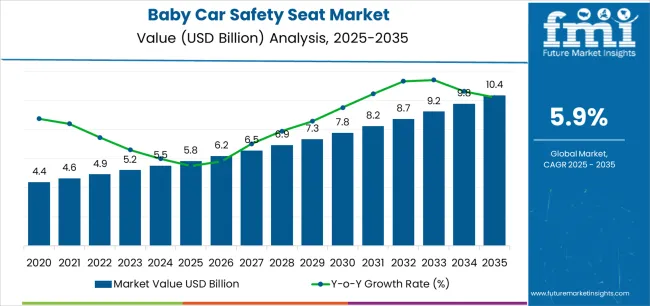

The Baby Car Safety Seat Market is estimated to be valued at USD 5.8 billion in 2025 and is projected to reach USD 10.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.9% over the forecast period.

The baby car safety seat market is expanding steadily as awareness regarding child safety and vehicle protection standards continues to rise globally. Market growth is being driven by stringent government regulations, increased parental focus on infant safety, and the growing adoption of advanced car seat technologies. Manufacturers are emphasizing ergonomic design, lightweight materials, and enhanced comfort features to cater to diverse consumer preferences.

The market’s current scenario reflects high competition and product differentiation based on safety certifications and installation convenience. In developed economies, premium and technologically advanced models are witnessing strong uptake, while emerging markets are experiencing growth through affordability-driven demand and online accessibility.

Continuous innovation in seat adjustability, energy absorption materials, and smart monitoring systems is further improving product reliability The future outlook remains positive as rising vehicle ownership, enhanced road safety initiatives, and consumer education campaigns are expected to sustain market momentum and drive long-term adoption across global automotive and childcare segments.

| Metric | Value |

|---|---|

| Baby Car Safety Seat Market Estimated Value in (2025 E) | USD 5.8 billion |

| Baby Car Safety Seat Market Forecast Value in (2035 F) | USD 10.4 billion |

| Forecast CAGR (2025 to 2035) | 5.9% |

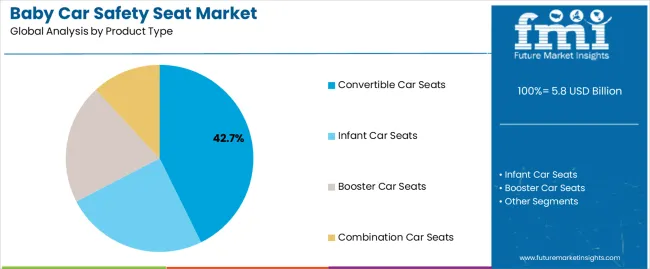

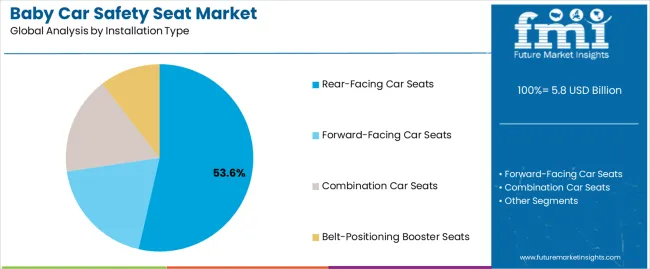

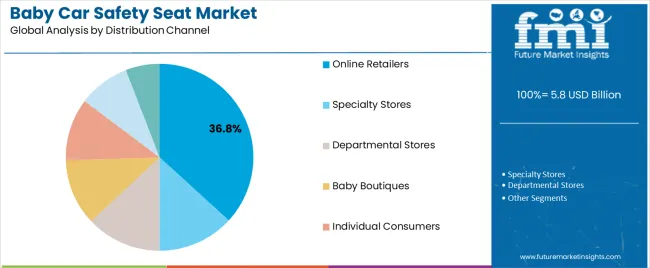

The market is segmented by Product Type, Installation Type, and Distribution Channel and region. By Product Type, the market is divided into Convertible Car Seats, Infant Car Seats, Booster Car Seats, and Combination Car Seats. In terms of Installation Type, the market is classified into Rear-Facing Car Seats, Forward-Facing Car Seats, Combination Car Seats, and Belt-Positioning Booster Seats. Based on Distribution Channel, the market is segmented into Online Retailers, Specialty Stores, Departmental Stores, Baby Boutiques, Individual Consumers, Car Rental Companies, and Others (Supermarkets, Hypermarkets, Authorized Dealerships). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The convertible car seats segment, holding 42.70% of the product type category, has been leading the market due to its flexibility and long-term usability. These seats can transition from rear-facing to forward-facing configurations, making them cost-effective and appealing to parents seeking value and extended functionality.

Adoption has been reinforced by increasing regulatory compliance, improved comfort designs, and growing availability across both offline and online retail platforms. Manufacturers are focusing on lightweight construction, superior impact protection, and enhanced latch systems to improve installation efficiency.

Demand stability has also been supported by promotional campaigns highlighting the product’s lifespan advantages The segment’s growth outlook remains strong, driven by continuous product innovation and expanding consumer preference for adaptable, safety-certified car seats that ensure protection throughout multiple stages of child development.

The rear-facing car seats segment, accounting for 53.60% of the installation type category, has remained dominant owing to its superior safety performance in protecting infants during collisions. Adoption is being supported by recommendations from global safety authorities and pediatric associations emphasizing rear-facing positioning for infants and toddlers.

The segment’s growth has been reinforced by advances in crash impact absorption, seat anchoring mechanisms, and user-friendly adjustment features that simplify installation. Consumer awareness initiatives and stricter vehicle safety standards have further increased adoption rates.

Manufacturers are investing in design improvements to optimize space utilization and enhance comfort without compromising safety With regulatory frameworks mandating prolonged rear-facing usage in several regions, this segment is projected to maintain leadership and continue contributing significantly to overall market revenue.

The online retailers segment, representing 36.80% of the distribution channel category, has emerged as the leading sales platform due to the convenience and variety it offers consumers. Growth has been accelerated by the increasing penetration of e-commerce, competitive pricing strategies, and availability of detailed product information that aids purchase decisions.

Online platforms enable easy comparison of brands, certifications, and safety features, supporting informed buying behavior among parents. Enhanced logistics networks and quick delivery services have also contributed to rising adoption.

Manufacturers are leveraging digital marketing and exclusive online partnerships to strengthen brand visibility and reach broader audiences As consumer confidence in online transactions continues to increase, the segment is expected to sustain its momentum, driving consistent revenue growth within the global baby car safety seat market.

Infant car seats upsurge the global market with a 6.0% CAGR through 2035.

| Attributes | Details |

|---|---|

| Top Product Type | Infant Car Seats |

| CAGR ( 2025 to 2035) | 6.0% |

This rising popularity is attributed to:

Based on the installation type, the rear-facing car seats segment is expected to rise at a 5.8% CAGR from 2025 to 2035.

| Attributes | Details |

|---|---|

| Top Installation Type | Rear-facing Car Seats |

| CAGR ( 2025 to 2035) | 5.8% |

The section analyzes the global baby car safety seat market by country, including the United Kingdom, the United States, China, South Korea, and Japan. The table presents the CAGR for each country, indicating the expected market growth through 2035.

| Countries | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.0% |

| United Kingdom | 7.4% |

| Japan | 7.2% |

| China | 6.9% |

| United States | 6.5% |

South Korea is swiftly emerging as a pivotal player in the global baby car safety seat market. It is expected to expand at a CAGR of 8.0% from 2025 to 2035. This remarkable growth trajectory underscores South Korea's burgeoning influence and potential to reshape the landscape of child safety solutions worldwide.

South Korea's baby car safety seat market is increasing due to the country's strong automotive industry and a growing emphasis on child safety. The government's initiatives to promote the use of safety seats for children and boost consumer awareness about the importance of child passenger safety have fueled the growth in the market. Collaborations between automotive and baby car safety seat manufacturers to integrate safety features into vehicles have further contributed to market expansion.

The United Kingdom market is expected to rise at a CAGR of 7.4% through 2035. Stringent safety regulations and increasing awareness among parents regarding child passenger safety have significantly contributed to market growth. The United Kingdom government's initiatives to promote car safety seats for infants and toddlers have also played a vital role in boosting market demand. A wide range of innovative safety products and technological advancements have driven market expansion in the United Kingdom.

Japan remains a significant contributor to the global baby car safety seat market, forecasting a consistent growth trajectory of 7.2% CAGR until 2035.

Japan's baby car safety seat market is growing steadily due to strict safety regulations, technological advancements, and increasing consumer awareness about child safety. The Japanese government's efforts to promote road safety and enforce rules mandating safety seats for infants and toddlers have significantly driven the market’s growth. Introducing innovative products with enhanced safety features and ergonomic designs has fueled consumer demand, leading to market expansion in Japan.

China is rapidly emerging as a dominant force in the global baby car safety seat market, showcasing an impressive CAGR of 6.9%, expected to endure from 2025 to 2035. This robust growth trajectory solidifies China's position as a key player in the industry, underlining its potential to influence market dynamics on a global scale significantly.

China's baby car safety seat market is experiencing explosive growth due to several factors. Urbanization, rising birth rates, and increasing awareness among parents about child safety during car travel have fueled market growth. Government initiatives to promote road safety and enforce regulations mandating safety seats for children have also stimulated market expansion.

The expanding middle-class population and growing consumer preference for premium safety products have driven China's demand for baby car safety seats.

The United States is steadily emerging as a significant contender in the worldwide baby car safety seat market, with a projected CAGR of 6.5% through 2035.

The baby car safety seat market is witnessing significant growth in the United States due to rising disposable income levels and an increasing emphasis on child welfare. A strong regulatory framework mandating the use of safety seats for children has further propelled market growth in the United States.

Key market players investing in research and development to introduce advanced safety features and ergonomic designs have also contributed to market expansion. Also, the rising popularity of convertible car seats and booster seats catering to varying age groups has boosted market demand and adoption rates.

Major global baby car safety seat players are implementing various strategies to drive growth and enhance their market presence. In Europe, where the baby car seat market is significant, companies focus on complying with strict safety regulations and product innovation to gain a competitive edge.

These players are investing in research and development to introduce advanced features such as impact-absorbing materials, adjustable harness systems, and ergonomic designs that cater to changing consumer needs.

Manufacturers are forging strategic partnerships and collaborations with automotive manufacturers and retailers to expand distribution channels and increase market penetration across European regions. By leveraging their product development expertise and meeting the high demand for safety seats, these companies intend to solidify their market share and drive growth in the European baby car seat market.

On a global level, major companies in the baby car safety seat industry are targeting emerging markets like Asia-Pacific, where the demand for safety seats is rapidly increasing. These companies are establishing manufacturing facilities and distribution networks in key countries such as China and India to capitalize on the growing market size and capture a more significant market share.

Key players are pursuing strategic acquisitions and mergers to strengthen their market position and gain access to new technologies and resources.

Recent Developments

The global baby car safety seat market is estimated to be valued at USD 5.8 billion in 2025.

The market size for the baby car safety seat market is projected to reach USD 10.4 billion by 2035.

The baby car safety seat market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in baby car safety seat market are convertible car seats, infant car seats, booster car seats and combination car seats.

In terms of installation type, rear-facing car seats segment to command 53.6% share in the baby car safety seat market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Baby Bath and Shower Products Market Size and Share Forecast Outlook 2025 to 2035

Baby Doll Market Size and Share Forecast Outlook 2025 to 2035

Baby Shoes Market Size and Share Forecast Outlook 2025 to 2035

Baby Ear Thermometer Market Size and Share Forecast Outlook 2025 to 2035

Baby Food Dispensing Spoon Market Size and Share Forecast Outlook 2025 to 2035

Baby Pacifier Thermometer Market Size and Share Forecast Outlook 2025 to 2035

Baby Crib Sheet Market Size and Share Forecast Outlook 2025 to 2035

Baby Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Baby Diaper Market Growth, Forecast, and Trend Analysis 2025 to 2035

Baby Powder Market - Size, Share, and Forecast 2025 to 2035

Baby Sling Market Size and Share Forecast Outlook 2025 to 2035

Baby Bottle Holder Market Size and Share Forecast Outlook 2025 to 2035

Baby Toddler Bar Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Baby Snacks Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Baby Oil Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Baby Food Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Baby Milk Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Baby Bottle Industry Analysis In Indonesia Growth - Trends & Forecast 2025 to 2035

Baby Bouncers Market Analysis by Product Type, Design, Price, Material, End-User, Distribution Channel and Region 2025 to 2035

Baby Play Mats Market Analysis - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA