The Fragranced Personal Care Products Market is expected to record a valuation of USD 38,506.3 million in 2025 and USD 61,206.4 million in 2035, with an increase of USD 22,700.1 million, which equals a growth of 59% over the decade. The overall expansion represents a CAGR of 4.7% and reflects a 1.6X increase in market size.

During the first five-year period from 2025 to 2030, the market increases from USD 38,506.3 million to USD 46,348.7 million, adding USD 7,842.4 million, which accounts for 34.5% of the total decade growth. This phase records steady adoption across daily-use categories such as body washes, creams, and deodorants, driven by rising consumer awareness of fragrance-based hygiene and skin-friendly formulations. Body washes & soaps dominate this period as they contribute to over 33% of total category sales, supported by product diversification into sensitive-skin and natural-derived variants.

The second half from 2030 to 2035 contributes USD 14,857.7 million, equal to 65.5% of total growth, as the market advances from USD 46,348.7 million to USD 61,206.4 million. This acceleration is powered by the premiumization of fragranced skincare, demand for long-lasting and alcohol-free mists, and integration of fine fragrance DNA into mass personal care. Long-lasting scent formulations capture a larger share above 44% by 2035, while software-enabled customization platforms and AI-based product personalization tools drive the next phase of category expansion in e-commerce and specialty beauty retail channels.

Fragranced Personal Care Products Market Key Takeaways

| Metric | Value |

|---|---|

| Fragranced Personal Care Products Market Estimated Value (2025E) | USD 38,506.3 million |

| Fragranced Personal Care Products Market Forecast Value (2035F) | USD 61,206.4 million |

| Forecast CAGR (2025 to 2035) | 4.7% |

From 2020 to 2024, the Fragranced Personal Care Products Market expanded steadily as premium body care and fine fragrance inspired personal care formats gained traction across mass retail and specialty beauty stores. During this period, leading brands such as Unilever, L’Oréal, and Procter & Gamble commanded nearly 40% of the global market revenue, driven by portfolio diversification into scented lotions, creams, and wash categories. Competitive differentiation was rooted in fragrance technology, skin compatibility, and value innovation, with mass brands introducing luxury-inspired sensory collections to bridge the gap between dermocosmetic and fragrance lines. Natural and alcohol-free formulations accounted for less than 15% of sales in 2024 but showed double-digit growth momentum toward 2025.

Demand for Fragranced Personal Care Products is expected to reach USD 38,506.3 million in 2025, with a notable shift toward AI-driven customization, sustainably sourced ingredients, and hybrid digital retail models. E-commerce and specialty beauty retail will collectively contribute over 50% of the growth by 2030, as brands integrate data-led personalization and subscription models into their distribution strategies. Traditional market leaders face rising competition from digital-native and niche clean beauty brands that emphasize transparency, fragrance storytelling, and eco-friendly packaging. The competitive advantage is progressively shifting from mass fragrance appeal to brand ecosystem strength, sustainability narratives, and direct consumer engagement.

The expansion of aromatherapy-inspired and mood-enhancing formulations has strengthened the role of fragrance as a wellness driver. Botanical and natural-derived scents, such as citrus, floral, and woody blends, are gaining share among consumers seeking sensorial relaxation and clean beauty assurance.

Brands are merging fine fragrance artistry with skincare science to deliver high-end scented creams, serums, and body mists. This fusion enhances product value perception and aligns with the "affordable luxury” trend dominating post-pandemic beauty purchasing behavior.

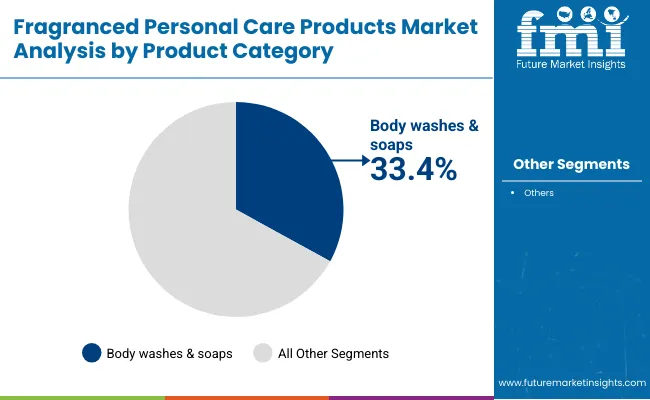

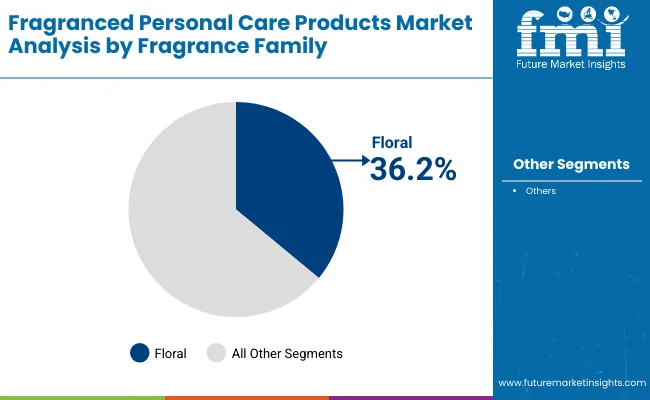

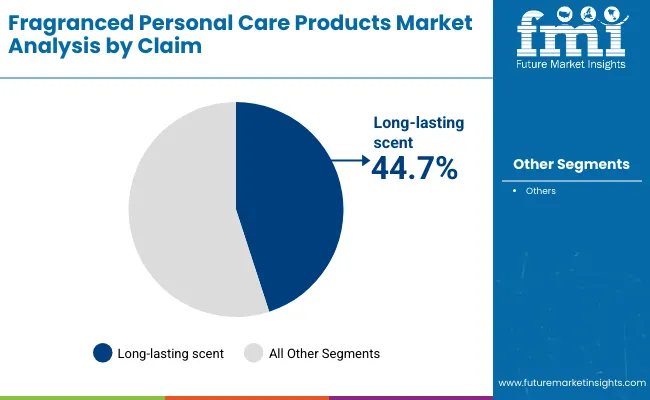

The Fragranced Personal Care Products Market is segmented by product category, fragrance family, claim, end user, channel, and region, capturing the evolving structure of global demand. By product category, the market includes body washes & soaps, body lotions & creams, deodorants, hand creams, and haircare (shampoo/conditioner)representing the core formats driving fragrance-based adoption in personal care. Segmentation by fragrance family comprises floral, citrus & fresh, gourmand & sweet, and woody & musk, reflecting consumer diversity in scent preferences and cultural fragrance associations. By claim, key segments include long-lasting scent, sensitive-skin friendly, natural-derived fragrance, and alcohol-free formulations, which align with health-conscious and premium lifestyle shifts.

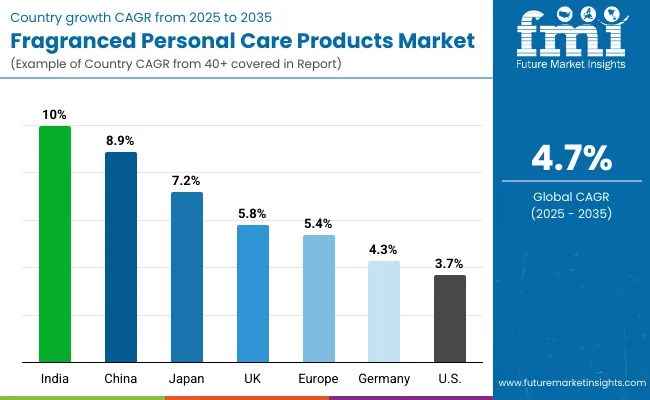

End user segmentation features women, men, unisex, and teens, each representing distinct usage motivations and product selection behaviors. Distribution channels include supermarkets & hypermarkets, e-commerce, pharmacies, and specialty beauty retail, emphasizing omnichannel access and rising online personalization trends. Regionally, the market covers North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa, with fastest growth expected in India (10.0% CAGR), followed by China (8.9%) and Japan (7.2%), as consumers in these regions increasingly embrace scented skincare as part of their daily wellness routines.

| Product Category | Value Share% 2025 |

|---|---|

| Body washes & soaps | 33.4% |

| Others | 66.6% |

The body washes & soaps segment is projected to contribute 33.4% of the Fragranced Personal Care Products Market revenue in 2025, maintaining its lead as the dominant product category. This leadership is driven by the rising consumer inclination toward daily-use hygiene formats infused with sophisticated fragrances, moisturizing actives, and skin-calming botanicals. Consumers are increasingly associating fragrance with cleanliness and emotional well-being, boosting the popularity of products that combine sensorial pleasure with dermatological benefits.

The segment’s growth is further supported by innovations in sulfate-free and pH-balanced formulations, as well as the integration of fine fragrance notes previously reserved for luxury perfumes. Compact formats such as foaming cleansers, shower gels, and body bars are gaining strong traction due to convenience and travel adaptability. As sustainability gains importance, manufacturers are investing in biodegradable soap bases and recyclable packaging to align with consumer eco-preferences. The body washes & soaps segment is expected to retain its position as the core driver of the Fragranced Personal Care Products Market through 2035, supported by continuous product upgrades, expanding fragrance portfolios, and growing penetration across both mass and premium retail channels.

| Fragrance Family | Value Share% 2025 |

|---|---|

| Floral | 36.2% |

| Others | 63.8% |

The floral fragrance segment is forecasted to hold 36.2% of the Fragranced Personal Care Products Market share in 2025, driven by its timeless appeal and wide integration across product categories such as body washes, creams, deodorants, and mists. Floral notes like rose, jasmine, peony, and lily are favored globally for their association with freshness, softness, and femininity qualities that resonate strongly with both traditional and modern consumers. The segment continues to benefit from innovation in synthetic aroma compounds and naturally derived essential oils that enhance longevity and olfactory complexity.

Floral blends are increasingly being adapted for gender-neutral and unisex products, contributing to their growing universal appeal. Furthermore, brands are developing multi-layered floral accords that evolve through wear, creating a perfume-like experience in daily personal care. The segment’s dominance is expected to continue as manufacturers explore sustainable sourcing of natural flowers and low-allergen compositions. With growing emphasis on mood-enhancing and wellness-oriented scents, floral fragrances are set to remain the cornerstone of the Fragranced Personal Care Products Market throughout the forecast period.

| Claim | Value Share% 2025 |

|---|---|

| Long-lasting scent | 44.7% |

| Others | 55.3% |

The long-lasting scent claim segment is projected to account for 44.7% of the Fragranced Personal Care Products Market revenue in 2025, establishing it as the most influential product positioning across categories. Consumers are increasingly prioritizing products that deliver enduring fragrance performance aligned with their lifestyle and environmental conditions. This shift is driven by advancements in microencapsulation and slow-release fragrance technologies, which enable scents to linger longer on skin and hair.

The segment’s leadership is reinforced by the expansion of active lifestyles and humid climate markets conditions where fragrance longevity plays a critical role in product choice. Brands are responding with innovative formulas that balance strong scent retention with skin safety, low alcohol content, and pH stability. The rise of alcohol-free body mists and moisture-locking fragrance creams further supports this claim’s dominance. As consumer perception of value increasingly ties to sensory persistence, the long-lasting scent segment is expected to remain at the forefront of market growth, influencing product innovation, branding, and pricing strategies through 2035.

Premiumization and Sensory Experience

The growing consumer preference for premium, sensorially rich personal care experiences is a key driver of the fragranced personal care products market. Consumers are increasingly associating fragrance with self-expression, emotional wellness, and daily indulgence. This has led to the introduction of fine fragrance-inspired creams, lotions, and body washes featuring layered scent profiles. Brands are leveraging luxury fragrance notes such as oud, amber, and white musk to differentiate their products. The premiumization trend also extends to packaging, texture, and formulation, creating a holistic, spa-like experience that elevates everyday personal care routines.

Clean Label and Sustainable Formulations

Rising awareness of ingredient safety and sustainability has fueled demand for clean, alcohol-free, and naturally derived fragranced products. Consumers are scrutinizing ingredient lists and choosing brands that emphasize transparency, ethical sourcing, and eco-friendly production. Manufacturers are responding by integrating essential oils, biodegradable surfactants, and recyclable packaging materials. The adoption of vegan and cruelty-free certifications further enhances brand credibility. This clean-label movement not only boosts trust but also drives long-term loyalty, as consumers seek fragrance experiences that align with both their health priorities and environmental consciousness.

Rising Regulatory Scrutiny on Fragrance Allergens

Stringent global regulations governing fragrance allergens and volatile organic compounds (VOCs) present a major restraint for market growth. Regions such as the EU and North America have introduced tighter labeling and compliance norms that restrict the use of certain synthetic fragrance ingredients. These regulations increase production complexity and formulation costs, particularly for mass-market players. Additionally, the rising prevalence of fragrance sensitivity among consumers is pushing brands to reformulate or limit scent intensity. This regulatory environment may constrain innovation speed and delay product launches in highly regulated regions.

AI-Driven Personalization and Digital Fragrance Profiling

The integration of artificial intelligence and digital tools into the fragrance creation process is emerging as a transformative trend. Brands are using AI algorithms to analyze consumer scent preferences, mood states, and skin chemistry to recommend personalized fragranced products. Digital fragrance profiling enables customers to experience virtual scent journeys, enhancing online shopping engagement. This data-driven personalization is fostering higher consumer satisfaction and repeat purchases. Furthermore, AI-assisted formulation helps optimize ingredient blends for longer wear and better olfactory balance, marking the next evolution in consumer-centric fragrance innovation.

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 8.9% |

| USA | 3.7% |

| India | 10.0% |

| UK | 5.8% |

| Germany | 4.3% |

| Japan | 7.2% |

| Europe | 5.4% |

The global Fragranced Personal Care Products Market exhibits notable regional variation in growth dynamics, shaped by lifestyle evolution, income levels, and fragrance consumption patterns. Asia-Pacific stands out as the fastest-growing region, led by India (10.0%) and China (8.9%), where rising disposable incomes, expanding urban populations, and growing grooming consciousness are fueling strong demand for scented body care and hygiene products. India’s momentum is further propelled by its expanding young consumer base and rapid digital retail adoption, while China’s growth reflects a blend of local fragrance innovation and luxury skincare crossovers appealing to premium buyers.

Japan (7.2% CAGR) continues to advance as a mature yet innovative market, driven by clean, subtle, and long-lasting fragrance preferences integrated into multifunctional skincare and haircare formats. In Europe, steady growth is supported by fragrance sophistication and sustainability leadership. The UK (5.8%) and Germany (4.3%) lead regional consumption, with strong demand for gender-neutral and natural-scented products reflecting eco-conscious lifestyle trends. Europe overall maintains a 5.4% CAGR, driven by premium product positioning and regulatory emphasis on allergen transparency and safe formulation practices.

In contrast, North America, led by the USA (3.7%), reflects a mature yet evolving landscape characterized by premiumization, brand diversification, and digital-first fragrance marketing. Growth in the region is supported by AI-driven personalization, expansion of body mist categories, and consumer preference for self-care rituals enhanced by aromatic formulations. Collectively, these patterns indicate that Asia-Pacific will continue to outpace global averages, while Western markets will focus on sustainability, innovation, and emotional wellness through fragrance-infused personal care.

| Year | USA Fragranced Personal Care Products Market (USD Million) |

|---|---|

| 2025 | 8075.34 |

| 2026 | 8359.34 |

| 2027 | 8653.33 |

| 2028 | 8957.66 |

| 2029 | 9272.69 |

| 2030 | 9598.80 |

| 2031 | 9936.38 |

| 2032 | 10285.83 |

| 2033 | 10647.57 |

| 2034 | 11022.04 |

| 2035 | 11409.67 |

The Fragranced Personal Care Products Market in the United States is projected to grow at a CAGR of 3.7% between 2025 and 2035, supported by sustained consumer spending on premium body care, scented lotions, and personal hygiene essentials. Demand is increasingly driven by wellness-oriented product formulations featuring clean fragrances, hypoallergenic ingredients, and long-lasting scents. Growth is particularly strong across the body wash and deodorant categories, as consumers shift toward daily-use products that deliver both freshness and skincare benefits. Major players like Bath & Body Works and Procter & Gamble are leveraging personalization, fragrance layering, and e-commerce subscription models to expand recurring revenue streams.

The Fragranced Personal Care Products Market in the United Kingdom is expected to expand at a CAGR of 5.8% through 2035, driven by the country’s evolving skincare and wellness culture emphasizing aromatherapy-inspired and eco-friendly fragranced formulations. Local and global brands are introducing biodegradable, natural fragrance blends and refill-based packaging to appeal to environmentally conscious consumers. The rise of niche perfumed skincare labels and sustainable bath brands is reshaping the competitive landscape. Retail innovation through experiential stores and online scent discovery tools continues to attract younger demographics seeking sensory-driven, ethically produced beauty solutions.

The Fragranced Personal Care Products Market in India is witnessing exceptional expansion, with a forecasted CAGR of 10.0% from 2025 to 2035. Rapid urbanization, rising disposable incomes, and increased awareness of personal hygiene are key growth enablers. The shift toward daily grooming rituals and affordable luxury is fostering demand for perfumed body lotions, deodorants, and soaps across both urban and semi-urban markets. Tier-2 cities are emerging as major consumption hubs due to wider product availability and influencer-led marketing. Local FMCG companies are capitalizing on indigenous ingredients and traditional aromas like sandalwood and jasmine to appeal to diverse cultural preferences.

The Fragranced Personal Care Products Market in China is projected to grow at a CAGR of 8.9%, marking one of the highest rates globally. Growth is powered by rising premium skincare consumption, cross-category innovation with fine fragrances, and an expanding male grooming segment. Domestic brands are blending traditional Chinese botanicals with modern perfumery to differentiate themselves in a highly competitive landscape. Urban consumers are showing strong interest in long-lasting and minimalist fragrances, often marketed through livestreaming and influencer collaborations. With continued investments in sustainable packaging and ingredient transparency, China is emerging as a fragrance trendsetter in Asia.

| Countries | 2025 Share (%) |

|---|---|

| USA | 21.0% |

| China | 10.7% |

| Japan | 6.2% |

| Germany | 13.8% |

| UK | 7.3% |

| India | 4.4% |

| Europe | 19.8% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 18.6% |

| China | 11.6% |

| Japan | 7.5% |

| Germany | 12.0% |

| UK | 6.5% |

| India | 5.3% |

| Europe | 18.1% |

The Fragranced Personal Care Products Market in Germany is projected to expand at a CAGR of 4.3% between 2025 and 2035, reflecting steady consumer demand for sophisticated scent profiles, dermatologically tested formulations, and sustainable fragrance technologies. German consumers exhibit a strong preference for mild, hypoallergenic, and naturally derived fragrances, often integrated into body lotions, shower gels, and hand creams. The country’s regulatory rigor under EU Cosmetic Directives has reinforced a market environment where safety, transparency, and eco-innovation define purchasing behavior. Major domestic and European players are investing in biodegradable ingredients, allergen-free scents, and refill-based packaging systems to meet consumer and environmental expectations.

Germany’s market performance is also characterized by the growing popularity of dermocosmetic fragrance hybrids, particularly those developed for sensitive skin and clinical-grade moisturization. Rising consumer interest in clean beauty and aroma therapeutic well-being has inspired brands to create scents that evoke calmness and balance rather than intensity. Distribution channels are diversifying, with pharmacies and specialty beauty retailers capturing significant market share due to consumer trust in dermatologist-endorsed and natural-certified products. The German market’s cautious yet quality-focused approach positions it as a benchmark for sustainable innovation and fragrance integrity across Europe.

| USA By Product Category | Value Share% 2025 |

|---|---|

| Body washes & soaps | 36.4% |

| Others | 63.6% |

The Fragranced Personal Care Products Market in the USA is forecast to grow steadily at a CAGR of 3.7% through 2035, underpinned by the country’s high consumer engagement with self-care, wellness, and premium grooming routines. American consumers increasingly favor body washes and soaps with long-lasting scents, clean formulations, and moisturizing ingredients, reflecting a shift from traditional perfumed products to hybrid skincare formats. Body mists and exfoliating scrubs with signature fragrance blends are gaining traction, particularly in Gen Z and millennial demographics.

Digital innovation plays a major role in market expansion, with AI-based fragrance matching, subscription programs, and online-exclusive scent layering kits emerging as key retail strategies. Major brands like Bath & Body Works and The Body Shop are leveraging sustainability narratives such as responsibly sourced essential oils and recyclable packaging to retain market leadership.

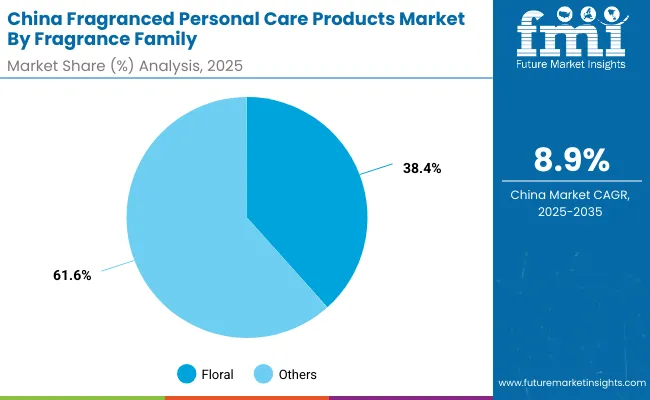

| China By Fragrance Family | Value Share% 2025 |

|---|---|

| Floral | 38.4% |

| Others | 61.6% |

The Fragranced Personal Care Products Market in China presents robust opportunities, expanding at a CAGR of 8.9%, the highest among major economies. The rise of young, urban consumers and the integration of luxury fragrance DNA into daily-use personal care are key growth enablers. Floral scents dominate the market, appealing to consumers who value sophistication and freshness in skincare and haircare routines. Domestic players are localizing scent palettes to resonate with regional cultural identities, such as osmanthus, peony, and bamboo-based aromas.

Digitally native Chinese brands are leveraging livestreaming commerce, AI-driven fragrance profiling, and influencer collaborations to scale awareness. The growing popularity of gender-neutral and wellness-inspired fragrances underscores the market’s maturity. As the middle-class consumer base expands, China will continue to shape the direction of global fragranced personal care through innovation, affordability, and digital-first retail ecosystems.

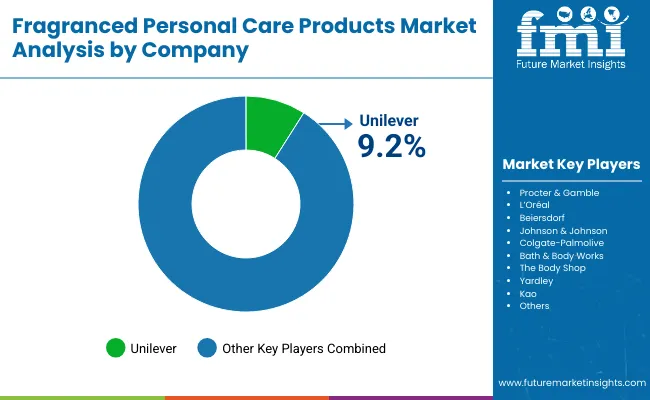

The Fragranced Personal Care Products Market is moderately fragmented, characterized by a mix of global FMCG giants, regional innovators, and niche boutique brands that collectively cater to varying consumer preferences across body care, skincare, and hygiene segments. Global leaders such as Unilever, L’Oréal, and Procter & Gamble hold notable market shares owing to their extensive distribution networks, diverse fragrance portfolios, and strong brand recognition. These companies are increasingly investing in AI-driven fragrance formulation, sustainable packaging, and digital personalization platforms to enhance consumer engagement and brand loyalty. Their innovation strategies center around long-lasting, clean-label fragrances and ingredient transparency to align with evolving global regulatory standards.

Mid-sized players, including Beiersdorf, Bath & Body Works, and The Body Shop, focus on niche positioning through ethically sourced ingredients, vegan fragrances, and aromatherapy-inspired formulations. They are expanding their footprint through e-commerce and experiential retail, offering seasonal scent collections and refillable product formats to strengthen sustainability credentials.

Meanwhile, specialized and heritage brands such as Yardley and Kao Corporation are leveraging their craftsmanship and heritage appeal to target selective segments seeking authenticity and timeless fragrance experiences. Boutique and indie labels are disrupting traditional dominance by offering gender-neutral scents, personalized body care lines, and limited-edition artisan fragrances that appeal to younger, value-conscious consumers.

Overall, competitive differentiation in the market is shifting from product pricing and scale toward brand storytelling, emotional engagement, and environmental accountability. As digital retail ecosystems mature, brands with strong omnichannel presence, community-led marketing, and circular economy initiatives are expected to strengthen their market position through 2035.

Key Developments in Fragranced Personal Care Products Market

| Item | Value |

|---|---|

| Quantitative Units | USD 38,506.3 Million |

| Product Category | Body lotions & creams, Body washes & soaps, Deodorants, Haircare (shampoo/conditioner), Hand creams |

| Fragrance Family | Floral, Citrus & fresh, Gourmand & sweet, Woody & musk |

| Claim | Long-lasting scent, Sensitive-skin friendly, Natural-derived fragrance, Alcohol-free body mist |

| Channel | Supermarkets & hypermarkets, E-commerce, Pharmacies, Specialty beauty retail |

| End User | Women, Men, Unisex, Teens |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Unilever, Procter & Gamble, L’Oréal, Beiersdorf, Johnson & Johnson, Colgate-Palmolive, Bath & Body Works, The Body Shop, Yardley, Kao |

| Additional Attributes | Dollar sales by product category and fragrance family, adoption trends in sustainable and clean-label formulations, rising demand for long-lasting and natural-derived scents, segment-specific growth in skincare, haircare, and body hygiene, revenue segmentation by channel (offline retail and e-commerce), integration of AI-driven fragrance personalization and digital scent profiling technologies, regional trends influenced by premiumization and wellness positioning, and innovations in encapsulated fragrance delivery, biodegradable packaging, and allergen-free formulation methods. |

The global Fragranced Personal Care Products Market is estimated to be valued at USD 38,506.3 million in 2025.

The market size for the Fragranced Personal Care Products Market is projected to reach USD 61,206.4 million by 2035.

The Fragranced Personal Care Products Market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in the Fragranced Personal Care Products Market are body washes & soaps, body lotions & creams, deodorants, hand creams, and haircare products (shampoo/conditioner).

In terms of fragrance range, the floral segment is expected to command the most significant share in the Fragranced Personal Care Products Market in 2025, accounting for 36.2% of total market value.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Personal Care Products Filling System Market Size and Share Forecast Outlook 2025 to 2035

Baby Personal Care Products Market Analysis - Size & Growth 2025 to 2035

Herbal Personal Care Products Market Size and Share Forecast Outlook 2025 to 2035

Anti-Foaming Personal Care Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Demand for Baby Personal Care Products in USA Size and Share Forecast Outlook 2025 to 2035

Hyaluronic Acid Personal Care Products Market Overview - Growth & Forecast 2025 to 2035

Personal Care Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Personal Care Appliances Market Size and Share Forecast Outlook 2025 to 2035

Personal Care Wipes Market Size and Share Forecast Outlook 2025 to 2035

Personal Care and Cosmetics Microalgae Market - Beauty & Skincare Trends 2025 to 2035

Personal Care Packaging Market Analysis by Application, Packaging Format, Capacity, and Region Forecast Through 2035

Personal Care Aid Market Growth – Industry Trends & Forecast 2024-2034

Suncare Products Market Size and Share Forecast Outlook 2025 to 2035

Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Sun Care Products Market Analysis – Growth, Applications & Outlook 2025–2035

Car Care Products Market Trends - Growth, Demand & Analysis 2025 to 2035

Nail Care Products Market Growth, Trends and Forecast from 2025 to 2035

Personalized Skincare Serum Market Trends – Demand & Forecast 2024-2034

Facial Care Products Market Size and Share Forecast Outlook 2025 to 2035

Dental Care Products Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA