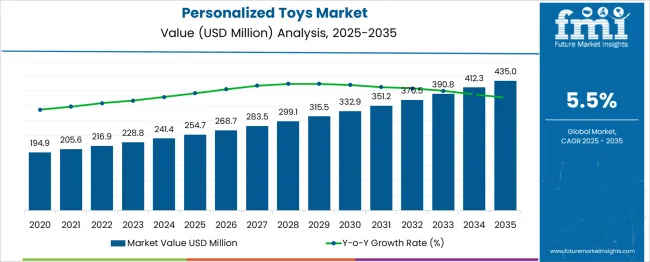

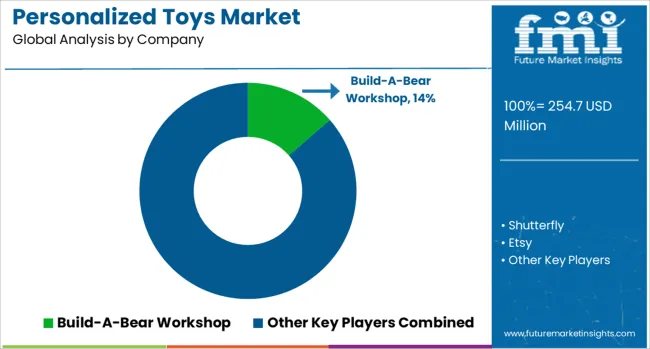

The Personalized Toys Market is estimated to be valued at USD 254.7 million in 2025 and is projected to reach USD 435.0 million by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

Analysis of 5-year growth contribution highlights a gradual acceleration trend, with the first phase (2025–2030) expanding from USD 254.7 million to 332.9 million, delivering USD 78.2 million, or 43.4% of the total opportunity.

The second half (2030–2035) adds USD 102.1 million, accounting for 56.6%, establishing a ratio of 1.3:1 in favor of the latter period. Annual increments illustrate widening gaps, with early-phase additions averaging USD 14 million per year, increasing to nearly USD 20 million annually in the second phase, signaling stronger momentum as personalization technologies scale and digital platforms mature.

This shift aligns with evolving consumer behavior favoring unique, experience-driven products supported by AI-based customization, 3D printing, and interactive design tools. The acceleration pattern also reflects growing integration of AR/VR visualization in e-commerce channels, enhancing consumer engagement and conversion rates.

As premiumization drives higher margins, manufacturers aiming for competitive advantage must prioritize modular product design, mass customization efficiency, and partnerships with online personalization platforms to capture accelerating demand in the back-end of the forecast horizon.

The personalized toys market occupies a small but rapidly expanding share across its parent markets. In the global toys market, it represents 0.2%, as mass-produced products dominate sales. Within the personalized gifts market, the share is higher at 0.8%, reflecting strong demand for custom gifting options. In the children’s toys market, personalized toys account for about 0.2%, since traditional toys and branded merchandise hold the majority share.

In the educational toys market, the share is close to 0.3%, supported by interest in learning-oriented customization for early childhood development. The largest share appears in the connected toys market, where personalized toys contribute around 2–3%, boosted by the fusion of digital interactivity with personalization. Although the overall percentage is small, growth is accelerating due to rising consumer preference for unique, experience-driven products.

The use of 3D printing, digital design tools, and e-commerce platforms has made personalization more accessible. These toys are increasingly popular as gifts for birthdays, special events, and educational purposes, creating a competitive niche within both traditional and tech-based toy categories. This trend indicates a strong potential for greater adoption as brands emphasize creativity and individuality in product offerings.

| Metric | Value |

|---|---|

| Personalized Toys Market Estimated Value in (2025 E) | USD 254.7 million |

| Personalized Toys Market Forecast Value in (2035 F) | USD 435.0 million |

| Forecast CAGR (2025 to 2035) | 5.5% |

The personalized toys market is experiencing accelerated growth, driven by increasing consumer preference for individualized experiences and emotional connection through customized products. Shifts in gifting culture, particularly among millennial and Gen Z parents, have contributed to a surge in demand for toys that carry personal relevance, such as names, messages, or likenesses. Technological advancements in digital embroidery, 3D printing, and online customization interfaces have enhanced production scalability and user accessibility.

The rise of e-commerce platforms offering tailored toy options, coupled with high social media engagement around personalized gifting, has strengthened market visibility. Moreover, increased parental spending on premium and emotionally engaging toys has expanded the consumer base for personalized toy offerings.

As awareness of child development and emotional intelligence grows, caregivers are prioritizing products that foster deeper emotional bonds. Regulatory attention to safe, non-toxic materials in the toy industry is also encouraging the adoption of premium, customizable products, paving the way for sustained expansion in both developed and emerging markets.

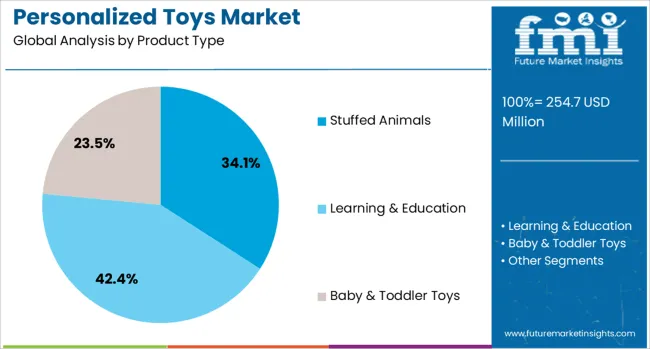

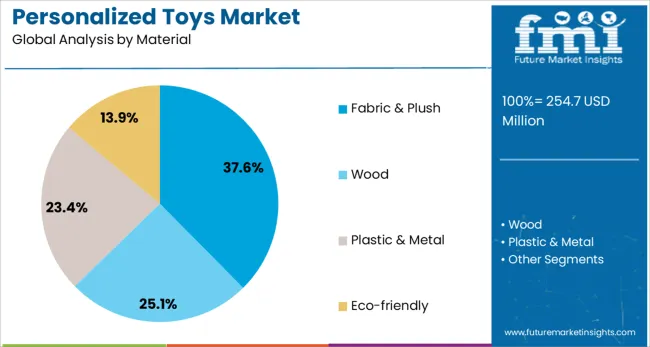

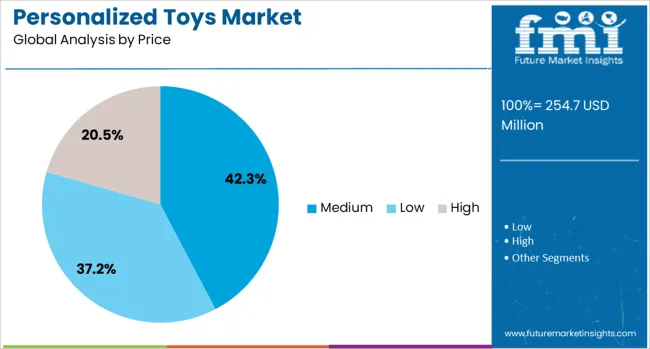

The personalized toys market is segmented by product type, material, price, age group, distribution channel and geographic regions. The personalized toys market is divided by product type into Stuffed Animals, Learning & Education, and Baby & Toddler Toys. In terms of material, the customized toys market is classified into Fabric & Plush, Wood, Plastic & Metal, and Eco-friendly.

Based on the price of the personalized toys, the market is segmented into Medium, Low, and High. By age group of the personalized toys market is segmented into Preschoolers (4-6), infants (0-2 yr), Toddlers (2-4), Primary School Age (6-9), Tweens (9-12), and Teens (12-15). By distribution channel of the personalized toys market is segmented into Online, E-commerce, Company website , and Offline.

Regionally, the personalized toys industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The stuffed animals segment is projected to account for 34.1% of the personalized toys market revenue share in 2025, making it the leading product type. The dominance of this segment is being driven by its high emotional appeal, tactile comfort, and ease of customization. Stuffed animals are frequently selected for personalization due to their soft construction, adaptability to embroidered text or voices, and perceived sentimental value among both children and adults.

The integration of interactive features such as audio messages and memory-foam stuffing has further elevated their perceived value. Demand has been reinforced by increased online gifting and celebration of life events such as birthdays and baby showers, where personalized plush toys serve both decorative and emotional purposes.

Manufacturers have also benefited from low production costs and rapid turnaround for bulk customized orders, improving profit margins. As gift personalization continues to influence consumer choices, stuffed animals are expected to remain the preferred medium for delivering personalized toy experiences.

The fabric and plush material segment is expected to represent 37.6% of the personalized toys market revenue share in 2025. The strong preference for this material is being influenced by its softness, safety, and compatibility with personalization techniques such as embroidery, heat-transfer, and patchwork. The tactile comfort offered by plush materials enhances the emotional attachment between children and their toys, which aligns with the core value proposition of personalized products.

Manufacturers have increasingly opted for hypoallergenic and sustainable plush fabrics in response to rising parental awareness around child safety and eco-conscious buying behavior. The ability to incorporate soft sensors and sound modules within plush material has further boosted its appeal in the interactive personalized toy segment.

Fabric and plush materials also enable ease of cleaning and long-term durability, which are important considerations for both buyers and caregivers. The combination of sensory appeal, safety, and customization flexibility continues to establish fabric and plush as the dominant material choice in this market.

The medium price segment is forecast to contribute 42.3% of the personalized toys market revenue share in 2025, reflecting its dominant appeal across budget-conscious yet quality-driven consumers. This price tier effectively balances affordability with sufficient personalization features, making it a popular choice for both casual buyers and repeat gift givers. Consumers within this segment are typically willing to pay a premium over generic toys for added emotional or creative value but still prioritize reasonable cost.

Market players have tailored offerings in this range to include customizable options such as name printing, message embroidery, or sound modules without significantly increasing production costs. The segment’s growth is further supported by e-commerce platforms offering bundled pricing, occasional discounts, and personalized recommendations, which in turn increase conversion rates.

Brands have also aligned product development with seasonal gifting occasions, ensuring that medium-priced personalized toys remain accessible without compromising on perceived value. This pricing strategy has enabled wide market penetration while sustaining consumer satisfaction and loyalty.

Personalized toys are being created to match individual design preferences and emotional value for consumers. Demand has grown for items featuring name embroidery, printed photos and customizable characters in plush toys, puzzles and action figures. E-commerce channels and retail stores have integrated design tools that allow easy customization and quick order processing. Brands offering precise printing, modular components and fast delivery capabilities are positioned to lead this specialized product segment driven by unique gifting and play experiences.

Personalized toys have been adopted by consumers looking for unique play items and memorable gifts. Options such as name printing, configurable designs and photo-based personalization have enhanced consumer appeal. Online visualization tools have allowed customers to preview designs before purchase, improving accuracy and reducing returns. Premium packaging and tailored messaging options have increased suitability for celebrations and seasonal gifting. As interest in distinctive products continues to grow, manufacturers and online platforms have collaborated to deliver flexible design systems combined with efficient production models to meet the expectations of fast fulfillment and high-quality personalization.

Personalized toy production has been challenged by customization requirements that increase lead times and operational costs. Maintaining consistency in color accuracy, print resolution and assembly for each unique order adds quality control burden. Inventory handling becomes complex when components differ across orders, creating risk of delays and material waste. Integration of online customization systems with factory workflows requires software upgrades and technical expertise. Errors in design selection or personalization details have led to higher return rates, impacting profitability. Price sensitivity in the toy category further restricts scaling personalized options, as manufacturers must balance affordability with premium customization features.

Opportunities have been created by advancements in digital customization tools that allow consumers to design bespoke toys online via color choices, name engravings, and character variations. Rising adoption of direct-to-consumer platforms has facilitated personalization models in both educational and collectible toy segments. Collaboration opportunities have been explored with entertainment franchises to offer limited-edition, user-customized toys. Demand from gifting and milestone occasions has been monetized through personalized packaging and messaging services. Licensing agreements with popular children's brands have enabled co-branded offerings. Expansion into craft and DIY personalization kits is being leveraged to stimulate creativity and engagement. Engagement with subscription-based personalization services is creating recurring revenue streams while enhancing customer loyalty across global consumer markets.

Prevailing trends show that augmented reality (AR) experiences are increasingly being integrated into personalized toys to allow virtual previews before purchase and interactive play after receipt. IoT-enabled personalized toys with embedded sensors are being adopted for adaptive learning and gamified feedback in educational categories. Growth in maker movement initiatives has led to 3D‑printed toy models customized per user requirements gaining popularity. Multi-platform toy lines combining personalization with digital storytelling apps are being commercialized. Lightweight, bio-based materials and non-toxic paints are being selected to align with safety regulations and parental preferences. Data analytics are being employed to recommend personalized toy suggestions based on user behavior, purchase history, and expressed interests, enhancing personalization at scale.

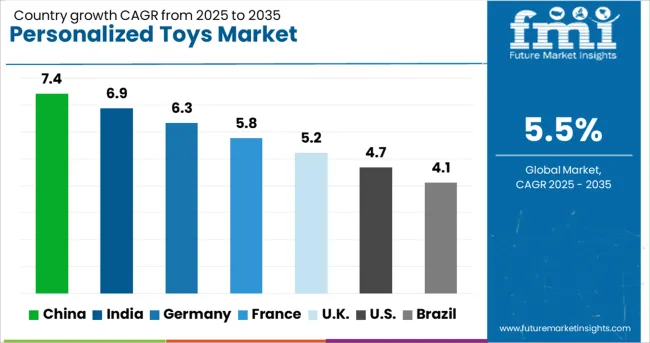

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

The global personalized toys market is projected to grow at a 5.5% CAGR from 2025 to 2035, supported by increased consumer interest in customization and creative play. Among BRICS nations, China leads at 7.4% with strong manufacturing capacity and e-commerce adoption, while India follows at 6.9%, driven by demand for personalized educational kits and gifting products.

Within OECD markets, Germany records 6.3% as premium customization gains traction, and France posts 5.8% with emphasis on handcrafted and luxury gifting toys. The UK grows at 5.2%, supported by subscription-based personalized toy models. The analysis covers over 40 countries, with five top-performing markets highlighted for reference.

China is expected to grow at 7.4% CAGR, supported by robust toy manufacturing capabilities and the growing trend of product personalization. Digital platforms dominate the market with tools for customizing plush toys, educational puzzles, and collector figurines. Companies are leveraging 3D printing technologies to scale personalization while reducing production lead times. Growth is further supported by collaborations between global character licensors and Chinese manufacturers to deliver exclusive personalized collections. Rising disposable incomes and demand for premium gifts among younger parents strengthen market potential.

India is forecast to grow at 6.9% CAGR, supported by strong e-commerce adoption and increasing preference for educational and gifting-oriented personalized toys. Popular formats include name-engraved wooden puzzles, DIY art kits, and photo-based board games. Domestic brands are introducing localized customization options through regional language printing and thematic personalization for festivals. Strategic partnerships with e-marketplaces enhance visibility and allow faster fulfillment of custom orders. Growing awareness of early learning benefits is fueling demand for personalized educational kits targeting preschool and primary segments.

Germany is projected to expand at 6.3% CAGR, driven by strong demand for personalized premium toys in categories such as wooden blocks, plush animals, and educational games. Manufacturers are implementing real-time digital configurators on brand websites to allow consumers to preview and modify toy designs instantly. Compliance with strict EU safety standards remains a critical factor, favoring domestic brands with high-quality manufacturing processes. Growth is also linked to the gifting segment, where personalized toys are increasingly chosen for birthdays and festive occasions. Local firms are leveraging innovative materials and precision printing to strengthen their market position.

France is expected to grow at 5.8% CAGR, supported by increasing demand for handcrafted toys and premium personalization services. Local artisans are leading the customization space with handmade plush dolls, engraved wooden puzzles, and luxury toy kits. Gifting occasions such as baby showers and birthdays contribute significantly to revenue generation. Digital platforms are gaining traction by offering interactive personalization tools for customers seeking quick ordering options. Cross-category collaborations with lifestyle and baby-care brands are enhancing visibility for artisanal personalized toys.

The UK is forecast to grow at 5.2% CAGR, supported by innovative subscription services offering monthly delivery of personalized DIY toy kits. Toy brands are integrating custom printing and engraving features within these subscription models to increase consumer engagement. Online platforms dominate the distribution landscape, providing real-time personalization previews and quick turnaround for orders. Collaborations with children’s book publishers and entertainment franchises are expanding thematic personalization options, targeting both gifting and learning segments. Rising popularity of creative play and educational toys continues to reinforce personalized toy adoption in the UK.

The personalized toys market is shaped by a mix of global toy giants, niche direct-to-consumer brands, creator marketplaces, and print-on-demand networks. Major players such as Mattel, LEGO, Hasbro, Moose Toys, and Spin Master leverage manufacturing scale, retail reach, and licensing agreements with popular IPs to drive seasonal demand, while Build-A-Bear, Wonderbly, and other specialists focus on experience-led customization and higher-margin upsells. Marketplaces like Etsy and Amazon Handmade aggregate small-scale producers that differentiate through design originality and customer service but face ongoing price competition. Print-on-demand providers including Shutterfly, Zazzle, and Printful enable scalable customization through integrated ordering and fast dispatch times. Competitive advantages hinge on IP access, operational speed, compliance with safety regulations such as EN71 and ASTM F963, and personalization depth beyond name printing to include language, skin tone, and co-created elements. Regional dynamics show North America and Western Europe leading in average order values, Asia-Pacific markets emphasizing licensed miniatures and social commerce, and China gaining share in custom photo-based toys. The most defensible market positions are held by brands that combine strong licensing portfolios, efficient operations, and compelling storytelling in their personalized offerings.

In June 2024, Build‑A‑Bear Workshop launched the Mothman Plush Legend Gift Set, a limited-edition release featuring a themed outfit and collectible plush. The product sold out within hours, reflecting strong demand among teen and adult fans and reinforcing the brand’s success in targeting the growing “kidult” segment.

| Item | Value |

|---|---|

| Quantitative Units | USD 254.7 Million |

| Product Type | Stuffed Animals, Learning & Education, and Baby & Toddler Toys |

| Material | Fabric & Plush, Wood, Plastic & Metal, and Eco-friendly |

| Price | Medium, Low, and High |

| Age Group | Preschoolers (4-6), infants (0-2 yr), Toddlers (2-4), Primary School Age (6-9), Tweens (9-12), and Teens (12-15) |

| Distribution Channel | Online, E-commerce, Company website , and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Build-A-Bear Workshop, Shutterfly, Etsy, Fisher-Price, Personalization Mall, Gund, Hallmark, Mark & Graham, Vivid Imaginations, Charmed Memories, Lovey Dovey Designs, The Toy Box, Custom Gifts by You, Teddy Bears of Witney, and Moonpig |

| Additional Attributes | Dollar sales by product type (plush toys, puzzles, dolls, games) and distribution channel (online, specialty retail, gift stores), driven by demand for unique gifting experiences and emotional value products. North America and Europe lead adoption, while Asia-Pacific shows rapid growth in e-commerce-driven personalization. Innovation focuses on interactive customization platforms, sustainable materials, and premium packaging to enhance consumer experience. |

The global personalized toys market is estimated to be valued at USD 254.7 million in 2025.

The market size for the personalized toys market is projected to reach USD 435.0 million by 2035.

The personalized toys market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in personalized toys market are stuffed animals, learning & education and baby & toddler toys.

In terms of material, fabric & plush segment to command 37.6% share in the personalized toys market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Personalized Immunotherapy Market Size and Share Forecast Outlook 2025 to 2035

Personalized Packaging Market Size and Share Forecast Outlook 2025 to 2035

Personalized Nutrition Market - Size, Share, and Forecast Outlook 2025 to 2035

Personalized Beauty Devices Market Trends - Growth & Forecast 2025 to 2035

Personalized Bakery Products Market Analysis by Product Type, Price Range, Sales Channel, End-User and Region 2025 to 2035

Personalized Medicine Market is segmented by Personalized Medicine Diagnostics, Medicine Therapeutics, and Medical Care from 2025 to 2035

Personalized Home Decor Market Insights & Forecast 2024-2034

Personalized Skincare Serum Market Trends – Demand & Forecast 2024-2034

Personalized Orthopaedic Implant Market

Hyper-Personalized Fitness Market Insights & Forecast 2025-2035

3D-Printed Personalized Masks Market Size and Share Forecast Outlook 2025 to 2035

Pet Toys Market Analysis – Size, Share & Forecast 2025 to 2035

Cat Toys Market Analysis by Product Type, Material Type, Sales Channel, End-User, Application and Region Through 2035

Kids Toys Market Size and Share Forecast Outlook 2025 to 2035

Fabric Toys Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Toys Market Size and Share Forecast Outlook 2025 to 2035

Male Sex Toys Market Forecast and Outlook 2025 to 2035

Die Cast Toys Market Size and Share Forecast Outlook 2025 to 2035

Connected Toys Market Size and Share Forecast Outlook 2025 to 2035

Traditional Toys and Games Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA