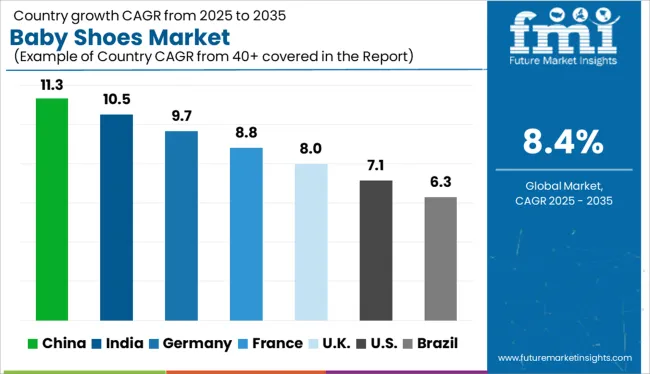

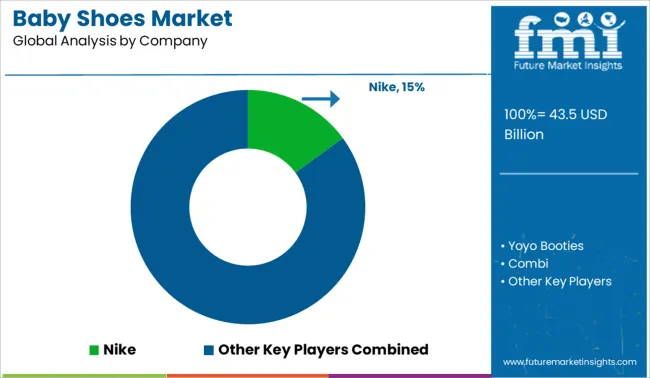

The Baby Shoes Market is estimated to be valued at USD 43.5 billion in 2025 and is projected to reach USD 97.4 billion by 2035, registering a compound annual growth rate (CAGR) of 8.4% over the forecast period.

| Metric | Value |

|---|---|

| Baby Shoes Market Estimated Value in (2025 E) | USD 43.5 billion |

| Baby Shoes Market Forecast Value in (2035 F) | USD 97.4 billion |

| Forecast CAGR (2025 to 2035) | 8.4% |

The Baby Shoes market is witnessing strong growth momentum, driven by rising birth rates in emerging economies, evolving consumer preferences, and growing emphasis on baby comfort and foot development. The current scenario is marked by increased awareness among parents regarding the importance of foot health, leading to higher demand for ergonomically designed and well-cushioned baby footwear. Brands are focusing on product innovation with soft materials, anti-slip soles, and breathable linings that enhance both safety and aesthetics.

Press releases and annual reports from leading players have emphasized the role of social media influence and e-commerce expansion in accelerating product visibility and accessibility. Sustainability trends are also reshaping product design, with companies increasingly investing in eco-friendly materials and ethical sourcing practices.

Future growth is expected to be driven by premiumization, personalization, and growing interest in gender-specific and occasion-specific footwear options The shift toward quality over quantity in parental buying behavior is further strengthening the market, providing a favorable landscape for both established and emerging baby shoe brands.

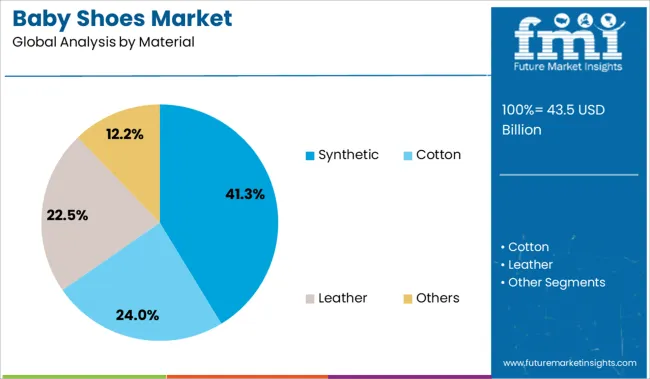

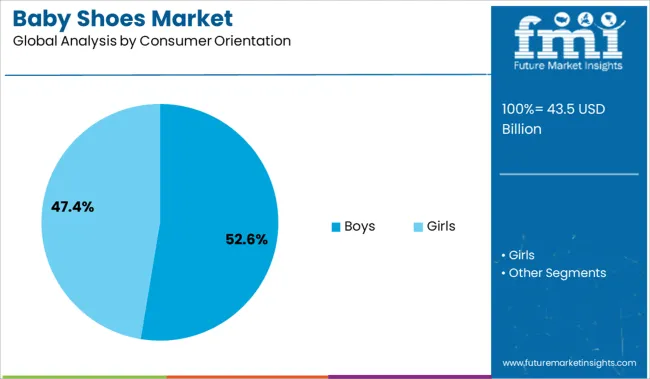

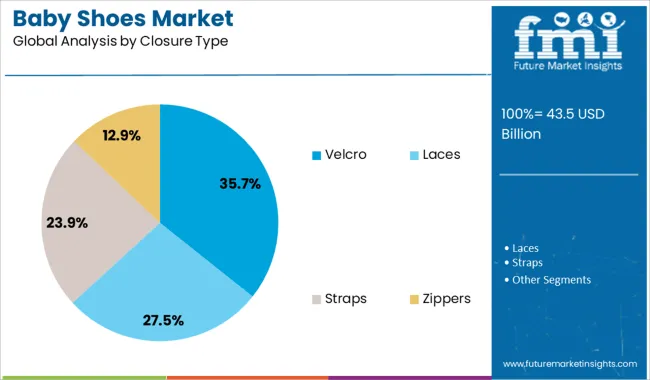

The market is segmented by Material, Consumer Orientation, Closure Type, and Sales Channel and region. By Material, the market is divided into Synthetic, Cotton, Leather, and Others. In terms of Consumer Orientation, the market is classified into Boys and Girls. Based on Closure Type, the market is segmented into Velcro, Laces, Straps, and Zippers. By Sales Channel, the market is divided into Online Retailers, Multi-brand Stores, Independent Small Stores, and Other Sales Channel. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The synthetic material segment is projected to account for 41.3% of the Baby Shoes market revenue share in 2025, making it the leading material category. This leadership has been supported by the durability, lightweight characteristics, and affordability of synthetic materials, as highlighted in product development updates and fashion industry news. Synthetic materials have been widely adopted due to their flexibility and ability to replicate the look of leather without the associated cost or maintenance challenges.

Brands have increasingly used synthetic options to offer vibrant colors and playful designs that appeal to both parents and children. These materials are also easier to clean and maintain, which aligns with the convenience-driven mindset of modern parents.

Furthermore, advancements in synthetic fabric technology have improved breathability and comfort, ensuring better protection for sensitive baby skin These attributes, combined with their compatibility with mass production and cost efficiency, have ensured the synthetic segment’s dominance in the market.

The boys segment is expected to represent 52.6% of the Baby Shoes market revenue share in 2025, making it the largest consumer orientation segment. This leading position has been influenced by higher product turnover rates, increased gifting behavior, and expanding choices in design and functionality for boys' footwear. Retail performance summaries and brand press releases have noted that parents often purchase more frequently for boys due to wear and tear or sizing needs, driving volume sales.

Additionally, market trends have shown that boys' collections tend to emphasize performance, durability, and active styling, which align with consumer expectations for outdoor and playtime use. The increasing availability of branded and character-themed shoes has also contributed to repeat purchases.

Manufacturers have responded by expanding their product lines and investing in designs that combine aesthetic appeal with practicality These factors have contributed to the segment's growth and reinforced its commanding share in the market.

The Velcro closure segment is forecasted to hold 35.7% of the Baby Shoes market revenue share in 2025, making it the most preferred closure type. This preference has been supported by the ease of use, secure fit, and time-saving benefits offered by Velcro systems. As highlighted in parenting blogs and children’s product launches, Velcro closures allow for quick fastening and removal, reducing frustration for both caregivers and children.

The feature is particularly favored by parents with toddlers learning to walk, as it ensures consistent support without the complexity of laces or buckles. Product catalogs and e-commerce data have shown that Velcro-closure shoes are highly rated for safety, adjustability, and child independence, further enhancing consumer confidence.

Brands have also embraced Velcro due to its compatibility with various upper materials and foot shapes These qualities have collectively driven the widespread adoption of Velcro-based shoes and established their position as the leading closure type in the market.

Baby shoes are designed to protect babies' feet from infections caused by dirt, dust, water, mud, and various climatic conditions as well as injuries caused by different objects. Because baby shoes are soft, they also prevent the baby's feet from deforming. They offer comfort while sitting, walking, and playing. They can handle both heavy use and light use. Thus, these types of shoes require a good design in order to be adaptable, lightweight, breathable, decent-looking, and fit appropriately.

Key manufacturers are launching new product lines composed of premium fabrics in response to the rising demand for baby shoes that are sophisticated, ergonomic, and comfortable. The market's growth potential is increased by the adoption of cutting-edge technologies in the production of baby shoes. However, significant players are extremely concerned about the proliferation of poor quality and counterfeit goods since it compromises their profitability and marketability. In the upcoming years, it is anticipated that the Baby shoes market would increase steadily. A significant element propelling the global market for baby shoes is the rise in demand for fashionable, fancy, yet comfortable footwear for children.

One of the primary trends driving the growth of the baby shoe market is quality fortification driven by design and material innovation. There is a great demand for high-quality baby footwear that is created and embellished with appealing colors and cartoon characters. As a result, market vendors are introducing such footwear. Moreover, the disposable income for the parents has increased and the parents tend to spend a high amount of money for ensuring safety by selecting branded products for their babies.

One of the significant market trends driving the growth of the children's footwear market is an increase in demand for personalized shoes. Leading providers in the premium market provide customized products with an aesthetic appeal. Personalization can range from design, logo, color, and buckles to embroidery or name insertion.

One of the reasons impeding the growth of the baby shoe market is the prevalence of counterfeit items. Counterfeit goods are created from poor-quality raw ingredients that are harmful in nature and can hurt a baby's skin. Customers may have difficulty distinguishing between authentic and fake products due to their similar appearance. The low cost of counterfeit goods fuels their popularity.

As a result, the availability of counterfeit items has a negative impact on vendors' sales and price strategies by diluting their market shares and hurting their brands. To overcome these obstacles, worldwide suppliers are forced to under-price their items, reducing their profit margins. It also has an impact on the market's value sales percentage. These factors may have a negative influence on the growth of the baby shoe market during the forecast period.

Clothing rental companies are aiding the development of the baby shoe market in the UK

Bundlee, the baby apparel rental firm, is also offering a baby and toddler shoe rental service as a result of a new agreement with eco-shoe maker Vivobarefoot. Bundle now offers a baby shoe rental in collaboration with VIVOBAREFOOT, the natural B-corp brand, in an effort to help parents with the problems caused by the frequent change in the size of their baby’s feet.

According to Bundlee, the average baby’s shoe size changes every four months and this is a frequent and expensive replacement cycle, with the majority of products ending up in the trash at end-of-life. This concept interests a large number of parents that are increasingly searching for sustainable options which are anticipated to be beneficial for the baby shoe market.

Additional revenue coming as a result of relaxation policy will fuel the market

According to the latest statistics, China has approximately 18 million newborn babies each year. Because the number of prospective customers is big and is not likely to shrink dramatically, the baby shoe market in China is expected to grow gradually. Furthermore, there are several economic developments in China that are more likely to have a beneficial impact on the industry. The one-child restriction has lately been eased, allowing a family to have a second child if one of the parents is the only kid. Previously, both parents had to be the only children in their families in order to be allowed to have a second child. This appears to be a good indicator for the Chinese baby shoe market.

Increasing popularity of e-commerce and rise in disposable incomes to boost the market

Rising Indian incomes and a diminishing middle class can both contribute significantly to the industry's future growth. Rising family income means a higher quality of a baby's necessities, such as more comfortable clothes and shoes, as well as a bigger range of sets. All of this costs money, which will be spent on a baby by parents.

Domestic producers appear to dominate the market, which could be attributed to reduced shipping and manufacturing costs. As one of the most favored distribution channels, online stores appear to dominate the market. This is because e-commerce is becoming increasingly popular in India. As a result, it might be argued that the infant shoes market is extremely appealing to potential new competitors and may offer prospects for growth.

Baby shoes made from cotton contribute a major share in the market

Baby’s skin is very sensitive and the use of synthetic materials can cause rashes and harm the baby’s feet. Parents are very selective when it comes to the well-being of their babies. Cotton is a soft fabric that is completely natural and suitable for use by babies. As a result, baby shoes made from cotton are preferred to a large extent.

Slip-on shoes are mostly preferred by buyers

The use of zippers can be unsafe when used for the delicate feet of babies while the lace-up category is considered to be comparatively complex. Hence, the slip-on type of shoes is mostly preferred by parents as they are easy to use and provides convenience for the parents. Moreover, the babies feel comfortable wearing the slip-on type of shoes as these shoes take the shape according to the baby’s feet structure.

Online Retailers will gain traction in the forecast period

Parents are always looking for new and trendy fashion for their beloved babies and want their babies to have the best. Hence, they tend to have a variety of options to choose from. This demand from the parents is fulfilled by online retailers which have a wide range of portfolios on their e-commerce platforms. Consequently, online retailers are expected to gain traction in the forecast period.

The key companies in the baby shoe market are concentrating on the development of their product and providing them at affordable rates with superior quality. Also, they are collaborating with local players to enhance their reach in the market.

For instance:

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | USD Million for Value |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania & Middle East & Africa (MEA) |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, the UK, France, Spain, Italy, Russia, South Africa, Northern Africa GCC Countries, China, Japan, South Korea, India, Thailand, Malaysia, Indonesia, Australia & New Zealand. |

| Key Segments Covered | Material, Consumer Orientation, Closure Type, Sales Channel, and Region. |

| Key Companies Profiled | Yoyo Booties; Combi; Goodbaby; Pigeon; Procter & Gamble; Baby Jay; Oasis Shoes; Adidas; New Balance; Nike; Trimfoot Co, LLC; Carter’s, Inc |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global baby shoes market is estimated to be valued at USD 43.5 billion in 2025.

The market size for the baby shoes market is projected to reach USD 97.4 billion by 2035.

The baby shoes market is expected to grow at a 8.4% CAGR between 2025 and 2035.

The key product types in baby shoes market are synthetic, cotton, leather and others.

In terms of consumer orientation, boys segment to command 52.6% share in the baby shoes market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Baby Changing Station Market Size and Share Forecast Outlook 2025 to 2035

Baby Car Safety Seat Market Forecast and Outlook 2025 to 2035

Baby Bath and Shower Products Market Size and Share Forecast Outlook 2025 to 2035

Baby Doll Market Size and Share Forecast Outlook 2025 to 2035

Baby & Toddler Carriers & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Baby Oral Care Market Size and Share Forecast Outlook 2025 to 2035

Baby Ear Thermometer Market Size and Share Forecast Outlook 2025 to 2035

Baby Food Dispensing Spoon Market Size and Share Forecast Outlook 2025 to 2035

Baby Pacifier Thermometer Market Size and Share Forecast Outlook 2025 to 2035

Baby Crib Sheet Market Size and Share Forecast Outlook 2025 to 2035

Baby Teeth Care Products Market Size and Share Forecast Outlook 2025 to 2035

Baby Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Baby Diaper Market Growth, Forecast, and Trend Analysis 2025 to 2035

Baby Powder Market - Size, Share, and Forecast 2025 to 2035

Baby Sling Market Size and Share Forecast Outlook 2025 to 2035

Baby Bottle Holder Market Size and Share Forecast Outlook 2025 to 2035

Baby Toddler Bar Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Baby Snacks Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Baby Oil Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Baby Food Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA