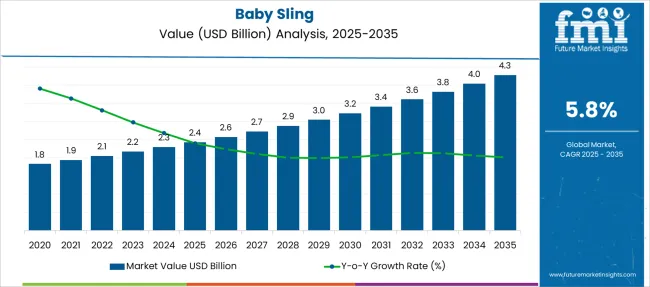

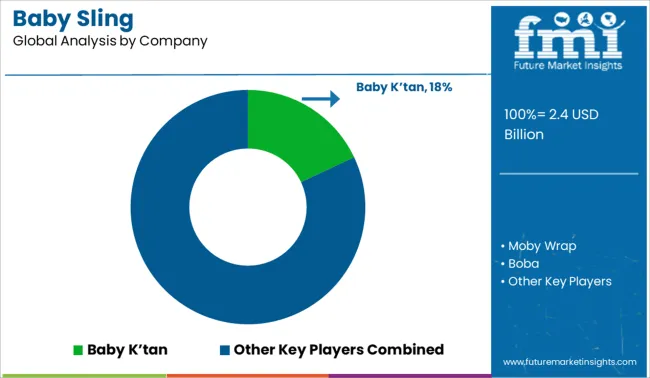

The Baby Sling Market is estimated to be valued at USD 2.4 billion in 2025 and is projected to reach USD 4.3 billion by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period.

| Metric | Value |

|---|---|

| Baby Sling Market Estimated Value in (2025E) | USD 2.4 billion |

| Baby Sling Market Forecast Value in (2035F) | USD 4.3 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

The baby sling market is experiencing consistent growth as modern parenting trends increasingly emphasize convenience, bonding, and ergonomic support during infant care. A rise in awareness regarding the physiological and psychological benefits of babywearing has created sustained demand, particularly in urban areas where mobility and comfort are valued. Health-conscious parents are prioritizing products that support spinal and hip development while allowing skin-to-skin contact, contributing to increased adoption.

This trend is further reinforced by endorsements from pediatric experts and parenting communities that advocate for close-contact solutions. Technological advancements in fabric and design, along with the growing availability of eco-friendly and hypoallergenic materials, are encouraging consumer trust. As birth rates stabilize and dual-income households grow, parents are seeking multifunctional and easy-to-use products that integrate seamlessly into daily routines.

The expanding range of stylish, breathable, and adjustable slings is enhancing product appeal, especially among millennial and Gen Z parents. Overall, the market outlook remains positive, supported by lifestyle shifts, digital influence, and growing emphasis on early child development..

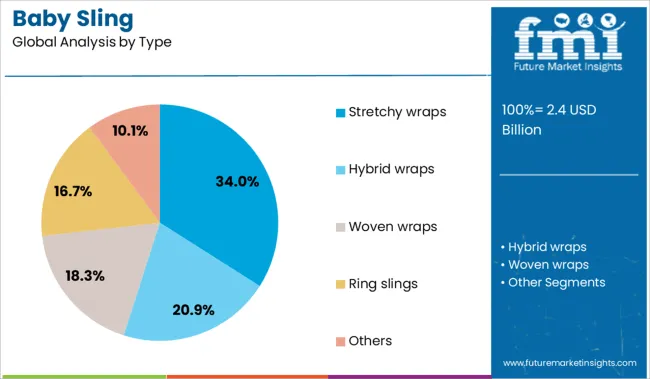

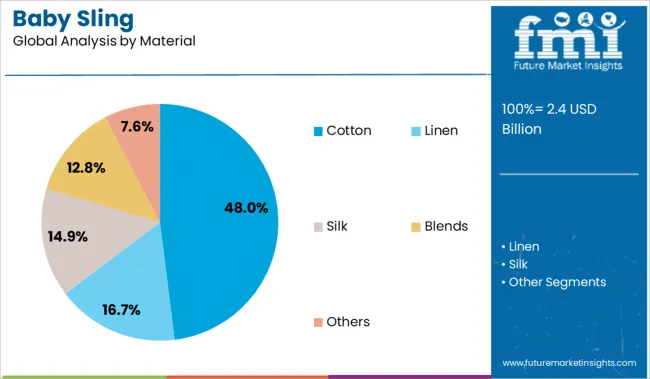

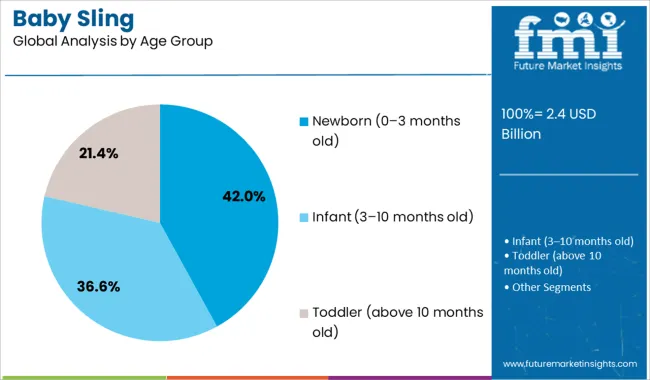

The baby sling market is segmented by type, material, age group, price range, distribution channel, and geographic regions. The baby sling market is divided by type into Stretchy wraps, Hybrid wraps, Woven wraps, Ring slings, and Others. The baby sling market is classified by material into Cotton, Linen, Silk, Blends, and Others. The baby sling market is segmented by age group into Newborn (0–3 months old), Infant (3–10 months old), and Toddler (above 10 months old). The baby sling market is segmented by price range into Low, Mid, and High. The distribution channel of the baby sling market is segmented into Online and Offline. Regionally, the baby sling industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The stretchy wraps segment is expected to account for 34% of the Baby Sling Market revenue share in 2025, making it the most preferred type among consumers. Growth in this segment has been driven by the wrap’s superior comfort, ease of use, and adjustability, which effectively cater to first-time parents. Stretchy wraps are known for their soft, elastic materials that offer a snug fit for infants, enhancing safety and parent-child bonding during early developmental stages.

These slings provide ergonomic support for both the baby and the wearer, allowing for extended periods of carrying without physical strain. Their flexibility allows for multiple carrying positions, which makes them suitable for various caregiving needs throughout the day.

The popularity of these wraps has also been reinforced by their compatibility with newborn care practices and postnatal recovery requirements. As parents prioritize closeness, mobility, and simplicity, stretchy wraps have maintained a strong position in the overall Baby Sling Market..

The cotton segment is projected to hold a dominant 48% revenue share in the Baby Sling Market by 2025, reflecting strong consumer preference for natural, breathable fabrics. The segment’s growth has been attributed to the material’s lightweight, hypoallergenic, and skin-friendly properties, which align with parental expectations for infant safety and comfort. Cotton slings offer excellent temperature regulation, reducing the risk of overheating while ensuring softness against the baby’s sensitive skin.

Additionally, cotton's durability and washability have made it a practical choice for daily use, further enhancing its value proposition for modern caregivers. As health-conscious consumers increasingly avoid synthetic materials, cotton-based Baby Sling Markets have gained popularity across both developed and emerging markets.

This trend is further supported by growing interest in organic and eco-friendly products that align with sustainable parenting values. The segment continues to benefit from innovations in weaving techniques and fabric blends, which provide improved elasticity and support without compromising breathability or comfort..

The newborn segment, comprising infants aged 0 to 3 months, is projected to contribute 42% of the Baby Sling Market revenue share in 2025, making it the leading age group. This dominance has been attributed to the heightened need for physical closeness and security during the early postnatal phase, when infant development is highly responsive to parental contact.

Baby Sling Markets for newborns are favored for their ability to promote bonding, regulate temperature, and support breastfeeding, all of which are critical in the first three months of life. The lightweight and form-fitting nature of slings provides essential head and neck support, which is especially important for this age group.

Increased awareness of the benefits of babywearing during infancy has led to widespread adoption, particularly among new parents seeking solutions that reduce colic, improve sleep patterns, and ease mobility. As families prioritize comfort and attachment in early caregiving, Baby Sling Markets designed specifically for newborns continue to dominate the market and shape future product innovation..

Demand for baby slings is rising as parents seek ergonomic, travel-friendly infant carriers with minimal bulk. Sales of adjustable wraps and hybrid carriers have surged across online platforms, driven by innovations in breathable fabrics, antimicrobial finishes, and region-specific sizing preferences.

Demand for baby slings with orthopedic certification rose 21% in 2025, especially in North America and Germany, where pediatric-endorsed brands outperformed generic alternatives. Product lines featuring lumbar support panels and hip-healthy leg positioning saw 32% higher repeat-purchase rates. Bamboo-cotton blends with OEKO-TEX certification gained traction in urban markets due to moisture-wicking properties and reduced skin irritation. In Southeast Asia, antimicrobial mesh variants designed for hot-weather use led to a 19% increase in hospital discharge kits including baby wraps. Compact ring slings with padded rails became the preferred SKUs in Japan, where stroller-free commuting demanded wearable transport options for infants under 9 kg.

Sales of baby slings via direct-to-consumer (DTC) platforms climbed 38% in 2025, supported by real-time virtual fitting tools and influencer-led brand discovery. Brands offering multiple torso-size options and elastic shoulder adjustments posted conversion rates 2.4× higher than standard one-size SKUs. Latin American startups leveraged local anthropometric data to tailor wraps for shorter torsos, increasing domestic brand share by 17%. USA-based subscription programs offering sling upgrades every six months reported 31% lower churn. Online unboxing content showcasing babywearing techniques boosted engagement across parenting forums, while guided live-streams increased cart value by 14% on average.

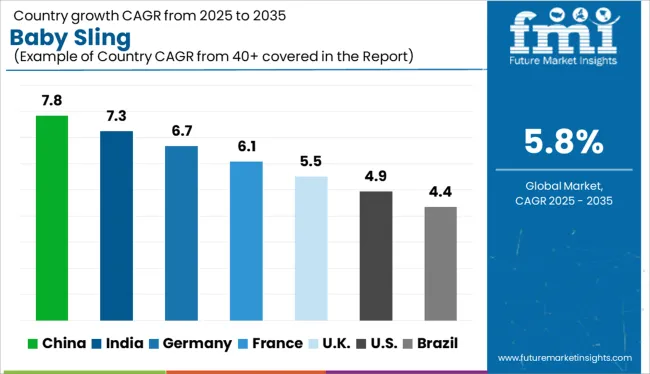

| Country | CAGR |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| France | 6.1% |

| UK | 5.5% |

| USA | 4.9% |

| Brazil | 4.4% |

| China | 8.5% |

| India | 7.9% |

| Germany | 7.2% |

| France | 6.6% |

| UK | 6.0% |

| USA | 5.4% |

| Brazil | 4.7% |

The global baby sling market is forecast to grow at a CAGR of 6.0% from 2025 to 2035. At the top of the growth spectrum, China (BRICS) leads with a CAGR of 7.8%, outperforming the global average by 1.8 percentage points, fueled by rising urban parenting trends, e-commerce penetration, and safety-conscious consumer behavior. India (BRICS) follows closely at 7.3% (+1.3 pp), driven by expanding middle-class adoption, growing awareness of ergonomic babywearing, and increased birth rates in tier-2 and tier-3 cities. Among OECD nations, Germany posts 6.7% (+0.7 pp), supported by demand for organic fabrics and sustainably produced infant care products. In contrast, the UK records 5.5% (–0.5 pp), while the United States trails at 4.9% (–1.1 pp), reflecting relatively mature markets where innovation and premiumization are the key growth levers. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

The market in China is forecast to expand at a CAGR of 7.8% between 2025 and 2035, supported by the rising adoption of ergonomic parenting solutions in urban areas. Between 2020 and 2024, demand was driven by major e-commerce platforms and influencer-led babywearing trends. Moving forward, increased focus on child safety certifications and breathable materials is pushing product innovation. Domestic brands are also localizing designs based on regional climates and consumer comfort.

India is projected to witness a CAGR of 7.3% in the market through 2035, led by increased parenting awareness and urban lifestyle shifts. From 2020 to 2024, the market gained traction in metros via social media parenting forums and baby product subscription models. The upcoming decade will see deeper market penetration in tier-2 and tier-3 cities, aided by offline retail expansion and value-based pricing.

Germany’s market is expected to grow steadily at a CAGR of 6.7% between 2025 and 2035, building on a strong culture of natural parenting and sustainability. During 2020–2024, the focus remained on organic materials and posture-supporting designs. The next decade will see increased adoption of hybrid slings combining wrap features with easy buckle systems. Eco-conscious buyers are also favoring slings produced under fair-trade certifications.

The market in the UK is projected to grow at a CAGR of 5.5% from 2025 to 2035, as convenience and comfort remain top priorities among new parents. Between 2020 and 2024, structured carriers dominated, but demand for soft slings surged due to their portability and bonding advantages. Looking ahead, parenting classes and midwife-endorsed brands are expected to drive confidence in sling usage, particularly for newborn care.

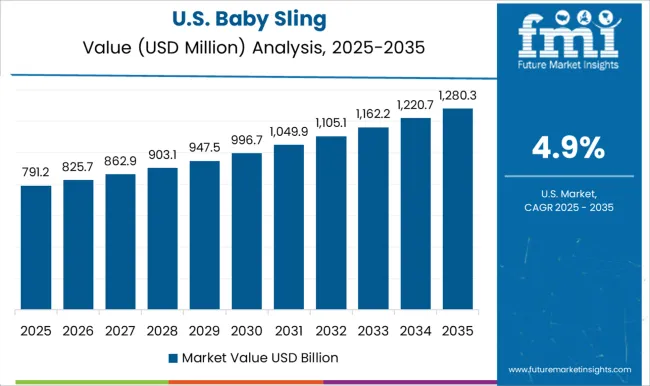

The baby sling industry in the United States is set to grow at a CAGR of 4.9% between 2025 and 2035, supported by rising demand for multifunctional parenting gear. From 2020 to 2024, compact designs and gender-neutral colors drove steady sales through both online and boutique outlets. Future growth will come from innovations such as moisture-wicking fabrics, adjustable fits for shared use, and American Pediatric Association (APA)-endorsed ergonomics.

Demand for baby slings in 2025 is gaining momentum with rising parental preference for ergonomic, hands-free infant-carrying solutions. Baby K’tan leads the global market with an 18% share, driven by its patented double-loop design and growing traction among urban parents. Sales of baby slings from Moby Wrap and Boba continue to expand across North America and Western Europe due to soft-stretch fabrics and newborn-specific offerings. Ergobaby is focusing on hybrid models that combine sling-style comfort with structured support, appealing to health-conscious caregivers. Maya Wrap is gaining popularity in niche markets owing to its breathable cotton-based ring sling line. The market is evolving toward sustainable, machine-washable fabrics, compact designs, and certifications that comply with global safety standards for babywearing.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.4 Billion |

| Type | Stretchy wraps, Hybrid wraps, Woven wraps, Ring slings, and Others |

| Material | Cotton, Linen, Silk, Blends, and Others |

| Age Group | Newborn (0–3 months old), Infant (3–10 months old), and Toddler (above 10 months old) |

| Price Range | Low, Mid, and High |

| Distribution Channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Baby K’tan, Moby Wrap, Boba, Ergobaby, and Maya Wrap |

| Additional Attributes | Dollar sales by sling type and carrying position, demand dynamics across newborn and toddler age groups, regional trends in ergonomic babywearing preferences, innovation in breathable fabrics and safety-locking mechanisms, environmental impact of textile sourcing and dye processes, and emerging use cases in postnatal mobility and travel-friendly parenting solutions. |

The global baby sling market is estimated to be valued at USD 2.4 billion in 2025.

The market size for the baby sling market is projected to reach USD 4.3 billion by 2035.

The baby sling market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in baby sling market are stretchy wraps, hybrid wraps, woven wraps, ring slings and others.

In terms of material, cotton segment to command 48.0% share in the baby sling market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Baby Changing Station Market Size and Share Forecast Outlook 2025 to 2035

Baby Car Safety Seat Market Forecast and Outlook 2025 to 2035

Baby Bath and Shower Products Market Size and Share Forecast Outlook 2025 to 2035

Baby Doll Market Size and Share Forecast Outlook 2025 to 2035

Baby & Toddler Carriers & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Baby Shoes Market Size and Share Forecast Outlook 2025 to 2035

Baby Oral Care Market Size and Share Forecast Outlook 2025 to 2035

Baby Ear Thermometer Market Size and Share Forecast Outlook 2025 to 2035

Baby Food Dispensing Spoon Market Size and Share Forecast Outlook 2025 to 2035

Baby Pacifier Thermometer Market Size and Share Forecast Outlook 2025 to 2035

Baby Crib Sheet Market Size and Share Forecast Outlook 2025 to 2035

Baby Teeth Care Products Market Size and Share Forecast Outlook 2025 to 2035

Baby Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Baby Diaper Market Growth, Forecast, and Trend Analysis 2025 to 2035

Baby Powder Market - Size, Share, and Forecast 2025 to 2035

Baby Bottle Holder Market Size and Share Forecast Outlook 2025 to 2035

Baby Toddler Bar Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Baby Snacks Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Baby Oil Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Baby Food Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA