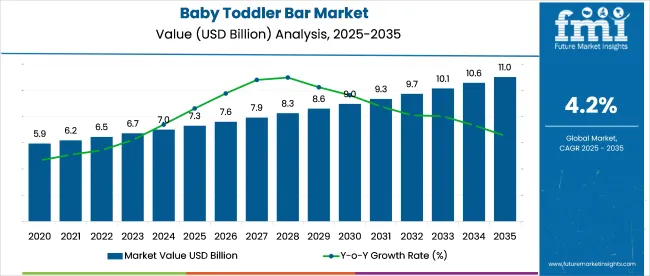

The global baby toddler bar market is estimated at USD 7.3 billion in 2025 and is projected to grow to USD 10.9 billion by 2035, at a CAGR of 4.2%. Production of baby toddler bars is being refined toward vegetable based and protein fortified bars that are believed to support early development and satiation. Brands investing in age appropriate texture design, portioned packaging, and natural sweeteners will outperform legacy snack makers.

Baby toddler bars hold a significant position in parent markets. In the baby food market, it accounts for approximately 3-5%, as toddler bars represent a small but growing segment of food products for young children. In the broader snacks market, the share is around 1-2%, as baby toddler bars cater specifically to children and are a niche within the general snack industry.

In the functional foods market, the share is about 2-3%, driven by the growing demand for functional foods designed to support health, growth, and development in young children. In the organic food market, its share is approximately 2-4%, as organic toddler bars appeal to health-conscious parents. In the health and wellness market, the share is around 1-2%, with an increasing focus on nutritious and balanced snack options for children.

In August 2024, Mark Teperson, CEO of Baby Bunting, commented on the company’s strategic shift amid a challenging retail environment in the baby products sector. While not focused exclusively on toddler bars, he reflects on broader trends in the baby nutrition and snack category. Baby Bunting’s turnaround strategy has included product innovation, streamlined pricing, and expansion efforts to enhance competitiveness and consumer reach.

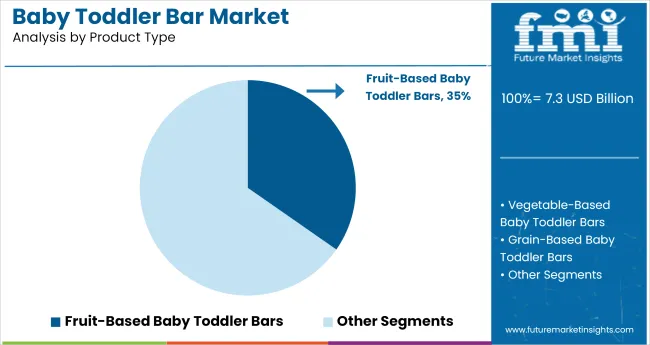

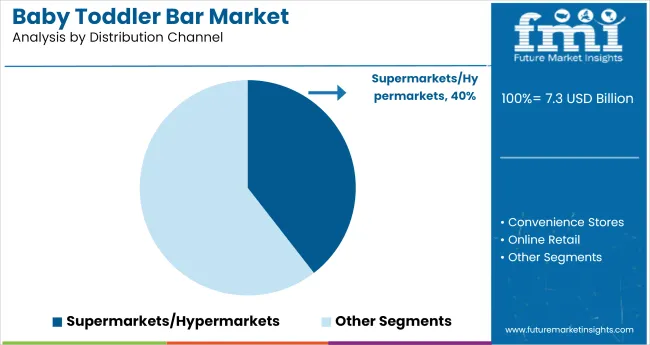

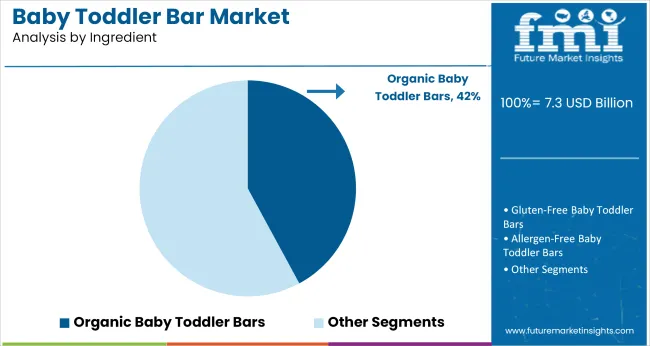

The industry is projected to grow with fruit-based bars leading the product segment at 34.7%. Supermarkets/hypermarkets will dominate distribution channels at 39.5%, and organic bars will hold the largest share in the ingredient segment with 42.1%.

Fruit-based baby toddler bars are expected to dominate the industry, accounting for 34.7% of the industry share in 2025. These bars are highly favored for their natural taste, nutritional content, and appeal to both parents and toddlers. The inclusion of fruits, such as apple, banana, and berries, provides essential vitamins and minerals while ensuring a convenient snack for toddlers. As consumers increasingly seek healthy, tasty alternatives to traditional snack foods, fruit-based toddler bars are poised to remain the preferred choice in the industry, especially in regions where natural, wholesome ingredients are prioritized.

Supermarkets and hypermarkets are projected to hold 39.5% of the industry share in 2025. These retail giants offer a wide range of baby toddler bars, providing easy access for parents looking for convenient, nutritious snacks for their children. The availability of both branded and private-label products in supermarkets makes it the primary distribution channel, attracting a broad consumer base. The organized retail space also benefits from effective promotional campaigns, in-store displays, and frequent sales events, which further drive the demand for toddler bars in these outlets.

Organic baby toddler bars are expected to capture 42.1% of the ingredient segment industry share in 2025. As health-conscious parents seek cleaner, non-GMO options, organic bars are gaining significant traction. These bars are made with organic, sustainably sourced ingredients, including fruits, whole grains, and plant-based proteins, providing a healthy, safe snack for toddlers. The rising awareness of the benefits of organic diets, combined with increasing concerns over food additives and pesticides, is pushing organic toddler bars to the forefront of the industry.

The industry is growing due to rising demand for convenient, nutritious snacks that support early childhood development. However, high price points and limited availability in developing regions are hindering industry expansion, particularly in lower-income and rural areas.

Rising Demand for Convenient and Nutritious Baby Snacks

The industry is expanding due to an increasing demand for convenient, nutritious snack options for young children. Parents are looking for healthy, ready-to-eat snacks that offer essential nutrients to support their child’s growth and development. With busy lifestyles and a growing awareness of the importance of early nutrition, baby toddler bars, made from natural ingredients and fortified with vitamins, are becoming a preferred choice. This shift is propelling the industry forward, as brands cater to the demand for balanced and portable nutrition.

High Price Points and Limited Availability in Developing Markets

Despite growth, the industry faces challenges, particularly from high price points and limited availability in developing regions. Premium ingredients used in toddler bars increase production costs, which can make these products less accessible in lower-income industries. Additionally, the lack of widespread distribution channels, especially in rural and developing areas, further restricts industry reach. These barriers hinder the industry’s expansion potential, particularly in regions with limited purchasing power and infrastructure.

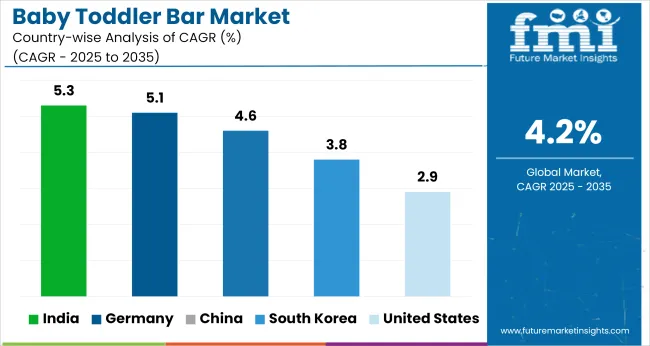

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 2.9% |

| India | 5.3% |

| China | 4.6% |

| Germany | 5.1% |

| South Korea | 3.8% |

Global industry demand is projected to rise at a 4.2% CAGR from 2025 to 2035. Of the five profiled countries out of 40 covered, India leads at 5.3%, followed by Germany at 5.1%, and China at 4.6%, while the United States posts 2.9% and South Korea records 3.8%. These rates translate to a growth premium of +26% for India, +21% for Germany, and +9% for China versus the baseline, while the United States shows slower growth.

Divergence reflects local catalysts: rising health-consciousness and growing demand for convenient and nutritious snacks in India and Germany, while more mature industries like the United States experience slower adoption and limited incremental growth in the baby toddler food sector.

The industry in the United States is projected to grow at a CAGR of 2.9% from 2025 to 2035. Demand has been shaped by rising interest in toddler-specific nutrition formats that offer convenience and perceived health benefits. Parents are purchasing clean-label, allergen-conscious bars that comply with pediatric dietary guidelines.

Bars enriched with iron, DHA, and fruit-based sweeteners are gaining traction. Shelf space in mass retail has been expanded for toddler-friendly formats. Growth is further supported by WIC-eligible product inclusion and partnerships between pediatricians and brands for trial packs. Promotion strategies targeting working parents through online grocery bundles continue to drive repeat purchases across subscription models.

India’s industry is projected to expand at a CAGR of 5.3% from 2025 to 2035. Demand is rising in metropolitan households seeking convenient and nutritious options for weaning-age children. Millet-based bars, often blended with dates, jaggery, and ghee, are gaining share due to regional ingredient familiarity and digestive benefits.

Pediatricians in urban clinics are recommending fortified snack bars with iron and calcium. D2C brands are launching customized sampler kits for first-time parents. Offline distribution is being strengthened through pharmacies and wellness chains. Government support for child nutrition startups and increased e-commerce access in Tier II cities are expected to accelerate brand penetration and repeat purchases over the next decade.

Demand is expected to grow at a CAGR of 4.6% between 2025 and 2035. Parents in Tier 1 and Tier 2 cities are shifting from sugary packaged snacks to portioned, nutrient-focused toddler bars. Domestic companies are reformulating rice- and oat-based variants with DHA, lutein, and probiotics, targeting brain and gut development.

E-commerce platforms like JD and Tmall support product sampling and influencer-driven education for young families. Cross-border brands from Japan and South Korea are increasing shelf presence in mother-baby stores. Regulatory clarity from the SAMR is encouraging product standardization, especially around labeling of allergens and nutrient claims, making toddler bars a key segment in early-stage functional food adoption.

Germany’s industry is projected to expand at a CAGR of 5.1% from 2025 to 2035. Parental preference for organic, additive-free toddler nutrition is reshaping product formulation. Brands are replacing traditional sweeteners with fruit concentrates and incorporating iron, zinc, and B12 for fortified blends.

Regional producers are leveraging EU organic certification to access specialty stores and pharmacy retail chains. Retailers are expanding shelf space for toddler-specific snacks, particularly those free from gluten, dairy, or common allergens. Demand is highest in urban households prioritizing convenience and health. German Food Code (LFGB) regulations are pushing manufacturers to reformulate for minimal processing and maximum transparency.

South Korea’s industry is anticipated to grow at a CAGR of 3.8% through 2035. Nutritional concerns among new parents are boosting demand for low-sugar, allergen-conscious snack options for toddlers. Locally made bars incorporate traditional grains like glutinous rice and millet, appealing to national dietary habits.

Functional claims around digestion, immunity, and visual development have gained visibility through pediatric clinic tie-ins and maternity hospital promotions. E-commerce channels are dominant, especially via parenting platforms that offer bundled monthly nutrition kits. Industry expansion is supported by MFDS regulations mandating disclosure of food origin, additive content, and nutrient density in toddler-focused packaged goods.

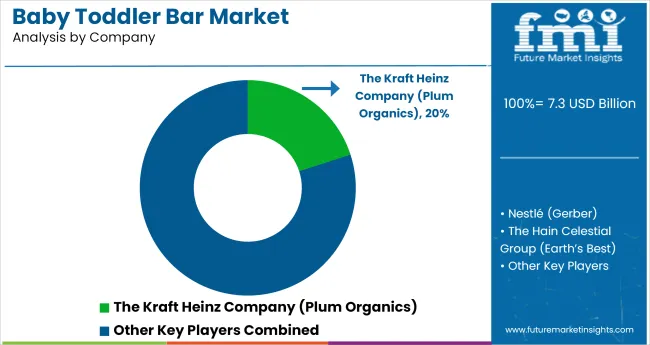

The global industry is led by The Kraft Heinz Company, particularly through its Plum Organics brand, which holds a significant share of approximately 20-25%. Plum Organics offers a variety of organic and nutritious snack options tailored for infants and toddlers, aligning with the growing demand for clean-label and health-conscious products. Their product range includes fruit and veggie bars, providing essential nutrients in convenient formats for busy parents. The brand's commitment to quality and innovation has positioned it as a leader in the industry.

Recent Industry Developments

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 7.3 billion |

| Industry Value (2035) | USD 10.9 billion |

| Forecast CAGR (2025 to 2035) | 4.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million units for volume |

| Product Type Segmentation | Fruit-Based Baby Toddler Bars, Vegetable-Based Baby Toddler Bars, Grain-Based Baby Toddler Bars, Nut-Based Baby Toddler Bars, Mixed Ingredient Baby Toddler Bars |

| Distribution Channel Segmentation | Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Drugstores/Pharmacies, Specialty Stores, Direct Sales |

| Ingredient Segmentation | Organic Baby Toddler Bars, Gluten-Free Baby Toddler Bars, Allergen-Free Baby Toddler Bars, Fortified/Enriched Baby Toddler Bars |

| Regions Covered | North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, Australia, New Zealand, GCC Countries, South Africa |

| Key Players Influencing the Industry | The Kraft Heinz Company (Plum Organics), Nestlé (Gerber), The Hain Celestial Group (Earth’s Best), Hero Group (Beech-Nut), Danone (Happy Family Organics) |

| Additional Attributes | Dollar sales by product type, distribution channel, and ingredient, increasing demand for organic and allergen-free baby foods, growth in online retail and convenience store channels, rising preference for fortified and nutritious options in baby food, regional trends in baby food consumption and product innovation. |

Product segmentation includes Fruit-Based Baby Toddler Bars, Vegetable-Based Baby Toddler Bars, Grain-Based Baby Toddler Bars, Nut-Based Baby Toddler Bars, and Mixed Ingredient Baby Toddler Bars.

The distribution landscape comprises Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Drugstores/Pharmacies, and Others such as Specialty Stores and Direct Sales.

Ingredient categories include Organic Baby Toddler Bars, Gluten-Free Baby Toddler Bars, Allergen-Free Baby Toddler Bars, and Fortified/Enriched Baby Toddler Bars.

Industry analysis has been carried out in key countries of North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus and the Middle East & Africa.

The size of the industry in 2025 is USD 7.3 billion.

The value of the industry in 2035 is projected to reach USD 10.9 billion, with a CAGR of 4.2%.

Organic baby toddler bars dominate the ingredient segment in the industry with a 42.1% industry share.

India will lead the industry with a 5.3% CAGR from 2025 to 2035.

The leading company in the industry is The Kraft Heinz Company (Plum Organics) with a 20% industry share.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Baby & Toddler Carriers & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Baby Changing Station Market Size and Share Forecast Outlook 2025 to 2035

Barrier System Market Forecast Outlook 2025 to 2035

Bariatric Surgery Device Market Forecast and Outlook 2025 to 2035

Baby Car Safety Seat Market Forecast and Outlook 2025 to 2035

Barium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Barrier Packaging Market Size and Share Forecast Outlook 2025 to 2035

Barrier Coated Papers Market Size and Share Forecast Outlook 2025 to 2035

Barrier Tube Packaging Market Size and Share Forecast Outlook 2025 to 2035

Barometer Market Size and Share Forecast Outlook 2025 to 2035

Barcode Scanner Market Size and Share Forecast Outlook 2025 to 2035

Barite Market Size and Share Forecast Outlook 2025 to 2035

Barbiturate Drug Market Analysis Size and Share Forecast Outlook 2025 to 2035

Bar Inspection System Market Size and Share Forecast Outlook 2025 to 2035

Baritainer Jerry Can Market Size and Share Forecast Outlook 2025 to 2035

Barrier Resins Market Size and Share Forecast Outlook 2025 to 2035

Bare Metal Cloud Market Size and Share Forecast Outlook 2025 to 2035

Bariatric Walking Aids Market Size and Share Forecast Outlook 2025 to 2035

Bariatric Walkers Market Size and Share Forecast Outlook 2025 to 2035

Bariatric Rollator Walkers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA