The global rice milk market is projected to grow at a significant rate with the rising preference of consumers for dairy-free products, especially due to lactose intolerance. The demand continues to rise among health-oriented consumers as awareness regarding the health benefits of rice milk increases.

The growing vegan and flexitarian consumer base has also stimulated this market, inspiring manufacturers to come up with unique formulations such as fortified rice milk with added vitamins and minerals. Also, the increased awareness and emphasis on sustainability and responsible food consumption are further fuelling the demand for plant-based milk products, such as rice milk.

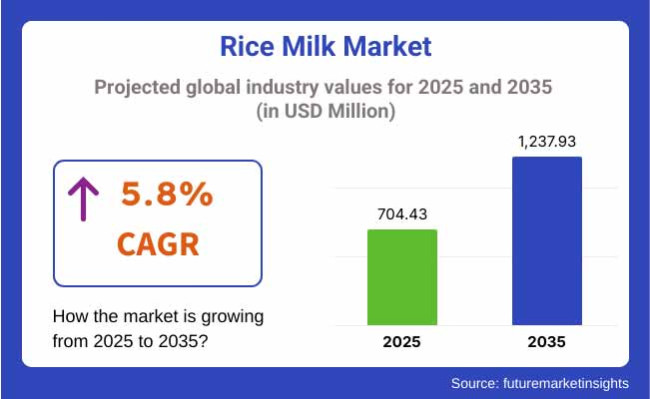

In 2025, the rice milk market was valued at approximately USD 704.43 million. By 2035, it is projected to reach USD 1,237.93 million, reflecting a compound annual growth rate (CAGR) of 5.8%. The increasing demand for non-dairy alternatives, rising penetration of organic and clean-label rice milk, and advancements in food processing technology are key factors propelling market expansion.

Furthermore, the growing availability of rice milk in various flavors and formulations, including unsweetened and flavored variants, is broadening its consumer base. Manufacturers are also focusing on innovative packaging solutions to enhance product shelf life and convenience.

North America leads the rice milk market, followed by Europe, owing to the rising preference of consumers toward dairy-free products, a growing vegan population, and increased incidences of lactose intolerance. Organic and fortified rice milk products are in high demand in the United States and Canada.

The upsurge in plant-based food retail chains and the market development of dairy-free product innovation in recent years has revealed significant opportunities for the market. Furthermore, the availability of influential market vendors and private-label product ranges with various rice milk formulations is expanding product availability and affordability.

The growing abundance of consumers opting for plant-based diets and sustainable food choices in Europe has contributed to the rice milk demand significantly. Rice milk demand is increasing in nations like the UK, Germany, France, and Italy, especially among lactose-intolerant consumers and those following a vegan diet.

Growth in dairy alternatives, along with supportive regulations, advances in food fortification technologies, and expanding supermarket shelf space, are also acting as barriers for the European market. Moreover, the growing availability of allergen-free foods and innovative product development are supporting the market penetration.

Driven by the increasing prevalence of lactose intolerance, the growing acceptance of plant-based diets, and the rising consumer awareness about functional foods, the rice milk market in the Asia-Pacific region is expected to grow at a rapid pace. In China, Japan, India, and South Korea, demand for rice milk as a traditional and eco-friendly dairy replacement is surging.

Moreover, the growing disposable income, burgeoning food and beverage industry, and escalating impact of Western dietary patterns are positively influencing the growth of the market. Manufacturers in the region are emphasizing the launch of affordable and nutrient-rich rice milk products to meet the varied consumer demands.

The global rice milk market is anticipated to witness substantial growth due to continuous advancements in food processing technology, product diversification, and the growing demand for dairy alternative products in the recent market. Due to manufacturers concentrating on increasing nutritional value, enhancing taste profiles, and strengthening distribution networks, the market shall experience buoyant gains over the upcoming years.

Challenges

High Production Costs and Supply Chain Complexities

Rice milk market also faces issues such as variable raw material prices, processing costs and transportation challenges. The price of good quality rice and the cost of fortification, packaging and distribution are a major concern in terms of profitability.

Furthermore, the ripples from climate change and geopolitical tensions are creating delays and shortages in the global supply chain. To mitigate these challenges, companies must do the following: optimize procurement strategies, invest in localized production, and strengthen logistics.

Regulatory Compliance and Market Competition

The rice milk industry must adhere to local food safety laws, labeling regulations, and dietary guidelines that differ from region to region. However, complying with these regulations and still producing desirable quality products can be a difficult task.

Moreover, the product faces competition from traditional dairy and also plant-based milk, including almond, soy, and oat milk. So companies have to differentiate their products through nutritional benefits, innovative flavors, and sustainable packaging.

Opportunities

Growing Demand for Dairy-Free and Plant-Based Alternatives

A rising incidence of lactose intolerance, dairy allergies and vegan lifestyles is fueling demand for plant-based milk alternatives such as rice milk. New trends in the dairy-free section are opening the door to a more health-oriented lifestyle and huge market opportunities. Including organic, short ingredient lists, and functional health benefits like extra calcium and vitamins will create a competitive edge for brands.

Expansion of E-Commerce and Retail Distribution

Online grocery shopping and direct-to-consumer sales channels are some of the significant trends that are shaping the rice milk market. E-commerce allows consumers to easily access a significant selection of plant-based milk products while fostering brand visibility and consumer engagement. Furthermore, forming non-competitive partnerships with supermarkets, health food shops, and cafes can improve product accessibility and market penetration.

With increasing awareness of health, dietary changes, and the need for sustainability, the rice milk market experienced significant growth between 2020 and 2024. And brands formulated products that were organic, fortified, and flavored, and they focused on texture and taste, trying to mimic dairy milk alternatives. However, ingredient sourcing issues, competition, and supply chain disruptions created hurdles to pricing and availability.

Technology developments in rice processing, eco-friendly packaging solutions, and nutrition enhancements are also expected to drive the market in the years 2025 to 2035. This will primarily be facilitated by innovations in plant-based protein enrichment, AI-driven supply chain management, and customized nutrition solutions. Companies focusing on product diversification, sustainability, and enhanced digital marketing will positively impact the market.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Focus on food safety, allergen labeling, and organic certification |

| Technological Advancements | Improved processing for better taste and texture |

| Industry Adoption | Growth in the vegan and lactose-intolerant consumer base |

| Supply Chain and Sourcing | Dependence on traditional rice cultivation and processing |

| Market Competition | Strong competition from soy, oat, and almond milk brands |

| Market Growth Drivers | Rising demand for dairy alternatives |

| Sustainability and Energy Efficiency | Introduction of biodegradable packaging |

| Integration of Smart Monitoring | Limited use of digital tracking in product quality |

| Advancements in Product Innovation | Development of flavored and fortified rice milk |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | AI-driven compliance tracking and blockchain-based ingredient traceability |

| Technological Advancements | AI-driven product customization and nutrient enhancement |

| Industry Adoption | Expansion into personalized nutrition and functional rice milk |

| Supply Chain and Sourcing | Sustainable and locally sourced rice varieties to reduce environmental impact |

| Market Competition | Increased innovation in hybrid plant-based milk formulations |

| Market Growth Drivers | Smart packaging, bioengineered nutrition, and probiotic-infused rice milk |

| Sustainability and Energy Efficiency | Widespread adoption of carbon-neutral production and eco-friendly farming |

| Integration of Smart Monitoring | AI-driven production monitoring and IoT-enabled packaging for freshness tracking |

| Advancements in Product Innovation | Launch of plant-based hybrid beverages and zero-waste packaging solutions |

The USA is a significant market for rice milk, propelled by the growing adoption of plant-based dairy alternatives and the growing prevalence of lactose intolerance. Increasing demand for vegan and allergen-free food products has immensely driven the growth of the rice milk market.

Moreover, the growing availability of the product through various distribution channels, such as supermarkets and online retail platforms, is also driving the market growth. The growing impact of health-conscious consumers and progressive innovation in organic or fortified rice milk is further helping the growth of this market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.0% |

Concern about sustainability and increasing consumer awareness is driving the growth of the rice milk market in the UK. Growing dairy allergies and lactose intolerance have boosted rice milk consumption even more.

Major food and beverage companies are also expanding product lines with vegan-friendly options, which is benefiting the market. Further government promotion of plant-based nutrition and the availability of a wide range of rice milk flavors is also supporting the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.6% |

Countries such as Germany, France and Italy are seeing an explosion in rice milk consumption on the back of rising veganism and the worries about lactose intolerance. Strong presence of plant-based dairy brands and increasing shelf space in supermarkets for alternative milk products are key growth factors.

Food safety regulation and sustainability-guided production practices also reform the market state. Demand is also being propelled by the growing application of rice milk in foodservice establishments, such as cafés and restaurants.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.7% |

Japan's rice milk market is growing with the strong cultural preference for rice-based goods and the growing transition towards lactose-free goods. Market Growth: The growing demand for healthy drinks and functional drinks fortified with vitamins and minerals is one of the major driving factors for the market.

Moreover, the introduction of novel packaging alternatives and aggressive marketing efforts by beverage companies are fueling consumer demand. Health-conscious people also use rice milk with added nutritious ingredients.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.1% |

The market for rice milk in South Korea has been steadily growing as demand for dairy-free and plant-based alternatives increases. The market is driven by the consumers' inclination towards healthy, low-calorie drinks.

Besides, the trend of adding rice milk to functional and protein-fortified beverages also contributes to its popularity. The indexed penetration of e-commerce platforms and partnerships between food producers and retailers are improving market penetration.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.2% |

| Distribution Channel | Market Share (2025) |

|---|---|

| Supermarket & Hypermarket | 55% |

The rice milk markets were divided into supermarkets and hypermarkets, convenience stores, and others. Such retail outlets are pivotal in making rice milk products accessible to a wide customer base, including both fitness-focused consumers and individuals who are avoiding dairy products. Their large share of the market can be credited with the rise of 'one-stop shops' that cater to nearly every type of plant-based milk under the sun. Large retail chains significantly helped propel rice milk adoption by upping their plant-based product sections.

Promotional initiatives, including in-store sampling, special offers, and striking displays, have also motivated customers to try rice milk substitutes. The competitive utilization of supermarkets and hypermarkets has a competitive advantage by the way they enter new products to the market at a fast rate and build a strong database of loyal consumers. As consumers tend to favor healthier options, supermarkets and hypermarkets are anticipated to remain at the forefront, in developed areas where they have prioritized convenience and variety.

In addition, these retail outlets are supporting the new trend of conscious consumption by improving their range of organic, eco-friendly, and sustainable products. As a result, this trend is expected to continue contributing to the sales of rice milk in these outlets, which makes them key players in the growth of the market.

| Form | Market Share (2025) |

|---|---|

| Liquid | 68% |

Liquid rice milk is projected to continue to hold the largest share of the market, as it is easy to use, versatile, and compatible with various diets. As to the fact that it comes in liquid form, it's especially common in drinks like smoothies, espresso, and sweet tea, making it a great dairy-free milk alternative. Its versatility in cooking and baking also makes it popular.

The easy availability of liquid rice milk is leading to increased access for consumers, as this product is available in multiple packaging sizes and in ready-to-drink formats. Moreover, liquid rice milk is highly accessible and convenient, as it is a lactose-free, cholesterol-free, and vegan option to conventional milk, which several consumers welcome.

Consumers also tend to prefer a nutritious dairy alternative. Therefore, innovations like fortified liquid rice milk with extra vitamins and minerals to broaden liquid rice milk's target market are expected to help drive demand for liquid rice milk. Moreover, the growing concern towards eco-sustainability, where liquid rice milk is mostly packaged in recyclable or environmental-friendly materials, adds to its allure.

Due to its multiple usages in our everyday diet and the increasing application of rice milk in various windows of the industry, rice milk in liquid form is expected to dominate the market until 2030, alongside the trend for plant-based diets and moving toward healthier options.

Storage and shelf life of milk, along with lactose intolerance and dairy allergies, are fuelling the growth of the rice milk market. Rice milk is becoming trendy because it has a light flavor, and it's naturally sweet, and its hypoallergenic properties make for the ideal dairy-free alternative for many consumers.

The increase in awareness regarding the nutritional and health benefits associated with plant-based diets, along with the growth of the vegan and vegetarian population, is making a significant contribution to the growth of the market.

In addition, improvements in rice milk production technologies, such as enhanced processing methods that preserve essential nutrients, have contributed to its popularity. The rice milk market is expected to register a healthy global Compound Annual Growth Rate (CAGR) of 5.8%, thanks to increasing consumer demand as well as new product innovations and growing availability in retail shops and online platforms.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Califia Farms | 28-33% |

| Rice Dream | 20-25% |

| Eden Foods | 15-20% |

| The Rice Company | 10-15% |

| Oatly Group AB | 7-11% |

| Other Companies (combined) | 15-25% |

| Company Name | Key Offerings/Activities |

|---|---|

| Califia Farms | In 2025, Califia Farms introduced a new line of flavored rice milk, including vanilla and chocolate variants, to appeal to a broader consumer base. These new offerings cater to those seeking a richer, more indulgent plant-based milk experience. With the rise in demand for dairy-free alternatives, Califia Farms continues to innovate by expanding its product offerings across various beverage categories. |

| Rice Dream | In 2024, Rice Dream launched a new organic rice milk option, further solidifying its position in the market by catering to consumers looking for clean-label, organic alternatives. This initiative reflects the growing consumer preference for certified organic products that align with health-conscious, sustainable lifestyles. Rice Dream has also focused on improving packaging to increase product sustainability. |

| Eden Foods | In 2025, Eden Foods enhanced its rice milk product line by introducing a fortified version with added calcium and vitamin D, targeting health-conscious consumers looking to increase their nutrient intake. This fortified product offers an enriched alternative to traditional dairy milk and addresses the needs of those seeking plant-based products with additional health benefits. |

| The Rice Company | In 2024, The Rice Company focused on expanding its global presence by entering new markets in Europe and Asia, where the demand for dairy-free milk alternatives is on the rise. This strategic move is part of the company’s long-term plan to increase market share and solidify its position as a global leader in the rice milk sector. The company also introduced eco-friendly packaging options to appeal to environmentally conscious consumers. |

| Oatly Group AB | In 2025, Oatly Group expanded its plant-based beverage range to include a rice milk-based drink aimed at the growing demand for oat and rice milk blends. By leveraging its strong brand presence in the dairy-free market, Oatly is able to successfully tap into the growing trend of mixing plant-based milk types to create new, appealing flavors and nutritional profiles for consumers. |

Key Company Insights

Califia Farms (28-33%)

Califia Farms is a major player in the rice milk market, holding a considerable market share owing to its strong brand recognition and product innovation efforts. The brand’s recent venture into flavored rice milk products paves the way for the company to be a frontrunner in satisfying changing consumer appetites.

Having made both original rice milk and flavored rice milk, Califia Farms is in a strong position in the growing market for this type of beverage. In addition, the company’s collaborations with retail and e-commerce platforms have expanded its reach and accessibility, promoting sustained growth in the plant-based beverage market.

Rice Dream (20-25%)

Rice Dream was a leading brand in the Rice milk segment and was predominantly recognized by people looking for lactose-free and dairy-free milk alternatives. Moreover, with its strong commitment to organic rice milk products, the company has been attracting a growing number of consumers seeking clean, organic food.

Rice Dream has maintained its leadership position due to its strong distribution network and commitment to sustainability, especially in packaging. Given the growing popularity of organic and natural products, this acquisition will also likely drive additional growth as Rice Dream expands in this segment.

Eden Foods (15-20%)

Through quality and health-driven products, Eden Foods has carved out a stronghold for itself in the growing rice milk market. The launch of fortified rice milk with added calcium and vitamin D has been appealing to customers who want to lead a healthy lifestyle and are replacing dairy milk with plant-based options that have health benefits.

Eden Foods’ focus on organic ingredients and non-GMO products has bolstered its image with health-oriented shoppers. Product diversification will be critical for the company's post-market structure.

The Rice Company (10-15%)

Market Players are actively and steadily growing the market share in rice milk market, the company is targeting global expansion with its focus on innovation. The company’s plan to penetrate new regions internationally corresponds with the coronavirus pandemic which has propelled the market for plant-based beverages worldwide.

Moreover, the brand’s focus on eco-friendly practices and packaging differentiates it from competitors who are also looking to capitalize on the growing market for sustainable products. The Rice Company's pursuit of global expansion will enable it to penetrate emerging markets where plant-based milk substitutes are becoming popular.

Oatly Group AB (7-11%)

Despite being best known for its oat milk product line, leading the oat milk sector, Oatly Group AB is also expanding its rice milk product availability. The increase in product diversity and the development of multi-plant-based milk blends with rice milk as a base proved the company’s decision to expand its product range.

Oatly is already uniquely positioned with an option to explore a diversified product portfolio by innovating and launching in smaller-sized markets with various nutritional profiles and flavor options. With strong brand recognition and distribution networks, Oatly looks set to continue its success in the global plant-based milk space.

Other Key Players (15-25% Combined)

Several other companies are contributing to the growth of the rice milk market:

The overall market size for rice milk market was USD 704.43 million in 2025.

The rice milk market expected to reach USD 1,237.93 million in 2035.

The growing popularity of plant-based alternatives, lactose intolerance awareness, health-conscious consumer trends, and increasing vegan diets will drive the rice milk market demand during the forecast period.

The top 5 countries which drives the development of rice milk market are USA, UK, Europe Union, Japan and South Korea.

Liquid rice milk segment driving market growth to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Litre) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 4: Global Market Volume (Litre) Forecast by Distribution Channel, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 6: Global Market Volume (Litre) Forecast by Form, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 8: Global Market Volume (Litre) Forecast by Source, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 10: Global Market Volume (Litre) Forecast by End-Use, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 14: North America Market Volume (Litre) Forecast by Distribution Channel, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 16: North America Market Volume (Litre) Forecast by Form, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 18: North America Market Volume (Litre) Forecast by Source, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 20: North America Market Volume (Litre) Forecast by End-Use, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 24: Latin America Market Volume (Litre) Forecast by Distribution Channel, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 26: Latin America Market Volume (Litre) Forecast by Form, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 28: Latin America Market Volume (Litre) Forecast by Source, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 30: Latin America Market Volume (Litre) Forecast by End-Use, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 34: Europe Market Volume (Litre) Forecast by Distribution Channel, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 36: Europe Market Volume (Litre) Forecast by Form, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 38: Europe Market Volume (Litre) Forecast by Source, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 40: Europe Market Volume (Litre) Forecast by End-Use, 2018 to 2033

Table 41: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Asia Pacific Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 43: Asia Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 44: Asia Pacific Market Volume (Litre) Forecast by Distribution Channel, 2018 to 2033

Table 45: Asia Pacific Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 46: Asia Pacific Market Volume (Litre) Forecast by Form, 2018 to 2033

Table 47: Asia Pacific Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 48: Asia Pacific Market Volume (Litre) Forecast by Source, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 50: Asia Pacific Market Volume (Litre) Forecast by End-Use, 2018 to 2033

Table 51: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: MEA Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 53: MEA Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 54: MEA Market Volume (Litre) Forecast by Distribution Channel, 2018 to 2033

Table 55: MEA Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 56: MEA Market Volume (Litre) Forecast by Form, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 58: MEA Market Volume (Litre) Forecast by Source, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 60: MEA Market Volume (Litre) Forecast by End-Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Form, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Source, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Litre) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 11: Global Market Volume (Litre) Analysis by Distribution Channel, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 15: Global Market Volume (Litre) Analysis by Form, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 19: Global Market Volume (Litre) Analysis by Source, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 23: Global Market Volume (Litre) Analysis by End-Use, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 26: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 27: Global Market Attractiveness by Form, 2023 to 2033

Figure 28: Global Market Attractiveness by Source, 2023 to 2033

Figure 29: Global Market Attractiveness by End-Use, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Form, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Source, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 41: North America Market Volume (Litre) Analysis by Distribution Channel, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 45: North America Market Volume (Litre) Analysis by Form, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 49: North America Market Volume (Litre) Analysis by Source, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 53: North America Market Volume (Litre) Analysis by End-Use, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 56: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 57: North America Market Attractiveness by Form, 2023 to 2033

Figure 58: North America Market Attractiveness by Source, 2023 to 2033

Figure 59: North America Market Attractiveness by End-Use, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Form, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Source, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 71: Latin America Market Volume (Litre) Analysis by Distribution Channel, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 75: Latin America Market Volume (Litre) Analysis by Form, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 79: Latin America Market Volume (Litre) Analysis by Source, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 83: Latin America Market Volume (Litre) Analysis by End-Use, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Source, 2023 to 2033

Figure 89: Latin America Market Attractiveness by End-Use, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 101: Europe Market Volume (Litre) Analysis by Distribution Channel, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 105: Europe Market Volume (Litre) Analysis by Form, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 109: Europe Market Volume (Litre) Analysis by Source, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 113: Europe Market Volume (Litre) Analysis by End-Use, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 116: Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 117: Europe Market Attractiveness by Form, 2023 to 2033

Figure 118: Europe Market Attractiveness by Source, 2023 to 2033

Figure 119: Europe Market Attractiveness by End-Use, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Asia Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 122: Asia Pacific Market Value (US$ Million) by Form, 2023 to 2033

Figure 123: Asia Pacific Market Value (US$ Million) by Source, 2023 to 2033

Figure 124: Asia Pacific Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 125: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Asia Pacific Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 128: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Asia Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 131: Asia Pacific Market Volume (Litre) Analysis by Distribution Channel, 2018 to 2033

Figure 132: Asia Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 133: Asia Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 134: Asia Pacific Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 135: Asia Pacific Market Volume (Litre) Analysis by Form, 2018 to 2033

Figure 136: Asia Pacific Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 137: Asia Pacific Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 138: Asia Pacific Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 139: Asia Pacific Market Volume (Litre) Analysis by Source, 2018 to 2033

Figure 140: Asia Pacific Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 141: Asia Pacific Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 142: Asia Pacific Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 143: Asia Pacific Market Volume (Litre) Analysis by End-Use, 2018 to 2033

Figure 144: Asia Pacific Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 145: Asia Pacific Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 146: Asia Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 147: Asia Pacific Market Attractiveness by Form, 2023 to 2033

Figure 148: Asia Pacific Market Attractiveness by Source, 2023 to 2033

Figure 149: Asia Pacific Market Attractiveness by End-Use, 2023 to 2033

Figure 150: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 152: MEA Market Value (US$ Million) by Form, 2023 to 2033

Figure 153: MEA Market Value (US$ Million) by Source, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 155: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: MEA Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 158: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: MEA Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 161: MEA Market Volume (Litre) Analysis by Distribution Channel, 2018 to 2033

Figure 162: MEA Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 163: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 164: MEA Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 165: MEA Market Volume (Litre) Analysis by Form, 2018 to 2033

Figure 166: MEA Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 167: MEA Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 168: MEA Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 169: MEA Market Volume (Litre) Analysis by Source, 2018 to 2033

Figure 170: MEA Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 171: MEA Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 173: MEA Market Volume (Litre) Analysis by End-Use, 2018 to 2033

Figure 174: MEA Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 175: MEA Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 176: MEA Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 177: MEA Market Attractiveness by Form, 2023 to 2033

Figure 178: MEA Market Attractiveness by Source, 2023 to 2033

Figure 179: MEA Market Attractiveness by End-Use, 2023 to 2033

Figure 180: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Rice Water Skincare Market Forecast and Outlook 2025 to 2035

Rice Water Haircare Market Size and Share Forecast Outlook 2025 to 2035

Rice Shampoo Bar Market Size and Share Forecast Outlook 2025 to 2035

Rice Bran Oil for Skin Care Market Size and Share Forecast Outlook 2025 to 2035

Rice Bran Oil Infusions Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Rice Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Rice Bran Derivatives Market Size and Share Forecast Outlook 2025 to 2035

Rice Mill Machine Market Size and Share Forecast Outlook 2025 to 2035

Rice Derivative Market Size and Share Forecast Outlook 2025 to 2035

Rice Polishing Machines Market Size and Share Forecast Outlook 2025 to 2035

Rice Water Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Rice Bran Oil Market Analysis by Type, End User, and Region Through 2035

Rice Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Rice Bran Wax Market Analysis - Size, Share, and Forecast 2025 to 2035

Rice Cake Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Rice-based Products Market Analysis by Product Type, Distribution Channel, and Region Through 2035

Key Players & Market Share in Rice Water Haircare Sector

Market Share Breakdown of Rice Shampoo Bar Manufacturers

Rice Paper Stand Up Pouch Market Growth & Sustainable Packaging 2024-2034

Rice Protein Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA