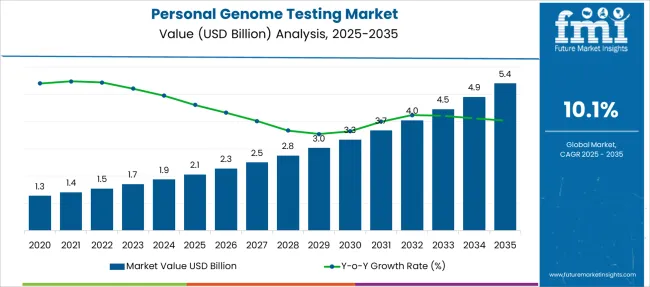

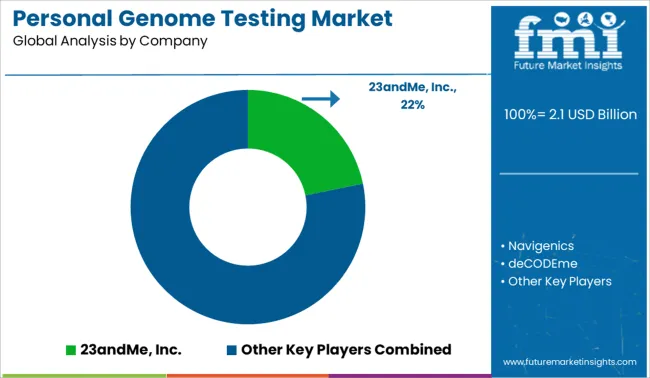

The Personal Genome Testing Market is estimated to be valued at USD 2.1 billion in 2025 and is projected to reach USD 5.4 billion by 2035, registering a compound annual growth rate (CAGR) of 10.1% over the forecast period.

| Metric | Value |

|---|---|

| Personal Genome Testing Market Estimated Value in (2025 E) | USD 2.1 billion |

| Personal Genome Testing Market Forecast Value in (2035 F) | USD 5.4 billion |

| Forecast CAGR (2025 to 2035) | 10.1% |

The personal genome testing market is growing rapidly as advances in genetic sequencing technologies have made testing more accessible and affordable. Increased public interest in personalized healthcare and disease risk assessment is driving demand for genome testing services. The ability to identify genetic predispositions enables individuals and healthcare providers to make informed decisions about prevention and treatment.

Research and healthcare reports highlight significant growth in applications related to oncology, where genomic data supports targeted therapies and early diagnosis. Moreover, increased investment in precision medicine and growing awareness about genetic testing benefits have fueled market expansion.

Technological improvements and integration of testing into routine healthcare are expected to sustain growth. Segment leadership is anticipated from targeted testing types and oncology applications due to their clinical relevance and high adoption rates.

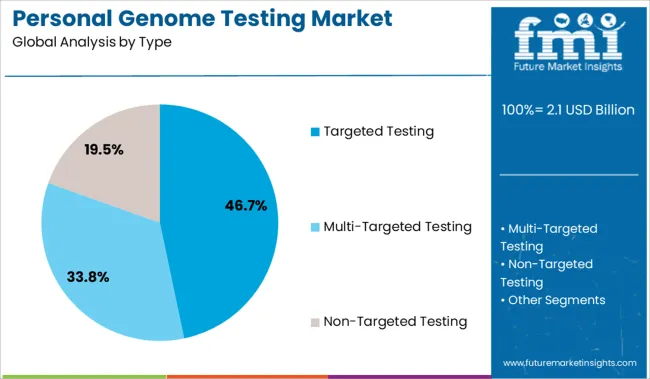

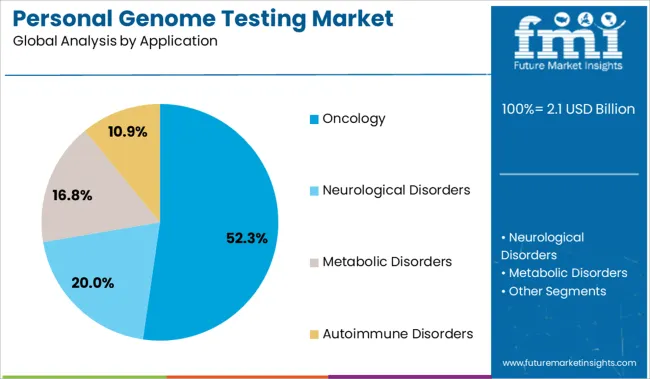

The market is segmented by Type and Application and region. By Type, the market is divided into Targeted Testing, Multi-Targeted Testing, and Non-Targeted Testing. In terms of Application, the market is classified into Oncology, Neurological Disorders, Metabolic Disorders, and Autoimmune Disorders. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The targeted testing segment is expected to represent 46.7% of the personal genome testing market revenue in 2025. This segment’s growth is driven by the focused approach of testing specific genes associated with particular conditions, allowing for cost-effective and clinically actionable results. Targeted tests are preferred by clinicians for their precision in identifying mutations linked to hereditary diseases and cancer risks.

The ability to tailor tests based on individual or family history enhances their diagnostic value. As healthcare systems emphasize personalized medicine, targeted testing has become a primary choice for genetic screening and risk assessment.

This focused method supports efficient clinical decision-making and patient management, contributing to sustained demand.

The oncology segment is projected to hold 52.3% of the market revenue in 2025, making it the leading application area for personal genome testing. Genetic testing in oncology enables the identification of mutations that drive cancer development, guiding targeted treatment options and improving patient outcomes.

Testing also supports early detection and risk stratification, helping healthcare providers implement personalized screening protocols. The rise of precision oncology and increased availability of targeted therapies have amplified the importance of genomic data in cancer care.

Patients and clinicians benefit from more effective treatment planning and monitoring, which enhances survival rates and quality of life. As personalized medicine continues to advance, oncology will remain a dominant application for personal genome testing.

With the expansion of DTC genetic tests' application areas, the market share for personal genome testing increases. The market for personal genome testing is being expanded by businesses that provide DTC tests for use in continuing research, sports, nutrition, and other areas.

The range of services offered by genetic testing, such as data security, identification of ancestors, race and nature of family, increasing its usage in clinical practices, surges demand for personal genome testing.

The low cost value of genome testing across clinics, ranging from USD 99 to USD 2000, drives the demand for personal genome testing. Rising prevalence of genetic diseases related to genotype, phenotype, or mutation, and its need for detection and prevention propels the personal genome testing market growth.

The ability to detect genetic abnormalities in the early gestation period of 8 to 10 weeks surges the demand for personal genome testing. Growing R&D activities, along with government initiatives in the field, escalates the adoption of personal genome testing.

Increasing awareness and discoveries in the field of genetic testing, as well as the option to determine the sex of a fetus, broadens the personal genome testing market share. Descriptive information regarding analytical validity and clinical validity of the tests offered by the service provide, increases the demand for personal genome testing.

The requirement for identification and addressing of specific needs, personalized direct-to-consumer genetic tests, escalates the personal genome testing market size. Favorable reimbursement policies and increasing coverage for preventative genetic testing elevate the personal genome testing market share.

Due to the shortage of trained professionals, end users face significant issues in analyzing genomic data, hindering the personal genome testing market growth. Rigid regulatory requirements for product approvals are expected to hamper the demand for personal genome testing.

The personal genome testing market size is further obstructed owing to standardization concerns of genetic testing-based diagnostics.

Furthermore, the unavailability of doctors and genetic counselors, along with closing of test-running laboratories leading to disruption, limitation and challenges during the pandemic, hampered the adoption of personal genome testing.

Scepticism and criticism regarding genetic testing from healthcare professionals, owing to lack of evidence, thwarts the personal genome testing market share.

The desire for personal genome testing is curbed by the loss of discretion and control over customers' genetic material, as well as the risk that testing procedures could lead to a third party accessing clients' DNA information.

Unexplored emerging markets in developing economies and a high number of customers opting for online genetic testing are anticipated to promote the global personal genome testing market growth.

Moreover, the adoption of personal genome testing increases owing to the growth in the personalized medicine market, especially among the pharmaceutical companies. The shift of focus from clinical science to bioinformatics, and the increasing popularity of these techniques, increases the demand for personal genome testing.

Increased efficiency, accuracy, and new innovations and techniques further propel the demand for personal genome testing.

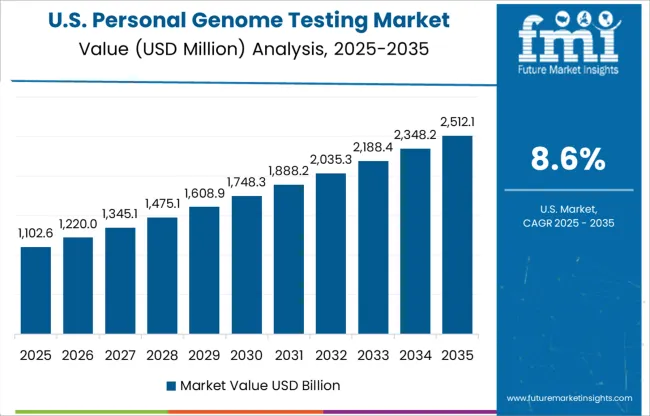

North America holds the leading position in the personal genome testing market share, with a revenue of 37.3%.

This is owing to the rise in cases of genetic diseases and an increasing demand for technologically advanced medical equipment for treatment. The availability of a substantial number of key players dealing with genetic tests in this region surges the demand for personal genome testing.

High awareness about at-home testing among the U.S. population promotes the global personal genome testing market growth.

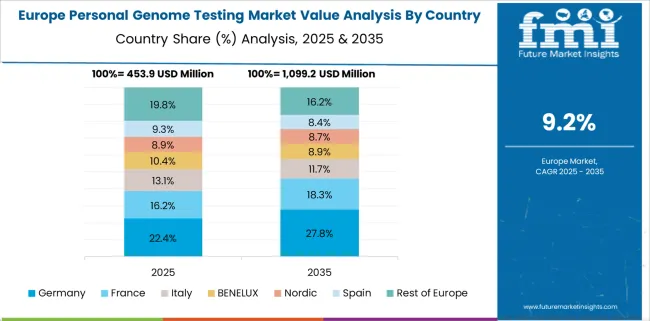

Europe has the second leading personal genome testing market share, with a revenue share of 26%.

The rising demand for technologically advanced medical equipment for treatment in this region promotes personal genome testing market growth.

The presence of key players, as well as new players entering the market causing competition, secures the expansion of the personal genome testing market size.

Due to rising knowledge of the advantages of genetic testing, the personal genome testing market share is predicted to increase in Asia-Pacific. Personal genome testing is becoming more popular as a result of growing awareness of numerous genetic illnesses and an increase in their prevalence in this area.

Rapid development of healthcare infrastructures across Asian countries further promotes market growth.

Several market players, through research and development activities, are coming up with innovative strategies to refine genetic testing in clinics. They are also implementing schemes to protect the privacy of their clients’ DNA information.

Emerging players such as 3x4 Genetics, 3billion, CircaGene, Bione, Athletic Genetix, etc. are offering various services such as DNA-based fitness programs, genetic testing for rare diseases, personalized genetic test platforms, microbiome testing, genetic testing for athletes, etc.

Some of the key market participants in the personal genome testing market are 23andMe Inc., Navigenics, deCODEme, Color Genomics Inc., Personal Genome Diagnostics Inc., Counsyl, Inc., Quest Diagnostics, Gene By Gene Ltd., Laboratory Corporation of America Holdings, Thermo Fisher Scientific, QIAGEN N.V., Agilent Technologies, Inc., F. Hoffmann-La Roche Ltd., Bio-Rad Laboratories Inc., BGI, MYRIAD GENETICS, INC. (MYRIAD RBM, INC.), Eurofins Scientific, CSL Ltd., Abbott Laboratories, Invitae Corporation, Ambry Genetics, BioReference, Progenity Inc., and others are coming up with new innovations to perfect the extraction of genetic material.

Rising cases of chronic diseases are increasing the adoption of personal genome testing. This is attributed to the growth of key players in the market, which is increasing competitiveness in the market, surging the demand for personal genome testing.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 10.1% from 2025 to 2035 |

| Base year for estimation | 2024 |

| Historical data | 2020 to 2024 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis, |

| Segments covered | Type, Application, and Region. |

| Regional scope | North America; Western Europe; Eastern Europe; Middle East; Africa; ASEAN; South Asia; Rest of Asia; Australia and New Zealand |

| Country scope | USA, Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, Belgium, Poland, Czech Republic, China, India, Japan, Australia, Brazil, Argentina, Colombia, Saudi Arabia, UAE, Iran, South Africa |

| Key companies profiled | 23andMe Inc.; Navigenics; deCODEme; Color Genomics Inc.; Personal Genome Diagnostics Inc.; Counsyl, Inc.; Quest Diagnostics; Gene By Gene Ltd.; Laboratory Corporation of America Holdings; Thermo Fisher Scientific; QIAGEN N.V.; Agilent Technologies, Inc.; F. Hoffmann-La Roche Ltd.; Bio-Rad Laboratories Inc.; BGI; MYRIAD GENETICS, INC. (MYRIAD RBM, INC.); Eurofins Scientific; CSL Ltd.; Abbott Laboratories; Invitae Corporation; Ambry Genetics; BioReference; Progenity Inc.; Burning Rock Biotech Ltd.; Celera Group; PerkinElmer Inc.; Quest Diagnostics Inc.; ELITech Group; Roche Diagnostics Corp.; Applied Biosystems Inc.; Roche Molecular Diagnostics Inc.; Transgenomic Inc.; Color Genomics; EasyDNA; Family Tree DNA; Full Genome Corporation Inc.; Helix OpCo LLC; Karmagenes SA; Living DNA Ltd.; MyHeritage; 24 Genetics; The SkinDNA Company Pty Ltd; DNA Forensics Laboratory Pvt. Ltd. |

| Customization scope | Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. |

The global personal genome testing market is estimated to be valued at USD 2.1 billion in 2025.

The market size for the personal genome testing market is projected to reach USD 5.4 billion by 2035.

The personal genome testing market is expected to grow at a 10.1% CAGR between 2025 and 2035.

The key product types in personal genome testing market are targeted testing, multi-targeted testing and non-targeted testing.

In terms of application, oncology segment to command 52.3% share in the personal genome testing market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Personal Care Products Filling System Market Size and Share Forecast Outlook 2025 to 2035

Personal Fitness Training Software Market Size and Share Forecast Outlook 2025 to 2035

Personal Emergency Response System (PERS) Market Size and Share Forecast Outlook 2025 to 2035

Personal Care Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Personal Protective Equipment Market Size and Share Forecast Outlook 2025 to 2035

Personality Assessment Solution Market Size and Share Forecast Outlook 2025 to 2035

Personalized Immunotherapy Market Size and Share Forecast Outlook 2025 to 2035

Personal Care Appliances Market Size and Share Forecast Outlook 2025 to 2035

Personal Navigation Devices Market Size and Share Forecast Outlook 2025 to 2035

Personal Watercraft Jet Ski Market Size and Share Forecast Outlook 2025 to 2035

Personalized Packaging Market Size and Share Forecast Outlook 2025 to 2035

Personalized Toys Market Size and Share Forecast Outlook 2025 to 2035

Personal Care Wipes Market Size and Share Forecast Outlook 2025 to 2035

Personalized Nutrition Market - Size, Share, and Forecast Outlook 2025 to 2035

Personal Watercraft Market Growth - Trends & Forecast 2025 to 2035

Personal Mobility Devices Market Analysis - Trends, Growth & Forecast 2025 to 2035

Personalized Beauty Devices Market Trends - Growth & Forecast 2025 to 2035

Personalized Bakery Products Market Analysis by Product Type, Price Range, Sales Channel, End-User and Region 2025 to 2035

Personal CRM Market Report - Growth & Forecast 2025 to 2035

Personal Care and Cosmetics Microalgae Market - Beauty & Skincare Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA