety. |

Key Market Insights

Collins Aerospace (Raytheon Technologies) (18-22%)

Collins Aerospace leads in AI-powered aviation ice detection, providing advanced aircraft de-icing sensors, automated anti-icing solutions, and real-time risk monitoring systems.

Honeywell International Inc. (14-18%)

Honeywell specializes in AI-driven ice detection radar, integrating automated ice warning systems for aviation, roadway safety, and industrial applications.

Vaisala Oyj (12-16%)

Vaisala focuses on AI-enhanced road and airport ice detection systems, utilizing smart weather monitoring technology for predictive ice prevention.

Laird Thermal Systems (8-12%)

Laird provides AI-assisted ice sensing and detection solutions for automotive, aerospace, and industrial applications, with a focus on advanced thermal management.

OTT HydroMet (6-10%)

OTT HydroMet specializes in hydrological and environmental ice detection, integrating AI-powered sensors for remote monitoring and predictive analytics.

Other Key Players (30-40% Combined)

Several sensor technology firms, aerospace safety providers, and industrial ice monitoring companies contribute to next-generation ice detection innovations, AI-powered predictive analytics, and automated ice prevention systems. Key contributors include:

The overall market size for the ice detection system market was USD 1,828.6 Million in 2025.

The ice detection system market is expected to reach USD 2,363.7 Million in 2035.

The demand for ice detection systems is rising due to increasing aviation safety regulations, growing adoption of automated ice detection in transportation, and advancements in sensor technology. The expansion of cold climate infrastructure projects and the need for real-time ice monitoring in critical applications are further driving market growth.

The top 5 countries driving the development of the ice detection system market are the USA, Canada, Germany, China, and Japan.

Magneto Restrictive and Optical Ice Detectors are expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 4: Global Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 6: Global Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 8: North America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 10: North America Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 12: North America Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Latin America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 15: Latin America Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 16: Latin America Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 18: Latin America Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 21: Western Europe Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 22: Western Europe Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 23: Western Europe Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 24: Western Europe Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 28: Eastern Europe Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 29: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 30: Eastern Europe Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2019 to 2034

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 36: South Asia and Pacific Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 38: East Asia Market Volume (Units) Forecast by Country, 2019 to 2034

Table 39: East Asia Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 40: East Asia Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 41: East Asia Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 42: East Asia Market Volume (Units) Forecast by End Use, 2019 to 2034

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2019 to 2034

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 46: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 48: Middle East and Africa Market Volume (Units) Forecast by End Use, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by End Use, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 5: Global Market Volume (Units) Analysis by Region, 2019 to 2034

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 9: Global Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 12: Global Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 13: Global Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 14: Global Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 15: Global Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 16: Global Market Attractiveness by Product Type, 2024 to 2034

Figure 17: Global Market Attractiveness by End Use, 2024 to 2034

Figure 18: Global Market Attractiveness by Region, 2024 to 2034

Figure 19: North America Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 20: North America Market Value (US$ Million) by End Use, 2024 to 2034

Figure 21: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 23: North America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 26: North America Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 27: North America Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 30: North America Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 31: North America Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 34: North America Market Attractiveness by Product Type, 2024 to 2034

Figure 35: North America Market Attractiveness by End Use, 2024 to 2034

Figure 36: North America Market Attractiveness by Country, 2024 to 2034

Figure 37: Latin America Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 38: Latin America Market Value (US$ Million) by End Use, 2024 to 2034

Figure 39: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 44: Latin America Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 45: Latin America Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 48: Latin America Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 49: Latin America Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 52: Latin America Market Attractiveness by Product Type, 2024 to 2034

Figure 53: Latin America Market Attractiveness by End Use, 2024 to 2034

Figure 54: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 55: Western Europe Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 56: Western Europe Market Value (US$ Million) by End Use, 2024 to 2034

Figure 57: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 63: Western Europe Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 66: Western Europe Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 67: Western Europe Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 70: Western Europe Market Attractiveness by Product Type, 2024 to 2034

Figure 71: Western Europe Market Attractiveness by End Use, 2024 to 2034

Figure 72: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 73: Eastern Europe Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 74: Eastern Europe Market Value (US$ Million) by End Use, 2024 to 2034

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 81: Eastern Europe Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 85: Eastern Europe Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 88: Eastern Europe Market Attractiveness by Product Type, 2024 to 2034

Figure 89: Eastern Europe Market Attractiveness by End Use, 2024 to 2034

Figure 90: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 91: South Asia and Pacific Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 92: South Asia and Pacific Market Value (US$ Million) by End Use, 2024 to 2034

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 106: South Asia and Pacific Market Attractiveness by Product Type, 2024 to 2034

Figure 107: South Asia and Pacific Market Attractiveness by End Use, 2024 to 2034

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 109: East Asia Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 110: East Asia Market Value (US$ Million) by End Use, 2024 to 2034

Figure 111: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 116: East Asia Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 117: East Asia Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 120: East Asia Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 121: East Asia Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 122: East Asia Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 124: East Asia Market Attractiveness by Product Type, 2024 to 2034

Figure 125: East Asia Market Attractiveness by End Use, 2024 to 2034

Figure 126: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 127: Middle East and Africa Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 128: Middle East and Africa Market Value (US$ Million) by End Use, 2024 to 2034

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 139: Middle East and Africa Market Volume (Units) Analysis by End Use, 2019 to 2034

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 142: Middle East and Africa Market Attractiveness by Product Type, 2024 to 2034

Figure 143: Middle East and Africa Market Attractiveness by End Use, 2024 to 2034

Figure 144: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ice Cream Coating Market Size and Share Forecast Outlook 2025 to 2035

Ice-cream Premix and Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Ice Cream Equipment Market Size and Share Forecast Outlook 2025 to 2035

Ice Boxes Market Size and Share Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Ice Cream and Frozen Dessert Market from 2025 to 2035

Analysis and Growth Projections for Iced Tea Business

Ice Cream Packaging Market - Outlook 2025 to 2035

Ice Cream Processing Equipment Market Growth - Trends, Demand & Innovations 2025 to 2035

Ice Cream Service Supplies Market - Premium Serving Essentials 2025 to 2035

Ice Cream Parlor Market Analysis by Type, Product Type, and Region Through 2035

Breaking Down Market Share in the Ice Cream Parlor Industry

Ice Cube Tray Market Trends & Growth Forecast 2024-2034

Ice Cream Container Market Size & Trends Forecast 2024-2034

Ice Maker Machines Market

Ice Transport Buckets Market

Ice-cream Maker Market

ICE Start And Stop System Market Size and Share Forecast Outlook 2025 to 2035

Rice Water Skincare Market Forecast and Outlook 2025 to 2035

Rice Water Haircare Market Size and Share Forecast Outlook 2025 to 2035

Rice Shampoo Bar Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA