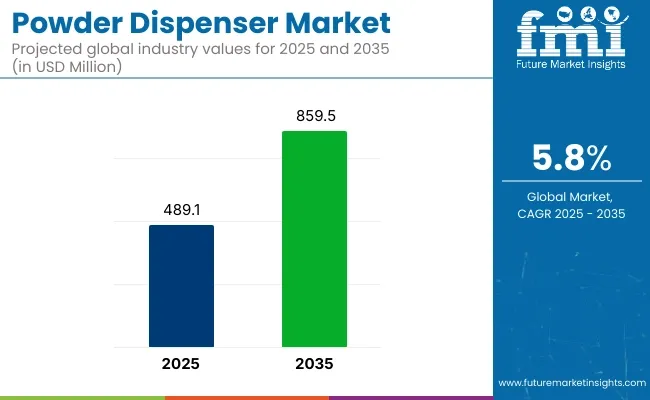

The powder dispenser market is projected to grow from USD 489.1 million in 2025 to USD 859.5 million by 2035, registering a CAGR of 5.8% during the forecast period. Sales in 2024 reached USD 462.2 million, underscoring the sector's resilience and growing demand across pharmaceuticals, food and beverage, cosmetics, and chemical industries. This growth is attributed to the increasing need for precise, hygienic, and efficient powder handling solutions that enhance product quality and meet stringent regulatory standards.

| Attributes | Description |

|---|---|

| Estimated Market Size (2025E) | USD 489.1 million |

| Projected Market Value (2035F) | USD 859.5 million |

| Value-based CAGR (2025 to 2035) | 5.8% |

GOJO announced introduction of the Next Generation in Dispensing Technology - the PURELL® ES10. The newest dispensing system offers less maintenance, less waste, a sleeker design, and a softer dispensing sound. "The ES10 Dispensing System is our simplest and most sustainable touch-free dispensing system and there is nothing like it in the industry today," said Stephanie Schneider, Chief Product Officer. "At GOJO, we are problem solvers.

Our team thrives on understanding important human problems and bringing innovative well-being solutions to our customers that meet their needs and provide the best hand hygiene solutions to their patrons, patients, and employees. It is this passion for learning that drove the development of our newest dispensing system that leapfrogs all other systems with less maintenance, less waste, and more ways to impress."

The shift towards sustainable and environmentally friendly solutions has significantly influenced the powder dispenser market. Manufacturers have been focusing on developing dispensers that are recyclable, biodegradable, and made from renewable resources. Innovations include the integration of biodegradable materials, modular designs, and the use of recycled components to reduce environmental impact.

These advancements align with global sustainability goals and regulatory requirements, making powder dispensers an attractive option for environmentally conscious industries. Additionally, the development of automated dispensing systems has enhanced efficiency and consistency in production processes, further driving market growth.

The powder dispenser market is poised for significant growth, driven by increasing demand in pharmaceuticals, food and beverage, and cosmetics industries. Companies investing in sustainable materials, innovative designs, and eco-friendly production processes are expected to gain a competitive edge.

As global supply chains expand and environmental regulations become more stringent, the adoption of powder dispensers is anticipated to rise, offering cost-effective and eco-friendly solutions for product packaging and dispensing. Furthermore, the integration of smart technologies and automation in powder dispenser applications is expected to enhance operational efficiency and meet the evolving needs of various industries.

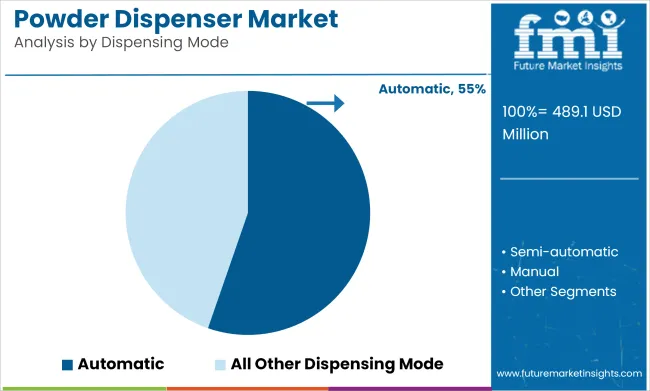

Automatic powder dispensers are projected to capture approximately 55.3% of the global powder dispenser market by 2025, as they have been widely integrated into industrial and commercial settings that require consistent dosing, reduced human intervention, and contamination-free processing. These dispensers have been engineered to support high-volume operations with minimal variance, especially in environments governed by hygiene and safety regulations.

Controlled dispensing has been enabled through programmable settings, load cell integration, and real-time monitoring systems. Touchless operation and automated shutoff functions have further contributed to their use in pharmaceutical compounding, food formulation, and manufacturing lines involving bulk powder transfer.

Automatic systems have been preferred in settings where workflow continuity, labor efficiency, and ingredient traceability are prioritized. Their compatibility with filling lines, mixing stations, and sealed containers has allowed seamless incorporation into automated production frameworks. As precision, product integrity, and cost-efficiency continue to shape material handling processes, automatic dispensers are expected to remain the most widely adopted dispensing mode, driven by their scalability, reliability, and compatibility with digital manufacturing systems.

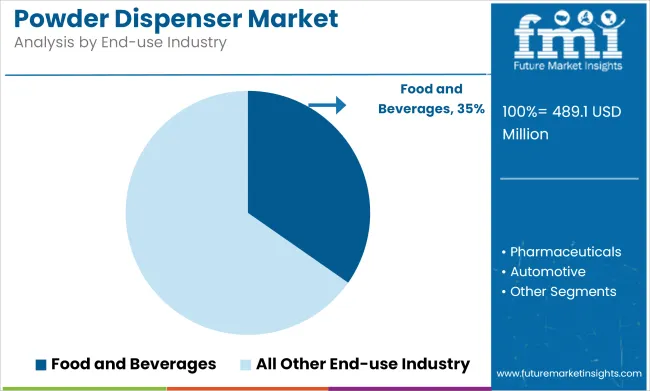

The food and beverages industry is forecasted to dominate the powder dispenser market by 2025, holding an estimated 34.7% market share, due to its extensive use of powdered ingredients in the formulation of bakery products, instant beverages, dairy mixes, nutritional supplements, spices, and flavoring agents.

Powder dispensers have been employed to ensure consistent ingredient delivery, maintain batch accuracy, and meet hygiene standards across large-scale production facilities. Automated and semi-automated dispensers have been utilized in dry food blending operations, where measured dosing of powders such as flour, sugar, protein isolates, and thickeners has been required. These systems have supported HACCP-compliant processes, minimizing cross-contamination and operator exposure.

Dispenser systems have also been adopted in beverage manufacturing, particularly for powdered drink mixes, where uniformity, dust control, and moisture protection have been critical. The ability to pre-program dispensing cycles has facilitated seamless integration with continuous or batch production formats. As food processors continue to optimize quality control, throughput, and regulatory compliance, powder dispensers are expected to maintain strong relevance in this sector. Their deployment has been further supported by increasing demand for ready-to-eat, fortified, and personalized nutrition products worldwide.

Pharma Companies Increase the Demand for Automatic Powder Dispensers

The need for accurate powder dispensing systems is being driven by pharmaceutical businesses' increasing use of automated manufacturing processes. This is especially critical for clinical trial materials and small-batch specialty drugs, where precision is essential. Maintaining high standards of quality requires accurate dispensing equipment, which is becoming increasingly important as more businesses move toward automation.

Personalized Nutrition Products Require Precise Powder Measurements

Rising consumer interest in personalized nutrition and supplements is fueling demand in health food stores and nutrition centers. These businesses require accurate powder dispensing systems to cater to specific dietary needs. Likewise, the expansion of coffee shops and specialty beverage retailers has created a market demand for powder dispensing systems that can precisely handle powdered ingredients like cocoa, protein supplements, and flavoring agents.

Research Labs and Industries Require Enclosed Powder Dispensers

Workplace safety is a prime focus for companies. There is a higher need for enclosed powder dispensing systems that lower exposure in industrial settings. For use in chemical and material science research, research labs are also looking for accurate powder dispensing devices. The need for user-friendly powder dispensing solutions for consumers buying dry goods and spices is also being fueled by the growth of self-service bulk grocery stores.

High Initial Investment is a Deterrent for Small Businesses

High initial investment costs for automated powder dispensing systems are a significant challenge, especially for small businesses and startups. These high initial expenses makes it tough for smaller companies to invest, despite the long-term operational benefits. This financial barrier hinders adoption in many industries.

Maintaining Accuracy of Dispensing can be Challenging

Another significant issue is maintaining uniform dispensing accuracy across several powder kinds with differing densities and flow characteristics. Product quality may be impacted by dispensing errors brought on by the difficulty of managing such variations. In sectors like pharmaceuticals, where extreme precision is essential, this is especially worrisome. Furthermore, operations may be disrupted by the need for routine maintenance and possible downtime problems, particularly in high-volume applications where uptime is crucial.

The integration of IoT capabilities in industrial powder dispensing systems is a key trend, allowing for remote monitoring and automated inventory management. This technology enhances operational efficiency by providing real-time data on dispenser performance and stock levels, enabling businesses to optimize their supply chains and minimize downtime with proactive maintenance.

Modular dispensing systems are gaining traction, offering the flexibility to be reconfigured for different powder types and portion sizes. This adaptability is particularly beneficial for businesses with diverse product lines, allowing them to easily switch between powders without needing separate dispensers. Such systems enhance efficiency and reduce operational complexity.

Anti-static and moisture-control features are essential for dispensing hygroscopic and sensitive powders, ensuring product quality. Additionally, UV sterilization and antimicrobial surface treatments are being incorporated into food-grade dispensers to meet hygiene standards.

The adoption of smart calibration systems is also increasing, enabling automatic adjustments based on powder characteristics for optimal dispensing accuracy.

Due to hygienic considerations, touchless dispensing devices are becoming more and more popular in public and retail settings. In an effort to reduce the spread of germs, consumers are increasingly searching for contact-free alternatives. These systems are especially well-liked in busy places like cafes and grocery stores since they provide comfort and security.

Compact countertop dispensers have become popular, particularly for usage at home with goods like protein powders, coffee, and vitamins. These dispensers make it simple for customers to handle their portioning requirements. The growth is a reflection of the growing need for effective and personalized at-home solutions.

Additionally, consumers' growing awareness of sustainability is fueling the market for dispensing solutions with recyclable components and low waste. Furthermore, for accurate portion control, dispensers with digital displays and accurate measurement indicators are preferred. The adoption of subscription-based powder products, combined with compatible dispensing systems, is also on the rise, offering convenience and regular supply to customers.

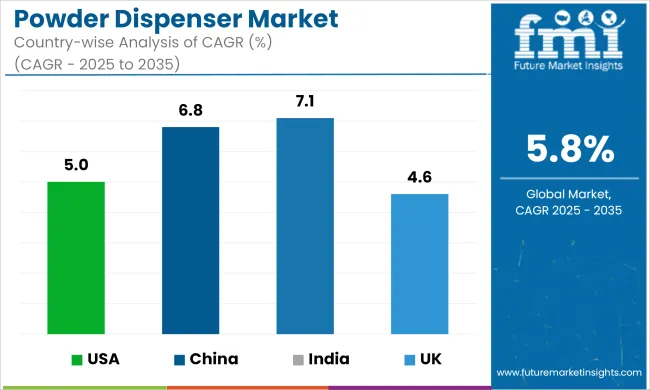

| Countries | CAGR |

|---|---|

| USA | 5.0% |

| China | 6.8% |

| India | 7.1% |

| UK | 4.6% |

Consumer preferences have shifted towards smart powder dispensers with IoT connectivity and mobile app integration, particularly in urban households and small businesses. Apogee Powder Systems and PowderTech Solutions have responded by introducing AI-enabled dispensers with predictive maintenance features and consumption tracking capabilities.

The market has seen increased demand for compact, aesthetically pleasing dispensers for home use, especially for coffee and nutritional supplements. Companies like AutoMeasure and SmartDose Technologies have focused on developing subscription-based models combining premium dispensers with regular powder deliveries.

Chinese consumers have embraced automated powder dispensers in bubble tea shops and modern coffee chains, driving innovation in multi-powder dispensing systems. Local manufacturers like Shanghai PowderTech and Beijing AutoFill have developed specialized dispensers with touchscreen interfaces and QR code payment integration.

The market has experienced strong growth in smart vending machines featuring powder dispensers. Companies have focused on developing cloud-connected systems that enable remote monitoring and automated inventory management for commercial applications.

Indian consumers have shown increasing interest in affordable powder dispensers for small retail shops and tea stalls. Companies like Pune Dispensing Solutions and Delhi AutoMech have introduced entry-level automated dispensers with basic features at competitive price points.

The market has seen growth in demand for dispensers with battery backup features due to power fluctuations. Manufacturers have focused on developing robust, low-maintenance systems suitable for harsh environmental conditions and heavy usage.

British consumers have gravitated towards eco-friendly powder dispensers with reusable container compatibility and energy-efficient features. Market leaders like PrecisionPour UK and AutoDispense Systems have introduced recycling programs for old dispensers and developed energy-monitoring capabilities.

The focus has shifted to premium dispensers with customizable settings for specialty coffee shops and health food stores. Businesses have made investments in creating intuitive user interfaces and offering thorough training courses to clients.

For industrial and pharmaceutical applications in particular, German consumers have placed a high value on accuracy and dependability in powder dispensing systems. Companies like TechnoDispense and PräzisionSystem have focused on developing high-precision dispensers with advanced calibration features.

The market has seen increased adoption of modular dispensing systems allowing for easy upgrades and maintenance. Manufacturers have emphasized developing systems compliant with strict industrial standards while maintaining energy efficiency and minimal waste generation.

| Company Name | Company Expertise |

|---|---|

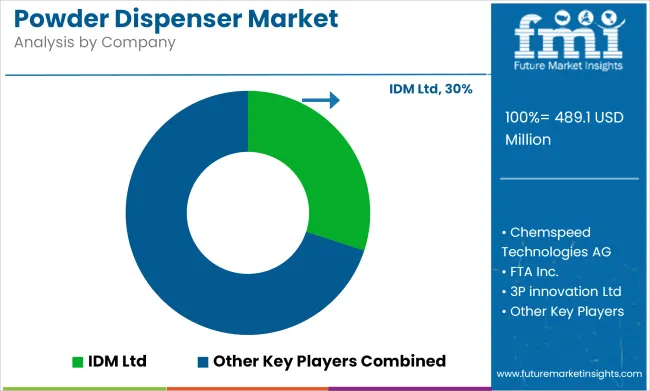

| IDM Ltd | Specializes in powder dispensing solutions for various industries. |

| Capsugel | Expertise in capsule filling and powder dispensing systems, particularly in pharmaceuticals. |

| Chemspeed Technologies AG | Focuses on automated dispensing and high-precision laboratory equipment. |

| FTA Inc. | Known for powder dispensing technology for industrial and food applications. |

Software integration capabilities are becoming a crucial differentiator in the powder dispenser market. Established companies are producing in-house systems for tracking consumption of powders. This gives organizations a better control, and provides precise and effective dispensing. These cutting-edge systems are enhancing operations.

High-precision dispensers for pharmaceutical applications are being introduced by laboratory manufacturers, while coffee equipment manufacturers are taking advantage of their current connections with coffee shops to provide customized dispensers for powdered ingredients. In their respective domains, both segments are generating fierce competition. Both segments are creating strong competition in their respective fields.

Asian manufacturers are dominating the compact dispenser segment, especially for home use, by offering innovative designs and competitive pricing. These dispensers are increasingly popular due to their affordability and functionality. Additionally, startups focusing on IoT-enabled dispensers for the supplement and nutrition market have garnered significant investment, enhancing competition and innovation across the industry.

One important trend is the creation of hybrid dispensing systems, which enables companies to manage several powder kinds with fast-change mechanisms. Businesses that frequently need to swap between different components will find this operational flexibility especially useful as it increases productivity and eliminates the need for additional dispensers.Subscription-based models are being implemented to reduce initial investment barriers for customers.

Due to their ability to improve customer service and operational efficiency, mobile apps for remote dispenser monitoring and maintenance scheduling are growing in popularity. Businesses may improve overall operational management and reduce downtime in high-demandareas by using these apps to analyze inventory levels, plan maintenance, and monitor dispenser function.

Powder producers and dispensing system suppliers are working together for providing adjusted and customized solutions for different products. Such partnerships ensure that dispensers are used according to the characteristics of specific powder types. This results in better handling, higher accuracy, and uniformity in dispensing. This also enhances product quality and reduces waste during the dispensing process.

High-end automated systems are now available for lease with maintenance packages, giving smaller enterprises more economical access to cutting-edge technology. Customers can also begin with basic models and progressively add functionality as their needs change thanks to modular upgrade paths. Recertification and refurbishment programs for second-hand dispensers further promote sustainability and cost-efficiency.

The market was valued at USD 489.1 million in 2025.

The market is predicted to reach a size of USD 859.5 million by 2035.

Some of the key companies manufacturing powder dispensers include IDM Ltd, Capsugel, Chemspeed Technologies AG, and others.

India is expected to be a prominent hub for powder dispenser manufacturers.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Key Players & Market Share in Powder Dispenser Manufacturing

Powdered Cellulose Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Powdered Soft Drinks Market Size and Share Forecast Outlook 2025 to 2035

Powder Packing Machine Market Size and Share Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Powder Induction and Dispersion Systems Business

Leading Providers & Market Share in Powder Packing Machines

Powder Injection Molding Market Growth – Trends & Forecast 2025 to 2035

Powdered Fats Market – Growth, Demand & Industrial Applications

Powdered Beverage Market Outlook – Growth, Demand & Forecast 2024-2034

Powder Feed Center Market

Powder Funnels Market

Powdered Hand Soap Market

Powder Coating Guns Market

Dry Powder Inhaler Market Size and Share Forecast Outlook 2025 to 2035

Egg Powder Market - Size, Share, and Forecast Outlook 2025 to 2035

Lip Powder Market Analysis by Form, End-User, Sales Channel and Region from 2025 to 2035

Dry Powder Refilling Machine Market

Baby Powder Market - Size, Share, and Forecast 2025 to 2035

Milk Powder Packaging Market Size and Share Forecast Outlook 2025 to 2035

Milk Powder Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA