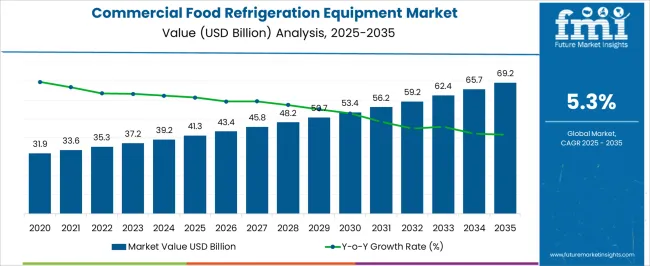

The commercial food refrigeration equipment market is projected to reach USD 41.3 billion in 2025 and expand to USD 69.2 billion by 2035, reflecting a CAGR of 5.3% during the forecast period. Over the next decade, the market is anticipated to experience strong momentum as foodservice operators, supermarkets, cold storage facilities, and convenience stores expand their footprint globally.

The comparison between 2025 and 2035 shows not only numerical growth but also a clear shift in technology adoption, with energy-efficient compressors, IoT-enabled monitoring, and eco-friendly refrigerants gaining prominence. The transition is driven by stricter environmental standards and the need to optimize operational costs in high-consumption industries. By 2035, automation and digital integration will be key differentiators, with predictive maintenance and smart sensors minimizing downtime and enhancing equipment life cycles.

Consumer-driven demand for fresh, frozen, and ready-to-eat food products is pushing restaurants, bakeries, and hypermarkets to invest in advanced refrigeration solutions. The 10-year growth trend also indicates that emerging economies will contribute a larger share of global revenue as urbanization, rising disposable incomes, and the expansion of modern retail formats accelerate adoption. Ultimately, the 2025–2035 comparison highlights both volume expansion and qualitative transformation toward sustainable, connected, and cost-effective refrigeration systems.

| Metric | Value |

|---|---|

| Commercial Food Refrigeration Equipment Market Estimated Value in (2025 E) | USD 41.3 billion |

| Commercial Food Refrigeration Equipment Market Forecast Value in (2035 F) | USD 69.2 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

The commercial food refrigeration equipment market is shaped by five interconnected parent markets that collectively define its share and long-term demand. The food retail and supermarket sector holds the largest share at 35%, as supermarkets, hypermarkets, and convenience stores rely heavily on refrigerated display cases, freezers, and cold rooms to maintain product quality and extend shelf life.

The foodservice and hospitality sector contributes 30%, with restaurants, hotels, cafes, and quick-service chains demanding efficient refrigeration for meal prep, storage, and customer-facing displays. The cold storage and logistics sector accounts for 20%, driven by the rise of frozen food, dairy, and meat supply chains requiring large-scale warehouse refrigeration and refrigerated transport. The food processing and manufacturing market represents 10%, where commercial-scale refrigeration ensures compliance with food safety regulations and supports continuous production cycles.

Healthcare and institutional market holds 5%, with hospitals, schools, and catering services relying on refrigeration for safe storage of food and beverages. The food retail and foodservice sectors account for 65% of total demand, underscoring that consumer-facing industries remain the dominant growth drivers, while cold chain expansion and food processing add strategic depth to the market’s global share distribution.

The commercial food refrigeration equipment market is experiencing stable growth, supported by the expansion of foodservice establishments, evolving cold-chain logistics, and stringent food safety regulations. Current market conditions are being shaped by consistent replacement demand in mature economies and rapid infrastructure development in emerging markets, where urbanization and rising disposable incomes are driving food retail expansion.

Manufacturers are focusing on energy efficiency, advanced temperature control, and environmentally compliant refrigerants to align with regulatory frameworks and operational cost objectives. Market competition is influenced by innovation in design, enhanced storage capacity, and digital monitoring capabilities that improve operational efficiency.

Future growth is expected to be driven by increasing adoption of modular and customizable solutions, integration of IoT-based maintenance systems, and the transition toward eco-friendly refrigerants in response to global sustainability initiatives With a well-established distribution network and rising emphasis on reducing food waste, the sector is positioned for sustained revenue expansion and broader technological adoption over the forecast period.

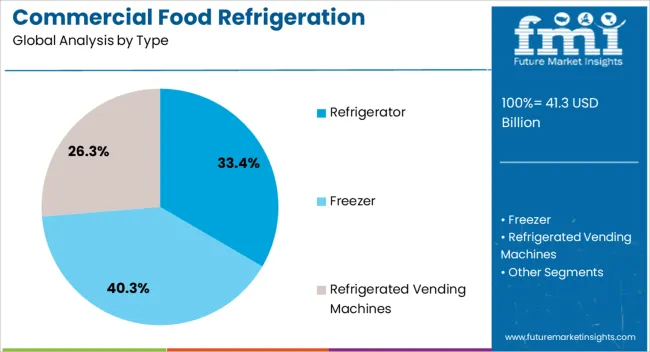

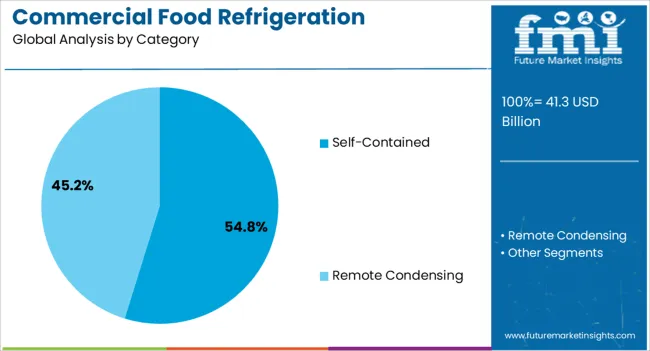

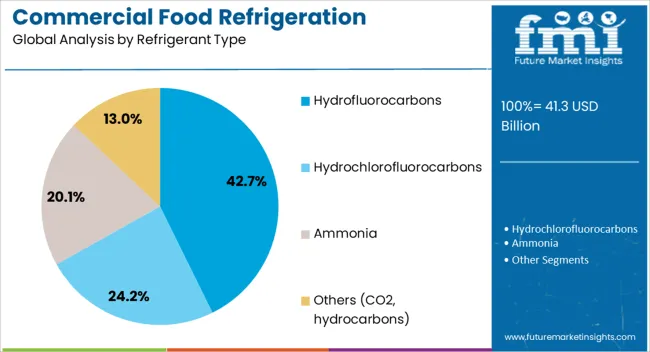

The commercial food refrigeration equipment market is segmented by type, category, refrigerant type, application, distribution channel, and geographic regions. By type, the commercial food refrigeration equipment market is divided into refrigerators, freezers, and Refrigerated Vending Machines. In terms of category, the commercial food refrigeration equipment market is classified into Self-Contained and Remote Condensing. Based on refrigerant type, the commercial food refrigeration equipment market is segmented into Hydrofluorocarbons, Hydrochlorofluorocarbons, Ammonia, and Others (CO2, hydrocarbons).

By application, commercial food refrigeration equipment market is segmented into Food Retail, Food Distribution, Food Production, Others (Manufacturing facilities, agriculture etc.), and Food Service. By distribution channel, commercial food refrigeration equipment market is segmented into Direct and Indirect. Regionally, the commercial food refrigeration equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The refrigerator segment, holding 33.4% of the type category, is leading the market due to its critical role in preserving perishable food items across a wide range of commercial applications. Demand has been reinforced by consistent requirements from supermarkets, restaurants, and institutional kitchens, where reliability and consistent temperature control are essential.

Technological improvements in compressor efficiency and insulation have enhanced performance, reducing operational costs and supporting compliance with energy standards. Manufacturers are leveraging design innovations to improve space utilization and offer flexible configurations, which has further strengthened the segment’s appeal.

The segment’s resilience is maintained through its necessity in both new installations and replacement cycles, ensuring recurring demand. Increasing awareness of food safety and waste reduction has further supported adoption rates, while long-term growth prospects are underpinned by integration of smart controls and predictive maintenance systems, enhancing operational reliability and lifecycle performance.

The self-contained segment, accounting for 54.8% of the category share, has secured dominance by offering ease of installation, compact design, and operational flexibility. Its integrated structure eliminates the need for remote condensing units, reducing installation complexity and upfront costs, making it a preferred choice for small and medium-sized commercial kitchens.

Demand has been supported by the growing trend toward modular kitchen layouts, where mobility and adaptability are prioritized. Energy-efficient models with improved airflow and temperature regulation have strengthened the segment’s competitive position, while maintenance convenience has further encouraged adoption.

The market share of self-contained units is sustained by replacement demand in high-turnover foodservice environments, and advancements in noise reduction and compact refrigeration systems are expanding application potential. As energy regulations tighten and sustainability initiatives advance, manufacturers are introducing environmentally friendly refrigerants and higher-efficiency compressors, ensuring continued preference for self-contained units in diverse commercial settings.

The hydrofluorocarbons (HFCs) segment, representing 42.7% of the refrigerant type category, maintains its lead due to its widespread compatibility with existing refrigeration systems and reliable thermodynamic performance. Adoption is supported by its proven cooling efficiency, stability, and safety profile, which have been critical in maintaining consistent product preservation across the foodservice sector.

The segment’s current dominance is influenced by the extensive installed base of HFC-compatible systems, making it the default choice for many replacement and maintenance projects. While regulatory pressures are promoting a shift toward low-global-warming-potential alternatives, transitional demand for HFCs remains steady as operators plan phased equipment upgrades.

Manufacturers are focusing on optimizing HFC systems to meet interim efficiency targets and reduce leakage rates, ensuring compliance while maintaining operational reliability. Over the forecast period, gradual regulatory transitions, combined with infrastructure adaptation timelines, are expected to sustain market relevance for HFCs, particularly in cost-sensitive and retrofit-driven applications.

The commercial food refrigeration equipment market is driven by demand for processed foods, strict food safety norms, retail expansion, and cost efficiency requirements. These dynamics highlight refrigeration as a backbone of modern food supply chains globally

The commercial food refrigeration equipment market is projected to expand steadily, driven by the rising global demand for processed, frozen, and ready-to-eat foods. Restaurants, quick-service chains, hypermarkets, and supermarkets increasingly rely on advanced cold storage to ensure longer shelf life and preserve product quality. With urban lifestyles fueling dining out trends and fast-paced consumption patterns, the demand for reliable refrigeration equipment has surged in both developed and emerging economies. Additionally, the global trade of perishable products such as meat, seafood, dairy, and fresh produce requires robust cold chain infrastructure, further accelerating adoption. As consumer preferences evolve toward convenience-driven food choices, refrigeration systems play an essential role in ensuring consistent supply, safety, and freshness across regions.

Regulatory compliance is a critical market driver, as governments and food authorities worldwide impose stringent rules to maintain hygiene and prevent spoilage. Standards related to temperature control, storage handling, and contamination prevention directly influence equipment design, performance, and certification requirements. Businesses in the foodservice, retail, and hospitality industries must invest in high-quality refrigeration systems to meet these benchmarks and avoid penalties. Failure to comply not only risks financial loss but also damages brand reputation. This dynamic has created consistent demand for efficient, reliable systems that guarantee food safety across diverse environments. As regulations tighten, manufacturers gain opportunities by offering solutions tailored to sector-specific guidelines, ensuring businesses remain competitive and compliant in a highly regulated landscape.

The expansion of restaurants, cafés, supermarkets, and food retail outlets significantly drives demand for commercial food refrigeration equipment worldwide. Quick-service restaurant chains, particularly in Asia-Pacific and North America, require high-capacity refrigeration to manage large volumes and serve increasing consumer traffic. Simultaneously, growing supermarket and hypermarket networks necessitate display and storage units capable of maintaining diverse temperature zones for fresh and frozen products. E-commerce grocery delivery services are also creating new refrigeration needs, especially for last-mile storage hubs. With growing consumer expectations for product freshness and variety, the need for robust, large-scale refrigeration solutions continues to rise. This infrastructure expansion across foodservice and retail highlights refrigeration as an operational backbone supporting modern consumer supply chains.

Operational cost control has emerged as a significant market dynamic, with businesses actively seeking refrigeration equipment that balances efficiency and long-term performance. Refrigeration systems are among the largest contributors to energy consumption in food retail and service sectors. As a result, operators prioritize solutions that minimize electricity usage while delivering consistent cooling capacity. In addition to direct energy costs, maintenance, repair, and downtime impact overall profitability, pushing demand for durable systems with lower lifecycle expenses. Manufacturers are addressing these cost concerns by optimizing system design and offering customizable solutions for different operational scales. This ongoing focus on cost-effectiveness ensures that refrigeration equipment remains a strategic investment for businesses aiming to balance quality, safety, and financial sustainability.

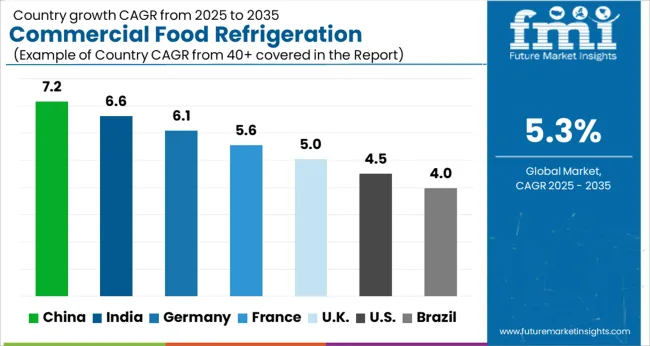

| Country | CAGR |

|---|---|

| China | 7.2% |

| India | 6.6% |

| Germany | 6.1% |

| France | 5.6% |

| UK | 5.0% |

| USA | 4.5% |

| Brazil | 4.0% |

The global commercial food refrigeration equipment market is projected to grow at a CAGR of 5.3% from 2025 to 2035. China leads expansion at 7.2%, followed by India at 6.6%, Germany at 6.1%, the UK at 5.0%, and the USA at 4.5%. Growth is driven by surging demand for processed and frozen foods, the expansion of supermarkets and hypermarkets, and stricter food safety standards across both developed and emerging economies. China and India are accelerating adoption due to rapid retail infrastructure growth and rising cold chain investments, while Germany and the UK emphasize compliance with stringent storage regulations. The USA continues to expand through innovations in foodservice operations and the strengthening of distribution networks. The analysis covers 40+ countries, with the leading markets detailed below.

The commercial food refrigeration equipment market in China is forecasted to expand at a CAGR of 7.2% from 2025 to 2035, supported by strong growth in retail, foodservice, and cold chain logistics. Rising demand for frozen and packaged foods, coupled with government-backed investments in food safety and storage infrastructure, is a key market driver. Domestic manufacturers are innovating with energy-efficient designs and automation, while international players are expanding partnerships for wider distribution. The shift toward advanced supermarket and hypermarket chains, along with e-commerce-driven cold chain expansion, strengthens adoption across urban and semi-urban regions.

The commercial food refrigeration equipment market in India is anticipated to grow at a CAGR of 6.6% from 2025 to 2035, fueled by rapid urbanization, the growth of quick-service restaurants, and the expansion of modern retail chains. The rise of online grocery platforms and food delivery services is significantly boosting cold storage demand. Government initiatives supporting cold chain infrastructure development are enhancing equipment adoption, while rising disposable incomes drive demand for high-quality packaged foods. Domestic manufacturing is expanding under “Make in India,” with global players investing in joint ventures to cater to local needs.

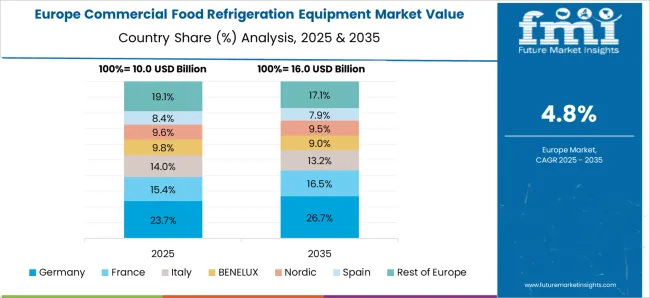

Germany’s commercial food refrigeration equipment market is expected to advance at a CAGR of 6.1% between 2025 and 2035, driven by stringent EU food safety regulations and consumer preference for fresh and frozen food. Foodservice operators are increasingly adopting advanced refrigeration technologies to meet efficiency and compliance requirements. Retailers and supermarkets are investing in sustainable storage solutions and automated display refrigeration systems. Innovation in refrigeration design, energy-saving equipment, and digital monitoring tools are gaining traction, with domestic manufacturers collaborating closely with EU suppliers to enhance efficiency and sustainability.

The UK market for commercial food refrigeration equipment is forecast to expand at a CAGR of 5.0% from 2025 to 2035, supported by the growing foodservice sector and modernization of retail infrastructure. Rising demand for ready-to-eat meals and packaged food, combined with government focus on food safety compliance, is strengthening adoption. Supermarkets and convenience stores are upgrading refrigeration units to advanced, efficient models, while restaurants and catering services invest in compact and cost-effective solutions. Import dependence remains high, but local distributors and service providers are increasing their presence to ensure faster delivery and maintenance support.

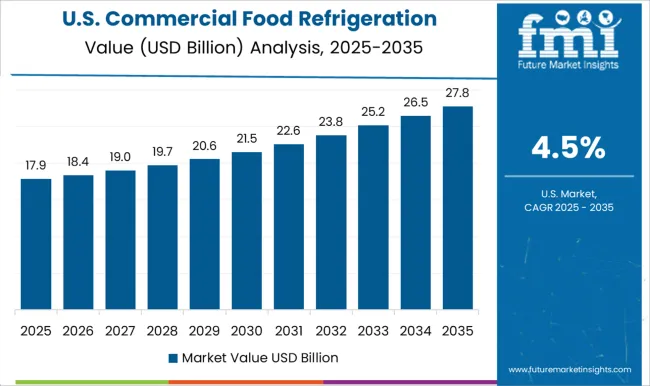

The USA commercial food refrigeration equipment market is projected to grow at a CAGR of 4.5% between 2025 and 2035, driven by expansion in foodservice operations and increasing demand for energy-efficient solutions. Restaurants, hotels, and institutional kitchens are adopting advanced refrigeration systems to reduce operational costs and meet environmental regulations. Growth in frozen food consumption and e-commerce-led grocery delivery services also adds momentum to equipment demand. Domestic manufacturers emphasize high-quality production, while international companies strengthen their USA presence with innovative designs and extended service networks.

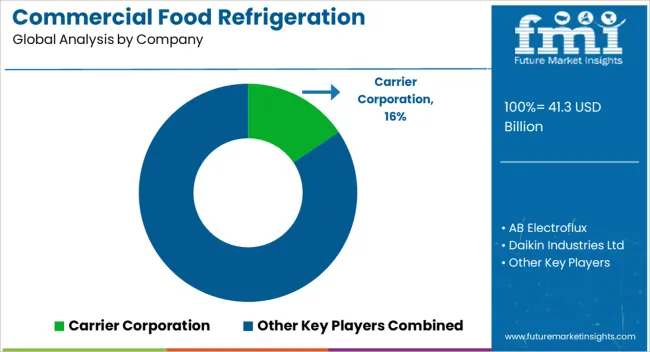

Competition in the commercial food refrigeration equipment market is driven by energy efficiency, regulatory compliance, and advanced cooling technologies tailored for food safety and storage. Carrier Corporation and Daikin Industries Ltd lead globally, offering large-scale refrigeration systems with digital monitoring, eco-friendly refrigerants, and integrated service networks. Johnson Controls International Plc and Emerson Electric Co focus on smart refrigeration solutions, emphasizing IoT integration, energy optimization, and predictive maintenance tools for supermarkets, restaurants, and cold chain facilities. United Technologies Corporation and GEA Group AG differentiate with large-scale industrial refrigeration and customized turnkey solutions, particularly for food processing and storage hubs.

Dover Corporation, Frigoglass SAIC, and Hussmann Corporation maintain strong positions in retail refrigeration, delivering display cases, vending systems, and cold storage cabinets tailored for supermarkets, hypermarkets, and convenience stores. Liebherr Group and Epta Corporation are recognized for their innovation in modular refrigeration systems and sustainable designs, aligning with global efficiency mandates. Hoshizaki and Ugur Sogutma Makinalari Sanayi cater to niche segments such as compact refrigeration for foodservice operators and small businesses, while Fujimark Corporation and AB Electroflux build regional competitiveness through cost-effective, durable solutions. Competitive strategies highlight modular product design, lifecycle cost reduction, and compliance with refrigerant transition mandates.

| Item | Value |

|---|---|

| Quantitative Units | USD 41.3 Billion |

| Type | Refrigerator, Freezer, and Refrigerated Vending Machines |

| Category | Self-Contained and Remote Condensing |

| Refrigerant Type | Hydrofluorocarbons, Hydrochlorofluorocarbons, Ammonia, and Others (CO2, hydrocarbons) |

| Application | Food Retail, Food Distribution, Food Production, Others (Manufacturing facilities, agriculture etc.), and Food Service |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Carrier Corporation, AB Electroflux, Daikin Industries Ltd, Dover Corporation, Emerson Electric Co, Frigoglass SAIC, Fujimark Corporation, GEA Group AG, Hussmann Corporation, Johnson Controls International Plc, United Technologies Corporation, Liebherr Group, Epta Corporation, Ugur Sogutma Makinalari Sanayi, and Hoshizaki |

| Additional Attributes | Dollar sales, share, and growth projections across regions and product categories, they would seek competitor benchmarking, pricing trends, and distribution channel performance to identify gaps and opportunities. |

The global commercial food refrigeration equipment market is estimated to be valued at USD 41.3 billion in 2025.

The market size for the commercial food refrigeration equipment market is projected to reach USD 69.2 billion by 2035.

The commercial food refrigeration equipment market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in commercial food refrigeration equipment market are refrigerator, walk in refrigerator, commercial reach in refrigerator, under/top counter refrigerator, reach in refrigerator, merchandiser and display refrigerator, freezer, blast freezer, contact freezer, refrigerated vending machines, display cases/show cases and others (ice machine, ice cream machine etc.).

In terms of category, self-contained segment to command 54.8% share in the commercial food refrigeration equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Electric Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA