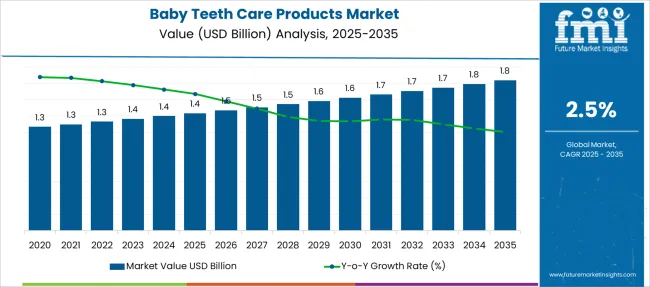

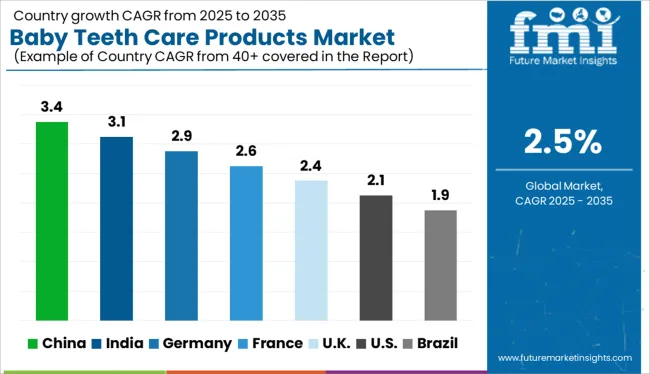

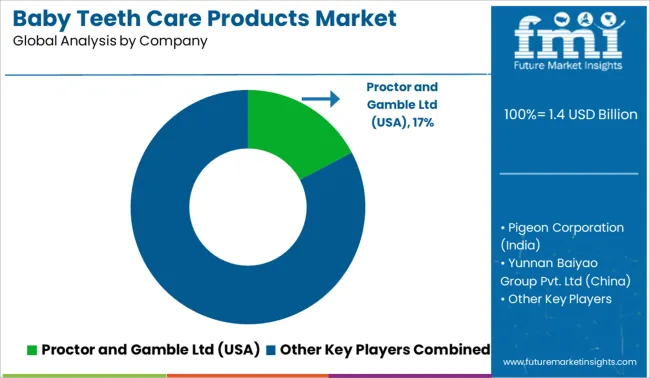

The Baby Teeth Care Products Market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 1.8 billion by 2035, registering a compound annual growth rate (CAGR) of 2.5% over the forecast period.

| Metric | Value |

|---|---|

| Baby Teeth Care Products Market Estimated Value in (2025 E) | USD 1.4 billion |

| Baby Teeth Care Products Market Forecast Value in (2035 F) | USD 1.8 billion |

| Forecast CAGR (2025 to 2035) | 2.5% |

The baby teeth care products market is expanding steadily as parents become more attentive to early oral hygiene practices for infants and toddlers. Growing awareness about the importance of preventing dental issues from infancy has led to increased demand for specialized baby oral care products.

Innovations in product design and safety features have made baby toothbrushes more appealing to caregivers seeking gentle yet effective cleaning solutions. Pediatric dental health campaigns and parental education initiatives have further encouraged routine teeth cleaning from an early age.

Additionally, rising birth rates and increasing disposable incomes in emerging markets have broadened the consumer base. Retail availability through various channels has also improved access to affordable products tailored for babies. Looking ahead, the market is expected to benefit from continued product innovation, affordable pricing, and heightened focus on infant oral care. Segmental growth is expected to be driven by the Toothbrush product type, low price range products, and applications focused on infants.

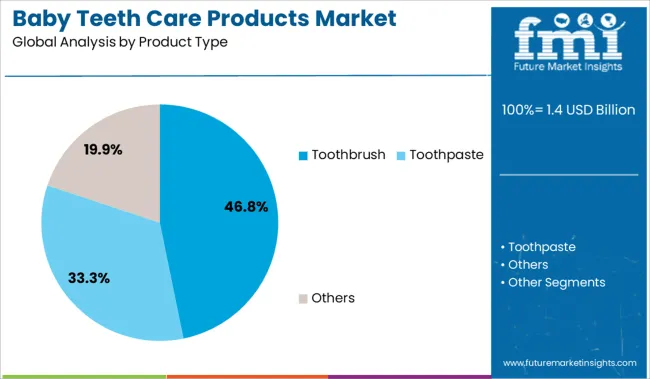

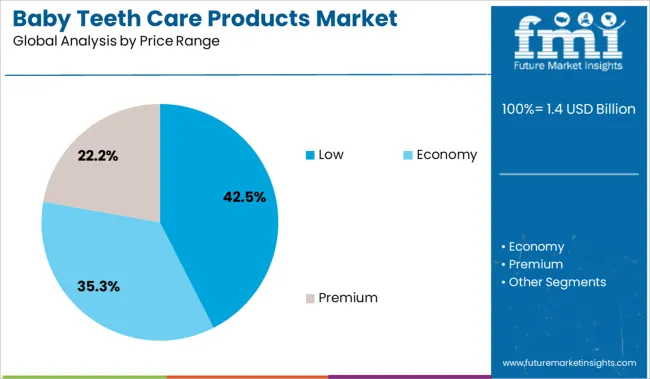

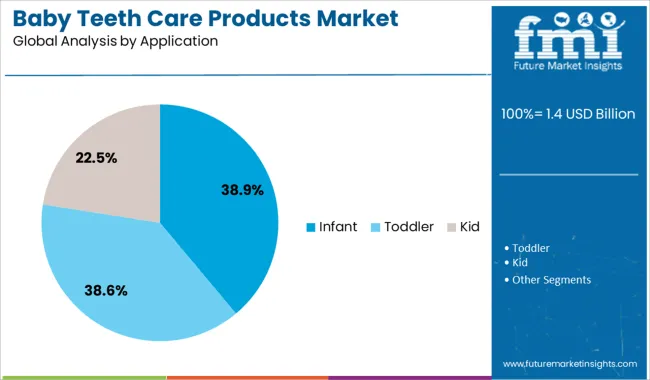

The market is segmented by Product Type, Price Range, Application, and Sales Channels and region. By Product Type, the market is divided into Toothbrush, Toothpaste, and Others. In terms of Price Range, the market is classified into Low, Economy, and Premium. Based on Application, the market is segmented into Infant, Toddler, and Kid. By Sales Channels, the market is divided into Supermarkets & Hypermarkets, Departmental Stores, Convenience Stores, Online, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Toothbrush segment is projected to hold 46.8% of the baby teeth care products market revenue in 2025, maintaining its position as the leading product type. This segment’s growth has been driven by the essential role toothbrushes play in early oral hygiene routines.

Parents prefer soft-bristled, ergonomically designed toothbrushes that are safe and easy for infants to use. Manufacturers have focused on child-friendly designs with features that encourage regular use and minimize discomfort.

The rise of parental awareness about gum health and cavity prevention has increased the emphasis on toothbrush use from infancy. As dental professionals continue to recommend toothbrushes as a primary care tool, the segment is expected to sustain its leadership.

The Low price range segment is expected to contribute 42.5% of the baby teeth care products market revenue in 2025, reflecting strong consumer preference for affordable options. The availability of budget-friendly toothbrushes and oral care kits has made baby teeth care accessible to a broader population, especially in price-sensitive markets.

Parents often seek cost-effective products that do not compromise on safety or functionality. Retailers have responded by offering a range of low-priced products with essential features to meet the demand for everyday oral care.

Additionally, the increase in multi-pack offerings and promotions has made low-priced products attractive. The focus on affordability is anticipated to keep this segment dominant as caregivers balance cost with quality.

The Infant segment is projected to hold 38.9% of the baby teeth care products market revenue in 2025, establishing it as the leading application category. This segment’s growth is attributed to the focus on early oral health practices starting from the eruption of the first tooth.

Parents and healthcare providers have emphasized the importance of gentle care tailored specifically for infants’ sensitive gums and developing teeth. Educational efforts have raised awareness about preventing early childhood caries through proper cleaning techniques and product use.

Product innovation has targeted infant-specific needs, including smaller brush heads and gentle bristles. With increased attention to oral hygiene starting at infancy, this segment is expected to maintain its market leadership and drive overall growth in baby teeth care products.

Babies under the age of two are more prone to tooth decay and ECC disorders because of their food eating behavior. As a result, there is a high demand for baby teeth care products. Dentists advise using cavity-preventive fluoride toothpaste, which encourages the sales of baby tooth care products.

Moreover, in response to concerns about fluoride-induced enamel fluorosis, some manufacturers introduced low-fluoride "pediatric" toothpaste with less than 600 ppm fluoride.

In general, there are many different baby tooth care products on the market, making it more available and high sales of baby tooth care products. The increased awareness to prevent the rates of early childhood caries (ECC) or baby bottle tooth decay is a significant factor driving the demand for the baby teeth care products.

During the projected period, the baby teeth care products market is expected to develop at a healthy rate across all geographies. The demand for baby teeth care products is projected to be driven by ECC and other dental-related illnesses.

China and India, both rising economies, have a greater population with oral disorders such as tooth decay and periodontal disease in infants, among other things, encouraging the sales of baby teeth care products. Oral disorders impact more than 3 billion individuals worldwide, according to the FDI World Dental Federation, and this number is even higher for children.

Parents are now focusing on baby teeth care products as a preventive strategy, which is fueling the sales of baby teeth care products. Due to its large population, the United States has a large baby teeth care products market share.

Some of the key players operating in the global baby teeth care products market are NUK, Oragel, Baby Banana, Jordan Toothbrush, The Brushies, Colgate, Kiss My Face, Oral-B (P&G), Tom's, Jack n' Jill, Weleda Calendula, Babyganics, Nuby and others holding a substantial baby teeth care products market share.

| Report Attribute | Details |

|---|---|

| Growth rate | CAGR of 2.5% from 2025 to 2035 |

| Base year for estimation | 2024 |

| Historical data | 2020 to 2024 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in USD billion, volume in kilotons, and CAGR from 2025 to 2035 |

| Report coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis, |

| Segments covered | Product type, price range, application, sales channel, region |

| Regional scope | North America; Western Europe; Eastern Europe; Middle East; Africa; ASEAN; South Asia; Rest of Asia; Australia and New Zealand |

| Country scope | USA, Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, Belgium, Poland, Czech Republic, China, India, Japan, Australia, Brazil, Argentina, Colombia, Saudi Arabia, UAE, Iran, South Africa |

| Key companies profiled | NUK; The Brushies; Baby Banana; Jordan Toothbrush; Colgate; Oral-B (P&G); Oragel; Tom's; Jack n' Jill; Kiss My Face; Weleda Calendula; Babyganics; Nuby and others. |

| Customization scope | Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. |

The global baby teeth care products market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the baby teeth care products market is projected to reach USD 1.8 billion by 2035.

The baby teeth care products market is expected to grow at a 2.5% CAGR between 2025 and 2035.

The key product types in baby teeth care products market are toothbrush, toothpaste and others.

In terms of price range, low segment to command 42.5% share in the baby teeth care products market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Baby Personal Care Products Market Analysis - Size & Growth 2025 to 2035

Demand for Baby Personal Care Products in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Baby Personal Care Products in USA Size and Share Forecast Outlook 2025 to 2035

Baby Oral Care Market Size and Share Forecast Outlook 2025 to 2035

Suncare Products Market Size and Share Forecast Outlook 2025 to 2035

Baby Safety Products Market Analysis - Size, Share & Trends 2025 to 2035

Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Sun Care Products Market Analysis – Growth, Applications & Outlook 2025–2035

Car Care Products Market Trends - Growth, Demand & Analysis 2025 to 2035

Baby Personal Care Market Analysis by Product Type, Nature, Age Group, Sales, and Region

Nail Care Products Market Growth, Trends and Forecast from 2025 to 2035

Facial Care Products Market Size and Share Forecast Outlook 2025 to 2035

Dental Care Products Market Size and Share Forecast Outlook 2025 to 2035

Baby Bath and Shower Products Market Size and Share Forecast Outlook 2025 to 2035

Personal Care Products Filling System Market Size and Share Forecast Outlook 2025 to 2035

The Dementia Care Products Market is segmented by Memory Exercise & Activity Products, Daily Reminder Products and Dining Aids from 2025 to 2035

Men’s Skincare Products Market Size, Growth, and Forecast for 2025 to 2035

Pregnancy Care Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Post Shave Care Products Market Size and Share Forecast Outlook 2025 to 2035

Europe Pet Care Products Market Growth, Trends and Forecast from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA