About The Report

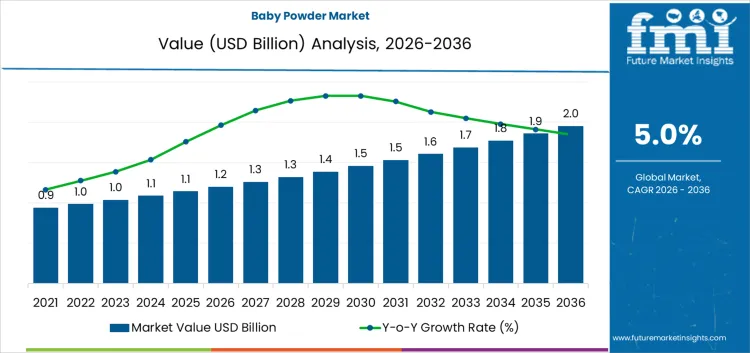

The baby powder market is expected to experience moderate growth from 2026 to 2036. Starting at USD 1.2 billion in 2026, the market is projected to reach USD 2.0 billion by 2036, reflecting a compound annual growth rate (CAGR) of 5%. This steady growth is driven by the increasing demand for baby care products, particularly in emerging markets where rising disposable incomes and a growing middle class are boosting consumer spending on infant health and wellness. Baby powder, traditionally used for keeping babies' skin dry and preventing rashes, continues to be a popular product in the baby care segment.

The market’s expansion is also supported by innovations in formulations, such as the introduction of hypoallergenic, natural, and organic baby powders to meet growing consumer demand for safer, chemical-free products. Additionally, the increasing awareness of infant skincare and the focus on high-quality, gentle baby care products are driving demand. Over the forecast period, the market is expected to continue its growth trajectory, with the expansion of the baby care product portfolio and increased focus on product safety and skin health.

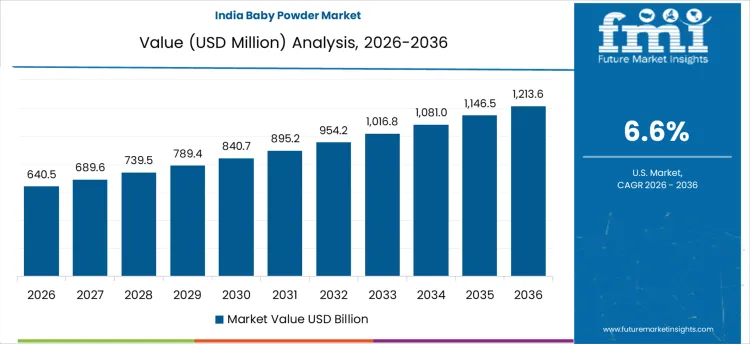

The long-term value accumulation curve for the baby powder market reveals a steady, incremental increase in market value over the forecast period. From 2026 to 2031, the market will grow from USD 1.2 billion to USD 1.5 billion, reflecting an absolute increase of USD 0.3 billion. This phase will experience a steady acceleration in growth, driven by increasing awareness around infant skincare and the rising demand for high-quality, safe products. New formulations focused on organic and hypoallergenic ingredients will help expand the consumer base and drive demand for baby powder.

From 2031 to 2036, the market will continue to grow from USD 1.5 billion to USD 2.0 billion, representing an additional absolute increase of USD 0.4 billion. The growth during this period will be more incremental as the market matures, with demand for baby powders stabilizing. The shift toward more health-conscious products and a continued preference for natural and chemical-free formulations will sustain growth, but at a slower pace compared to the earlier phase. The long-term value accumulation curve suggests a stable, ongoing increase in market value, with gradual but consistent growth driven by consumer demand for safer, more natural baby care products.

| Metric | Value |

|---|---|

| Industry Sales Value (2026) | USD 1.2 billion |

| Industry Forecast Value (2036) | USD 2.0 billion |

| Industry Forecast CAGR 2026 to 2036 | 5% |

Historical demand for baby powder was shaped by its widespread use in infant care to absorb moisture, reduce friction, and help prevent diaper rash and skin irritation, making it a staple in baby hygiene routines worldwide. Baby powder products traditionally contained either talc or alternative absorbents such as cornstarch, with historical growth supported by rising birth rates and expanding distribution in supermarkets, pharmacies, and retail channels as baby care categories matured. Consumer preferences have shifted over time toward formulations perceived as safer and gentler on delicate skin, driving product innovation around hypoallergenic, fragrance free, and talc free variants. Increased awareness of infant skin health and hygiene has been a key factor in market expansion, particularly in Asia Pacific, which held the largest market revenue share in 2024.

Future demand for the baby powder market is expected to grow at a steady rate over the next decade as demographic trends, changing consumer preferences, and evolving retail channels support continued uptake. Industry forecasts project market growth at compound annual rates in the mid single digits, with overall global market value rising toward approximately USD 2.1 billion–USD 2.5 billion by the early to mid 2030s depending on the source. Key growth factors include increasing consumer awareness about safe and natural baby care products, rising disposable incomes that support spending on infant hygiene, and expanding e commerce channels that improve product accessibility. There is a marked shift toward talc free and organic formulations reflecting safety concerns and regulatory influences, including major brands phasing out talc based powders and introducing cornstarch or botanical derived alternatives. Demographic drivers such as higher birth rates in emerging markets and growing middle class populations further reinforce demand, while innovation in product formats and branding continues to broaden appeal beyond infant care to general personal and skin hygiene uses, although manufacturers must address formulation quality and ingredient preferences as markets evolve.

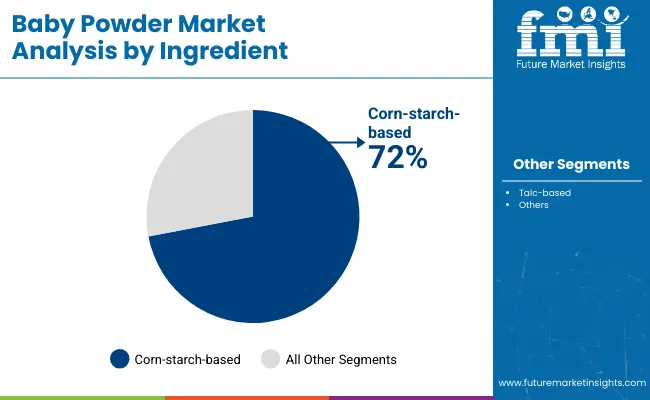

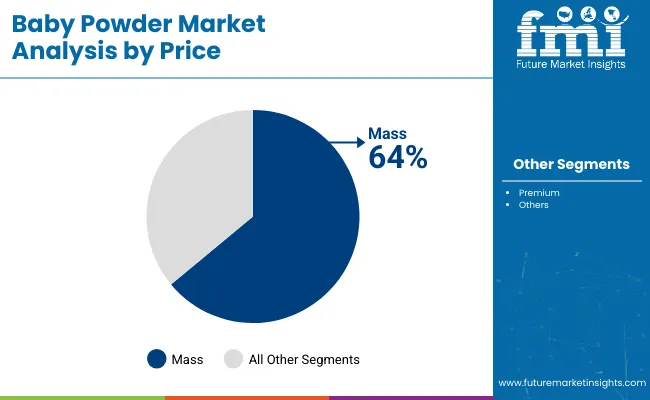

The global baby powder market is segmented by ingredient and price. Among ingredients, corn-starch-based baby powders lead the market, capturing 72% of the share, followed by talc-based powders. Corn-starch-based powders are preferred for their natural, hypoallergenic properties and are considered safer for babies. On the price side, mass products dominate, holding 64% of the share, followed by premium baby powders. Mass baby powders are widely available and affordable, making them the go-to choice for most consumers.

Corn-starch-based baby powders are the leading ingredient type in the baby powder market, holding 72% of the share. This growth is driven by the increasing consumer preference for natural, safe, and hypoallergenic alternatives to talc-based powders, especially as awareness about the potential health risks associated with talc has risen. Corn-starch-based powders are often marketed as a gentler and safer option for babies' sensitive skin, offering a natural way to absorb moisture and prevent diaper rash. With concerns over the use of talc in baby powders and a growing trend toward natural and organic products, corn-starch-based baby powders have gained significant market share. Additionally, corn-starch-based powders are more affordable and widely available, making them accessible to a broad range of consumers. As the demand for safe, chemical-free products increases, corn-starch-based baby powders are expected to continue to lead the market.

Mass baby powder products are the leading price segment in the market, capturing 64% of the share. This demand is primarily driven by the affordability and wide availability of mass-market baby powders. These products are typically priced lower, making them accessible to a larger consumer base. Mass baby powders are commonly available in supermarkets, pharmacies, and online, allowing parents to easily find them in a variety of retail outlets. The affordability and effectiveness of mass-market baby powders, combined with their trusted use in daily baby care routines, drive their continued dominance. While premium baby powders are growing in popularity due to their high-end formulations, mass products remain the preferred choice for many due to their cost-effectiveness and the ongoing demand for affordable baby care solutions. As the market continues to grow, mass baby powders are expected to maintain their dominant position due to their price advantage and widespread consumer base.

The baby powder market involves finely milled powders formulated for infant hygiene to absorb moisture and reduce friction. Products are sold through retail pharmacies, supermarkets, e commerce platforms, and maternal care channels. Market activity reflects consumer preferences for gentle, safe formulations with acceptable sensory profiles and dermatological compatibility. Regulatory requirements governing ingredient safety and labelling influence product formulation. Production depends on raw material supply for talc alternatives, oils, and plant derived powders. Competitive dynamics include branded and private label offerings. Demand patterns align with birth rates, caregiving practices, and awareness of skin irritation prevention.

Growth in the baby powder market is supported by ongoing demand for infant skincare and hygiene products in both developed and emerging regions. Caregivers prioritise products that help manage moisture in warm and humid climates, reducing diaper rash risk and skin chafing. Expansion of maternal health awareness and paediatric recommendations for safe infant care encourage consistent use of gentle powders. Retail expansion into urban and rural channels improves product reach. Marketing that emphasises dermatological testing, hypoallergenic ingredients, and suitability for sensitive skin resonates with health conscious consumers. E commerce penetration further broadens access, allowing comparison shopping, direct delivery, and repeat purchase convenience across demographic segments.

Restraints in the baby powder market include heightened scrutiny of ingredient safety and potential health concerns associated with traditional formulations. Public debates and varying regulatory interpretations regarding talc and inhalation risks have shifted some consumer demand toward talc free alternatives or away from powders altogether. Price sensitivity in cost constrained markets can limit uptake of premium or branded products. Variability in birth rates across key regions affects stable demand projection for infant specific products. Some caregivers opt for multi purpose or liquid alternatives perceived as less dusty, which constrains category growth. Supply chain volatility in raw materials for plant based powders or specialised excipients adds cost pressure for manufacturers.

Emerging trends in the baby powder market include formulation shifts toward talc free and plant derived powders aimed at consumer concerns about safety and sustainability. Manufacturers are increasing transparency on ingredient sourcing and testing to support confidence in product safety and dermatological performance. Growth in organic and clean label positioning reflects broader skincare preferences extending into infant care. Packaging innovations that improve dispensing control and reduce airborne dust are also gaining attention. Digital engagement via online parenting communities and targeted social media education reinforces product awareness and provides platforms for feedback. Expansion of multifunctional powders that combine absorption with soothing botanicals or prebiotic components is influencing future product development and segmentation.

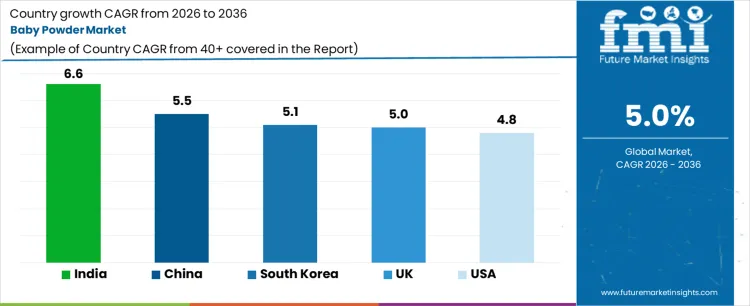

The baby powder market is experiencing moderate growth globally, driven by increasing awareness of baby hygiene, the growing population, and rising disposable incomes. In emerging markets like India and China, the market is growing at a stronger pace, fueled by rising birth rates, increasing awareness of baby care products, and the expansion of retail channels. Developed markets such as the USA, UK, and South Korea are seeing steady demand, supported by a focus on high-quality baby care products. As parents continue to seek trusted brands for baby care and hygiene, the demand for baby powder, particularly talc-based and baby-friendly natural alternatives, remains consistent across various regions.

| Country | CAGR 2026 to 2036 |

|---|---|

| India | 6.6% |

| China | 5.5% |

| South Korea | 5.1% |

| UK | 5% |

| USA | 4.8% |

The baby powder market in India is projected to grow at a steady rate, with a projected CAGR of 6.6% from 2026 to 2036. As India’s population continues to grow and disposable incomes rise, demand for baby care products, including baby powders, is increasing. The country’s rapidly expanding retail sector and the growing focus on baby hygiene are key drivers of this growth. Parents in India are becoming more conscious about the quality of baby products, leading to a higher demand for trusted and high-quality baby powders. Furthermore, the rise of e-commerce in India makes baby powder more accessible to a larger consumer base. With a growing middle class and increasing awareness about baby care, the baby powder market in India is expected to expand at a strong pace.

China is expected to experience steady growth in the baby powder market, with a projected CAGR of 5.5% from 2026 to 2036. As the world’s most populous country, China’s demand for baby care products, including baby powders, is growing due to rising consumer awareness, an expanding middle class, and increasing disposable incomes. The demand for baby hygiene products in China is also being fueled by the growing focus on health and wellness. While China’s market for baby powder is relatively mature, the increasing popularity of natural and organic baby products is contributing to market growth. With a large consumer base and growing retail channels, particularly through e-commerce platforms, the baby powder market in China is expected to grow steadily in the coming years.

The baby powder market in South Korea is projected to experience steady growth, with a projected CAGR of 5.1% from 2026 to 2036. South Korea has a well-established market for baby products, driven by a focus on high-quality baby care. Parents in South Korea are increasingly concerned about the safety and quality of products used for their children, driving demand for trusted baby powder brands. The rise in health-conscious consumers, along with increasing urbanization, is further supporting the growth of the market. Additionally, South Korea’s strong retail infrastructure and growing online sales channels are making baby powder more accessible to a larger population. As the market continues to evolve, with an increasing preference for natural and organic baby products, the baby powder market in South Korea is expected to grow steadily.

The baby powder market in the UK is expected to see moderate growth, with a projected CAGR of 5% from 2026 to 2036. The UK’s market for baby care products, including baby powder, is influenced by growing awareness of the safety and ingredients of products used for baby hygiene. Parents in the UK are increasingly looking for baby powders made from natural and organic ingredients, driving the demand for alternative options. With the rising demand for eco-friendly and chemical-free baby care products, the market is also benefiting from a shift towards more sustainable options. As the baby care industry in the UK continues to evolve and consumers become more discerning about product ingredients, the baby powder market is expected to expand steadily.

The baby powder market in the USA is projected to grow at a moderate pace, with a projected CAGR of 4.8% from 2026 to 2036. The USA has a large market for baby care products, and while the demand for baby powder remains steady, it is evolving as more parents seek natural and organic alternatives. The increasing awareness of potential health concerns related to traditional talc-based baby powders is driving a shift toward natural ingredients such as cornstarch-based powders. With a growing focus on baby wellness and hygiene, the demand for high-quality, safe, and gentle baby powder products is expected to persist. E-commerce and retail channels are also making baby powder more accessible to a larger consumer base. Despite the mature market, the trend toward organic and chemical-free products will continue to support steady growth in the baby powder market in the USA.

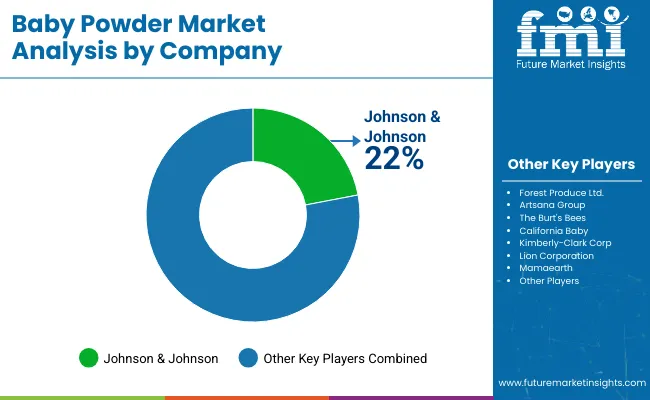

The baby powder market is evolving as consumers seek safe, natural, and hypoallergenic products for their babies. Johnson & Johnson leads the market with its well-known baby powder products, offering trusted, gentle formulations that have become synonymous with baby care. Their extensive brand recognition and reputation for quality have cemented their leadership position in the sector. Forest Produce Ltd., Artsana Group, and The Burt's Bees are significant competitors, each offering unique formulations that cater to different consumer needs. Forest Produce Ltd. focuses on natural and organic baby powder alternatives, while Artsana Group offers baby powder products under its popular brand Chicco, known for their gentle formulations. The Burt's Bees provides a range of natural baby care products, including baby powder alternatives made with organic ingredients.

California Baby, Kimberly-Clark Corp, and Lion Corporation further contribute to the competitive landscape by offering trusted, hypoallergenic baby powder solutions. California Baby is known for its focus on natural and organic baby care products, while Kimberly-Clark Corp offers baby care products under brands like Huggies, which include gentle, dermatologist-tested powders. Lion Corporation specializes in baby care products with a focus on safety and comfort, catering to the Japanese and broader Asian markets. Mamaearth, Mee Mee, and Mothercare also play key roles by offering baby powders that emphasize safety, natural ingredients, and skin protection. Mamaearth is recognized for its eco-friendly products, while Mee Mee and Mothercare provide a range of baby care products focused on gentle, effective formulations. These companies compete by focusing on product innovation, brand trust, and meeting the growing demand for safe, natural baby care solutions. As consumer awareness around ingredient safety continues to grow, the baby powder market is expected to expand, driving further competition and innovation.

| Items | Values |

|---|---|

| Quantitative Units (2026) | USD Billion |

| Ingredient | Corn starch based, Talc based |

| Price Segment | Mass, Premium |

| Companies | Johnson & Johnson, Forest Produce Ltd., Artsana Group, The Burt’s Bees, California Baby, Kimberly Clark Corp, Lion Corporation, Mamaearth, Mee Mee, Mothercare |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Additional Attributes | Dollar sales by ingredient and price segment, and by region. Includes analysis of market trends for baby powder products, demand patterns for corn starch vs talc formulations, pricing dynamics across mass and premium segments, distribution and retail channel influences, regulatory and safety considerations, competitive positioning and market share of key companies, innovation in formulation and packaging, and assessment of impact on infant care routines and parental preferences. |

The global baby powder market is estimated to be valued at USD 1.2 billion in 2026.

The market size for the baby powder market is projected to reach USD 2.0 billion by 2036.

The baby powder market is expected to grow at a 5.0% CAGR between 2026 and 2036.

The key product types in baby powder market are corn-starch-based and talc-based.

In terms of price, mass segment to command 64.0% share in the baby powder market in 2026.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Baby Powder Market Analysis - Size, Share & Trends 2025 to 2035

Korea Baby Powder Market Analysis – Size, Share & Trends 2025 to 2035

Western Europe Baby Powder Market Analysis – Size, Share & Trends 2025 to 2035

The Powder Injection Molding Market is segmented by Material Type (Metal Powder, Ceramic Powder, and Others), End-Use Industry (Automotive, Healthcare, Aerospace & Defense, Electronics, Consumer Goods, and Others), and Region, with a forecast period from 2026 to 2036 by FMI.

The Baby Bath and Shower Products Market is segmented by Product Type (Baby Body Wash, Baby Shampoo, Baby Bath Oil, and Baby Bubble Bath), Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Online Retail, and Pharmacies), Packaging Type (Bottles, Tubes, Pump Dispensers, and Sachets), and Region. Forecast for 2026 to 2036.

The Baby Personal Care Market is segmented by Product Type (Skincare, Haircare, Toiletries, Fragrances, and Others), Ingredient Type (Organic/Natural, Conventional), Distribution Channel (Supermarkets/Hypermarkets, Pharmacies, Online, Specialty Stores), and Region. Forecast for 2026 to 2036.

Baby Toiletries Market Size and Share Forecast Outlook 2026 to 2036

Baby Personal Care Products Market Size and Share Forecast Outlook 2026 to 2036

Powdered Facial Toners Market Analysis Size and Share Forecast Outlook 2026 to 2036

Powdered Scalp Treatments Market Size and Share Forecast Outlook 2026 to 2036

Powdered Face Masks Market Size and Share Forecast Outlook 2026 to 2036

Baby Diaper Market Forecast and Outlook 2026 to 2036

Powdered Cellulose Market Size and Share Forecast Outlook 2026 to 2036

Baby Breathing Monitor Market Size and Share Forecast Outlook 2026 to 2036

Powder-to-Serum Microcapsules Market Size and Share Forecast Outlook 2025 to 2035

Baby Changing Station Market Size and Share Forecast Outlook 2025 to 2035

Baby Car Safety Seat Market Forecast and Outlook 2025 to 2035

Baby Doll Market Size and Share Forecast Outlook 2025 to 2035

Baby & Toddler Carriers & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Powdered Soft Drinks Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.