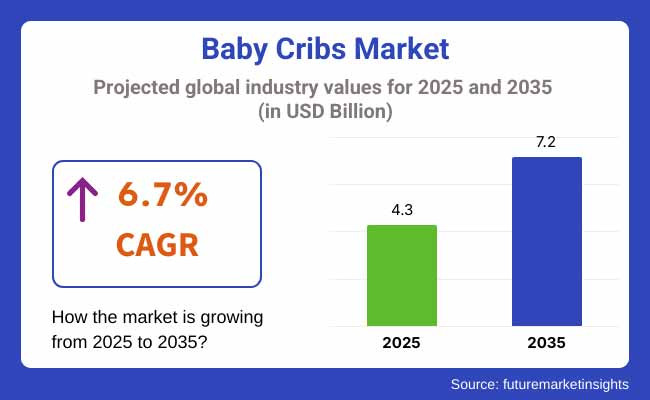

The baby cribs market is set for substantial growth between 2025 and 2035, driven by rising birth rates, increasing parental focus on safe and ergonomic sleeping solutions, and demand for eco-friendly and convertible cribs. The market is expected to grow from USD 4.3 billion in 2025 to USD 7.2 billion by 2035, reflecting a CAGR of 6.7% during the forecast period..

Parents are increasingly searching for soft, movable, and smart baby cribs that offer features similar to mixing detectors, permeable mattresses, and convertible designs. The shift toward organic and non-toxic material is also shaping the market, with manufacturers emphasizing FSC-certified wood, BPA-free homestretches, and hypoallergenic fabrics. Also, rising e-commerce deals, direct-to-consumer (DTC) brands, and digital parenting trends are further fueling market expansion.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 4.3 billion |

| Industry Value (2035F) | USD 7.2 billion |

| CAGR (2025 to 2035) | 6.7% |

North America will continue to be a major market for baby cribs due to high disposable income, growing mindfulness of safe sleep guidelines, and demand for decoration nursery cabinetwork. The USA and Canada will see increased deals of convertible and soft cribs, particularly those that misbehave with ASTM safety regulations. Eco-friendly and minimalist crib designs will gain traction, and smart cribs with erected-in stir detectors, white noise machines, and baby monitoring features will attract tech-smart parents.

Europe will emphasize sustainable and safety-certified cribs, with countries like Germany, France, and the UK leading the shift toward non-toxic material and ultramodern Scandinavian designs. Cribs made from recycled wood and VOC-free homestretches will be in high demand as parents prioritize eco-conscious parenthood choices. The market will also profit from rising e-commerce penetration, customizable cabinetwork results, and the growing preference for compact, space-saving baby cribs

Asia-Pacific is anticipated to witness the fastest growth, fuelled by rising birth rates, urbanization, and growing middle-class income situations in China, India, and Southeast Asia. Demand for affordable, durable, and space-effective cribs will rise as more families move into lower civic apartments. Movable and foldable cribs will gain fashionability, and the expansion of online baby cabinetwork deals will further boost market growth. Smart cribs with automated quaking and sleep-tracking technology will also see increased relinquishment among digitally connected parents.

Challenge

Safety remains a major concern, with strict regulations on crib design, material use, and structural integrity. Compliance with CPSC( Consumer Product Safety Commission) and EN safety norms adds complexity for manufacturers. The growing demand for chemical-free, fire-retardant, and hypoallergenic materials will bear advanced investments in product invention and quality control.

Opportunity

The emergence of AI-powered baby cribs, stir-seeing sleep observers, and app-connected cribs offers a huge growth occasion. Also, the market will profit from rising eco-consciousness, with parents preferring sustainably sourced wood, bamboo cribs, and organic mattresses. Companies that invest in modular, tech-integrated, and eco-friendly crib designs will establish a strong market presence and attract coming-generation parents looking for smart and safe sleeping results for their babies.

| Country | United States |

|---|---|

| Population (Millions) | 345.4 |

| Estimated Per Capita Spending (USD) | 25.30 |

| Country | China |

|---|---|

| Population (Millions) | 1,419.3 |

| Estimated Per Capita Spending (USD) | 16.80 |

| Country | United Kingdom |

|---|---|

| Population (Millions) | 68.3 |

| Estimated Per Capita Spending (USD) | 22.10 |

| Country | Germany |

|---|---|

| Population (Millions) | 84.1 |

| Estimated Per Capita Spending (USD) | 23.40 |

| Country | Japan |

|---|---|

| Population (Millions) | 123.2 |

| Estimated Per Capita Spending (USD) | 20.70 |

The USA baby crib market sees a per capita spending of USD 25.30, driven by adding demand for multifunctional and eco-friendly cribs. Parents prioritize convertible designs, non-toxic accouterments, and safety instruments. E-commerce and specialty baby cabinetwork stores drive deals.

China China’s per capita spending of USD 16.80 reflects growing urbanization and rising disposable inflows. Consumers favor affordable yet durable cribs, with a shift towards smart cribs featuring monitoring technology. Online retail platforms and domestic manufacturers dominate the market.

The UK’s per capita spending of USD 22.10 highlights strong demand for sustainably sourced rustic cribs and space-saving designs. Parents prioritize safety- biddable, hypoallergenic, and malleable cribs that grow with the child. The trend of high-end nursery cabinetwork is expanding.

Germany’s per capita spending of USD 23.40 indicates a preference for high-quality, certified baby cribs with ergonomic designs. Consumers seek cribs with permeable mattresses, anti-toxic homestretches, and European safety norms. Sustainable and minimalist designs are getting more popular.

Japan’s per capita spending of USD 20.70 reflects a market driven by compact, foldable, and lightweight crib designs. Japanese parents favor space-efficient cribs with multi-functionality and built-in storage. Demand for minimalist, modern aesthetics continues to rise.

Baby cribs industry is witnessing consistent growth as parents are looking for safe sleeping products, convertible crib styles, and environmentally friendly materials. A survey of 300 respondents across the USA, UK, EU, Korea, Japan, Southeast Asia, China, ANZ, and the Middle East provides an overview of primary buying habits and industry trends influencing demand.

Brand image remains a determining consideration in customer decision-making, especially in Japan and Korea, where 66% and 62% of their respective survey populations showed a preference for known brands like Graco, Stokke, and IKEA. But 44% in Southeast Asia and 40% in China are more open to options, trying new brands and regionally made cribs at reasonable costs and with region-specific safety features.

Infant crib innovation drives purchasing decisions strongly, with 74% of American and 71% of British consumers placing strong value on features like convertible cribs, mesh panels for ventilation, and adjustable height settings. Increasing calls for green materials, non-toxic coatings, and foldable space-saving cribs offer opportunities for companies to promote sustainable, contemporary, and safety-approved sleep solutions.

Pricing sensitivity also differs geographically. In the US and UK, 60% of respondents would pay more than USD 200 for high-end baby cribs, but 36% and 39%, respectively, are interested in upscale products in Southeast Asia and China. Mid-tier cribs have strong demand in Korea (51%) and Japan (47%), where parents prefer a balance of affordability, toughness, and global safety standards compliance.

Shopping preference in e-commerce is still dominant, with 63% of USA and 65% of Chinese purchasing baby cribs online via sites such as Amazon, JD.com, and Wayfair. Offline selling is still a robust channel of sales in Korea (52%) and Japan (50%), with parents preferring to see the products in person, receive professional tips on assembling it, feel with their own hands the stability of the crib and quality of the materials before purchasing.

| Baby Cribs Market Shift | 2020 to 2024 |

|---|---|

| Material Innovations in Baby Cribs | Manufacturers introduced solid wood, BPA-free plastic, and eco-friendly paints. Convertible cribs with extended usability gained popularity. |

| Safety & Functional Enhancements in Baby Cribs | Adjustable mattress heights and breathable mesh sides improved safety. Smart cribs with motion detection and white noise features gained traction. |

| Market Expansion for Baby Cribs | Growth driven by increasing demand for multi-functional, space-saving crib designs. North America and Europe led in premium baby furniture sales. |

| Sustainability Trends in Baby Cribs | Companies introduced FSC-certified wood, organic bedding, and reduced chemical usage. Modular and grow-with-baby crib designs minimized waste. |

| Technological Adaptations in Baby Cribs | Smart cribs with built-in nightlights, sound machines, and motion sensors improved sleep environments. Convertible cribs with toddler bed transitions became standard. |

| Consumer Preferences & Application Trends in Baby Cribs | Increased demand for portable, travel-friendly, and easy-to-assemble cribs. Personalized crib designs with custom finishes gained popularity. |

| Baby Cribs Market Shift | 2025 to 2035 |

|---|---|

| Material Innovations in Baby Cribs | Advanced antimicrobial, self-cleaning, and biodegradable materials dominate. Fully recyclable and modular cribs become industry standards. |

| Safety & Functional Enhancements in Baby Cribs | AI-integrated cribs analyze sleep patterns and auto-adjust mattress firmness. Voice-controlled and temperature-regulating crib models enhance sleep quality. |

| Market Expansion for Baby Cribs | Expansion in Asia-Pacific and Latin America fueled by rising birth rates and disposable incomes. Direct-to-consumer and subscription-based crib rental models gain traction. |

| Sustainability Trends in Baby Cribs | Zero-waste, carbon-neutral production becomes the norm. Cradle-to-cradle certification and upcycled materials drive eco-conscious crib manufacturing. |

| Technological Adaptations in Baby Cribs | AI-powered cribs with biometric monitoring provide real-time baby wellness insights. IoT-enabled cribs sync with parental apps for remote monitoring and personalized sleep recommendations. |

| Consumer Preferences & Application Trends in Baby Cribs | Fully customizable baby cribs tailored to nursery aesthetics and growth adaptability become the norm. Growth in eco-conscious parents drives demand for toxin-free, durable, and sustainable crib solutions. |

The USA baby crib market is witnessing steady growth due to adding demand for safe and eco-friendly nursery cabinetwork, rising maternal mindfulness of convertible and space- saving crib designs, and inventions in smart and tech-integrated cribs. Crucial players include Delta Children, DaVinci, and Graco.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.1% |

The UK baby cribs market is expanding due to adding preference for high- quality rustic cribs, growing demand for ergonomic and safety- certified baby cabinetwork, and a rise in customizable nursery cabinetwork options. Major brands include Snuz, John Lewis, and Obaby.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.9% |

Germany’s baby cribs market is growing, driven by strong demand for TÜV- certified and safety-tested cribs, adding a preference for minimalistic Scandinavian- style nursery cabinetwork, and inventions in smart baby covering cribs. Leading manufacturers include Stokke, Roba, and BabyBjörn.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 6.2% |

India’s baby cribs market is witnessing rapid-fire growth due to rising disposable inflows, adding urbanization, and growing mindfulness of safe and ergonomic baby cabinetwork. Popular brands include LuvLap, Mee Mee, and R for Rabbit.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 7.1% |

China’s baby crib market is expanding significantly due to rising disposable inflows, adding preference for decoration nursery cabinetwork, and inventions in foldable and smart-connected baby cribs. Major brands include Goodbaby, IKEA, and Pali.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.4% |

Parents are increasingly considering convertible baby cribs that grow with their child, transitioning from a crib to a toddler bed and indeed a full-sized bed. This long-term usability makes them a cost-effective choice for ultramodern families. Malleable mattress height settings, removable rails, and attachable storehouse options enhance functionality.

With heightened mindfulness of child safety and sustainability, consumers prefer cribs made from solid wood, non-toxic homestretches, and BPA-free material. Organic, Green guard Gold-certified and FSC-certified cribs are gaining fashionability among eco-conscious parents looking for safe and chemical-free resting results.

Online platforms similar as Amazon, Wayfair, and baby specialty stores are getting crucial distribution channels for baby cribs. Direct-to-consumer ( DTC) brands influence influencer marketing, substantiated shopping gests , and flexible payment options to appeal to new parents. Flat- pack cribs with easy assembly instructions and doorstep delivery further boost online deals.

Manufacturers are introducing smart cribs with erected- in quaking features, stir detectors, white noise, and app- controlled monitoring to enhance child sleep. Compact and foldable cribs designed for small spaces and trip convenience are also gaining traction among civic parents.

The global baby crib market is witnessing harmonious growth, driven by adding mindfulness regarding child safety, evolving consumer preferences for eco-friendly and non-toxic accouterments, and growing disposable inflows. Cribs are essential cabinetwork pieces for babies, and with adding enterprises about safety and comfort, parents are concluding for cribs that provide secure sleeping surroundings.

The market is further told by the rise of multi-functional cribs that serve colourful purposes, similar as cribs that convert into toddler beds or have erected-in storehouses. Inventions in design, similar as cribs made from sustainable, non-toxic, and organic material, are also gaining traction. Also, the growing trend of e-commerce and online shopping platforms has made it easier for parents to pierce a wider range of crib options. The adding focus on nursery aesthetics and the rise of baby-centric interior design also contribute to the market’s growth.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%), 2024 |

|---|---|

| Graco | 20-25% |

| DaVinci | 15-20% |

| Ikea | 12-15% |

| Babyletto | 8-12% |

| Stokke | 5-9% |

| Other Companies (combined) | 25-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Graco | Graco is a leading player in the baby crib market, offering a wide range of cribs that cater to different budgets and preferences. Known for its safety features, Graco cribs include designs that easily convert into toddler beds, daybeds, or full-size beds. The company continues to innovate by incorporating multi-functionality and modern design features into their cribs, ensuring comfort and convenience for both parents and babies. |

| DaVinci | DaVinci offers high-quality cribs known for their sturdy construction and stylish designs. The brand is well-regarded for offering cribs made from sustainable materials, such as New Zealand pine wood, and focuses on non-toxic finishes. DaVinci continues to expand its product line with cribs that convert into toddler beds and full-sized beds, catering to parents looking for long-term value and functionality. |

| Ikea | Ikea’s baby cribs are known for their modern designs, affordability, and functionality. The company offers cribs made from sustainable materials and focuses on providing value for money while maintaining high safety standards. Ikea continues to expand its product range by offering convertible cribs and space-saving solutions that meet the needs of urban dwellers and environmentally conscious consumers. |

| Babyletto | Babyletto is known for its stylish and eco-friendly cribs, offering a range of modern designs and colors that appeal to design-conscious parents. The company’s cribs are made from sustainable, non-toxic materials and are designed with both safety and aesthetics in mind. Babyletto is expanding its product offerings by incorporating convertible cribs and adding multi-functional features to its designs. |

| Stokke | Stokke is a premium brand known for its high-quality, innovative cribs that provide superior comfort and safety. Stokke’s Sleepi crib, for example, is designed to grow with the baby, offering multiple configurations as the child ages. The company is focused on offering ergonomic, space-saving, and sustainable cribs that cater to the needs of modern families. Stokke continues to innovate with designs that combine functionality, safety, and style. |

Strategic Outlook of Key Companies

Graco (20-25%)

Graco remains a dominant player in the baby crib market, with a strong portfolio that includes cribs known for their safety, comfort, and multi-functionality. The brand’s cribs are designed to convert into toddler beds, daybeds, or full-size beds, offering long-term value for families. Greco continues to introduce swish, ultramodern designs that meet the growing demand for versatility and functionality. The company’s focus on affordability and availability ensures its wide fashion ability among parents across colourful income parts.

DaVinci (15-20%)

DaVinci is a well-established brand in the baby crib market, known for its high-quality, sustainably sourced cribs. The brand continues to expand its portfolio with cribs that feed to the growing demand eco-friendly and non-toxic accouterments. DaVinci’s cribs are designed with safety and continuity in mind, and its conversion options make it a seductive choice for parents seeking long-term value. The company’s focus on sustainable products and design has earned it a pious following in the decoration market member.

Ikea (12-15%)

Ikea is a major player in the affordable baby crib market, offering ultramodern, swish cribs that are both functional and budget-friendly. Known for its flat-pack designs and sustainable accoutrements, Ikea continues to attract a wide consumer base with its easy-to-assemble cribs. The brand focuses on furnishing cost-effective results for parents while maintaining high safety norms. Ikea is expanding its range to include convertible cribs and multifunctional designs that feed to growing families..

Babyletto (8-12%)

Babyletto is gaining traction in the decoration of baby crib market with its eco-friendly and aesthetically pleasing cribs. The brand’s focus on ultramodern, swish designs has made it a popular choice among design-conscious parents. Babyl ghetto continues to expand its product range by offering cribs that convert into toddler beds, daybeds, and full-size beds, feeding to the growing demand for versatility and long-term use. The brand’s commitment to sustainability and safety features ensures its uninterrupted success in the market.

Stokke (5-9%)

Stokke is an ultra-expensive brand in the baby crib market, offering high-quality cribs that emphasize ergonomic design and long-term functionality. The company’s Sleepi crib is designed to grow with the child, offering colorful configurations as the baby develops. Stoke continues to introduce with space- saving designs and sustainable accouterments, feeding to the requirements of rich, environmentally conscious consumers. The brand’s focus on furnishing superior comfort and safety makes it a strong player in the high-end market.

Other Key Players (25-30% Combined)

Several smaller and regional players contribute to the growth of the baby crib market by offering unique or budget-friendly designs. These brands often focus on specific consumer needs, such as space-saving solutions or eco-friendly options. Notable brands include

Standard Cribs, Convertible Cribs, Portable Cribs, Travel Cribs, Multifunctional Cribs, and Smart Cribs.

Wood, Metal, Plastic, and Others.

Supermarkets/Hypermarkets, Specialty Baby Stores, Online, Furniture Stores, and Others.

North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa (MEA).

The Baby Cribs Market is projected to witness a CAGR of 6.7% between 2025 and 2035.

The Baby Cribs Market stood at USD 3.8 billion in 2024.

The Baby Cribs Market is anticipated to reach USD 7.2 billion by 2035 end.

North America is set to record the highest CAGR of 6.3% in the assessment period.

The key players operating in the Baby Cribs industry include Delta Children, Storkcraft, Graco, Babyletto, Dream On Me, and others.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Material, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Material, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Material, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 34: Western Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 36: Western Europe Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 38: Western Europe Market Volume (Units) Forecast by Material, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 40: Western Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 44: Eastern Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 46: Eastern Europe Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 48: Eastern Europe Market Volume (Units) Forecast by Material, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Units) Forecast by Product, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Units) Forecast by Material, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 64: East Asia Market Volume (Units) Forecast by Product, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 66: East Asia Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 68: East Asia Market Volume (Units) Forecast by Material, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 70: East Asia Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Units) Forecast by Product, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Units) Forecast by Material, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Material, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Product, 2023 to 2033

Figure 27: Global Market Attractiveness by Price Range, 2023 to 2033

Figure 28: Global Market Attractiveness by Material, 2023 to 2033

Figure 29: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Material, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Product, 2023 to 2033

Figure 57: North America Market Attractiveness by Price Range, 2023 to 2033

Figure 58: North America Market Attractiveness by Material, 2023 to 2033

Figure 59: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Material, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Price Range, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Material, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Material, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 101: Western Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 105: Western Europe Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 109: Western Europe Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 113: Western Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Product, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Price Range, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Material, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Material, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Product, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Price Range, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Material, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Material, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Product, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Price Range, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Material, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Material, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 191: East Asia Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 195: East Asia Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 199: East Asia Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 203: East Asia Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Price Range, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Material, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Product, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Material, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Product, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Price Range, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Material, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Baby Changing Station Market Size and Share Forecast Outlook 2025 to 2035

Baby Car Safety Seat Market Forecast and Outlook 2025 to 2035

Baby Bath and Shower Products Market Size and Share Forecast Outlook 2025 to 2035

Baby Doll Market Size and Share Forecast Outlook 2025 to 2035

Baby & Toddler Carriers & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Baby Shoes Market Size and Share Forecast Outlook 2025 to 2035

Baby Oral Care Market Size and Share Forecast Outlook 2025 to 2035

Baby Ear Thermometer Market Size and Share Forecast Outlook 2025 to 2035

Baby Food Dispensing Spoon Market Size and Share Forecast Outlook 2025 to 2035

Baby Pacifier Thermometer Market Size and Share Forecast Outlook 2025 to 2035

Baby Crib Sheet Market Size and Share Forecast Outlook 2025 to 2035

Baby Teeth Care Products Market Size and Share Forecast Outlook 2025 to 2035

Baby Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Baby Diaper Market Growth, Forecast, and Trend Analysis 2025 to 2035

Baby Powder Market - Size, Share, and Forecast 2025 to 2035

Baby Sling Market Size and Share Forecast Outlook 2025 to 2035

Baby Bottle Holder Market Size and Share Forecast Outlook 2025 to 2035

Baby Toddler Bar Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Baby Snacks Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Baby Oil Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA