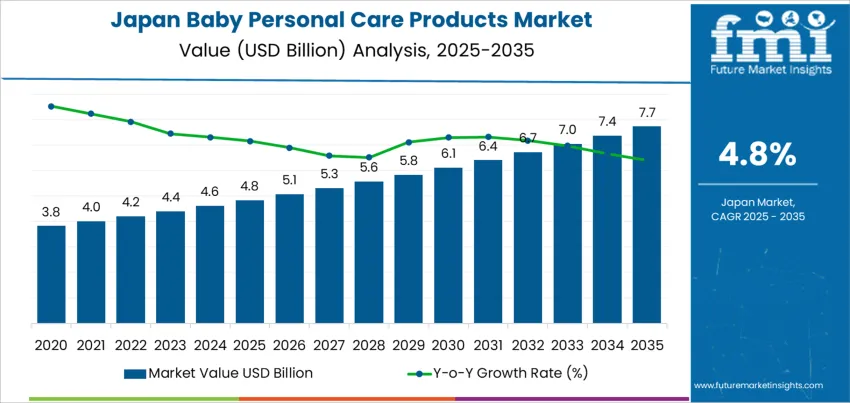

The demand for baby personal care products in Japan is expected to grow from USD 4.8 billion in 2025 to USD 7.7 billion by 2035, reflecting a compound annual growth rate (CAGR) of 4.8%. Baby personal care products, including diapers, wipes, lotions, shampoos, and soaps, continue to experience steady demand as parents prioritize safe, effective, and gentle products for their infants. The growth is driven by Japan's stable birth rate and an increasing focus on high-quality, hypoallergenic baby care solutions that cater to both domestic and global consumer preferences.

The market will see consistent growth, starting at USD 4.8 billion in 2025, with gradual increases each year. By 2026, the market will rise to USD 5.1 billion, reaching USD 5.3 billion in 2027, and USD 5.6 billion by 2028. By 2035, the market for baby personal care products is forecasted to reach USD 7.7 billion, reflecting steady demand across various product segments, including skincare, hygiene, and baby-specific cosmetic products.

The baby personal care products market in Japan is expected to experience steady growth over the next decade. Starting at USD 4.8 billion in 2025, the market will grow to USD 5.1 billion in 2026, USD 5.3 billion in 2027, and USD 5.6 billion in 2028. By 2029, demand will rise to USD 5.8 billion, and by 2030, it will reach USD 6.1 billion. By 2035, the market is forecasted to reach USD 7.7 billion, driven by the continued demand for high-quality, safe, and eco-friendly products for infant care.

The growth contribution index highlights that the majority of the market's growth will be driven by the increasing focus on natural and organic ingredients in baby care products, as well as a shift towards more sustainable packaging. Early years (2025-2029) will see gradual increases in demand, with steady contributions across different product categories. However, in the latter half of the forecast period, demand will accelerate slightly as consumer awareness of eco-friendly and high-performance baby care products grows, contributing more significantly to the overall market expansion. This indicates that while growth remains consistent, the latter years will likely see higher growth contributions from premium and organic product lines.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 4.8 billion |

| Industry Forecast Value (2035) | USD 7.7 billion |

| Industry Forecast CAGR (2025-2035) | 4.8% |

Demand for baby personal care products in Japan is rising even as birth rates remain low. Many parents are willing to spend more per child on quality and safety. Baby skin care products-including lotions, creams, bath products and gentle cleansers-remain the largest segment in the baby care market. Growing parental concern over infant skin sensitivity and hygiene drives the use of mild, high quality formulations rather than basic products. Producers respond by offering baby friendly lotions, shampoos, wipes and bath items designed for sensitive skin and minimal irritation. The trend toward natural and organic ingredients has gained traction among Japanese consumers who prioritise safety and skin friendliness for infants. This shift contributes to growth in premium, natural or organic baby care offerings.

At the same time, demand is supported by evolving parenting practices, changing lifestyles, and retail distribution shifts. More dual income households and busy parents look for convenient baby care solutions-pre formulated bath, wash and lotion products help address time constraints while ensuring good hygiene. The rise of e commerce and online retail channels simplifies access to specialised or imported baby care brands, making it easier for parents to purchase trusted products from home. This convenience encourages continued spending on baby care items beyond the newborn phase, as babies grow and care needs change. As long as parents value product safety, skin health and convenience, demand for baby personal care products in Japan is likely to grow steadily in coming years.

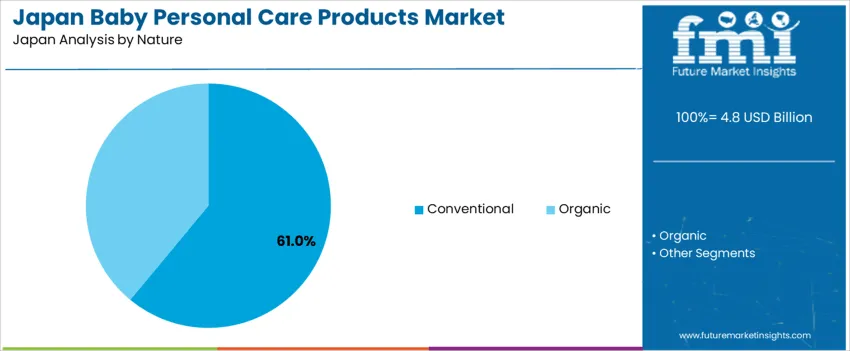

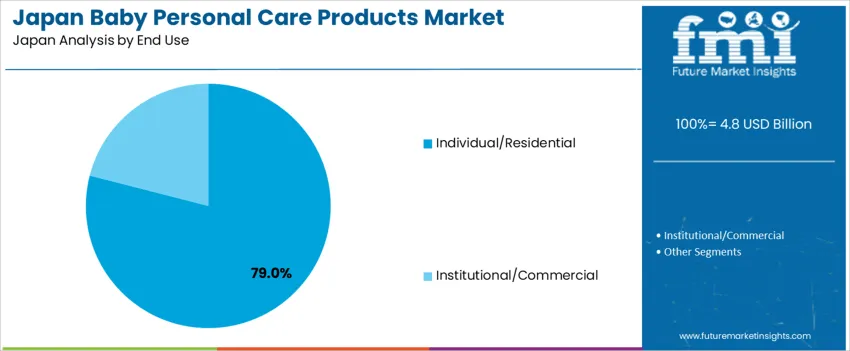

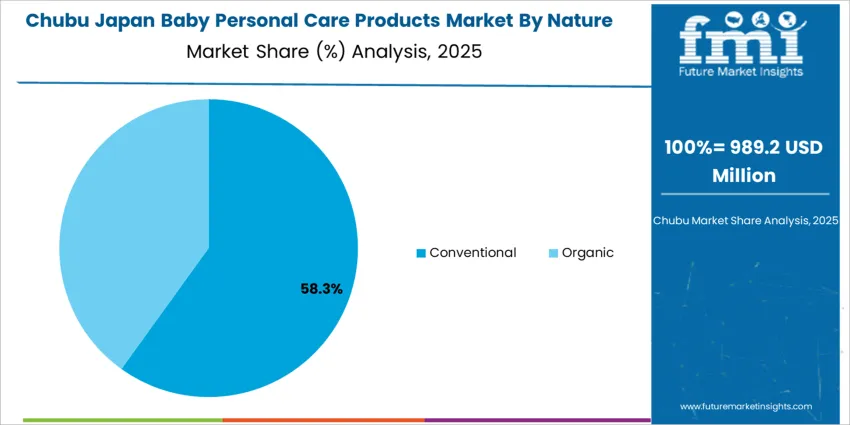

The demand for baby personal care products in Japan is driven by nature and end-use. The leading nature is conventional, accounting for 61% of the market share, while individual/residential use dominates the end-use sector, capturing 79% of the demand. Baby personal care products are essential in maintaining the health and comfort of infants, and as consumer preferences shift toward quality and safety, the demand for both conventional and organic products continues to grow. The residential sector remains the primary consumer of these products, reflecting the strong focus on infant care in Japan.

Conventional baby personal care products lead the demand in Japan, holding 61% of the market share. These products include traditional formulations that are commonly used for bathing, moisturizing, and diapering babies. Conventional baby care products are widely trusted for their effectiveness, availability, and reasonable pricing, making them a staple for many parents. They often contain mild ingredients and are formulated to be safe for babies’ sensitive skin.

The demand for conventional baby personal care products is driven by their long-established reputation for safety and effectiveness. While organic and natural alternatives are gaining popularity, conventional products still dominate due to their widespread availability and the trust parents place in brands with a long history of producing baby care solutions. As the demand for baby products remains steady in Japan, conventional baby care products are expected to maintain their leading role in the market, offering a balance of quality, affordability, and reliability for parents.

Individual/residential use is the dominant end-use sector for baby personal care products in Japan, accounting for 79% of the market share. Parents and guardians are the primary consumers of baby care products, purchasing items such as diapers, lotions, shampoos, and wipes for home use. This demand is driven by the growing awareness of infant skin care and the increasing focus on providing the best hygiene and comfort for babies at home.

The demand for baby personal care products in the individual/residential sector is influenced by the high standard of care that Japanese parents strive to provide. With the emphasis on safety and quality, baby personal care products are integral to daily routines for infant care. As awareness of the importance of baby health and hygiene grows, the demand for these products is expected to remain strong in the residential sector. Additionally, as more parents seek products with better ingredients and formulations for their babies, the residential sector will continue to lead the demand for baby personal care products in Japan.

Demand for baby personal care products in Japan has shown consistent growth over the past several years. The overall baby care product market is projected to grow steadily, driven by rising parental preference for gentle, safe, and effective formulations for infants and toddlers. Baby skincare items, such as lotions, creams, oils, wipes, soaps, shampoos, and bath washes, represent a significant portion of this demand. Growth is supported by increasing awareness of baby hygiene and skincare, as well as the ongoing need for replacement and age appropriate care products.

One key driver is rising awareness among parents about infant skin sensitivity and hygiene. Many parents prioritize safe and mild personal care products, which drives demand for gentle washes, creams, lotions, and oils. Another driver is growing interest in organic and natural formulations for baby skin care, particularly among health conscious consumers. Higher disposable incomes and a willingness to spend on premium, high quality baby products further support demand. Additionally, as urban lifestyles lead to greater dual income households, products that provide convenience, such as baby wipes and ready to use lotions, have become more relevant. The ongoing need to replace products as babies grow beyond the newborn stage also contributes to steady market growth.

One restraint is the decline in Japan's birth rate, which limits the long term growth potential for baby product demand. With fewer infants, the overall demand for baby care products is reduced. Another constraint is the cost of premium or organic baby care items, which may deter budget conscious families. Strict regulatory requirements and safety standards for infant care products can also increase production costs for manufacturers, limiting the introduction of new or niche products. Additionally, competition from generic or low cost alternatives could suppress demand for premium baby care items.

A key trend is the growing demand for organic and natural ingredient baby care products. Parents are increasingly seeking formulations that are gentle on baby skin and free from harsh chemicals. Another trend is the rise in demand for baby bath and shower products, reflecting a growing emphasis on hygiene and skin care from early infancy. There is also increased demand for convenience oriented products, such as baby wipes and gentle washes, which cater to busy parents. Additionally, premiumization is evident as more parents are willing to invest in high quality, dermatologist tested baby products. Online retail and e commerce also play a significant role in influencing growth by improving access to a wide variety of baby care products.

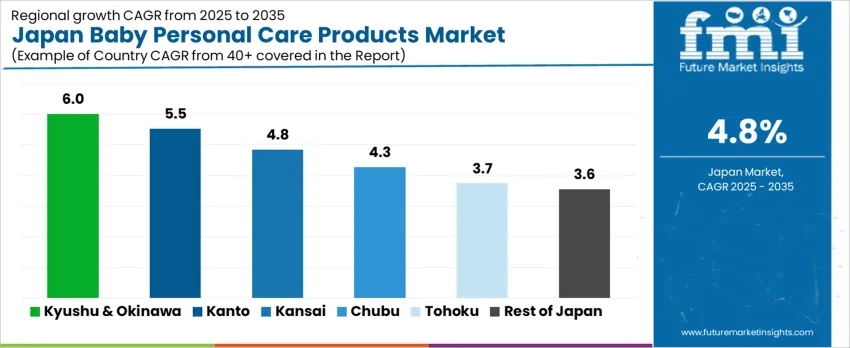

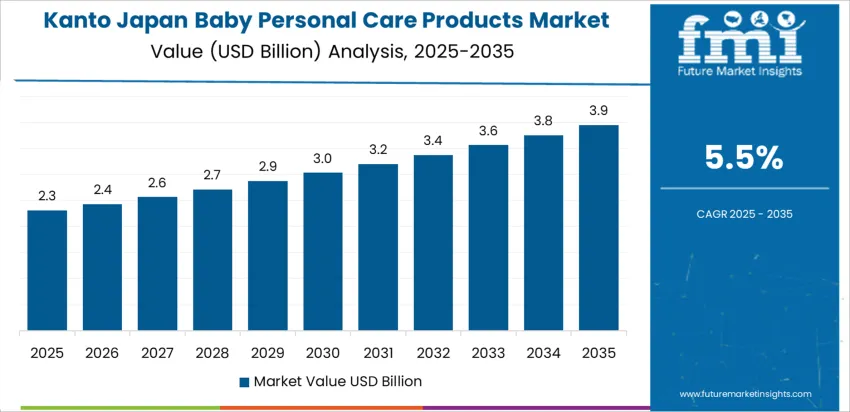

The demand for baby personal care products in Japan shows consistent growth across all regions. Kyushu & Okinawa leads with a projected CAGR of 6.0 percent. Kanto follows at 5.5 percent, driven by high urban population density and strong retail presence. The Kinki region is forecast at 4.8 percent, while Chubu, Tohoku, and the Rest of Japan show more modest growth at 4.3, 3.7, and 3.6 percent respectively. These differences reflect variations in demographic patterns, birth rates, consumer awareness about infant care, retail distribution networks, and economic conditions across regions.

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 6.0 |

| Kanto | 5.5 |

| Kinki | 4.8 |

| Chubu | 4.3 |

| Tohoku | 3.7 |

| Rest of Japan | 3.6 |

In Kyushu & Okinawa, demand for baby personal care products is expected to grow at a 6.0 percent CAGR. The region continues to register relatively higher birth rates compared to other parts of Japan. This demographic trend sustains demand for baby shampoos, lotions, diapers, and related skin care items. Rural and semi urban communities in the region often rely on convenience stores and local distributors for baby care essentials. Rising awareness about gentle, infant safe skincare formulations encourages parents to purchase premium products rather than low cost alternatives. In addition, growing tourism in Okinawa and seasonal migration to coastal areas prompts more households to buy travel size baby care kits, feeding demand for portable packaging and disposable baby products. Regional pharmacies and drugstores have expanded their baby care sections to meet this trend. As more young families prefer ready to use products with mild dermatological profiles, the market for baby personal care products in Kyushu & Okinawa is likely to sustain above average growth.

In Kanto, demand for baby personal care products is projected to grow at 5.5 percent annually. Kanto includes major metropolitan areas where lifestyle pressures and busy routines increase reliance on ready made baby care items such as pre moistened wipes, gentle cleansers, and hypoallergenic lotions. High population density and urban living drive frequent shopping trips to supermarkets, drugstores, and convenience chains. As working parents become more common, time saving products and trusted branded items gain popularity. Growing awareness about infant skin sensitivity and allergy prevention among urban parents leads to greater use of premium and dermatologically tested baby personal care products. Moreover, retail penetration via e commerce and express delivery services supports greater accessibility across Kanto, even in suburbs and commuter zones. With ongoing innovation in child safe packaging and baby friendly formulations, demand is likely to remain robust among new parents, contributing to sustained growth in the baby care products segment across the region.

In the Kinki region, demand for baby personal care products is forecast at 4.8 percent CAGR. Urban centers such as Osaka and Kyoto contribute to stable demand, supported by steady—but somewhat lower—birth rates compared to more rural zones. Consumers in Kinki show growing interest in natural and organic baby care products, including plant based ointments, gentle shampoos, and eco friendly diaper options. The presence of small and medium scale manufacturers that specialize in baby care goods adds diversity to the market. Retailers in the region increasingly offer curated baby product bundles that include skincare, bathing supplies, and disposable items. Cultural emphasis on careful child rearing and traditional sensitivity to hygiene supports consistent demand. While birth rates are not high enough to drive rapid expansion, a loyal customer base and rising consumer preferences for quality and safety ensure steady adoption of baby personal care products across Kinki.

In Chubu, demand for baby personal care products is expected to grow at 4.3 percent annually. The region’s mix of semi urban and rural areas sees moderate birth rates and household growth. Parents in this region increasingly adopt modern childcare practices, including the use of marketed baby skincare and hygiene products. Some households still depend on traditional home remedies, but as national awareness campaigns promote infant skin health and pediatric hygiene, more caregivers are switching to commercially formulated baby lotions, cleanser bars, and moisturizers. Local pharmacies and supermarkets have expanded baby care aisles to stock mild, fragrance free options. The presence of manufacturing and packaging industries in Chubu supports supply chains for baby care goods. As convenience becomes more valued, usage of ready to use items like disposable diapers and baby wipes increases. Though growth is slower than in highly urbanized regions, gradual shifts in parenting trends and increased health consciousness support sustainable demand in Chubu.

In Tohoku, demand for baby personal care products is forecast at a 3.7 percent CAGR. This rate reflects relatively low birth rates and more conservative consumer behavior in the region. Many families continue to rely on simple, traditional methods for baby care rather than specialty products. Nonetheless, increasing access to retail chains, growing health awareness, and rising interest in gentle skincare for infants contribute to gradual growth. Particularly among younger parents, there is a trend toward purchasing hypoallergenic soaps, moisturizers, and disposable diapers for convenience. Seasonal urban migration for work or education also creates pockets of demand in suburban zones. Baby care brands that offer affordable mid range products often find buyers seeking balance between cost and quality in Tohoku. As local economies recover and household incomes stabilize, uptake of baby care products is likely to rise slowly over time.

In the Rest of Japan, covering smaller prefectures and rural areas outside major metropolitan or industrial zones, demand for baby personal care products is projected at a 3.6 percent CAGR. Birth rates in many rural areas remain low, which constrains growth. Cultural reliance on traditional childcare methods continues to limit widespread adoption of commercial baby care products. Nonetheless, increasing awareness of infant skin sensitivity and hygiene drives demand among younger parents, especially for mild cleansers and diaper care items. Limited but expanding access to retail and delivery services enables broader distribution of baby care products even in remote areas. Cost consciousness remains high, thus affordable, value oriented products tend to perform better than premium brands. As rural populations gradually modernize and adopt urban style consumption habits, demand for baby personal care products is likely to grow steadily, albeit at a modest pace.

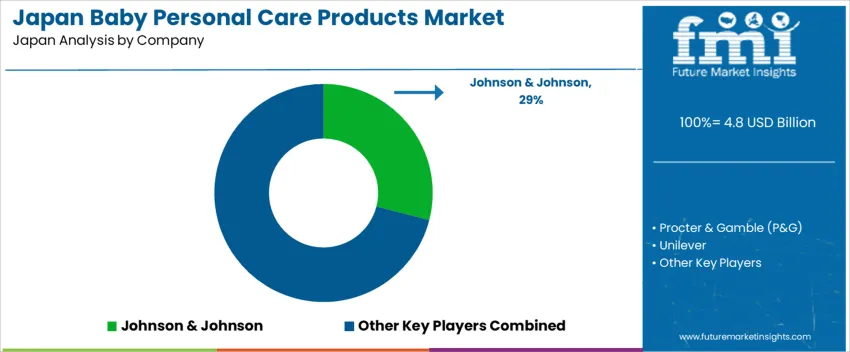

Demand for baby personal care products in Japan remains substantial despite demographic headwinds, sustained by high per child spending and rising interest in safe and gentle infant care. Recent market analyses place the Japan baby personal care market at about USD 1.9 billion in 2024. Skin care products formed the largest segment that year within baby care offerings. Major players in this space include Johnson & Johnson (with about 29 % share among leading firms), Procter & Gamble (P&G), Unilever, Kimberly Clark Corporation, and The Himalaya Drug Company. These companies supply a range of baby toiletries, skincare creams, oils, wipes, and washing products for babies and toddlers.

Competition among these firms centers on product safety, formulation quality, and responsiveness to consumer demand. Parents in Japan increasingly favour products with mild ingredients, hypoallergenic and dermatologically tested formulas, and visible suitability for sensitive infant skin. Firms that emphasise gentle cleansers, low irritation lotions, and clear safety documentation gain trust among caregivers. Another axis of competition is product range and versatility — companies offering complete baby care lines (bath products, lotions, wipes, oils) tend to serve a broader set of needs for households. Distribution channels also matter: reliable supply via supermarkets, pharmacies, online stores, and specialty boutiques shapes market reach and convenience for young parents. Providers that combine rigorous safety standards, breadth of offerings, and convenient availability aim to maintain or grow their share in Japan’s baby personal care market.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | Japan |

| Product | Skincare, Toiletries, Hair Care, Body Care, Oral Care |

| Nature | Conventional, Organic |

| End Use | Individual/Residential, Institutional/Commercial |

| Price | Mass, Premium |

| Gender | Unisex, Boys, Girls |

| Key Companies Profiled | Johnson & Johnson, Procter & Gamble (P&G), Unilever, Kimberly-Clark Corporation, The Himalaya Drug Company |

| Additional Attributes | The demand for baby personal care products in Japan is influenced by the growing awareness among parents regarding the safety and quality of products for their children. Skincare products dominate, but hair care, body care, and oral care are also significant. Organic products are gaining popularity due to concerns over chemical ingredients in baby care products. The market sees both mass and premium product offerings, with premium products being targeted more toward consumers seeking higher-quality or specialized care for their children. Major companies such as Johnson & Johnson, Procter & Gamble, and Unilever provide a wide range of baby personal care products. The market is expected to grow as more institutional and residential users seek safe, effective solutions for baby hygiene, while also responding to growing consumer demand for organic options. |

The demand for baby personal care products in Japan is estimated to be valued at USD 4.8 billion in 2025.

The market size for the baby personal care products in Japan is projected to reach USD 7.7 billion by 2035.

The demand for baby personal care products in Japan is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in baby personal care products in Japan are skincare, toiletries, hair care, body care and oral care.

In terms of nature, conventional segment is expected to command 61.0% share in the baby personal care products in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Baby Personal Care Products Market Analysis - Size & Growth 2025 to 2035

Demand for Baby Personal Care Products in USA Size and Share Forecast Outlook 2025 to 2035

Baby Personal Care Market Analysis by Product Type, Nature, Age Group, Sales, and Region

Personal Care Products Filling System Market Size and Share Forecast Outlook 2025 to 2035

Baby Teeth Care Products Market Size and Share Forecast Outlook 2025 to 2035

Herbal Personal Care Products Market Size and Share Forecast Outlook 2025 to 2035

Fragranced Personal Care Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Anti-Foaming Personal Care Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Hyaluronic Acid Personal Care Products Market Overview - Growth & Forecast 2025 to 2035

Demand for Professional Hair Care Products in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Baby Powder Market Analysis - Size, Share & Trends 2025 to 2035

Personal Care Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Personal Care Appliances Market Size and Share Forecast Outlook 2025 to 2035

Personal Care Wipes Market Size and Share Forecast Outlook 2025 to 2035

Personal Care and Cosmetics Microalgae Market - Beauty & Skincare Trends 2025 to 2035

Personal Care Packaging Market Analysis by Application, Packaging Format, Capacity, and Region Forecast Through 2035

Personal Care Aid Market Growth – Industry Trends & Forecast 2024-2034

Baby Oral Care Market Size and Share Forecast Outlook 2025 to 2035

Suncare Products Market Size and Share Forecast Outlook 2025 to 2035

Baby Safety Products Market Analysis - Size, Share & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA