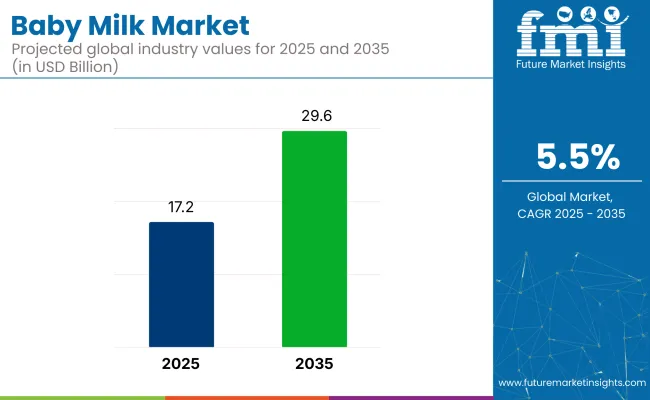

The global baby milk market is set to experience significant growth, expanding from USD 17.2 billion in 2025 to USD 29.6 billion by 2035, registering a CAGR of 5.5% during the forecast period. This expansion is fuelled by increasing awareness regarding infant nutrition, rising disposable incomes, and growing parental demand for high-quality, fortified infant milk products across both developing and developed economies.

Consumers are progressively opting for organic, non-GMO, and functional infant milk formulas that offer additional health benefits, such as probiotics, DHA, and nucleotides, aimed at boosting immunity, digestion, and cognitive development in infants.

A noteworthy development in this direction occurred in July and September 2023, when Danone Early Life Nutrition officially announced its plan to introduce an innovative infant formula in China. This product features milk phospholipid-coated lipid droplets that closely mimic the structure of human breast milk, under the trademark Nuturis™.

This innovation, disclosed during the Growth Asia Summit 2023 by Danone’s Vice President and reported by Food Business Africa and Nutra Ingredients Asia, highlights the company’s strategy to address the growing Chinese demand for scientifically advanced baby nutrition solutions.

Regionally, Asia Pacific is anticipated to be the fastest-growing market due to rising birth rates, rapid urbanization, and heightened awareness of infant health. Major economies such as China and India are leading this demand surge. Meanwhile, North America and Europe remain mature yet essential markets, characterized by consumer preference for organic and premium infant milk products. These regions continue to invest in research and product development to meet evolving parental expectations for safety, quality, and enhanced nutritional benefits.

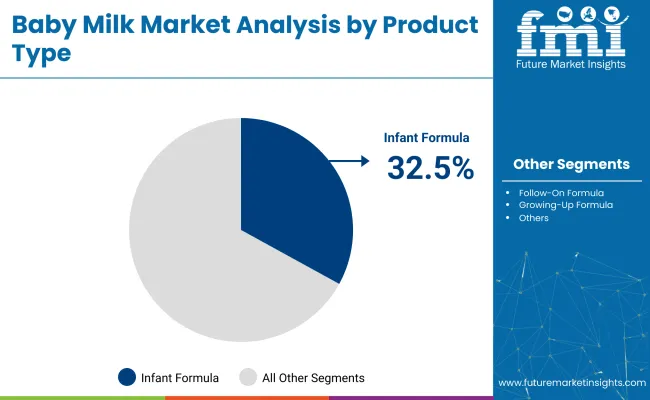

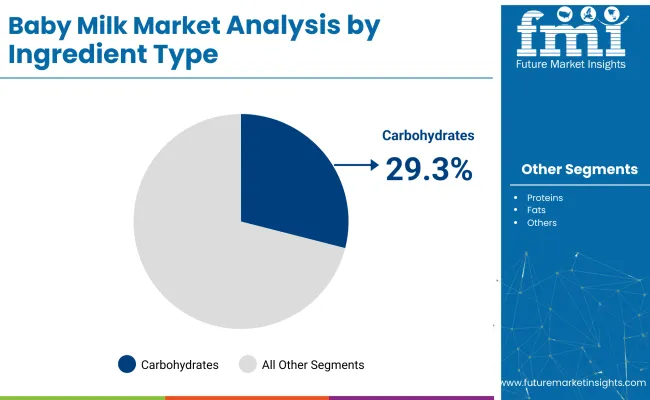

The industry is led by infant formula (0 - 6 months), carbohydrates, powder form, cow milk-based sources, conventional products, and hypermarkets, driven by affordability, nutrition focus, and rising urban retail infrastructure.

Infant formula for babies aged 0 - 6 months remains the leading product type, accounting for 32.5% of the market share in 2025.The rise in working mothers and demand for convenient feeding solutions have significantly fuelled the growth of this segment.

Carbohydrates dominate the ingredient type segment, holding a 29.3% market share in 2025. As the essential energy source for infants, carbohydrates play a critical role in supporting early development, including brain function and growth.

Powder form continues to lead the form segment, contributing 68.4% of the global industry share in 2025. This preference stems from powder products’ affordability, longer shelf life, and ease of storage compared to liquid alternatives.

Cow milk-based baby formulas dominate the source segment, representing 80.1% of the market share in 2025. Cow milk remains a preferred base due to its rich protein, fat, and nutrient content essential for infant development.

Hypermarkets and supermarkets lead the distribution channel segment, accounting for 42.6% of the market share in 2025. These retail outlets attract consumers due to their extensive variety of baby milk brands, product types, and immediate availability.

Premiumisation and plant-based innovation are reshaping the industry. Brands are launching high-end and specialty formulas with clean-label ingredients and functional nutrients to meet evolving parental demands.

Premiumisation Trend Fueled by Parents Choosing High-Quality Nutrition

Premium infant milk formulas are gaining traction as parents opt for high-quality and specialized nutrition. Nestlé has executed a premiumisation strategy amid declining birth rates, emphasizing higher-end SKUs like NAN and Illuma, while maintaining affordability in mass-market segments.

Bobbie, a USA-based brand, launched organic European-style formula to address labeling concerns and gained retail presence during the formula shortage. These shifts reflect consumer preference toward trusted, transparent brands. As fewer children are born per household, spending on premium infant nutrition continues to rise.

Innovation in Plant-Based and Specialty Formulations Driving Market Diversity

Demand for plant-based and allergen-free formulas has accelerated due to dietary sensitivities and sustainability concerns. Else Nutrition introduced a dairy- and soy-free plant-based infant formula made from almonds, buckwheat, and tapioca, targeting USA families seeking clean-label alternatives.

Danone’s Dairy & Plants Blend formula combined soy and dairy proteins to cater to vegetarian preferences and reduce carbon footprint. These innovations support growing interest in lactose-free and hypoallergenic options. The inclusion of probiotics, HMO, and omega-3 fatty acids is being pursued for immune and cognitive benefits.

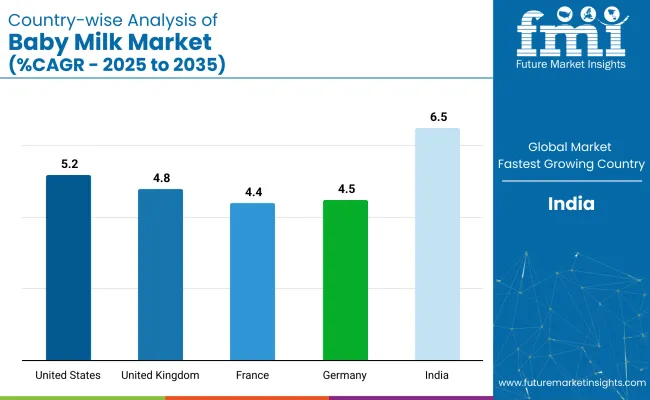

The market study identifies key trends across more than 30 countries. Producers operating in top opportunist nations can align their strategies based on formulation innovation, nutritional enhancement, distribution improvements, and evolving consumer preferences.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 5.2% |

| United Kingdom | 4.8% |

| France | 4.4% |

| Germany | 4.5% |

| India | 6.5% |

The United States industry is set to grow at a CAGR of 5.2% from 2025 to 2035. Rising awareness of infant nutrition and demand for organic, non-GMO, and additive-free formulas fuel this growth.

The United Kingdom industry is projected to register a CAGR of 4.8% from 2025 to 2035. Increasing preference for clean-label, hypoallergenic, and organic infant milk drives demand.

Baby milk market in france is estimated to grow at a CAGR of 4.4% between 2025 and 2035. The market benefits from French consumers' strong preference for high-quality, nutritious, and traceable food products.

German industry is set to expand at a 4.5% CAGR between 2025 and 2035. With a well-established organic culture and stringent quality standards, the demand for safe, nutrient-rich baby milk products remains high.

Indian industry is expected to grow at the fastest rate globally, with a 6.5% CAGR from 2025 to 2035. This growth is driven by rising disposable incomes, urbanization, and increased awareness of infant nutrition, especially among the middle class.

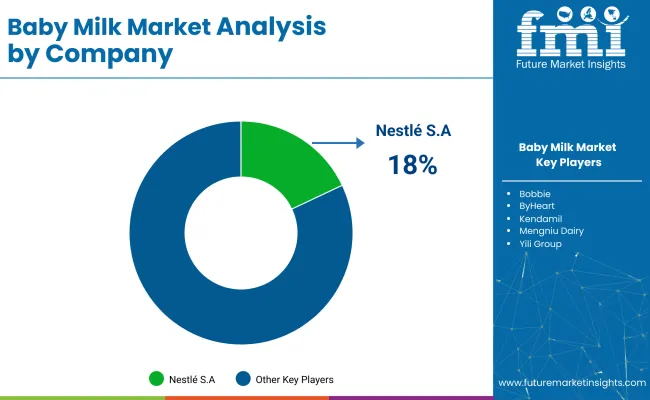

The industry is moderately fragmented, with Leading players like Nestlé S.A., Danone S.A., and Reckitt Benckiser (Mead Johnson) holding significant shares through vast product lines, strong branding, and global distribution. These leaders prioritize advanced formulations, clinical trials, and nutritional science-backed innovations to sustain dominance.

Emerging companies such as Bubs Australia, Bobbie, and ByHeart cater to specialized demands like organic, goat milk-based, and clean-label formulas. Growing consumer interest in human milk oligosaccharides (HMOs), A2 protein, and probiotics is driving product innovation.

Recent Baby Milk Market News

| Report Attributes | Details |

|---|---|

| Market Size (2025E) | USD 17.2 billion |

| Projected Market Size (2035F) | USD 29.6 billion |

| CAGR (2025 to 2035) | 5.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projection Period | 2025 to 2035 |

| Quantitative Units | USD billion for value & thousand units for volume |

| By Product Type (Segment 1) | Infant Formula (0 - 6 months), Follow-on Formula (6 - 12 months), Growing-up Formula (12 - 36 months), Specialty Baby Formula, Hypoallergenic Formula, Lactose-free Formula, Premature Baby Formula, Other Specialty Formulas |

| By Ingredient Type (Segment 2) | Carbohydrates, Fats, Proteins, Vitamins & Minerals, Prebiotics & Probiotics, Others |

| By Form (Segment 3) | Powder, Liquid Concentrate, Ready-to-feed |

| By Source (Segment 4) | Cow Milk Based, Soy Based, Goat Milk Based, Other Plant-based Alternatives |

| By Distribution Channel (Segment 5 ) | Hypermarkets & Supermarkets, Pharmacies & Drug Stores, Convenience Stores, Online Retail, E-commerce Platforms, Direct-to-consumer Websites, Subscription Services, Specialty Stores, Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | USA, Canada, Germany, UK, France, Italy, Spain, China, India, Japan, Australia, South Korea, Brazil, Mexico, Argentina, Saudi Arabia, South Africa, UAE |

| Key Players Influencing the Market | Arla Foods amba , Ausnutria Dairy Corporation Ltd., Abbott Laboratories, Bellamy's Organic, Biostime (H&H Group), Bobbie, Bubs Australia Limited, ByHeart , China Feihe Limited, Danone S.A., FrieslandCampina N.V., Hipp GmbH & Co. Vertrieb KG, Holle Baby Food AG, Kendamil , Mengniu Dairy, Morinaga Milk Industry Co., Ltd., Nestlé S.A., Perrigo Company plc, Reckitt Benckiser Group plc (Mead Johnson), Yili Group |

| Additional Attributes | Dollar sales, share, segment-wise growth of organic and plant-based formulas, online channel penetration trends, innovations in human milk oligosaccharides (HMOs), sustainability-driven packaging adoption |

The market is segmented into infant formula (0-6 months), follow-on formula (6-12 months), growing-up formula (12-36 months), specialty baby formula, hypoallergenic formula, lactose-free formula, premature baby formula, and other specialty formulas.

The market includes carbohydrates, fats, proteins, vitamins & minerals, prebiotics & probiotics, and others.

The market is divided into powder, liquid concentrate, and ready-to-feed.

The market comprises cow milk-based, soy-based, goat milk-based, and other plant-based alternatives.

The market includes hypermarkets & supermarkets, pharmacies & drug stores, convenience stores, online retail, e-commerce platforms, direct-to-consumer websites, subscription services, specialty stores, and others.

The market is categorized into North America, Europe, Asia Pacific,Latin America (and Middle East & Africa.

The market is forecasted to reach USD 29.6 billion by 2035.

The market is anticipated to grow at a CAGR of 5.5% during the period 2025 to 2035.

The Market is estimated to reach USD 18.9 billion in 2025.

Infant formula for babies aged 0-6 months is expected to hold a 32.5% share in 2025.

Asia Pacific, led by India, is expected to be the key growth region with a 6.5% CAGR.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Baby Changing Station Market Size and Share Forecast Outlook 2025 to 2035

Baby Car Safety Seat Market Forecast and Outlook 2025 to 2035

Baby Bath and Shower Products Market Size and Share Forecast Outlook 2025 to 2035

Baby Doll Market Size and Share Forecast Outlook 2025 to 2035

Baby & Toddler Carriers & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Baby Shoes Market Size and Share Forecast Outlook 2025 to 2035

Baby Oral Care Market Size and Share Forecast Outlook 2025 to 2035

Baby Ear Thermometer Market Size and Share Forecast Outlook 2025 to 2035

Baby Food Dispensing Spoon Market Size and Share Forecast Outlook 2025 to 2035

Baby Pacifier Thermometer Market Size and Share Forecast Outlook 2025 to 2035

Baby Crib Sheet Market Size and Share Forecast Outlook 2025 to 2035

Baby Teeth Care Products Market Size and Share Forecast Outlook 2025 to 2035

Baby Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Baby Diaper Market Growth, Forecast, and Trend Analysis 2025 to 2035

Baby Powder Market - Size, Share, and Forecast 2025 to 2035

Baby Sling Market Size and Share Forecast Outlook 2025 to 2035

Baby Bottle Holder Market Size and Share Forecast Outlook 2025 to 2035

Baby Toddler Bar Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Baby Snacks Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Baby Oil Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA