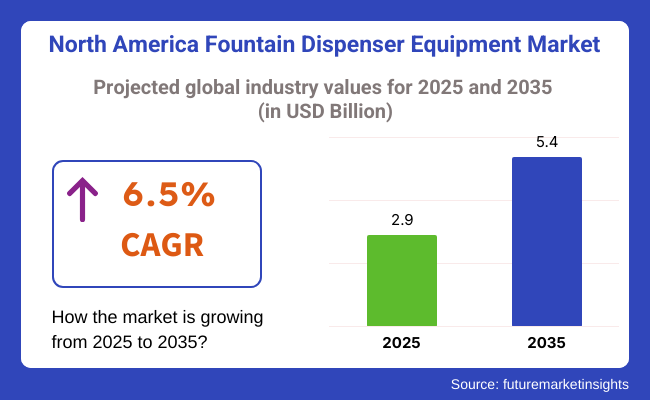

The North America fountain dispenser equipment market is valued at USD 2.9 billion in 2025 and is expected to grow at a 6.5% CAGR from 2025 to 2035. The sector is likely to grow up to USD 5.4 billion by the year 2035.

Increasing demand for automatic beverage dispensing solutions in quick-service restaurants, cinemas, convenience stores, and institutional catering operations driven by consumers' shifting sentiments towards customization and hygiene is one of the principal growth drivers.

The increasing footprint of the food service industry in North America is providing significant stimulus to the use of modern fountain dispensers. As QSR chains and self-serve restaurants grow, the need for equipment that can provide speed, efficiency, and multiple flavors simultaneously is increasing. Consumers are increasingly expecting drink customization through flavor shots, carbonation levels, and sugar level control-something modern dispensers are set to provide.

Hygiene and health are at the forefront of concerns in the post-pandemic era. Touchless dispensers, antimicrobial surfaces, and automated cleaning protocols are the new norm. Operators are installing these features to comply with regulations and gain customers' trust, particularly in busy environments. These trends are forcing manufacturers to be innovative both functionally and design-wise.

Digitization is also revolutionizing the way the dispenser landscape is being redefined. IoT connectivity, real-time monitoring, and remote diagnostics are being used to optimize maintenance schedules, reduce downtime, and deliver consistent beverage quality. Fountain dispenser equipment is thus evolving from passive hardware to smart, networked assets within broader food service ecosystems.

Despite being a mature industry, North America presents new opportunities for growth through upgrades and replacements of existing units. Additionally, the increase in sustainable beverage drinking-organic soft drinks, flavored water, and low-calorie drinks-is spurring the usage of dispensers with modular, multi-ingredient compatibility. The convergence of health, convenience, and digital functionality will likely spur steady industry expansion over the next decade.

Automated machines in the industry are expected to capture 64.5% of the industry by 2025, with semi-automated units will hold 22%.Automated fountain dispensers are widely installed and used in QSR segments, convenience stores, and entertainment venues.

These machines let users select personalized drinks from the screen interface and can offer anything from flavor customization and portion control to a full experience. An example of such a machine is the Freestyle dispenser from Coca-Cola; it is a digital platform that allows the consumer to mix more than 100 drink combinations. The Freestyle's popular brands from players like Burger King and AMC Theatres indicate the rising interest in beverage solutions that are interactive or tech-enabled.

Pepsico's Spire units prove very useful since they offer the same digital beverage customization and allow retailers to benefit from comprehensive analytics. Not only does this enhance the user experience, but it also makes it possible for companies to monitor what consumers prefer, reducing wastage and facilitating inventory control.

The semi-automated machines will thus constitute 22% of the industry share and are favored in traditional fast-food facilities and an institutional setting where control by staff is preferred. The interaction of operators operates these dispensers and is therefore suitable for environments interested in portion consistency with proper operational control, like cafeterias, hospitals, and school canteens.

For example, companies such as Lancer Worldwide and Cornelius Inc. provide very reliable semi-automated systems designed as back-of-house solutions with user-friendliness and low maintenance needs.

Thus, like other parts of food service where speed, customization, and hygiene are the keywords, automated machines will continue to lead. That said, semi-automated models will still hold worth in different cost-sensitive or high-control settings that still require employee oversight. Manitowoc, Multiplex, and Zummo Innovaciones Mecánicas are also changing the course of the equipment world through innovations that meet various operational requirements.

The placement scenario exists in the North America fountain dispenser equipment industry as a moderating factor in customer engagement and operations. By 2025, dispensers in front of the register will lead the industry with 58% of the industry share, while back-of-register placements will account for 42%.

The continued vulnerabilities of this placement type are in connection with the widespread adoption of self-serve models in quick-service restaurants (QSRs), convenience stores, and fast-casual dining segments. Here, customers are empowered to personalize their beverages-select flavors and control portions-which adds to customer satisfaction as well as enhances an additional push in labor productivity within the store environment.

Coca-Cola (through Freestyle machines) and PepsiCo (with Spire systems) have successfully marketed the concept of front-facing digital fountain units as tools for consumer engagement and providing significant data analytics to businesses. Major chains, including Five Guys and Subway, are also integrating front-of-register systems into business processes to streamline operations, thus allowing for upselling via visual interaction with beverage options.

Behind-the-register fountains, accounting for 42% of the industry, are favored in traditional formats where beverage dispensing is associated with varying degrees of staff control. These types of setups are generally complemented by drive-thrus, cinemas, and institutional food service establishments, including schools, airports, and hospitals, which tend to favor optimized control in consistent portioning. Cornelius, Lancer Worldwide, and Manitowoc manufacture more compact back-of-counter fountain systems that integrate well into escorted operations.

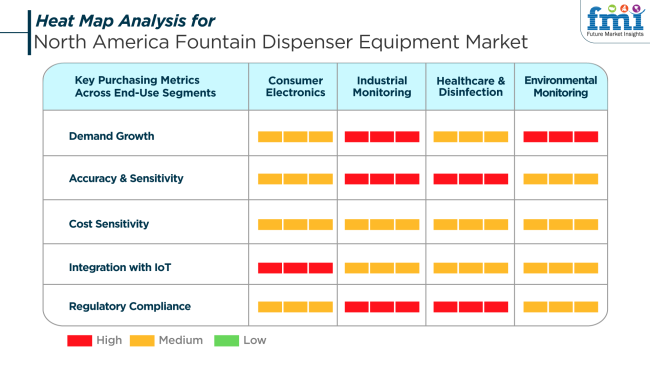

Fountain dispenser buying trends vary by industry but are strongly weighted toward digital integration, affordability, and hygiene compliance. In consumer-facing kiosk and food outlet industries with electronic integration, growth demand is strong, driven by user engagement and seamless digital operations. IoT connectivity is central, enabling touchless payment and instant performance feedback.

Industrial and institutional applications-e.g., manufacturing complexes or cafeteria facilities of considerable size-seem to have very high growth in demand for dispensers that are able to dispense large volumes reliably with minimal human involvement. Cost and compliance are most crucial in this case, with buyers seeking durable systems with less maintenance and food safety compliance.

In health or environmental centers offering drink stations, sanitary design and accuracy take precedence. Models reducing the risk of contamination with the ability to accommodate individual choices are optimal. In every industry, modularity, remote examination, and compatibility with healthier beverages are re-engineering buying habits, cementing smart dispensers as a utility anchor in infrastructure built for the future.

The industry increased steadily from 2020 to 2024 due to technological advancements and changing consumer sentiments. The use of touch-screen interfaces, self-cleaning systems, and improved beverage mixing systems improved user experience and efficiency.

The COVID-19 pandemic accelerated the uptake of contactless dispensing technology, and major players such as Coca-Cola introduced touchless Freestyle dispensers that allowed customers to select and pour beverages with their mobile devices.

Automatic dispensers led the market share due to convenience and hygiene demands. Quick-service restaurants (QSRs) and convenience stores were among the major adopters, employing such technologies to offer personalized beverage options and simplify complexity.

Transitioning into 2025 to 2035, the industry will keep expanding based on the trajectory of digital adoption, sustainability, and evolving consumption patterns. Internet of Things (IoT) connectivity and data insights will enable real-time tracking, predictive upkeep, and personalized consumer experience.

It will be led by sustainability, with producers emphasizing energy-efficient technologies, recyclable components, and water usage reduction. The home business will grow through increasing at-home usage and the demand for tailor-made beverage solutions.

Companies will spend more on R&D to develop miniaturized, easy-to-use dispensers that are suitable for use in the home. Strategic partnerships and acquisitions, such as the acquisition of CAB Spa by Celli Group, will play a crucial role in adding product ranges and penetrating emerging industries.

Comparative Market Shift (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Introduction of touch-screen interfaces and automated cleaning systems | Integration of IoT connectivity and data analytics for real-time monitoring |

| Demand for contactless and customizable beverage options | Focus on personalized experiences and home-based consumption |

| QSRs and convenience stores' dominance | Incorporation into residential and healthcare industries |

| First steps towards eco-friendly designs and materials | Emphasis on energy-efficient systems and recyclable parts |

| Standardized dispensers with minimal customization | Design and development of compact and easy-to-use dispensers for multifarious applications |

| Partnerships between beverage companies and dispenser manufacturers | More mergers and acquisitions to expand product portfolios |

| Compliance with hygiene and safety norms | Enactment of stricter environmental and sustainability regulations |

| Technological innovation and pandemic-driven need for contactless solutions | Demand for sustainability and personalized experiences from consumers |

| High installation and maintenance costs | Navigating through challenging regulatory environments and maintaining data protection |

| Coca-Cola, PepsiCo, Lancer Worldwide, Manitowoc Ice | Extension of established players and emergence of new entrants with emphasis on innovation |

The industry is vulnerable to several strategic threats, which are primarily related to operational disruption, shifting beverage trends, and regulatory scrutiny. Disruption of the supply chain of electronic components and stainless steel, both of which are essential in producing dispensers, is one of the key vulnerabilities. Procuring such inputs in a delayed fashion or at increased costs can lead to delivery delays and scalability.

Changing consumer preferences is another concern. Increased demand for non-carbonated, sugared drinks is reducing traditional fountain drink sales volume. Businesses must constantly alter their equipment to accommodate non-carbonated, plant-based, or nutrient-enhanced beverages, requiring R&D spending and formulation compatibility.

Regulatory risks are also building up, particularly in sanitation and energy consumption. Harsher food safety regulations necessitate antimicrobial technology, robotic washing cycles, and precise temperature control-all factors that fuel equipment complexity and compliance costs. Companies that fail to change quickly run the risk of becoming less competitive in an economy where hygiene guarantees are rapidly emerging as irreducible.

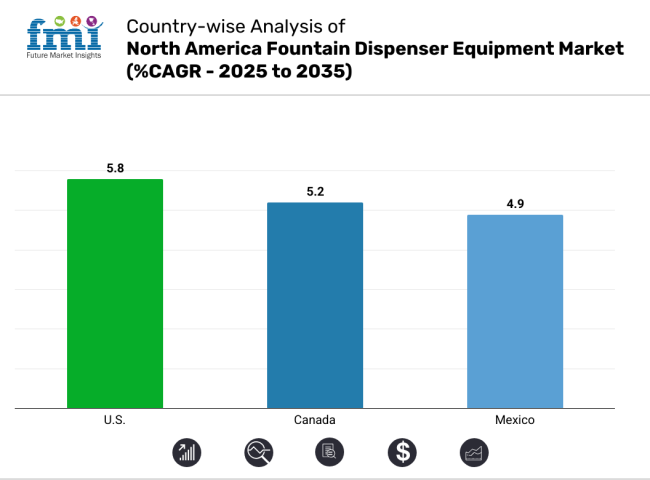

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 5.8% |

| Canada | 5.2% |

| Mexico | 4.9% |

The USA industry is anticipated to develop at 5.8% CAGR throughout the study period. The well-established presence of the food service sector, coupled with growing consumer inclination towards self-service beverage options, is propelling demand for fountain dispenser machinery. Fast-food chains, quick-service restaurants, and movie theaters continue to invest in advanced dispensing systems in order to enhance operational efficiency and customer experience.

The emphasis on hygienic and contactless beverage dispensing technologies has further driven innovation, leading vendors to implement touchless interfaces, smart sensors, and automated portion controls. Further, the move towards energy-efficient equipment and sustainability has led to higher penetration rates of sophisticated fountain dispensers.

The manufacturers are concentrating on minimizing CO₂ emissions and enhancing refrigeration technologies in line with changing environmental norms in the USA With increasing emphasis on customization and variety in the beverages, particularly in carbonated drinks and flavored water, foodservice operators are increasingly dependent on modular and high-capacity dispensing units.

The fact that the industry has key global players with headquarters in the USA also supports domestic industry growth through ongoing innovation and rapid response to evolving consumer trends. In general, the USA offers a mature but dynamic industry environment with sustained demand, technology innovation, and mass commercial application.

The Canadian industry is anticipated to expand at a 5.2% CAGR throughout this study. Canada's food and beverage service industry has demonstrated considerable recovery and development, creating an encouraging environment for the uptake of new fountain dispenser equipment. Canada's restaurant chains and entertainment centers are spending money on self-service soft drink dispensing systems to increase throughput and serve changing consumer preferences.

The increase in demand for low-calorie, flavored, and functional soft drinks is opening new dimensions of beverage customizing and variation in fountain dispenser machines. Equipment improvements specifically geared to the Canadian climate, such as frost-resistance dispensing parts and power-saving devices, are also proving popular.

Escalating environmental controls and increasing energy expenses have driven operators to prefer equipment that encourages energy efficiency and waste reduction. IoT functionality built into beverage dispensers also interests firms looking for data-driven inventory control and maintenance schedules.

As cities expand and demand for convenience-focused solutions continues to grow, the adoption of smaller, multifunction dispenser units is increasingly common. Although the Canadian industry will not equal that of the USA in size, its concentration on quality, technology uptake, and sustainability still drives it to be an important source of regional growth for the North America fountain dispenser equipmentindustry.

The Mexican industry is anticipated to expand at 4.9% CAGR throughout research. Economic growth and ongoing growth in the fast-food and casual dining industries are major forces driving growing demand for North America fountain dispenser equipment in Mexico.

Urban areas are seeing increased consumer traffic at restaurants, theaters, and entertainment areas, leading firms to install high-volume, dependable beverage dispensers. Increased disposable incomes and changing life patterns have ensured that there has been growing popularity for flavored beverages and carbonated soft drinks, courtesy of readily accessible self-service opportunities.

To that effect, the proliferation of global fast foods and expansions in franchising business in Mexican urban centers has necessitated standardized, scalable, and effective dispensation solutions for their beverages. Local companies are also turning their attention to operational effectiveness and cost savings, which is promoting the installation of multi-flavor and automatic dispensing machines.

Although some infrastructural and economic limitations prevail in rural settings, urban Mexico remains strong on the growth curve. Local equipment suppliers are also working with international manufacturers, aiding in the reduction of the technology gap and the availability of state-of-the-art equipment. With the diversification of the hospitality and entertainment industries, Mexico's fountain dispenser equipment industry will continue to grow steadily through 2035.

The North America fountain dispenser equipment industry is controlled by a number of large, established players that provide innovative and efficient equipment to the foodservice and beverage industries. Drinking industry leaders like The Coca-Cola Company and PepsiCo are not only famous for their powerful brand value in the beverage industry but also for having their sophisticated fountain dispensing solutions that are very high-quality, reliable, and tailor-made products for a vast number of business needs.

These firms' huge distribution bases and humongous alliances with restaurants, convenience stores, and other foodservice units create a dominating position in the marketplace. Firms like FBD Partnership, LP, and Lancer Worldwide maintain a continuous edge in terms of machine design improvements, efficiency in systems, and simplicity in operating systems by producing highly customized and specialized fountain dispenser solutions.Keurig Dr Pepper Inc. and Manitowoc Ice are also serious contenders, introducing advanced ice-making and beverage dispensing technologies to the industry.

At the same time, such players as Cornelius, Multiplex, and CELLI SPA are aimed at the emerging demand for combined beverage solutions that integrate product dispensing with innovative cooling and mixing solutions. The multifaceted industry presence on the industry guarantees competitiveness, while each competitor targets distinctive features and accommodates special industry requirements, ranging from premium restaurant systems to affordable solutions for small businesses.

Market Share Analysis by Company

| Company | Estimated Market Share (%) |

|---|---|

| The Coca-Cola Company | 18-22% |

| PepsiCo | 15-18% |

| FBD Partnership, LP | 12-15% |

| Lancer Worldwide | 10-13% |

| Keurig Dr Pepper Inc. | 8-10% |

| Other Players | 33-37% |

Key Company Insights

The Coca-Cola Company leads the North America fountain dispenser equipment industry with an estimated 18-22% industry share. The company's dominance is driven by its global brand name and broad product line, from various fountain dispenser models suitable for many commercial uses.PepsiCo ranks second with a 15-18% industry share, providing top-notch fountain dispensing solutions to support its broad beverage line, catering to large-scale and independent businesses in the region.

FBD Partnership, LP has around 12-15% industry share with its innovative beverage dispensing solutions that focus on waste reduction and efficiency. Lancer Worldwide has a 10-13% industry share with reliable, user-friendly, and customizable fountain dispensers to foodservice operators. Keurig Dr Pepper Inc. has an 8-10% industry share with a combination of beverage innovation and technology in fountain dispensing. Other players such as Manitowoc Ice, Cornelius, Multiplex, and CELLI SPA fill the industry with niche players providing specialized equipment that focuses on integrated cooling, mixing, and dispensing solutions, serving niche segments in the foodservice and beverage industry.

By machine type, the industry is segmented into automated, semi-automated, and manual.

By channel, the industry is categorized into restaurants (quick-service, limited-service, full-service), business & industry, travel & leisure (hotels/lodging, airports), healthcare (hospitals, others), education (colleges & universities, K-12 schools), entertainment venues (sports stadiums, cinemas, others), residential, and others (convenience stores, supermarket foodservice).

By placement, the industry is divided into in-front of the register and behind the register.

By country, the industry is segmented into the USA, Canada and Mexico.

The industry is expected to reach USD 2.9 billion in 2025.

The industry is projected to grow to USD 5.4 billion by 2035.

The industry is expected to grow at a CAGR of approximately 5.8% during the forecast period.

Automated machines are a key segment in the industry.

Key players include The Coca-Cola Company, PepsiCo, FBD Partnership, LP, Lancer Worldwide, Keurig Dr Pepper Inc., Cornelius, Multiplex, CELLI SPA, Manitowoc Ice, and Follett Products, LLC.

Table 1: Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 2: Market Volume (Units) Forecast by Country, 2019 to 2034

Table 3: Market Value (US$ Million) Forecast by Machine Type, 2019 to 2034

Table 4: Market Volume (Units) Forecast by Machine Type, 2019 to 2034

Table 5: Market Value (US$ Million) Forecast by Channel, 2019 to 2034

Table 6: Market Volume (Units) Forecast by Channel, 2019 to 2034

Table 7: Market Value (US$ Million) Forecast by Placement, 2019 to 2034

Table 8: Market Volume (Units) Forecast by Placement, 2019 to 2034

Table 9: Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 10: Market Volume (Units) Forecast by Country, 2019 to 2034

Table 11: Market Value (US$ Million) Forecast by Machine Type, 2019 to 2034

Table 12: Market Volume (Units) Forecast by Machine Type, 2019 to 2034

Table 13: Market Value (US$ Million) Forecast by Channel, 2019 to 2034

Table 14: Market Volume (Units) Forecast by Channel, 2019 to 2034

Table 15: Market Value (US$ Million) Forecast by Placement, 2019 to 2034

Table 16: Market Volume (Units) Forecast by Placement, 2019 to 2034

Figure 1: Market Value (US$ Million) by Machine Type, 2024 to 2034

Figure 2: Market Value (US$ Million) by Channel, 2024 to 2034

Figure 3: Market Value (US$ Million) by Placement, 2024 to 2034

Figure 4: Market Value (US$ Million) by Country, 2024 to 2034

Figure 5: Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 6: Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 7: Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 8: Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 9: Market Value (US$ Million) Analysis by Machine Type, 2019 to 2034

Figure 10: Market Volume (Units) Analysis by Machine Type, 2019 to 2034

Figure 11: Market Value Share (%) and BPS Analysis by Machine Type, 2024 to 2034

Figure 12: Market Y-o-Y Growth (%) Projections by Machine Type, 2024 to 2034

Figure 13: Market Value (US$ Million) Analysis by Channel, 2019 to 2034

Figure 14: Market Volume (Units) Analysis by Channel, 2019 to 2034

Figure 15: Market Value Share (%) and BPS Analysis by Channel, 2024 to 2034

Figure 16: Market Y-o-Y Growth (%) Projections by Channel, 2024 to 2034

Figure 17: Market Value (US$ Million) Analysis by Placement, 2019 to 2034

Figure 18: Market Volume (Units) Analysis by Placement, 2019 to 2034

Figure 19: Market Value Share (%) and BPS Analysis by Placement, 2024 to 2034

Figure 20: Market Y-o-Y Growth (%) Projections by Placement, 2024 to 2034

Figure 21: Market Attractiveness by Machine Type, 2024 to 2034

Figure 22: Market Attractiveness by Channel, 2024 to 2034

Figure 23: Market Attractiveness by Placement, 2024 to 2034

Figure 24: Market Attractiveness by Country, 2024 to 2034

Figure 25: Market Value (US$ Million) by Machine Type, 2024 to 2034

Figure 26: Market Value (US$ Million) by Channel, 2024 to 2034

Figure 27: Market Value (US$ Million) by Placement, 2024 to 2034

Figure 28: Market Value (US$ Million) by Country, 2024 to 2034

Figure 29: Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 30: Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 31: Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 32: Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 33: Market Value (US$ Million) Analysis by Machine Type, 2019 to 2034

Figure 34: Market Volume (Units) Analysis by Machine Type, 2019 to 2034

Figure 35: Market Value Share (%) and BPS Analysis by Machine Type, 2024 to 2034

Figure 36: Market Y-o-Y Growth (%) Projections by Machine Type, 2024 to 2034

Figure 37: Market Value (US$ Million) Analysis by Channel, 2019 to 2034

Figure 38: Market Volume (Units) Analysis by Channel, 2019 to 2034

Figure 39: Market Value Share (%) and BPS Analysis by Channel, 2024 to 2034

Figure 40: Market Y-o-Y Growth (%) Projections by Channel, 2024 to 2034

Figure 41: Market Value (US$ Million) Analysis by Placement, 2019 to 2034

Figure 42: Market Volume (Units) Analysis by Placement, 2019 to 2034

Figure 43: Market Value Share (%) and BPS Analysis by Placement, 2024 to 2034

Figure 44: Market Y-o-Y Growth (%) Projections by Placement, 2024 to 2034

Figure 45: Market Attractiveness by Machine Type, 2024 to 2034

Figure 46: Market Attractiveness by Channel, 2024 to 2034

Figure 47: Market Attractiveness by Placement, 2024 to 2034

Figure 48: Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Drinking Fountain Market Size and Share Forecast Outlook 2025 to 2035

Floating Fountains Market Size and Share Forecast Outlook 2025 to 2035

Oil Dispenser Market

Tape Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Tray Dispensers Market Size and Share Forecast Outlook 2025 to 2035

Beer Dispensers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Soap Dispenser Market Trends - Demand & Forecast 2025 to 2035

Competitive Overview of Tape Dispenser Companies

Tape Dispenser Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Water Dispenser Market Trends - Growth & Demand Forecast 2025 to 2035

Strap Dispenser Market

Powder Dispenser Market Analysis by Product Type, Size, Dispensing Mode, End-use Industry, and Region through 2025 to 2035

Cereal and Dry Food Dispensers Market – Fresh & Convenient Dispensing 2025-2035

Key Players & Market Share in Powder Dispenser Manufacturing

Bespoke Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Bespoke Dispenser Manufacturers

Pump and Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Beverage Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Examining Market Share Trends in the Pump and Dispenser Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA