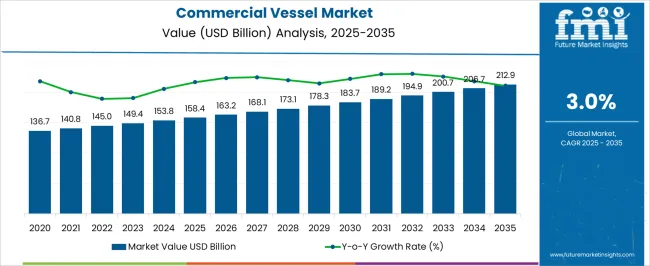

The global commercial vessel market is anticipated to expand from USD 158.8 billion in 2025 to USD 212.9 billion by 2035, reflecting a CAGR of 3.0%. Inflection point mapping reveals specific phases where the trajectory of market growth shifts due to changing trade patterns, fleet renewal cycles, and regulatory developments affecting shipbuilding and marine operations. Between 2025 and 2027, moderate growth momentum is expected, as new vessel orders gradually rise to replace aging fleets and accommodate steady global trade flows.

A notable inflection point emerges around 2028–2029, when increasing investments in fuel-efficient designs, LNG-powered ships, and retrofitting projects accelerate demand, especially from major shipping lines seeking cost optimization. From 2030 to 2032, growth stabilizes as order backlogs are fulfilled and shipyards face limited capacity expansions, leading to a short-term plateau effect in deliveries.

A second inflection point emerges during 2033–2034, as the development of emerging maritime trade routes, infrastructure improvements in Asian ports, and rising demand for container and bulk carriers stimulate new vessel construction activity. By 2035, the market is expected to reach USD 212.9 billion, driven by long-term replacement cycles and modernization efforts, although overall momentum is expected to remain steady rather than steep.

| Metric | Value |

|---|---|

| Commercial Vessel Market Estimated Value in (2025 E) | USD 158.4 billion |

| Commercial Vessel Market Forecast Value in (2035 F) | USD 212.9 billion |

| Forecast CAGR (2025 to 2035) | 3.0% |

The commercial vessel market is strongly influenced by five interconnected parent markets, each contributing uniquely to overall demand and growth. The cargo vessels market holds the largest share at 38%, driven by expanding global trade and the continuous need to transport bulk commodities, containerized goods, and general cargo across international routes. The tanker vessels market contributes 30%, as the transport of crude oil, refined petroleum products, liquefied natural gas (LNG), and chemicals remains essential to global energy supply chains. The offshore support and specialized vessels market accounts for 15%, supported by rising offshore oil and gas activities, marine infrastructure projects, and offshore wind energy developments requiring supply, maintenance, and service vessels.

The passenger vessels market holds a 10% share, fueled by the growth of coastal transportation, ferry services, and the revival of cruise tourism across major coastal economies. The fishing and aquaculture vessels market represents 7%, driven by rising seafood consumption, modernized fishing fleets, and expanding aquaculture operations aimed at improving efficiency and compliance with international maritime standards.

The commercial vessel market is experiencing steady growth, driven by the rising demand for efficient maritime transportation, energy transition initiatives, and global trade expansion. Increasing international trade volumes are influencing investments in modern fleet expansion and replacement of aging vessels with more fuel-efficient and technologically advanced ships. Growing environmental regulations and carbon emission standards are accelerating the adoption of alternative fuel types such as liquefied natural gas and other low-emission propulsion technologies.

Rising demand for logistics optimization and cargo transport efficiency is also encouraging the development of specialized vessel types designed for specific trade routes and cargo types. Technological advancements in ship design, including digital monitoring systems, fuel-efficient engines, and advanced hull structures, are improving operational performance and reducing lifecycle costs.

With continued growth in e-commerce, global supply chains, and offshore energy projects, the market is positioned to benefit from both new build and retrofitting activities The integration of environmentally sustainable fuels and smart navigation technologies is expected to further reinforce growth opportunities over the forecast period.

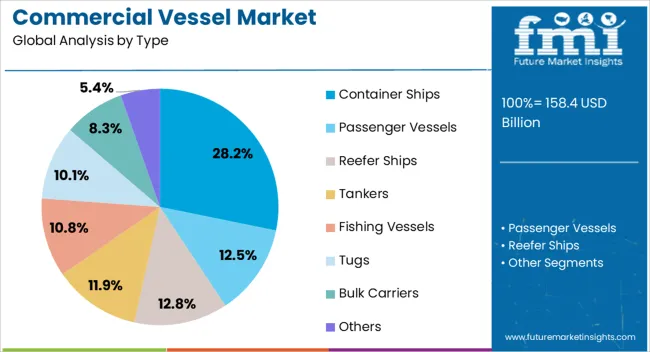

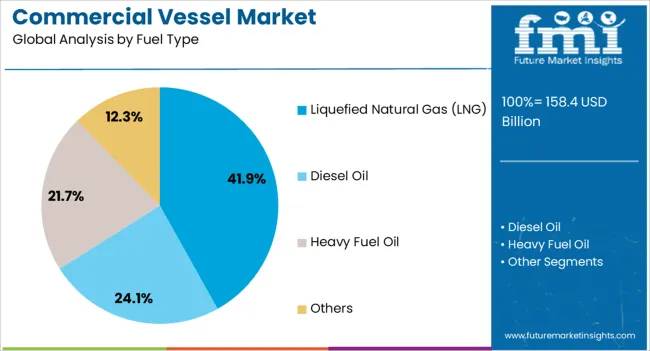

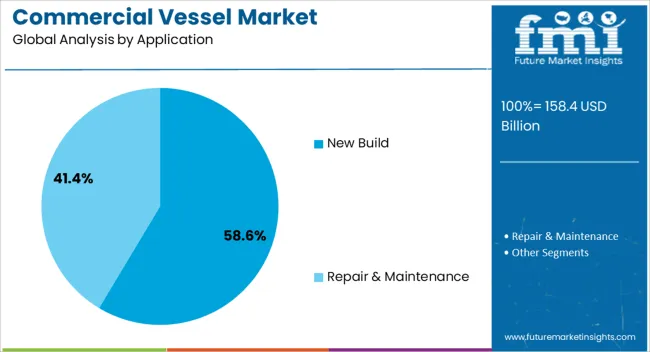

The commercial vessel market is segmented by type, fuel type, application, and geographic regions. By type, commercial vessel market is divided into Container Ships, Passenger Vessels, Reefer Ships, Tankers, Fishing Vessels, Tugs, Bulk Carriers, and Others. In terms of fuel type, commercial vessel market is classified into Liquefied Natural Gas (LNG), Diesel Oil, Heavy Fuel Oil, and Others. Based on application, commercial vessel market is segmented into New Build and Repair & Maintenance. Regionally, the commercial vessel industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The container ships segment is projected to hold 28.2% of the commercial vessel market revenue share in 2025, making it the leading vessel type. This leadership is being driven by the continued expansion of global trade and the growing demand for high-capacity cargo transportation. Container ships offer standardized cargo handling, rapid loading and unloading capabilities, and compatibility with intermodal transport systems, which enhances operational efficiency.

The segment benefits from increasing investments in port infrastructure and terminal automation, which improve turnaround times and reduce operational bottlenecks. Rising e-commerce volumes and just-in-time delivery models are further reinforcing the need for container vessels capable of transporting large quantities of goods across international shipping lanes.

Additionally, technological innovations in hull design, propulsion efficiency, and digital monitoring systems are enhancing fuel efficiency, reducing operational costs, and supporting regulatory compliance These factors collectively contribute to the container ships segment maintaining its leadership position within the commercial vessel market.

The liquefied natural gas fuel type segment is anticipated to account for 41.9% of the commercial vessel market revenue share in 2025, establishing it as the leading fuel type category. This growth is being driven by increasing environmental regulations, stricter emissions standards, and the global shift toward cleaner maritime fuels.

LNG-powered vessels offer lower carbon dioxide, sulfur oxide, and nitrogen oxide emissions compared with conventional heavy fuel oil engines, making them compliant with International Maritime Organization requirements. Adoption of LNG fuel is being facilitated by expanding bunkering infrastructure at key ports and growing investments by shipowners in dual-fuel and LNG-ready vessels.

The segment’s rise is also supported by technological advancements in LNG storage, engine performance, and energy efficiency, which reduce operational costs while maintaining high performance As global trade volumes expand and environmental concerns intensify, LNG is expected to remain the dominant alternative fuel choice, encouraging widespread deployment across new vessel builds and retrofitting projects.

The new build application segment is expected to hold 58.6% of the commercial vessel market revenue share in 2025, positioning it as the dominant application category. This leadership is being driven by increasing global demand for modern, fuel-efficient, and environmentally compliant vessels to replace aging fleets.

New build vessels enable adoption of the latest propulsion systems, energy-saving designs, digital monitoring technologies, and alternative fuel solutions such as LNG, supporting long-term operational efficiency. Shipowners are prioritizing new builds to meet expanding trade volumes, ensure regulatory compliance, and leverage technological advancements that cannot be easily integrated into existing vessels.

The segment is further supported by rising investment in specialized ships designed for container transport, bulk carriers, and other cargo types, ensuring enhanced capacity and operational reliability As international trade and maritime logistics continue to grow, the preference for new build vessels is expected to remain strong, reinforcing their dominant market share and enabling fleet modernization initiatives worldwide.

The commercial vessel market is expanding due to rising global trade, maritime logistics, and offshore operations. Regulatory compliance from the International Maritime Organization drives investments in safety-compliant and low-emission vessels. Advancements in shipbuilding, propulsion systems, and onboard automation improve fuel efficiency, operational reliability, and cargo handling. Offshore exploration, coastal trade, and specialized cargo shipping offer additional growth prospects. Shipping operators are upgrading fleets to increase carrying capacity, ensure regulatory compliance, and achieve better voyage economics.

The commercial vessel market is witnessing steady growth driven by expanding global trade volumes and cross-border shipping activities. Rising demand for container ships, bulk carriers, and tankers is fueled by international trade of manufactured goods, energy resources, and raw materials. Expanding e-commerce networks and growing import-export operations are pushing shipping companies to invest in modern fleets with greater carrying capacity. Port infrastructure upgrades and new shipping routes are further stimulating vessel procurement. Market participants are focusing on fuel-efficient and large-capacity ships to enhance operational profitability and meet growing demand from logistics providers, commodity traders, and shipping operators.

Strict maritime regulations and safety standards are shaping the operational dynamics of the commercial vessel market. International conventions by International Maritime Organization mandate compliance with safety, emissions, and operational protocols. Regulations concerning ballast water treatment, sulfur emissions, and marine pollution prevention directly influence vessel design and operational costs. Shipowners are compelled to invest in modern equipment and compliant machinery to meet certification requirements. Adhering to safety guidelines ensures lower liability risks and better insurance coverage, while compliance boosts acceptance in international shipping lanes. Regulatory adherence remains a decisive factor for maintaining competitiveness and operational continuity.

Ongoing advancements in shipbuilding techniques, hull designs, and propulsion systems are influencing the commercial vessel market positively. Modern construction methods enhance structural strength, reduce maintenance costs, and increase vessel lifespan. Innovations in propulsion technologies such as hybrid systems, LNG-powered engines, and energy-efficient hull coatings are helping operators reduce fuel consumption and improve voyage economics. Automation and digital monitoring solutions are improving navigational accuracy, cargo handling efficiency, and fleet management. These advancements enhance operational reliability and lower downtime, making vessels more cost-effective and appealing to global shipping operators seeking competitive advantages.

The commercial vessel market is experiencing growth from expanding offshore activities and marine logistics operations. Offshore oil and gas exploration, subsea construction, and renewable energy installations are increasing demand for support vessels, anchor handlers, and platform supply ships. Growing inter-island and coastal trade is creating opportunities for small and medium cargo vessels. Expansion of global supply chains and cold chain logistics is supporting demand for specialized ships such as reefer vessels and LNG carriers. Shipping companies are partnering with logistics firms and energy operators to expand service portfolios and capture emerging market opportunities across maritime sectors.

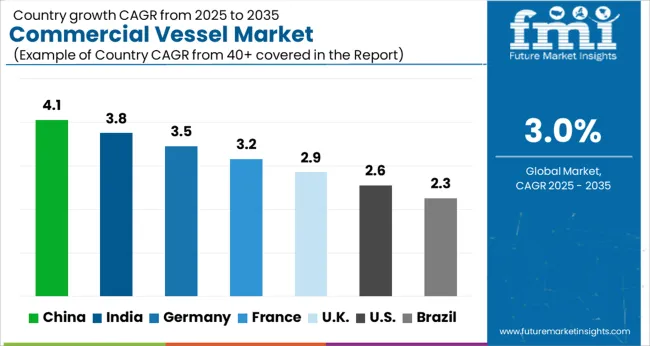

| Country | CAGR |

|---|---|

| China | 4.1% |

| India | 3.8% |

| Germany | 3.5% |

| France | 3.2% |

| UK | 2.9% |

| USA | 2.6% |

| Brazil | 2.3% |

The global commercial vessel market is projected to grow at a CAGR of 3.0% from 2025 to 2035. China leads expansion at 4.1%, followed by India at 3.8%, Germany at 3.5%, the UK at 2.9%, and the USA at 2.6%. Growth is supported by rising seaborne trade, expansion of maritime logistics networks, and increasing demand for energy-efficient ship designs. China and India drive large-scale shipbuilding and fleet expansion due to strong export-oriented industries and growing regional trade, while Germany, the UK, and the USA focus on advanced vessel engineering, compliance with international maritime standards, and modernization of existing fleets. The analysis includes over 40 countries, with the leading markets detailed below.

The commercial vessel market in China is projected to grow at a CAGR of 4.1% from 2025 to 2035, driven by increasing maritime trade, port infrastructure expansion, and rising demand for cargo and container ships. The country’s shipbuilding industry is among the largest globally, and domestic yards are investing in advanced vessel designs, automation systems, and fuel-efficient propulsion technologies. Demand for bulk carriers, tankers, and specialized cargo vessels continues to rise as China strengthens its export-oriented economy. Government initiatives to upgrade inland waterways and coastal shipping routes are accelerating procurement of modern vessels. Collaborations with global marine technology providers are helping local shipyards adopt advanced navigation systems, digital monitoring, and green fuel integration.

The commercial vessel market in India is expected to grow at a CAGR of 3.8% from 2025 to 2035, supported by rising seaborne trade, coastal shipping, and inland waterway development. Demand for cargo vessels, tankers, and passenger ferries is increasing with the growth of industrial production and exports. Domestic shipyards are upgrading capabilities to manufacture larger, more efficient vessels with advanced propulsion and navigation systems. Government initiatives such as Sagarmala are fostering investments in ports, shipbuilding clusters, and maritime logistics infrastructure. Collaborations with global marine engineering firms are enabling technology transfer, skill development, and adoption of environmentally compliant designs. The focus on enhancing coastal trade, reducing logistics costs, and improving shipping efficiency is contributing to steady market growth.

Germany’s commercial vessel market is projected to grow at a CAGR of 3.5% from 2025 to 2035, driven by demand for container ships, tankers, and offshore support vessels. The country has a strong maritime engineering base, with shipyards focusing on advanced designs, automation, and energy-efficient propulsion systems. Growth in European maritime trade and port modernization projects is fueling vessel demand. Manufacturers are investing in hybrid propulsion, alternative fuels, and digital fleet management systems to meet EU environmental regulations. Collaborations with international marine technology firms are enhancing R&D, production efficiency, and vessel performance. The market benefits from Germany’s strong logistics sector, which requires reliable and specialized vessels for cargo and offshore operations.

The commercial vessel market in the UK is expected to grow at a CAGR of 2.9% from 2025 to 2035, supported by increasing maritime logistics, coastal trade, and port development activities. Demand for ferries, cargo ships, and offshore service vessels is growing with the expansion of offshore energy projects and cross-border trade. Domestic shipbuilders are focusing on modular designs, improved fuel efficiency, and integration of digital monitoring systems. Collaborations with global shipbuilding and marine engineering firms are enabling the adoption of advanced propulsion technologies and environmentally friendly vessel designs. Investments in modernizing port infrastructure and enhancing maritime supply chains are encouraging the procurement of new vessels, particularly for coastal and short-sea routes.

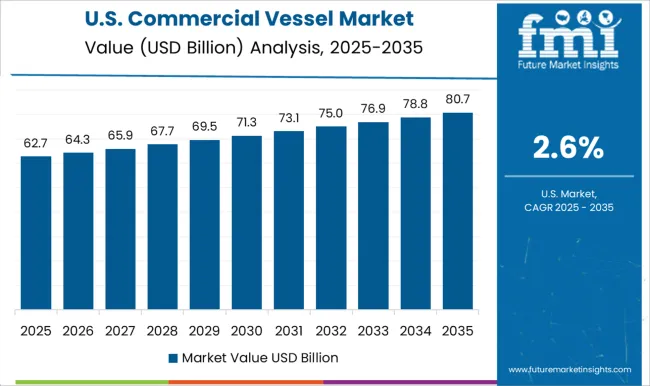

The commercial vessel market in the US is projected to grow at a CAGR of 2.6% from 2025 to 2035, driven by demand for cargo vessels, tankers, and offshore support ships. The expansion of maritime logistics, coastal shipping, and offshore energy exploration is fueling vessel construction. Domestic shipyards are investing in automation, advanced materials, and hybrid propulsion technologies to meet industry requirements. Government programs supporting inland waterways, port modernization, and maritime workforce development are creating favorable conditions for vessel production. Collaborations with global marine technology providers are helping integrate advanced navigation, safety, and monitoring systems. The growth of e-commerce and intermodal logistics networks is indirectly boosting demand for efficient commercial shipping fleets.

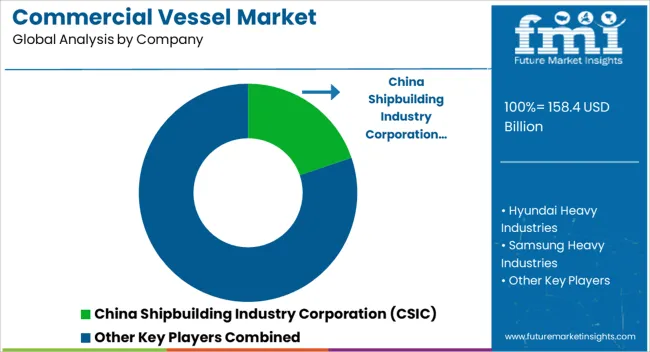

Competition in the commercial vessel market is defined by shipbuilding capacity, fuel efficiency, and compliance with international maritime regulations. China Shipbuilding Industry Corporation (CSIC) leads with large-scale production of container ships, bulk carriers, and tankers, emphasizing cost-effective construction, integrated supply chains, and global export reach. Hyundai Heavy Industries and Samsung Heavy Industries compete with technologically advanced vessels offering improved fuel efficiency, LNG propulsion systems, and enhanced automation for navigation and cargo handling. Daewoo Shipbuilding & Marine Engineering differentiates through specialization in LNG carriers, offshore support vessels, and ultra-large container ships, focusing on engineering precision, safety systems, and digital monitoring technologies. Other major players, such as Fincantieri, Guangzhou Shipyard International, and Mitsui O.S.K. Lines (MOL), compete through diverse portfolios that include passenger vessels, ferries, Ro-Ro vessels, and multipurpose cargo ships. Fincantieri emphasizes design flexibility, onboard systems integration, and energy-efficient propulsion for cruise ships and passenger ferries.

Guangzhou Shipyard International targets mid-sized cargo vessels and multipurpose ships, focusing on cost efficiency, shorter lead times, and competitive pricing. Mitsui O.S.K. Lines operates as a major ship operator and charterer, boasting a diverse fleet that leverages global logistics networks, operational reliability, and long-term charter contracts. Strategies focus on integrating LNG and hybrid propulsion, optimizing hull design to reduce drag, and deploying digital twins and condition-monitoring systems to enhance operational efficiency. Partnerships with component suppliers, port operators, and logistics firms are leveraged to ensure timely delivery and long-term service contracts. Companies also emphasize turnkey solutions covering vessel design, construction, retrofitting, and lifecycle support.

| Item | Value |

|---|---|

| Quantitative Units | USD 158.4 Billion |

| Type | Container Ships, Passenger Vessels, Reefer Ships, Tankers, Fishing Vessels, Tugs, Bulk Carriers, and Others |

| Fuel Type | Liquefied Natural Gas (LNG), Diesel Oil, Heavy Fuel Oil, and Others |

| Application | New Build and Repair & Maintenance |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | China Shipbuilding Industry Corporation (CSIC), Hyundai Heavy Industries, Samsung Heavy Industries, Daewoo Shipbuilding & Marine Engineering, Fincantieri, Guangzhou Shipyard International, and Mitsui O.S.K. Lines (MOL) |

| Additional Attributes | Dollar sales by vessel type (cargo, tanker, passenger, fishing) and size, share by region and operation segment, growth trends, maritime regulations, fuel efficiency, emerging propulsion systems, and competitive positioning. |

The global commercial vessel market is estimated to be valued at USD 158.4 billion in 2025.

The market size for the commercial vessel market is projected to reach USD 212.9 billion by 2035.

The commercial vessel market is expected to grow at a 3.0% CAGR between 2025 and 2035.

The key product types in commercial vessel market are container ships, passenger vessels, reefer ships, tankers, fishing vessels, tugs, bulk carriers and others.

In terms of fuel type, liquefied natural gas (lng) segment to command 41.9% share in the commercial vessel market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial and Industrial Rotating Rack Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Baking Rack Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Blast Freezer Market Size and Share Forecast Outlook 2025 to 2035

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA