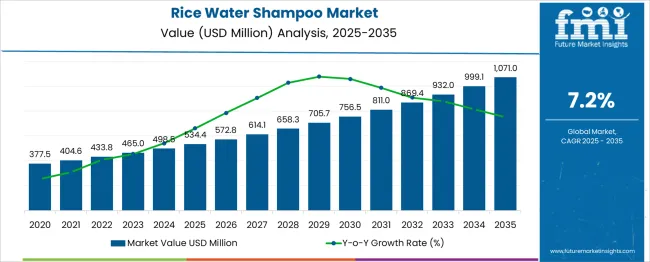

The rice water shampoo market is estimated to be valued at USD 534.4 million in 2025 and is projected to reach USD 1071.0 million by 2035, registering a compound annual growth rate (CAGR) of 7.2% over the forecast period. The market dynamics reflect significant shifts in competitive positioning as consumer preferences and industry trends evolve. Between 2020 and 2025, the market grows from USD 377.5 million to USD 534.4 million, driven by established brands consolidating their presence through expanded product portfolios, targeted marketing campaigns, and a focus on premium, natural ingredient-based segments. During this period, smaller and niche players encounter challenges related to limited distribution and brand visibility amid intensifying competition. The rising consumer inclination toward natural and traditional beauty remedies, such as rice water-based formulations, supports steady market expansion.

From 2026 to 2030, the market advances from USD 572.8 million to USD 705.7 million, fueled by the entry of innovative indie brands offering health-conscious products enriched with natural extracts and eco-friendly ingredients. These new entrants leverage digital platforms and social media to engage younger demographics, prompting shifts in market share. The demand for personalized hair care solutions and transparency in ingredient sourcing gains importance, driving both established and emerging players to innovate continuously. Between 2031 and 2035, the market further expands from USD 756.5 million to USD 1,071.0 million. Leading companies intensify investments in product innovation, sustainability initiatives, and the expansion of global distribution networks, particularly targeting emerging markets with growing beauty product consumption. Despite these gains, market share erosion persists among less adaptable players unable to meet evolving consumer demands for efficacy and ethical sourcing. Overall, the market remains dynamic, with innovation, brand strength, and consumer engagement serving as crucial factors influencing competitive advantage and market share evolution through 2020 to 2035.

| Metric | Value |

|---|---|

| Rice Water Shampoo Market Estimated Value in (2025 E) | USD 534.4 million |

| Rice Water Shampoo Market Forecast Value in (2035 F) | USD 1071.0 million |

| Forecast CAGR (2025 to 2035) | 7.2% |

The rice water shampoo market accounts for an emerging niche within the global hair care segment, contributing approximately 1.8–2.5% share of the overall shampoo category. Within the broader personal care industry, its share is smaller, estimated at around 0.3–0.5%, due to its current position as a specialized product driven by natural ingredient preferences. In the herbal and organic shampoo category, rice water shampoos hold a stronger foothold of nearly 5–6%, as consumers increasingly prefer plant-based and chemical-free formulations. Among premium hair care solutions, this segment captures around 2–3% share, supported by its association with traditional remedies and wellness-oriented positioning. Across e-commerce platforms, its presence is notable as online retail accelerates demand for niche, ingredient-focused products.

Growth is reinforced by claims associated with hair strengthening, scalp nourishment, and reduced breakage, which resonate strongly with health-conscious buyers. The segment’s expansion is aided by influencer-led campaigns and content marketing strategies emphasizing natural beauty rituals. Brands are leveraging this by launching sulfate-free, paraben-free formulations and targeting consumers seeking alternatives to conventional shampoos. Despite being a small share in the overall market, rice water shampoo products are gaining relevance by appealing to individuals prioritizing authenticity and minimalistic care. Their gradual move toward mainstream adoption indicates a steady trajectory, especially as regional players and global brands invest in herbal product portfolios to tap into this opportunity-driven category.

The rice water shampoo market is gaining strong momentum globally, supported by rising consumer awareness around traditional beauty remedies and natural hair care practices. Demand is being driven by a growing preference for chemical-free and nutrient-rich formulations that align with the clean beauty movement.

Rice water, known for its amino acids, vitamins, and antioxidants, has increasingly been adopted in shampoos to strengthen hair, improve shine, and reduce breakage. As consumers shift toward personalized wellness and self-care routines, brands are investing in product diversification across form types, fragrances, and sustainable materials.

Rise of e-commerce, influencer marketing, and organic certification trends has further expanded the reach and appeal of rice water shampoo products. With strong growth prospects in both developed and emerging markets, the category is expected to maintain upward momentum, particularly as ingredient transparency and product efficacy become central to consumer decision-making in the beauty and personal care sector..

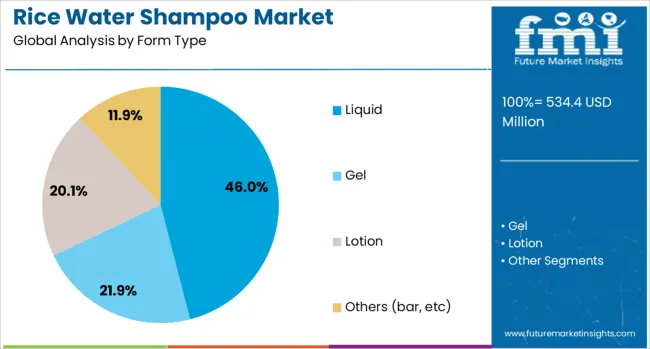

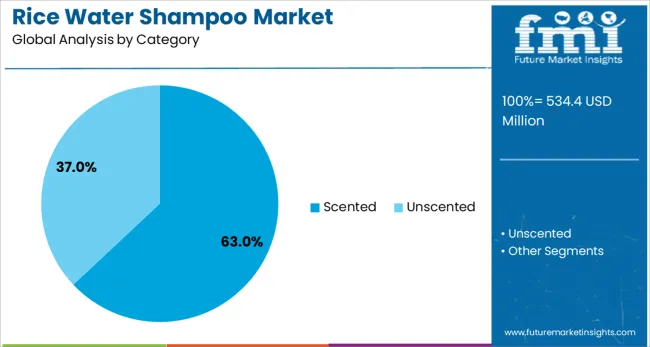

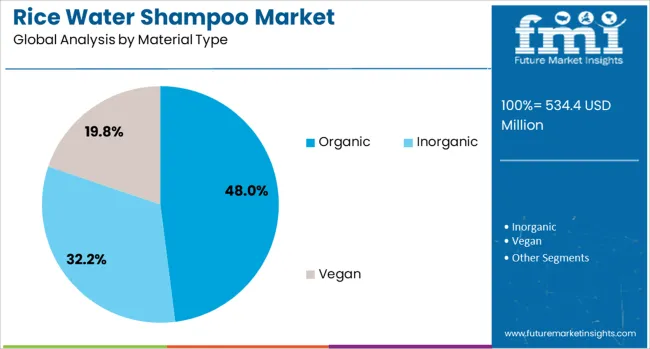

The rice water shampoo market is segmented by form type, category, material type, hair type, consumer group, price range, distribution channel, and geographic regions. The rice water shampoo market is divided by form type into Liquid, Gel, Lotion, and Others (bar, etc). In terms of the category, the rice water shampoo market is classified into Scented and Unscented. Based on the material type, the rice water shampoo market is segmented into Organic, Inorganic, and Vegan. The rice water shampoo market is segmented by hair type into Dry, Dandruff, Thinning, Damaged/colour treated, and Other (oily, frizzy). The consumer group of the rice water shampoo market is segmented into Female, Male, and Unisex. The price range of the rice water shampoo market is segmented into Medium, Low, and High. The distribution channel of the rice water shampoo market is segmented into Online and Offline. Regionally, the rice water shampoo industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The liquid form type segment is projected to account for 46% of the Rice Water Shampoo market revenue share in 2025, establishing it as the leading form type. The segment’s dominance has been driven by the familiarity and ease of use associated with liquid shampoos, which continue to be preferred by consumers for their versatility in daily hair care routines. Liquid formulations have allowed for uniform distribution of rice water extract and other active ingredients, enhancing the effectiveness of cleansing and conditioning properties.

Moreover, the formulation enables the infusion of additional botanical agents and essential oils that complement rice water’s natural benefits. Manufacturers have also prioritized liquid variants for faster scalability in mass production and improved shelf stability.

The widespread availability of liquid rice water shampoos across retail channels and online platforms has reinforced their position as the most accessible option. These factors, combined with user-friendly packaging and compatibility with most hair types, have solidified the segment’s leadership in the overall market..

The scented category segment is expected to contribute 63% of the Rice Water Shampoo market revenue share in 2025, representing the dominant category preference. The appeal of scented shampoos has been elevated by growing consumer expectations for sensory experiences that combine hair nourishment with fragrance satisfaction. The inclusion of aromatic elements in rice water shampoo formulations has allowed brands to enhance perceived luxury and promote brand differentiation.

Floral, herbal, and citrus scent profiles have become particularly popular, supporting the emotional and wellness-driven aspects of personal care. The scented segment has also benefited from the psychological influence of fragrance on consumer perception of cleanliness and freshness, encouraging product loyalty.

Formulators have responded to this trend by using naturally derived essential oils to align with clean beauty standards. As consumer demand for multi-sensory and mood-enhancing products continues to rise, the scented category is anticipated to sustain its lead through innovation in fragrance integration and evolving olfactory preferences..

The organic material type segment is projected to hold 48% of the Rice Water Shampoo market revenue share in 2025, marking it as the most prominent material type. Growth in this segment has been supported by increasing consumer focus on ingredient transparency, sustainability, and the long-term health impact of personal care products. Shampoos formulated with certified organic rice water and plant-based ingredients have gained traction as consumers seek to avoid synthetic additives, parabens, and sulfates.

The rise has further influenced the shift toward organic solutions in environmentally conscious consumption and preference for cruelty-free and vegan products. Brands operating in this segment have emphasized ecological packaging and ethical sourcing practices, reinforcing consumer trust and regulatory compliance.

As regulatory standards for organic labeling become more rigorous globally, companies with certified formulations have gained a competitive advantage. The organic segment continues to expand as it resonates with health-conscious and eco-aware shoppers.

The rice water shampoo segment is expanding through demand for natural ingredients, e-commerce growth, and product diversification, but faces hurdles like high pricing, limited awareness, and formulation challenges that require strategic investment for wider adoption.

The rice water shampoo category has been positioned strongly within the natural and herbal hair care segment. Consumer preferences have shifted toward ingredient-based solutions, making rice water shampoos appealing for those seeking authentic and chemical-free alternatives. Increased awareness of traditional remedies has fueled curiosity, especially in regions with strong cultural connections to rice water practices. Market growth is being supported by expanding digital awareness campaigns, endorsements by influencers, and the rise of self-care routines that emphasize plant-based products. The appeal is heightened by claims of improved scalp health, enhanced shine, and reduced hair breakage. This trend is expected to sustain as buyers continue prioritizing safe, natural ingredients for daily grooming routines.

E-commerce platforms have played a decisive role in accelerating the adoption of rice water shampoos by providing greater accessibility and variety to global consumers. Direct-to-consumer (D2C) brands have leveraged online channels to create niche product lines and interact with buyers directly. Digital marketing strategies, including targeted social media campaigns and influencer collaborations, have amplified consumer interest in ingredient-led products. Subscription-based models and trial-size packaging have also contributed to higher adoption rates. Reviews and user-generated content on platforms like Instagram and YouTube are shaping purchase decisions, making online presence critical for growth. This dynamic has allowed smaller players to compete effectively with established brands without heavy reliance on physical retail distribution.

Brand differentiation has become essential as competition intensifies in the natural hair care segment. Companies are introducing rice water shampoos enriched with additional botanical extracts, vitamins, and essential oils to enhance performance and meet diverse consumer expectations. Sulfate-free, paraben-free, and cruelty-free claims are being highlighted to attract conscious consumers. Packaging innovations, such as eco-friendly materials and refillable options, are gaining relevance in premium segments. Regional players are developing specialized variants focusing on hair types prevalent in their markets, while global brands are capitalizing on heritage-driven narratives to promote authenticity. This strategic emphasis on product diversity is influencing consumer perception and creating a competitive edge for brands investing in personalization and clean-label promises.

Despite the growing popularity, certain challenges are restraining the pace of market expansion for rice water shampoos. Limited consumer awareness in rural and semi-urban areas is affecting penetration levels, while high price points compared to conventional shampoos are deterring cost-sensitive buyers. Authentic sourcing and preservation of rice extract properties pose formulation challenges for manufacturers, impacting scalability. Counterfeit products and misleading claims in unregulated online marketplaces are reducing consumer trust. Logistics costs for natural ingredients and compliance with global cosmetic regulations are adding complexity to production cycles. Overcoming these challenges requires sustained investment in quality assurance, educational marketing, and partnerships with reliable supply chain vendors to maintain credibility and growth momentum.

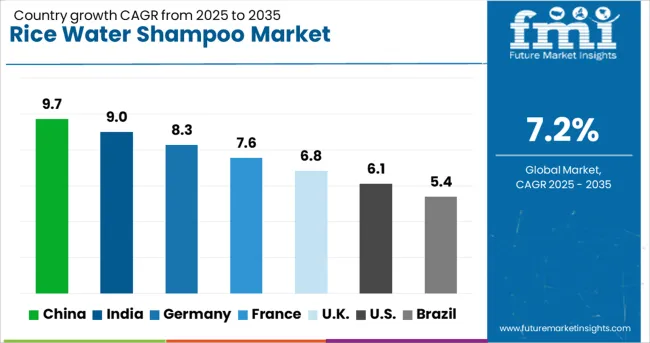

| Country | CAGR |

|---|---|

| China | 9.7% |

| India | 9.0% |

| Germany | 8.3% |

| France | 7.6% |

| UK | 6.8% |

| USA | 6.1% |

| Brazil | 5.4% |

The rice water shampoo market is projected to grow globally at a CAGR of 7.2% from 2025 to 2035, with China leading at 9.7% due to rising adoption of herbal hair care and aggressive e-commerce strategies. India follows at 9.0%, supported by consumer inclination toward traditional beauty practices and influencer-driven campaigns. France posts 7.6%, benefiting from expanding clean-label hair care trends, while the UK achieves 6.8% as natural ingredient-based solutions gain traction in specialty retail. The USA remains comparatively slower at 6.1%, shaped by increasing preference for niche products and digital brand engagement, making Asia a dominant growth hub.

The CAGR of the rice water shampoo market in the United Kingdom was estimated at approximately 4.9% during 2020–2024 and later advanced to nearly 6.8% for the 2025–2035 period. This increase in growth rate is attributed to stronger consumer confidence in natural and botanical-based formulations combined with higher digital penetration of niche hair care products. Market acceleration has been supported by aggressive online campaigns, influencer collaborations, and a rising preference for sulfate-free and clean-label shampoos. British consumers have shown increasing interest in ingredient-led solutions that address scalp nourishment and hair repair, which has helped brands expand through premium positioning. The convenience of D2C models and curated online subscriptions further stimulated adoption.

China’s rice water shampoo market CAGR stood at approximately 6.9% from 2020–2024 and surged to about 9.7% for 2025–2035, driven by strong adoption of traditional remedies integrated with modern hair care preferences. Social commerce platforms and influencer-led marketing strategies accelerated awareness, while major e-commerce portals enabled extensive product reach into tier-2 and tier-3 cities. Domestic manufacturers collaborated with global players to launch innovative herbal-based formulations, while consumer demand for sulfate-free and paraben-free products strengthened premium positioning. Rapid expansion of cross-border e-commerce and duty-free formats added to sales momentum. This growth trajectory is expected to persist as ingredient-focused beauty routines dominate consumer choices across age groups.

The CAGR for India’s rice water shampoo market was close to 6.4% during 2020–2024 and later reached an impressive 9.0% in the 2025–2035 period. The improvement in growth has been influenced by consumer trust in natural formulations and a strong shift toward herbal-based grooming products. Expanding distribution across online marketplaces and regional retail outlets boosted availability in both metropolitan and semi-urban markets. High levels of social media engagement and content-driven awareness have also played a crucial role in shaping purchasing decisions. Domestic and global brands are adopting competitive pricing strategies and introducing variants designed for diverse hair types to sustain demand.

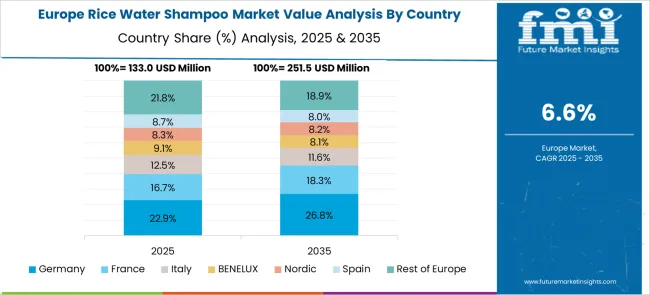

France reported a CAGR of nearly 5.8% during 2020–2024, which increased to around 7.6% between 2025 and 2035. This growth momentum has been shaped by consumer inclination toward premium, clean-label hair care solutions and growing interest in heritage-inspired beauty rituals. French buyers have embraced sulfate-free, paraben-free shampoos that complement the country’s established preference for natural beauty. Specialist retailers and concept stores have introduced exclusive rice water shampoo ranges targeting wellness-conscious shoppers. The appeal of eco-friendly packaging formats and refillable options has further reinforced consumer confidence in premium brands.

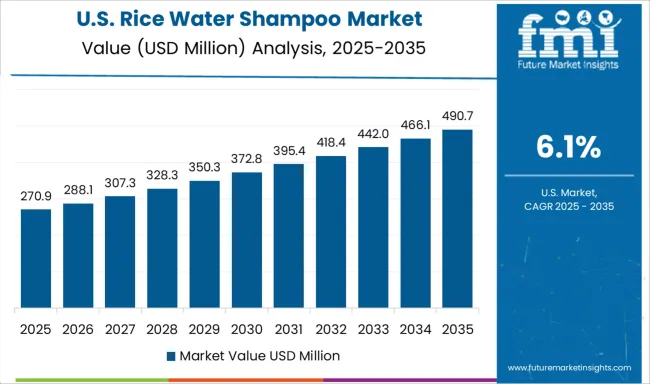

The CAGR for the United States rice water shampoo market was nearly 4.6% during 2020–2024 and later increased to approximately 6.1% for the 2025–2035 period. This upward shift is attributed to growing consumer interest in niche, ingredient-based hair care solutions combined with digital-first retail strategies. Influencer-driven content and endorsements have played a significant role in shaping buying behavior, especially among millennials and Gen Z consumers. Premiumization has been observed as buyers increasingly prefer sulfate-free and clean-label products to address scalp sensitivity and hair damage concerns. Subscription models offered by D2C brands, along with bundled offerings through major online marketplaces, have boosted overall adoption levels, making the segment a profitable niche for both domestic and global players.

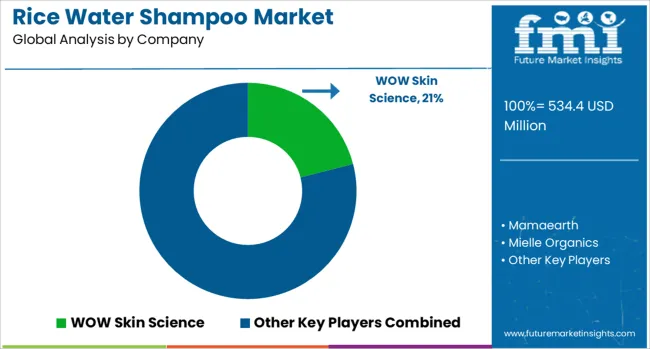

The rice water shampoo market features leading global and regional hair care brands such as WOW Skin Science, Mamaearth, Mielle Organics, The Body Shop, Briogeo, Klorane, Herbal Essences, and The Earth Collective, each playing a critical role in shaping consumer preferences. WOW Skin Science and Mamaearth have captured significant traction in Asia through strong positioning around herbal and chemical-free formulations. Mielle Organics leverages its expertise in textured hair care to build a loyal base across North America, while The Body Shop integrates natural ingredients with its established ethical brand narrative. Briogeo and Klorane focus on premium clean-label positioning, targeting consumers seeking botanical-based, sulfate-free solutions for scalp and hair health.

Herbal Essences, backed by P&G, capitalizes on its global network to drive mainstream adoption of nature-inspired shampoos, while The Earth Collective positions itself as a luxury niche brand with ingredient transparency and advanced herbal blends. Competitive differentiation relies on product storytelling, D2C channel strength, and innovation in multi-benefit formulations, including claims related to strengthening, anti-breakage, and shine enhancement. Limited-edition launches, eco-friendly packaging initiatives, and influencer collaborations are becoming essential growth levers. The segment continues to experience momentum through digital-first strategies and localized marketing approaches, reinforcing rice water shampoo’s position as a high-potential category within natural hair care.

In February 2024, Briogeo launched across 500 Cosmo Prof stores in the USA and online, expanding professional salon distribution

| Item | Value |

|---|---|

| Quantitative Units | USD 534.4 Million |

| Form Type | Liquid, Gel, Lotion, and Others (bar, etc) |

| Category | Scented and Unscented |

| Material Type | Organic, Inorganic, and Vegan |

| Hair Type | Dry, Dandruff, Thinning, Damaged/colour treated, and Other (oily, frizzy) |

| Consumer Group | Female, Male, and Unisex |

| Price Range | Medium, Low, and High |

| Distribution Channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | WOW Skin Science, Mamaearth, Mielle Organics, The Body Shop, Briogeo, Klorane, Herbal Essences, and The Earth Collective |

| Additional Attributes |

The global rice water shampoo market is estimated to be valued at USD 534.4 million in 2025.

The market size for the rice water shampoo market is projected to reach USD 1,071.0 million by 2035.

The rice water shampoo market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in rice water shampoo market are liquid, gel, lotion and others (bar, etc).

In terms of category, scented segment to command 63.0% share in the rice water shampoo market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Rice Bran Fatty Alcohols Market Size and Share Forecast Outlook 2025 to 2035

Rice Bran Oil for Skin Care Market Size and Share Forecast Outlook 2025 to 2035

Rice Bran Oil Infusions Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Rice Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Rice Bran Derivatives Market Size and Share Forecast Outlook 2025 to 2035

Rice Mill Machine Market Size and Share Forecast Outlook 2025 to 2035

Rice Derivative Market Size and Share Forecast Outlook 2025 to 2035

Rice Polishing Machines Market Size and Share Forecast Outlook 2025 to 2035

Rice Bran Oil Market Analysis by Type, End User, and Region Through 2035

Rice Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Rice Bran Wax Market Analysis - Size, Share, and Forecast 2025 to 2035

Rice Cake Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Rice Milk Market Trends - Dairy-Free Nutrition & Industry Growth 2025 to 2035

Rice-based Products Market Analysis by Product Type, Distribution Channel, and Region Through 2035

Rice Paper Stand Up Pouch Market Growth & Sustainable Packaging 2024-2034

Rice Protein Market

Rice Shampoo Bar Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Rice Shampoo Bar Manufacturers

Rice Water Skincare Market Forecast and Outlook 2025 to 2035

Rice Water Haircare Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA