The Europe Licorice Extract market is set to grow from an estimated USD 211.4 million in 2025 to USD 319.0 million by 2035, with a compound annual growth rate (CAGR) of 4.2% during the forecast period from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated Europe Industry Size (2025E) | USD 211.4 million |

| Projected Europe Value (2035F) | USD 319.0 million |

| Value-based CAGR (2025 to 2035) | 4.2% |

The European licorice extract market is expected to grow at a high rate due to a rising preference for natural ingredients in the pharmaceutical, food and beverage, and other industrial sectors. Licorice extract has captured the European market as a key ingredient because of its functional properties and is used in many fields. Its wide application ranging from herbal medicines to confectionaries and special drinks is giving it a stronghold in the market of Europe.

Growing emphasis on clean-label products and sustainable sourcing has become a major driver of the European licorice extract market. Companies are developing new extraction technologies, including the use of supercritical carbon dioxide extraction and vacuum drying, to increase the level of purity and bioavailability of licorice extract.

The introduction of licorice extracts, which comprise plant-based sweeteners and functional beverages, is further driving the market for the product. Established domestic players and the commitment to the ethical approach in doing business have established Europe as a large market for the licorice extract market.

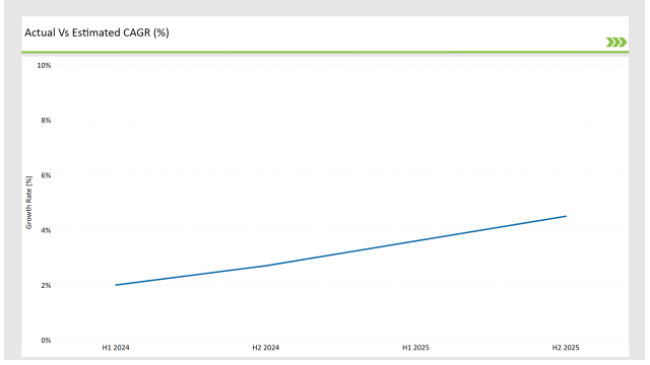

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Licorice Extract market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 2.0% (2024 to 2034) |

| H2 2024 | 2.7% (2024 to 2034) |

| H1 2025 | 3.6% (2025 to 2035) |

| H2 2025 | 4.5% (2025 to 2035) |

H1 signifies period from January to June, H2 Signifies period from July to December

For the European Licorice Extract market, the sector is predicted to grow at a CAGR of 2.0% during the first half of 2024, with an increase to 2.7% in the second half of the same year. In 2025, the growth rate is anticipated to slightly decrease to 3.6% in H1 but is expected to rise to 4.5% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| March-2024 | Expansion of Processing Facilities- F&C Licorice established a new state-of-the-art extraction plant in Italy to cater to the growing demand for high-purity licorice extracts in Europe. |

| February-2024 | Clean-Label Product Launches- Mafco Worldwide launched a line of organic liquid licorice extracts tailored for premium beverage and confectionery applications. |

| January- 2024 | Licensing Agreements- F&C Licorice entered into an exclusive licensing agreement with a European nutraceutical company for the distribution of its premium licorice powders. |

The Growing Trend of Natural Ingredients for Pharmaceuticals and Functional Foods

The booming Licorice Extract market is growing mainly due to the increased use of natural and plant-based ingredients. Recent studies have shown that the anti-inflammatory, antioxidant, and immune-enhancer properties of these bacterial products are mainly exploited by pharmaceutical companies not only in the developing phase but also in the formulation of herbal and over-the-counter drugs.

For example, glycyrrhizin extract is widely used in treatments for respiratory infections, digestive issues, and liver ailments. Companies like Naturex have been introducing fortified licorice powders that include complementary botanicals for consumers looking for healthy, health-conscious foods in Europe.

The food and beverage sector also represents a massive user of licorice extracts, especially in the preparation of functional beverages, sugar-free confectionery, and specialty teas. FrieslandCampina Ingredients has entered into partnerships with local food brands to create special formulations using liquid licorice extracts that provide health benefits and fulfill the increasing requirement for clean-label and organic ingredients.

Technological Advancement in the Extraction Process Improves Product Quality

European licorice extract is improved with innovation in extraction processes, using supercritical carbon dioxide extraction and freeze-drying techniques to enable the attainment of high-purity extracts with increased stability and bioavailability. F&C Licorice has introduced vacuum drying techniques for the production of powdered licorice extract, with reduced nutrient loss and improved functional properties.

Liquid licorice extract formulations have evolved to allow concentrates that are specifically suitable for use in premium confectionery and beverages. For instance, Mafco Worldwide presents organic liquid licorice extract lines that respond to the growing demand for clean-label, eco-friendly ingredients in European markets. These technological enhancements bring about better quality and open routes for the use of these extracts within the varied sectors.

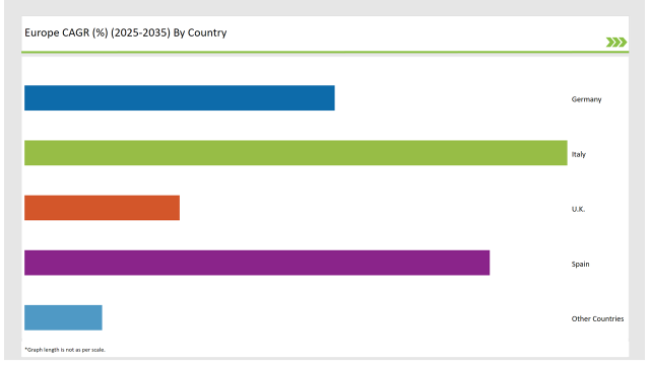

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market Share (%) |

|---|---|

| Germany | 20% |

| Italy | 35% |

| UK | 10% |

| Spain | 30% |

| Other Countries | 5% |

Licorice extracts have established their place in the markets in Germany, where licorice has been readily used among the aggressive pharmaceutical industries and promotion of plant-based medicines.

Glycyrrhizin extracts are widely applied for medicinal purposes for respiratory and gastrointestinal disorders. Major pharmaceutical companies, like Bayer AG, have recently started to introduce high-purity licorice extracts in their herbal medicine portfolios, showing the country's interest in natural remedies scientifically proven.

FrieslandCampina Ingredients is collaborating with small confectionery companies in this region to make premium-grade liquid licorice extracts available for use in sugar-free candies and syrups, which is driving demand in the food and beverages market.

France is a particularly stimulating market for licorice extracts in the premium beverage and cosmetic sectors. Beverage companies from France infuse their specialty drinks and syrups with liquid licorice extracts that create unique flavor profiles and help to add health benefits to the ingredients. The leading companies include Pernod Ricard, which has developed licorice-infused products and herbal liqueurs to satisfy the demand for innovative and health-oriented alcoholic beverages.

Personal care and cosmetic sectors are targeting consumers concerned with brightening as well as inflammation. French luxury skincare brand Clarins has introduced licorice root-derived ingredients with treatments for hyperpigmentation and very sensitive skin on their product rosters thus garnering attention across the world.

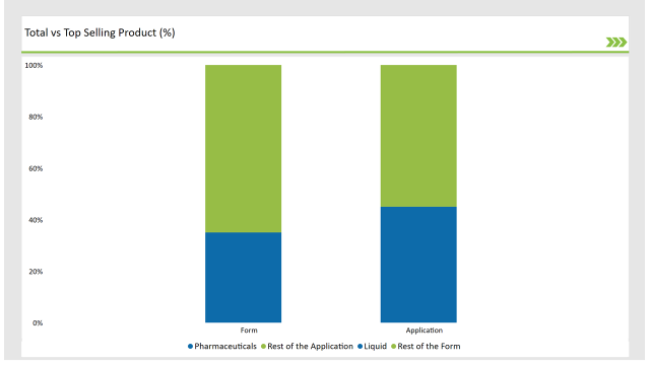

% share of Individual Categories Application and Form in 2025

| Main Segment | Market Share (%) |

|---|---|

| Application (Pharmaceuticals) | 45% |

| Remaining segments | 55% |

Pharmaceuticals Dominate Market Share

The pharmaceutical market has a very high market share due to the rise in demand for natural and medicinal ingredients for various formulations. Glycyrrhizin and deglycyrrhizinated licorice (DGL) extracts are used widely in traditional medicinal preparations that are applied in treating ulcers, liver disorders, and respiratory infections.

To fulfil the rigorous industry standards, companies like Naturex are putting their emphasis on the production of pharmaceutical-grade licorice extracts that have better bioavailability and purity. The extracts are being innovated for inclusion in the advanced development of capsules, syrups, and topical treatments, and thus shall be improved.

| Main Segment | Market Share (%) |

|---|---|

| Form (Liquid) | 35% |

| Remaining segments | 65% |

Liquid Licorice Extract Expanding in Premium Applications

The segment of liquid licorice extract application in premium sections is growing rapidly, primarily in the beverage and confectionary sectors. These extracts not only improve flavour, but they are also useful for making specialty drinks, herbal teas, and artisanal confectionaries.

Mafco Worldwide's organic liquid licorice extract lines are aimed at premium brands that focus on the production of high-quality functional beverages. The broad application range of liquid licorice extracts further solidifies their position as a clean-label and plant-based formulation choice.

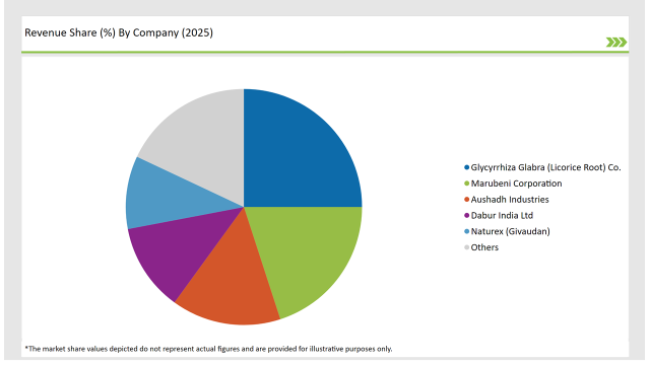

2025 Market share of Europe Licorice Extract manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Glycyrrhiza Glabra (Licorice Root) Co. | 25% |

| Marubeni Corporation | 20% |

| Aushadh Industries | 15% |

| Dabur India Ltd | 12% |

| Naturex (Givaudan) | 10% |

| Others | 18% |

Note: The above chart is indicative in nature

The European licorice extract market is comprised of players such as Naturex, F&C Licorice, Mafco Worldwide, and FrieslandCampina Ingredients which hold the majority share in the market. These firms are well recognized for their advanced extraction technologies, robust distribution networks, and innovative product portfolios to stay ahead in the competition.

For instance, Naturex has partnered with drug-based manufacturers for high-purity licorice extracts customized for medicinal use. F&C Licorice has sought to gain more ground in the European region by putting up modern extraction facilities as well as strategic alliances with nutraceutical companies. Mafco Worldwide's emphasis on organic and clean-label licorice extracts places it at the forefront of high-end and wellness-oriented markets.

Cost-effective solutions of licorice extract for industrial use are also achieving good momentum among the regional players. Sustainability initiatives such as traceable supply chains and regenerative farming methods fit into this growing demand in Europe for ethically sourced and environment-friendly ingredients.

As per Application, the industry has been categorized into Pharmaceutical, Food and Beverage, and Others.

As per Form Type, the industry has been categorized into Powder, and Liquid.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

The Europe Licorice Extract market is projected to grow at a CAGR of 4.2% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 319.0 million.

Key factors driving the licorice extract market include the increasing demand for natural flavoring agents in food and beverages, as well as the growing awareness of the health benefits associated with licorice, such as its anti-inflammatory and antioxidant properties. Additionally, its applications in pharmaceuticals and herbal remedies further contribute to market growth.

The highest consumption of licorice extract is primarily seen in Italy and Spain, where it is widely used in confectionery and traditional herbal products. Germany and the United Kingdom also contribute significantly to the market due to their demand in food, beverages, and pharmaceuticals.

Leading manufacturers include Glycyrrhiza Glabra (Licorice Root) Co., Marubeni Corporation, Aushadh Industries, Dabur India Ltd., known for their innovative and sustainable production techniques and a variety of product lines.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Europe Trolley Bus Market Size and Share Forecast Outlook 2025 to 2035

Europe Protease Market Size and Share Forecast Outlook 2025 to 2035

Europe Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe & USA Consumer Electronics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe Plant-Based Meal Kit Market Size and Share Forecast Outlook 2025 to 2035

Europe Temperature Controlled Packaging Solutions Market Size and Share Forecast Outlook 2025 to 2035

Europe Rubber Derived Unrefined Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Europe Pet Food Market Analysis by Nature, Product Type, Source, Pet Type, Packaging, Distribution Channel, and Country - Growth, Trends, and Forecast through 2025 to 2035

Europe's Golden Generation Travel Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA