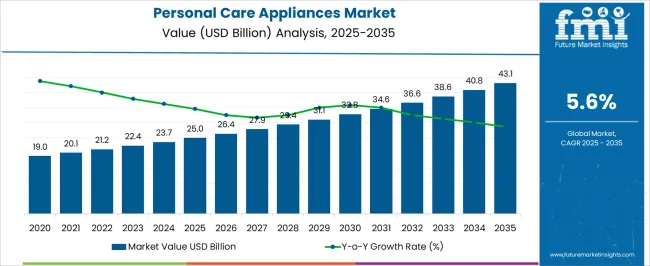

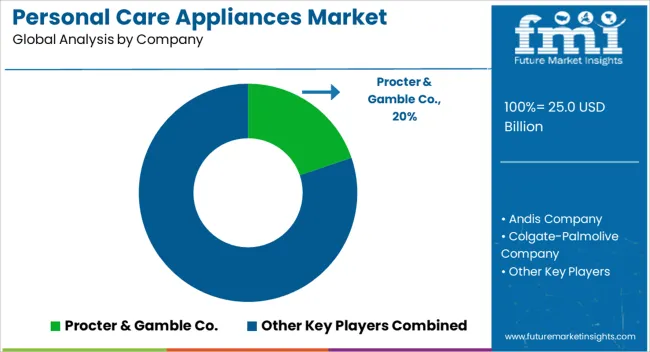

The Personal Care Appliances Market is estimated to be valued at USD 25.0 billion in 2025 and is projected to reach USD 43.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period. The chart depicts a consistent upward trajectory supported by increasing consumer interest in grooming, skincare, and home-based beauty treatments. Between 2020 and 2025, the market gradually expands from USD 19.0 billion to USD 26.4 billion, reflecting steady adoption of appliances such as electric shavers, hair dryers, trimmers, and facial devices.

From 2026 to 2030, the curve steepens, moving from USD 27.9 billion to USD 32.8 billion, showing strong mid-term growth as rising disposable incomes, digital retail channels, and the popularity of personalized beauty appliances fuel higher sales. By 2035, the market crosses USD 43 billion, though the YoY growth rate indicates a gradual decline as adoption levels increase and the market reaches maturity. Despite this tapering growth rate, absolute revenues remain high, suggesting strong consumer retention and replacement demand.

| Metric | Value |

|---|---|

| Personal Care Appliances Market Estimated Value in (2025 E) | USD 25.0 billion |

| Personal Care Appliances Market Forecast Value in (2035 F) | USD 43.1 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The personal care appliances market is expanding steadily, fueled by rising consumer interest in grooming and wellness. Increased awareness about personal hygiene and the influence of social media have driven demand for innovative grooming devices.

Product advancements focusing on convenience, safety, and multifunctionality have attracted a broad customer base. The trend toward at-home beauty routines and the growing adoption of self-care practices have supported market growth.

Moreover, urbanization and rising disposable incomes, especially among women, have led to greater spending on personal care products. The market outlook remains positive, with continued innovation in appliance technology and growing consumer preference for cordless devices enhancing product appeal. Segment growth is expected to be driven by shaving and hair removal appliances, the women consumer group, and cordless power supply options.

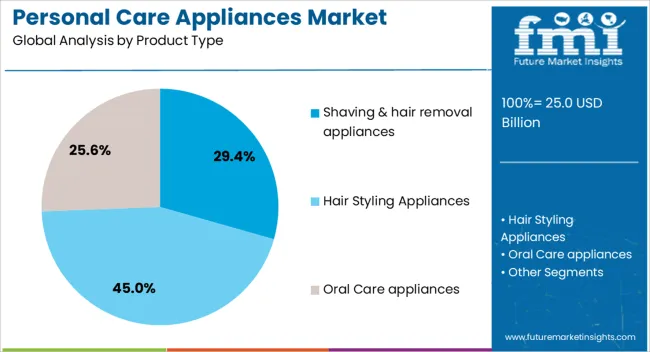

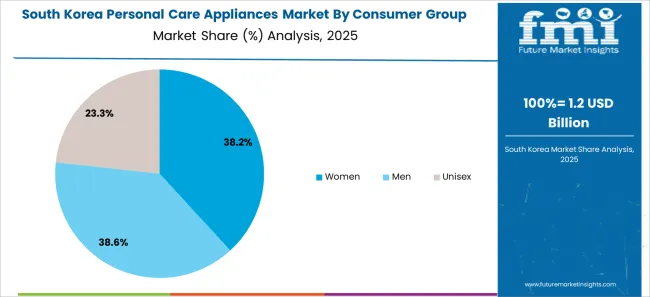

The personal care appliances market is segmented by product type, consumer group, power supply, end use, distribution channel, and geographic regions. By product type, the personal care appliances market is divided into Shaving & hair removal appliances, Hair Styling Appliances, Oral Care appliances, Skin Care Appliances, Massage & Relaxation Appliances, and Others. In terms of the consumer group, the personal care appliances market is classified into Women, Men, and Unisex.

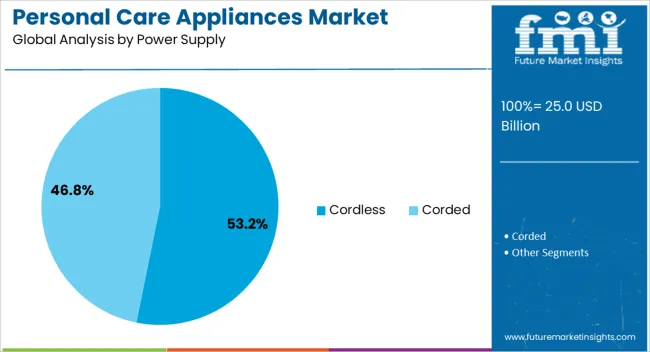

Based on power supply, the personal care appliances market is segmented into Cordless and Corded. By end use, the personal care appliances market is segmented into Residential and Commercial. By distribution channel, the personal care appliances market is segmented into Online channels and Offline Channels. Regionally, the personal care appliances industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The shaving and hair removal appliances segment is forecasted to hold 29.4% of the market revenue in 2025, reflecting strong consumer preference for personal grooming solutions. This segment has expanded due to the growing emphasis on hair removal and styling as part of daily personal care.

Advances in technology have led to devices that are more effective, gentle on skin, and easy to use, encouraging repeat purchases and brand loyalty. The convenience of at-home use combined with features such as skin protection and precision trimming has made these appliances popular among consumers seeking quick grooming options.

As personal grooming trends evolve, the demand for shaving and hair removal devices is expected to rise, solidifying this segment’s market position.

The women consumer group is projected to account for 38.7% of the personal care appliances market revenue in 2025, continuing to lead market consumption. Women have historically been the primary consumers of grooming and beauty appliances, driven by increasing self-care awareness and product availability tailored to their needs.

Marketing strategies targeting women emphasize product efficacy, comfort, and style, which resonate strongly with this group. The expansion of online retail and social media marketing has further amplified product visibility and engagement among women consumers.

As personalization and multifunctionality become key factors in purchasing decisions, women’s demand for innovative personal care appliances is expected to remain robust.

The cordless segment is expected to hold 53.2% of the market revenue in 2025, reflecting growing consumer preference for portability and convenience. Cordless personal care appliances offer flexibility for use at home or on the go without being tethered to a power outlet.

Improvements in battery technology have extended usage time and reduced charging periods, making cordless devices more reliable and attractive. Consumers favor cordless appliances for their ease of handling and storage, especially in travel and compact living situations.

The increasing trend of wireless technology integration and smart features in personal care appliances is anticipated to strengthen the cordless segment’s position further.

The personal care appliances industry is influenced by shifting consumer grooming habits, premiumization of devices, dominance of e-commerce platforms, and ongoing challenges from counterfeiting and pricing pressures. Together, these factors shape the growth trajectory and competitive dynamics of the category.

Personal care appliances have seen heightened attention as consumers increasingly opt for at-home grooming and beauty routines. The demand for hair dryers, straighteners, electric shavers, and epilators has been driven by the convenience they provide compared to salon visits. This change has been further influenced by busy lifestyles, cost-effectiveness of home treatments, and widespread brand availability across both physical and digital channels. Growth has been encouraged by marketing strategies targeting younger demographics and promotional campaigns emphasizing time-saving benefits. E-commerce platforms have reinforced this trend by offering easy access, discounting, and wide-ranging product options. Collectively, these dynamics have accelerated the consumer shift toward owning advanced appliances for personal grooming and beauty routines.

The personal care appliances sector has experienced a shift toward premiumization, with consumers showing readiness to pay more for multifunctional devices. Hair styling tools with adjustable settings, electric toothbrushes with smart cleaning modes, and epilators with pain-reduction features are examples of this expansion. Manufacturers are focusing on product differentiation by integrating ergonomic designs, long-lasting performance, and skin-friendly elements. This transition has created stronger brand loyalty while also elevating average unit prices in both mass and premium categories. The ability to combine multiple functions within a single appliance appeals to modern buyers seeking value and convenience. As a result, premium appliances have significantly expanded their contribution to overall category sales.

The rise of digital channels has become a defining factor for the personal care appliances industry. Online sales have grown to command a substantial portion of overall revenues as consumers prefer the convenience of browsing multiple brands, reading peer reviews, and accessing competitive pricing. Companies have increasingly used social media marketing, influencer partnerships, and targeted advertising to strengthen visibility in this domain. Seasonal promotions and flash sales offered by platforms have further accelerated purchase decisions. Subscription models for oral care appliances and replacement parts have also gained popularity, supporting recurring revenue streams. This transformation has made e-commerce a primary contributor to the global expansion of personal care appliance sales.

Despite strong demand, the industry faces persistent challenges, particularly from pricing pressures and counterfeit products. The widespread presence of low-cost alternatives, often produced in unregulated markets, undermines premium and mid-tier brand positioning. This price-driven competition has compelled established players to balance affordability with quality assurance, often squeezing profit margins. Counterfeiting has further damaged consumer trust, with inferior replicas affecting brand reputations and product safety perceptions. Manufacturers have responded by strengthening distribution networks, introducing authentication mechanisms, and expanding after-sales services. Regulatory interventions and consumer awareness campaigns have supported efforts to counter these issues, yet maintaining brand integrity remains one of the most critical hurdles for the sector.

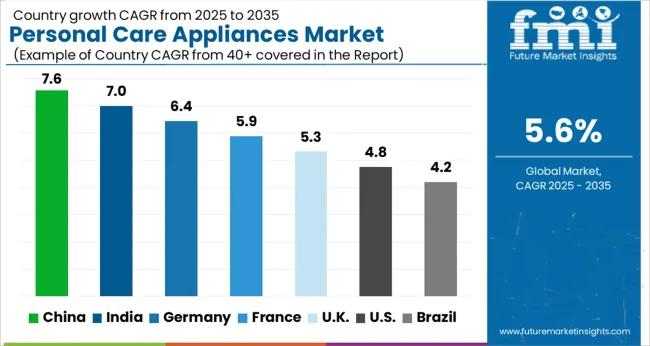

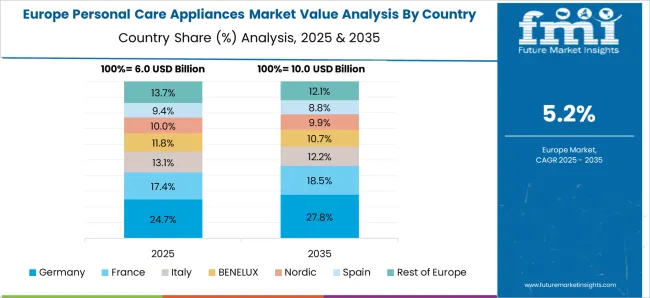

The personal care appliances market is projected to expand globally at a CAGR of 5.6% from 2025 to 2035, supported by rising interest in grooming, wellness routines, and home-based beauty solutions. China leads with a CAGR of 7.6%, driven by expanding middle-class spending, premiumization of grooming tools, and strong adoption of hair styling and oral care devices. India follows at 7.0%, supported by increasing disposable income, higher penetration of e-commerce, and popularity of multifunctional appliances among younger consumers. France grows at 5.9%, reflecting solid consumer preference for electric shavers, epilators, and wellness-oriented appliances backed by well-established retail distribution. The United Kingdom posts 5.3%, where growth is linked to wider adoption of smart personal care devices, online retail expansion, and rising awareness of grooming among men. The United States registers 4.8%, paced by a mature market environment, yet maintaining steady interest in advanced electric shavers, oral care tools, and premium hair dryers. This analysis indicates Asia-Pacific as the primary growth hub, with Europe showing resilience in specialized categories and the United States maintaining steady but moderate progress in grooming and wellness appliances.

China’s market has been characterized by rising at-home grooming and a strong e-commerce habit. A CAGR of 7.6% is expected for 2025–2035, after an estimated 6.5% during 2020–2024, which places China above the 5.6% global path. Demand has been pulled by premium hair styling tools, electric shavers, and smart oral care, with social-commerce and livestream retail used as amplification engines. Higher discretionary spending and frequent promo cycles have supported rapid model refreshes. Distribution through specialty beauty chains and app-first marketplaces has created dependable replenishment for accessories and brush heads. In my view, China’s scale in digital retail and brand experimentation keeps the growth premium intact.

India’s trajectory has been powered by a young customer base and fast online adoption. A CAGR of 7.0% is projected for 2025–2035, following about 6.0% in 2020–2024, which stays above the 5.6% global average. Entry-to-mid price bands have been expanded, while salon-style outcomes at home have been positioned as value. Subscriptions for oral care heads and trimmer blades have increased retention. Regional language marketing and influencer tutorials have converted first-time buyers in tier-2 and tier-3 towns. In my opinion, India’s mix of affordability, digital reach, and gifting occasions keeps volumes rising across hair care, male grooming, and oral care.

France has shown steady appetite for premium shavers, epilators, and hair care devices. A CAGR of 5.9% is anticipated for 2025–2035, versus roughly 5.0% in 2020–2024, slightly above the 5.6% global trend. Pharmacy-parapharmacy and specialty beauty chains have been used as high-trust channels, while D2C sites have raised basket sizes through bundles. Travel-friendly devices and noise-reduced dryers have appealed to urban households. Loyalty programs and buy-now-pay-later options have helped premiumize without deterring purchase intent. My take is that France’s brand-led retail and discerning consumers sustain pricing power and keep the category on a healthy climb.

The United Kingdom has moved from cautious recovery to firmer demand. A CAGR of 5.3% is expected for 2025–2035, compared with about 4.4% in 2020–2024, which places the UK just under the 5.6% global figure. Early growth had been tempered by higher living costs and slower upgrade cycles, yet category mix shifted in favor of mid-premium dryers, multi-styling tools, and electric toothbrushes with app guidance. Supermarket and pure-play e-commerce have been used to run seasonal value packs that raise penetration. In my view, tighter ranging and better after-sales support have improved confidence and lifted replacement intent.

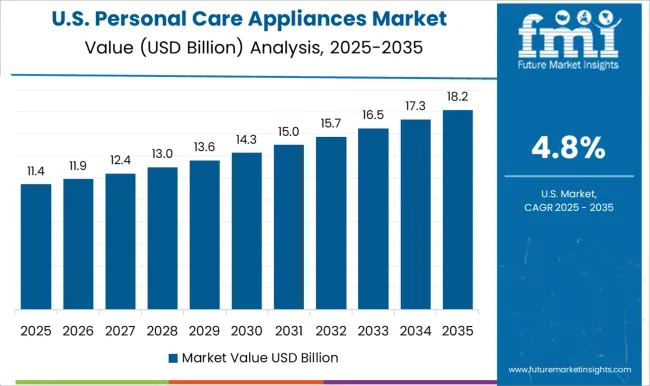

The United States has presented a mature but steady profile. A CAGR of 4.8% is projected for 2025–2035, after about 4.1% in 2020–2024, slightly below the 5.6% global pace. Club, mass, and online channels have been used for family bundles and multi-head trimmer kits that defend volume. Replacement brush heads and filter elements have underpinned recurring revenue for oral care and cleansing devices. Influencer content has encouraged at-home hair styling, while pro-look outcomes without salon visits have become a key pitch. My view is that the market remains resilient due to high household penetration and stable refill economics.

The personal care appliances sector has been shaped by a diverse mix of multinational consumer goods leaders, electronics conglomerates, and grooming specialists. Companies such as Procter & Gamble Co., Andis Company, Colgate-Palmolive Company, Conair Corporation, Dyson Limited, Flyco, Groupe SEB, Havells India, Helen of Troy, Koninklijke Philips N.V., Lion Corporation, Panasonic Corporation, Shiseido Company, Spectrum Brands, Inc., and Wahl Clipper Corporation play pivotal roles in shaping competition across global and regional markets. Procter & Gamble, Philips, and Panasonic continue to dominate through their expansive product portfolios that cover grooming tools, oral care appliances, and hair styling devices, supported by global retail and e-commerce distribution channels. Their leadership is further reinforced by consistent investment in R&D and product standardization that appeals to both mature and developing markets. Dyson and Groupe SEB have built strong market positions through design-led innovation and premium product positioning, appealing to consumers seeking cutting-edge technologies. Conair, Wahl, and Andis emphasize their heritage in professional grooming, leveraging trusted brand reputations across both consumer and salon segments.

Flyco and Havells India are rapidly scaling their footprint by offering affordable, locally adapted appliances that cater to cost-sensitive markets while ensuring strong after-sales support. Lion Corporation and Shiseido emphasize oral and beauty appliances, securing their dominance across Asian regions with brand credibility and consumer preference. Key competitive strategies include the expansion of digital-first sales channels, investment in energy-efficient appliances, and diversification into wellness-oriented categories such as scalp health devices, beauty massagers, and oral hygiene systems. Personalization and consumer engagement are increasingly becoming central to differentiation, with data-driven product development helping brands meet evolving expectations. The success of players in this industry hinges on maintaining a balance between premium innovation for advanced markets and affordability for emerging economies, while continuing to build trust and loyalty through quality, durability, and brand identity.

| Item | Value |

|---|---|

| Quantitative Units | USD 25.0 Billion |

| Product Type | Shaving & hair removal appliances, Hair Styling Appliances, Oral Care appliances, Skin Care Appliances, Massage & Relaxation Appliances, and Others |

| Consumer Group | Women, Men, and Unisex |

| Power Supply | Cordless and Corded |

| End Use | Residential and Commercial |

| Distribution Channel | Online channels and Offline Channels |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Procter & Gamble Co., Andis Company, Colgate-Palmolive Company, Conair Corporation, Dyson Limited, Flyco, Groupe SEB, Havells India, Helen of Troy, Koninklijke Philips N.V., Lion Corporation, Panasonic Corporation, Shiseido Company, Spectrum Brands, Inc., and Wahl Clipper Corporation |

| Additional Attributes | Dollar sales, share, growth rates, competitive positioning, consumer adoption trends, pricing strategies, retail channels, innovation pipelines, regional opportunities, regulatory shifts, and future demand forecasts. |

The global personal care appliances market is estimated to be valued at USD 25.0 billion in 2025.

The market size for the personal care appliances market is projected to reach USD 43.1 billion by 2035.

The personal care appliances market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in personal care appliances market are shaving & hair removal appliances, _electric shavers, _trimmers & epilators, _ipl hair removal devices, _other (nose & ear trimmers), hair styling appliances, _hair dryers, _hair straighteners, _curling irons and wands, _hair clippers and trimmers, oral care appliances, _electric toothbrushes, _water flossers, _whitening devices, skin care appliances, _anti-aging devices, _facial cleansing tools, _facial massagers, _other (ultrasonic pore extractors), massage & relaxation appliances, _hair growth stimulation, _foot and leg massagers, _electric body massagers, _muscle massage guns and others.

In terms of consumer group, women segment to command 38.7% share in the personal care appliances market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Personal Protective Equipment Market Size and Share Forecast Outlook 2025 to 2035

Personality Assessment Solution Market Size and Share Forecast Outlook 2025 to 2035

Personalized Immunotherapy Market Size and Share Forecast Outlook 2025 to 2035

Personal Navigation Devices Market Size and Share Forecast Outlook 2025 to 2035

Personal Genome Testing Market Size and Share Forecast Outlook 2025 to 2035

Personal Watercraft Jet Ski Market Size and Share Forecast Outlook 2025 to 2035

Personalized Packaging Market Size and Share Forecast Outlook 2025 to 2035

Personalized Toys Market Size and Share Forecast Outlook 2025 to 2035

Personalized Nutrition Market - Size, Share, and Forecast Outlook 2025 to 2035

Personal Watercraft Market Growth - Trends & Forecast 2025 to 2035

Personal Mobility Devices Market Analysis - Trends, Growth & Forecast 2025 to 2035

Personalized Beauty Devices Market Trends - Growth & Forecast 2025 to 2035

Personalized Bakery Products Market Analysis by Product Type, Price Range, Sales Channel, End-User and Region 2025 to 2035

Personal CRM Market Report - Growth & Forecast 2025 to 2035

Personalized Medicine Market is segmented by Personalized Medicine Diagnostics, Medicine Therapeutics, and Medical Care from 2025 to 2035

Personal Fitness Trainer Market - Trends, Growth & Forecast 2025 to 2035

Personalized Home Decor Market Insights & Forecast 2024-2034

Personal Emergency Response System Market Analysis – Growth & Forecast 2024-2034

Personal Protective Gloves Market

Personal Protective Equipment Packaging Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA