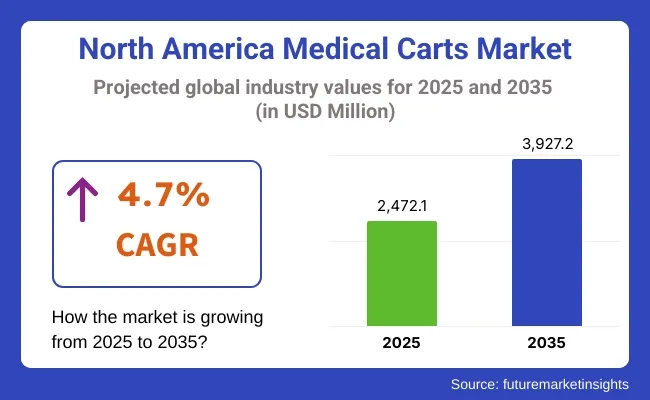

The North America Medical Carts market is expected to reach approximately USD 2,472.1 million in 2025 and expand to around USD 3,927.2 million by 2035, reflecting a compound annual growth rate (CAGR) of 4.7% over the forecast period.

The Medical Cart Industry in North America is anticipated to grow steadily between 2025 and 2035, supported by the rapid integration of digital technologies in healthcare delivery and the increasing emphasis on mobility and efficiency at the point of care.

Medical carts- computer-on-wheels (COWs), medication carts, crash carts, and procedure carts-have emerged as important tools to improve clinical workflows, reduce medical errors, and enhance patient experience, the option of the first medical device software products that have the advantages of integrating the functions above to offer higher protection of medial malpractices at more affordable prices.

As electronic health records, real-time data entry, and barcode medication administration become leaner in their operations, hospitals increasingly require mobile workstations that enable bedside documentation and continuity of care. Currently, hospitals and ambulatory care centers are acquiring these carts to speed up workflows, alleviate nurse fatigue and enhance caregiver productivity.

| Metric | Value (USD Million) |

|---|---|

| Industry Size (2025E) | USD 2,472.1 Million |

| Industry Value (2035F) | USD 3,927.2 Million |

| CAGR (2025 to 2035) | 4.7% |

The North America medical cart market has witnessed a comprehensive impact over the years owing to advancements in the healthcare infrastructure, rising patient demographics, and growing stringent regulatory requirements. Mobile workstations have been implemented in hospitals and ambulatory care centers to increase the mobility of clinicians and facilitate the use of patient data.

The integration of medical systems with Electronic Medical Records (EMR) as record systems demanded their use, mostly because other healthcare providers, such as pharmacies and laboratories, were becoming more EMR-compatible. Market trends in the cart market include the segmentation of carts into ergonomic and battery-electric models for optimal mobility and a safe mode of storing generic products.

All these factors are the reason why there has been an increased emphasis on infection control, prompting the introduction of antimicrobial coatings. As manufacturers release modular and customizable cart varieties, they can help healthcare environments adapt to a range of settings and optimize clinical workflows.

The Anesthesia Carts Segment Dominates the Market Due to The Rising Number of Surgical Procedures.

The anesthesia cart is crucial to organizing and securing drugs, airway equipment, and monitoring supplies used during surgery and emergency procedures. The market in North America is primarily driven by the high volume of surgeries, the near-universal adoption of electronic medication administration systems (eMAR), and the connection to automated dispensing cabinets.

Demand in this segment has increased due to a greater emphasis on security and hygiene, including features such as lockable compartments, intelligent drawer systems, and antimicrobial surfaces. The USA fully supports advanced OR infrastructure and the digitization of perioperative workflow. Among the future trends are AI-powered inventory tracking, biometric access to drawers, and wireless integration with anesthesia information management systems (AIMS).

The Emergency Crash Carts Segment Dominates the Market Due To The Critical Need For Rapid Access To Life-Saving Medications

In a code blue response, emergency crash carts are vital, stocked with medications, defibrillators, and intubation equipment. In North America, it is customary to deploy these carts in emergency departments, intensive care units (ICUs), and surgical suites. The main objective for the market growth is in hospital accreditation requirements such as Joint Commission standards, increasing emphasis on preparedness for rapid response, and further development of advanced mobility features and RFID-tagged inventory systems.

Growing numbers of ambulatory surgery centers (ASCs) and specialty emergency facilities in the USA and Canada are further driving demand. Innovation is concentrating on modular cart design, pre-assembled specialty crash carts (such as pediatric, cardiac), and color-coded systems to enhance workflow during resuscitation.

The Hospital Segment Dominates The North America Medical Cart Market Due To The High Patient Influx.

Healthcare entities are the largest consumers of medical carts in North America, with diverse needs across inpatient, surgical, emergency room, and intensive care departments. The hospitals need carts that can be customized, are durable, and can integrate with EMR, aiding care coordination and mobility. Growth is further driven by the establishment of point-of-care delivery models, increasing investments in smart hospital infrastructure, and the demand for materials resistant to infections.

In the United States, hospitals have a special focus on medical carts that are integrated with wireless patient monitoring and clinical decision support systems. Fleet management software to assist large hospital-wide cart systems and battery carts for recharging devices on the go will be a future trend.

The Ambulatory Surgical Centers (ASCs) Segment Leads The Market Due To The Growing Demand For Efficient Medical Carts.

Outpatient surgery centers are quickly adopting medical carts to enhance the flow of outpatient surgical procedures. Orthopedics, ophthalmology, and pain-managed clinics find these carts valuable for providing their patients with safe medical management in smaller, less cumbersome, mobile, and specialty-specific delivery devices (e.g. for endoscopy, IV therapy), increasing turnaround time, and improved patient safety.

The growing volume of elective same-day procedures, regulatory support for expansion of outpatient services, and emphasis on standardization drive development in this market. In the USA and Canada, ASCs are presently investing in lightweight carts with digital medication management capability, including power solutions, and cloud-connected inventory systems. Future innovations will focus on cart-user touch screen interfaces with remote support tools and eco-friendly cart manufacturing materials.

The North America Medical Cart Market Faces Challenges, Such as High Initial Costs, Which Are Hindering Seamless Adoption and Operational Efficiency.

Challenges across Various Medical Cart Segments in North America. The North American medical cart market comprises a few aspects that may halt the various products from getting a wide-scale adoption, or some aspects of operational efficiency. Another major issue is the potentially steep upfront cost of advanced carts, particularly those that feature batteries, power management systems, built-in monitors, and locked drawers for medication storage.

Front-end investment is a roadblock for budget-sensitive facilities, especially small clinics and rural hospitals. Moreover, the maintenance and servicing requirements for power modules as well as IT components can contribute to higher lifecycle costs.

Another big hurdle is tech compatibility- many healthcare providers are working off old or fragmented (IT) infrastructures, making info streams between cars and EHR platforms, barcode scanners, and diagnostic peripherals less than seamless. Utilization of storage space, cable management, network connectivity, and device interoperability are other hurdles in implementing the technology.

Investments In Hospital Upgrades And The Expansion Of Ambulatory Surgical Centers (ASCs) Create Opportunities For Advanced, Customizable Medical Carts.

The North American healthcare industry is an evolving scenario that is expected to drive the growth of the medical cart market, including the medical cart segment. Among the most promising is the trend toward home and telemedicine-enabled care. As healthcare providers seek to deliver services beyond conventional hospital environments, there is a growing demand for lightweight, mobile carts that facilitate virtual consultations, remote diagnostics, and the transport of portable documentation.

The integration of AI and smart technologies similarly introduces capabilities for advanced features, such as usage analytics, automated inventory control, and predictive maintenance, that improve efficiency and proper asset management. Specialty-specific modular cart systems (e.g,. anesthesia, oncology, ICU) - running aftermarket potential.

Infection Control Features

Infection prevention is a priority for North American healthcare providers, and protection-focused medical cart design is evolving from this commitment to hygiene. Carts must be constructed with smooth, non-porous surfaces, sealed seams, and minimal crevices to prevent the buildup of microbes and facilitate effective cleaning. In recent years, materials with natural antimicrobial properties, like powder-coated metals and synthetic resins, are commonly used to prevent bacterial growth.

Touchless elements, such as automatic drawer access and sensor-based controls, are becoming increasingly popular to minimize the spread of pathogens through physical interaction. The use of removable and machine-washable accessories, as well as components that can be disinfected between rounds, is helping customers maintain good cart sanitation practices. Carts for isolation wards and infectious disease units often have UV-resistant surfaces and are compatible with aggressive disinfectants.

The North American medical cart market is witnessing a rise in demand for smart technologies and connectivity solutions to domain operational intelligence in near real-time, which is one of the emerging trends in this region. By integratingwith RFID tags and Bluetooth beacons, carts are offering real-time location tracking, inventory management, and usage analytics throughout hospital networks.

This leads to improved asset utilization, reduced equipment loss, and real-time, dynamic allocation based on demand. Another major trend is the tailoring of carts for specialty departments like oncology, surgery, and telehealth. These carts come with department-specific modules, diagnostic tools, and medication storage solutions to support more specialized workflow needs.

With remote and hybrid care models on the rise, there is a growing need for carts that enable virtual visits, remote monitoring, and at-home diagnostics.

The North American Medical Cart Market has shown steady growth in the past few years, driven by increasing demand for point-of-care solutions, rising hospital admissions, and technological advancements. From 2020 to 2024, technological advances and the higher adoption of EHR-integrated carts by healthcare providers are expected to drive the market, enhancing workflow efficiency at various healthcare facilities. The COVID-19 pandemic further escalated demand for mobile workstations in hospitals.

Among the key trends are the migration towards battery-operated, ergonomic, and antimicrobial-coated carts, which aim to improve infection control and clinician productivity. Revealing the region’s digital health evolution, telemedicine carts are catching on. The rise in regulatory standards focusing on Patient safety, workflow optimization in hospitals, and ambulatory care centers, alongside ongoing investments in healthcare infrastructure, suggests that the market has a long way to go.

Market Outlook

The medical cart market for North America is dominated by the United States; well in place with diverse healthcare infrastructure, high volume of hospital admissions, and strict regulations for patient safety. The ramp-up of the market for high-tech medical carts is becoming imminent: more and more healthcare facilities are using EHR-integrated mobile workstations, surgical procedures are increasing, and infection control continues to receive significant attention.

Leaders in the industry, such as Ergotron and Capsa Healthcare, continue to bring to market carts characterized by ergonomics, battery operation, and antimicrobial coating. Government initiatives aimed at driving digital transformation in healthcare and enhancing telemedicine are positive contributors to the market.

With increasing investments being poured into smart healthcare facilities, a steady growth path remains in the cards for the US medical cart market, driven by the power of technology and workflow optimization.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.1% |

Market Outlook

Increased investments in healthcare, demand for mobile workstations, and the expansion of ASCs are factors driving the growth of the Canadian medical cart market. Digital health initiatives from the government, combined with demographic shifts toward an older population with increased care needs, also contribute to the growth impetus. EHR-compatible and battery-powered carts are increasingly being installed in hospitals to enhance efficiency.

Some of the key focus areas for players include antimicrobial coatings, combined with lightweight designs, to facilitate mobility and infection control. The patient safety and workflow efficiency focus of the Canadian healthcare system will ensure steady growth of this market, which is getting additional support from the technological advancements in smart medical carts and telehealth integration.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Canada | 4.0% |

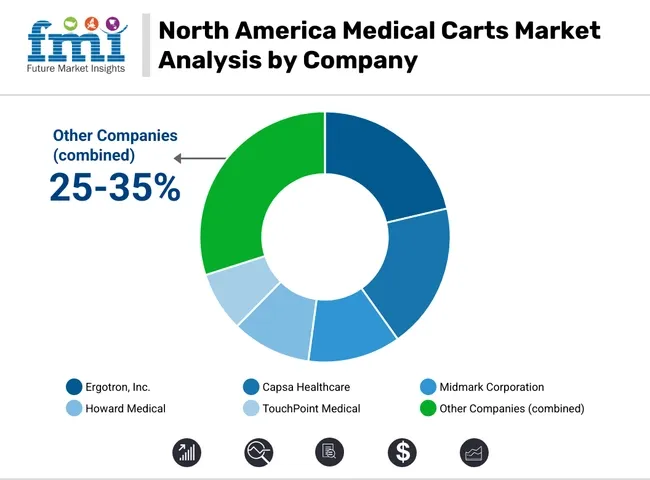

North America's medical cart market is very mature and competitive. The market is increasingly owing to factors like rising penetration of electronic health records (EHR), increasing patient mobility requirements, and growing demand for point-of-care (POC) technologies.

Mobile workstations and medicine carts are increasingly being adopted by clinical establishments, hospitals, and facilities providing long-term care so as to improve workflow efficiency, quality patient safety, and mobility for caregivers. Technology-integrated ergonomic solutions offered by global as well as regional players dominate the market.

Other Key Players (25-35% Combined) Additional companies contributing to innovation and service expansion in the North American market include:

These companies support evolving clinical needs with specialized cart solutions, including antimicrobial coatings, battery-powered systems, and modular components tailored to varied healthcare environments.

Emergency Carts, Procedure/Treatment Carts, Anaesthesia Carts, Medical Computer Carts and Others.

Powered and Non-Powered (Mechanical).

Metal, Plastic and Wood.

Hospitals, Clinics, Ambulatory Surgical Centres, Diagnostic Centres and Others.

United States, Canada and Mexico.

The North America Medical Cart industry is projected to witness CAGR of 4.7% between 2025 and 2035.

The North America Medical Cart industry stood at USD 2,361.1 million in 2024.

The North America medical cart industry is anticipated to reach USD 3,927.2 million by 2035 end.

United States is expected to show a CAGR of 4.2% in the assessment period.

The key players operating in the North America Medical Cart industry are Ergotron, Inc., Capsa Healthcare, Midmark Corporation, Howard Medical, TouchPoint Medical, Advantech Co., Ltd., JACO, Inc., Altus Inc., AFC Industries, Harloff Manufacturing Co. and Others

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Country, 2018 to 2033

Table 2: Industry Analysis and Outlook Volume (Units) Forecast by Country, 2018 to 2033

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by Product, 2018 to 2033

Table 4: Industry Analysis and Outlook Volume (Units) Forecast by Product, 2018 to 2033

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by Material, 2018 to 2033

Table 6: Industry Analysis and Outlook Volume (Units) Forecast by Material, 2018 to 2033

Table 7: Industry Analysis and Outlook Value (US$ Million) Forecast by Energy Source, 2018 to 2033

Table 8: Industry Analysis and Outlook Volume (Units) Forecast by Energy Source, 2018 to 2033

Table 9: Industry Analysis and Outlook Value (US$ Million) Forecast by End User, 2018 to 2033

Table 10: Industry Analysis and Outlook Volume (Units) Forecast by End User, 2018 to 2033

Table 11: Industry Analysis and Outlook Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: Industry Analysis and Outlook Volume (Units) Forecast by Country, 2018 to 2033

Table 13: Industry Analysis and Outlook Value (US$ Million) Forecast by Product, 2018 to 2033

Table 14: Industry Analysis and Outlook Volume (Units) Forecast by Product, 2018 to 2033

Table 15: Industry Analysis and Outlook Value (US$ Million) Forecast by Material, 2018 to 2033

Table 16: Industry Analysis and Outlook Volume (Units) Forecast by Material, 2018 to 2033

Table 17: Industry Analysis and Outlook Value (US$ Million) Forecast by Energy Source, 2018 to 2033

Table 18: Industry Analysis and Outlook Volume (Units) Forecast by Energy Source, 2018 to 2033

Table 19: Industry Analysis and Outlook Value (US$ Million) Forecast by End User, 2018 to 2033

Table 20: Industry Analysis and Outlook Volume (Units) Forecast by End User, 2018 to 2033

Figure 1: Industry Analysis and Outlook Value (US$ Million) by Product, 2023 to 2033

Figure 2: Industry Analysis and Outlook Value (US$ Million) by Material, 2023 to 2033

Figure 3: Industry Analysis and Outlook Value (US$ Million) by Energy Source, 2023 to 2033

Figure 4: Industry Analysis and Outlook Value (US$ Million) by End User, 2023 to 2033

Figure 5: Industry Analysis and Outlook Value (US$ Million) by Country, 2023 to 2033

Figure 6: Industry Analysis and Outlook Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 7: Industry Analysis and Outlook Volume (Units) Analysis by Country, 2018 to 2033

Figure 8: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 9: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 10: Industry Analysis and Outlook Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 11: Industry Analysis and Outlook Volume (Units) Analysis by Product, 2018 to 2033

Figure 12: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 13: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 14: Industry Analysis and Outlook Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 15: Industry Analysis and Outlook Volume (Units) Analysis by Material, 2018 to 2033

Figure 16: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 17: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 18: Industry Analysis and Outlook Value (US$ Million) Analysis by Energy Source, 2018 to 2033

Figure 19: Industry Analysis and Outlook Volume (Units) Analysis by Energy Source, 2018 to 2033

Figure 20: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Energy Source, 2023 to 2033

Figure 21: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Energy Source, 2023 to 2033

Figure 22: Industry Analysis and Outlook Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 23: Industry Analysis and Outlook Volume (Units) Analysis by End User, 2018 to 2033

Figure 24: Industry Analysis and Outlook Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 25: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 26: Industry Analysis and Outlook Attractiveness by Product, 2023 to 2033

Figure 27: Industry Analysis and Outlook Attractiveness by Material, 2023 to 2033

Figure 28: Industry Analysis and Outlook Attractiveness by Energy Source, 2023 to 2033

Figure 29: Industry Analysis and Outlook Attractiveness by End User, 2023 to 2033

Figure 30: Industry Analysis and Outlook Attractiveness by Country, 2023 to 2033

Figure 31: Industry Analysis and Outlook Value (US$ Million) by Product, 2023 to 2033

Figure 32: Industry Analysis and Outlook Value (US$ Million) by Material, 2023 to 2033

Figure 33: Industry Analysis and Outlook Value (US$ Million) by Energy Source, 2023 to 2033

Figure 34: Industry Analysis and Outlook Value (US$ Million) by End User, 2023 to 2033

Figure 35: Industry Analysis and Outlook Value (US$ Million) by Country, 2023 to 2033

Figure 36: Industry Analysis and Outlook Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: Industry Analysis and Outlook Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: Industry Analysis and Outlook Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 41: Industry Analysis and Outlook Volume (Units) Analysis by Product, 2018 to 2033

Figure 42: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 43: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 44: Industry Analysis and Outlook Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 45: Industry Analysis and Outlook Volume (Units) Analysis by Material, 2018 to 2033

Figure 46: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 47: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 48: Industry Analysis and Outlook Value (US$ Million) Analysis by Energy Source, 2018 to 2033

Figure 49: Industry Analysis and Outlook Volume (Units) Analysis by Energy Source, 2018 to 2033

Figure 50: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Energy Source, 2023 to 2033

Figure 51: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Energy Source, 2023 to 2033

Figure 52: Industry Analysis and Outlook Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 53: Industry Analysis and Outlook Volume (Units) Analysis by End User, 2018 to 2033

Figure 54: Industry Analysis and Outlook Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 55: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 56: Industry Analysis and Outlook Attractiveness by Product, 2023 to 2033

Figure 57: Industry Analysis and Outlook Attractiveness by Material, 2023 to 2033

Figure 58: Industry Analysis and Outlook Attractiveness by Energy Source, 2023 to 2033

Figure 59: Industry Analysis and Outlook Attractiveness by End User, 2023 to 2033

Figure 60: Industry Analysis and Outlook Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Northern Blotting Market Size and Share Forecast Outlook 2025 to 2035

Northern Europe Calcium Sulphate Market Size and Share Forecast Outlook 2025 to 2035

North America Boat Trailer Market Size and Share Forecast Outlook 2025 to 2035

North America Cryogenic Label Printer Market Size and Share Forecast Outlook 2025 to 2035

North America Chitosan Market Size and Share Forecast Outlook 2025 to 2035

North America Underground Mining Vehicle Market Size and Share Forecast Outlook 2025 to 2035

North America Bulk Aseptic Packaging Market Size and Share Forecast Outlook 2025 to 2035

North America Licorice Extract Market Size and Share Forecast Outlook 2025 to 2035

North America Par Baked Bread Market Size and Share Forecast Outlook 2025 to 2035

North America Silo Bags Market Size and Share Forecast Outlook 2025 to 2035

North America Fresh Meat Packaging Market Size and Share Forecast Outlook 2025 to 2035

North America Ceramic Barbeque Grill Market Size and Share Forecast Outlook 2025 to 2035

North America Temperature Sensor Market Size and Share Forecast Outlook 2025 to 2035

North American Dietary Supplements Market Size and Share Forecast Outlook 2025 to 2035

North America Head-up Display Market Size and Share Forecast Outlook 2025 to 2035

North America, Europe & Asia Pacific Legal Cannabis Market Size and Share Forecast Outlook 2025 to 2035

North America Ceiling Cassette Market Size and Share Forecast Outlook 2025 to 2035

North America Pressure Regulating Valves Market Size and Share Forecast Outlook 2025 to 2035

North America Flame Retardant Thermoplastics Market Size and Share Forecast Outlook 2025 to 2035

Fire Pit Market Analysis in North America - Growth, Trends and Forecast from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA