Sales of licorice extract in North America are estimated at USD 87.3 million in 2025 and are projected to reach USD 181.6 million by 2035, reflecting a CAGR of 7.6% over the forecast period.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 87.3 million |

| Projected Value (2035F) | USD 181.6 million |

| CAGR (2025 to 2035) | 7.6% |

This expansion is being driven by rising consumer demand for natural sweeteners and bioactive ingredients across the food, pharmaceutical, and personal care industries.

By 2025, per capita usage of licorice extract is estimated between 0.3 and 0.6 grams in 2025, with projections rising up to 0.9 grams by 2035 depending on country. The United States is forecast to generate USD 142.8 million in licorice extract sales by 2035, followed by Canada at USD 38.8 million, reflecting growing penetration across food, nutraceutical, and personal care applications.

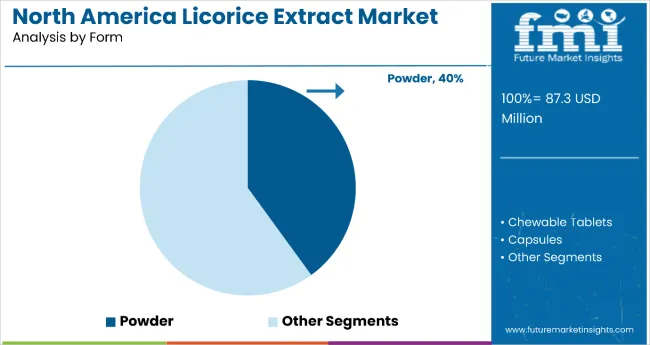

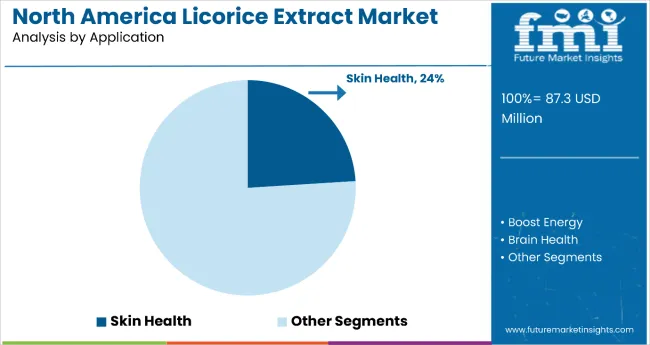

Powder licorice extract remains the largest contributor to demand, accounting for 40.0% of total sales in 2025. Growth is supported by adoption in functional foods and nutraceuticals that require standardized potency and ease of incorporation. By application, skin health extract commands 24.0% of overall demand as licorice extract anti-inflammatory and brightening benefits are increasingly recognized in topical formulations. Other notable forms include chewable tablets and capsules for energy and brain health supplements, as well as gummies and liquids for various digestive, immune, and liver support functions.

Adoption is particularly strong among supplement producers, food manufacturers, and cosmetic companiesseeking clean-label, plant-based ingredients for product differentiation. Leading players focus on traceable sourcing, advanced extraction technologies, and expanding application scope, while regulatory compliance and standardized quality benchmarks underpin growth. Regional disparities persist, with the USA leading innovation, but Canada’s market share is steadily increasing with new product launches and expanding distribution networks.

The licorice extract market in North America is classifiedby form, application, and country. By form, the key classification includes powder, chewable tablets, capsules (gelatin and HPMC), gummies/chews, and liquid. By application, the segment covers skin health, boost energy, brain health, colon health, digestive health, immune support, and liver support. By countries, the analysis covers United States and Canada.

Powder formulations are projected to dominate sales in 2025, due to rising demand among manufacturers in functional foods, dietary supplements, and beverage concentrates. Other forms, such as chewable tablets and liquids, address specialized applications in energy supplements, skin health, and digestive support.

Licorice extract applications in North America encompass diverse health and wellness categories, catering to varying consumer needs and industrial formulations. Skin health formulations are expected to remain the primary application segment in 2025, followed by digestive health and immune support. Application preferences are evolving to match consumer health trends and therapeutic research developments.

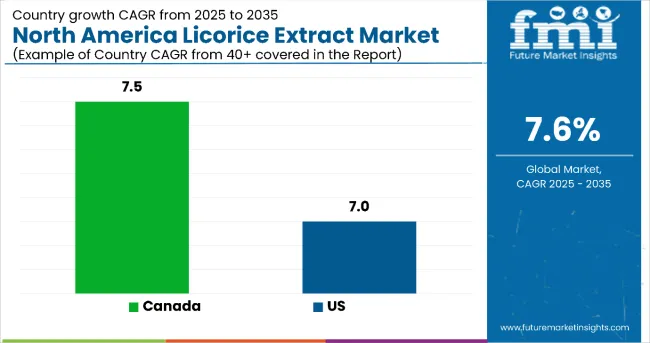

| Countries | CAGR (2025 to 2035) |

|---|---|

| Canada | 7.5% |

| USA | 7% |

Licorice extract sales will not grow uniformly across North America. The United States continues to lead market expansion, followed by Canada, both supported by product innovation and distribution channel growth. The table below shows share and cohort values for each regional market in 2025.

Between 2025 and 2035, demand for licorice extract is projected to expand across North America, but the pace of growth will vary based on nutraceutical innovation, regulatory frameworks, and consumer health trends. Canada is expected to grow at a CAGR of 7.5%, outpacing the projected 7% in the USA This acceleration is underpinned by several factors such as robust dietary supplement industry infrastructure, expanding functional food manufacturing capabilities, and increasing adoption of plant-based therapeutic ingredients across health and wellness sectors.

The country's emphasis on clean-label products and natural ingredient innovation creates a favorable environment for licorice extract adoption, particularly among premium supplement manufacturers and specialty health food companies. Per capita consumption in the USA is projected to rise from 0.31 grams in 2025 to 0.65 grams by 2035, reflecting the mainstreaming of herbal ingredients in wellness applications.

Both countries exhibit mature supplement markets with steady growth driven by health-conscious consumer behavior and natural ingredient integration rather than rapid demographic shifts. The United States maintains its leadership position through established distribution networks, extensive research infrastructure, and robust regulatory frameworks supporting botanical extract commercialization.

Collectively, these two countries represent the entirety of North American licorice extract demand. Still, their growth trajectories highlight the importance of country-specific approaches in product development, regulatory compliance, and consumer education initiatives.

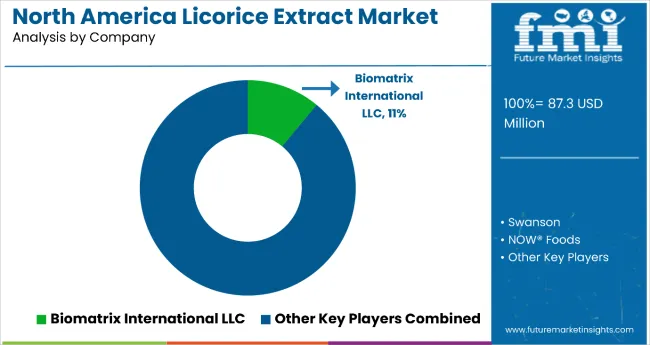

The competitive environment is characterized by a mix of established botanical extract companies and specialized ingredient manufacturers. Technical expertise and supply chain relationships, rather than product innovation alone, remain decisive success factors: the leading suppliers collectively serve more than 8,000 food manufacturing, nutraceutical, and cosmetic facilities across North America and maintain strong industrial channel presence.

Mafco Worldwide LLC maintains a strong positioning as a comprehensive licorice extract provider. The company offers extensive licorice extract formulations across multiple concentration levels and functional specifications, with particular strength in technical support and custom extraction services. Its core range of powder and liquid variants provides deep penetration in food processing channels while maintaining broad coverage through ingredient distribution networks.

Norevo GmbH, leveraging specialized botanical processing expertise and global supply chain capabilities, positions licorice extract within its broader natural ingredient portfolio. The company's focus on standardized formulations and pharmaceutical-grade variants reinforces its role as a premium supplier for health-conscious supplement manufacturers across North American markets.

Maruzen Pharmaceuticals Co., Ltd. benefits from an extensive pharmaceutical heritage and established relationships with nutraceutical manufacturers throughout North America. Recent product development focuses on high-potency formulations that address multiple therapeutic applications, targeting both efficacy and safety standards in dietary supplement manufacturing.

F&C Licorice Ltd. maintains a significant presence in the natural sweetener category with specialized licorice extract formulations designed for different industrial applications. The company's technical capabilities and application support programs support premium positioning in key North American food processing hubs.

Aushadhi Herbal focuses on comprehensive herbal solutions and maintains a strong presence in the Ayurvedic and traditional medicine sectors. The company's emphasis on organic certification and traceable sourcing appeals to North American manufacturers seeking authentic botanical ingredients with cultural heritage and technical support.

Private-label programs at major ingredient distributors are expanding assortment at competitive price points, putting margin pressure on smaller suppliers while supporting broader access to licorice extract ingredients. Consolidation is likely to continue as technical capabilities and regulatory compliance partnerships become critical for maintaining supply relationships and application development support in this specialized category.

Key Developments

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 87.3 Million |

| Form | Chewable Tablets, Capsules (Gelatin and HPMC), Gummies/Chews, Powder, and Liquid |

| Application | Boost Energy, Brain Health, Colon Health, Digestive Health, Immune Support, Liver Support, and Skin Health |

| Regions Covered | North America |

| Country Covered | United States and Canada |

| Key Companies Profiled | Biomatrix International LLC, Swanson, Bio-Botanica Inc. (Nature's Answer), NOW® Foods, Horbäach, Carlyle Nutritionals, LLC, NIKKO CHEMICALS CO., LTD., Hard Eight Nutrition LLC, Nature's Sunshine Products, Inc., and Other Players |

| Additional Attributes | Dollar sales by application and product form, regional demand trends, competitive landscape, consumer preferences for natural licorice-based products, integration with traceable sourcing models, innovations in extraction methods, and quality standardization for diverse industrial applications |

The global north america licorice extract market is estimated to be valued at USD 87.3 million in 2025.

The market size for the north america licorice extract market is projected to reach USD 181.6 million by 2035.

The north america licorice extract market is expected to grow at a 7.6% CAGR between 2025 and 2035.

The key product types in north america licorice extract market are chewable tablets, capsules, _gelatin, _hpmc, gummies/ chews, powder and liquid.

In terms of application, boost energy segment to command 42.7% share in the north america licorice extract market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Latin America Licorice Extract Market Report – Growth, Demand & Forecast 2025-2035

North America Boat Trailer Market Size and Share Forecast Outlook 2025 to 2035

North America Cryogenic Label Printer Market Size and Share Forecast Outlook 2025 to 2035

North America Chitosan Market Size and Share Forecast Outlook 2025 to 2035

North America Underground Mining Vehicle Market Size and Share Forecast Outlook 2025 to 2035

North America Bulk Aseptic Packaging Market Size and Share Forecast Outlook 2025 to 2035

North America Par Baked Bread Market Size and Share Forecast Outlook 2025 to 2035

North America Silo Bags Market Size and Share Forecast Outlook 2025 to 2035

North America Fresh Meat Packaging Market Size and Share Forecast Outlook 2025 to 2035

North America Ceramic Barbeque Grill Market Size and Share Forecast Outlook 2025 to 2035

North America Temperature Sensor Market Size and Share Forecast Outlook 2025 to 2035

North American Dietary Supplements Market Size and Share Forecast Outlook 2025 to 2035

North America Head-up Display Market Size and Share Forecast Outlook 2025 to 2035

North America, Europe & Asia Pacific Legal Cannabis Market Size and Share Forecast Outlook 2025 to 2035

North America Ceiling Cassette Market Size and Share Forecast Outlook 2025 to 2035

North America Pressure Regulating Valves Market Size and Share Forecast Outlook 2025 to 2035

North America Flame Retardant Thermoplastics Market Size and Share Forecast Outlook 2025 to 2035

Fire Pit Market Analysis in North America - Growth, Trends and Forecast from 2025 to 2035

North America Electrical Testing Services Market - Growth & Demand 2025 to 2035

North America In-building Wireless Market Growth - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA