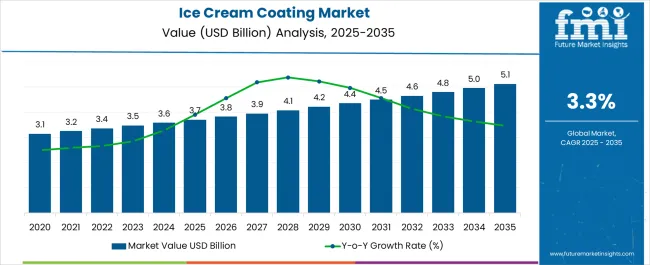

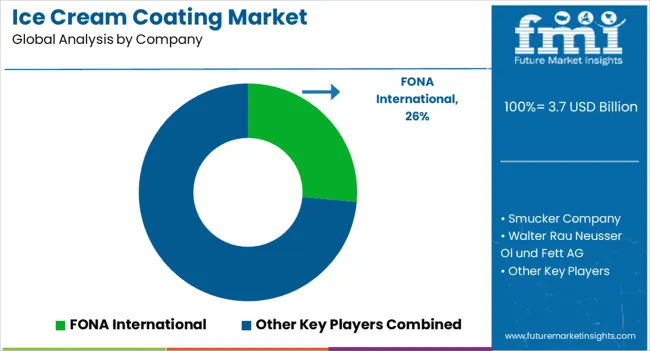

The global ice cream coating market is valued at USD 3.7 billion in 2025 and is expected to reach USD 5.1 billion by 2035, reflecting a CAGR of 3.3%. Factors driving this growth include the rising demand for premium and indulgent frozen desserts, growing consumer preference for multi-textured ice cream products, and expanding distribution across food service channels.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 3.7 billion |

| Projected Value (2035F) | USD 5.1 billion |

| CAGR (2025 to 2035) | 3.3% |

Increasing per capita ice cream consumption in emerging markets, particularly in Asia Pacific, and continuous flavor innovations have also contributed to the expansion of the ice cream coating market globally.

By 2030, the global market is forecast to reach USD 4.4 billion, reflecting steady growth during the first half of the decade. The absolute dollar increase between 2025 and 2035 is expected to be robust, indicating sustained expansion fueled by rising demand for premium and indulgent ice cream coatings. Market dynamics will continue to be influenced by evolving quality standards, sustainable sourcing practices, and regulatory compliance. These factors remain critical for competitive success globally.

The ice cream coating market holds approximately 38% of the total ice cream inclusions and toppings industry, driven by its role in enhancing product appeal, texture, and flavor customization. It accounts for around 29% of the global chocolate applications in frozen desserts market, supported by rising consumer demand for premium, indulgent, and visually appealing ice cream offerings.

The market contributes nearly 26% to the confectionery-based food coatings segment, particularly in applications requiring high-quality flavor delivery and aesthetic appeal. It holds close to 21% of the dipping and enrobing applications in frozen snacks, where coatings play a critical role in sensory experience and product differentiation. The share in the clean-label confectionery coatings market reaches about 28%, reflecting growing consumer preference for natural, minimally processed, and transparent ingredient solutions.

The market is undergoing structural change driven by rising demand for indulgence-oriented ice creams, premium frozen desserts, and healthier alternatives such as sugar-free and organic coatings. Advances in coating formulations, including plant-based chocolate alternatives, reduced-sugar blends, and functional ingredient incorporation, have expanded usage across diverse applications.

Manufacturers are investing in customized coating solutions offering tailored melting points, thickness, and flavor profiles to enhance both consumer experience and industrial efficiency. Strategic partnerships between chocolate manufacturers, flavor houses, and frozen dessert producers are accelerating innovation pipelines. Clean-label positioning, sustainable sourcing of cocoa and dairy ingredients, and rising penetration in Asia Pacific are reshaping global competition and pushing conventional coating suppliers to adapt their offerings.

The market is growing rapidly due to increasing consumer demand for natural, premium, and indulgent frozen desserts. Consumers seek coatings that enhance texture, flavor, and health benefits, driving innovation in product formulations. Advances in technology allow manufacturers to improve coating consistency, bioavailability, and shelf life. Increased interest in organic, clean-label, and plant-based coatings is expanding market opportunities.

Collaborations between producers and foodservice brands, coupled with the rise of e-commerce, enhance market reach across regions. Sustainability trends and consumer preference for authentic, high-quality ingredients further bolster growth. As retail and HoReCa sectors expand, the ice cream coating market is positioned for strong, sustained growth globally from 2025 to 2035.

Growth is fueled by rising consumer demand for indulgent, premium, and plant-based frozen desserts featuring innovative coatings that enhance taste and texture. Advances in formulation technologies improve coating consistency and shelf life, while health-conscious consumers increasingly prefer clean-label, organic, and allergen-free options. Market expansion is further supported by e-commerce and retail channel growth worldwide.

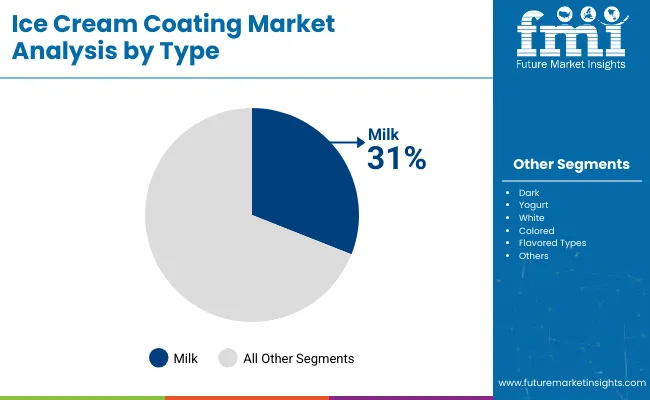

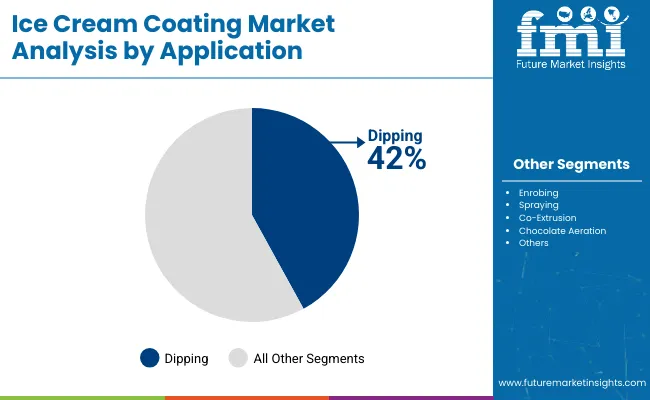

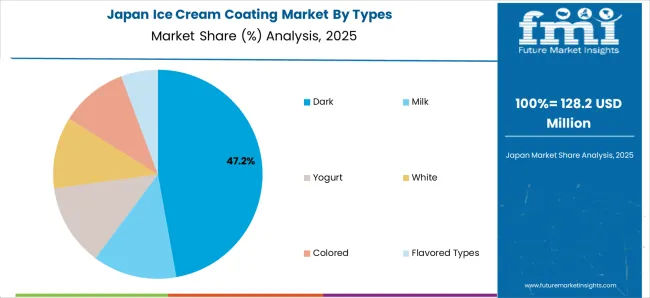

The market is segmented by type, application, end-user, and region. By type, the market is segmented into dark, milk, yogurt, white, colored and flavored types. Based on application, the market is divided into dipping, enrobing, spraying, co-extrusion and chocolate aeration. In terms of End-user, the market is categorized into parlors, dairies, HoReCa and others, such as specialty manufacturers, catering services, and niche ice cream artisans. Regionally, the market is classified into North America, Latin America, Europe, the Middle East and Africa, East Asia, and South Asia.

The milk coating segment is projected to be the most lucrative in 2025, commanding 31% of the total ice cream coating market share by type. Its creamy texture and balanced flavor make it a consumer favorite, consistently driving high sales. Milk coatings offer versatility, blending easily with popular flavor inclusions like nuts and wafers, which encourages ongoing product innovation. This segment is seeing increased adoption not only in industrial-scale production but also in artisan and premium lines, especially across emerging markets where traditional flavors are being modernized to meet evolving tastes.

The demand growth is further supported by its compatibility with a wide variety of frozen treats and its rising popularity in both dairy-centric and HoReCa (Hotel, Restaurant, Catering) channels. Developing regions are showing significant growth potential for milk coatings, driven by expanding consumer bases and increasing disposable incomes, positioning this segment as a key contributor to the global ice cream coating market’s robust expansion.

Dipping remains the dominant application segment in the ice cream coating market, projected to secure a 42% share in 2025. Its popularity stems from the simplicity, speed, and appealing aesthetics it offers both manufacturers and consumers. The dipping process allows for uniform and quick coating adhesion, facilitating production efficiency and high-quality finished products. Additionally, it supports multi-layered or striped textural effects, enhancing product appeal.

Dipping is especially favored in on-the-go ice cream formats such as bars and cones, which are experiencing renewed demand across retail chains and ice cream parlors globally. The lower operational complexity of dipping compared to enrobing makes it a cost-effective choice for large-scale and small-scale producers alike. Its strong presence in street-side and impulse purchase formats underlines its market importance. Overall, dipping plays a critical role in meeting consumer expectations for convenience, variety, and visual appeal, driving its leadership in ice cream coating applications.

Rising consumer demand for natural and clean-label ice cream coatings is driving market growth. Increasing preference for plant-based, organic, and sustainable coatings pushes manufacturers to invest in advanced extraction and formulation technologies. This shift broadens product portfolios, improves product purity, and aligns with evolving health trends. Companies are focusing on eco-friendly sourcing and innovative processing methods to meet consumer expectations for quality and safety, positioning themselves competitively in this growing sector. The emphasis on natural ingredients and transparent labeling is fostering innovation and expanding applications across frozen desserts worldwide.

Growing consumer health awareness boosts demand for functional and specialty ice cream coatings.

Consumers increasingly seek coatings that offer added benefits, such as reduced sugar, allergen-free options, and inclusion of superfoods or probiotics. Manufacturers respond by enhancing formulations to improve nutritional value and sensory experience without compromising taste and texture. This trend towards health-conscious consumption encourages product diversification and innovation. The rising interest in wellness-oriented frozen treats drives expansion in retail and HoReCa channels, contributing significantly to market growth.

Innovation in product development and sustainability is expanding market opportunities in ice cream coatings.

Advanced technologies enable the creation of novel coated formats, including gluten-free, low-fat, and indulgent premium varieties. Companies prioritizing sustainable ingredient sourcing, reduced environmental impact, and compliance with regulatory standards gain competitive advantages. These trends attract environmentally aware consumers and foster loyalty. Continuous R&D efforts are creating coatings with improved shelf life, texture, and flavor profiles, supporting long-term growth. Market diversification is seen in expanding applications from traditional ice cream bars to artisanal and plant-based frozen desserts globally.

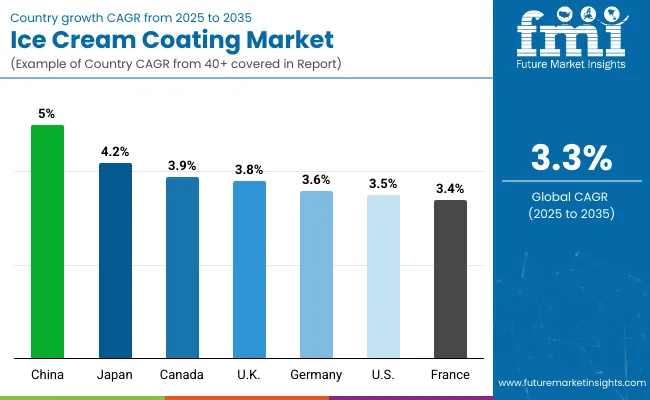

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 5.0% |

| Japan | 4.2% |

| Canada | 3.9% |

| UK | 3.8% |

| Germany | 3.6% |

| USA | 3.5% |

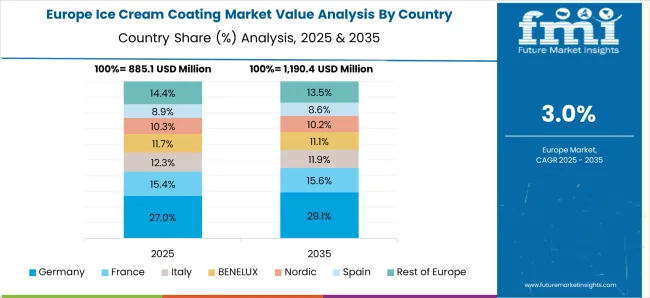

| France | 3.4% |

China leads with a CAGR of 5.0%, driven by urbanization, rising incomes, and e-commerce growth that fuel demand for premium coatings. Japan follows at 4.2%, with convenience and health-focused consumer preferences. Canada’s market grows at 3.9%, supported by demand for organic and allergen-free coatings. The UK grows at 3.8%, led by premiumization and sustainable sourcing. Germany expands at 3.6%, driven by artisanal gelato cafes and functional coatings. The USA sees 3.5% growth, focused on vegan, organic, and premium treats, while France leads with 3.4%, emphasizing gourmet flavors and clean-label products.

The report covers an in-depth analysis of 40+ countries; seven top-performing OECD countries are highlighted below.

Revenue from ice cream coating in China, projected to expand at a CAGR of 5.0% from 2025 to 2035. Rapid urbanization, rising disposable incomes, and increasing demand for premium frozen desserts fuel this growth. Manufacturers are investing in production facility expansions and technological advancements. E-commerce platforms significantly boost market reach, while innovative coatings blending traditional and modern flavors appeal to diverse consumers. Focus on sustainable sourcing and government incentives further support industry development, positioning China as a critical growth hub.

Demand for ice cream coating in Japan is anticipated to grow at a CAGR of 4.2% from 2025 to 2035. Consumer preference for health-focused, convenient, and premium coated frozen snacks drives expansion. Thin, crisp coatings are favored, especially in mochi and bite-sized formats. Convenience stores and vending machines dominate retail distribution. Japanese manufacturers emphasize traditional flavors like matcha and yuzu while maintaining high-quality ingredient standards. Continuous process innovations sustain steady market growth against evolving consumer needs.

Demand for ice cream coating in Canada is projected to grow at a 3.9% CAGR by 2035, marked by steady demand for organic, allergen-free, and clean-label products. Rising health awareness pushes consumers towards natural coatings and healthier formulations. Retailers and foodservice operators expand premium provisioning, while ethnic and artisanal flavors contribute to product diversity. Collaborations between manufacturers and distributors enhance availability. Technological advancements improve product quality, positioning Canada as a growing market with increasing consumer sophistication.

Sales of ice cream coating in the UK are expected to grow at 3.8% CAGR, driven by premiumization and private-label expansion in supermarkets. Consumer concerns about sustainable and ethically sourced ingredients shape buying behaviors. The lockdown period sparked growth in indulgent at-home desserts, benefiting coated ice cream products. Functionality and low-calorie options gain consumer appeal, while transparency around ingredient sourcing becomes pivotal. Strong private-label offerings and innovation in coating formats support competitive advantage.

Sales of ice cream coating in Germany are expected to grow at 3.6% CAGR, benefits from artisan gelato parlors and frozen dessert cafes. Consumer interest in functional coatings fiber-enhanced or yogurt-based rises steadily. Younger consumers favor colorful and textured coatings. Manufacturers invest in automation and high-quality ingredient sourcing to maintain cellar-age improvements. Environmental sustainability, regulatory compliance, and quality assurance remain key priorities amid rising competition in the region.

Demand for ice cream coating in the USA is projected to grow at a 3.5% CAGR, driven largely by the rising demand for premium frozen desserts such as multi-textured bars and sandwiches. Consumers increasingly prioritize health, fueling demand for reduced-sugar, vegan, and organic coating options. Established players in the market are leading with strong R&D investments and a diversified product portfolio to cater to evolving consumer preferences. The wide availability of these coatings is supported by a strong presence across retail and specialty channels. Additionally, sustainability and clean-label trends are shaping product development and market growth, creating more opportunities amid fierce competition in this dynamic market.

Revenue from ice cream coating in France is expected to grow at a CAGR of 3.4%, driven largely by the rising popularity of gourmet cafés and urban consumers seeking premium products. Regional flavors like raspberry and lavender heavily influence innovative coating developments, creating unique taste experiences that appeal to local preferences. The market is also adapting to stricter food regulations by focusing on cleaner labels and additive-free coatings, which are increasingly demanded by health-conscious consumers. Premium techniques such as aerated and textured coatings are becoming more popular. French manufacturers emphasize research and development to align with sophisticated consumer tastes and regulatory requirements, strengthening France’s position in specialty and artisanal ice cream coatings.

The market is moderately fragmented, with a mix of global giants and regional specialists contributing to competitive dynamics. Key players such as Barry Callebaut, Smucker Company, and Chr. Hansen Holding A/S has a significant influence due to its diversified portfolios, global distribution capabilities, and investment in coating innovation. Mid-tier and regional players like Göteborgsfood Budapest Ltd. and Walter Rau Neusser Ol und Fett AG compete primarily on pricing and custom formulation offerings for niche markets.

Top companies are focusing on differentiation through clean-label innovations, expansion of plant-based and functional coatings, and flavor diversification. Strategic partnerships, regional capacity expansions, and sustainability-driven sourcing are central to their growth initiatives. Barry Callebaut is pushing forward with cocoa sustainability programs, while Smucker and Palsgaard are expanding coating portfolios to meet low-sugar and allergen-free trends. Companies like FONA International and Blommer Chocolate are also investing in AI-led R&D to accelerate product development and speed-to-market.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 3.7 billion |

| Types | Dark, Milk, Yogurt, White, Colored, Flavored Types |

| Application | Dipping, Enrobing, Spraying, Co-Extrusion, Chocolate Aeration |

| End User | Parlors, Dairies, Horeca (Hotel, Restaurants, Café), Other (Specialty Manufacturers, Catering Services, and Niche Ice Cream Artisans) |

| Regions Covered | North America, Latin America, Europe, the Middle East and Africa, East Asia, South Asia |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia, and 40+ countries |

| Key Players | FONA International, Smucker Company, Walter Rau Neusser Ol und Fett AG, Blommer Chocolate Company, Palsgaard, Göteborgsfood Budapest Ltd., Barry Callebaut, Bunge Loders Croklaan, Kwality Icecreams, Chr. Hansen Holding A/S |

| Additional Attributes | Dollar sales by value, m arket share analysis by coating type, flavor, and form, c ountry-wise analysis across North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America, c ompetitive landscape, c onsumer preferences for natural versus indulgent coatings |

The global ice cream coating market is estimated to be valued at USD 3.7 billion in 2025.

The market size for the ice cream coating market is projected to reach USD 5.1 billion by 2035.

The ice cream coating market is expected to grow at a 3.3% CAGR between 2025 and 2035.

The key product types in ice cream coating market are dark, milk, yogurt, white, colored and flavored types.

In terms of application, dipping segment to command 42.3% share in the ice cream coating market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

ICE Start And Stop System Market Size and Share Forecast Outlook 2025 to 2035

Ice Boxes Market Size and Share Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Iced Tea Business

Ice Detection System Market Trends, Growth & Forecast 2025 to 2035

Ice Cube Tray Market Trends & Growth Forecast 2024-2034

Ice Maker Machines Market

Ice Transport Buckets Market

Ice-cream Premix and Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Ice Cream Equipment Market Size and Share Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Ice Cream and Frozen Dessert Market from 2025 to 2035

Ice Cream Packaging Market - Outlook 2025 to 2035

Ice Cream Processing Equipment Market Growth - Trends, Demand & Innovations 2025 to 2035

Ice Cream Service Supplies Market - Premium Serving Essentials 2025 to 2035

Ice Cream Parlor Market Analysis by Type, Product Type, and Region Through 2035

Breaking Down Market Share in the Ice Cream Parlor Industry

Ice Cream Container Market Size & Trends Forecast 2024-2034

Ice-cream Maker Market

Rice Bran Fatty Alcohols Market Size and Share Forecast Outlook 2025 to 2035

Rice Water Skincare Market Forecast and Outlook 2025 to 2035

Rice Water Haircare Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA