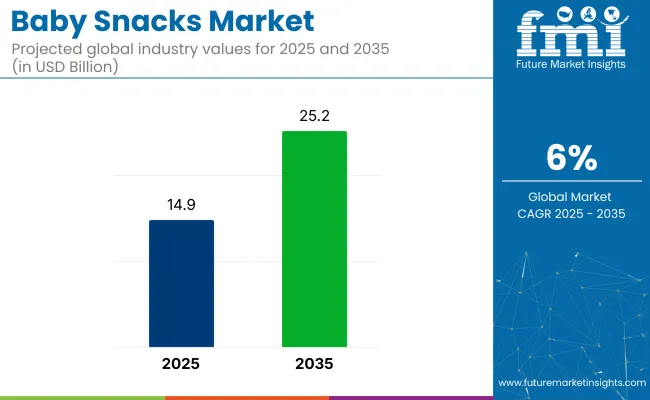

The global baby snacks market is set to expand significantly from USD 14.9 billion in 2025 to USD 25.2 billion by 2035, registering a steady CAGR of 6%.

Growing health consciousness among parents, demand for clean-label convenience, and the rising preference for organic and allergen-free formulations are key drivers behind this growth. As parents seek alternatives to conventional baby food, innovations in vegetable-based and whole-food snacks are gaining momentum.

A major turning point in consumer sentiment emerged from a 2025 BBC News investigation, which revealed that many popular baby food pouches contained excessive sugar and critically low levels of essential nutrients like iron and vitamin C. Notably, even savory options provided less than 5% of a toddler’s iron requirement, and misleading “no added sugar” labels drew public backlash.

These findings triggered regulatory discussions around front-of-pack sugar warnings and stricter nutrition transparency. The outcome is an accelerated demand for nutrient-rich, whole-food-based, transparently labeled baby snacks.

The industry holds a niche yet growing share within its parent markets. In the baby food market, it accounts for approximately 5-7%, as these snacks are a specialized segment focused on providing convenient, nutritious options for infants and toddlers. Within the broader snacks market, the share is around 1-2%, as these snacks cater to a specific demographic.

In the health and wellness food market, the share is about 2-3%, driven by the increasing demand for organic, healthy snacks for young children. Within the packaged food market, these snacks represent approximately 3-4%, as they are typically packaged for convenience. In the convenience food market, the share is around 2-3%, as baby snacks are designed for easy, on-the-go consumption for busy parents.

Leading companies like Gerber (Nestlé), Happy Family Organics, Kraft Heinz, and Little Freddie are innovating with functional nutrition formats-such as teething crisps, melt-in-mouth veggie wafers, and iron-fortified finger foods-catering to both infants and toddlers. With clean labeling, responsible sourcing, and developmental nutrition at the forefront, the industry is poised for responsible growth.

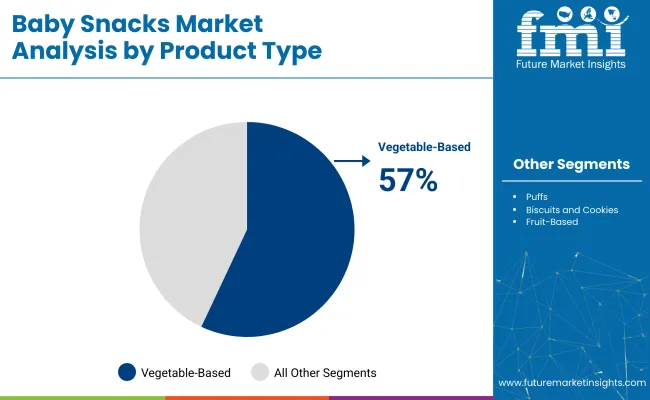

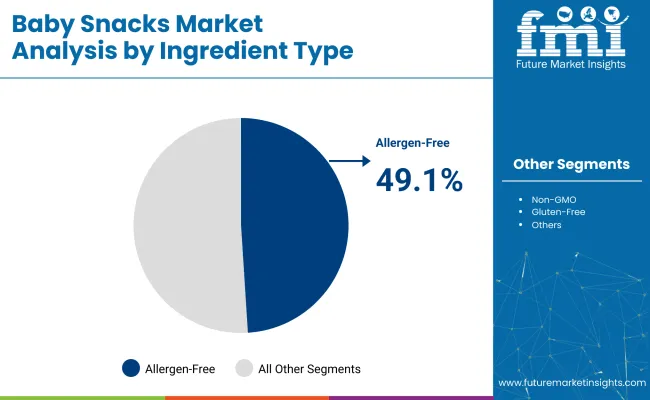

The industry is projected to grow with vegetable-based snacks, allergen-free ingredients, and direct-to-consumer channels leading the way in 2025. Vegetable-based snacks will dominate with 57%, allergen-free ingredients will capture 49.1%, and direct-to-consumer platforms will hold 23.8% of the industry share.

Vegetable-based snacks are expected to dominate the product category in the industry with a 57% share in 2025. Health-conscious parents are increasingly choosing these nutrient-rich, clean-label snacks for infants and toddlers, aligning with pediatric dietary recommendations.

These snacks are rich in fiber, vitamins, and natural flavors, promoting better satiety and nutrition. Brands are launching products like baked veggie sticks, puffed snacks, and dehydrated vegetable bites to support weaning stages and encourage healthy eating habits. As concerns over sugar and additives in traditional snacks rise, demand for plant-based, minimally processed options is accelerating.

Allergen-free ingredients are projected to lead the formulation segment, accounting for 49.1% of the industry share in 2025. As food allergies become more prevalent among infants, parents are increasingly seeking formulations free from major allergens like dairy, soy, eggs, gluten, and nuts. This trend is fueled by the need for food that ensures infant safety, particularly for first-time parents concerned about allergic reactions.

Regulatory support from pediatric associations and the growing availability of hypoallergenic snack options contribute to the segment's growth. Brands are developing rice, quinoa, and oat-based alternatives fortified with essential nutrients, catering to the demand for clean and transparent ingredient labels.

Direct-to-consumer (DTC) platforms are expected to dominate the distribution channel segment, capturing 23.8% of the industry share in 2025. Modern parents increasingly prefer purchasing these snacks directly from trusted brand websites and subscription platforms, prioritizing convenience, speed, and personalized options.

DTC platforms enable brands to offer customized bundles, allergen-specific filters, and exclusive organic or premium snack lines. Social media and digital parenting communities further amplify the reach of DTC channels, enhancing brand loyalty through targeted sampling and AI-powered recommendations. As traditional retail faces limitations in variety and shelf space, DTC offers a more agile and scalable growth path.

The industry is growing due to health-focused innovations, clean-label products, and the rise of e-commerce and subscription models. Parents prioritize nutritious, allergen-free snacks for their children, and online platforms are offering convenience and personalized options.

Health-First Snacking: Nutrient-Rich, Clean-Label Innovations

Parents are increasingly choosing nutrient-dense, clean-label snacks for their infants and toddlers. Brands are fortifying products with essential nutrients like vitamins, iron, and protein to support childhood development. Leading companies like Gerber and Plum Organics are launching whole-grain snacks, fruit bars, and non-GMO yogurts, while offering plant-based alternatives like sweet potatoes and quinoa.

Allergen-free and gluten-free options are becoming popular, with packaging innovations such as resealable pouches and portion-controlled trays adding to convenience. Certification demands for USDA Organic and Non-GMO Project Verified products are also rising.

E-Commerce and Subscription Models Expanding Industry Reach

E-commerce and subscription models are transforming how these snacks reach consumers. Parents are using direct-to-consumer platforms to receive curated monthly snack boxes, which allow them to sample new products without visiting stores. Digital marketplaces like Amazon Baby Store and specialty retailers are showcasing health-focused, user-rated snacks.

Subscription services are offering personalized bundles tailored to specific ages, allergies, and flavor preferences, catering to busy households. Brands are leveraging social media advertising, influencer collaborations, and mobile apps to engage millennial parents and emphasize repeat-purchase convenience.

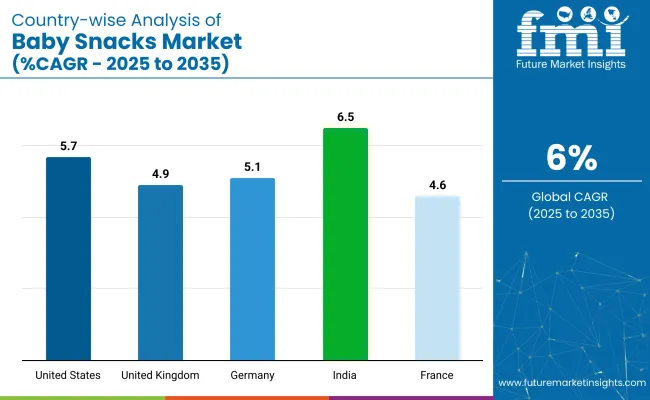

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 5.7% |

| United Kingdom | 4.9% |

| India | 6.5% |

| Germany | 5.1% |

| France | 4.6% |

The industry demand is projected to rise at a 6% CAGR from 2025 to 2035. Of the five profiled countries out of 40 covered, India leads at 6.5%, followed by the United States at 5.7% and Germany at 5.1%, while the United Kingdom records 4.9% and France posts 4.6%.

These rates translate to a growth premium of +8% for India, +2% for the United States, and -4% for Germany versus the baseline, whereas the United Kingdom and France trail by -18% and -23%, respectively. Divergence reflects local catalysts: increasing demand for organic and nutritious baby snacks in India, expanding baby food markets in the USA, and the slow but steady growth in traditional industries in Europe.

The industry in the United States is set to record a CAGR of 5.7% from 2025 to 2035. Demand has been anchored by health-oriented parenting, with fruit purées, whole-grain crackers, and dairy puffs preferred for toddlers. Leading brands-Gerber, Happy Family, Plum Organics-have shifted toward transparent labelling and superfood inclusions.

Clean-label certification and allergen-management protocols have reinforced retailer confidence. Online grocery expansion has widened geographic reach, while big-box shelf resets have granted high-traffic visibility. Functional additions such as probiotics and iron have been incorporated to align with pediatric nutrition advice, sustaining repeat purchase rates.

Sales of baby snacks in the United Kingdom are projected to grow at a CAGR of 4.9% through 2035. Lower-sugar formulations, driven by HFSS regulation, have guided reformulation using fruit purées, ancient grains, and vegetable puffs. Ella’s Kitchen and Organix have emphasized nutrient density and compostable packaging, winning listings across grocery multiples and independent pharmacies.

Baby-led weaning has normalized finger-food uptake, so texture-rich wafers and soft breadsticks have gained favor. Retailers have responded by dedicating aisle space to portion-controlled packs that assist parents in managing snack frequency.

Demand for baby snacks in India is estimated to grow at a CAGR of 6.5% during 2025 to 2035. Rising maternal awareness and time-pressed households have increased reliance on conveniently packed nutrient-dense bites. Domestic start-ups such as Slurrp Farm and Timios have introduced ragi, moong-dal, and jaggery blends that resonate with regional taste palates.

Government nutrition drives have highlighted iron and protein gaps, encouraging fortified snack launches. Direct-to-consumer channels and pharmacy chains have penetrated tier-2 cities, expanding category reach. Ayurvedic positioning has been adopted to communicate natural functional benefits without synthetic additives.

The industry in Germany is expected to grow at a CAGR of 5.1% through 2035. Organic certification and non-GMO assurance have remained central to purchase decisions. Brands including Hipp and Holle have employed spelt and oat in biscuit and fruit-bar formats, supported by strict toxin-screening regimes.

Retailers maintain planogram slots for low-sugar, allergen-light options endorsed by pediatric associations. Educational campaigns on early nutrient balance have encouraged repeated purchases of iron-enriched snacks. Supply chains have prioritized recyclable trays and paper-based overwraps to satisfy packaging directives.

The industry in France is projected to grow at a CAGR of 4.6% through 2035. Gourmet sensibilities have propelled demand for culinary-authentic snacks like vegetable crisps, baked crackers, and soft fruit cubes. Suppliers Babybio and Good Goût have blended quinoa, beetroot, and goat cheese into textures suitable from six months.

National health-agency guidance on reduced salt and sugar has reinforced reformulation momentum. Organic provenance and short ingredient lists are highlighted on shelf-edge labels, reinforcing parental trust. Category growth benefits from a mature pharmacy channel that curates premium infant-nutrition assortments.

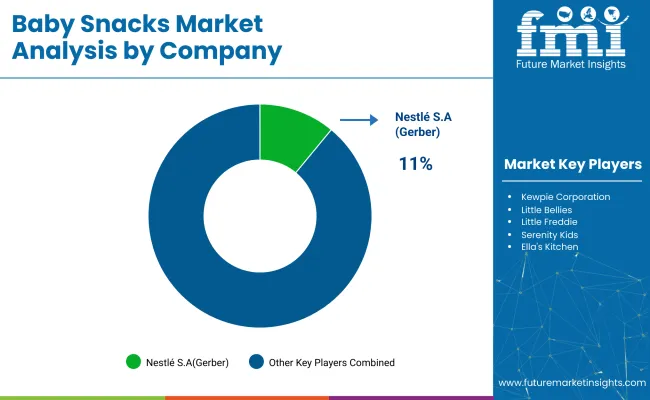

The baby snack industry is shaped by dominant players, key players, and emerging brands. Dominant players such as Nestlé S.A. (Gerber), Danone S.A. (Happy Baby Organics), and The Kraft Heinz Company lead the global industry with strong brand equity, wide retail reach, and diverse product offerings.

Key players like Amara Organic Foods, Serenity Kids, and Sprout Foods emphasize clean-label innovation and digital-first distribution strategies. Emerging players, including Little Bellies and Little Freddie, are gaining traction in regional industries by focusing on organic, allergen-free snacks and affordable pricing, catering to evolving parental preferences and local nutritional guidelines.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 14.9 billion |

| Projected Industry Size (2035) | USD 25.2 billion |

| CAGR (2025 to 2035) | 6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million units for volume |

| Product Types Analyzed (Segment 1) | Puffs, Biscuits and Cookies, Fruit-Based Snacks, Yogurt Drops and Freeze-Dried Snacks, Vegetable-Based Snacks, Teething Biscuits and Rusks |

| Ingredient Types Analyzed (Segment 2) | Organic, Conventional, Non-GMO, Gluten-Free, Allergen-Free |

| Distribution Channels Analyzed (Segment 3) | Supermarkets and Hypermarkets, Convenience Stores and Drugstores, Specialty Baby Stores, Online Retail, Direct-to-Consumer, Others |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Saudi Arabia, UAE, South Africa |

| Key Players influencing the Industry | Abbott Laboratories, Amara Organic Foods, Danone S.A. (Happy Baby Organics), Ella's Kitchen, Hain Celestial Group (Earth's Best), Hero Group (Beech-Nut), Kewpie Corporation, Little Bellies, Little Freddie, Nestlé S.A. (Gerber), Plum Organics (Campbell Soup Company), Serenity Kids, Sprout Foods, Inc., The Kraft Heinz Company |

| Additional Attributes | Dollar sales by snack category, demand for organic and allergen-free formulations, retail vs. D2C share, emerging snacking formats like freeze-dried and vegetable-based options, innovations in nutrition and packaging |

By product type, the industry is segmented into puffs, biscuits and cookies, fruit-based snacks, yogurt drops and freeze-dried snacks, vegetable-based snacks, and teething biscuits and rusks.

By ingredient type, the industry is segmented into organic, conventional, non-GMO, gluten-free, and allergen-free.

By distribution channel, the industry includes supermarkets and hypermarkets, convenience stores and drugstores, specialty baby stores, online retail, direct-to-consumer, and others.

By region, the industry is categorized into North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and Middle East & Africa.

The industry is projected to be valued at USD 14.9 billion in 2025.

The industry is forecast to reach USD 25.2 billion by 2035.

The industry is expected to grow at a CAGR of 6% during the forecast period.

Vegetable-based snacks lead the industry with a 57% share in 2025.

Nestlé S.A. (Gerber) is the leading player in the industry, holding an 11% industry share.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Baby Changing Station Market Size and Share Forecast Outlook 2025 to 2035

Baby Car Safety Seat Market Forecast and Outlook 2025 to 2035

Baby Bath and Shower Products Market Size and Share Forecast Outlook 2025 to 2035

Baby Doll Market Size and Share Forecast Outlook 2025 to 2035

Baby & Toddler Carriers & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Baby Shoes Market Size and Share Forecast Outlook 2025 to 2035

Baby Oral Care Market Size and Share Forecast Outlook 2025 to 2035

Baby Ear Thermometer Market Size and Share Forecast Outlook 2025 to 2035

Baby Food Dispensing Spoon Market Size and Share Forecast Outlook 2025 to 2035

Baby Pacifier Thermometer Market Size and Share Forecast Outlook 2025 to 2035

Baby Crib Sheet Market Size and Share Forecast Outlook 2025 to 2035

Baby Teeth Care Products Market Size and Share Forecast Outlook 2025 to 2035

Baby Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Baby Diaper Market Growth, Forecast, and Trend Analysis 2025 to 2035

Baby Powder Market - Size, Share, and Forecast 2025 to 2035

Baby Sling Market Size and Share Forecast Outlook 2025 to 2035

Baby Bottle Holder Market Size and Share Forecast Outlook 2025 to 2035

Baby Toddler Bar Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Baby Oil Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Baby Food Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA