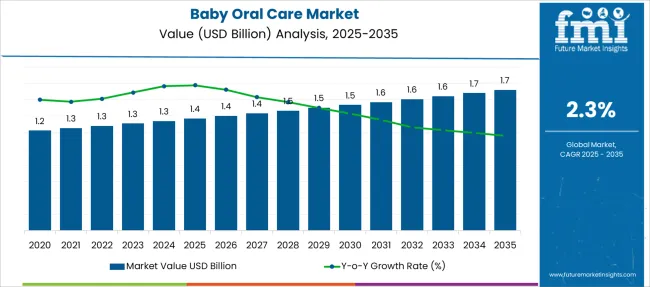

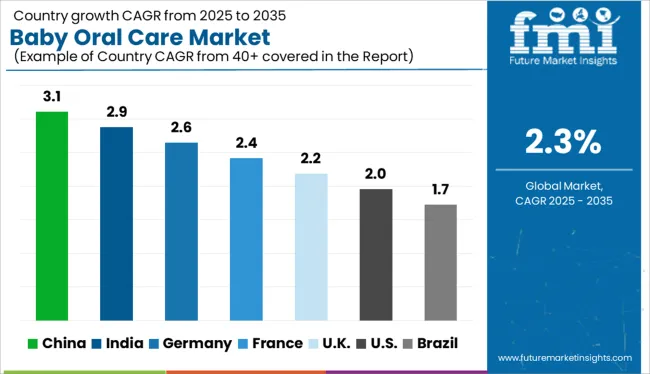

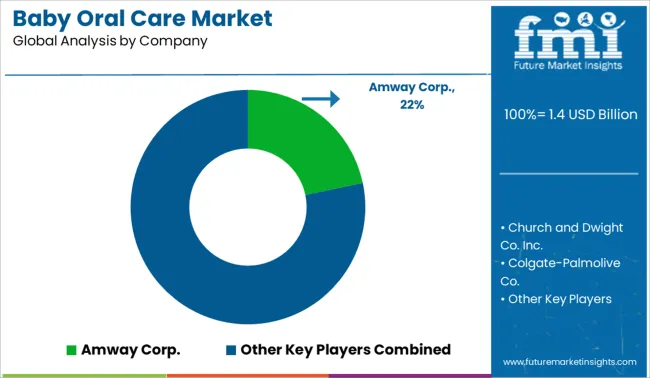

The Baby Oral Care Market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 1.7 billion by 2035, registering a compound annual growth rate (CAGR) of 2.3% over the forecast period.

| Metric | Value |

|---|---|

| Baby Oral Care Market Estimated Value in (2025 E) | USD 1.4 billion |

| Baby Oral Care Market Forecast Value in (2035 F) | USD 1.7 billion |

| Forecast CAGR (2025 to 2035) | 2.3% |

The baby oral care market is witnessing strong growth due to increasing parental awareness regarding early dental hygiene and rising incidences of childhood dental disorders. With pediatric dental professionals emphasizing preventive care from infancy, consumers are increasingly adopting age appropriate oral hygiene products.

The market is also benefitting from improvements in product formulation, such as the introduction of fluoride free and natural ingredient based options that align with safety expectations for infants and toddlers. Brand engagement through educational campaigns and the expansion of product availability across offline and online platforms are supporting market penetration.

Additionally, the growth of urban middle income households and improved access to pediatric health guidance are creating favorable conditions for sustained market expansion. The future outlook remains optimistic as consumer focus on safe, effective, and convenient baby care solutions continues to rise globally.

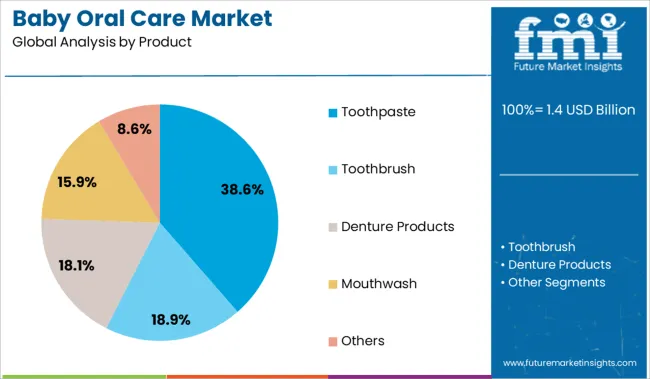

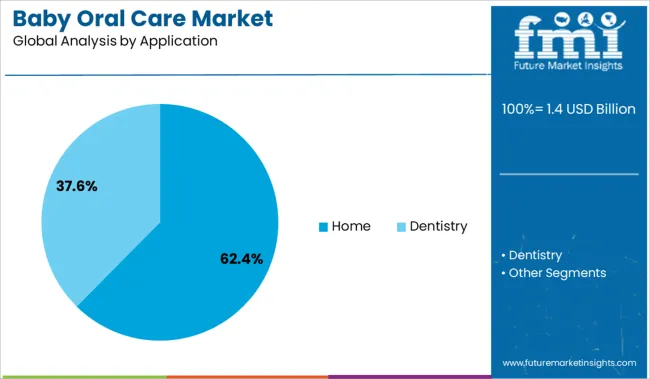

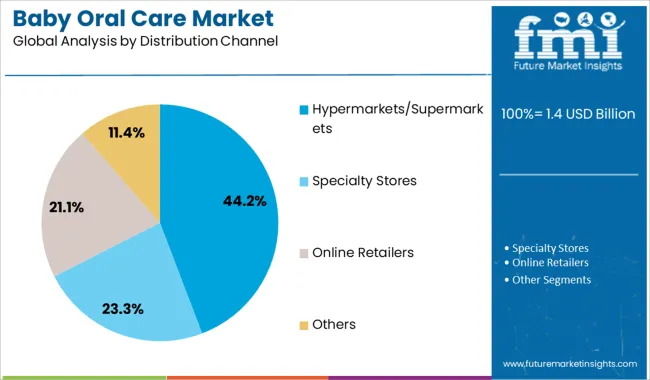

The market is segmented by Product, Application, and Distribution Channel and region. By Product, the market is divided into Toothpaste, Toothbrush, Denture Products, Mouthwash, and Others. In terms of Application, the market is classified into Home and Dentistry. Based on Distribution Channel, the market is segmented into Hypermarkets/Supermarkets, Specialty Stores, Online Retailers, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The toothpaste segment is projected to account for 38.60% of the total revenue by 2025 within the product category, making it the most significant segment. This growth is driven by heightened consumer preference for daily oral hygiene routines and the availability of specialized toothpaste options for infants and toddlers.

These products are often developed with mild flavors, non toxic ingredients, and age appropriate fluoride levels, enhancing both safety and compliance. Increasing endorsements by pediatric dentists and regulatory approvals for baby safe formulations have reinforced consumer confidence.

As parents increasingly prioritize preventive care and early oral habits, toothpaste remains a central component of baby oral care routines, ensuring its leading position within the product segment.

The home segment is expected to capture 62.40% of the total market revenue by 2025 within the application category, positioning it as the dominant segment. This is supported by the growing trend of parents managing daily oral care at home with increasing access to pediatric dental information.

The development of easy to use tools such as finger brushes and baby training toothbrushes has enhanced the effectiveness of at home routines. Convenience, affordability, and privacy of home based care are key drivers behind its widespread adoption.

Additionally, post pandemic behavioral shifts have encouraged greater reliance on at home healthcare practices, reinforcing the home segment's leadership in the baby oral care market.

The hypermarkets and supermarkets segment is projected to hold 44.20% of total revenue by 2025 under the distribution channel category, establishing itself as the leading segment. This is attributed to the convenience of physical product examination, brand comparisons, and immediate product availability in store.

Consumers often prefer these outlets due to promotional pricing, bundled offers, and the ability to explore a wide range of baby care products in one place. The presence of dedicated baby product sections and increasing partnerships between oral care brands and retail chains are enhancing product visibility and consumer trust.

As a result, hypermarkets and supermarkets continue to be the most preferred distribution channel in the baby oral care market.

One of the key elements influencing this market is the growth in the incidence of early childhood tooth decay. Cavities that form in infants and toddlers due to tooth decay can be brought on by a variety of things, including bacteria and a regular diet high in sugar. Early childhood tooth decay has several known causes, including inadequate teeth care after meals and failure to follow basic oral hygiene regimens at home. Parents are favoring new and inventive organic products as a result of the rise in pediatric teeth extractions, which will significantly contribute to the market's growth during the projection period.

There are a lot of significant manufacturers in the sector, and vendors are creating new technologies to serve their clients. Companies often plan conferences and programs on dental education, and they collaborate with regional suppliers and retailers to improve product visibility in an effort to establish a reputation. The market will continue to rise in the years to come as a result of the recent increase in product visibility and accessibility.

High Penetration of Counterfeit Goods

A considerable increase in the occasions where governments and other authorities have confiscated counterfeit products as a result of the rise in the number of products accessible on the market is evidence of the emergence of such products. The market's major brands' credibility and reputation are seriously threatened by the existence of fake oral care products. Therefore, the presence of counterfeit products will be a significant obstacle to the market's expansion.

Growing Emphasis on Organic Products

Manufacturers and users of baby oral care products all around the world are placing increased emphasis on organic alternatives. Baby oral care producers now incorporate natural ingredients in their products due to the rising demand for organic beauty and personal care products. The global infant oral care market is expected to experience some major trends over the course of the forecast period, including the emergence of organic toothpaste and new launches.

In the upcoming years, the prevalence of cavities, gum disease, and tooth decay is likely to increase, driving up toothpaste consumption. In order to appeal to the wide range of tastes of babies, many flavors of organic toothpaste are being introduced.

Due to the widespread availability of the product, the toothbrush segment is anticipated to increase at the fastest rate throughout the forecasted period. It is also the most popular way to maintain oral hygiene. Many consumers have been drawn to toothbrush modifications like electric toothbrushes and changes in bristle size and quality because they offer better oral care outcomes.

In the long run, increased disposable income and spending on oral hygiene products are expected to fuel market expansion. The home market makes the most use of oral care items. The best way to utilize these goods at home is to lower the cost of going to the dentist for a variety of reasons. Due to the rise in dental disorders and growing public awareness of healthcare, the market is likely to experience considerable expansion.

With a revenue share of more than 35.0% in 2024, the hypermarkets and supermarkets category dominated the industry. These markets bring together a wide range of goods from various brands. Products for oral hygiene are conveniently available in supermarkets and hypermarkets. The global market has been segmented into hypermarkets/supermarkets, specialty shops, online retailers, and others based on distribution channels.

There is likely to be a huge increase in the sales of dental care items through online merchants, specialized shops, and other venues. Due to the rise in online shoppers following the pandemic, the internet market will grow at a faster rate of 3.3% from 2025 to 2035. These platforms provide a large selection of products, and orders are filled swiftly. The capability of having the goods delivered on the same day is likely to be crucial to the expansion of this market.

Long-term revenue growth is likely to be highest in Asia Pacific due to its vast population and rising parental awareness of oral health, particularly in China and India. Over the next few years, the market expansion is anticipated to be driven by a high disposable income and the accessibility of oral hygiene products designed exclusively for babies. The need for oral hygiene products is being driven by the younger population's rising rate of cavities and other dental problems.

Due to the release of cutting-edge products on the market and ongoing research and development in the industry, North America will also experience stable expansion over the course of the projection period. The purpose of these campaigns is to raise consumer awareness of the value of using oral care products while also increasing sales of oral care goods.

Europe, Latin America, the Middle East, and Africa are expected to see moderate revenue growth, owing to increased awareness of innovative oral hygiene products among individuals in many of these regions.

Joint Ventures and Product Innovation to be the Go-to-Market Move

There are many domestic and foreign competitors in the fiercely competitive baby oral care sector. To improve their market positions, the firms are implementing strategic techniques like joint ventures, mergers and acquisitions, and product innovation. To help children's dental health and oral motor skills, Safe-O-Kid, one of India's fastest-growing baby product brands, introduced innovative Oral Care and Sensory Kits in July 2025. Children up to the age of 12 can buy the product.

Latest Developments in the Baby Oral Care Market

Colgate-Palmolive Company

The Colgate-Palmolive Company and its affiliates produce and market consumer goods all over the world. It functions through two divisions: oral, home and personal care, and pet nutrition. The oral, personal, and home care division of the corporation is where the Colgate kids' toothbrushes and toothpaste are sold. Pharmaceuticals for dentists and other oral health professionals are also part of the oral care industry. The business uses retailers, wholesalers, distributors, and online retailers to market and sell its dental, personal, and home care goods.

Procter &Gamble

The business offers consumers across the globe branded consumer packaged goods. Baby, feminine and family care, beauty, fabric and home care, and health care and grooming are its five operating segments. The business sells baby dental care items under the Oral-B kids brand in the healthcare sector. The business sells its goods to consumers via mass merchandisers, department stores, wholesalers, baby shops, pharmacies, and online retailers.

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 2.3% from 2025 to 2035 |

| Base Year of Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Billion and Volume in Units and F-CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, growth factors, Trends, and Pricing Analysis |

| Key Segments Covered | By Product, By Application, By Distribution Channel, By Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Middle East & Africa; Oceania |

| Key Countries Profiled | USA, Canada, Brazil, Mexico, Germany, Italy, France, United Kingdom, Spain, Russia, China, Japan, India, GCC Countries, Australia |

| Key Companies Profiled | Colgate-Palmolive Company; Johnson & Johnson; Church & Dwight Co. Inc.; Unilever; Proctor & Gamble; Pigeon Corporation; Anchor Group; Oriflame; Amway; Dr. Fresh; Chattem; Dabur; Splat Baby |

| Customization & Pricing | Available upon Request |

The global baby oral care market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the baby oral care market is projected to reach USD 1.7 billion by 2035.

The baby oral care market is expected to grow at a 2.3% CAGR between 2025 and 2035.

The key product types in baby oral care market are toothpaste, toothbrush, denture products, mouthwash and others.

In terms of application, home segment to command 62.4% share in the baby oral care market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Baby Changing Station Market Size and Share Forecast Outlook 2025 to 2035

Baby Car Safety Seat Market Forecast and Outlook 2025 to 2035

Baby Bath and Shower Products Market Size and Share Forecast Outlook 2025 to 2035

Baby Doll Market Size and Share Forecast Outlook 2025 to 2035

Baby & Toddler Carriers & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Baby Shoes Market Size and Share Forecast Outlook 2025 to 2035

Baby Ear Thermometer Market Size and Share Forecast Outlook 2025 to 2035

Baby Food Dispensing Spoon Market Size and Share Forecast Outlook 2025 to 2035

Baby Pacifier Thermometer Market Size and Share Forecast Outlook 2025 to 2035

Baby Crib Sheet Market Size and Share Forecast Outlook 2025 to 2035

Baby Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Baby Diaper Market Growth, Forecast, and Trend Analysis 2025 to 2035

Baby Powder Market - Size, Share, and Forecast 2025 to 2035

Baby Sling Market Size and Share Forecast Outlook 2025 to 2035

Baby Bottle Holder Market Size and Share Forecast Outlook 2025 to 2035

Baby Toddler Bar Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Baby Snacks Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Baby Oil Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Baby Food Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Baby Milk Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA