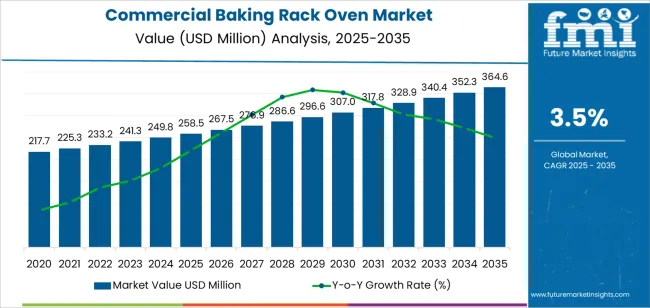

The commercial baking rack oven market is valued at USD 258.5 million in 2025 and is projected to reach USD 364.6 million by 2035, advancing at a CAGR of 3.5%. Growth is driven by the expanding commercial bakery sector, rising preference for high-capacity baking equipment, and the need for consistent product quality in food production environments. Rack ovens offer uniform heat distribution, reduced baking time, and efficient batch processing, making them suitable for commercial bakeries, supermarket in-store baking operations, and institutional kitchens.

Electric rack ovens account for the largest share due to clean operation, precise temperature control, and compatibility with standard kitchen infrastructure, while gas and oil systems support high-volume production environments. Bakery applications represent the dominant share of demand, followed by supermarket bakery programs as retailers expand fresh-baked product offerings. Asia Pacific, particularly China and India, leads growth due to rapid foodservice expansion and modernization of the bakery industry, while Europe and North America show steady demand supported by established commercial baking operations. Competition in the commercial baking rack oven remains moderate, with key companies such as MIWE Michael Wenz GmbH, Revent International, and Sveba Dahlen focusing on energy-efficient heating systems, programmable controls, and service support capabilities to strengthen market positioning.

Commercial baking rack oven technology addresses critical production challenges, including temperature uniformity maintenance in large-batch operations, loading efficiency optimization in high-volume baking applications, and energy consumption consistency across extended production runs. The foodservice sector's shift toward automated baking processes and standardized product output creates sustained demand for rack oven solutions capable of processing diverse product types, varying batch sizes, and multiple recipe requirements with minimal temperature variation and consistent quality output. Supermarket bakeries are adopting commercial baking rack ovens for in-store production, where baking consistency directly impacts product appeal and customer satisfaction requirements. The technology's ability to produce uniform baking results with excellent product appearance reduces waste rates and accelerates production workflows.

Commercial bakery operators and institutional food producers are investing in commercial baking rack oven systems to enhance competitive positioning through improved production capacity metrics and expanded product portfolio capabilities. The integration of advanced heating technologies and optimized airflow designs enables these ovens to achieve energy efficiency 20-35% better than conventional systems while maintaining baking performance characteristics. However, initial capital investment requirements for commercial-grade rack oven systems and facility infrastructure barriers for proper installation may pose challenges to market expansion in cost-sensitive bakery segments and regions with limited access to commercial kitchen infrastructure.

Between 2025 and 2030, the commercial baking rack oven market is projected to expand from USD 258.5 million to USD 296.6 million, representing a 35.9% increase in total forecast growth for the decade. This phase of development will be shaped by rising demand for automated baking solutions in commercial bakeries and foodservice sectors, product innovation in energy-efficient heating technology and control systems, as well as expanding integration with bakery production lines and food safety monitoring platforms. Companies are establishing competitive positions through investment in advanced temperature control designs, programmable baking systems, and strategic market expansion across commercial bakery operations, supermarket in-store bakeries, and institutional food production applications.

From 2030 to 2035, the market is forecast to grow from USD 296.6 million to USD 364.6 million, adding another USD 68.0 million, which constitutes 64.1% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized rack oven systems, including advanced steam injection features and programmable baking profiles tailored for specific product types and production volume requirements, strategic collaborations between oven manufacturers and bakery equipment suppliers, and an enhanced focus on energy efficiency and operational cost optimization. The growing emphasis on food production consistency and operational efficiency will drive demand for advanced, high-performance commercial baking rack oven solutions across diverse food production applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 258.5 million |

| Market Forecast Value (2035) | USD 364.6 million |

| Forecast CAGR (2025-2035) | 3.5% |

The commercial baking rack oven market grows by enabling bakery operators to achieve superior baking consistency and production efficiency while reducing labor costs in commercial food production operations. Bakery facilities face mounting pressure to improve output quality and operational throughput, with commercial baking rack oven systems typically providing 25-40% time savings over conventional deck ovens, making these specialized systems essential for competitive bakery operations. The commercial bakery and foodservice industries' need for high-capacity baking creates demand for advanced rack oven solutions that can accommodate multiple rack levels, maintain precise temperature control, and ensure consistent baking results across diverse product types and batch sizes.

Food production automation initiatives promoting standardized baking processes and consistent quality output drive adoption in commercial bakeries, supermarket operations, and institutional kitchens, where baking efficiency has a direct impact on production capacity and operational costs. The global shift toward fresh-baked products and on-site production accelerates commercial baking rack oven demand as food retailers seek equipment solutions that maximize space utilization and enable flexible product offerings. However, limited awareness of operational best practices and higher equipment costs compared to conventional deck ovens may limit adoption rates among small-scale bakeries and regions with traditional baking methods and limited technical support infrastructure.

The market is segmented by energy source, application, and region. By energy source, the market is divided into electric, oil, and gas. Based on application, the market is categorized into bakery, supermarket, and others. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

The electric segment represents the dominant force in the commercial baking rack oven market, capturing approximately 61.0% of total market share in 2025. This advanced category encompasses standard electric heating configurations, programmable temperature control variants, and specialized energy-efficient models optimized for commercial baking applications, delivering precise temperature management and superior operational flexibility in food production operations. The electric segment's market leadership stems from its reliable heating architecture, clean operation characteristics, and compatibility with standard commercial kitchen infrastructure across bakeries, supermarket operations, and institutional food facilities.

The gas segment maintains a substantial 24.0% market share, serving operators who require high-heat output capabilities through natural gas and propane-powered systems, cost-effective energy consumption, and specialized heating characteristics that accommodate high-volume production environments. The oil segment represents 15.0% market share through industrial baking applications requiring alternative fuel sources and specialized heating configurations.

Key advantages driving the electric segment include:

Bakery applications dominate the commercial baking rack oven market with approximately 68.0% market share in 2025, reflecting the extensive adoption of rack oven systems across artisan bakeries, wholesale bread production, and specialty baked goods manufacturing operations. The bakery segment's market leadership is reinforced by widespread implementation in bread production (28.0%), pastry baking (22.0%), and specialty product manufacturing (18.0%), which provide essential productivity advantages and quality consistency in commercial baking environments.

The supermarket segment represents 21.0% market share through specialized applications including in-store bakery operations (11.0%), fresh bread programs (6.0%), and prepared food production (4.0%). Other applications account for 11.0% market share, driven by adoption in institutional kitchens (5.0%), hotel food production (4.0%), and catering operations (2.0%).

Key market dynamics supporting application preferences include:

The market is driven by three concrete demand factors tied to food production efficiency and quality outcomes. First, commercial bakery expansion creates increasing requirements for high-capacity baking equipment, with global commercial bakery production exceeding 400 million tons annually in major markets worldwide, requiring reliable commercial baking rack oven systems for bread production, pastry manufacturing, and specialty baked goods fabrication. Second, supermarket in-store bakery growth and fresh product demand drive adoption of flexible baking technology, with commercial baking rack ovens improving production versatility by 30-45% while enabling on-demand baking programs that meet consumer preferences for fresh-baked products used extensively in retail food operations. Third, food safety regulations and consistency requirements accelerate deployment across commercial kitchens, with commercial baking rack ovens integrating seamlessly into HACCP compliance programs and enabling standardized baking processes that ensure product safety and quality in food production facilities.

Market restraints include capital cost barriers affecting independent bakeries and small-scale food producers, particularly where conventional deck ovens remain adequate for limited production volumes and where equipment budgets constrain adoption of automated rack oven systems. Installation complexity requirements for proper ventilation and utility connections pose adoption challenges for facilities lacking appropriate infrastructure, as commercial baking rack oven performance depends heavily on adequate electrical capacity, ventilation systems, and floor space that vary significantly across facility types and building configurations. Limited availability of trained operators in emerging markets creates additional barriers, as commercial baking requires specialized knowledge in rack oven operation, temperature management, and maintenance practices to achieve target production efficiency levels.

Key trends indicate accelerated adoption in Asian foodservice markets, particularly China and India, where commercial bakery operations and foodservice infrastructure are expanding rapidly through urbanization trends and changing consumer preferences driving demand for baked goods. Technology advancement trends toward programmable control systems with recipe storage capabilities, energy-efficient heating elements for reduced operating costs, and steam injection systems enabling artisan-style baking are driving next-generation product development. However, the market thesis could face disruption if conveyor oven technologies achieve breakthrough capabilities in matching rack oven flexibility while offering superior throughput, potentially reducing demand for traditional rack oven systems in specific production segments.

| Country | CAGR (2025-2035) |

|---|---|

| China | 4.7% |

| India | 4.4% |

| Germany | 4.0% |

| Brazil | 3.7% |

| USA | 3.3% |

| UK | 3.0% |

| Japan | 2.6% |

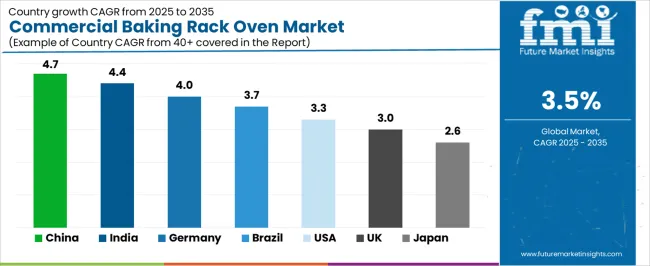

The commercial baking rack oven market is gaining momentum worldwide, with China taking the lead thanks to aggressive bakery industry expansion and foodservice modernization programs. Close behind, India benefits from growing bakery sector investment and retail food infrastructure development, positioning itself as a strategic growth hub in the Asia-Pacific region. Brazil shows strong advancement, where expanding supermarket bakery operations and commercial food production infrastructure strengthen its role in South American foodservice supply chains. The USA demonstrates robust growth through advanced baking technology initiatives and foodservice sector investment, signaling continued adoption in commercial bakery applications. Japan stands out for its precision baking expertise and advanced food production technology integration, while UK and Germany continue to record consistent progress driven by artisan bakery operations and commercial food manufacturing. China and India anchor the global expansion story, while established markets build stability and technology leadership into the market's growth path.

The report covers an in-depth analysis of 40+ countries, with top-performing countries highlighted below.

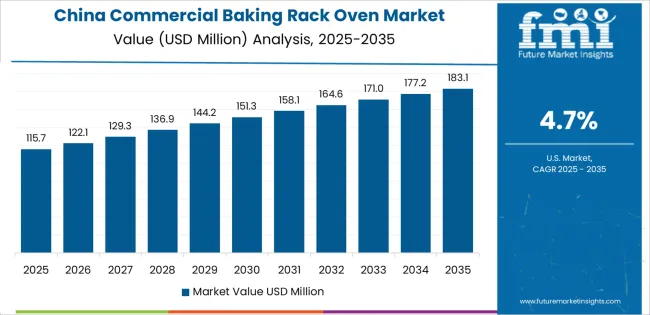

China demonstrates the strongest growth potential in the Commercial Baking Rack Oven Market with a CAGR of 4.7% through 2035. The country's leadership position stems from comprehensive bakery industry expansion, intensive foodservice infrastructure development programs, and aggressive commercial kitchen modernization targets driving adoption of advanced baking technologies. Growth is concentrated in major urban regions, including Beijing, Shanghai, Guangzhou, and Chengdu, where commercial bakeries, supermarket chains, and hotel food operations are implementing commercial baking rack oven systems for productivity enhancement and quality improvement. Distribution channels through foodservice equipment distributors, bakery equipment specialists, and direct manufacturer relationships expand deployment across bakery chains, retail food operations, and institutional kitchen facilities. The country's food industry modernization policies provide support for commercial equipment adoption, including subsidies for energy-efficient equipment implementation and food safety compliance upgrades.

Key market factors:

In major metropolitan areas, Maharashtra, Karnataka, and Tamil Nadu regions, the adoption of commercial baking rack oven systems is accelerating across commercial bakeries, supermarket operations, and hotel food production facilities, driven by expanding middle-class consumption and increasing demand for baked goods. The market demonstrates strong growth momentum with a CAGR of 4.4% through 2035, linked to comprehensive bakery sector expansion and increasing investment in commercial food production capabilities. Indian operators are implementing commercial baking rack oven technology and modern baking processes to improve production efficiency while meeting growing consumer demand for quality baked goods in retail and foodservice channels serving urban markets. The country's food processing development initiatives create sustained demand for commercial baking equipment, while increasing emphasis on food safety drives adoption of modern oven systems that enhance production consistency.

Germany's advanced bakery sector demonstrates sophisticated implementation of commercial baking rack oven systems, with documented case studies showing 25-35% production efficiency improvement in commercial baking operations through equipment optimization strategies. The country's food production infrastructure in major bakery regions, including Bavaria, Baden-Württemberg, North Rhine-Westphalia, and Lower Saxony, showcases integration of rack oven technologies with existing bakery operations, leveraging expertise in artisan baking traditions and commercial food production. German bakery operators emphasize quality standards and energy efficiency, creating demand for advanced commercial baking rack oven solutions that support production commitments and environmental sustainability requirements. The market maintains strong growth through focus on bakery automation and operational excellence, with a CAGR of 4.0% through 2035.

Key development areas:

The Brazilian market leads in Latin American commercial baking rack oven adoption based on expanding supermarket bakery operations and growing commercial food production infrastructure in major urban centers. The country shows solid potential with a CAGR of 3.7% through 2035, driven by retail sector investment and increasing domestic demand for fresh-baked products across bread consumption, pastry offerings, and specialty baked goods categories. Brazilian operators are adopting commercial baking rack oven technology for consistency in supermarket bakery programs, particularly in in-store baking requiring flexible production capacity and in commercial bakeries where equipment efficiency impacts operational economics. Technology deployment channels through foodservice equipment distributors, bakery equipment representatives, and financing programs expand coverage across retail food operations and commercial bakery facilities.

Leading market segments:

The USA market leads in advanced commercial baking rack oven applications based on integration with sophisticated bakery management systems and comprehensive food production automation platforms for enhanced operational efficiency. The country shows solid potential with a CAGR of 3.3% through 2035, driven by artisan bakery growth and increasing adoption of commercial baking technologies across retail bakeries, supermarket operations, and institutional food production facilities. American operators are implementing commercial baking rack oven systems for diverse production requirements, particularly in artisan bakeries demanding flexible baking capabilities and in supermarket programs where space efficiency directly impacts store economics. Technology deployment channels through equipment dealers, foodservice distributors, and leasing companies expand coverage across diverse bakery operations.

Leading market segments:

The UK market demonstrates consistent implementation focused on commercial bakery operations and supermarket in-store programs, with documented integration of commercial baking rack oven systems achieving 20-30% efficiency improvements in baking operations. The country maintains steady growth momentum with a CAGR of 3.0% through 2035, driven by bakery sector presence and retail food requirements for consistent baking capabilities in fresh product programs. Major food production regions, including London, Birmingham, Manchester, and Glasgow, showcase deployment of rack oven technologies that integrate with existing bakery infrastructure and support quality requirements in commercial and retail baking operations.

Key market characteristics:

Japan's commercial baking rack oven market demonstrates sophisticated implementation focused on quality-oriented bakery operations and retail food production, with documented integration of advanced baking systems achieving exceptional product consistency in commercial baking operations. The country maintains steady growth momentum with a CAGR of 2.6% through 2035, driven by bakery excellence culture and emphasis on product quality principles aligned with Japanese food production standards. Major food production regions, including Tokyo, Osaka, Nagoya, and Fukuoka, showcase advanced deployment of rack oven technologies that integrate seamlessly with bakery operations and comprehensive quality control systems.

Key market characteristics:

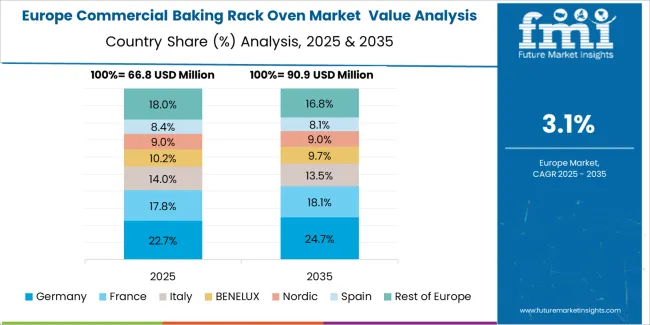

The commercial baking rack oven market in Europe is projected to grow from USD 94.9 million in 2025 to USD 133.8 million by 2035, registering a CAGR of 3.5% over the forecast period. Germany is expected to maintain its leadership position with a 32.1% market share in 2025, declining slightly to 31.5% by 2035, supported by its extensive bakery infrastructure and major artisan production centers, including Bavaria, Baden-Württemberg, and North Rhine-Westphalia baking regions.

France follows with a 19.3% share in 2025, projected to reach 19.7% by 2035, driven by comprehensive artisan bakery traditions and commercial food production programs in major urban regions. The United Kingdom holds a 15.8% share in 2025, expected to reach 16.1% by 2035 through supermarket bakery expansion and commercial baking operations. Italy commands a 13.2% share in both 2025 and 2035, backed by artisan bakery culture and food production manufacturing. Spain accounts for 9.4% in 2025, rising to 9.7% by 2035 on bakery sector growth and retail food expansion. The Rest of Europe region is anticipated to hold 10.2% in 2025, expanding to 10.8% by 2035, attributed to increasing commercial baking rack oven adoption in Nordic countries and emerging Central & Eastern European bakery operations.

The Japanese commercial baking rack oven market demonstrates a mature and quality-focused landscape, characterized by sophisticated integration of electric-powered rack oven systems with existing artisan bakery infrastructure across commercial bread production, retail bakery operations, and specialty food manufacturing facilities. Japan's emphasis on baking precision and product quality drives demand for equipment that supports consistency commitments and operational standards in competitive food markets. The market benefits from strong partnerships between international equipment providers and domestic foodservice distributors including major trading companies, creating comprehensive service ecosystems that prioritize technical support and maintenance programs. Bakery operations in Tokyo, Osaka, Nagoya, and other major metropolitan areas showcase advanced baking implementations where commercial baking rack oven systems achieve exceptional product consistency through optimized temperature control and comprehensive operator training programs.

The South Korean commercial baking rack oven market is characterized by growing international equipment provider presence, with companies maintaining significant positions through comprehensive technical support and installation capabilities for commercial bakery operations and retail food production applications. The market demonstrates increasing emphasis on bakery automation and operational efficiency, as Korean operators increasingly demand advanced baking solutions that integrate with production management infrastructure and quality monitoring systems deployed across commercial food facilities. Regional equipment distributors are gaining market share through strategic partnerships with international manufacturers, offering specialized services including operator training programs and maintenance support for bakery and foodservice operations. The competitive landscape shows increasing collaboration between multinational equipment companies and Korean foodservice specialists, creating hybrid service models that combine international product development expertise with local technical support capabilities and rapid response systems.

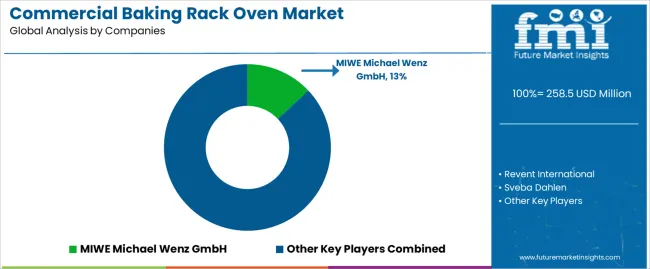

The commercial baking rack oven market features approximately 25-30 meaningful players with moderate fragmentation, where the top three companies control roughly 31-35% of global market share through established distribution networks and comprehensive product portfolios. Competition centers on baking performance reliability, energy efficiency, and service support capabilities rather than price competition alone. MIWE Michael Wenz GmbH leads with approximately 13.0% market share through its comprehensive bakery equipment solutions portfolio and European market presence.

Market leaders include MIWE Michael Wenz GmbH, Revent International, and Sveba Dahlen, which maintain competitive advantages through global distribution infrastructure, advanced heating technology, and deep expertise in bakery application engineering across multiple food production sectors, creating trust and reliability advantages with commercial bakery operators and supermarket food programs. These companies leverage research and development capabilities in energy efficiency optimization and ongoing technical support relationships to defend market positions while expanding into emerging bakery markets and specialized application segments.

Challengers encompass Baxter and Sinmag, which compete through specialized product offerings and strong regional presence in key bakery markets. Product specialists, including Bongard, Polin, and Wachtel, focus on specific oven configurations or regional markets, offering differentiated capabilities in custom baking solutions, artisan-focused equipment, and competitive pricing structures.

Regional players and emerging equipment manufacturers create competitive pressure through localized manufacturing advantages and responsive service capabilities, particularly in high-growth markets including China and India, where proximity to bakery operations provides advantages in technical support responsiveness and customer relationships. Market dynamics favor companies that combine proven baking performance with comprehensive service offerings that address the complete production cycle from equipment installation through operator training and maintenance support.

Commercial baking rack ovens represent advanced food production equipment that enable bakery operators to achieve 25-40% time savings compared to conventional deck ovens, delivering superior batch processing efficiency and temperature consistency with enhanced space utilization and operational flexibility in demanding commercial baking applications. With the market projected to grow from USD 258.5 million in 2025 to USD 364.6 million by 2035 at a 3.5% CAGR, these specialized baking systems offer compelling advantages - productivity enhancement, quality consistency, and space efficiency - making them essential for bakery applications (68.0% market share), supermarket operations (21.0% share), and food production facilities seeking alternatives to conventional deck ovens that compromise production capacity through limited batch sizes and longer baking cycles. Scaling market adoption and technology deployment requires coordinated action across food industry policy, commercial kitchen infrastructure development, equipment manufacturers, bakery operators, and foodservice equipment investment capital.

How Governments Could Spur Local Production and Adoption?

How Industry Bodies Could Support Market Development?

How OEMs and Technology Players Could Strengthen the Ecosystem?

How Suppliers Could Navigate the Shift?

How Investors and Financial Enablers Could Unlock Value?

| Item | Value |

|---|---|

| Quantitative Units | USD 258.5 Million |

| Energy Source | Electric, Oil, Gas |

| Application | Bakery, Supermarket, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ countries |

| Key Companies Profiled | MIWE Michael Wenz GmbH, Revent International, Sveba Dahlen, Baxter, Sinmag, Fimak, Pavailller, Polin, Siouthstar, Blodgett, Bongard, Salva Bakery & Pastry, Wachtel, Macadams International, KYUDENSHAMONO Equipment |

| Additional Attributes | Dollar sales by energy source and application categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with equipment manufacturers and distribution networks, commercial facility requirements and specifications, integration with bakery production systems and food safety platforms, innovations in heating technology and control systems, and development of specialized baking solutions with enhanced energy efficiency and operational capabilities. |

The global commercial baking rack oven market is estimated to be valued at USD 258.5 million in 2025.

The market size for the commercial baking rack oven market is projected to reach USD 364.6 million by 2035.

The commercial baking rack oven market is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in commercial baking rack oven market are electric , oil and gas.

In terms of application, bakery segment to command 68.0% share in the commercial baking rack oven market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Blast Freezer Market Size and Share Forecast Outlook 2025 to 2035

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Electric Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA