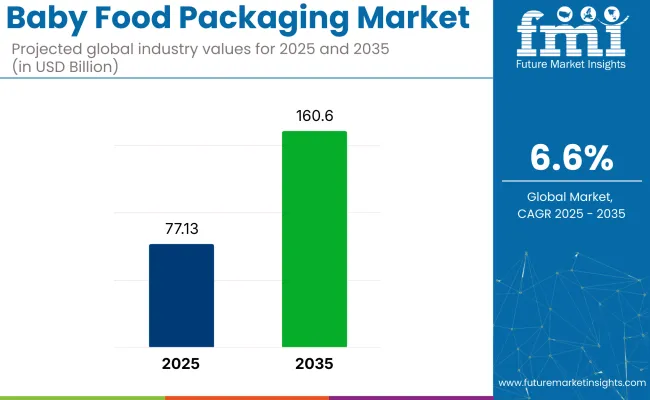

The global baby food packaging market is projected to grow at a valuation of USD 77.13 billion in 2025 to USD 160.6 billion by 2035 at a CAGR of 6.6% during the forecast period.

This growth is driven by the increasing demand for safe, secure, and convenient packaging solutions for baby food products. As the awareness around infant health continues to rise, the need for hygienic packaging that preserves the nutritional integrity of the food while ensuring its safety is propelling industry expansion. Additionally, the rising concerns over plastic waste are encouraging the shift toward eco-friendly packaging solutions.

As regulations around food packaging become more stringent, there is a significant shift toward scalable packaging solutions. In January 2025, an article published by the USA News stated that the USA Food and Drug Administration set new maximum lead levels for baby foods, including jarred fruits and vegetables, yogurts, and dry cereals, aiming to reduce young children's exposure to the toxic metal, which can cause developmental and neurological issues.

The agency issued final guidance that it estimates could decrease lead exposure from processed baby foods by approximately 20% to 30%. While the limits are voluntary for food manufacturers, the FDA will have the authority to take enforcement action if products exceed the established levels.

The industry holds a specific share in various parent markets. It accounts for approximately 5-7% of the food packaging market, as it focuses on specialized packaging for infant nutrition. In the flexible packaging market, the baby food packaging sector contributes about 6-8%, driven by the widespread use of flexible pouches due to their convenience. Within the plastic packaging market, it holds around 4-6%, as a significant portion of baby food packaging is made from plastic materials, including bottles and containers.

The market's share in the paper packaging market is estimated at 3-5%, as paper-based solutions are increasingly used for eco-friendly packaging. In the glass packaging market, the baby food packaging sector accounts for about 2-3%, with glass jars used for premium baby food items. These shares emphasize the niche but important role of baby food packaging across multiple sectors.

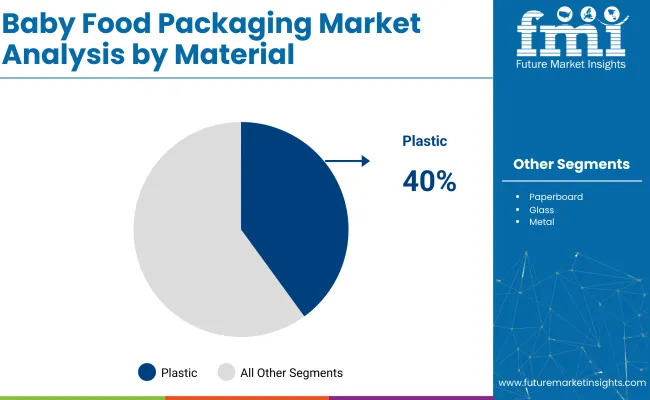

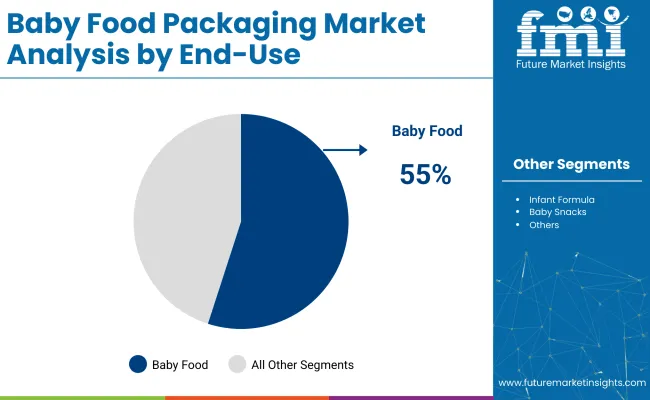

The industry is divided into materials, product types, packaging, and end use. Materials used include plastic, paperboard, glass, and metal. Plastic accounts for 40% share. In terms of product types, the market covers both powder and liquid formats. The powdered form holds 55% of the share.

In 2025, the plastic material segment is projected to dominate the industry, holding a 40% share. Plastic is cost-effective, flexible, and can preserve the quality of baby food.

Powdered baby food, particularly infant formula and cereals, is expected to hold a 55% share of the industry in 2025. This product format is popular due to its convenience, long shelf life, and ease of transportation.

Pouch packaging is expected to hold a 40% share of the industry in 2025. Pouches are growing in popularity due to their lightweight, ease of use, and ability to preserve the product's freshness and nutrients.

The packaging of infant formula is expected to account for 50% of the industry in 2025. The demand for infant formula continues to rise as more parents turn to formula feeding.

The industry is being driven by increasing demand for convenience and safety. Technological advancements and evolving consumer preferences are propelling growth, while high production costs and regulatory complexities are limiting expansion.

Increasing demand for convenient and safe packaging solutions is driving industry growth

The demand for convenient, ready-to-eat baby food products is being boosted by the growing number of working parents. Packaging solutions that offer portability, ease of use, and safety are being increasingly preferred by consumers.

There is a rising demand for nature-friendly packaging materials, including biodegradable films, recyclable plastics, and paperboard, as consumers and manufacturers are becoming more environmentally conscious. This shift toward eco-friendly solutions, combined with stricter regulations on packaging waste, is driving industry growth. Manufacturers are focusing on adopting these materials to meet both consumer and regulatory demands.

High production costs and regulatory complexities are limiting industry growth

Despite the growth potential, the industry is facing challenges related to high production costs and regulatory complexities. The adoption of sustainable packaging materials often comes with higher manufacturing expenses, which are being passed on to the consumer. Additionally, varying packaging and labeling regulations across different regions add complexity to industry expansion, requiring additional investment in compliance.

Manufacturers are struggling to balance the demand for innovative packaging with the need to maintain affordability. These factors are potentially hindering the widespread adoption of advanced packaging solutions and may slow down the industry growth.

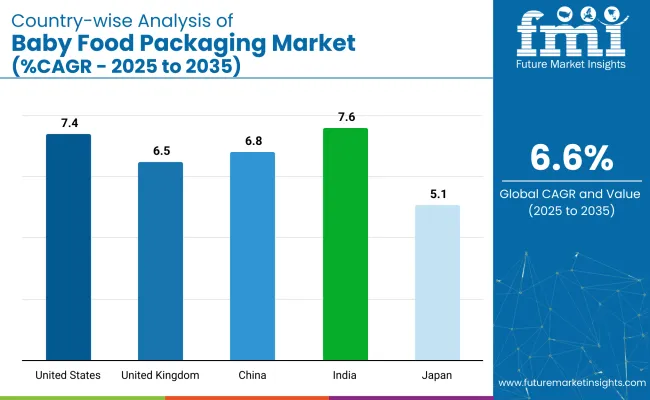

| Countries | CAGR (%) |

|---|---|

| United States | 7.4% |

| United Kingdom | 6.5% |

| China | 6.8% |

| India | 7.6% |

| Japan | 5.1% |

In the global context, the OECD countries, including the United States and the United Kingdom, exhibit steady growth. The United States, with a projected CAGR of 7.4%, leads the charge, driven by increasing demand for convenient and tamper-proof packaging solutions.

The country's expanding consumer base for high-quality baby food packaging, alongside the growing importance of safety and user experience, makes it a key player in the global market. The United Kingdom, at a CAGR of 6.5%, shows stable growth, supported by rising demand for eco-friendly and high-quality packaging solutions, with companies like Gerresheimer and AptarGroup spearheading innovations.

In contrast, India, a key player within the BRICS group, is experiencing faster growth, with a projected CAGR of 7.6%. India’s increasing birth rates and rising disposable incomes are fueling a growing demand for high-quality, safe packaging solutions.

The expanding middle class and the rise of e-commerce further accelerate the demand for convenient and eco-friendly packaging. Additionally, China, within the ASEAN region, is expanding at a CAGR of 6.8%, driven by rapid industrialization, increased demand for packaged baby food, and advancements in packaging technologies.

The OECD countries contribute to the steady demand for Baby Food Packaging, with the USA having high demand for advanced packaging solutions, while India and China in the BRICS and ASEAN groups offer the highest growth potential due to their emerging middle classes. Both developed and emerging markets will play crucial roles in shaping the future of the industry at a global level.

The United States industry is expected to grow at a CAGR of 7.4% through 2035. Growth is supported by increasing demand for convenient, tamper-proof packaging solutions that preserve the integrity of baby food products.

The United Kingdom industry is projected to grow at a CAGR of 6.5% through 2035. Growth is being driven by rising demand for high-quality packaging solutions in the baby food industry, alongside increasing consumer demand for eco-friendly alternatives.

The industry is expected to grow at a CAGR of 6.8% through 2035. Expansion is driven by rapid industrialization, increased demand for packaged baby food, and advancements in packaging technologies.

The industry is expected to grow at a CAGR of 7.6% through 2035. Growth is driven by increasing birth rates and rising disposable incomes. Local companies like Bormioli Pharma, SGD Pharma, and Piramal Glass are expanding their production capacities and improving packaging quality to meet growing demand.

The industry is projected to grow at a CAGR of 5.1% through 2035. Growth is supported by the country’s advanced manufacturing sector and strong focus on product safety and packaging quality.

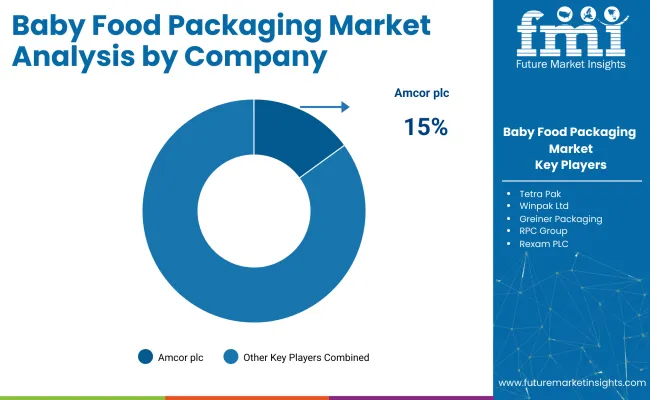

The global industry is characterized by a diverse range of players segmented key manufacturers, suppliers, and distributors, among others, in the supply chain. Key players like Amcor plc, Tetra Pak, and Sonoco Products Company dominate the industry due to their extensive product portfolios, technological advancements, and strong global presence in the food and beverage packaging sector.

Other significant players such as Winpak Ltd, Greiner Packaging, and Printpack focus on specialized markets, offering innovative packaging solutions tailored to the unique requirements of baby food products. Emerging players like Logos Packaging and Guala Pack S.p.A. target regional markets with cost-effective and niche product offerings, catering to specific consumer needs and preferences.

Recent Baby Food Packaging Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 77.13 billion |

| Projected Market Size (2035) | USD 160.6 billion |

| CAGR (2025 to 2035) | 6.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value, metric tons for volume |

| Materials Analyzed (Segment 1) | Plastic; Paperboard; Glass; Metal |

| Product Types Analyzed (Segment 2) | Powder; Liquid |

| Packaging Types Covered (Segment 3) | Pouches; Bottles; Cartons; Cans; Other packaging types |

| End-Use Segments Covered (Segment 4) | Infant formula, Baby snacks, Baby food, Other end-uses |

| Regions Covered | Asia Pacific; North America; Europe; Latin America; Middle East & Africa |

| Countries Covered | United States; Canada , United Kingdom; Germany; France; Italy; Spain; Netherlands , China; India; Japan; South Korea; Australia , Brazil ; Mexico; Argentina , Saudi Arabia; UAE; South Africa; Egypt; Turkey |

| Key Players Influencing the Industry | Amcor plc; Tetra Pak; Sonoco Products Company; Winpak Ltd; Greiner Packaging; Printpack; Logos Packaging; Guala Pack S.p.A.; Ardagh Group; Mondi Group; Bemis Company Inc. , Rexam PLC , RPC Gr oup |

| Additional Attributes | Dollar sales by material type (plastic, paperboard, glass, metal); Growth in liquid vs powder product types; Packaging format trends (pouches, bottles, cans); Regional industry demand for baby food packaging solutions; Technological advancements in packaging |

The industry is segmented into plastic, paperboard, glass, and metal.

The industry includes powder and liquid product types.

The industry covers pouches, bottles, cartons, cans, and others.

The industry includes infant formula, baby snacks, baby food, and others.

The industry spans Asia Pacific, North America, Europe, Latin America, and Middle East & Africa.

The projected market value of the Baby Food Packaging Market in 2025 is USD 77.13 billion.

The forecast market value of the Baby Food Packaging Market by 2035 is USD 160.6 billion.

The expected CAGR for the Baby Food Packaging Market from 2025 to 2035 is 6.6%.

Plastic will lead the Baby Food Packaging Market in 2025 with a 40% market share.

Asia Pacific, particularly India, is expected to be the key growth region for the Baby Food Packaging Market.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Baby Changing Station Market Size and Share Forecast Outlook 2025 to 2035

Baby Car Safety Seat Market Forecast and Outlook 2025 to 2035

Baby Bath and Shower Products Market Size and Share Forecast Outlook 2025 to 2035

Baby Doll Market Size and Share Forecast Outlook 2025 to 2035

Baby & Toddler Carriers & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Baby Shoes Market Size and Share Forecast Outlook 2025 to 2035

Baby Oral Care Market Size and Share Forecast Outlook 2025 to 2035

Baby Ear Thermometer Market Size and Share Forecast Outlook 2025 to 2035

Baby Pacifier Thermometer Market Size and Share Forecast Outlook 2025 to 2035

Baby Crib Sheet Market Size and Share Forecast Outlook 2025 to 2035

Baby Teeth Care Products Market Size and Share Forecast Outlook 2025 to 2035

Baby Diaper Market Growth, Forecast, and Trend Analysis 2025 to 2035

Baby Powder Market - Size, Share, and Forecast 2025 to 2035

Baby Sling Market Size and Share Forecast Outlook 2025 to 2035

Baby Bottle Holder Market Size and Share Forecast Outlook 2025 to 2035

Baby Toddler Bar Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Baby Snacks Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Baby Oil Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Baby Milk Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Baby Bottle Industry Analysis In Indonesia Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA