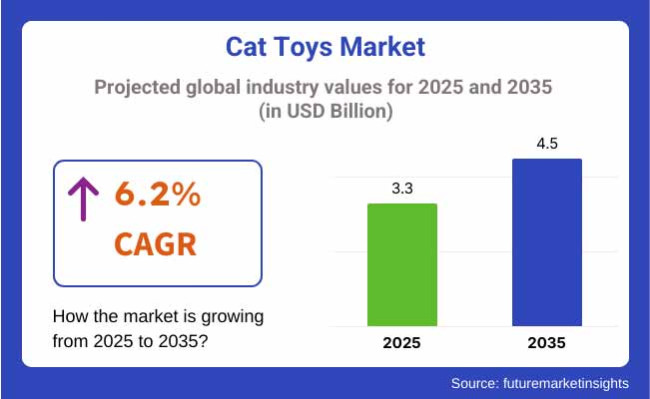

The cat toys market is anticipated to grow substantially, from USD 3.3 billion in 2025 to USD 4.5 billion in 2035, with a CAGR of 6.2% during the forecast period. The key drivers for growth are increased pet humanization, increased disposable incomes, and increased demand for enrichment and interactive-based toys. Advances in technology have also promoted the use of smart and autonomous pets that are specifically made to entertain animals, even in the absence of the owners.

The evolving demand of pet owners toward toys that encourage physical exercise, mental stimulation, and cognitive development are driving new product launches. Puzzle toys, motion-sensitive toys, and treat-dispensing toys are gaining traction, reflecting the improvement trend in pet welfare. Furthermore, eco-sensitive pet owners are seeking eco-friendly and non-toxic materials, pushing companies to produce biodegradable and recyclable products.

Urbanization and lifestyle transformation have led to growth in single-pet households, with owners spending on premium and durable toys. Automated toys driven by artificial intelligence are poised to lead the industry as they solve the growing number of busy pet owners seeking high-performance pet entertainment devices. Growth in subscription-based toy models is also assisting in generating recurring revenues for big industry players.

Producers are focusing on diversification and customization of products through digital platforms and e-commerce, delivering products. Increasing exposure to online shopping, in addition to the social media effect on buying behavior, is increasing industry exposure and consumer engagement.

As such, firms are adding marketing to influencer sponsorship and product demonstration.Regulatory compliance with toy safety standards continues to be at the top of the agenda. Stricter regulation on material composition and strength standards will impact production processes. Organizations that invest research and development expenditure to comply with these while developing innovations will have a competitive advantage.

Emerging directions like technology, green initiatives, and studies of feline interaction behavior are driving increased demand for cat toys. The direction towards robots and artificially intelligent toys, that provide stimuli even in the absence of the owner, is dominating the industry. Predator-like behavior-oriented toys, i.e., robot mice and laser toys, are increasing due to their ability to draw long-term interest and stimulate interaction.

Longevity and durability are rapidly becoming part of the core concerns, with individuals opting for non-toxic, long-lasting, and sustainable toys. The firms are addressing this requirement by using superior-quality silicone, natural fibers, and reinforced plastic that provides an extended lifespan for the product. Pet owners also require interactive toys that can be operated by remote smartphone apps, providing a higher level of interaction through digital means.

Price is always a key consideration for consumers making any purchases, and quality smart toys can cost a premium, so they are worth a premium price. Budget-minded consumers look for low-cost solutions that don’t sacrifice too much in function for the price, though. Subscription concepts designed around some sort of thematic monthly delivery of play items are getting more and more traction for providing longitudinal novelty.

Pet ownership was largely driven by the pandemic, which led people to adopt cats to keep them company during lockdown. Accordingly, cat owners tend to invest in toys that promote both physical and mental exercise for their cats. Revenge play has led to the introduction of automatic laser toys, motion-sensing toys and smart feeders that keep felines entertained in the absence of their humans.

PetSafe (which makes a number of pet toys, most notably a series of barking control products) and KONG (best known for its signature rubber toy with that never quite seems to die) have expanded their offerings to include cats with products designed to tap into cats’ inherent hunting instincts, including feather wands, teasers and puzzle play toys. There has been a rise in our friendly feline toys, such as bamboo types and organic cotton toys, as there is a growing consumer demand for sustainable solutions.

During the forecast period, the industry will be dominated by smart playthings that use technology to harness artificial intelligence to activate play toys that get to know a cat's preferences over time and set daily routines. Motion sensors and smart technology will help create toys that are able to learn and adapt to a cat's activity level and will need little human input to keep it interesting.

Sustainability is still going to be a megatrend as producers will turn to practical biodegradable and recyclable materials to meet the consumers' need for environmentally acceptable business. We will also see a trend towards personalized cat toys that are made specifically for each breed and size, with every toy being catered to the needs of each type of cat. With the increasing availability of premium-priced pet products, we can expect to see the expansion of customization and luxury factors in the industry as pet owners desire to provide optimal care to their pets.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Pet adoption boosted due to the pandemic. | Increased pet health and mental stimulation awareness. |

| Innovations in AI-based interactive toys for customized play. | Ongoing demand for green and sustainable products. |

| Launch of automated laser toys, motion sensor toys, and interactive puzzle toys. | Expansion of green toys produced using organic cotton and bamboo. |

| Designing smart pet toys that can learn and adapt according to cats' behavior through the use of motion sensors. | Personalized and custom cat toys based on different breeds of cats. |

| Playful cat toys stimulating the natural habits of cats such as playing and hunting. | Smartphone-controlled pet toys so that the owner can initiate it from a remote location. |

| Utilization of AI technology for toys that adapt to the cat's playing patterns. | The use of motion sensors and smart technology to create automatic play. |

| Growing trend for biodegradable and sustainable toys. | Growing demand for natural material such as bamboo and organic cotton. |

| Green manufacturing processes with an emphasis on recyclable and biodegradable products. | Increased interest in zero-waste products within the pet toy segment. |

The industry is faced with a portfolio of issues that can impact growth and consumer confidence. The biggest threat is increased regulatory focus on the safety of pet toys. Increased quality control and material measures have the potential to drive up the cost of production, leading manufacturers to be forced onto a tightrope between compliance and cost. Companies that are unable to meet adapting safety standards risk product recall and reputational loss.

Supply chain disruption is another acute issue, predominantly in raw materials procurement. Reliance on overseas material suppliers of goods such as electronic sensors and green materials keeps the avenue of price swings and transit issues open. Greater emphasis on local materials and local solution manufacturing will lessen the risks.

Industry saturation and boredom among consumers due to repetitive product releases can lead to demand stagnation. In response, brands must focus on continuous innovation with the help of AI, smart technology, and behavioral science to develop unique and engaging toy solutions. Companies that invest in strategic marketing, branding, and product differentiation will be well-positioned to attain long-term growth in such a competitive industry.

The global cat toys market presents regional pricing trends for cat toys in different areas, considering the higher pet ownership rate, disposable number income, and product innovation. In North America (USA & Canada), toys range from USD 3 for basic toys like feather wands to over USD 50 for tech-enabled smart toys. Interactive toys in the mid-range, including puzzle feeders and simple motorized mice, are priced at USD 10 and USD 25.

In contrast to normal toys, subscription boxes are becoming very popular (KitNipBox, etc.), retailing at USD 15-30 per month. Europe (UK, Germany, France) - USD 2-USD 45 per toy, eco/ designer toys usually carry a 10-20% premium. The market is supported by strong eCommerce penetration.

In Asia-Pacific, the budget segment, where toys cost between USD 1.50 and USD 7, leads with China, while Japan’s high-end products, such as Catit Senses 2.0, begin at USD 15. Price sensitivity is what drives sales in India, with 70% of sales falling under USD 5. In Latin America (Brazil, Mexico), toys are priced below USD 5, while the toy segment in USA brands like KONG retails at USD 16 or more.

The Middle East (UAE) has the luxury demand, and electronic toys are 20-30% more expensive than USArates. Smart and eco-friendly toys have elevated pricing trends - which are adding 5% to prices across the year - and online discounts (10-20%) remain a global margin headwind.

The industry is expected in 2025 to grow predominantly by two types of products, Interactive Toys and Chew Toys, which are projected to hold industry shares of 28% and 20%, respectively.

Interactive toys gain popularity as owners seek to stimulate their pets mentally and physically. North America has witnessed increased demand for such products as more cats stay indoors. The introduction of innovative toys like the ScoopFree Smart Scoop by PetSafe and Smarty Kat, which simulates the act of capturing, and the Hunting Feeder, which promotes slow eating while stimulating the cat's mind, are excellent examples.

At the same time, pet owners are searching for premium products offering enrichment and entertainment, so the last trend is said to indicate a movement toward higher-quality interactive toys. The previous trend is therefore driven by ensuring a better quality of life for their pets.

The rise of chew toys, with this category having an estimated industry share of 20%, is attributed to their dental health benefits and engagement. KONG has launched biodegradable chew toys in Europe to satisfy the rising demand for environmentally friendly products. Trixie, a key player in Germany, is dedicated to producing eco-friendly interactive toys from sustainable materials.

In fact, these trends show the rising consumer preference for chew toys that are more natural and durable. In Asia, especially in Japan, there seems to be a considerable demand for high-tech products for pets, such as Petcube Play, which allows owners to interact with their cats using a mobile app. This drive toward tech-based, interactive toys reflects the desire for advanced and convenient solutions for pet care.

In 2025, Rubber is expected to dominate the industry, holding 30% of the industry share, while Plastic will account for 25% of the industry share.

Rubber toys are the most popular in North America due to their high durability and dental health benefits. The most important brands include KONG, which designs rubber toys with a treat dispenser for more interaction, while Nylabone aims for rubber chew toys that are very lengthy and non-toxic. Denotes durability and enablement of versatility, such that needed entertainment and developmental benefits are given to the cats using it.

In Europe, lean more toward only eco-friendly toys made from natural materials, as plastics are being avoided. Carrying the new trend, most German companies, such as Trixie, are already coming out with more sustainable products that will be welcomed in environmental consciousness among pet owners. Some of the materials are under design for recyclability or biodegradability as well.

High-tech interactive toys like ''Petcube Play'' are becoming popular among pet owners in Asia, especially Japan. Rubber and plastic toys are still popular, with increased emphasis on safety and quality in addition to mental stimulation. The trend toward tech-driven, interactive products is growing in urban areas, where storage constraints make indoor entertainment solutions considerably more appealing.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 7.1% |

| UK | 6.9% |

| France | 6.8% |

| Germany | 7% |

| Italy | 6.7% |

| South Korea | 7.2% |

| Japan | 7.1% |

| China | 7.6% |

| Australia | 6.9% |

| New Zealand | 6.8% |

The United States is facing long-term expansion with more focus on pet health, pet play high-tech technology, and the pet humanization trend. Intelligent and interactive cat toys, like motion-sensing and smartphone-accessible toys, are facing international acceptance by cat owners to create more stimulation.

Subscription-based products are also a propelling factor for the industry, ensuring convenience and product variety for customers. Apart from that, sustainability is increasingly becoming a big factor with organizations manufacturing eco-friendlier and nontoxic goods. Kong, Petstages, and SmartyKat are leading the industry and have a strongly established pet industry.

The UK industry is expanding due to the popularity of cats as pets and an increased awareness of the necessity to stimulate their bodies and minds physically and mentally. Feather teasers, puzzle toys, and laser interactive items are the most sought-after by city dog owners. Besides this, demand for eco-friendly, biodegradable, and environment-friendly materials is also driving purchases, with the emphasis being on natural and handmade products among the majority of brands.

Direct-to-consumer companies and online platforms have experienced exponential sales, offering consumers the convenience of easily accessing a range. Major pet companies such as Rosewood, Ancol, and Happy Pet are continuously trying to meet the evolving needs of pet owners.

The French industry has been increasing consistently due to a robust pet culture and growing interest in high-quality products. French consumers prefer to use high-quality, long-lasting, and design-based cat toys that cater to the French preference for quality and beauty.

There is increasing demand for designer and luxury pet products, with both international and domestic brands focusing on high-end pet owners. There is also a growing demand for eco-friendly, handmade toys from natural materials such as wool and recycled materials. Pet influencers and internet marketing are also driving online sales and brand awareness.

Germany's industry is characterized by an emphasis on veterinarian-recommended, high-quality, and functional toys that encourage exercise as well as mental development. Treat-dispensing toys and interactive agility items are increasing in popularity as indoor cats require stimulating homes.

The industry is also observing a growing interest in organic and nontoxic materials, which merely echoes Germany's general environmental consciousness. Industry trend drivers such as Trixie, Karlie, and Hunter continue to ensure that these evolving consumer needs are being met with secure and durable goods. Pet specialty store outlets and web services have also ensured better access.

Italy's industry is growing similarly, with rising pet adoption and the craving for homemade and handmade products. Italian pet owners are particularly drawn to fashionable, good-looking pet accessories like wooden and textile handmade toys. The trend towards multiple cat households is also creating a stir in the interactive toys that challenge and allure cats as well as encourage them to move by exercise or play.

Lastly, there is also a new emerging demand for premium, natural, and biodegradable products due to how much Italian consumers care about becoming green. As e-commerce has increased, international brands have also gained momentum in the Italian industry.

The industry in South Korea is increasing at a very rapid pace due to increasing numbers of pet families and the increasing trend of high-end pet grooming. Advanced levels of technology achieved by people have led to the boom for cat toys based on AI, controlled through apps and interactive robotics.

Automated pet devices with long-range play and tracking capabilities, which are smarter, are strongly demanded by metropolitan-based pet keepers. Online and offline retail are being dominated by online and offline specialty stores and by local players, as well as international imports catering to pet lovers who appreciate product quality and ease.

Japan's cultural fondness for cats is maintaining the demand in Japan's economy, and cat-keeping is particularly prevalent in the urban environment. Small residential areas have promoted demands for convenience and space-saving items that are enjoyable and provide exercise. Coupled with this, the emphasis on quality and durability also reflects consumer preference, where products of high quality and durability are desired.

Sophisticated and high-tech toys like sensor-based toys and AI-based toys are increasingly being favored in the nation's highly digitized consumer economy. The use of traditional hand-crafted pet toys, including wooden toys and cloth toys, is also a developing trend in the industry.

China's industry is also witnessing fast-paced development with growing disposable incomes and rising numbers of families keeping pets. Advanced-technology pet toys, such as AI and smart app-enabled ones, are highly sought-after due to the country's popularity for advanced technology solutions.

Social media and live-streaming platforms have become highly featured in promoting products that inform consumer purchasing, as well as brand awareness. Cross-border business has become more fashionable in offering consumers access to high-end international brands. China's strong manufacturing base has brought with it a plethora of local players with low-cost but innovative pet products, adding further impetus to industry growth.

Australia's industry is growing modestly with support from increasing pet ownership and high enthusiasm for pet health and enrichment. Australian pet owners favor high-quality, eco-friendly, and durable toys, and they have a preference for locally made natural products.

Enrichment toys, such as treat-dispensing toys and puzzle feeders, are increasingly being demanded by owners to keep their indoor cats active and stimulated. An established country pet care sector, along with expanded online shopping stores, ensures access to an extensive variety. Local players, as well as international players, still drive the dynamics of the industry.

New Zealand's industry is increasing steadily with increased interest in eco-friendly and ethical pet products. There is significant demand in New Zealand for handmade, biodegradable, and natural-material toys, which indicate the country's general environmental consciousness.

Interactive and enrichment toys like puzzle games and feather wands are particularly popular among cat owners who are concerned with stimulating the minds and bodies of their cats. The industry is also seeing a rise in internet shopping, with online pet shops offering various products. Local and foreign brands are also following the evolving needs of customers.

The industry is still seeing tremendous growth as more and more people take pets into their homes, thus increasing the competition among the major players trying to get hold of this emerging industry. Major brands in the industry include Kong Company, Petstages (Outward Hound), Catit (Hagen Group), and SmartyKat (Worldwise), and they are coming up with innovations to answer the increased need for those interactive, tough, and stimulating toys that consider both mental and physical form with an improved well-being for cats.

Kong Company is the known leader in pet toys and remains a dominant name with its focus on tough as well as interactive products, which encourage both play and mental stimulation, as with its wide variety of offerings, such as Kong Classic and all its different puzzle toys.

All these are designed to engage cats and provide them with enrichment to meet their instincts for play. Likewise, Petstagescontinues to broaden its product portfolio under Outward Hound by developing puzzle toys and motion-activated gimmicks for cats, resulting in an enjoyable and challenging experience for felines.

That would be Catit within the Hagen Group because they will be more up-to-date on the high-tech, motion-activated toys used to catch that predatory instinct in cats. Catit also dedicates itself to safety and sustainability by choosing eco-friendly materials and following the trend of environmentally conscious pet care products. SmartyKat (Worldwise) is also in the same line when taking advantage of sustainability trends; it has an entire collection of toys from recycled and non-toxic materials to lure eco-friendly parents for their pets.

Apart from the traditional toy formats, one observes an increasing demand for the subscription-based commodity of pet toy boxes that bring an array of engaging yet personalized objects to meet the individual needs of the pets. Such innovations would be in addition to the growing interactive, technologically oriented toys, which are making the competition fierce among companies that want to develop differentiation along innovation lines for modern pet owners' evolving needs.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Kong Company | 15-20% |

| Petstages (Outward Hound) | 12-16% |

| Catit (Hagen Group) | 10-14% |

| SmartyKat ( Worldwise ) | 8-12% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Kong Company | The i ndustry leader in durable, chew-resistant, and treat-dispensing cat toys. Focuses on enrichment, interactive play, and stress relief. |

| Petstages (Outward Hound) | Specializes in interactive, motion-activated, and chew-friendly cat toys. Known for mentally stimulating puzzle toys. |

| Catit (Hagen Group) | Offers high-quality, interactive, and multi-functional toys, including cat tunnels, water fountains, and track-based toys. |

| SmartyKat ( Worldwise ) | Produces eco-friendly, organic catnip toys, along with motion and sound-activated play items for feline engagement. |

Key Company Insights

Kong Company (15-20%)

Expanding its range of treat-dispensing cat toys, integrating rubber and silicone materials for durability.

Petstages (Outward Hound) (12-16%)

Innovating in puzzle-based and motion-activated toys, targeting indoor cats with high-energy play solutions.

Catit (Hagen Group) (10-14%)

Strengthening its track toy and interactive toy portfolio with a focus on smart and self-entertaining features.

SmartyKat (Worldwise) (8-12%)

Increasing its eco-friendly and organic cat toy lines, using recycled materials and natural catnip blends.

Other Key Players (40-50% Combined)

By product type, the industry is segmented into Interactive toys, chew toys, feather toys, ball toys, plush toys, laser toys, and others.

By material type, the industry is categorized into rubber, plastic, fabric, sisal, and others.

By sales channel, the industry is divided into supermarkets/hypermarkets, specialty pet stores, online, convenience stores, and others.

By end user, the industry is segmented into kittens, adult cats, and senior cats.

By application, the industry is categorized into exercise & fitness, stress relief, training & stimulation, and entertainment.

By region, the industry is divided into North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa (MEA).

The industry is expected to reach USD 3.3 billion in 2025.

The industry is projected to grow to USD 4.5 billion by 2035.

China is expected to experience significant growth with a 7.6% CAGR during the forecast period.

The Interactive Toys segment is one of the most popular categories in the industry.

Leading companies include Kong Company, Petstages (Outward Hound), Catit (Hagen Group), SmartyKat (Worldwise), Frisco (Chewy), Yeowww! Catnip, and PetFusion.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Product, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Product, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Product, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 21: Global Market Attractiveness by Product, 2023 to 2033

Figure 22: Global Market Attractiveness by Material Type, 2023 to 2033

Figure 23: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 45: North America Market Attractiveness by Product, 2023 to 2033

Figure 46: North America Market Attractiveness by Material Type, 2023 to 2033

Figure 47: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Material Type, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Product, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Product, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Product, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Material Type, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Material Type, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Product, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Distribution Channel, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Product, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Material Type, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Educational Toys Market Analysis and Overview by Category, End-use Sector, and Area through 2035

Cathode Materials for Solid State Battery Market Size and Share Forecast Outlook 2025 to 2035

Cathodic Protection Market Size and Share Forecast Outlook 2025 to 2035

Cat Litter Product Market Size and Share Forecast Outlook 2025 to 2035

Cattle Feed Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Catalog Management System Market Size and Share Forecast Outlook 2025 to 2035

Cattle Squeeze Market Size and Share Forecast Outlook 2025 to 2035

Cathodic Acrylic Market Size and Share Forecast Outlook 2025 to 2035

Cattle Feeder Panels Market Size and Share Forecast Outlook 2025 to 2035

Cattle Head Catch Market Size and Share Forecast Outlook 2025 to 2035

Cattle Grooming Chute Market Size and Share Forecast Outlook 2025 to 2035

Catering Management Market Size and Share Forecast Outlook 2025 to 2035

Catecholamines Market Size and Share Forecast Outlook 2025 to 2035

Cattle Handling Systems Market Size and Share Forecast Outlook 2025 to 2035

Cattle Blower Market Size and Share Forecast Outlook 2025 to 2035

Cattle Mineral Feeder Market Size and Share Forecast Outlook 2025 to 2035

Cattle Feeder Market Size and Share Forecast Outlook 2025 to 2035

Cat Vaccines Market Size and Share Forecast Outlook 2025 to 2035

Cat Food Toppers Market Size and Share Forecast Outlook 2025 to 2035

Cattle Management Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA