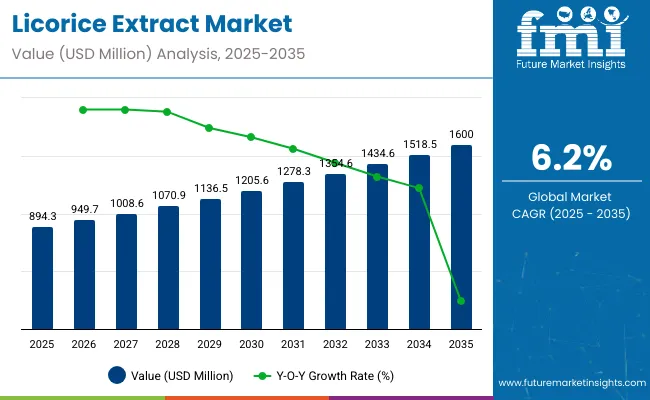

The licorice extract market is projected to grow from USD 894.3 million in 2025 to USD 1,600 million by 2035, registering a CAGR of 6.2% during the forecast period. The market is expanding due to increased utilization of licorice extracts in nutraceuticals, herbal supplements, pharmaceuticals, and functional foods.

Consumers are increasingly turning to plant-based immunity boosters, which is propelling demand for licorice as a natural adaptogen and anti-inflammatory agent. Applications in digestive health, skin health, and liver support formulations are further broadening the product’s market potential. The global shift toward clean-label, botanical ingredients in dietary products is strengthening the demand for glycyrrhizin-rich and de-glycyrrhizinated licorice (DGL) variants.

| Metrics | Values |

|---|---|

| Industry Size 2025 | USD 894.3 million |

| Industry Value 2035 | USD 1,600 million |

| CAGR 2025 to 2035 | 6.2% |

The market is being influenced by increasing demand for natural botanical extracts, rising interest in Ayurvedic and Traditional Chinese Medicine (TCM) formulations, and growing adoption of licorice in cosmeceuticals and oral care. Innovations in delivery formats-including capsules, chewable tablets, gummies, and HPMC-based supplements-are expanding consumer access. Companies are also focusing on high-purity extracts, standardized concentrations, and organic licorice sourcing to meet global regulatory and quality standards.

The licorice extract market is projected to reach USD 894.3 million in 2025. In the herbal extracts and botanicals market, it captures a notable 7-9% share, thanks to its use in flavoring, pharmaceuticals, and therapeutic products. In the wider flavor and fragrance ingredients market, licorice extract accounts for approximately 1-2%, valued for its sweet, complex taste profile.

As part of the nutraceutical ingredients market, it holds around 3-5%, leveraged for its anti-inflammatory, digestive, and respiratory health benefits. In the personal care and cosmetic ingredients market, its share is about 1-2%, used in skincare and oral care formulations. Within the pharmaceutical excipients and ingredients market, licorice extract contributes roughly 2-3%, particularly in cough syrups, throat lozenges, and anti-inflammatory drugs.

In July 2022, Givaudan, Bühler, and Cargill joined forces with FoodTech HUB Latam and the Food Technology Institute (ITAL) to establish a cutting-edge food innovation center in Campinas, Brazil-widely regarded as the country’s technology hub. This strategic collaboration aims to accelerate the development of sustainable and future-focused food and beverage solutions. The center will serve as a regional innovation platform, enabling all three companies to co-create next-generation products aligned with evolving consumer demands and environmental priorities.

The trade landscape for licorice extract is expanding steadily, driven by increasing global demand across pharmaceutical, food & beverage, tobacco, and cosmetic industries. Major licorice-producing countries, including China, Iran, and India, export substantial volumes of licorice roots, extracts, and refined derivatives to meet international market needs. These nations benefit from suitable climatic conditions, extensive cultivation, and established extraction infrastructure, enabling them to remain competitive in the global trade of licorice products.

Per capita consumption of licorice extract varies widely across regions and is influenced by factors such as cultural preferences, traditional medicinal use, dietary habits, and the presence of licorice-based products in the market. In some countries, licorice is commonly consumed as a flavoring agent in confectionery and beverages, as well as in pharmaceutical and herbal applications.

| Particular | Value CAGR |

|---|---|

| H1(2024 to 2034) | 6.2% |

| H2(2024 to 2034) | 5.8% |

| H1(2025 to 2035) | 5.9% |

| H2(2025 to 2035) | 6.1% |

The above table presents the expected CAGR for the global Licorice Extract industry over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 6.2%, followed by a slightly lower growth rate of 5.8% in the second half (H2) of the same decade.

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase slightly to 5.9% in the first half and remain relatively moderate at 6.1% in the second half. In the first half (H1) the industry witnessed an decrease of 30 BPS while in the second half (H2), the industry witnessed an increase of 30 BPS

The expansion of the licorice extract market is being driven by increasing demand in pharmaceutical, nutraceutical, and personal care applications, with rising interest being shown in plant-based and functional health ingredients.

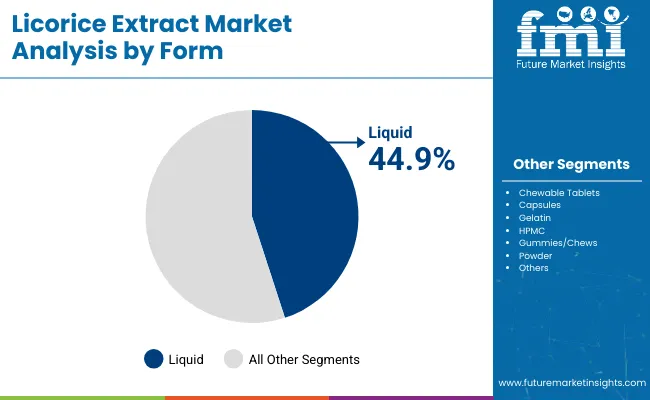

The liquid licorice extract segment is projected to become the leading form by 2025, with a 44.9% market share. A higher concentration, ease of formulation, and rapid absorption are making it highly preferred across pharmaceutical and industrial applications. Frequent usage is being seen in cough syrups, herbal tonics, and skincare emulsions due to its ability to be mixed uniformly with other ingredients.

The liquid licorice extract segment is projected to become the leading form by 2025, with a 44.9% market share. A higher concentration, ease of formulation, and rapid absorption are making it highly preferred across pharmaceutical and industrial applications. Frequent usage is being seen in cough syrups, herbal tonics, and skincare emulsions due to its ability to be mixed uniformly with other ingredients.

Its flavor-enhancing properties in beverages and confectionery are being favored by food manufacturers. Further reinforcement of its dominance is being provided by increasing demand for natural, plant-based ingredients across Western and Asian medicine systems.

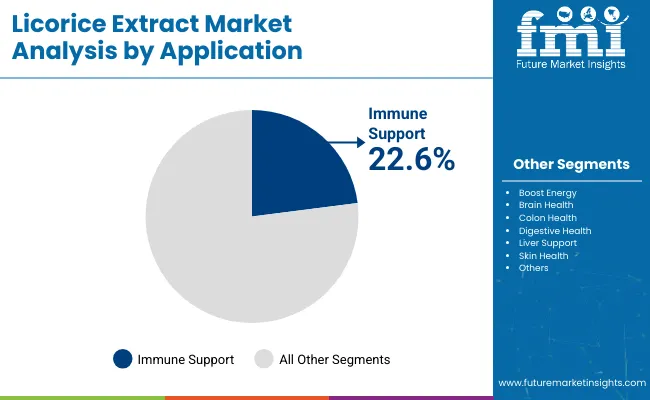

The immune support application within the licorice extract market is expected to account for 22.6% of the total share by 2025. Rising interest in botanical solutions for strengthening the body’s natural defenses is driving this segment. Antiviral and anti-inflammatory properties have been shown by glycyrrhizin, the key bioactive in licorice, leading to its popularity in traditional and modern formulations for immune health.

A surge in immunity-based products has been triggered by the COVID-19 pandemic, resulting in licorice extract becoming a staple in teas, functional foods, and nutraceutical blends. High demand continues to be observed in North America, Europe, and East Asia.

The global trend towards natural ingredients in medicinal supplements is driven by increasing consumer preference for health-conscious choices. Licorice extracts have gained prominence due to their versatile therapeutic properties.

They are known for their ability to reduce inflammation, combat microbial infections, and protect liver health. These qualities make licorice extracts valuable in treating conditions such as hyperlipidemia (elevated blood lipids) and skin hyperpigmentation caused by inflammation.

The demand for licorice extracts in medicinal supplements is bolstered by their efficacy and safety profile compared to synthetic alternatives. Consumers are increasingly opting for natural remedies that offer holistic health benefits.

This shift is not only influencing consumer choices but also shaping the sales dynamics for botanical extracts like licorice. As research continues to validate their therapeutic uses, licorice extracts are expected to play a significant role in the future of natural healthcare solutions.

The resurgence of interest in herbal medicine, particularly Chinese herbal remedies, is propelling the licorice extract sales forward. Traditional Chinese medicine (TCM) has gained recognition for its holistic approach to health, which includes the use of herbs like licorice root.

In regions such as the USA and Europe, there is a growing acceptance and demand for TCM practices, driving the adoption of licorice extracts in pharmaceutical and dietary supplement formulations.

Licorice extract's popularity in herbal medicine stems from its diverse therapeutic benefits, ranging from respiratory and digestive health support to its use in skincare and dermatology. As more consumers seek natural alternatives with proven efficacy, the demand for licorice extracts is expanding beyond traditional sales.

This trend presents lucrative opportunities for manufacturers and suppliers involved in the herbal medicine supply chain, positioning licorice extract as a key ingredient in modern healthcare solutions.

The increasing consumer awareness of immune health has spurred significant industry growth for licorice extracts. Particularly among younger demographics, there is a heightened focus on maintaining overall well-being and enhancing immune function. Licorice extracts are valued for their ability to support immune health through their anti-inflammatory and antioxidant properties.

In response to rising health, concerns such as allergies, asthma, and autoimmune diseases, consumers are turning to natural supplements that offer immune-boosting benefits. Licorice extracts, known for their bioactive compounds like glycyrrhizin, glycyrrhetinic acid, and flavonoids, are recognized for their potential in supporting immune responses and promoting resilience against infections.

The preference for plant-based, gluten-free, and sugar-free products aligns with current health trends, driving the demand for licorice extracts in immune health supplements. Manufacturers are responding by developing innovative formulations that harness the therapeutic potential of licorice extracts, thereby expanding their industry presence in the nutritional supplement industry.

The dietary supplement industry is witnessing substantial investments in research and development to meet the growing demand for health-promoting products. Advances in production technologies are enabling manufacturers to enhance the efficacy, safety, and bioavailability of dietary supplements, including those containing licorice extracts.

Technological innovations are crucial in addressing consumer preferences for functional beverages and supplements that offer targeted health benefits. Research into the biological mechanisms of licorice extracts, particularly their effects on immune modulation and metabolic health, is driving product innovation. This scientific progress is essential for developing evidence-based formulations that meet regulatory standards and consumer expectations.

Furthermore, the emergence of antibiotic-resistant pathogens underscores the need for alternative health solutions. Licorice extracts are being explored for their potential to support microbiota diversity and enhance immune defense mechanisms against infectious diseases.

As the dietary supplement sales evolves, investments in technology and research will continue to shape the future landscape, promoting sustainable growth and innovation in health-promoting products.

Licorice extract's applications extend beyond internal health supplements to skincare formulations, where it is valued for its dermatological benefits. In skincare, licorice extract is prized for its ability to inhibit tyrosinase, an enzyme involved in melanin production. By reducing melanin synthesis, licorice extract helps fade dark spots and hyperpigmentation, promoting a more even skin tone.

Additionally, licorice extract exhibits potent antioxidant and anti-inflammatory properties, which contribute to its effectiveness in calming skin irritation and redness. These attributes make it a versatile ingredient in skincare products targeted at sensitive skin, acne-prone skin, and those seeking anti-aging benefits.

The demand for natural and plant-based skincare solutions has driven the popularity of licorice extract in the beauty industry. Consumers are increasingly drawn to products that offer holistic benefits while minimizing exposure to synthetic chemicals. As skincare trends continue to prioritize natural ingredients with proven efficacy, licorice extract remains a key player in meeting these evolving consumer preferences.

Innovation hubs and test markets serve as critical platforms for accelerating product development and market entry strategies in the nutrition industry. These hubs facilitate collaboration among stakeholders from diverse sectors, fostering synergies in research, development, and commercialization efforts.

By leveraging innovation hubs, manufacturers gain access to advanced technologies and expertise, enabling them to enhance product formulations and production processes. This collaborative approach accelerates innovation cycles and improves the competitiveness of nutrition products, including those incorporating licorice extracts.

Tests play a pivotal role in validating consumer preferences and optimizing marketing strategies. Manufacturers can gauge product performance, adjust packaging designs, refine pricing strategies, and tailor distribution channels based on real-time feedback. This iterative process allows for rapid adaptations and improvements, ensuring products meet consumer expectations and regulatory requirements.

The integration of innovation hubs and test indutries enables manufacturers to navigate complex industry dynamics effectively. By embracing technological advancements and industry insights, companies can capitalize on emerging trends and seize opportunities for growth in the competitive nutrition product landscape.

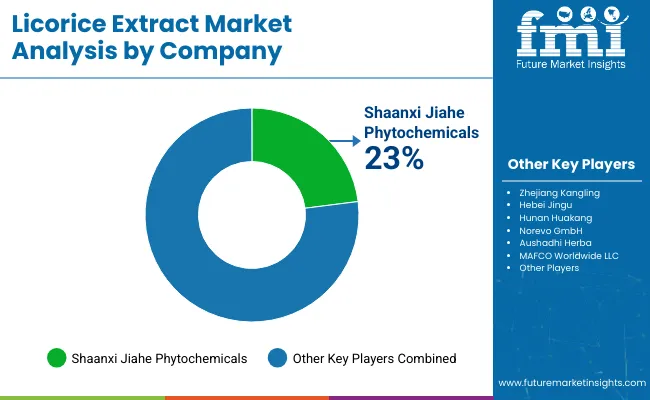

The licorice extract industry demonstrates a moderate to high level of player concentration, characterized by a mix of dominant leaders and smaller, regional firms shaping the landscape.

Key players such as Naturex SA, Frutarom Industries Ltd. (a subsidiary of International Flavors & Fragrances Inc.), and Shaanxi Fujie Pharmaceutical Co., Ltd. command significant company shares owing to their extensive product portfolios, robust distribution networks, and substantial investments in research and development.

These industry giants leverage economies of scale, established brand equity, and rigorous quality control protocols to maintain their competitive edge. In parallel, numerous smaller and regional companies compete by specializing in niche segments or specific geographic. They differentiate themselves through unique product formulations, emphasizing organic ingredients, sustainable practices, and localized insights.

Industry competition is driven by continuous innovation, adherence to stringent quality standards, and meeting regulatory requirements, reflecting a growing consumer preference for natural health products. This dynamic environment, shaped by the interplay between major and minor players, fosters overall growth and spurs innovation across the licorice extract sector.

According to an analysis by FMI (Future Market Insights), tier 1 companies hold approximately 25% to 30% of the industry share, with tier 2 players accounting for 35% to 40%. The remaining industry share is captured by tier 3 players, underscoring the diversity and competitiveness within the licorice extract industry.

The industry's value chain begins with sourcing raw licorice from regions known for optimal growing conditions, such as China, Spain, and the Middle East. These regions are renowned for producing high-quality licorice due to favorable climatic and soil conditions. Raw licorice undergoes processing and extraction by various companies, resulting in diverse product forms such as powders, extracts, capsules, and liquids.

These extracted licorice products are then distributed through multiple channels, including pharmaceuticals, dietary supplements, cosmetics, and the food and beverage industries, to reach end consumers globally. This comprehensive value chain ensures that licorice extract products meet diverse demands while adhering to quality and regulatory standards across different applications.

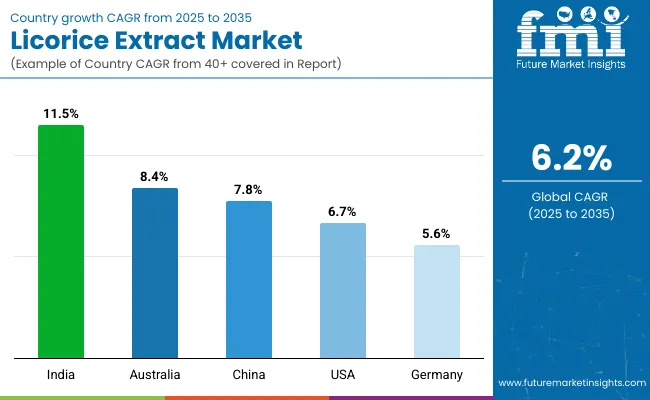

The following table shows the estimated growth rates of the top five geographies. Australia and India are set to exhibit high licorice extract consumption, recording CAGRs of 8.4% and 11.5%, respectively, through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| United States | 6.7% |

| Germany | 5.6% |

| China | 7.8% |

| Australia | 8.4% |

| India | 11.5% |

The licorice extract category in the United States is projected to grow at a CAGR of 6.7% from 2025 to 2035. This growth is driven by increasing consumer awareness and adoption of natural health supplements. As consumers seek alternatives to synthetic products, licorice extract's medicinal properties, including anti-inflammatory and digestive benefits, are gaining traction.

The category is supported by robust research and development activities aimed at expanding product applications in dietary supplements, skincare, and pharmaceuticals. Additionally, stringent regulatory standards ensure product quality and safety, further boosting consumer confidence in licorice extract-based products.

In Germany, the licorice extract category is expected to grow at a CAGR of 5.6% during the forecast period. The country's industry growth is driven by increasing demand for functional foods and beverages enriched with natural ingredients. Licorice extract, known for its antioxidant and anti-inflammatory properties, is increasingly incorporated into functional food products aimed at promoting digestive health and immune support.

Moreover, pharmaceutical applications of licorice extract in treating respiratory ailments and skin conditions contribute to market expansion. The emphasis on organic and sustainable sourcing practices further aligns with consumer preferences for clean-label products in Germany's health-conscious market.

China leads the licorice extract market with a robust CAGR of 7.8% from 2025 to 2035. Traditional Chinese medicine (TCM) values licorice root for its therapeutic benefits in treating various ailments, including digestive disorders and respiratory illnesses. The country's rich herbal medicine heritage drives extensive cultivation and processing of licorice, supporting a diverse range of product formulations.

Rising disposable incomes and health awareness among Chinese consumers propel demand for licorice extract in dietary supplements and herbal remedies. Government initiatives to promote TCM globally further bolster China's role as a key producer and exporter of licorice extract.

Australia's licorice extract market is anticipated to grow at a rapid CAGR of 8.4% during the forecast period. The country's market expansion is fuelled by increasing consumer preference for natural health solutions and botanical ingredients.

Licorice extract's anti-inflammatory and antioxidant properties make it popular in skincare and dietary supplement formulations catering to Australia's health-conscious population. The Industry benefits from stringent regulatory frameworks ensuring product safety and efficacy, which support the growing adoption of licorice extract across diverse applications, including cosmetics and functional foods.

India exhibits the highest CAGR of 11.5% in the licorice extract Industry from 2025 to 2035, driven by expanding applications in Ayurvedic medicines and nutraceuticals. Licorice extract, known locally as "Yashtimadhu," holds significant cultural and medicinal value in traditional Indian medicine.

Increasing healthcare expenditures, coupled with growing consumer awareness of natural remedies, propel demand for licorice extract in treating digestive ailments, skin disorders, and respiratory conditions. The country's thriving pharmaceutical and herbal medicine sectors further contribute to Industry growth, supported by government initiatives promoting traditional medicine research and development.

The licorice extract market is led by established global producers like MAFCO Worldwide LLC, Shaanxi Jiahe Phytochemicals, and Norevo GmbH, known for their large-scale production capabilities, global distribution, and compliance with pharmaceutical and food-grade standards. These companies cater to diverse applications including confectionery, pharmaceuticals, tobacco, and nutraceuticals.

Key players such as Zhejiang Kangling, Hebei Jingu, Hunan Huakang, and VPL Chemicals focus on consistent quality and region-specific customization, particularly across Asia-Pacific and the Middle East. Emerging and specialized firms like Zagros Licorice, F&C Licorice, Sepidan Osareh, and Ransom Naturals emphasize sustainable sourcing and high-purity extracts. The market is becoming more competitive as demand rises for natural sweeteners, clean-label ingredients, and herbal therapeutics.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 894.3 million |

| Projected Market Size (2035) | USD 1,600 million |

| CAGR (2025 to 2035) | 6.20% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value |

| Applications Analyzed | Boost Energy, Brain Health, Colon Health, Digestive Health, Immune Support, Liver Support, Skin Health |

| Form Types Analyzed | Chewable Tablets, Capsules, Gelatin, HPMC, Gummies/Chews, Powder, Liquid |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East & Africa |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, France, United Kingdom, China, India, Japan, Australia, UAE, South Africa |

| Key Players Influencing the Market | Shaanxi Jiahe Phytochemicals, Zhejiang Kangling, Hebei Jingu, Hunan Huakang, Norevo GmbH, Aushadhi Herba, MAFCO Worldwide LLC, F&C Licorice, VPL Chemicals, Zagros Licorice, Ransom Naturals, Sepidan Osareh |

| Additional Attributes | Dollar sales growth by application (energy, digestive health), regional demand trends, competitive landscape, pricing strategies, distribution channels, consumer preferences, formulation innovations |

As per application, the industry has been categorized into Boost Energy, Brain Health, Colon Health, Digestive Health, Immune Support, Liver Support and Skin Health

The segment is further categorized into Chewable Tablets, Capsules, Gelatin, HPMC, Gummies/Chews, Powder and Liquid

Industry analysis has been carried out in key countries of North America, Latin America, Europe, East Asia, South Asia, Oceania and Middle East & Africa

The Licorice Extract sales is estimated to reach sales nearly USD 894.3 million by 2025.

Licorice Extract industry revenue is expected to increase at a CAGR of around 6.2% during the period 2025 to 2035.

Licorice Extract sales increased a CAGR of around 5.3% over the past half-decade.

The global Licorice Extract industry value will be around USD 1,600 million in 2035.

Sichuan Union Herb, Shaanxi Jiahe Phytochemicals, Zhejiang Kangling, Hebei Jingu, Hunan Huakang, and others are expected to be the top players driving the industry growth.

Innovative applications, research formulations, and medicinal properties are the factors driving growth of Licorice Extract growth.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA