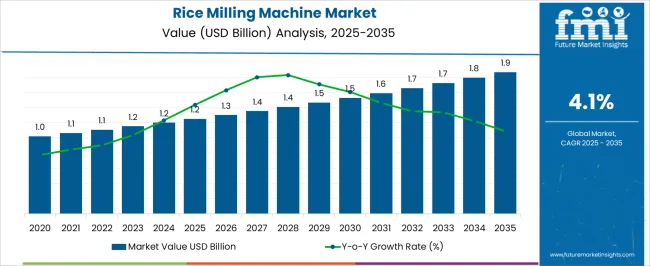

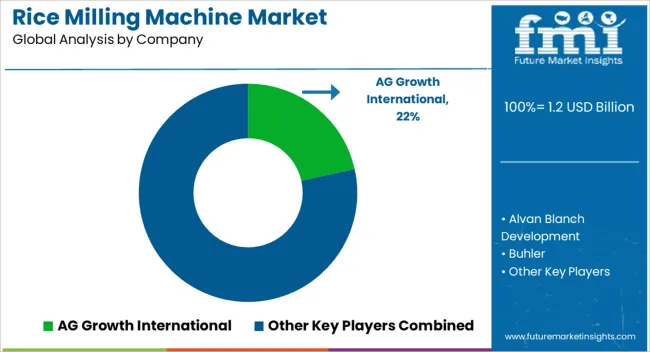

The rice milling machine market is estimated to be valued at USD 1.2 billion in 2025 and is projected to reach USD 1.9 billion by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period.

Over the first five years from 2021 to 2025, the market shows gradual growth, moving from USD 1.0 billion to USD 1.2 billion. This growth is driven by the increasing demand for efficient milling processes in rice production, as well as technological improvements that enhance milling precision and energy efficiency. Between 2026 and 2030, the market remains steady, reaching USD 1.7 billion by 2030, with annual increments progressing from USD 1.2 billion to USD 1.3 billion, 1.4 billion, 1.5 billion, and 1.6 billion. This phase sees a focus on automation, the introduction of advanced milling technologies, and improvements in output quality and yield, particularly in emerging economies with growing agricultural industries.

Between 2031 and 2035, the market continues to expand, achieving USD 1.9 billion by 2035, with values increasing through USD 1.7 billion, 1.8 billion, and finally 1.9 billion. This period reflects broader market penetration, driven by the adoption of eco-friendly, energy-efficient rice milling machines, alongside increased demand for higher-quality rice products globally. These trends indicate steady growth with incremental technological advancements over the next decade.

| Metric | Value |

|---|---|

| Rice Milling Machine Market Estimated Value in (2025 E) | USD 1.2 billion |

| Rice Milling Machine Market Forecast Value in (2035 F) | USD 1.9 billion |

| Forecast CAGR (2025 to 2035) | 4.1% |

The agricultural machinery market is one of the primary drivers, contributing around 25-30%, as rice milling machines are essential equipment used in the post-harvest processing of rice, making them a critical part of agricultural machinery. The food processing equipment market also plays a significant role, accounting for about 20-25%, since rice milling is a vital part of food processing, particularly in regions where rice is a staple food. The cereal and grain processing market contributes approximately 15-20%, as rice milling is a key process in converting raw rice into consumable forms, ensuring the final product's quality and consistency.

The packaging machinery market supports the rice milling market with around 10-12% share, as rice needs to be packaged efficiently after milling for distribution, often using automated systems. Lastly, the farming and food supply chain market contributes around 8-10%, with rice milling being a crucial step in the overall supply chain, transforming harvested rice into a marketable product for consumers. These parent markets collectively highlight the vital role of rice milling machines within the broader agricultural, food processing, and supply chain industries, driven by the need for efficient, high-quality processing and automation.

The rice milling machine market is witnessing sustained expansion driven by rising global rice consumption, technological advancements in milling efficiency, and increasing demand for high quality processed rice. Automation and integration of advanced cleaning and polishing systems are enabling higher yields and reduced grain breakage, meeting both domestic and export quality standards.

Governments in rice producing countries are supporting modernization initiatives through subsidies and infrastructure investments, further accelerating the adoption of advanced milling systems. Growing awareness of post harvest loss reduction and value addition in rice processing is pushing millers to upgrade from traditional setups to more efficient machinery.

The market outlook remains positive as investments in energy efficient systems, digital monitoring tools, and scalable plant configurations continue to shape the industry’s future growth trajectory.

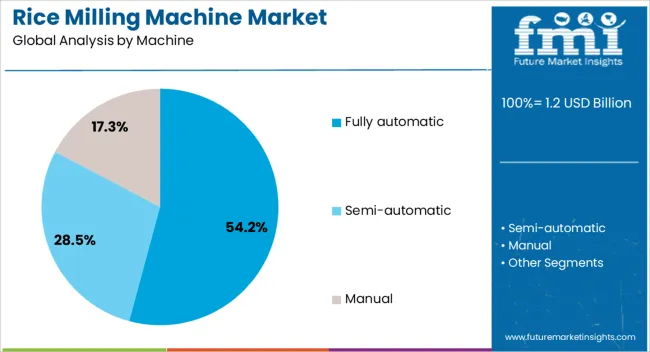

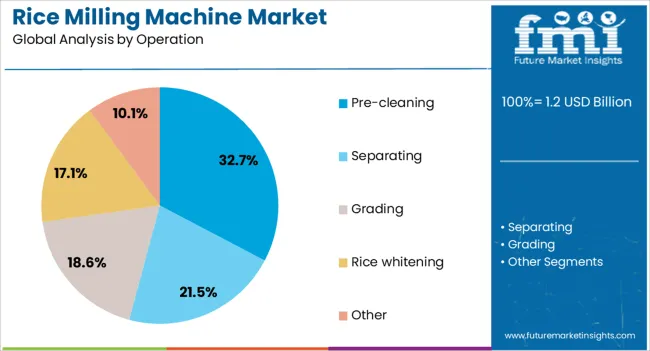

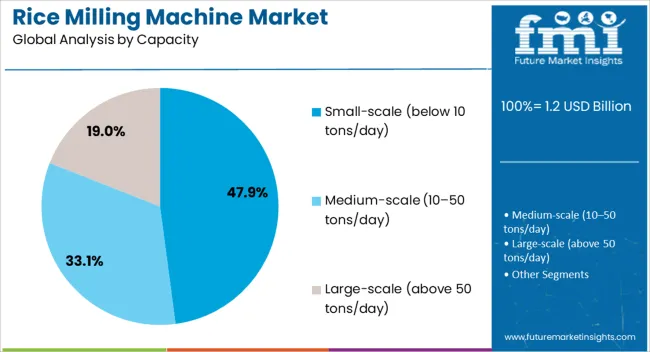

The rice milling machine market is segmented by machine, operation, capacity, end use, and geographic regions. By machine, rice milling machine market is divided into fully automatic, semi-automatic, and manual. In terms of operation, rice milling machine market is classified into pre-cleaning, separating, grading, rice whitening, and other. Based on capacity, rice milling machine market is segmented into small-scale (below 10 tons/day), medium-scale (10–50 tons/day), and large-scale (above 50 tons/day). By end use, rice milling machine market is segmented into commercial mills and farmers/small millers. Regionally, the rice milling machine industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fully automatic machine segment is projected to hold 54.20% of total market revenue by 2025 within the machine category, positioning it as the leading segment. This growth is driven by its ability to integrate multiple processing stages, including cleaning, dehusking, polishing, and grading, into a seamless operation.

These systems reduce manual intervention, improve operational efficiency, and ensure consistent product quality. Adoption has been further encouraged by labor cost reduction, higher throughput capacity, and the ability to meet strict quality certifications for export markets.

The fully automatic configuration is increasingly preferred by medium and large scale rice processors seeking to optimize productivity and minimize wastage.

The pre-cleaning operation segment is expected to account for 32.70% of market revenue by 2025 under the operation category, making it a key processing stage. This prominence is due to its critical role in removing impurities such as stones, dust, husks, and other foreign materials before milling.

Effective pre-cleaning ensures higher milling efficiency, prevents damage to downstream equipment, and improves the final rice quality. The segment’s growth is further supported by the increased demand for high quality rice in both domestic and international markets, where purity standards are strictly regulated.

Modern pre-cleaning systems with automated sieving and aspiration technologies have enhanced throughput and operational reliability.

The small-scale capacity segment, defined as below 10 tons per day, is projected to represent 47.90% of total market revenue by 2025 in the capacity category, making it the dominant capacity type. This is attributed to the widespread presence of smallholder farmers and local millers in major rice producing regions.

Small-scale units require lower capital investment, offer operational flexibility, and can cater to localized demand. Their portability and ease of installation make them particularly suitable for rural and semi-urban settings.

The segment is also benefiting from the availability of compact yet efficient machinery that delivers quality output while maintaining low operating costs, supporting livelihoods and community-based rice processing initiatives.

As rice consumption continues to increase globally, particularly in Asia and Africa, the demand for advanced milling technologies that improve yield, quality, and processing efficiency is on the rise. Challenges include high equipment costs, maintenance requirements, and the need for skilled labor to operate and maintain sophisticated machines. Opportunities lie in the development of energy-efficient, low-cost, and automated milling solutions that cater to small and medium-sized rice mills. Trends indicate the growing preference for eco-friendly, multi-functional machines that enhance processing capabilities and product quality. Suppliers providing cost-effective, high-performance, and easy-to-use rice milling solutions are best positioned to capture the expanding market, especially in emerging economies.

The rice milling machine market is driven by the increasing demand for rice as a staple food in many regions, particularly Asia-Pacific, Africa, and Latin America. The need for automated milling solutions that enhance productivity, reduce labor costs, and improve rice quality is growing. Traditional manual rice milling methods are being replaced by automated machines that offer higher efficiency, consistent quality, and lower processing time. Additionally, the push for energy-efficient systems that reduce operational costs while maintaining high output is influencing market growth. As the demand for rice continues to increase globally, rice mills are adopting advanced technologies to cater to the growing need for processed rice, especially premium varieties such as white and parboiled rice.

The rice milling machine market faces challenges related to high equipment costs, particularly for automated and high-capacity machines. While these machines offer greater efficiency and quality, the initial investment can be a barrier for smaller rice mills, especially in developing economies. The cost of maintenance, spare parts, and technical support adds to the overall operational expenses. Regulatory constraints related to food safety and product quality standards are also influencing the design and production of rice milling machines. The complexity of operating and maintaining advanced machines requires skilled labor, which can be a limiting factor in regions with a shortage of qualified personnel. To overcome these challenges, suppliers are focusing on providing cost-effective, easy-to-operate solutions that require minimal maintenance while still meeting regulatory standards.

Opportunities in the rice milling machine market are primarily centered around the development of energy-efficient, multi-functional machines that can handle different rice varieties and milling processes. These machines are capable of reducing power consumption while providing higher output, making them ideal for both small and large-scale rice mills. The increasing emphasis on reducing the environmental impact of rice milling operations is prompting manufacturers to design machines that minimize energy use and waste. Additionally, hybrid and modular rice milling systems that can process multiple stages of rice milling (e.g., de-husking, whitening, and polishing) are gaining popularity. As the market in emerging economies continues to grow, suppliers offering low-cost, high-performance solutions that cater to local needs are well-positioned to capture a significant market share.

The rice milling machine market is trending toward increased automation, the integration of IoT, and the development of smart milling solutions. Automated rice milling machines are increasingly being used to streamline the milling process, reduce labor costs, and improve production efficiency. IoT-enabled rice milling systems allow for real-time monitoring, predictive maintenance, and performance optimization, reducing downtime and enhancing overall mill productivity. Moreover, smart milling machines equipped with sensors can adjust settings based on the type and quality of rice being processed, improving consistency and quality. As demand for high-quality rice grows, particularly in developed markets, the trend toward automation and smart technology is expected to accelerate, providing further growth opportunities for manufacturers who can offer advanced, reliable, and cost-effective solutions.

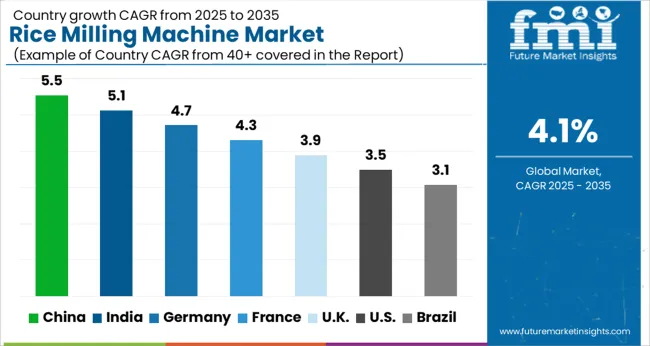

| Country | CAGR |

|---|---|

| China | 5.5% |

| India | 5.1% |

| Germany | 4.7% |

| France | 4.3% |

| UK | 3.9% |

| USA | 3.5% |

| Brazil | 3.1% |

The global rice milling machine market is expected to grow at a CAGR of 4.1% from 2025 to 2035. China leads with 5.5%, followed by India at 5.1% and Germany at 4.7%. The UK and USA show more moderate growth rates of 3.9% and 3.5%, respectively. The market is driven by growing demand for high-quality rice, advancements in automated milling technologies, and increasing rice-based product consumption. Government initiatives, as well as the rise in rice exports and specialty rice varieties, are further contributing to the market's expansion globally. The analysis spans 40+ countries, with leading markets profiled below.

The rice milling machine market in China is expected to grow at a CAGR of 5.5% from 2025 to 2035. As the world’s largest producer and consumer of rice, China’s demand for advanced rice milling technologies is driven by the need to improve production efficiency and ensure high-quality output. The country’s growing agricultural sector, supported by the government’s push for modernizing farming techniques, is fueling the market’s expansion. Additionally, China’s large-scale rice mills and the increasing preference for automated and energy-efficient milling machines are contributing to the growth. The demand for value-added rice products, such as rice flour and rice-based snacks, is also boosting the need for advanced milling machines capable of producing fine-quality rice. The rise in domestic consumption and export activities, particularly in the Asia-Pacific region, is supporting the country’s growth in the rice milling machine market.

The rice milling machine market in India is projected to grow at a CAGR of 5.1% from 2025 to 2035. As the second-largest producer of rice globally, India’s rice milling market is driven by the need to enhance milling efficiency and improve rice quality for both domestic consumption and export purposes. With a large portion of India’s population dependent on agriculture, modernizing the rice milling process is critical to improving productivity and meeting growing demand. The increasing adoption of automatic rice mills, which offer higher output and better rice quality, is fueling the market. Additionally, the government’s support through subsidies for agricultural mechanization and the rise of private investments in the food processing sector are contributing to market growth. As more mills upgrade to advanced machines capable of processing higher volumes of rice efficiently, the market is expected to expand further.

The rice milling machine market in Germany is expected to grow at a CAGR of 4.7% from 2025 to 2035. Although Germany is not a major rice producer, the country’s strong food processing industry and demand for high-quality rice products are driving the growth of rice milling machines. Germany’s focus on efficient food production and precision milling technologies is creating demand for advanced milling equipment. With a large and growing food industry, which includes a significant number of rice-based products such as rice flour, rice cakes, and snacks, the demand for high-performance rice milling machines is on the rise. Germany’s strong commitment to automation and technology in food processing is pushing the market for rice milling machines toward more energy-efficient and higher-output systems. As Europe sees increased consumption of rice-based products, especially in the health and organic food sectors, Germany’s rice milling equipment market is set to expand further.

The UK rice milling machine market is projected to grow at a CAGR of 3.9% from 2025 to 2035. As rice consumption in the country continues to rise, the demand for high-quality milling machines to process rice for the food industry is increasing. The UK food processing sector, with a growing demand for processed rice products, is contributing to the expansion of the rice milling equipment market. Additionally, the UK’s trend toward automation in food production and demand for energy-efficient solutions is pushing manufacturers toward developing more sophisticated rice milling technologies. The rise of rice-based products such as ready-to-eat meals, snacks, and flour is driving the need for modernized milling machines capable of producing fine, high-quality rice. The growing market for organic and premium rice varieties also supports the demand for advanced rice milling technologies.

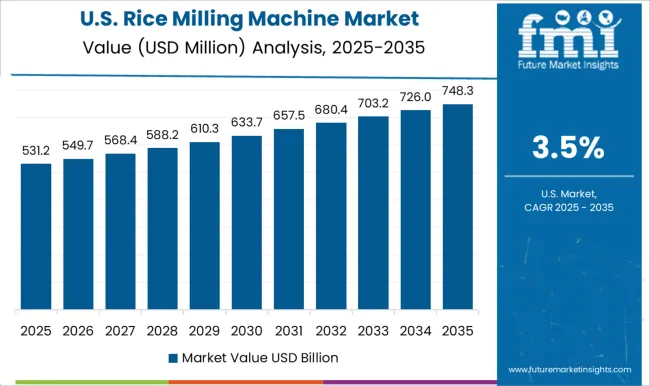

The USA rice milling machine market is expected to grow at a CAGR of 3.5% from 2025 to 2035. While the USA is not a leading rice producer, the country has a significant demand for rice milling machines due to its large food processing industry and rice-based products market. The growing interest in premium rice, such as organic and specialty varieties, is driving the adoption of more advanced milling equipment that can handle the increased production of high-quality rice. The USA food sector's focus on automation and improving food processing efficiency is contributing to the demand for modern rice milling machines. With the rise of packaged rice products, ready-to-eat meals, and snack foods, there is a growing need for efficient milling systems to meet the production requirements. The rise in rice exports to other regions also supports the market’s growth in the USA

In the rice milling machine market, competition is driven by technological innovation, production efficiency, and cost-effectiveness. AG Growth International is a key player, offering a wide range of advanced rice milling equipment focused on high throughput and consistent output. The company emphasizes reliability and ease of operation, making its machinery suitable for both small and large-scale rice processing. Alvan Blanch Development competes with energy-efficient and versatile rice milling solutions, targeting both developed and emerging markets, with a focus on customization for specific processing needs. Bühler, a major competitor, is renowned for its high-tech milling systems that ensure maximum output, energy efficiency, and minimal grain breakage.

The company’s milling solutions are widely used in both rice and grain processing, with a strong focus on automation and precision control. Fowler Westrup provides technologically advanced rice milling systems designed to enhance product quality and reduce waste. Their solutions are tailored for the global market, with an emphasis on durability and long-term service life. Hubei Bishan Machinery and Hubei Fotma Machinery focus on providing cost-effective rice milling solutions with a strong presence in China and other Asian markets.

Both companies emphasize efficient, high-performance machines designed for small and medium-sized milling operations. Lushan Win Tone Engineering offers innovative milling equipment with a focus on high output and easy maintenance, making it a popular choice for international rice processors. Mill Master Machinery focuses on creating complete milling plants, offering fully automated systems with a high level of precision and control. Satake remains a leader in the market, providing comprehensive rice milling machinery, including grading, husking, and polishing equipment. Its systems are known for their efficiency, low noise, and minimal waste. Yamanoto is another strong competitor, focusing on providing high-quality milling machines that deliver uniform rice output and energy savings.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.2 billion |

| Machine | Fully automatic, Semi-automatic, and Manual |

| Operation | Pre-cleaning, Separating, Grading, Rice whitening, and Other |

| Capacity | Small-scale (below 10 tons/day), Medium-scale (10–50 tons/day), and Large-scale (above 50 tons/day) |

| End Use | Commercial mills and Farmers/small millers |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AG Growth International, Alvan Blanch Development, Buhler, Fowler Westrup, Hubei Bishan Machinery, Hubei Fotma Machinery, Lushan Win Tone Engineering, Mill Master Machinery, Satake, and Yamanoto |

| Additional Attributes | Dollar sales by machine type (rice milling, rice polishing, rice grading), capacity (small, medium, large-scale), and application (food processing, agriculture). Demand dynamics are influenced by the rising global demand for rice, technological advancements in milling efficiency, and the need for automation in rice processing. Regional trends show significant growth in Asia-Pacific and Africa, driven by increasing rice production, population growth, and the modernization of agricultural processes. |

The global rice milling machine market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the rice milling machine market is projected to reach USD 1.9 billion by 2035.

The rice milling machine market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in rice milling machine market are fully automatic, semi-automatic and manual.

In terms of operation, pre-cleaning segment to command 32.7% share in the rice milling machine market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Rice Bran Fatty Alcohols Market Size and Share Forecast Outlook 2025 to 2035

Rice Water Skincare Market Forecast and Outlook 2025 to 2035

Rice Water Haircare Market Size and Share Forecast Outlook 2025 to 2035

Rice Shampoo Bar Market Size and Share Forecast Outlook 2025 to 2035

Rice Bran Oil for Skin Care Market Size and Share Forecast Outlook 2025 to 2035

Rice Bran Oil Infusions Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Rice Bran Derivatives Market Size and Share Forecast Outlook 2025 to 2035

Rice Derivative Market Size and Share Forecast Outlook 2025 to 2035

Rice Water Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Rice Bran Oil Market Analysis by Type, End User, and Region Through 2035

Rice Bran Wax Market Analysis - Size, Share, and Forecast 2025 to 2035

Rice Cake Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Rice Milk Market Trends - Dairy-Free Nutrition & Industry Growth 2025 to 2035

Rice-based Products Market Analysis by Product Type, Distribution Channel, and Region Through 2035

Key Players & Market Share in Rice Water Haircare Sector

Market Share Breakdown of Rice Shampoo Bar Manufacturers

Rice Paper Stand Up Pouch Market Growth & Sustainable Packaging 2024-2034

Rice Protein Market

Rice Mill Machine Market Size and Share Forecast Outlook 2025 to 2035

Rice Polishing Machines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA