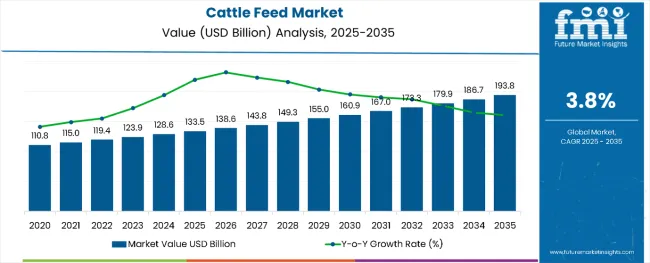

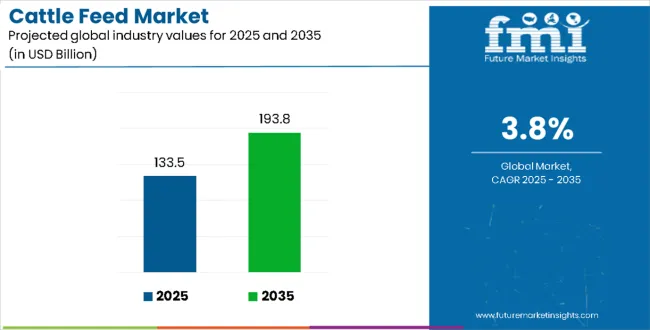

The global cattle feed market is projected to grow from USD 133.5 billion in 2025 to approximately USD 193.8 billion by 2035, recording an absolute increase of USD 60.2 billion over the forecast period. This translates into a total growth of 45.1%, with the market forecast to expand at a compound annual growth rate (CAGR) of 3.8% between 2025 and 2035.

The overall market size is expected to grow by nearly 1.45X during the same period, supported by the rising global cattle population and increasing demand for animal protein products across developing and developed markets.

Cattle Feed Market Key Takeaways

| Metric | Value |

|---|---|

| Cattle Feed Market Value (2025) | USD 133.5 billion |

| Cattle Feed Market Forecast Value (2035) | USD 193.8 billion |

| Cattle Feed Market Forecast CAGR | 3.8% |

Between 2025 and 2030, the cattle feed market is projected to expand from USD 133.5 billion to USD 161.1 billion, resulting in a value increase of USD 27.6 billion, which represents 45.9% of the total forecast growth for the period. This phase of growth will be shaped by rising cattle farming activities in emerging markets, increasing focus on livestock productivity enhancement, and growing demand for quality feed formulations. Feed manufacturers are expanding production capabilities to meet diverse nutritional requirements across different cattle farming systems and geographic regions.

From 2030 to 2035, the market is forecast to grow from USD 161.1 billion to USD 193.8 billion, adding another USD 32.6 billion, which constitutes 54.1% of the overall ten-year expansion. This period is expected to be characterized by technological advancements in feed processing, development of specialized nutritional formulations, and increasing adoption of precision feeding systems. The growing emphasis on sustainable livestock production and feed efficiency optimization will drive demand for innovative feed solutions and specialized manufacturing expertise.

Between 2020 and 2025, the cattle feed market experienced steady expansion, driven by increasing global meat consumption and growing awareness about the importance of quality nutrition in livestock production. The market developed as cattle farmers recognized the value of scientifically formulated feeds in improving animal health, productivity, and feed conversion ratios. Rising disposable incomes in emerging markets and expanding commercial cattle farming operations contributed significantly to market development during this period.

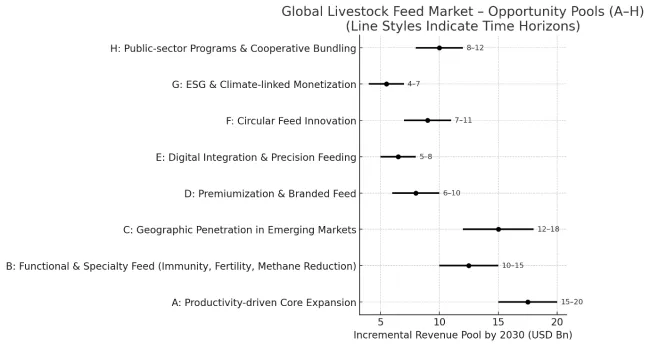

The decade ahead is transformative for cattle feed. Farmers, cooperatives, policymakers, and innovators are converging on one goal: productive, sustainable, and climate-smart livestock systems. This creates eight powerful growth pathways, together unlocking USD 67-101 billion in incremental revenue by 2035.

Pathway A - Productivity-Driven Core Expansion.

Fortified feed blends of protein, vitamins, and minerals are scaling rapidly. Smallholder and commercial farms adopt to boost milk yields and weight gain. This remains the largest near-term growth lever. Expected revenue pool: USD 15-20 billion by 2035.

Pathway B - Functional & Specialty Feed.

Probiotics, enzymes, omega-3s, and phytogenic additives enter mainstream adoption. Methane-reducing formulations offer climate benefits while enhancing productivity. Opportunity size: USD 10-15 billion.

Pathway C - Geographic Penetration.

Emerging markets in Asia, Africa, and Latin America move from traditional feed to structured rations. Localized feed mills and low-cost formulations drive expansion. Potential pool: USD 12-18 billion.

Pathway D - Premiumization & Branded Feed.

Branded, certified feed with traceability (organic, non-GMO, antibiotic-free) gains traction among high-income farmers and export-oriented producers. Incremental value: USD 6-10 billion.

Pathway E - Digital Integration & Precision Feeding.

IoT sensors and AI-based ration balancing transform feed into a data-driven service. Mobile dashboards track yield, health, and emissions. Expected revenue pool: USD 5-8 billion.

Pathway F - Circular Feed Innovation.

Upcycling of distillers’ grains, oilseed cakes, and food waste delivers cost-effective, sustainable feed. Adoption is accelerating in both advanced and resource-constrained markets. Market pool: USD 7-11 billion.

Pathway G - ESG & Climate-Linked Monetization.

Low-emission feeds tied to carbon credits and ESG-linked premiums create financial upside. Certification in sustainable dairy and beef strengthens adoption. By 2035, this may add USD 4-7 billion.

Pathway H - Public-Sector Scale-Up.

Governments and cooperatives push structured feed through food security and climate adaptation programs. Subsidy inclusion expands reach to millions of smallholders. Expected upside: USD 8-12 billion.

The cattle feed market is experiencing significant growth, driven by the increasing global demand for beef and dairy products and the rising emphasis on animal health and productivity. As the global cattle population expands, the need for nutritionally balanced feed that enhances milk yield, improves meat quality, and supports overall animal well-being becomes even more critical. The push toward sustainable livestock practices has further encouraged the development of advanced feed formulations designed to optimize performance while minimizing environmental impact.

Key factors contributing to market growth include:

The market is segmented by product type, form, and region. By product type, the market includes concentrate foods, roughages (such as pasture, hay, silage, straw, hulls, and root crops), feed additives, and extruded feeds. Based on form, the market is categorized into pellets, extruded feeds, mash, cubes, flakes, silage, hay, straw, liquids, grit, and block feeds. Regionally, the market covers key countries including India, Japan, the United Kingdom, the United States, Germany, China, and Brazil.

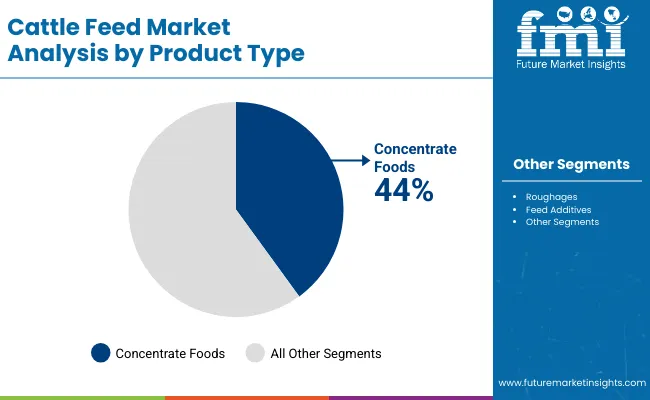

Concentrate foods are projected to account for 44% of the cattle feed market in 2025. This leading share is supported by the widespread use of concentrate feeds in commercial dairy and beef operations where high energy and protein content are essential for optimal animal performance.

Concentrate foods provide essential nutrients in easily digestible forms, making them preferred choices for lactating cows and growing cattle. The segment benefits from established manufacturing processes and proven effectiveness in improving feed conversion ratios and animal productivity.

The dominance of concentrate foods reflects their critical role in modern cattle nutrition programs where balanced energy and protein ratios directly impact milk production and weight gain performance. These formulations typically contain grains, protein meals, and essential vitamins that complement forage-based diets in commercial operations.

Feed manufacturers have developed sophisticated concentrate blends that address specific nutritional requirements for different cattle categories including dairy cows, beef cattle, and growing animals. The segment's growth is further supported by increasing adoption of Total Mixed Ration systems in commercial dairy operations where concentrates are precisely blended with roughages to optimize nutritional delivery.

Advanced concentrate formulations also incorporate feed additives and performance enhancers that improve digestive efficiency and animal health outcomes, making them indispensable components of modern cattle feeding programs across both intensive and extensive production systems.

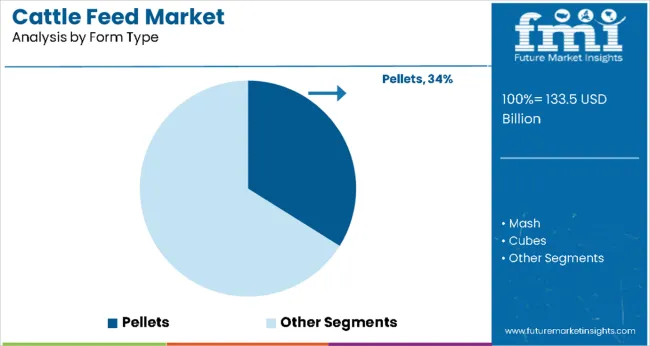

Pellets are expected to represent 34% of cattle feed form type demand in 2025. This dominant share reflects the practical advantages of pelleted feeds including reduced feed waste, improved handling characteristics, and better nutrient density compared to other forms.

Pelleted feeds offer convenient storage and transportation benefits while maintaining nutritional integrity and reducing selective feeding behaviors in cattle. The segment benefits from widespread acceptance among commercial cattle operations and established pelleting infrastructure across major feed manufacturing regions.

The pelleting process enhances feed palatability and digestibility while eliminating dust formation that can affect animal respiratory health and feed handling efficiency. Modern pelleting technologies enable manufacturers to produce uniform feed particles that ensure consistent nutrient distribution and reduce sorting behavior in cattle feeding systems.

The physical structure of pelleted feeds allows for better integration of liquid nutrients, fats, and heat-sensitive ingredients that would otherwise be difficult to incorporate in mash or loose feed forms. Pelleted feeds demonstrate superior storage characteristics with reduced susceptibility to spoilage and contamination compared to other feed forms, making them particularly valuable in humid climates and extended storage applications.

The segment's continued growth is supported by increasing mechanization in cattle feeding operations where pelleted feeds can be efficiently handled through automated feeding systems, reducing labor requirements while maintaining consistent feed delivery. Additionally, pelleted feeds enable precise portion control and simplified inventory management in large-scale cattle operations where feed efficiency and cost control are critical success factors.

The Cattle Feed market is advancing steadily due to increasing cattle populations and growing demand for animal protein products. However, the market faces challenges including fluctuating raw material prices, regulatory requirements for feed safety, and competition from alternative protein sources. Technological innovations in feed formulation and processing continue to influence product quality and market development patterns.

Development of Specialized Nutritional Formulations

The growing focus on precision nutrition is enabling feed manufacturers to develop specialized formulations tailored to specific cattle breeds, production stages, and farming systems. Advanced feed formulations incorporate targeted nutrients, probiotics, and performance enhancers that optimize animal health while improving production efficiency. These specialized products are particularly valuable for high-producing dairy operations and intensive beef production systems where marginal improvements in feed efficiency can significantly impact profitability.

Integration of Sustainable Feed Ingredients and Processing Technologies

Modern cattle feed manufacturers are incorporating alternative protein sources and sustainable ingredients that reduce environmental impact while maintaining nutritional quality. Development of advanced processing technologies including extrusion, pelleting, and liquid coating systems enables better nutrient utilization and feed palatability. Advanced processing also supports incorporation of heat-sensitive nutrients and bioactive compounds that enhance animal health and production performance.

| Country | CAGR (%) |

|---|---|

| India | 8.2 |

| Japan | 4.3 |

| United Kingdom | 3.5 |

| South Korea | 3.4 |

| Brazil | 3.0 |

| United States | 2.8 |

| China | 2.1 |

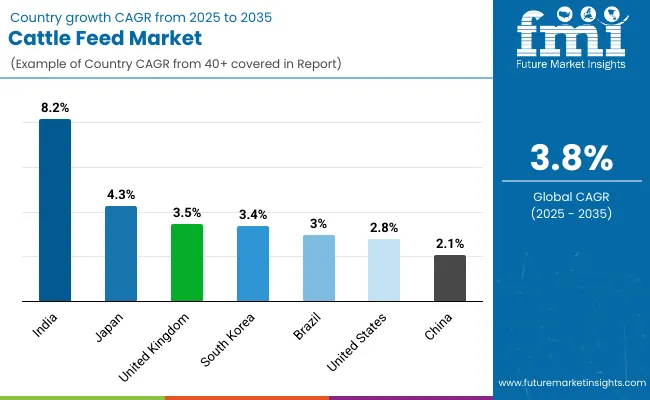

The global cattle feed market shows diverse growth trends across major regions. India leads with the highest projected growth at 8.2% CAGR, driven by its large cattle population, expanding dairy sector, and government livestock development programs promoting scientifically formulated feeds. Japan follows with 4.3% CAGR, supported by advanced livestock technology, premium beef production, and precision feeding systems.

The United Kingdom and Germany both exhibit moderate growth at 3.5% CAGR and 3.4%, fueled by strong dairy industries, sustainability initiatives, and demand for high-quality feed formulations. Brazil maintains steady expansion at 3.0% CAGR, leveraging extensive pasture-based cattle systems and export-oriented beef production.

The United States grows at 2.8% CAGR, supported by large-scale commercial operations and advanced feed manufacturing capabilities. China shows emerging potential with 2.1% CAGR, reflecting modernization of cattle farming and rising domestic protein consumption.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from cattle feed in India is projected to exhibit strong growth at 8.2% CAGR through 2035, driven by the country's large cattle population and expanding dairy industry. India's traditional reliance on cattle for milk production and growing commercial farming operations are creating significant demand for quality feed formulations. The government's focus on livestock productivity improvement and dairy sector modernization programs are supporting increased adoption of scientifically formulated cattle feeds across rural and commercial farming operations.

India's expanding organized dairy sector and growing awareness about the importance of balanced nutrition in cattle farming are enabling market development across diverse geographic regions. The country's focus on self-sufficiency in animal protein production and export potential in dairy products support comprehensive cattle feed market growth.

Revenue from cattle feed in Japan is expanding at 4.3% CAGR, supported by the country's advanced livestock technology and premium beef production systems. Japan's emphasis on high-quality beef production, particularly for premium Wagyu cattle, creates demand for specialized feed formulations that enhance meat quality and marbling characteristics. The country's aging rural population and focus on production efficiency are driving adoption of advanced feed technologies and convenient feed forms.

Japan's technological leadership in feed processing and quality control systems enables production of specialized cattle feeds that meet stringent quality requirements. The country's focus on food safety and traceability extends to cattle feed production, creating demand for premium feed ingredients and advanced manufacturing processes.

Revenue from cattle feed in the United Kingdom is projected to grow at 3.5% CAGR, supported by the country's significant dairy industry and established beef production systems. UK farmers demonstrate strong preference for high-quality feed formulations that optimize milk production and animal health while meeting stringent environmental and welfare standards. The country's focus on sustainable agriculture and carbon footprint reduction is driving adoption of environmentally friendly feed ingredients and efficient production systems.

The United Kingdom's emphasis on livestock welfare and sustainable farming practices aligns with market trends toward feeds that support animal health while reducing environmental impact. The country's position as a major dairy producer supports consistent demand for specialized dairy cattle feed formulations.

Revenue from cattle feed in the United States is expanding at 2.8% CAGR, driven by large-scale commercial cattle operations and advanced feed manufacturing infrastructure. The US cattle industry's focus on efficiency and productivity creates consistent demand for scientifically formulated feeds that optimize animal performance across diverse production systems. The country's position as a major beef producer and established feedlot industry support significant cattle feed consumption volumes.

The United States' technological leadership in feed manufacturing and quality control enables production of specialized formulations that meet diverse cattle nutrition requirements. The country's emphasis on production efficiency and cost optimization drives adoption of feeds that improve feed conversion ratios and reduce production costs.

Demand for cattle feed in South Korea is projected to grow at 3.4% CAGR, driven by the country's focus on high-quality livestock production and advanced farming practices. South Korean cattle farmers show a strong preference for feeds that meet stringent nutritional standards while promoting animal welfare and efficient production. The country’s premium beef and dairy industries are key drivers of demand for high-quality feed formulations.

South Korea's leadership in feed technology influences trends toward more effective and innovative feed solutions. The growing interest in organic and non-GMO farming systems supports a rise in demand for certified organic cattle feeds.

Revenue from cattle feed in China is expanding at 2.1% CAGR, driven by the country's large-scale livestock operations and growing domestic beef consumption. China's modernization of cattle farming practices and increasing adoption of commercial feed formulations are creating opportunities for quality feed manufacturers. The country's focus on food security and livestock productivity improvement supports development of advanced feed manufacturing capabilities across major agricultural regions.

China's expanding middle class and rising protein consumption create consistent demand for cattle products, driving increased feed requirements across both dairy and beef production systems. The government's agricultural modernization policies and support for large-scale farming operations enable adoption of scientifically formulated feeds that optimize production efficiency.

Demand for cattle feed in Brazil is projected to grow at 3.0% CAGR, supported by the country's position as a global leader in beef production and expanding cattle herd sizes. Brazil's extensive pasture-based cattle systems and growing integration of supplemental feeding practices create significant demand for specialized feed formulations. The country's export-oriented beef industry and focus on production efficiency drive adoption of feeds that optimize animal performance while maintaining cost competitiveness.

Brazil's favorable climate conditions and abundant feed ingredient availability support development of locally adapted feed formulations that meet specific nutritional requirements for tropical cattle production. The country's emphasis on sustainable cattle production and environmental stewardship influences feed formulation trends toward environmentally responsible ingredients and production methods.

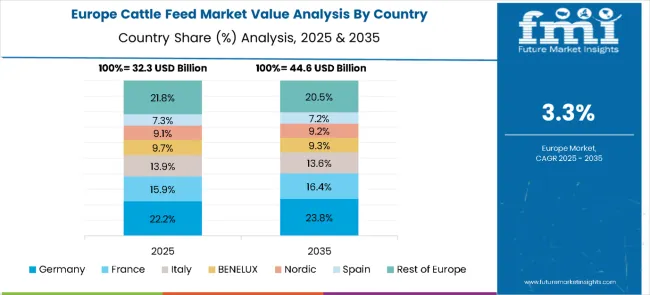

The cattle feed market in Europe is projected to grow from USD 32.3 billion in 2025 to USD 44.6 billion by 2035, registering a CAGR of 3.3% over the forecast period. Germany is expected to maintain its leadership with a 22.2% share in 2025, followed by France at 15.9%, reflecting strong livestock farming and feed production capacity.

Italy accounts for 13.9% of the market, while the BENELUX region represents 9.7% and the Nordic countries hold 9.1%. Spain captures 7.3%, while the Rest of Europe collectively contributes 21.8%. By 2035, Germany will further strengthen its position with a 23.8% share, France will reach 16.4%, and Italy will stand at 13.6%.

BENELUX and the Nordic region are projected at 9.3% and 9.2%, respectively, while Spain will account for 7.2%, and the Rest of Europe will represent 20.5%, indicating steady regional growth across the continent.

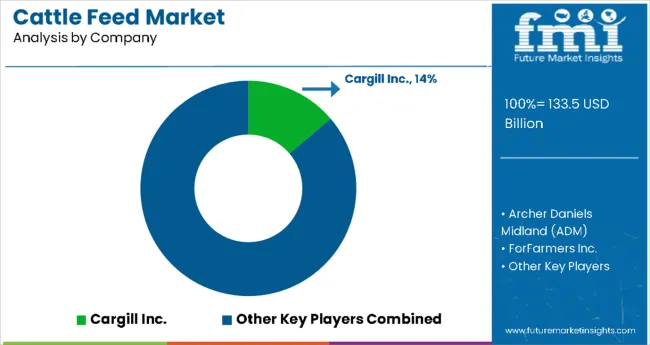

The cattle feed market is characterized by competition among global agricultural conglomerates, regional feed manufacturers, and specialized nutrition companies. Leading players are investing in advanced feed formulation technologies, production capacity expansion, and strategic acquisitions to strengthen their market positions across key geographic regions.

Cargill Inc. leads the market with a 14% share, leveraging its integrated supply chain and global manufacturing network to deliver consistent feed solutions. Archer Daniels Midland (ADM) holds 11.7% market share, focusing on innovation in feed ingredients and sustainable production practices. ForFarmers Inc. commands 8.4% of the market through specialized regional expertise and customer-focused service delivery. De Heus maintains 7.3% market share with emphasis on nutritional innovation and technical support services, while Land O'Lakes Inc. accounts for 5.5% through its cooperative model and farmer-focused approach to feed manufacturing and distribution.

The cattle feed market is central to food security, dairy productivity, meat quality, and rural livelihoods. With climate volatility, sustainability mandates, and rising protein demand, the sector faces pressure to balance feed efficiency, animal welfare, and environmental impact. Coordinated action from governments, industry bodies, OEMs/agri-tech players, suppliers, and investors is essential to transition toward climate-smart, digitally optimized, and nutritionally advanced cattle feed systems.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 133.5 Billion |

| Product Type | Concentrate Foods, Roughages (Pasture, Hay, Silage, Straw & Hulls, Root Crops), Feed Additive |

| Form | Pellets, Extruded Feeds, Mash, Cubes, Flakes, Silage, Hay, Straw, Liquids, Grit, Block Feeds |

| Regions Covered | India, Japan, United Kingdom, United States, Germany, China, Brazil |

| Country Covered | India, Japan, United Kingdom, United States, Germany, China, Brazil, and 40+ countries |

| Key Companies Profiled | BASF SE, DSM, Cargill, Inc, ADM, Animal Nutrition, Kemin Industries, Inc, Biomin Holding GmbH, Nutreco, Land O'Lakes, Inc, Farmer's Grain Company, Godrej Agrovet Ltd. |

| Additional Attributes | Dollar sales by product/form type, regional demand (key markets), competition among feed leaders, farmer preference (nutritional vs conventional), livestock tech integration, feed innovations, and sustainable precision nutrition adoption |

As of 2025, the market for cattle feed is expected to be valued at USD 133.5 billion.

By 2035, the market value of cattle feed is expected to reach USD 193.7 billion.

From 2025 to 2035, the cattle feed market is expected to flourish at a CAGR of 3.8%.

The concentrate foods segment is expected to account for a market share of 3.8% in 2025.

India is likely the top-performing market, with a CAGR of 8.2%.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cattle Feeder Panels Market Size and Share Forecast Outlook 2025 to 2035

Cattle Feeder Market Size and Share Forecast Outlook 2025 to 2035

Cattle Mineral Feeder Market Size and Share Forecast Outlook 2025 to 2035

Dairy Cattle Feed Market

Cattle Squeeze Market Size and Share Forecast Outlook 2025 to 2035

Cattle Head Catch Market Size and Share Forecast Outlook 2025 to 2035

Cattle Grooming Chute Market Size and Share Forecast Outlook 2025 to 2035

Cattle Handling Systems Market Size and Share Forecast Outlook 2025 to 2035

Cattle Blower Market Size and Share Forecast Outlook 2025 to 2035

Cattle Management Software Market Size and Share Forecast Outlook 2025 to 2035

Cattle Supplies Market Analysis & Forecast for 2025 to 2035

Cattle Nutrition Market Analysis by Cattle Type, Nutrition Type, Application, Life Stage Through 2025 to 2035

Smart Cattle Market

Automatic Cattle Waterer Market – Trends & Growth Forecast 2025 to 2035

Feed Mixer Market Forecast and Outlook 2025 to 2035

Feed Grade Spray-dried Animal Plasma (SDAP) Market Size and Share Forecast Outlook 2025 to 2035

Feed Electrolytes Market Size and Share Forecast Outlook 2025 to 2035

Feed Micronutrients Market Size and Share Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Feed Flavors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA