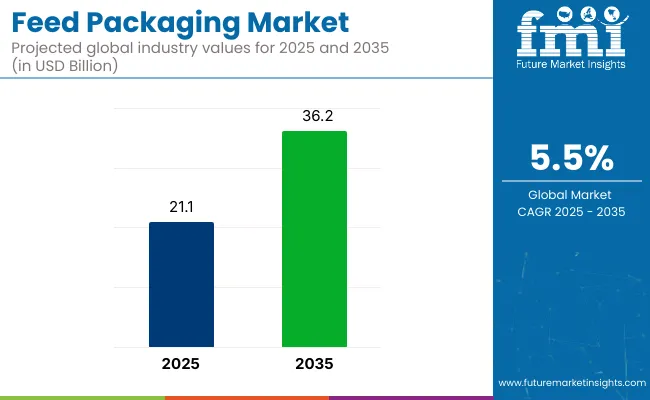

The global Feed Packaging Market is estimated at USD 21.1 billion in 2025 and is projected to reach USD 36.0 billion by 2035, expanding at a CAGR of 5.5% during the forecast period.

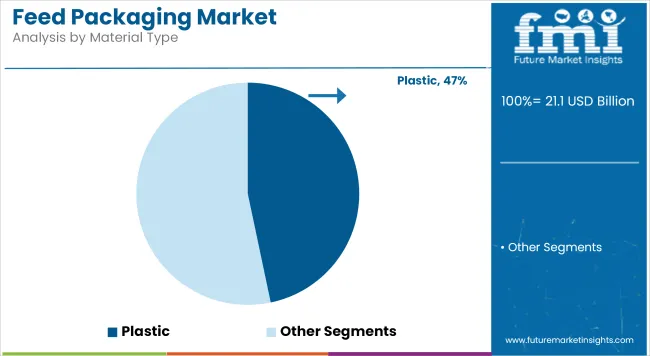

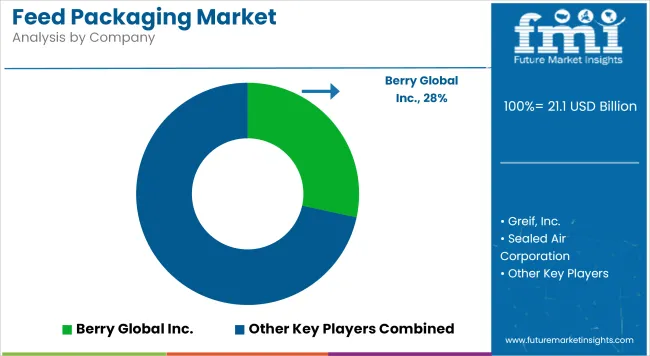

In 2025, the market is dominated by Plastic materials, accounting for 47% of the share, while Flexible packaging leads the Packaging Type segment with 58%. Berry Global Inc. commands the largest company share at 28%, with other key players making up the remaining 72%.

The Feed Packaging Market growth is driven by rising demand for flexible and plastic packaging solutions that enhance feed preservation and transport efficiency. The expanding livestock sector and increasing awareness of feed quality are expected to fuel adoption. However, regulatory constraints on plastic usage in some regions may pose challenges.

North America leads growth, supported by technological advancements and established supply chains, while Asia-Pacific is emerging as a promising market due to increasing animal husbandry activities. Overall, market players focusing on innovation and sustainable packaging alternatives are poised

The Feed Packaging Market is segmented by Packaging Type into Flexible and Rigid; by Material Type into Plastic (including Polyethylene and Polypropylene), Paper, Jute, Metal, and Glass; by Livestock into Poultry, Ruminants, Swine, and Others (Aquatic animals and Equine); by Feed Type into Dry, Wet, and Chilled & Frozen; and by Region including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and Middle East & Africa.

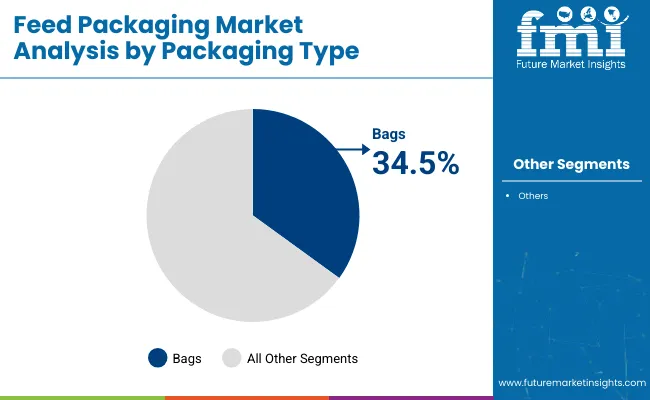

In 2025, the Flexible packaging segment leads the market with a 58% share, supported by its advantages in lightweight, adaptability, and cost efficiency compared to rigid packaging. Flexible packaging enables better preservation of feed quality through enhanced barrier properties and ease of handling, which drives its demand among livestock feed manufacturers.

However, the Rigid packaging segment faces slower growth due to higher material costs and limited flexibility but retains relevance in applications requiring durable, reusable containers. The growing preference for flexible packaging solutions, driven by advances in materials and consumer convenience, is expected to sustain this segment’s dominance through 2035, while innovations in rigid packaging could carve niche opportunities in select markets.

The Plastic segment commands the largest share at 47% in 2025, driven primarily by widespread use of polyethylene (PE) and polypropylene (PP) due to their excellent durability, moisture resistance, and cost-effectiveness. Paper packaging follows as a sustainable alternative gaining traction amid increasing environmental regulations and consumer demand for eco-friendly materials.

Jute, metal, and glass segments hold smaller shares but maintain relevance in specific regional markets or specialized packaging needs. Growth in plastic packaging is supported by ongoing innovations in recyclable and biodegradable polymers, balancing performance with regulatory pressures. The material mix is expected to evolve gradually, with plastic retaining dominance but paper and other sustainable materials expanding their footprint by 2035.

The Dry feed segment dominates the market in 2025, reflecting its widespread use across various livestock categories due to ease of storage and longer shelf life. Wet feed follows with a smaller share, used predominantly in specialized or formulated feeds requiring higher moisture content. Chilled & Frozen feed represents the smallest segment but shows potential growth driven by aquaculture and premium feed applications that demand preservation of nutritional quality through temperature control.

Packaging solutions for each feed type vary significantly, with dry feed favoring moisture-resistant flexible packaging and wet or chilled feed requiring more robust barrier properties. Growth across all feed types is projected through 2035, with innovations in packaging materials enhancing preservation and convenience.

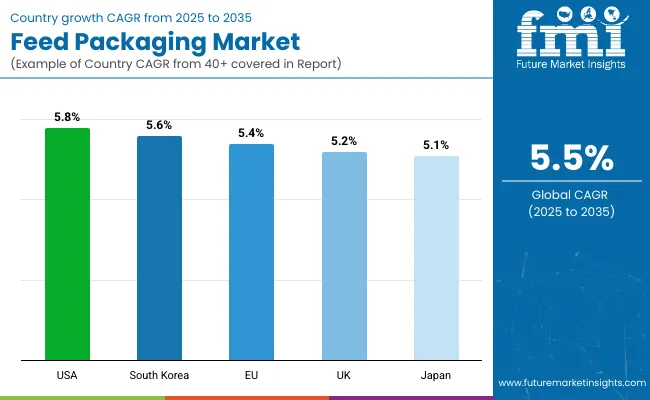

The United States Feed Packaging Market is projected to grow at a CAGR of 5.8% from 2025 to 2035. Valued significantly within the North American region, the USA benefits from advanced livestock farming practices and a mature feed industry focused on quality and safety. Regulatory frameworks around feed packaging and materials, including FDA guidelines, drive demand for high-performance packaging that preserves feed integrity.

Innovations in flexible and plastic packaging formats are widely adopted, supporting efficient storage and transportation. Consumer preference for sustainably sourced packaging is gradually influencing market trends, prompting manufacturers to invest in recyclable and biodegradable materials.

The USA market is also influenced by consolidation in feed production and packaging companies, which enhances scale and distribution efficiency. Strong distribution channels and technological adoption position the United States as a leading and lucrative market within feed packaging globally.

South Korea’s Feed Packaging Market is expected to grow at a CAGR of 5.6% between 2025 and 2035. The market is driven by a dynamic livestock sector focused on poultry, swine, and aquaculture, requiring efficient and reliable feed packaging solutions to maintain feed quality. South Korea emphasizes modernization and automation in feed production and packaging processes, supporting adoption of advanced flexible and plastic packaging formats.

Government initiatives to promote sustainability are influencing packaging choices, with an increased focus on eco-friendly materials and waste reduction. The compact geographic nature of the country necessitates packaging that optimizes space and logistics. South Korea’s feed packaging market benefits from strong R&D investments and collaboration between packaging manufacturers and feed producers to innovate high-barrier materials that extend shelf life and reduce contamination risk.

The European Union’s Feed Packaging Market is forecast to grow at a CAGR of 5.4% from 2025 to 2035. The market is characterized by strict environmental regulations that encourage the use of recyclable and biodegradable materials in packaging. The livestock sector across member countries demands packaging solutions that ensure feed safety, traceability, and shelf life extension.

Plastic packaging retains a significant share but is increasingly complemented by paper and bio-based materials to meet sustainability targets. The EU’s feed packaging landscape is influenced by consumer awareness and policy pressure to reduce plastic waste and carbon footprint.

Innovation in flexible packaging technologies that combine performance with eco-friendliness is prominent. Key markets within the EU, including Germany, France, and the Netherlands, showcase robust demand supported by advanced supply chains and feed production infrastructure.

The United Kingdom Feed Packaging Market is anticipated to grow at a CAGR of 5.2% over 2025 to 2035. Post-Brexit regulatory adjustments continue to influence packaging standards and trade flows, but the market remains resilient due to strong domestic feed production and livestock sectors. The UK market prioritizes packaging solutions that balance feed protection with environmental responsibility, accelerating demand for recyclable and sustainable materials.

Flexible packaging formats dominate due to their cost-effectiveness and performance in preserving feed quality. Innovations in barrier technologies and lightweight packaging reduce transportation emissions and costs. Consumer and industry pressures drive suppliers toward sustainable sourcing and circular economy principles. The UK market benefits from a well-established feed industry supported by modern logistics and distribution infrastructure, with growth expected from expanding aquaculture and specialty animal feed segments.

Japan’s Feed Packaging Market is forecast to grow at a CAGR of 5.1% during 2025 to 2035. The market is driven by the country’s significant livestock and aquaculture industries, which demand high-quality, reliable packaging to ensure feed freshness and safety. Japan emphasizes precision and innovation, leading to adoption of advanced packaging materials such as high-barrier films and multi-layer composites that extend shelf life and resist moisture.

The market is also shaped by regulatory focus on reducing plastic waste and encouraging recyclable materials. Compact packaging designs are favored to optimize space in storage and transportation, reflecting Japan’s logistical constraints. Collaboration between packaging manufacturers and feed producers fosters continuous innovation tailored to evolving feed formulations and environmental standards. Consumer expectations for product safety and sustainability underpin steady growth in the Japanese feed packaging sector.

The Feed Packaging Market is moderately consolidated, with leading companies such as Berry Global Inc., Huhtamaki, Constantia Flexibles, and Amcor holding significant market shares. Berry Global Inc. leads with a 28% share, leveraging a broad product portfolio spanning flexible and rigid packaging solutions tailored to diverse livestock feed requirements. Market leaders focus on innovation in sustainable materials, driven by increasing regulatory pressure and consumer demand for eco-friendly packaging.

Development of recyclable, biodegradable, and bio-based packaging materials is a key strategic priority to balance performance with environmental compliance.

Global players maintain extensive distribution networks and invest in advanced manufacturing technologies to improve packaging efficiency and barrier properties.

Collaboration with feed producers enables customization aligned with specific feed types and regional requirements. Mid-sized and regional companies, such as LC Packaging and Schur Flexibles, are carving niche positions by focusing on specialized packaging formats and local market expertise.

Startups and smaller innovators are introducing novel materials and smart packaging solutions incorporating moisture and freshness indicators, aiming to disrupt traditional formats. However, scaling and regulatory approvals remain challenges for these new entrants. Technological advances in multilayer films and lightweight packaging are expected to drive competition further.

Overall, the competitive landscape is shaped by the need for sustainable innovation, cost efficiency, and adaptability to evolving livestock industry demands. Companies investing in R&D and sustainable supply chains are poised to lead through the forecast period.

| Aspect | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Market Segmentation | Packaging Type, Material Type, Livestock, Feed Type, Region |

| Packaging Type | Flexible, Rigid |

| Material Type | Plastic (Polyethylene, Polypropylene), Paper, Jute, Metal, Glass |

| Livestock | Poultry, Ruminants, Swine, Others (Aquatic animals, Equine) |

| Feed Type | Dry, Wet, Chilled & Frozen |

| Geographic Coverage | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Market Dynamics | Drivers, Restraints, Opportunities |

| Competitive Landscape | Profiles of Leading Companies, Market Shares, Strategic Initiatives |

| Regulatory Analysis | Impact of Regional and Country-Specific Regulations |

| Sustainability Trends | Adoption of Eco-friendly Packaging Materials |

| Country-Level Analysis | United States, South Korea, European Union, United Kingdom, Japan |

| Supply Chain Overview | Key Participants, Value Chain Analysis |

The market is projected to reach USD 36.0 billion by 2035.

A CAGR of 5.5% is expected during this period.

Flexible packaging leads with a 58% share as of 2025.

Plastic, especially polyethylene and polypropylene, accounts for 47% of the market.

North America leads, with strong growth expected in East Asia and South Asia & Pacific.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Feed Mixer for Livestock Market Size and Share Forecast Outlook 2025 to 2035

Feed Preparation Machine Market Size and Share Forecast Outlook 2025 to 2035

Feed Additive Nosiheptide Premix Market Size and Share Forecast Outlook 2025 to 2035

Feeder Container Market Size and Share Forecast Outlook 2025 to 2035

Feed Machine Market Forecast Outlook 2025 to 2035

Feed Pigment Market Forecast and Outlook 2025 to 2035

Feed Mixer Market Forecast and Outlook 2025 to 2035

Feed Grade Spray-dried Animal Plasma (SDAP) Market Size and Share Forecast Outlook 2025 to 2035

Feed Electrolytes Market Size and Share Forecast Outlook 2025 to 2035

Feed Micronutrients Market Size and Share Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Feed Flavors Market Size and Share Forecast Outlook 2025 to 2035

Feed Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Mycotoxin Binders Market Size and Share Forecast Outlook 2025 to 2035

Feed Phytogenics Market Size and Share Forecast Outlook 2025 to 2035

Feed Carbohydrase Market Size and Share Forecast Outlook 2025 to 2035

Feed Grade Oils Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Mycotoxin Detoxifiers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Premix Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Feed Phytogenic Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA