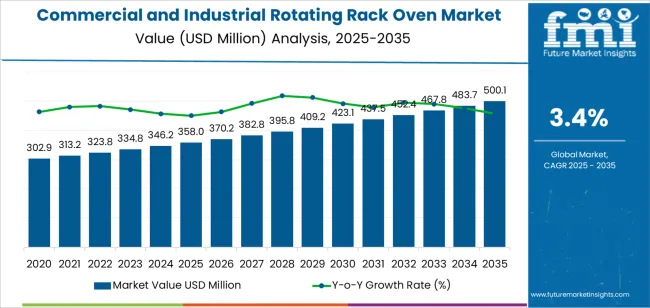

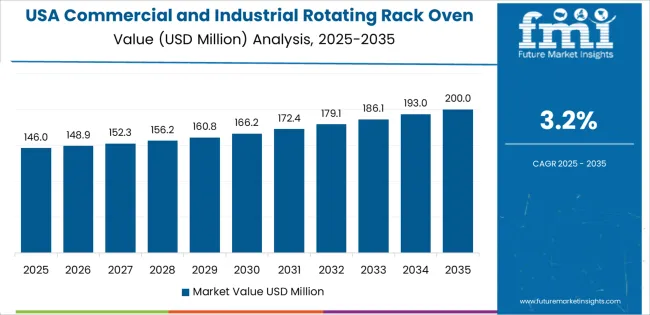

The commercial and industrial rotating rack oven market increases from USD 358.0 million in 2025 to USD 500.1 million by 2035 at a CAGR of 3.4%, reflecting a gradual movement toward saturation as installation activity shifts from expansion-led adoption to replacement-driven demand. From 2025 to 2030, revenue grows to USD 423.1 million as annual unit volumes rise from roughly 370.2 thousand to 423.1 thousand units, supported by higher bakery throughput, broader use of multi-rack systems, and steady demand for programmable convection performance. Facilities producing above 1,500 kg/day represent the largest share of new installations, while smaller bakeries transition from deck ovens to rotating racks for batch uniformity. Performance upgrades involving uniform heat distribution, improved steam systems, and 8–12% thermal-efficiency gains sustain procurement momentum.

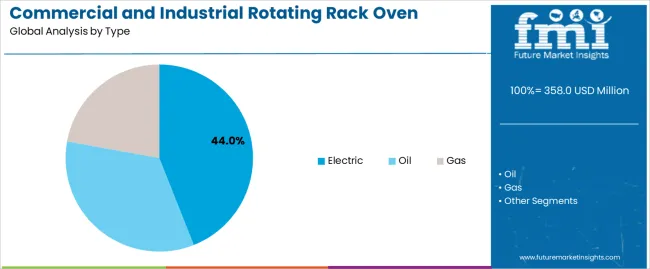

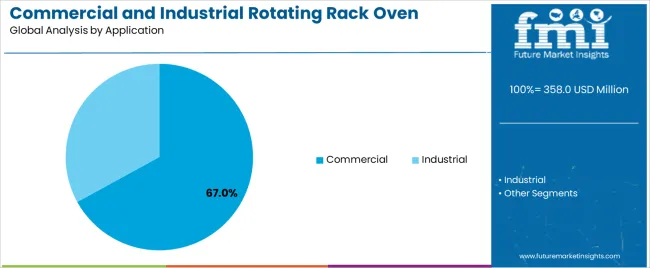

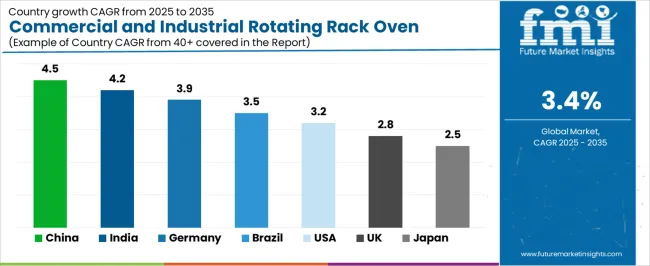

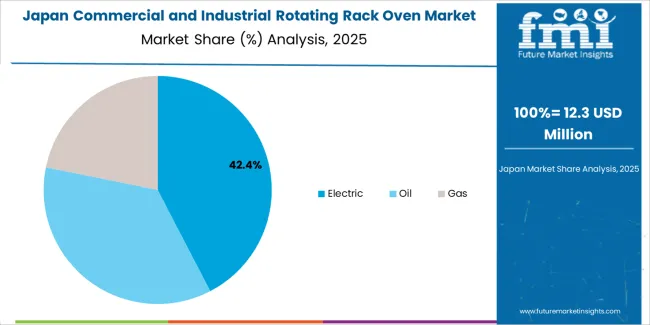

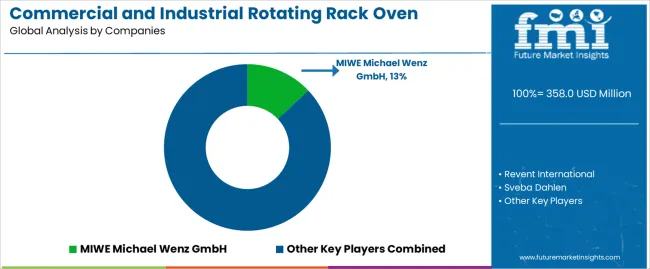

Between 2030 and 2035, the market advances from USD 423.1 million to USD 500.1 million as unit deployment reaches 483.7–500.1 thousand units, driven by renewal cycles, modernization of industrial baking lines, and increased automation adoption across frozen-bakery and par-baked production hubs. Electric ovens hold 44.0% of type share due to compatibility with urban bakeries and low-emission requirements, while the commercial segment leads with 67.0% of application demand as retail bakeries, supermarket bakeries, cafés, and foodservice kitchens rely on rotating racks for consistent daily output. Country-level growth is led by China at 4.5%, followed by India at 4.2% and Germany at 3.9%, with Brazil at 3.5%, USA at 3.2%, UK at 2.8%, and Japan at 2.5%. Competitive presence includes MIWE Michael Wenz GmbH, Revent International, Sveba Dahlen, Baxter, Sinmag, Fimak, Pavailler, Polin, Siouthstar, Blodgett, Bongard, Salva Bakery & Pastry, Wachtel, Macadams International, KYUDENSHA, and MONO Equipment, supported by differentiation in airflow engineering, insulation design, digital control systems, and steam stability.

Replacement cycles strengthen the saturation trend, with most purchases tied to upgrading thermal performance, airflow consistency, or digital control features rather than adding new capacity. Manufacturers observe a rising emphasis on operational refinement rather than broad equipment rollout, reflecting the maturity of core markets in North America and Europe.

After 2033, the market displays late-stage adoption characteristics, including modest incremental sales and stable replacement intervals. Growth continues, but it is increasingly linked to incremental technology improvements and process optimization rather than structural increases in the installed base.

Between 2025 and 2030, the Commercial and Industrial Rotating Rack Oven Market increases from USD 358.0 million to USD 423.1 million, indicating a sustained mid-cycle acceleration pattern supported by rising food-processing throughput and higher adoption of multi-rack baking systems across commercial bakeries, institutional kitchens, and industrial food lines. Annual unit demand rises from roughly 370.2 thousand to 423.1 thousand units, reflecting a consistent 2.7–3.4 % yearly gain. Growth momentum is driven by demand for ovens offering uniform convection performance, programmable bake cycles, and energy-consumption levels optimized through heat-recovery modules. Facilities with production capacities above 1,500 kg/day account for the largest share of new installations, while smaller bakeries increasingly shift from deck ovens to rotating rack systems for batch consistency.

From 2030 to 2035, market expansion strengthens from USD 423.1 million to USD 500.1 million, with unit deployment advancing to approximately 483.7–500.1 thousand units. Momentum during this period is shaped by replacement-driven purchases, production-line modernization, and thermal-efficiency improvements of 8–12 % achieved through advanced insulation and airflow optimization. Industrial operators prioritize ovens capable of multi-program loading, rapid heat-recovery times, and integrated steam-injection control for standardized output across high-volume SKUs. Growth is further supported by expansion of frozen bakery manufacturing in Asia-Pacific and the Middle East, contributing 10–13 % of total incremental demand. As automation adoption increases, facilities move toward ovens with real-time diagnostics, PLC-linked temperature control, and maintenance-interval prediction, reinforcing a stable upward trajectory in market momentum through 2035.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 358 million |

| Market Forecast Value (2035) | USD 500.1 million |

| Forecast CAGR (2025–2035) | 3.4% |

Demand for commercial and industrial rotating rack ovens is rising as bakeries, institutional kitchens, and food-processing plants seek consistent baking quality and higher production throughput. Rotating rack ovens circulate heated air evenly around loaded racks, ensuring uniform browning, moisture retention, and predictable batch repeatability across bread, pastries, and prepared foods. Facilities value programmable controls, steam-injection options, and heat-recovery systems that maintain product consistency while reducing energy consumption. Manufacturers refine insulation performance, burner efficiency, and airflow geometry to improve temperature stability under continuous operation. As food service chains and central production units expand output, rotating rack ovens serve as reliable, scalable equipment for meeting daily volume targets. These factors support strong demand in North America, Europe, and rapidly industrializing markets in Asia-Pacific.

Market expansion is also driven by modernization of mid-size bakeries and increased regulatory emphasis on hygiene and workplace safety. Producers adopt stainless-steel interiors, tool-free cleaning access, and sealed door systems to maintain sanitation standards during multi-shift operations. Enhanced digital interfaces, fault diagnostics, and compatibility with preventive-maintenance software improve uptime and reduce service costs. Growth in frozen-dough production and par-baked goods accelerates installation of ovens that tolerate frequent loading cycles and varied humidity requirements. Although high upfront costs remain a barrier for small operators, long-term operational savings and improved product consistency offset investment concerns. Continued development of energy-efficient burners, variable-speed fans, and modular rack configurations ensures steady adoption of rotating rack ovens across commercial baking and industrial food-processing environments.

The commercial and industrial rotating rack oven market is segmented by type, application, and region. By type, the market is divided into electric, oil, and gas ovens. Based on application, it is categorized into commercial and industrial users. Regionally, the market is segmented into North America, Europe, East Asia, South Asia, Latin America, and the Middle East & Africa. These divisions reflect differences in heating-source availability, facility layouts, and regional production patterns affecting oven selection.

The electric segment accounts for approximately 44.0% of the commercial and industrial rotating rack oven market in 2025, making it the leading type category. This position is supported by consistent installation suitability in bakeries, foodservice kitchens, and mid-scale production environments where electrical infrastructure is stable and emissions restrictions limit the use of combustion-based systems. Electric ovens provide controlled heat distribution, steady temperature recovery, and compatibility with enclosed production areas that require predictable thermal behavior and low exhaust output.

Manufacturers design electric models with insulated chambers, programmable controls, and staged heating elements that maintain uniform baking conditions across rotating racks. Adoption is strong in North America and Europe, where commercial bakeries often operate in urban settings with regulatory requirements tied to indoor air quality. Electric ovens also suit facilities with limited venting capacity, making them practical for retail bakeries and institutional food operations. Their maintenance routines involve fewer combustion components, supporting predictable service schedules. The segment maintains its leading share because electric heating aligns with facility constraints, energy-management programs, and operational needs for consistent batch uniformity across a wide range of baked products.

The commercial segment represents about 67.0% of the total commercial and industrial rotating rack oven market in 2025, making it the dominant application category. This reflects widespread use of rack ovens in retail bakeries, supermarket in-store bakeries, cafés, and foodservice operations where continuous production of bread and pastries requires predictable heat transfer and consistent batch outcomes. Commercial facilities rely on rotating rack ovens to handle varied product lines while maintaining output uniformity in compact spaces.

These users often operate with variable daily volumes, making the rotating mechanism valuable for balancing airflow and reducing manual handling during baking cycles. Manufacturers supply configurations with programmable settings, steam injection options, and optimized rack rotation speeds that support routine production across small and medium batch sizes. Adoption is strong in North America and Europe, where commercial bakery formats remain widely used, and in East Asia, where expanding café and bakery chains increase demand for compact, dependable ovens. The commercial segment holds its lead because these facilities require reliable equipment that fits within limited kitchen footprints while supporting continuous baking schedules, straightforward operator routines, and stable product quality across a range of dough and pastry formulations.

The commercial and industrial rotating rack oven market is growing as bakeries, food-service operations and large-scale production facilities seek consistent baking results and higher throughput. These ovens support uniform heat distribution, larger batch capacities and efficient handling of dough-based products. Growth is supported by expanding bakery sectors, rising demand for ready-to-eat items and modernization of food-processing lines. Adoption is limited by high equipment costs, installation space requirements and the need for skilled operators. Manufacturers are improving insulation, airflow control and energy efficiency to enhance product quality and reduce operating costs across different production environments.

Demand rises as commercial bakeries and food producers require ovens capable of supporting continuous production with minimal downtime. Rotating rack ovens provide uniform baking across multiple trays, reducing batch variability and improving product consistency. Operators value the ability to handle diverse bakery items using programmable controls that support repeatable results. Growth in supermarkets with in-store bakeries and expansion of quick-service food outlets also increase the need for reliable high-capacity ovens that streamline daily production cycles and maintain steady output during peak hours.

Adoption faces constraints related to high upfront cost, significant floor-space requirements and the need for proper ventilation and utility connections. Smaller bakeries may hesitate to invest in large rotating units due to budget limitations or limited production volumes. Maintenance needs, including regular cleaning and inspection of burners, fans and rotating mechanisms, add to operating costs. Facilities with older infrastructure may struggle to support installation without upgrades. These factors reduce adoption among small operations or businesses prioritizing low-cost, compact baking equipment.

Trends include improved heat-retention materials, more precise airflow engineering and digital control systems with programmable baking profiles. Energy-efficient burners and steam-injection options are increasingly used to enhance product texture while reducing fuel consumption. Touchscreen interfaces and remote monitoring capabilities are becoming more common in industrial settings. Manufacturers are also focusing on modular designs that simplify installation and service access. As bakery production diversifies, ovens with flexible rack configurations and faster preheating times are gaining traction across both commercial and industrial markets.

| Country | CAGR (%) |

|---|---|

| China | 4.5% |

| India | 4.2% |

| Germany | 3.9% |

| Brazil | 3.5% |

| USA | 3.2% |

| UK | 2.8% |

| Japan | 2.5% |

The Commercial and Industrial Rotating Rack Oven Market is expanding steadily worldwide, with China leading at a 4.5% CAGR through 2035, supported by rapid growth in commercial bakeries, food processing industries, and increased adoption of automated baking equipment. India follows at 4.2%, driven by rising demand for packaged bakery products, expansion of quick-service restaurants, and modernization of baking facilities. Germany records 3.9%, reflecting advanced engineering capabilities, energy-efficient oven designs, and strong demand from artisanal and industrial bakeries. Brazil grows at 3.5%, benefiting from urbanization and rising consumption of baked goods. The USA, at 3.2%, remains a mature market focused on performance optimization and high-capacity ovens, while the UK (2.8%) and Japan (2.5%) emphasize compact, efficient, and precision-controlled baking technologies for both commercial and specialized production environments.

China is projected to grow at a CAGR of 4.5% through 2035 in the commercial and industrial rotating rack oven market. Demand increases as bakery chains, catering firms, and large food producers expand output capacity. Manufacturers introduce improved airflow systems, heat-retention structures, and easy-clean interiors suited for dense production schedules. Regional factories upgrade equipment to meet consistent batch requirements across varying product types. Local distributors widen access to energy-efficient models. Growth in quick-service restaurants strengthens ongoing procurement. Market development aligns with rising adoption of automated baking processes supporting predictable throughput across multiple industrial facilities.

India is expected to rise at a CAGR of 4.2% through 2035 in the commercial and industrial rotating rack oven market. Growth in institutional kitchens, bakery franchises, and packaged-snack producers drives the need for high-capacity ovens. Manufacturers supply modular racks, stable heating chambers, and simplified maintenance features. Regional distributors serve tiered cities where bakery clusters continue expanding. Contract bakers adopt rotating systems to meet rising retail demand. Equipment upgrades support consistent batch cycles for bread, pastries, and specialized baked goods. Market activity reflects broader adoption of automated baking tools across emerging production sites in metropolitan and regional markets.

Germany is projected to grow at a CAGR of 3.9% through 2035 in the commercial and industrial rotating rack oven market. Strong bakery traditions and advanced production systems maintain steady equipment replacement cycles. Manufacturers emphasize precise temperature control, balanced airflow, and durable chamber materials suited for continuous workloads. Industrial bakeries upgrade ovens to support uniform output across high-volume product assortments. Retail chains procure compact rotating models for in-store preparation. Engineering requirements reinforce consistent performance across regional bakery facilities. Market progression aligns with ongoing interest in standardised baking processes across commercial kitchens, retail bakeries, and industrial production lines nationwide.

Brazil is expected to grow at a CAGR of 3.5% through 2035 in the commercial and industrial rotating rack oven market. Expansion of commercial bakeries, regional snack producers, and institutional food programs increases demand for dependable ovens. Manufacturers introduce reinforced frames, stable heating modules, and user-friendly control panels. Distributors support procurement across major urban centres and emerging regional markets. Contract producers adopt rotating racks to maintain consistent output during peak periods. Market movement follows rising packaged-bread and bakery-snack consumption nationwide. Operators emphasize reliable equipment capable of delivering uniform quality across varied product mixes and shifting production schedules.

USA is projected to grow at a CAGR of 3.2% through 2035 in the commercial and industrial rotating rack oven market. Demand increases as commercial bakeries, institutional kitchens, and contract food manufacturers modernize production lines. Vendors supply ovens with controlled airflow, consistent thermal distribution, and durable racks supporting repetitive cycles. Retail baking operations add compact units for daily batch work. Growth in packaged baked goods reinforces procurement across regional facilities. Market activity aligns with rising demand for equipment supporting predictable throughput and standardized product quality across large-scale baking operations serving national distribution channels.

UK markets are expected to advance at a CAGR of 2.8% through 2035 in the commercial and industrial rotating rack oven market. Expanding bakery chains, catering services, and convenience-food producers strengthen equipment demand. Manufacturers supply compact footprints, balanced heat distribution, and user-friendly control interfaces suited for varied operations. Regional suppliers serve both small bakeries and high-throughput production sites. Demand grows for ovens supporting reliable daily batch cycles. Market progression aligns with operational needs across retail, hospitality, and institutional kitchens requiring consistent output and predictable equipment performance.

Japan is projected to grow at a CAGR of 2.5% through 2035 in the commercial and industrial rotating rack oven market. Interest in compact baking systems, convenience-food production, and small-scale commercial kitchens supports moderate demand growth. Manufacturers design space-efficient ovens with precise heating and durable components. Retail bakeries adopt models suited for narrow footprints. Production units serving convenience stores integrate rotating systems to ensure consistent baked output. Market activity reflects demand for reliable equipment supporting frequent batch cycles in dense urban settings. Distribution networks extend product availability across national regions with growing commercial baking requirements.

The global commercial and industrial rotating rack oven market is moderately concentrated, shaped by manufacturers supplying baking equipment for bakeries, food-service chains, and industrial production lines. MIWE Michael Wenz GmbH holds a strong position with energy-efficient ovens designed for uniform heat distribution and consistent batch quality. Revent International and Sveba Dahlen maintain significant presence in high-volume baking, offering rack ovens built for durability, steam stability, and precise temperature control. Baxter and Sinmag provide broad product ranges suited for retail bakeries and mid-scale production. Fimak, Pavailler, and Polin strengthen competition through modular configurations and systems engineered for varied dough types. Siouthstar, Blodgett, and Bongard expand regional supply with reliable ovens that balance capacity, footprint, and operating cost.

Salva Bakery & Pastry, Wachtel, Macadams International, KYUDENSHA, and MONO Equipment diversify the segment with ovens optimized for artisan bakeries, frozen-dough operations, and continuous daily use. Competition across the market is influenced by thermal efficiency, loading ergonomics, steam system design, and cycle consistency. Strategic differentiation relies on insulation quality, digital controls, and automation features that support repeatable baking outcomes. As bakeries focus on energy reduction and production flexibility, manufacturers with strong heat-management engineering, reliable service networks, and platforms adaptable to both small retail environments and industrial plants are positioned to strengthen long-term market presence.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Type | Electric, Oil, Gas |

| Application | Commercial, Industrial |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ additional countries |

| Key Companies Profiled | MIWE Michael Wenz GmbH, Revent International, Sveba Dahlen, Baxter, Sinmag, Fimak, Pavailler, Polin, Siouthstar, Blodgett, Bongard, Salva Bakery & Pastry, Wachtel, Macadams International, KYUDENSHA, MONO Equipment |

| Additional Attributes | Dollar sales by type and application categories, regional adoption trends across North America, Europe, and Asia-Pacific, competitive landscape among oven manufacturers, material and energy-efficiency requirements, integration with bakery production lines, distribution and service network considerations |

The global commercial and industrial rotating rack oven market is estimated to be valued at USD 358.0 million in 2025.

The market size for the commercial and industrial rotating rack oven market is projected to reach USD 500.1 million by 2035.

The commercial and industrial rotating rack oven market is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key product types in commercial and industrial rotating rack oven market are electric, oil and gas.

In terms of application, commercial segment to command 67.0% share in the commercial and industrial rotating rack oven market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Blast Freezer Market Size and Share Forecast Outlook 2025 to 2035

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Electric Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA