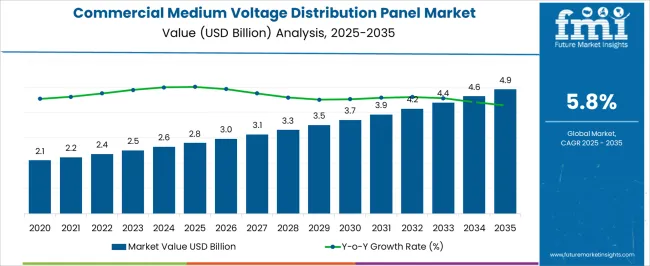

The commercial medium voltage distribution panel market is projected to grow from USD 2.8 billion in 2025 to USD 4.9 billion by 2035, registering a CAGR of 5.8% during the forecast period. Between 2025 and 2030, the market is expected to rise from USD 2.8 billion to USD 3.7 billion, driven by increasing demand for efficient electrical distribution systems in commercial and industrial infrastructure. Year-on-year analysis shows steady growth, with values reaching USD 3.0 billion in 2026 and USD 3.1 billion in 2027, supported by expanding urbanization, infrastructure development, and upgrading of electrical networks. By 2028, the market is forecasted to reach USD 3.3 billion, advancing to USD 3.5 billion in 2029 and USD 3.7 billion by 2030. Growth will be further fueled by the rising adoption of smart grid technologies, renewable energy integration, and energy-efficient distribution solutions. These dynamics position the commercial medium voltage distribution panel market as a critical component in modernizing electrical infrastructure, with ample opportunities for innovation in sustainability and power management technologies.

| Metric | Value |

|---|---|

| Commercial Medium Voltage Distribution Panel Market Estimated Value in (2025 E) | USD 2.8 billion |

| Commercial Medium Voltage Distribution Panel Market Forecast Value in (2035 F) | USD 4.9 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

The commercial medium voltage distribution panel market is expanding steadily as demand for efficient and reliable power distribution systems increases across commercial buildings and facilities. The need to upgrade aging electrical infrastructure and accommodate higher power loads is driving investments in modern distribution panels.

Safety regulations and standards are becoming more stringent, requiring advanced panel designs that ensure protection against electrical faults and overloads. Innovations in panel construction, including improved insulation and modular configurations, are enhancing installation flexibility and system scalability.

The rising adoption of smart building technologies and energy management systems is also fueling market growth by integrating distribution panels with digital monitoring capabilities. As commercial real estate development continues globally, the market outlook remains positive. Segment growth is expected to be led by flush mounting panels due to their space-saving design and ease of integration with building architecture.

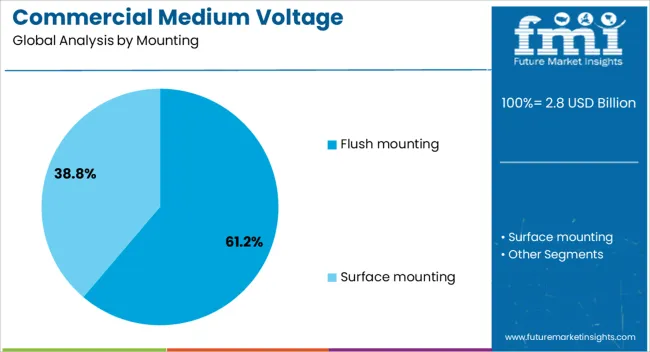

The commercial medium voltage distribution panel market is segmented by mounting, and geographic regions. By mounting of the commercial medium voltage distribution panel market is divided into Flush mounting and Surface mounting. Regionally, the commercial medium voltage distribution panel industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The flush mounting segment is projected to account for 61.2% of the commercial medium voltage distribution panel market revenue in 2025, securing its place as the leading mounting type. This segment’s popularity is driven by the growing preference for distribution panels that can be seamlessly integrated into walls and architectural finishes without protruding elements.

Flush mounting panels offer space efficiency and aesthetic advantages, especially in commercial environments where clean and unobtrusive electrical installations are desired. The design allows for easier access during maintenance while maintaining safety and regulatory compliance.

Furthermore, construction trends favoring compact and modular electrical solutions have supported the adoption of flush mounting panels. As commercial buildings increasingly focus on streamlined interiors and optimal space utilization, flush mounting is expected to remain the dominant mounting style.

The commercial medium voltage distribution panel market is driven by increasing demand for reliable power distribution in expanding commercial buildings and infrastructure projects. Opportunities in smart grid integration and automation are reshaping the market, while challenges related to high costs and maintenance complexity remain. By 2025, overcoming these barriers through affordable solutions and improved technology will be essential for continued market growth.

The commercial medium voltage distribution panel market is growing due to the rising demand for reliable and efficient power distribution systems in commercial buildings. These panels ensure the safe and efficient distribution of electrical power, protecting equipment and reducing downtime. As businesses and industries expand globally, the need for reliable electrical infrastructure becomes critical. By 2025, this demand for efficient power distribution systems in commercial environments will continue driving the market's growth.

Opportunities in the commercial medium voltage distribution panel market are expanding with the growth of commercial construction and infrastructure projects. As commercial buildings and complexes grow larger and more energy-intensive, the need for robust power distribution systems is increasing. Furthermore, developments in retail, hospitality, and office buildings are pushing demand for advanced panels that can support high-energy consumption and smart building systems. By 2025, these opportunities will continue to fuel market growth, particularly in developing regions.

Emerging trends in the commercial medium voltage distribution panel market include the growing integration of smart grid technology and automation. These panels are increasingly being equipped with digital monitoring systems that allow for real-time tracking and management of power distribution. Smart features enable efficient load balancing, fault detection, and improved energy management. By 2025, these advanced features are expected to dominate the market as businesses demand more intelligent and efficient power distribution solutions.

Despite market growth, challenges such as high initial costs and maintenance complexity persist. The upfront cost of installing medium voltage distribution panels, especially those with advanced features, can be significant for small businesses or in regions with tight budgets. Additionally, maintaining these systems requires skilled personnel and specialized equipment, increasing operational costs. By 2025, addressing these challenges through cost-effective solutions and streamlined maintenance processes will be crucial for broader market adoption.

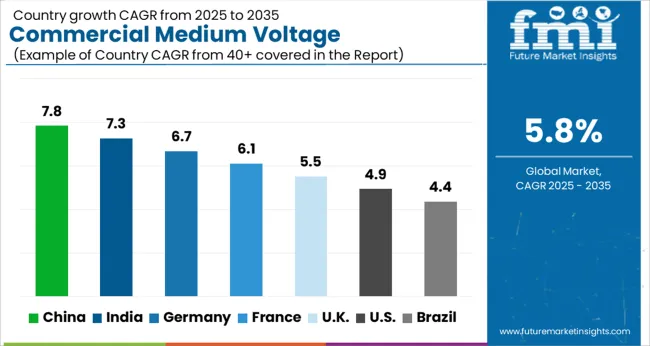

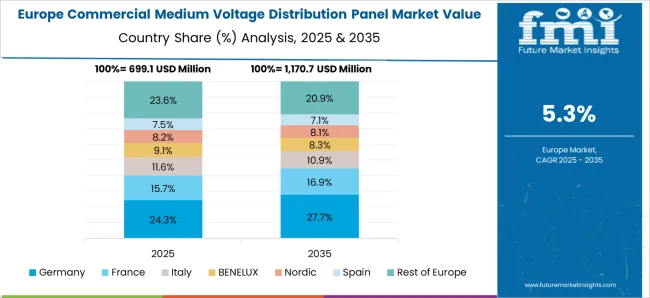

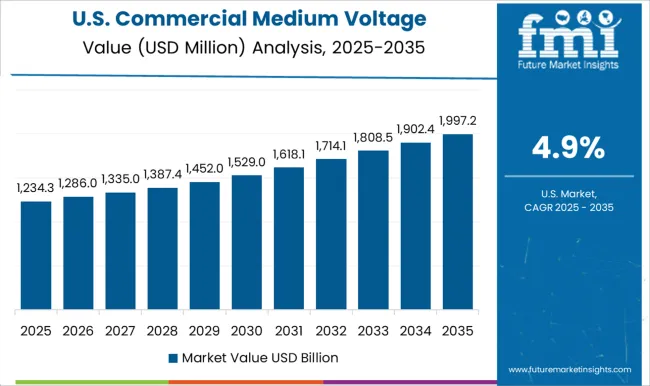

The global commercial medium voltage distribution panel market is projected to grow at a 5.8% CAGR from 2025 to 2035. China leads with a growth rate of 7.8%, followed by India at 7.3%, and Germany at 6.7%. The United Kingdom records a growth rate of 5.5%, while the United States shows the slowest growth at 4.9%. These varying growth rates are driven by factors such as increasing demand for energy-efficient electrical systems, industrialization, and infrastructure expansion. Emerging markets like China and India are witnessing higher growth due to rapid urbanization, industrial development, and investments in power distribution infrastructure, while more mature markets like the USA and the UK see steady growth driven by technological advancements, sustainability initiatives, and demand for reliable power solutions in commercial sectors. This report includes insights on 40+ countries; the top markets are shown here for reference.

The commercial medium voltage distribution panel market in China is growing at a robust pace, with a projected CAGR of 7.8%. China’s rapid industrialization, combined with the growing demand for efficient and reliable power distribution solutions in commercial buildings and infrastructure projects, is significantly driving market growth. The country’s focus on improving energy efficiency, upgrading electrical systems, and the increasing demand for renewable energy sources, such as wind and solar, is accelerating the adoption of medium voltage distribution panels. Additionally, China’s push for green building initiatives and smart city development further boosts market demand.

The commercial medium voltage distribution panel market in India is projected to grow at a CAGR of 7.3%. India’s expanding commercial and industrial sectors, along with increasing demand for efficient and safe power distribution systems, are key drivers of the market. The country’s rapid urbanization and infrastructure development, combined with the government’s focus on expanding electricity access and promoting renewable energy solutions, are fueling the adoption of medium voltage distribution panels. Additionally, India’s growing commercial real estate market and industrial expansion are contributing to the demand for reliable power distribution in buildings and facilities.

The commercial medium voltage distribution panel market in Germany is projected to grow at a CAGR of 6.7%. Germany’s strong focus on energy efficiency, sustainable infrastructure, and renewable energy sources is driving demand for advanced power distribution solutions. The country’s industrial sectors, including manufacturing, automotive, and construction, require reliable medium voltage distribution panels for efficient power management. Additionally, Germany’s commitment to upgrading its electrical grids to accommodate renewable energy sources, combined with regulatory requirements for energy-efficient buildings, is accelerating the adoption of medium voltage distribution panels in commercial and industrial applications.

The commercial medium voltage distribution panel market in the United Kingdom is projected to grow at a CAGR of 5.5%. The UK market is driven by the demand for reliable and efficient power distribution solutions in the commercial sector. The government’s focus on sustainability and reducing carbon emissions, along with the adoption of energy-efficient technologies, is contributing to the market’s steady growth. Additionally, the increasing demand for renewable energy systems and smart grid solutions in commercial buildings and infrastructure projects further accelerates the adoption of medium voltage distribution panels.

The commercial medium voltage distribution panel market in the United States is expected to grow at a CAGR of 4.9%. The USA market remains steady, driven by the growing demand for reliable power distribution solutions in commercial sectors such as office buildings, shopping centers, and industrial facilities. The increasing focus on energy efficiency, along with the country’s push for adopting renewable energy sources and integrating smart grid technologies, is contributing to market growth. However, slower growth in this mature market is due to the already established power distribution infrastructure, which requires upgrades and modernization to meet new demands.

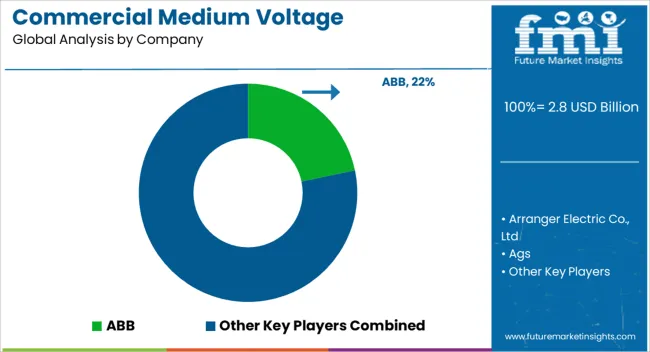

The commercial medium voltage distribution panel market is dominated by ABB, which leads with its high-quality, energy-efficient distribution panels designed to ensure reliable power distribution in commercial and industrial settings. ABB’s dominance is supported by its advanced technology, global reach, and commitment to providing innovative solutions for medium voltage electrical systems. Key players such as Eaton, General Electric, and Schneider Electric maintain significant market shares by offering reliable, safe, and cost-effective distribution panels that optimize energy usage and enhance system reliability in large-scale commercial buildings and facilities. These companies focus on improving panel efficiency, integrating smart grid technologies, and ensuring compliance with international safety standards.

Emerging players like Arranger Electric Co., Ltd, alfanar Group, and Legrand are expanding their market presence by offering specialized solutions tailored to the needs of specific industries, such as data centers, manufacturing facilities, and hospitals. Their strategies include enhancing energy management capabilities, focusing on customization, and offering scalable solutions to meet diverse customer needs. Market growth is driven by increasing demand for energy-efficient infrastructure, rising urbanization, and the need for reliable power distribution systems in commercial buildings. Innovations in automation, digital monitoring, and sustainable materials are expected to continue shaping competitive dynamics and fuel further growth in the global commercial medium voltage distribution panel market.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.8 Billion |

| Mounting | Flush mounting and Surface mounting |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Arranger Electric Co., Ltd, Ags, alfanar Group, ESL POWER SYSTEMS, INC., Eaton, EAMFCO, General Electric, INDUSTRIAL ELECTRIC MFG, Larsen & Toubro Limited, Legrand, Meba Electric Co., Ltd, NHP, Norelco, Paneltronics, RBaker, Symbiotic Systems, Siemens, and Schneider Electric |

| Additional Attributes | Dollar sales by panel type and application, demand dynamics across commercial, industrial, and utility sectors, regional trends in medium voltage distribution panel adoption, innovation in energy-efficient and smart grid integration technologies, impact of regulatory standards on safety and performance, and emerging use cases in renewable energy distribution and electric vehicle infrastructure. |

The global commercial medium voltage distribution panel market is estimated to be valued at USD 2.8 billion in 2025.

The market size for the commercial medium voltage distribution panel market is projected to reach USD 4.9 billion by 2035.

The commercial medium voltage distribution panel market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in commercial medium voltage distribution panel market are flush mounting and surface mounting.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Baking Rack Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Blast Freezer Market Size and Share Forecast Outlook 2025 to 2035

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Electric Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA