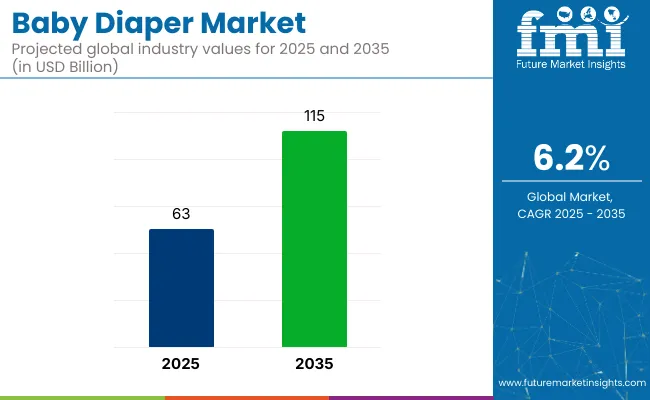

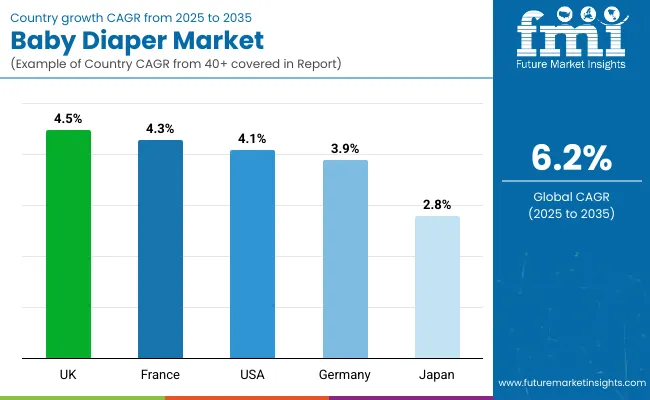

The global baby diaper market is set to grow at a CAGR of 6.2% and reach USD 115 billion by 2035, up from USD 63 billion in 2025. The growing working female population and increasing focus on skin-friendly baby diapers is driving growth. Premiumization, skin-friendliness and personalization are being focused on by baby diaper brands in developed markets.

Subscription-based and D2C diaper companies are increasing their market share. As per Future Market Insights' latest Q2, 2025 update on the global baby diapers market report, the market is likely to witness steady momentum throughout the forecast period.

As per Future Market Insights analysis, USA will continue to hold the largest market share, accounting for nearly 37% of the global diaper market. On the other hand, in terms of growth rate, China baby diaper market is likely to grow at a CAGR of 10% during the forecast period 2025 to 2035.

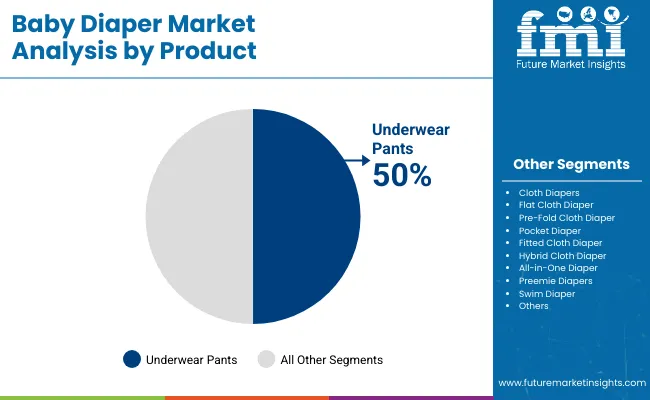

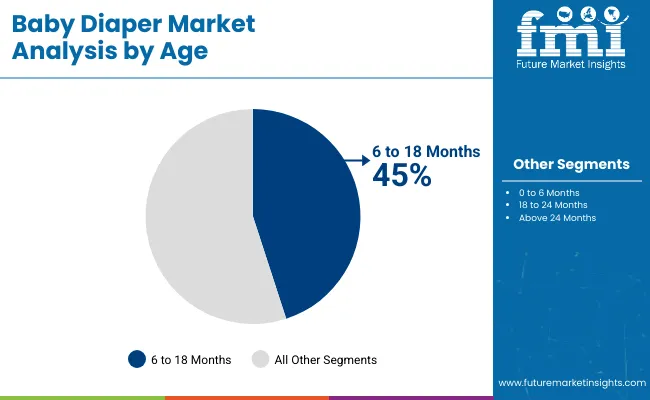

Underwear pants will continue to account for nearly 50% share of the market in 2025, owing to the convenience they provide. By age, 6 months to 18 month accounts for higher revenues than any other segment on account of the sweet spot of volume and price.

FMI Pro Tip: Although newborns use 10-12 diapers per day, which is higher than the age group 6 month to 18 month, the latter still account for higher revenue share. This is on account of higher unit price per diaper and higher leakage risk in outside settings.

Per capita spending on baby diapers varies significantly across regions, influenced by factors such as income levels, cultural preferences, and market availability. Developed markets like North America and Europe tend to have higher per capita spending due to widespread use of premium diaper products, greater awareness of infant hygiene, and higher disposable incomes. In contrast, emerging markets in Asia-Pacific, Latin America, and Africa show lower per capita spending, often driven by price sensitivity and varied adoption rates of disposable diapers. However, growing urbanization, rising middle-class populations, and increasing focus on child health are contributing to steady growth in per capita spending in these regions.

In developed markets like North America and Europe, demand for premium diapers with advanced features and eco-friendly options drives higher price points. Leading multinational companies focus on quality, comfort, and sustainability to meet stringent regulations and consumer expectations. Meanwhile, emerging markets in Asia-Pacific, Latin America, and Africa emphasize affordability and accessibility, with local and regional brands catering to price-sensitive customers.

The global baby diaper market has been analyzed across key segmentation parameters for the historical period 2020 to 2024 and forecast period 2025 to 2035. By product type, the market includes Underwear Pants, Cloth Diapers, Flat Cloth Diaper, Pre-Fold Cloth Diaper, Pocket Diaper, Fitted Cloth Diaper, Hybrid Cloth Diaper, All-in-One Diaper, Preemie Diapers, and Swim Diaper.

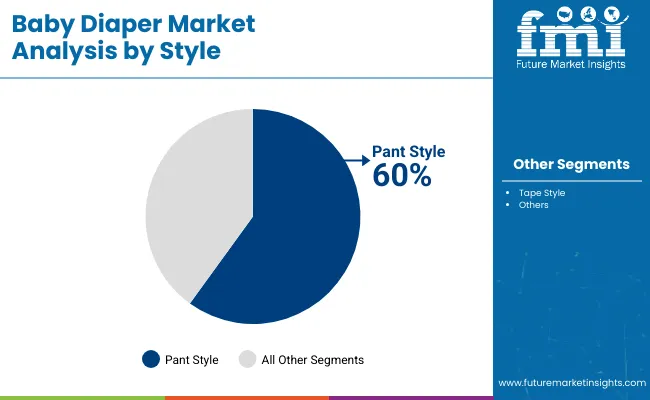

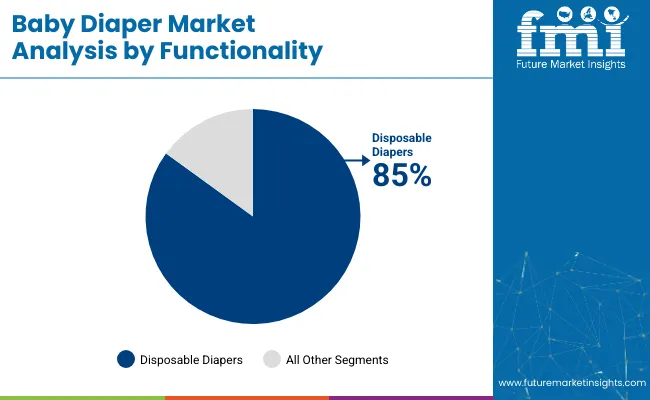

By age group, the market is segmented into 0 to 6 Months, 6 to 18 Months, 18 to 24 Months, and Above 24 Months. By style, the market is classified into Tape Style and Pant Style. Based on functionality, the market is divided into Disposable Diapers and Reusable Diapers. Regionally, the report covers North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and the Middle East and Africa.

FMI analysts expect underwear pants to remain the top-selling product type, capturing nearly 50% of global market share in 2025, driven by high adoption among parents in the 6 to 18-month group.

6 month to 18 month segment holds nearly 45% market share in 2025, owing to higher average price per unit. The 0 to 6 month segment follows, accounting for a substantial share of the market. The 18 to 24 months segment and above 24 months are least lucrative as potty training begins to reduce usage volume. Diaper usage is varied across geographies, with lower sales in Europe and North America observed compared to Asia Pacific.

By type, pant-style diapers are projected to lead the global baby diaper market with an estimated 60% market share in 2025, reflecting a decisive shift in consumer preference away from traditional tape-style diapers. Conversely, tape-style diapers continue to serve newborns where frequent changes and delicate skin handling are critical, but their role in the toddler segment is shrinking fast.

Disposable diapers will continue to command the lion’s share of the baby diaper market; over 85% of global sales in 2025 are expected to be accounted for by disposable diapers. Their widespread adoption can be attributed to convenience, ease of disposal, and advancements in absorbency technology.

In urban households, disposable diapers have become the default choice due to their time-saving nature and hygienic appeal. Meanwhile, reusable diapers, though eco-friendly and cost-effective in the long run, account for less than 15% of the market. Their limited uptake is primarily due to the added laundry burden and inconsistent performance in public or daycare settings. In urban households, disposable diapers are the default choice, especially among working parents and nuclear families.

The global baby diaper market is witnessing steady growth, fueled by rising birth rates in developing regions, increased participation of women in the workforce, and growing preference for premium, skin-friendly diapering solutions. The expansion of D2C and subscription-based diaper brands is further reshaping purchase behavior. However, the market is not without challenges, particularly around sustainability concerns and price sensitivity in emerging economies.

Pant-style diapers are dominating, especially among toddlers, due to ease of use and comfort.

The USA baby diaper market is expected to grow at a CAGR of 4.1% from 2025 to 2035. Despite being a mature market, growth is supported by the shift toward premium, organic, and skin-sensitive diapers. Leading players like Procter & Gamble, Kimberly-Clark, and Honest Co. dominate the landscape. Subscription-based D2C models and increasing demand for eco-friendly disposable diapers are shaping consumer behavior. Key trends in US baby diaper market include,

The UK baby diaper market is projected to expand at a CAGR of 4.5% during 2025 to 2035. Growth is driven by the rising preference for biodegradable diapers and a sharp increase in online diaper subscriptions. Brands like Tesco, Kit & Kin, and Pampers are prominent in the market. Retailers are also promoting reusable diaper lines in line with the government’s drive.

Germany’s baby diaper market is forecasted to register a CAGR of 3.9% between 2025 and 2035. As one of Europe’s most eco-conscious markets, demand is steadily shifting toward reusable and biodegradable options. Conventional brands face stiff competition from local startups offering sustainable diapering solutions.

France’s baby diaper market is projected to grow at a CAGR of 4.3% from 2025 to 2035, driven by rising demand for organic, skin-sensitive, and biodegradable diapers. Parents are increasingly prioritizing eco-friendly and dermatologically tested products, while domestic and EU-based brands continue to dominate both online and offline retail channels.

Japan’s baby diaper market is projected to grow at a CAGR of 2.8% over the forecast period. A declining birth rate and aging population cap overall demand, but premium and night-use diapers are seeing increased penetration. Companies like Unicharm lead the domestic market with advanced features like ultra-thin absorbents and breathable fabrics.

| Attribute | Details |

|---|---|

| Market Size (2025) | USD 63 billion |

| Forecast Size (2035) | USD 115 billion |

| CAGR (2025 to 2035) | 6.2% |

| Base Year | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Metric | Revenue in USD Billion and Volume in Units |

| By Product | Underwear Pants, Cloth Diapers (Flat, Pre-Fold, Pocket, Fitted, Hybrid), All-in-One Diapers, Preemie Diapers, Swim Diapers |

| By Age Group | 0 to 6 Months, 6 to 18 Months, 18 to 24 Months, Above 24 Months |

| By Style | Tape Style, Pant Style |

| By Functionality | Disposable Diapers, Reusable Diapers |

| By Region | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East & Africa |

| Key Countries | United States, Canada, Brazil, Germany, UK, France, Italy, Spain, China, India, Japan, GCC countries and more |

| Key Players | Procter & Gamble, Kimberly-Clark Corporation, Unicharm Corporation, The Honest Company, Ontex Group, Essity, First Quality Enterprises, Daio Paper Corporation, Domtar Corporation |

The global baby diaper market is valued at USD 63 billion in 2025 and is projected to reach USD 115 billion by 2035, growing at a CAGR of 6.2%.

Underwear pants are expected to dominate the global baby diaper market in 2025, holding nearly 50% market share.

The 6 to 18 months age group contributes nearly 45% of market revenue in 2025.

Pant style baby diapers hold around 60% market share in 2025, reflecting a global consumer shift toward convenience.

China leads with a projected CAGR of 10% (2025 to 2035), followed by India and other Asian markets, due to rising birth rates and urbanization.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Leading Providers & Market Share in Baby Diaper Industry

Nonwoven Baby Diaper Market Size and Share Forecast Outlook 2025 to 2035

United States Baby Diaper Market Growth, Trends and Forecast from 2025 to 2035

Biodegradable Baby Diapers Market Analysis – Trends, Growth & Forecast 2025-2035

Baby Changing Station Market Size and Share Forecast Outlook 2025 to 2035

Baby Car Safety Seat Market Forecast and Outlook 2025 to 2035

Diaper Rash Cream Market Size and Share Forecast Outlook 2025 to 2035

Baby Bath and Shower Products Market Size and Share Forecast Outlook 2025 to 2035

Baby Doll Market Size and Share Forecast Outlook 2025 to 2035

Baby & Toddler Carriers & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Diapers Market Analysis - Size, Share & Forecast 2025 to 2035

Baby Shoes Market Size and Share Forecast Outlook 2025 to 2035

Baby Oral Care Market Size and Share Forecast Outlook 2025 to 2035

Baby Ear Thermometer Market Size and Share Forecast Outlook 2025 to 2035

Baby Food Dispensing Spoon Market Size and Share Forecast Outlook 2025 to 2035

Baby Pacifier Thermometer Market Size and Share Forecast Outlook 2025 to 2035

Baby Crib Sheet Market Size and Share Forecast Outlook 2025 to 2035

Baby Teeth Care Products Market Size and Share Forecast Outlook 2025 to 2035

Baby Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Baby Powder Market - Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA