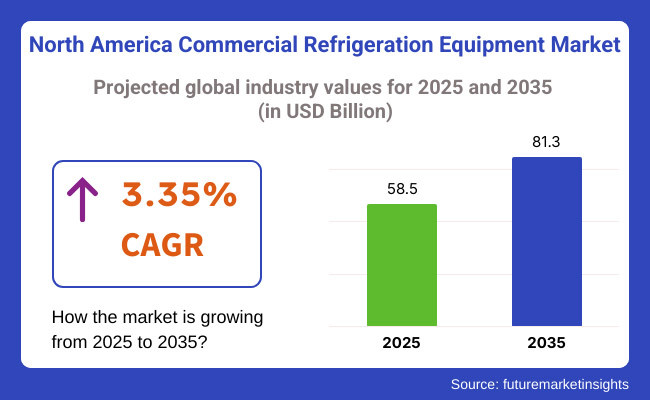

The North American commercial refrigeration equipment industry is estimated to account for USD 58.5 billion in 2025. It is anticipated to grow at a CAGR of 3.35% during the assessment period and reach a value of USD 81.3 billion by 2035.

In 2024, the world commercial refrigeration equipment industry witnessed significant growth due to a number of driving factors Increase in Demand for Frozen and Chilled Foods: Consumers were increasingly looking for convenience, and hence consumption of frozen and chilled food items increased. This trend prompted retailers and food service operators to invest in advanced refrigeration systems to meet the growing demand.

Technological Advances: Manufacturers introduced energy-saving and environmentally friendly refrigeration technology. Natural refrigerants and smart technology were utilized on a mass scale, aligning with global sustainability policy and reducing operational costs for companies.

Gazing ahead to 2025 and beyond, the industry is preparing for steady expansion: Emphasis on Sustainability: Stringent environmental regulations will make the application of green refrigeration technologies more prevalent. Businesses will invest in carbon footprint-saving systems and those running on eco-friendly refrigerants.

Technological Integration: The application of IoT and AI in refrigeration systems will enhance monitoring, predictive maintenance, and power management, providing cost savings as well as greater efficiency.

In a recent survey done by Future Market Insights among stakeholders in the commercial refrigeration equipment industry, several key insights influencing the direction of the industry emerged. Perhaps most striking was the increasing focus on sustainability.

More than 65% of manufacturers, retailers, and food service operators surveyed pointed to energy efficiency and environmentally friendly refrigerants as high priorities when making purchasing decisions.

Tighter regulatory requirements and increasing consumer consciousness regarding the environment have fast-tracked the shift towards natural refrigerants such as CO2 and hydrocarbons, which has compelled firms to innovate in this area.

Another notable trend mentioned in the survey was the growing use of smart refrigeration technologies. Over half of the respondents indicated that they have invested in IoT-enabled refrigeration equipment that offers real-time monitoring, predictive maintenance, and remote access.

This digital revolution is not only enhancing operational efficiency but also enabling companies to save on maintenance expenses and avoid equipment breakdowns. The respondents also indicated that AI-based inventory management and temperature optimization are emerging as differentiators in competitive industries.

Government regulations and mandatory certifications significantly influence the commercial refrigeration equipment industry, varying by country. The table below outlines the impact of these policies and required certifications across different nations:

SEMARNAT (Secretaría de Medio Ambiente y Recursos Naturales) regulates refrigerant usage and aligns with the Montreal Protocol. FIDE (Fideicomiso para el Ahorro de Energía Eléctrica) Certification for energy-efficient refrigeration equipment. NMX Standards provide voluntary guidelines for sustainability and energy efficiency in commercial refrigeration.

| Country/Region | Government Regulations and Mandatory Certifications |

|---|---|

| United States | The USA Department of Energy (DOE) has proposed new and amended energy conservation standards for commercial refrigeration equipment, aiming to enhance energy efficiency. Additionally, the Environmental Protection Agency (EPA) is phasing out high-global warming potential (GWP) refrigerants, encouraging the adoption of alternatives with lower environmental impact. |

| Canada | Canada enforces strict energy efficiency standards through Natural Resources Canada (NRCan) and aligns with EPA policies on reducing high-GWP refrigerants. The Energy Efficiency Regulations set minimum performance standards for commercial refrigeration equipment, ensuring compliance with environmental and efficiency goals. |

| Mexico | NOM (Normas Oficiales Mexicanas) Standards set performance and safety requirements for refrigeration systems. |

These regulatory measures and certifications are pivotal in steering the commercial refrigeration equipment sector toward greater energy efficiency and environmental sustainability.

| 2020 to 2024 (Past Trends) | 2025 to 2035 (Future Outlook) |

|---|---|

| Impact of COVID-19 (2020 to 2022): The industry faced supply chain disruptions, labor shortages, and fluctuating raw material costs due to pandemic-related restrictions. However, there was a rise in demand for cold storage solutions due to increased e-commerce grocery deliveries. | Post-Pandemic Recovery: The industry will continue stabilizing, with businesses increasing investments in energy-efficient and smart refrigeration solutions to enhance operational efficiency. |

| Growth of Cold Chain Logistics: The expansion of pharmaceutical and food cold chains drove demand for commercial refrigeration equipment, particularly in developing economies. | Smart and Connected Systems: The adoption of IoT-enabled and AI-driven refrigeration systems will become mainstream, enabling predictive maintenance and energy savings. |

| Regulatory Push for Sustainability: Governments worldwide introduced stricter regulations to phase out high-GWP refrigerants and promote eco-friendly alternatives like CO₂, ammonia, and hydrocarbons. | Stricter Environmental Compliance: Regulatory bodies will enforce more stringent energy efficiency and refrigerant policies, compelling manufacturers to innovate sustainable solutions. |

| Technological Advancements: Manufacturers introduced variable-speed compressors, energy-efficient LED lighting, and self-cleaning condenser technology to improve performance and reduce power consumption. | Sustainable Manufacturing Practices: Companies will increasingly adopt eco-friendly production processes, such as using recycled materials and reducing carbon emissions in their supply chains. |

| Industry Consolidation and Competition: The industry saw significant mergers and acquisitions as large players sought to strengthen their industry presence and expand global reach. | Emerging Industries Drive Growth: Asia-Pacific, Latin America, and Africa will witness rapid industry expansion due to urbanization, rising disposable incomes, and increased food retail infrastructure. |

| Challenges: Rising raw material costs, semiconductor shortages, and transportation bottlenecks affected manufacturing and delivery timelines. | Challenges Ahead: Geopolitical uncertainties, fluctuating raw material prices, and continued supply chain risks may impact profit margins and industry dynamics. |

Based on product type, the market is divided into beverage refrigerators, freezers & refrigerators, transportation refrigerators, glass door merchandisers, display cases, beverage dispensers, refrigerated vending machines, ice machines, and ice cream machines.

Among all the commercial refrigeration equipment in North America, freezers & refrigerators are the most commonly used. These appliances are vital in a wide range of industries, such as food retailing, food service, healthcare, and hospitality.

Supermarkets, convenience stores, and restaurants use them to hold perishable products and ensure food safety levels. Their extensive usage is prompted by strict food preservation laws and rising consumer demand for fresh and frozen foods.

Segmented by application, the market is categorized into food services, food & beverage retail, food & beverage manufacturing, and food & beverage distribution. Some of the most significant industries that employ commercial refrigeration equipment in North America include food services, food & beverage retailing, food & beverage manufacturing, and food & beverage distribution food & beverage retailing is the largest consumer.

Hypermarkets, supermarkets, and convenience stores heavily depend on refrigeration machines such as freezers, glass door merchandisers, and display cases to store and showcase perishable goods like meat, dairy, frozen foods, and beverages.

Carrier Global Corporation: (20-25%)

Major Products: Refrigeration systems, display cases, and cold storage solutions.

Strengths: Brand reputation, wide product range, and focus on energy-efficient technologies.

Recent Developments: Acquisition of Toshiba Carrier Corporation and investment in green refrigeration solutions.

Dover Corporation: (15-20%)

Major Products: Display cases, walk-in coolers, and refrigeration systems.

Strengths: Strong presence in the food retail sector and cutting-edge product offerings.

Recent Developments: Growth of CO2-based refrigeration systems to meet sustainability goals.

Emerson Electric Co.: (10-15%)

Key Products: Compressors, condensing units, and refrigeration systems.

Strengths: Compressor technology leadership and robust distribution network.

Recent Developments: Focus on digital refrigeration solutions and IoT-capable systems.

Hussmann Corporation: (10-12%)

Key Products: Display cases, walk-in coolers, and refrigeration systems.

Strengths: Retail and food service market presence.

Recent Trends: Low-GWP and energy-efficient refrigerant focus.

Standex International Corporation: (5-8%)

Major Products: Display cases, refrigeration systems, and custom-engineered solutions.

Strengths: Niche and customized solution emphasis.

Recent Trends: Investment in newer manufacturing technologies.

Other Players: (20-25%)

Major Companies: Lennox International, True Manufacturing, Heatcraft Worldwide Refrigeration, and local players.

Strengths: Local customer relationships and low-cost solutions.

The North American commercial refrigeration equipment industry is highly correlated with macroeconomic drivers like consumer expenditure, food retail growth, supply chain optimization, and regulatory regimes.

The industry has witnessed consistent growth, driven by urbanization, growing disposable income, and changing consumers' preferences for frozen and fresh produce.

The ongoing growth of supermarkets, quick-service restaurants, and online-based grocery delivery services is also driving demand for technologically advanced refrigeration solutions.

Regulator ally, North American governments are tightening environmental regulations, such as the phasing out of high-GWP refrigerants and the use of energy-efficient cooling technologies. Inflationary trends and supply chain disruptions have affected production costs, prompting manufacturers to localize supply chains and implement digital innovations such as IoT-enabled refrigeration for cost optimization.

Expansion into Cold Storage Logistics

Investment in modular cold storage solutions that address the needs of urban micro-fulfillment centers and last-mile delivery operations must be made by stakeholders, especially with the emergence of e-commerce grocery delivery and pharmaceutical cold chains.

Investment in energy-efficient mobile refrigeration for transport refrigeration will enable businesses to respond to the increasing need for perishable goods delivery.

Adoption of Natural Refrigerants & Compliance-Driven Innovation

The demand for low-GWP refrigerants such as CO₂ (R-744), propane (R-290), and ammonia (NH₃) is gaining momentum with regulatory requirements from the EPA and DOE.

Companies must focus on retrofitting current equipment with eco-friendly refrigerants and create adaptive hybrid cooling systems that are compliant with changing environmental regulations without sacrificing performance.

Smart Refrigeration & Predictive Maintenance as a Service

IoT-equipped refrigeration solutions with AI-driven temperature monitoring and predictive upkeep can minimize downtime and energy expenses considerably.

The stakeholders must investigate subscription-based offerings (Refrigeration-as-a-Service) under which retailers and foodservice businesses can lease smart refrigeration without initial capital investment, with promise of recurring revenue streams.

With respect to product type, the segment is classified into beverage refrigerators, freezers & refrigerators, transportation refrigerators, glass door merchandisers, display cases, beverage dispensers, refrigerated vending machines, ice machines, and ice cream machines.

In terms of application, the segment is divided into food services, food & beverage retail, food & beverage production, and food & beverage distribution.

In terms of country, the industry is segmented into USA, Canada, and Mexico.

Table 01: Market Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Product Type

Table 02: Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Product Type

Table 03: Market Value (US$ Million) and Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Application

Table 04: Market Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Country

Table 05: USA Market Value (US$ Million) and Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Region

Table 06: USA Market Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Product Type

Table 07: USA Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Product Type

Table 08: USA Market Value (US$ Million) and Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Application

Table 09: Canada Market Value (US$ Million) and Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Region

Table 10: Canada Market Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Product Type

Table 11: Canada Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Product Type

Table 12: Canada Market Value (US$ Million) and Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Application

Table 13: Mexico Market Value (US$ Million) and Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Region

Table 14: Mexico Market Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Product Type

Table 15: Mexico Market Value (US$ Million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Product Type

Table 16: Mexico Market Value (US$ Million) and Volume ('000 Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Application

Figure 01: Market Historical Demand, 2018 to 2022

Figure 02: Market Demand Forecast, 2023 to 2033

Figure 03: Historical Market Size (USD Million) (2018 to 2022)

Figure 04: Market Absolute $ Opportunity Analysis (2018 to 2033)

Figure 05: Market Size (USD Million) & YOY Growth (%) (2023 to 2033)

Figure 06: Market Share and BPS Analysis By Product Type – 2023 to 2033

Figure 07: Market Y-o-Y Growth Projections By Product Type, 2023 to 2033

Figure 08: Market Attractiveness By Product Type, 2023 to 2033

Figure 09: Incremental $ Opportunity By Product Type, 2023 to 2033

Figure 10: Market Share and BPS Analysis By Application – 2023 to 2033

Figure 11: Market Y-o-Y Growth Projections By Application, 2023 to 2033

Figure 12: Market Attractiveness By Application, 2023 to 2033

Figure 13: Incremental $ Opportunity By Application, 2023 to 2033

Figure 14: Market Share and BPS Analysis by Country – 2023 to 2033

Figure 15: Market Y-o-Y Growth Projections by Country, 2023 to 2033

Figure 16: Market Attractiveness by Country, 2023 to 2033

Figure 17: Incremental $ Opportunity By Country, 2023 to 2033

Figure 18: USA Market Share and BPS Analysis by Region – 2023 to 2033

Figure 19: USA Market Y-o-Y Growth Projections by Region , 2023 to 2033

Figure 20: USA Market Attractiveness by Region, 2023 to 2033

Figure 21: USA Market Share and BPS Analysis By Product Type – 2023 to 2033

Figure 22: USA Market Y-o-Y Growth Projections By Product Type, 2022 to 2033

Figure 23: USA Market Attractiveness By Product Type, 2023 to 2033

Figure 24: USA Market Share and BPS Analysis By Application – 2023 to 2033

Figure 25: USA Market Y-o-Y Growth Projections By Application, 2023 to 2033

Figure 26: USA Market Attractiveness By Application, 2023 to 2033

Figure 27: Canada Market Share and BPS Analysis by Region– 2023 to 2033

Figure 28: Canada Market Y-o-Y Growth Projections by Region, 2022 to 2033

Figure 29: Canada Market Attractiveness by Region, 2023 to 2033

Figure 30: Canada Market Share and BPS Analysis By Product Type – 2023 to 2033

Figure 31: Canada Market Y-o-Y Growth Projections By Product Type, 2023 to 2033

Figure 32: Canada Market Attractiveness By Product Type, 2023 to 2033

Figure 33: Canada Market Share and BPS Analysis By Application – 2023 to 2033

Figure 34: Canada Market Y-o-Y Growth Projections By Application, 2022 to 2033

Figure 35: Canada Market Attractiveness By Application, 2023 to 2033

Figure 36: Mexico Market Share and BPS Analysis by Region – 2023 to 2033

Figure 37: Mexico Market Y-o-Y Growth Projections by Region , 2022 to 2033

Figure 38: Mexico Market Attractiveness by Region, 2023 to 2033

Figure 39: Mexico Market Share and BPS Analysis By Product Type – 2023 to 2033

Figure 40: Mexico Market Y-o-Y Growth Projections By Product Type, 2022 to 2033

Figure 41: Mexico Market Attractiveness By Product Type, 2023 to 2033

Figure 42: Mexico Market Share and BPS Analysis By Application – 2023 to 2033

Figure 43: Mexico Market Y-o-Y Growth Projections By Application, 2022 to 2033

Figure 44: Mexico Market Attractiveness By Application, 2023 to 2033

The demand is primarily driven by consumer preferences for fresh and frozen foods, stringent energy efficiency regulations, and the expansion of food retail and cold storage logistics.

The food service sector, food retail industry (supermarkets, convenience stores), food processing plants, and pharmaceutical cold storage facilities rely heavily on commercial refrigeration solutions.

Stricter energy efficiency laws and the phase-out of high-GWP refrigerants are pushing companies to adopt sustainable and high-performance refrigeration technologies.

IoT-enabled smart monitoring, AI-based predictive maintenance, and the widespread use of natural refrigerants are enhancing efficiency and sustainability.

High upfront costs, regulatory compliance, and supply chain disruptions affecting raw material availability are the most significant challenges.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA