The market for baby personal care products is expected recovery steady as both the sales channel and end user in the market advance between 2025 and 2035, owing to enhanced parental awareness and increasing demand for natural and organic baby care products and rising disposable income. Some of those products include baby skincare, haircare, toiletries, diapers, and wipes, and parents are looking for gentle, chemical-free formulations.

A global shift toward premium and environmentally conscious baby care products is driving market growth, as brands innovate with plant-based ingredients, sustainable packaging, and dermatologically tested formulations. Moreover, the growing number of e-commerce platforms providing baby personal care products has made it easier for them to do comparison shopping for baby products that meet their specific needs. Additionally, consumer purchasing behaviour is driven by influencer marketing and product endorsement by paediatricians.

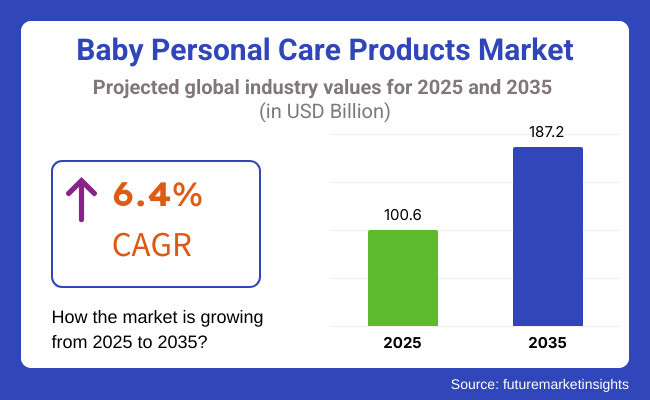

With a projected CAGR of 6.4% from 2025 to 2035, the market is increasingly being driven by the consumer shift toward high-quality, safe, and effective baby personal care formulations.

North America baby personal care products market is driven by the robust demand for organic and hypoallergenic formulations among the consumers. Parents in the United States and Canada are opting for chemical-free skincare, plant-based baby wipes and fragrance-free lotions to prevent allergic reactions and skin irritations. Also, consistent, subscription-based delivery of baby care product is increasing in the region, with sustainable consumption pattern to ensure the parents always have the product they need.

Europe is relatively mature as a market with a strong inclination towards natural and eco-friendly baby care products. Manufacturers have developed clean-label and certified organic products due to stringent regulations in countries such as Germany, France, and the UK regarding baby cosmetics and toiletries. Sustainable packaging and cruelty-free testing are strong selling points, and European shoppers are highly aware of their environmental footprints and the transparency of the ingredients in their products.

Region-wise, Asia-Pacific is expected to grow at a higher CAGR during the forecast period on account of increasing birth rates, urbanization and a growing middle-class population with higher spending capacity. In urman, npw hooses of China, lndit, nd Jpan are experiencing growing interest in higher coiling And imported baby personable life Goods, gryckl, and bby629.Moreover, considering the safety and naturalness of baby skincare and hygiene products, various herbal and Ayurveda formulations are gaining popularity which is shaping up new product innovations in the global baby care market.

Ensuring Product Safety and Avoiding Harmful Ingredients

The market for baby personal care products is highly scrutinized due to the concern over product safety, ingredient transparency, and regulatory compliance. Moms and dads are becoming more mindful about potential health hazards posed by chemicals such as parabens, phthalates, sulphates and artificial fragrances in baby shampoo, lotion and wipes. Studies connecting these ingredients to skin irritation, hormonal disruptions, and long-term health issues have resulted in increasing consumer demand for organic and hypoallergenic alternatives.

Globally, regulators are clamping down on safety standards, but different regulations around the globe pose headaches for manufacturers with more than one geographical market. For consumers, the presence of counterfeit and mischaracterized “natural” products only contributes to the confusion and makes it difficult for parents to trust those options that genuinely are safe. Brands need to focus on clear ingredient lists, certifications from reputable entities, and educate the consumer on their formulations to combat this. R&D efforts on developing baby care products that are gentle yet effective, will be essential in gaining credibility and expanding in the market.

Rising Demand for Organic and Sustainable Baby Care Products

The growing inclination toward the organic and sustainable lifestyle has been a major contributing factor in the baby personal care products market growth. As such, parents are in the pursuit of plant-based, non-toxic and cruelty-free product options that serve their child’s well-being while being aware of their footprint on the planet. There has been a surge in demand for biodegradable baby wipes, refillable skincare products, and eco-friendly packaging, leading manufacturers to innovate formulation and design.

Additionally, e-commerce has increased market availability, enabling small and independent businesses to prevail against established brands by providing premium, niche, and personalized baby care Subscription-based models of fulfilment for things like diapers, lotions, and bath products are becoming all the rage, delivering convenience for parents and steady earnings for brands. Businesses that prioritize sustainability, ethical sourcing, and transparency within their production process stand to gain great dividends as this market shift matures.

The baby personal care market underwent a faster progression towards organic and chemical-free formulations from 2020 to 2024. Longstanding brands and upstarts have broadened their lines to include plant-based skincare, fragrance-free wipes and gentle cleansing solutions to keep pace with increasing demand for non-toxic baby products. Sustainability, too, proved a key focus, with brands launching biodegradable diapers, refillable baby lotions and recycled packaging materials.

As we look into the future of 2025 to 2035, we will see the market further heavy down towards sustainability and ingredient transparency. Also, the increase in natural preservatives and biotechnology will pave the way for more efficient plant-based baby care solutions. Brands will also invest in digital education platforms to establish trust with parents by educating them about the sourcing of the ingredients, efficacy and safety standards. New baby care offerings that are customized for individual skin sensitivities and climate conditions will emerge, helping redefine the industry dynamic around innovation.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Stricter safety standards for baby skincare products |

| Technological Advancements | Introduction of plant-based preservatives and natural emulsifiers |

| Industry Adoption | Growth of organic-certified baby care brands |

| Supply Chain and Sourcing | Increase in ethically sourced natural ingredients |

| Market Competition | Entry of indie and eco-conscious baby care brands |

| Market Growth Drivers | Demand for chemical-free, hypoallergenic baby products |

| Sustainability and Energy Efficiency | Emergence of biodegradable baby wipes and reusable packaging |

| Consumer Preferences | Preference for fragrance-free and dermatologist-tested products |

| Retail and E-Commerce Growth | Surge in online sales and direct-to-consumer brands |

| Market Shift | 2025 to 2035 Trends |

|---|---|

| Regulatory Landscape | Global harmonization of ingredient safety regulations and mandatory transparency laws |

| Technological Advancements | Advances in bioengineered natural ingredients for improved safety and efficacy |

| Industry Adoption | Widespread adoption of clean-label and personalized baby care solutions |

| Supply Chain and Sourcing | Shift toward fully biodegradable and sustainable packaging solutions |

| Market Competition | Expansion of large brands into the premium organic baby care segment |

| Market Growth Drivers | Personalization, sustainable packaging, and eco-friendly formulations |

| Sustainability and Energy Efficiency | Full transition to carbon-neutral production and refillable baby care systems |

| Consumer Preferences | Increased demand for personalized, region-specific baby skincare solutions |

| Retail and E-Commerce Growth | Expansion of subscription-based baby care product services |

Growth in the USA baby personal care products market is being driven by the rising awareness of parents towards the hygiene and skincare of babies. Parents are increasingly looking for chemical-free alternatives, allowing organic and hypoallergenic products to go mainstream. As consumer preferences evolve, major brands are targeting sustainable packaging and plant-based formulations. E-commerce growth has also brought premium international brands closer to the consumers, significantly boosting the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.7% |

In the UK, the demand for baby personal care products is booming, as people are gravitating towards dermatological tested products, hypoallergenic, and eco-friendly products. Government regulations on baby skincare ingredients and rising consumer trust in certified organic brands are aiding the market growth. Other factors driving sector growth include increased disposable income and the growing popularity of online shopping for baby products.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.2% |

Germany, France, and Italy are the largest markets for baby personal care products in the EU, as natural and sustainable baby care solutions gain momentum. Stringent European Union regulations have made adding chemicals to baby cosmetics a very costly affair, thus driving innovation in formulations that are chemical free. Increasing awareness of skincare requirements for infants and the power of social media in promoting premium infant food brands are driving sales.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.3% |

The baby personal care market is expected to grow in Japan, driven by the demand for high-quality, technologically advanced skincare products. Japanese parents spent their time looking for soft, moisture-locked items with traditional components like rice bran and camellia oil. Fewer children means more spending per child and greater sales of premium baby care products. Retailers are also broadening their online offerings to accommodate the needs of digital-savvy customers.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.5% |

The baby personal care market in South Korea is evolving quickly, highlighting innovation in baby skincare and haircare. Strong beauty and cosmetics industries in the country are inspiring cutting-edge baby skincare formulations such as probiotic-infused creams, herbal-based washes and ingredients ranging from white lotus to pearl powder to glycerine and water sodium. Growing disposable income and consumer’s preference of luxury brands are further driving high-end baby care products market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.6% |

Hair Care & Skin Care Steer Market Growth with Parents Placing Emphasis on Mild and Safe Products

Due to the increasing demand for gentle, non-toxic, and dermatologically tested products among parents for their babies, the skin and hair care segments collectively dominate the baby personal care products market. As a daily necessity, these products maximize the well-being of an infant’s skin and hair by providing hydration, nourishment, and protection from external aggressors.

Skin care products hold the fastest-growing share of the baby personal care segment as these products are gentle and non-allergenic in nature specifically designed for babies' sensitive skin. Baby-specific products, in contrast to traditional skin care solutions, assure safety by limiting irritants and harsh chemicals.

The growing market adoption can be attributed to the increasing use of baby lotions, creams, and moisturizers containing natural ingredients like shea butter, aloe vera, and coconut oil, which parents prefer when choosing a clean-label product for their baby, with a focus on chemical-free skin care. According to studies, 65% of parents use organic-certified or dermatologist-approved baby skin care products, thus causing this segment to be in high demand.

The market has been further propelled by the rise of dedicated baby skin care lines, boasting eczema-friendly formulas, sun coverage with SPF and barrier-repair creams to provide optimal protection against dryness, allergens and skin irritants.

Developments in this direction, including the use of plant-based and cruelty-free ingredients, along with the inclusion of paraben-free, sulphate- free and fragrance-free ingredients in baby skin care formulations, have further propelled the adoption of baby skin care products, as it reflects sustainability, in addition to appealing to the consumer’s socio-economic priorities.

Probiotics-infused baby skincare solutions containing microbiome-balancing agents are helping build skin resilience and immunity and this drives the baby dermatology market growth, paving the way for innovation in baby dermatology.

Although skin care segment has some edge like hydration, protection, skin health enhancement but it faces challenges such as stringent regulatory approvals, high production cost for organic formulations and competition from generic baby care brands. Emerging innovations like AI driven personalized baby skin care recommendations, biodegradable packaging and sustainable ingredient sourcing are enhancing accessibility along with efficacy and sustainability in baby skin care products, thereby ensuring the global market grows.

Hair care products continue to be a strong category, driving sales for baby shampoos, conditioners and detanglers. Baby-specific products are designed to be tear-free, non-irritating, and mild surfactant-based compared to traditional hair care products.

The adoption of sulphate-free and hypoallergenic hair care products for babies such as 2-in-1 shampoo-conditioners, leave-in detanglers, and scalp-soothing oils are necessary for safe and effective hair nourishment, which has driven the demand. According to studies, more than 55% of parents look for paediatrician-recommended baby hair care products or dermatologically tested baby hair care products, which indicates that this segment will continue having customers.

The demand is further proved with the growing variety of specialized baby hair care products such as pH-based formula, scalp hydration treatments, whole strands relief that are highly effectual which is further enhancing the market demand that leads to ensuring sound scalp and hair growth.

Moreover, the inclusion of natural and plant-based extracts such as chamomile, almond oil, and coconut water in baby hair care formulations has also propelled the adoption, ensuring a chemical-free regime for grooming infants.

The launch of waterless and foaming baby shampoos, with improved rinse-off ability and eco-friendly formulations, led to the optimal growth of the market, providing enhanced convenience and sustainability in the baby personal care habits of consumers.

While the land of lather and rinse has reap benefits from the better scalp health, gentler cleansing and nourishment that are inherent to the category fewer of its brands are managing to keep affordability, threats from private label and constant bar–raising on tear-free technology. But the product differentiation, consumer penetration and confidence in the market for baby hair care products will still go on due to innovative developments in biodegradable baby shampoo packages, personalized hair care solutions based on baby's scalp conditions and these formulas endorsed by paediatricians.

The baby personal care products industry is poised to flourish with rising parental awareness towards baby hygiene, increasing demand for organic and chemical-free products along with increasing disposable income across developing economies. Bolds transform in the field of sustainable packaging, hypoallergenic formulation and use of plant based ingredients. Therefore, companies are focusing on health-conscious consumer’s niche by providing dermatologically tested, non-toxic & eco-friendly baby care products.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Johnson & Johnson | 18-22% |

| Procter & Gamble (P&G) | 15-20% |

| Unilever | 12-16% |

| Kimberly-Clark Corporation | 8-12% |

| The Himalaya Drug Company | 5-9% |

| Other Companies (combined) | 35-45% |

Key Company Offerings and Activities

| Company Name | Key Offerings/Activities |

|---|---|

| Johnson & Johnson | Top brand for baby shampoo, body lotion and powder, and hypoallergenic skincare products. |

| Procter & Gamble (P&G) | Includes Pampers baby wipes, mild cleansers and diaper rash creams. |

| Unilever | Manufactures Dove Baby skin-care line, including tear-free shampoos and moisturizing lotions. |

| Kimberly-Clark Corporation | Huggies wipes, and baby skincare for hygiene and comfort. |

| The Himalaya Drug Company | Offering herbal and organic baby care products such as lotions, powders, and oils. |

Johnson & Johnson (18-22%)

An internationally renowned player in baby personal care with gentle and clinically tested formulations, such as tear-free shampoos and moisturizing lotions.

Procter & Gamble (15-20%)

P&G leads the baby wipes and hygiene market, with an emphasis on dermatologically tested, hypoallergenic baby care products.

Unilever (12-16%)

The Dove Baby by Unilever range features gentle, pH-balanced skincare, addressing sensitive skin needs.

Kimberly-Clark Corporation (8–12%)

Huggies baby wipes and gentle skincare solutions provide warmth, comfort and safety for new-borns and toddlers.

The Himalaya Drug Company (5-9%)

A leader in the herbal baby care category, offering toxin-free, Ayurveda inspired personal care products.

Other Major Competitors (35-45% Combined)

The baby personal care market features brands that are natural, organic, and premium in its category. These include:

The Baby Personal Care Products Market was valued at approximately USD 100.6 billion in 2025.

The market is projected to reach USD 188.6 billion by 2035, growing at a compound annual growth rate (CAGR) of 6.4% from 2025 to 2035.

The demand for Baby Personal Care Products Market is expected to be driven by increasing parental awareness of baby hygiene, rising demand for organic and natural ingredients, expanding product innovations in mild and hypoallergenic formulations, and growing disposable income in emerging markets.

The top 5 countries contributing to the Baby Personal Care Products Market are the United States, China, India, Germany, and Brazil.

The Skin and Hair Care segment is expected to lead the Baby Personal Care Products market, driven by the increasing preference for chemical-free baby lotions, shampoos, and oils, along with innovations in dermatologically tested and paediatrician-approved products.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Price , 2017 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Price , 2017 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Price , 2017 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Price , 2017 to 2033

Table 17: Asia Pacific Excluding Japan Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 18: Asia Pacific Excluding Japan Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 19: Asia Pacific Excluding Japan Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2033

Table 20: Asia Pacific Excluding Japan Market Value (US$ Million) Forecast by Price , 2017 to 2033

Table 21: Japan Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 22: Japan Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 23: Japan Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2033

Table 24: Japan Market Value (US$ Million) Forecast by Price , 2017 to 2033

Table 25: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 26: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 27: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2033

Table 28: Middle East and Africa Market Value (US$ Million) Forecast by Price , 2017 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Price , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2017 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Price , 2017 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Price , 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Price , 2023 to 2033

Figure 17: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 18: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 19: Global Market Attractiveness by Price , 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by Price , 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Price , 2017 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Price , 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Price , 2023 to 2033

Figure 37: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 38: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 39: North America Market Attractiveness by Price , 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by Price , 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by Price , 2017 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Price , 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Price , 2023 to 2033

Figure 57: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 59: Latin America Market Attractiveness by Price , 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by Price , 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by Price , 2017 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by Price , 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by Price , 2023 to 2033

Figure 77: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 78: Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 79: Europe Market Attractiveness by Price , 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: Asia Pacific Excluding Japan Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 82: Asia Pacific Excluding Japan Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 83: Asia Pacific Excluding Japan Market Value (US$ Million) by Price , 2023 to 2033

Figure 84: Asia Pacific Excluding Japan Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: Asia Pacific Excluding Japan Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 86: Asia Pacific Excluding Japan Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: Asia Pacific Excluding Japan Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: Asia Pacific Excluding Japan Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 89: Asia Pacific Excluding Japan Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 90: Asia Pacific Excluding Japan Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 91: Asia Pacific Excluding Japan Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2033

Figure 92: Asia Pacific Excluding Japan Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 93: Asia Pacific Excluding Japan Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 94: Asia Pacific Excluding Japan Market Value (US$ Million) Analysis by Price , 2017 to 2033

Figure 95: Asia Pacific Excluding Japan Market Value Share (%) and BPS Analysis by Price , 2023 to 2033

Figure 96: Asia Pacific Excluding Japan Market Y-o-Y Growth (%) Projections by Price , 2023 to 2033

Figure 97: Asia Pacific Excluding Japan Market Attractiveness by Product Type, 2023 to 2033

Figure 98: Asia Pacific Excluding Japan Market Attractiveness by Sales Channel, 2023 to 2033

Figure 99: Asia Pacific Excluding Japan Market Attractiveness by Price , 2023 to 2033

Figure 100: Asia Pacific Excluding Japan Market Attractiveness by Country, 2023 to 2033

Figure 101: Japan Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 102: Japan Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 103: Japan Market Value (US$ Million) by Price , 2023 to 2033

Figure 104: Japan Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: Japan Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 106: Japan Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: Japan Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: Japan Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 109: Japan Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 110: Japan Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 111: Japan Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2033

Figure 112: Japan Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 113: Japan Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 114: Japan Market Value (US$ Million) Analysis by Price , 2017 to 2033

Figure 115: Japan Market Value Share (%) and BPS Analysis by Price , 2023 to 2033

Figure 116: Japan Market Y-o-Y Growth (%) Projections by Price , 2023 to 2033

Figure 117: Japan Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Japan Market Attractiveness by Sales Channel, 2023 to 2033

Figure 119: Japan Market Attractiveness by Price , 2023 to 2033

Figure 120: Japan Market Attractiveness by Country, 2023 to 2033

Figure 121: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 123: Middle East and Africa Market Value (US$ Million) by Price , 2023 to 2033

Figure 124: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 126: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 129: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 130: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 131: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Price , 2017 to 2033

Figure 135: Middle East and Africa Market Value Share (%) and BPS Analysis by Price , 2023 to 2033

Figure 136: Middle East and Africa Market Y-o-Y Growth (%) Projections by Price , 2023 to 2033

Figure 137: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 138: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 139: Middle East and Africa Market Attractiveness by Price , 2023 to 2033

Figure 140: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Baby Personal Care Market Analysis by Product Type, Nature, Age Group, Sales, and Region

Personal Care Products Filling System Market Size and Share Forecast Outlook 2025 to 2035

Baby Teeth Care Products Market Size and Share Forecast Outlook 2025 to 2035

Herbal Personal Care Products Market Size and Share Forecast Outlook 2025 to 2035

Fragranced Personal Care Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Anti-Foaming Personal Care Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hyaluronic Acid Personal Care Products Market Overview - Growth & Forecast 2025 to 2035

Personal Care Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Personal Care Appliances Market Size and Share Forecast Outlook 2025 to 2035

Personal Care Wipes Market Size and Share Forecast Outlook 2025 to 2035

Personal Care and Cosmetics Microalgae Market - Beauty & Skincare Trends 2025 to 2035

Personal Care Packaging Market Analysis by Application, Packaging Format, Capacity, and Region Forecast Through 2035

Personal Care Aid Market Growth – Industry Trends & Forecast 2024-2034

Baby Oral Care Market Size and Share Forecast Outlook 2025 to 2035

Suncare Products Market Size and Share Forecast Outlook 2025 to 2035

Baby Safety Products Market Analysis - Size, Share & Trends 2025 to 2035

Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Sun Care Products Market Analysis – Growth, Applications & Outlook 2025–2035

Car Care Products Market Trends - Growth, Demand & Analysis 2025 to 2035

Nail Care Products Market Growth, Trends and Forecast from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA